Global Ethical Investment Platforms Market Size, Share and Analysis Report By Component (Software, Services), By Investment Strategy (ESG Integration, Socially Responsible Investing (SRI), Impact Investing, Faith-based Investing, Others), By Asset Class (Equities, Fixed Income (Green Bonds), Alternatives & Private Equity, Others), By Investor Type (Retail Investors, High-Net-Worth Individuals (HNWIs), Institutional Investors), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172982

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

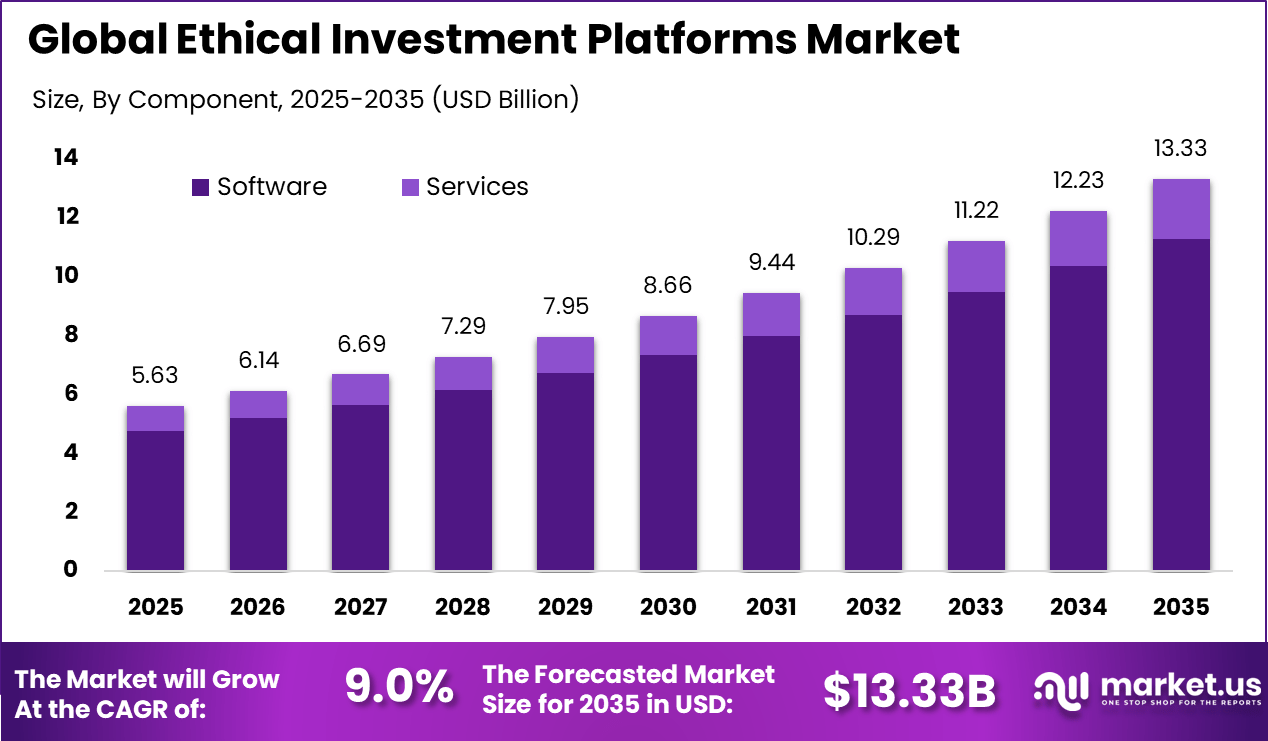

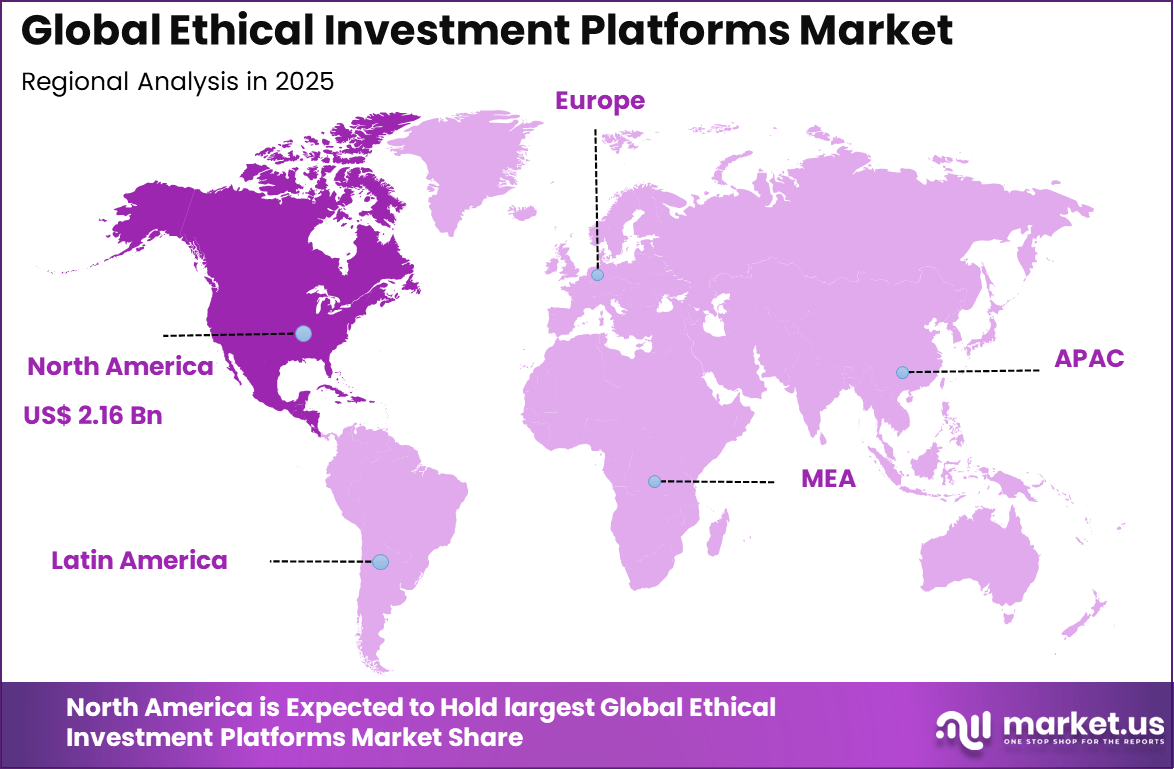

The Global Ethical Investment Platforms Market size is expected to be worth around USD 13.33 billion by 2035, from USD 5.63 billion in 2025, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.5% share, holding USD 2.16 billion in revenue.

The ethical investment platforms market can be defined as digital platforms that help individuals and institutions invest according to environmental, social, and governance priorities, alongside financial goals. It has been shaped by tools for screening, portfolio construction, reporting, and disclosures that allow users to understand how sustainability risks and impacts are being handled. Ethical investing has been widely described as an approach that considers a company’s behavior and governance, not only returns.

Growth in the ethical investment platforms market has been supported by broader awareness of social and environmental issues. Regulators and stakeholders have emphasized transparency in how investments affect communities and the environment. This has encouraged platform providers to integrate robust reporting and screening features. As investor interest in sustainability increases, these platforms have become important alternatives in the digital wealth management ecosystem.

The market for Ethical Investment Platforms is driven by rising investor interest in aligning money with personal values like sustainability and social good. Younger people especially seek ways to support clean energy and fair practices through easy apps and tools. Platforms respond by offering clear tracking of impact, which builds trust and pulls in more users. This human touch turns everyday savers into active backers of positive change.

Strong interest is shown in surveys where 77% of people in key markets want ethical handling of their savings. Many, around 57%, would change advisors if values do not match, proving real pressure on choices. Younger groups like millennials lead, picking options that reflect their care for the planet and society. This demand comes from daily news on issues like pollution or inequality. Families now teach kids about it, too. Platforms respond with simple tools to spot ethical fits fast.

For instance, in September 2025, Calvert Research and Management reaffirmed its commitment to its Principles for Responsible Investment amid global divergence. The firm emphasized ESG integration for international equity funds, responding to client demand for resilient, values-driven strategies.

