Global Essential Oils And Plant Extract For Livestock Market Size, Share Analysis Report By Type (Essential Oils, Plant Extracts), By Form (Liquid, Solid), By Function (Gut Health, Immunity, Yield, Others), By Livestock (Poultry, Cattle, Swine, Aquatic, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155209

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

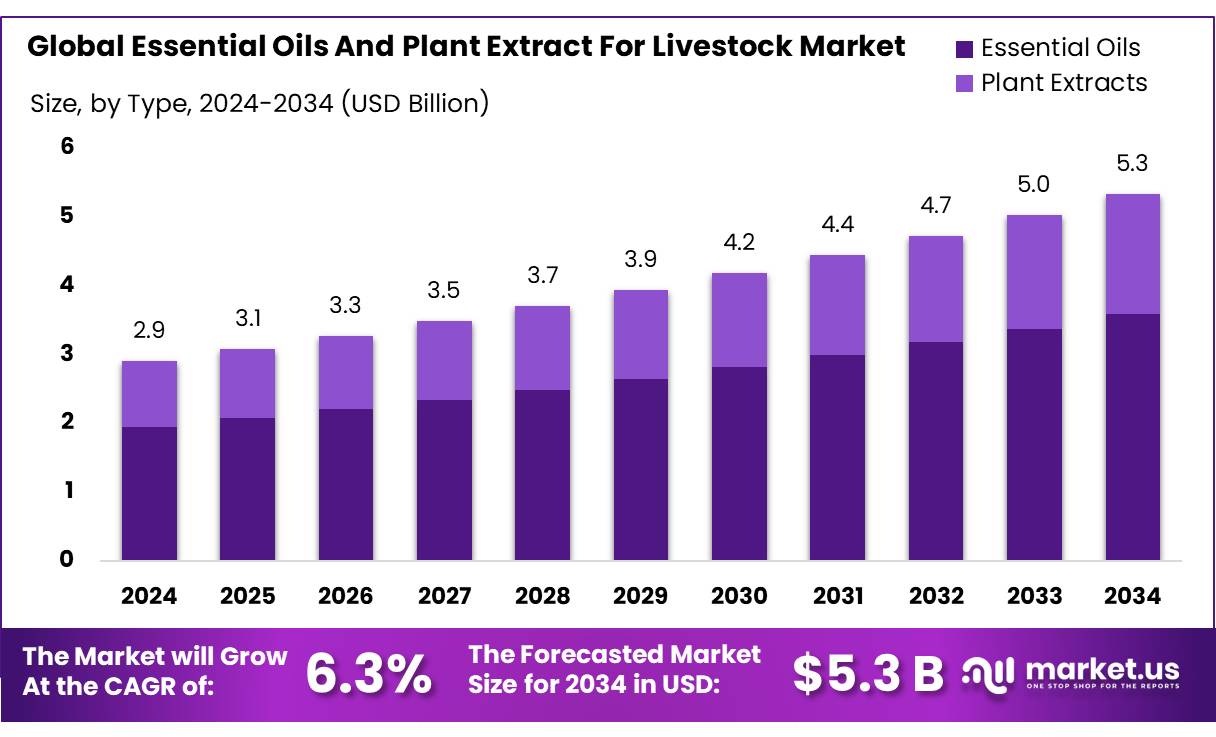

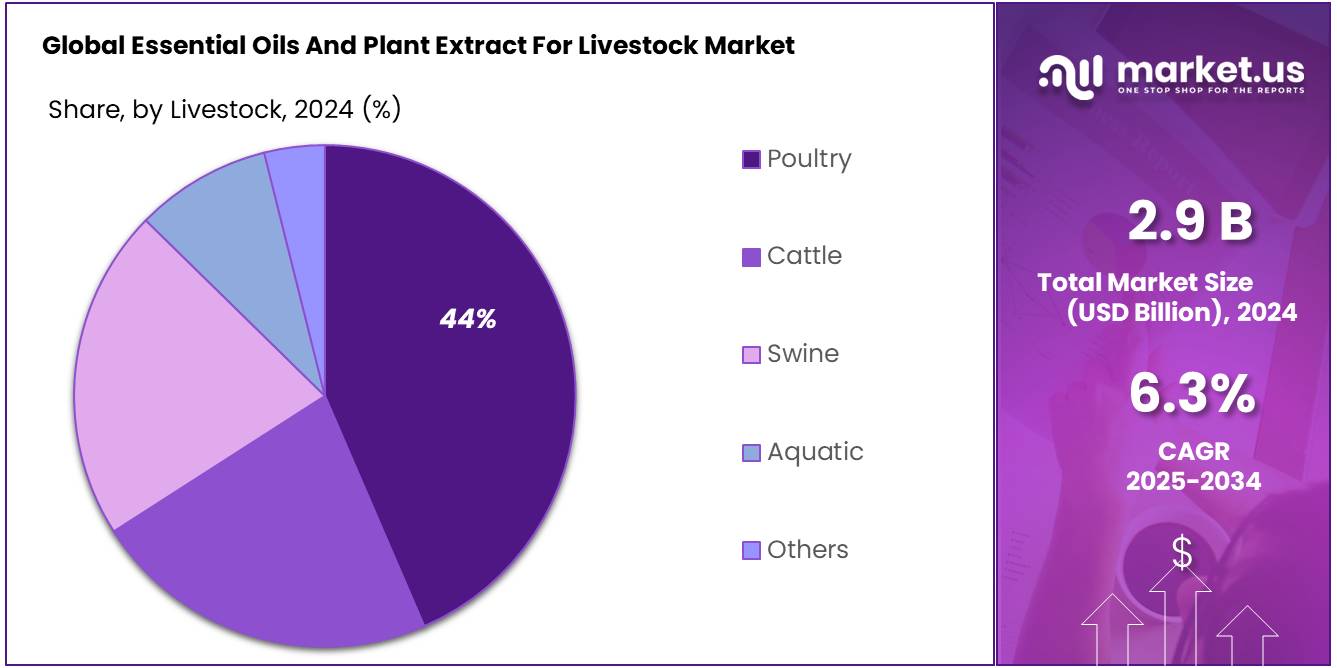

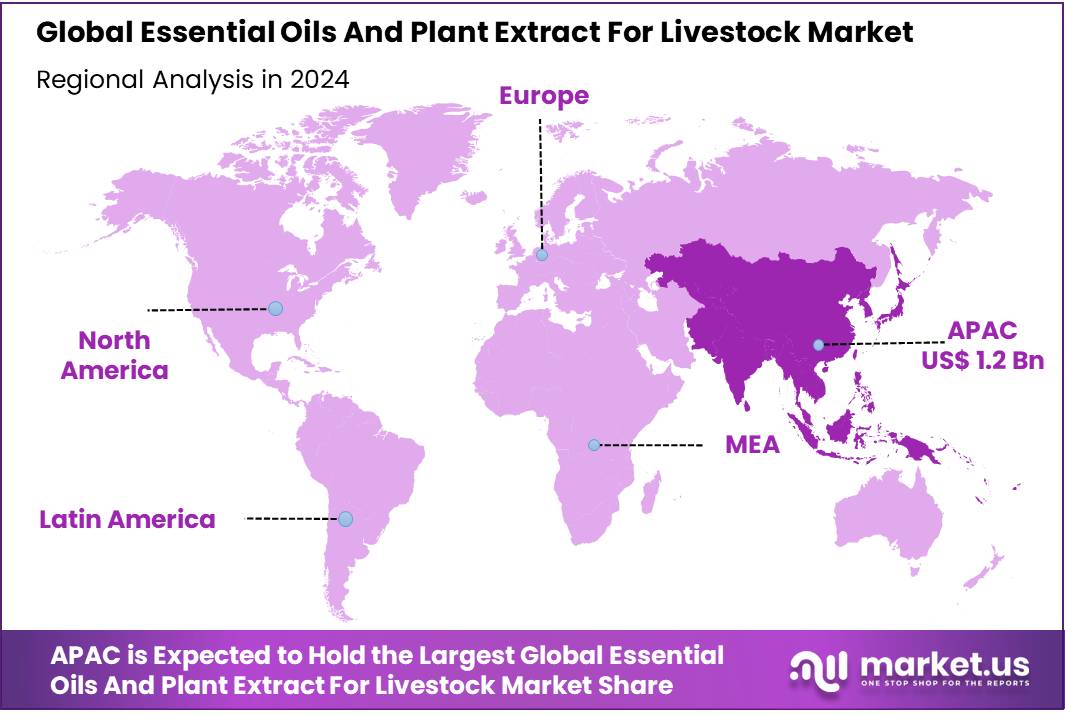

The Global Essential Oils And Plant Extract For Livestock Market size is expected to be worth around USD 5.3 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 44.70% share, holding USD 1.2 Billion revenue.

Essential oils and plant extracts for livestock concentrates sit at the intersection of three pressures: animal health, antimicrobial stewardship, and climate targets. Globally, agriculture accounts for ~40% of human-caused methane, with livestock responsible for ~32% (and cattle alone ~75% of enteric methane), making feed-based interventions attractive for both productivity and emissions outcomes. These macroforces frame a clear role for phytogenic additives—oregano, thyme, cinnamon, citrus, saponin-rich botanicals—used to modulate rumen fermentation, gut integrity, and pathogen load while avoiding antibiotic growth promoters.

