Global Esports Education Market Size, Share and Analysis Report By Course Type (Professional Player Training, Coaching & Management, Game Development, Broadcasting & Production, Others), By Learning Mode (Online Courses, In-person Training, Others), By End-User (Individual, Esports Organizations, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177079

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Course Type

- By Learning Mode

- By End User

- Regional Perspective

- Increasing Adoption Technologies

- Investment and Business Benefits

- Competitive Analysis

- Recent Developments

- Key Market Segments

- Report Scope

Report Overview

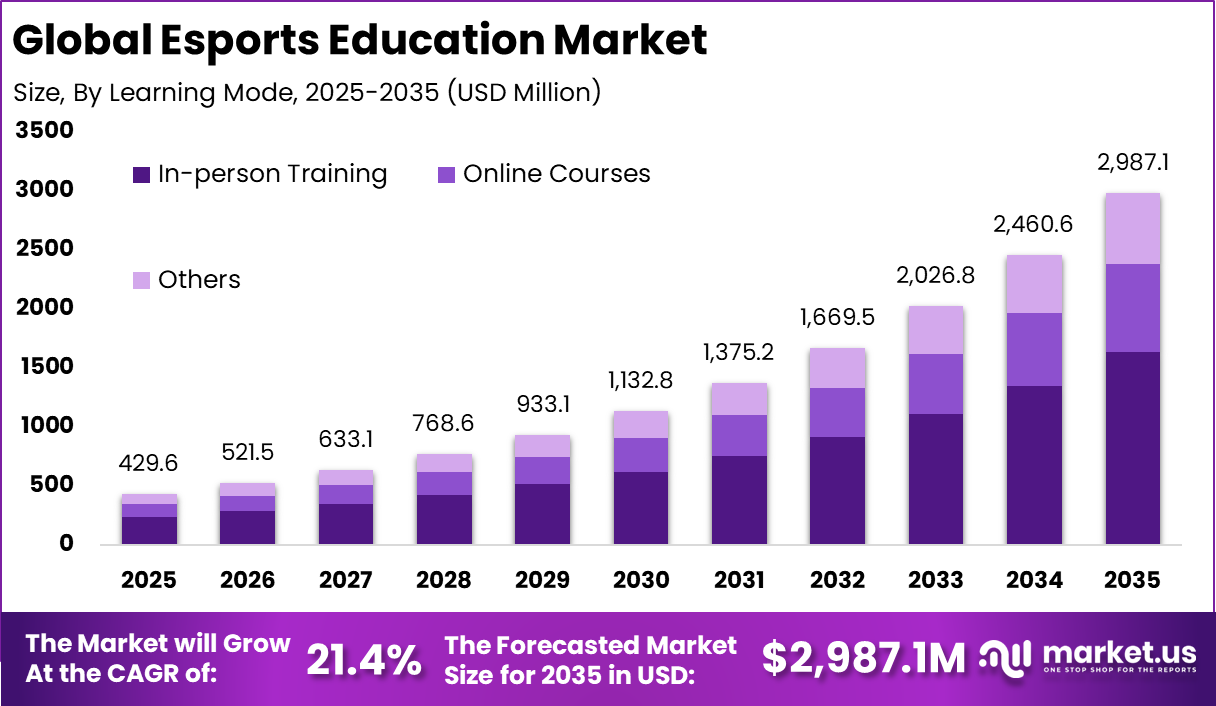

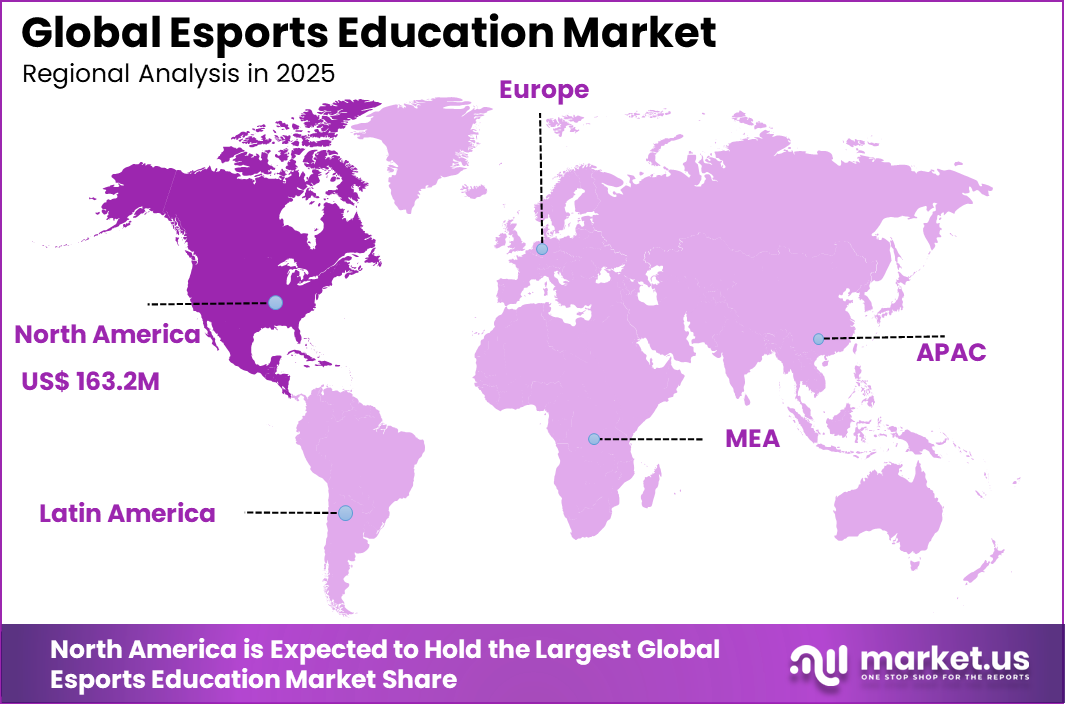

The Global Esports Education Market size is expected to be worth around USD 2,987.1 Million By 2035, from USD 429.6 Million in 2025, growing at a CAGR of 21.4% during the forecast period from 2026 to 2035. North America held a dominant Market position, capturing more than a 38% share, holding USD 163.2 Million revenue.

The Esports Education Market refers to structured academic and training programs focused on competitive gaming, esports management, and related digital skills. These programs are offered through schools, colleges, universities, and private training institutes. Education in this field covers both player development and non playing career paths such as event operations, broadcasting, analytics, coaching, and business management. The market has emerged as esports transitions from informal competition to a professionally organized industry.