Key Takeaway

- In 2025, platform and software solutions dominated the ethical investment platforms market with an 84.7% share, reflecting strong demand for digital tools that support portfolio screening, reporting, and compliance with responsible investing criteria.

- ESG integration led by strategy with a 58.9% share, as investors increasingly embed environmental, social, and governance factors directly into investment decision-making processes.

- Equities, including stocks and ETFs, accounted for 72.4%, highlighting investor preference for transparent, liquid instruments aligned with ethical and sustainability goals.

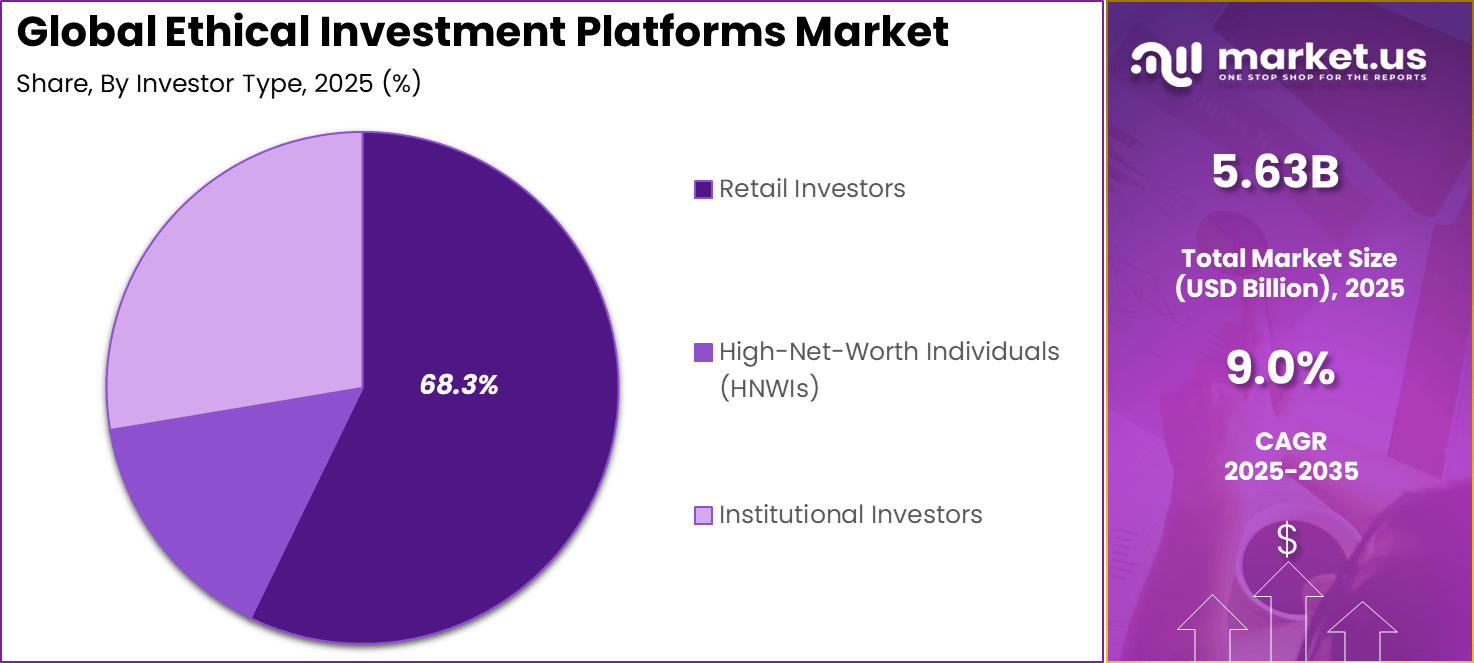

- Retail investors represented 68.3% of total adoption, driven by rising awareness of responsible investing and easier access through digital investment platforms.