Several factors are driving the adoption of essential oils and plant extracts in livestock feed. These natural additives are known to improve gut health, enhance immunity, and boost overall productivity in animals. The growing consumer preference for antibiotic-free and naturally-raised livestock products is influencing farmers to adopt these alternatives. Additionally, the increasing awareness of antimicrobial resistance (AMR) is prompting a shift towards sustainable and ethical livestock farming practices.

In India, the essential oils and plant extracts for livestock market is also witnessing growth. The Indian government has implemented several initiatives to support the livestock sector, including the National Livestock Mission Scheme, which provides a 50% capital subsidy up to Rs. 50 lakh for developing infrastructure related to feed and fodder processing . Furthermore, the Animal Husbandry Infrastructure Development Fund (AHIDF), established with an allocation of Rs. 15,000 crore, aims to increase private sector investment in developing animal husbandry infrastructure, including animal feed plants.

Key Takeaways

- Essential Oils And Plant Extract For Livestock Market size is expected to be worth around USD 5.3 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 6.3%.

- Essential Oils held a dominant market position, capturing more than a 67.2% share in the Essential Oils and Plant Extract for Livestock Market.

- Liquid held a dominant market position, capturing more than a 77.4% share in the Essential Oils and Plant Extract for Livestock Market.

- Gut Health held a dominant market position, capturing more than a 38.3% share in the Essential Oils and Plant Extract for Livestock Market.

- Poultry held a dominant market position, capturing more than a 44.7% share in the Essential Oils and Plant Extract for Livestock Market.

- Asia Pacific held a dominant market position, capturing 44.70% of the Essential Oils and Plant Extract for Livestock market, valued at about USD 1.2 Bn.

By Type Analysis

Essential Oils dominate with 67.2% due to their proven efficacy and natural appeal

In 2024, Essential Oils held a dominant market position, capturing more than a 67.2% share in the Essential Oils and Plant Extract for Livestock Market. This leadership stems from their broad-spectrum benefits, including antimicrobial, antioxidant, and digestive health properties, which make them a preferred choice in feed formulations. Rising restrictions on antibiotic growth promoters in key livestock-producing regions, coupled with consumer demand for residue-free meat, milk, and eggs, have accelerated their adoption. By 2025, usage of essential oils in livestock concentrates is expected to strengthen further, supported by government-backed initiatives promoting natural feed additives and sustainability in animal farming. Their versatility in improving feed efficiency and animal performance, along with easy integration into existing feed systems, ensures their continued dominance in the market.