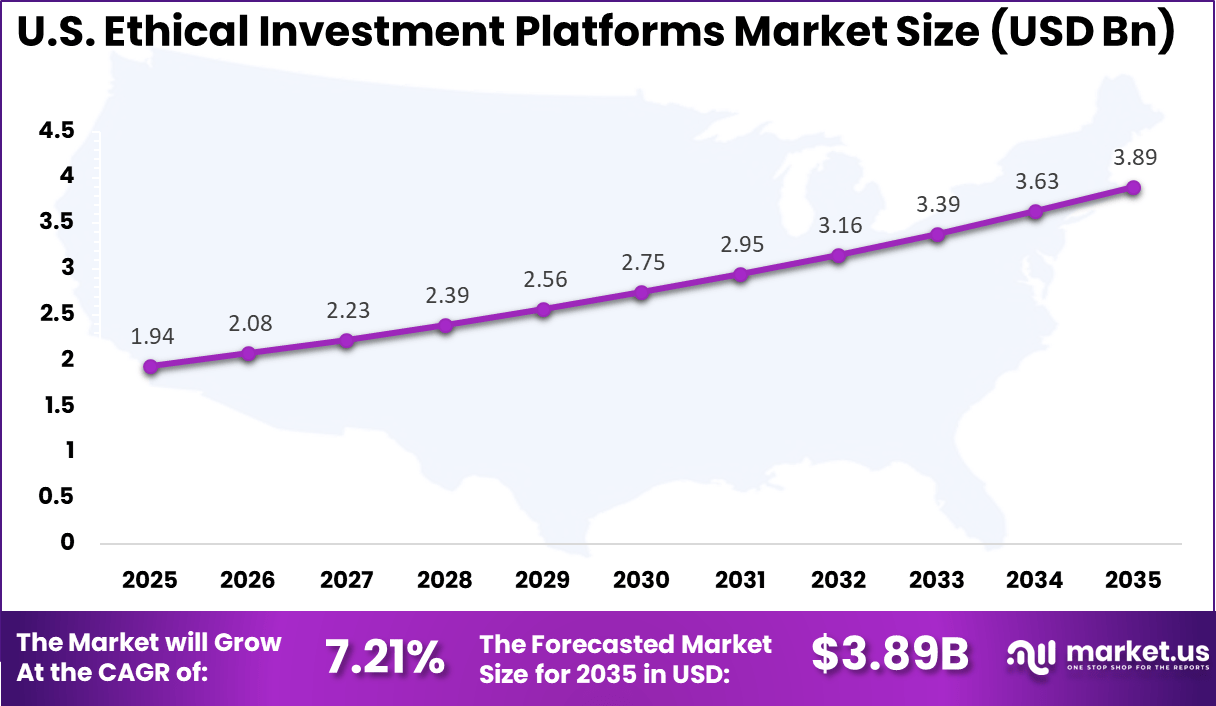

- The U.S. market reached USD 1.94 billion in 2025 and is expanding at a 7.21% CAGR, supported by growing interest in ESG-focused portfolios and fintech-enabled investing.

- North America held over 38.5% of the global market, backed by mature capital markets, strong ESG disclosure practices, and high adoption of digital investment platforms.

U.S. Market Size

The United States reached USD 1.94 Billion with a CAGR of 7.21%, indicating steady market expansion. Growth is driven by rising retail participation in ethical investing. Platforms continue to enhance user experience and reporting features. Investors increasingly align portfolios with sustainability goals. Market growth remains stable and consistent.

For instance, In November 2025, Betterment Holdings, Inc. introduced self directed investing for retail users, expanding its ethical investment offerings while continuing to support SRI portfolios focused on climate and social impact. This development strengthened U.S. leadership in accessible ethical platforms by allowing investors to align portfolios with personal priorities such as diversity and low carbon strategies amid rising ESG demand.

North America accounts for 38.5%, reflecting strong adoption of ethical investment platforms across the region. Investors show high awareness of responsible investing principles. Digital platforms are widely used to access ESG-focused investment options. Regulatory clarity supports transparency and disclosure. The region remains a key contributor to market activity.

For instance, in September 2025, Calvert Research and Management reaffirmed its commitment to responsible investing amid global policy divergence. From Bethesda, MD, Calvert emphasized principles-based capital allocation, strengthening North America’s position in ethical investing through transparent ESG frameworks and long-term sustainability focus.

Component Analysis

In 2025, The Platform/Software segment held a dominant market position, capturing an 84.7% share of the Global Ethical Investment Platforms Market. These tools make it simple for users to screen investments based on environmental, social, and governance criteria. They provide dashboards for monitoring portfolios in real time, helping investors stay aligned with their values. Demand grows as more people want tech that simplifies complex data into clear insights.

The rise of platform/software solutions stems from the need for scalable tools in a crowded market. Investors appreciate features like automated ESG scoring and compliance checks that save time. As digital adoption speeds up, these systems integrate seamlessly with banking apps and advisors. Their lead reflects a broader shift toward self-directed investing, where tech empowers decisions. Overall, this category sets the pace for innovation in responsible finance.

For Instance, in November 2025, Betterment Holdings, Inc. launched updated SRI portfolios including Climate Impact and Social Impact options. These enhancements allow users to customize sustainable investing through advanced software dashboards that track ESG metrics in real time. The move caters to growing demand for intuitive platforms in ethical finance.

Investment Strategy Analysis

In 2025, ESG integration holds 58.9%, making it the leading investment strategy. This approach incorporates environmental, social, and governance factors into investment decisions. Investors use ESG data to assess long-term risk and value. Integration allows ethical considerations without excluding asset classes. This strategy balances responsibility and performance.

Adoption of ESG integration is driven by growing awareness of sustainability issues. Investors seek alignment between values and financial goals. Platforms provide ESG scores and insights to support analysis. Continuous data updates improve reliability. This keeps ESG integration widely used.

For instance, in November 2025, Moneyfarm, Ltd. refined its ESG strategy to cut greenwashing risks and boost sustainable exposure. The update emphasizes strict criteria for fossil fuel exclusions and engagement practices, aligning portfolios with client values while targeting long-term performance.

Asset Class Analysis

In 2025, the Equities (Stocks, ETFs) segment held a dominant market position, capturing a 72.4% share of the Global Ethical Investment Platforms Market. These assets let investors target firms with strong ethical records, from renewable energy leaders to inclusive workplaces. ETFs shine for their low costs and broad exposure, drawing in beginners and pros alike. Liquidity and familiarity keep this class central to ethical portfolios.

Equities grow because they mirror real-world impact through ownership stakes. Investors track progress via quarterly reports on sustainability goals. This class benefits from rising demand for thematic funds focused on clean tech or fair trade. Its weight highlights how stocks and ETFs bridge ideals with accessible growth opportunities. The segment evolves with new listings tied to global challenges.

For Instance, in October 2025, Ethic, Inc. increased its stakes in key public companies via its tech-driven platform. Focusing on personalized ESG-aligned equities, the firm funnels capital into leaders tackling climate and inequality, blending values with competitive returns for advisors.

Investor Type Analysis

In 2025, Retail investors represent 68.3%, highlighting their central role in the market. Individual investors increasingly seek ethical investment options. Digital platforms make investing accessible and affordable. Retail users value clear information and guidance. Ease of entry supports strong participation.

Adoption among retail investors is driven by financial literacy and awareness. Investors use platforms to align investments with personal values. Educational tools support informed decisions. Mobile access increases engagement. This keeps retail investors as the primary user group.

For Instance, in February 2025, Aspiration Partners, Inc. integrated Clarity AI’s sustainability badges into its Green Marketplace app. This empowers retail users with verified climate data for ethical choices, expanding access to values-based investing tools.

Emerging Trend Analysis

The Ethical Investment Platforms market is being shaped by growing interest in environmental, social, and governance-aligned investment options that allow individuals and institutions to support responsible businesses. Investors are using digital platforms that screen companies based on ethical criteria such as carbon emissions, labor practices, and community impact.

This trend reflects a shift toward values-based investing where financial returns are balanced with social and environmental outcomes. As more investors seek meaningful impact, ethical platforms are gaining attention. Another emerging trend is the integration of advanced analytics that provide transparent reporting on sustainability metrics and portfolio impact.

These tools allow users to evaluate performance against ethical goals and understand how their investments contribute to broader outcomes. Enhanced transparency supports informed decision making and builds confidence among users that their capital aligns with stated values. This trend strengthens the appeal of ethical investment platforms by grounding choices in measurable data.