By Form Analysis

Liquid form dominates with 77.4% due to its ease of mixing and consistent dosing

In 2024, Liquid held a dominant market position, capturing more than a 77.4% share in the Essential Oils and Plant Extract for Livestock Market. The preference for liquid formulations is driven by their easy integration into feed and water systems, allowing uniform distribution and accurate dosing across large herds or flocks. Liquids also offer better bioavailability, ensuring faster absorption and improved efficacy in enhancing animal health and performance. By 2025, demand for liquid forms is expected to remain strong, supported by advancements in emulsification technology, extended shelf life, and the growing adoption of automated dosing systems in modern livestock farms. Their convenience and adaptability make them the go-to choice for both small and large-scale producers.

By Function Analysis

Gut Health dominates with 38.3% due to its role in boosting immunity and feed efficiency

In 2024, Gut Health held a dominant market position, capturing more than a 38.3% share in the Essential Oils and Plant Extract for Livestock Market. This dominance reflects the livestock industry’s focus on improving nutrient absorption, enhancing immunity, and reducing reliance on antibiotics through natural solutions. Essential oils and plant extracts targeting gut health help maintain a balanced microbiota, reduce pathogenic bacteria, and improve feed conversion ratios—key priorities for poultry, swine, and ruminant production. By 2025, demand for gut health applications is projected to grow further as producers adopt preventive health strategies and comply with stricter food safety and antimicrobial resistance regulations, ensuring consistent productivity and animal welfare.

By Livestock Analysis

Poultry dominates with 44.7% due to high production volumes and feed efficiency needs

In 2024, Poultry held a dominant market position, capturing more than a 44.7% share in the Essential Oils and Plant Extract for Livestock Market. The poultry sector’s rapid production cycles, high feed intake, and sensitivity to gut health challenges make it a prime user of essential oils and plant extracts. These additives help improve digestion, enhance immunity, and reduce the incidence of enteric diseases without relying on antibiotic growth promoters. By 2025, poultry’s share is expected to remain strong as global demand for chicken meat and eggs continues to rise, supported by growing consumer preference for antibiotic-free and naturally raised products, particularly in Asia-Pacific and Latin America.

Key Market Segments

By Type

- Essential Oils

- Plant Extracts

By Form

- Liquid

- Solid

By Function

- Gut Health

- Immunity

- Yield

- Others

By Livestock

- Poultry

- Cattle

- Swine

- Aquatic

- Others

Emerging Trends

Adoption of Natural Feed Additives in Livestock Nutrition

A significant trend in the livestock sector is the increasing adoption of natural feed additives, particularly essential oils and plant extracts, as alternatives to synthetic antibiotics. This shift is driven by growing consumer demand for antibiotic-free meat and dairy products, concerns over antimicrobial resistance (AMR), and a broader movement towards sustainable and ethical farming practices. For instance, in 2023, a study highlighted that rosemary oil improved feed efficiency in dairy cattle by 15%.

Governments are actively supporting this transition through various initiatives. In India, the Department of Animal Husbandry and Dairying launched the National Livestock Mission (NLM) during the 12th Five-Year Plan to enhance livestock productivity and improve feed and fodder availability. The NLM includes a sub-mission on feed and fodder development, which aims to promote the use of quality feed additives, including natural alternatives like essential oils and plant extracts.

Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), established with a corpus of ₹15,000 crore, provides financial assistance to private investors and entrepreneurs for setting up animal feed plants. This fund encourages the production and utilization of quality feed additives, facilitating the incorporation of natural ingredients into livestock nutrition.

These government-backed initiatives are instrumental in promoting the use of natural feed additives, aligning with the global trend towards healthier and more sustainable livestock production. By supporting the adoption of essential oils and plant extracts, these programs contribute to improved animal health, reduced reliance on antibiotics, and enhanced consumer confidence in livestock products.

Drivers

Natural Alternatives to Antibiotics: A Growing Necessity

One of the most compelling reasons for integrating essential oils and plant extracts into livestock feed is the escalating concern over antimicrobial resistance (AMR). AMR arises when bacteria evolve to resist the effects of medications that once killed them, rendering standard treatments ineffective. This phenomenon poses a significant threat to both human and animal health.