Driver Analysis

A primary driver of market growth is increasing awareness and concern about global challenges such as climate change and social inequality among younger investor segments. Millennials and Generation Z show stronger preference for investments that reflect personal values and support sustainable business practices.

For instance, in October 2025, Wealthsimple hit a big funding round to speed up its growth plans. They focus on smart tools for values-based choices in investing. This cash lets them build features users crave for ethical paths. It shows strong backing for meeting demand. Every day, investors get better access to good options.

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline ESG Awareness Growth Rising awareness among retail and institutional investors about environmental, social, and governance aligned investing. ~2.4% North America, Europe Short to Mid Term Regulatory Support Government policies promoting transparency, sustainability disclosures, and ethical fund classification. ~1.8% Europe, North America Mid Term Digital Investment Adoption Growing use of mobile and web based investment platforms improving access to ethical portfolios. ~1.5% North America, Asia Pacific Short Term Millennial and Gen Z Participation Strong preference among younger investors for values driven and impact focused investment options. ~1.3% North America, Europe Long Term Corporate Sustainability Focus Improved corporate ESG reporting and alignment increases the quality of ethical investment opportunities. ~1.1% Global Mid to Long Term Institutional Capital Allocation Rising participation of pension funds and asset managers allocating capital to ethical strategies. ~0.9% Europe, North America Long Term Restraint Analysis

One restraint on market expansion is the perception that ethical investments may underperform traditional portfolios due to restrictive screening criteria. Some investors believe that excluding certain sectors or companies limits diversification and reduces potential returns. This belief can slow adoption among investors focused primarily on financial outcomes.

Platforms must work to demonstrate that ethical portfolios can achieve competitive performance to overcome this barrier. Another restraint arises from inconsistent definitions of what constitutes ethical or sustainable investment criteria across regions and rating agencies.

Without harmonized standards, investment scoring and comparison can vary widely, making it difficult for users to evaluate options consistently. This fragmentation creates confusion and can reduce user confidence in platform offerings. Efforts to standardize ethical definitions are needed to support broader acceptance.

For instance, in September 2025, Nutmeg announced its rebranding to J.P. Morgan Personal Investing, retiring the Nutmeg brand by November. The transition integrates with Chase UK for seamless access to investments and savings. This shift highlights challenges in navigating regional regulations and platform changes. Investors face hurdles in comparing options amid such consolidations. Limited ethical choices persist due to varying standards.

Opportunity Analysis

There is strong opportunity in developing hybrid investment products that combine ethical screening with impact measurement features that quantify social and environmental contributions. Tools that help investors track changes in measurable outcomes such as carbon reduction or community investment can reinforce the value of ethical portfolios beyond financial returns.

Enhanced impact measurement supports deeper engagement and loyalty among users. Another opportunity lies in expanding educational resources that improve investor understanding of responsible finance principles.

Platforms can offer tutorials, guides, and scenario analyses that explain how ethical criteria influence investment selection and performance outcomes. Increasing financial literacy regarding sustainable investing empowers users to make informed decisions. Educational features also attract new users by making responsible investment more accessible.

For instance, in December 2025, Betterment launched self-directed investing tools and previewed direct indexing for 2026. Enhanced portfolios include Climate Impact and Social Impact options with low-carbon and diversity focuses. These tech upgrades make ethical tracking simpler via apps. The firm evolved its SRI offerings for personalized ESG alignment. Innovation draws tech-savvy crowds seeking impact visibility.

Challenge Analysis

A key challenge for the market is ensuring data quality and reliability used to evaluate ethical performance and sustainability metrics. Ethical investment decisions depend on accurate reporting from companies regarding environmental impact, governance practices, and social results.

Incomplete or inconsistent reporting undermines the effectiveness of screening tools and can mislead investors. Robust data collection and verification processes are necessary to uphold credibility. Another challenge is managing user expectations regarding the balance between ethical goals and financial performance.

Investors may have differing priorities, with some emphasizing impact score over return and others prioritizing financial growth. Balancing these expectations in portfolio design and platform communication requires careful strategy. Misalignment between user goals and portfolio outcomes can lead to dissatisfaction and reduced engagement.