In response to this growing challenge, many governments worldwide are implementing stricter regulations on the use of antibiotics in livestock. For instance, the European Union has banned the routine use of antibiotics as growth promoters in farmed animals, allowing their use only for treating individual sick animals. This policy shift is pushing farmers to seek alternative solutions to maintain animal health and productivity.

Essential oils and plant extracts offer a promising natural alternative. These plant-derived substances possess antimicrobial properties that can help control harmful bacteria in livestock without contributing to AMR. For example, studies have shown that incorporating eucalyptus oil in pig feed can reduce respiratory issues by up to 30%.

In India, the government is actively supporting the adoption of such natural alternatives. The National Livestock Mission Scheme provides a 50% capital subsidy, up to INR 50 lakh, for developing infrastructure related to feed and fodder processing. This initiative encourages private entrepreneurs and startups to invest in sustainable animal feed production, including the incorporation of essential oils and plant extracts.

Restraints

High Costs and Limited Access: Barriers to Widespread Adoption

Despite the growing interest in essential oils and plant extracts as natural additives in livestock feed, the high cost and limited availability of these products pose significant challenges, particularly for small-scale and resource-constrained farmers. The extraction and processing of essential oils are resource-intensive, leading to elevated prices that may not be economically viable for all producers. For instance, the elevated prices of essential oils and plant extracts can be a barrier for smaller livestock producers or those operating in price-sensitive markets.

In regions like sub-Saharan Africa, where agriculture is predominantly smallholder-based, the adoption of such natural additives is hindered by both cost and access. A 2023 study revealed that only 12% of livestock farmers in sub-Saharan Africa were familiar with natural feed additives. This lack of awareness, coupled with financial constraints, limits the widespread use of essential oils and plant extracts in these areas.

Furthermore, the regulatory landscape can add complexity to the adoption process. In the European Union, for example, phytogenic products must undergo a rigorous authorization process as feed additives, which includes comprehensive safety and efficacy evaluations by the European Food Safety Authority (EFSA). This process, while ensuring product safety, can be time-consuming and costly, potentially deterring smaller producers from pursuing certification.

Addressing these challenges requires concerted efforts from both the public and private sectors. Governments can play a pivotal role by offering subsidies or financial incentives to offset the initial costs associated with adopting natural feed additives. For example, providing capital subsidies for infrastructure development related to feed and fodder processing can encourage investment in sustainable practices. Additionally, enhancing awareness through training programs and extension services can equip farmers with the knowledge needed to make informed decisions about incorporating essential oils and plant extracts into livestock diets.

Opportunity

Government Support for Livestock Feed Innovation

A significant opportunity for the growth of essential oils and plant extracts in livestock feed lies in the Indian government’s robust support for feed and fodder infrastructure development. Through the National Livestock Mission (NLM), the government offers a 50% capital subsidy, up to ₹50 lakh, for establishing feed and fodder processing units, including facilities for hay, silage, total mixed ration (TMR) preparation, and fodder block making.

For instance, in Uttar Pradesh, 145 NLM-Entrepreneurship Development Programme (EDP) projects have been approved, with a total sanctioned subsidy of ₹32.91 crore. These projects are expected to contribute to an annual fodder production capacity of 28,000 metric tonnes, supporting the induction of 30,371 livestock and 2,200 poultry birds into the system.

This initiative is particularly beneficial for small and medium-sized enterprises (SMEs), Farmer Producer Organizations (FPOs), Self-Help Groups (SHGs), and individual entrepreneurs. The subsidy aims to enhance the availability and quality of animal feed, thereby improving livestock productivity and supporting sustainable farming practices.

This government-backed financial assistance not only reduces the financial burden on entrepreneurs but also encourages the adoption of innovative and sustainable feed solutions, including the incorporation of essential oils and plant extracts. By leveraging these subsidies, stakeholders can enhance the nutritional quality of livestock feed, improve animal health, and contribute to the overall growth of the livestock sector.

Regional Insights

Asia Pacific leads with 44.70% share and USD 1.2 Bn in 2024

In 2024, Asia Pacific held a dominant market position, capturing 44.70% of the Essential Oils and Plant Extract for Livestock market, valued at about USD 1.2 Bn. The region’s edge comes from its very large poultry and dairy bases (China, India, Indonesia, Thailand) and the rapid shift toward antibiotic-stewardship programs that push farmers to use natural gut-health solutions in concentrates and water lines.

Liquid essential-oil blends gain traction in integrated broiler operations because they dose evenly at scale and help maintain uniform flock performance. In swine and ruminants, plant extracts focused on digestion and immunity are being built into premixes to support feed conversion and reduce health setbacks during heat stress.

Modern feed mills across India and Southeast Asia are upgrading emulsification and microencapsulation, improving shelf life and palatability—key for high-throughput production. Contract growers also favor water-soluble formats that cut labor and support fast turnaround cycles.

Asia Pacific is expected to extend its lead on the back of expanding chilled and processed poultry demand, retailer programs favoring “antibiotic-responsible” sourcing, and more targeted blends (thymol, carvacrol, citrus bioflavonoids) designed for region-specific challenges like coccidiosis pressure and density-driven gut issues. Partnerships between additive formulators, integrators, and veterinary networks should widen distribution, while on-farm data logging and automated dosing improve ROI visibility, reinforcing Asia Pacific’s position as the growth engine for essential oils and plant extracts in livestock nutrition.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

IDENA SAS specializes in producing natural essential oils and plant extracts for the livestock industry. With a focus on sustainable and high-quality solutions, the company offers products that support animal health, productivity, and wellbeing. IDENA’s offerings are based on scientific research and tailored to meet the specific needs of various livestock, improving feed palatability and enhancing digestive health.

Kemin Industries is a global leader in the development of innovative nutritional products for the livestock sector. The company offers a range of essential oils and plant extracts that support animal health, performance, and immunity. Kemin’s products are designed to enhance feed efficiency and boost the overall growth of animals, promoting sustainable farming practices.

Novus International, Inc. is renowned for its cutting-edge solutions in animal nutrition and health, including essential oils and plant extracts. The company’s portfolio includes products that improve livestock performance, support immune health, and optimize feed efficiency. Novus emphasizes sustainability in its product development, ensuring that its solutions are not only effective but environmentally friendly.

Top Key Players Outlook

- IDENA SAS

- Kemin Industries, Inc.

- Novus International, Inc.

- DSM N.V.

- Trouw Nutrition Hifeed BV

- Phytosynthese

- Olmix S.A.

- Herbarom Laboratoire

- Orffa

- Indian Herbs Specialties Pvt. Ltd.

- Sensnutrition

Recent Industry Developments

In 2024, DSM N.V. participated in industry events such as EuroTier 2024, where they showcased their innovations in sustainable feed and farming solutions.

In 2024, Kemin introduced VANNIX™ C4, a phytogenic feed additive combining oregano essential oil, yucca extract, and tannic acid to support gut health in poultry.

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Essential Oils, Plant Extracts), By Form (Liquid, Solid), By Function (Gut Health, Immunity, Yield, Others), By Livestock (Poultry, Cattle, Swine, Aquatic, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape IDENA SAS, Kemin Industries, Inc., Novus International, Inc., DSM N.V., Trouw Nutrition Hifeed BV, Phytosynthese, Olmix S.A., Herbarom Laboratoire, Orffa, Indian Herbs Specialties Pvt. Ltd., Sensnutrition Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Essential Oils And Plant Extract For Livestock MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Essential Oils And Plant Extract For Livestock MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IDENA SAS

- Kemin Industries, Inc.

- Novus International, Inc.

- DSM N.V.

- Trouw Nutrition Hifeed BV

- Phytosynthese

- Olmix S.A.

- Herbarom Laboratoire

- Orffa

- Indian Herbs Specialties Pvt. Ltd.

- Sensnutrition