Key Market Segments

By Component

- Software

- Services

By Investment Strategy

- ESG Integration

- Socially Responsible Investing (SRI)

- Impact Investing

- Faith-based Investing

- Others

By Asset Class

- Equities

- Fixed Income (Green Bonds)

- Alternatives & Private Equity

- Others

By Investor Type

- Retail Investors

- High-Net-Worth Individuals (HNWIs)

- Institutional Investors

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Betterment Holdings, Inc., Wealthsimple, Inc., and Nutmeg Saving and Investment, Ltd. lead the ethical investment platforms market by offering digital portfolios aligned with ESG and values based investing. Their platforms combine automated investing with transparent screening of companies and funds. These providers focus on accessibility, clear impact reporting, and low entry barriers. Rising interest among younger and retail investors in responsible investing continues to strengthen their leadership.

Moneyfarm, Ltd., Ethic, Inc., OpenInvest, Inc., and Aspiration Partners, Inc. strengthen the market with customizable ESG portfolios and direct indexing solutions. Their offerings allow investors to align investments with personal values such as climate action and social impact. These companies emphasize data driven screening and client transparency. Growing demand for personalization supports wider adoption.

Sustainalytics, MSCI, Inc., Impax Asset Management Group plc, and Trillium Asset Management, LLC expand the ecosystem through ESG research, ratings, and asset management expertise. Their insights support platform credibility and regulatory alignment. These players focus on robust analytics and long term sustainability metrics. Increasing regulatory focus on ESG disclosures continues to drive steady growth in the ethical investment platforms market.

Top Key Players in the Market

- Betterment Holdings, Inc.

- Wealthsimple, Inc.

- Nutmeg Saving and Investment, Ltd.

- Moneyfarm, Ltd.

- Ethic, Inc.

- OpenInvest, Inc.

- Aspiration Partners, Inc.

- Earthfolio, LLC

- Sustainalytics

- MSCI, Inc.

- Calvert Research and Management

- Impax Asset Management Group plc

- Trillium Asset Management, LLC

- Arabesque Partners

- Folio Investing

- Others

Recent Developments

- In July 2025, Nutmeg Saving and Investment, Ltd., enhanced its 10 SRI portfolios with stricter ESG screening, avoiding fossil fuels and arms while optimizing for environmental risk. This update aligns with UK regulatory shifts, attracting purpose-driven investors.

- In April 2025, Impax Asset Management Group plc acquired SKY Harbor’s fixed income unit, adding £1.1 billion AUM in short-duration high-yield strategies. This bolsters sustainable fixed income offerings, diversifying beyond equities for institutional ESG clients.

Report Scope

Report Features Description Market Value (2025) USD 5.6 Bn Forecast Revenue (2035) USD 13.3 Bn CAGR(2025-2035) 9.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Investment Strategy (ESG Integration, Socially Responsible Investing (SRI), Impact Investing, Faith-based Investing, Others), By Asset Class (Equities, Fixed Income (Green Bonds), Alternatives & Private Equity, Others), By Investor Type (Retail Investors, High-Net-Worth Individuals (HNWIs), Institutional Investors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Betterment Holdings, Inc., Wealthsimple, Inc., Nutmeg Saving and Investment, Ltd., Moneyfarm, Ltd., Ethic, Inc., OpenInvest, Inc., Aspiration Partners, Inc., Earthfolio, LLC, Sustainalytics, MSCI, Inc., Calvert Research and Management, Impax Asset Management Group plc, Trillium Asset Management, LLC, Arabesque Partners, Folio Investing, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ethical Investment Platforms MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Ethical Investment Platforms MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Betterment Holdings, Inc.

- Wealthsimple, Inc.

- Nutmeg Saving and Investment, Ltd.

- Moneyfarm, Ltd.

- Ethic, Inc.

- OpenInvest, Inc.

- Aspiration Partners, Inc.

- Earthfolio, LLC

- Sustainalytics

- MSCI, Inc.

- Calvert Research and Management

- Impax Asset Management Group plc

- Trillium Asset Management, LLC

- Arabesque Partners

- Folio Investing

- Others