Esports education is increasingly viewed as a skill based pathway aligned with digital careers. Institutions are integrating esports into existing curricula to attract students interested in gaming and technology. Industry observations indicate that more than 50% of higher education institutions offering esports programs focus on management, production, and analytics rather than professional gameplay alone. This reflects a broadening educational scope beyond competitive performance.

One of the main driving factors is the rapid professionalization of the esports industry. Organized leagues, structured tournaments, and commercial sponsorships have increased the need for trained professionals. Esports organizations require skilled staff across operations, marketing, and technology roles. Education programs respond to this demand by formalizing skill development.

Demand for esports education is rising among students seeking alternative career paths linked to digital entertainment. Traditional sports management and media programs are being complemented by esports focused tracks. Surveys show that nearly 45% of esports program participants pursue non player career roles. This demand highlights the importance of structured education beyond gameplay skills.

Top Market Takeaways

- By course type, professional player training led the Esports Education Market with a 42.6% share, reflecting strong interest in competitive skill development.

- By learning mode, in person training remained the preferred format, accounting for 54.8% of total enrollment.

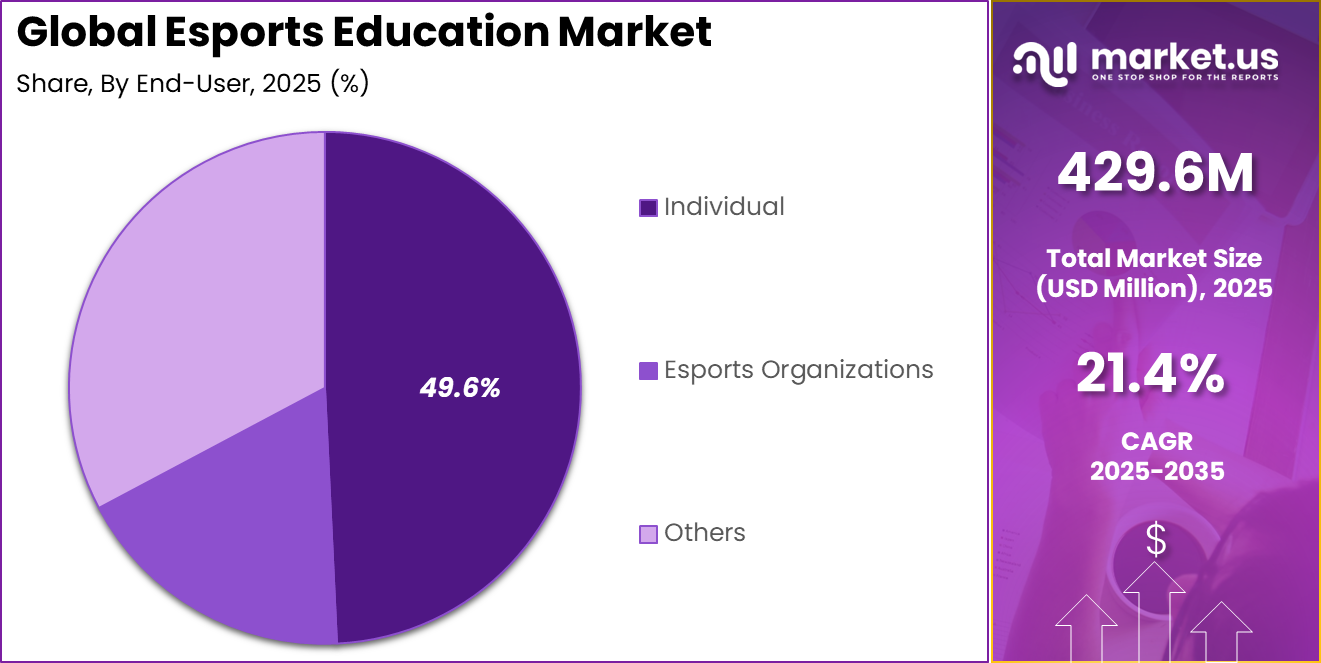

- By end user, individual learners held a 49.6% share, supported by self driven career and skill building goals.

- Regionally, North America dominated the market with a 38% share, supported by established esports ecosystems.

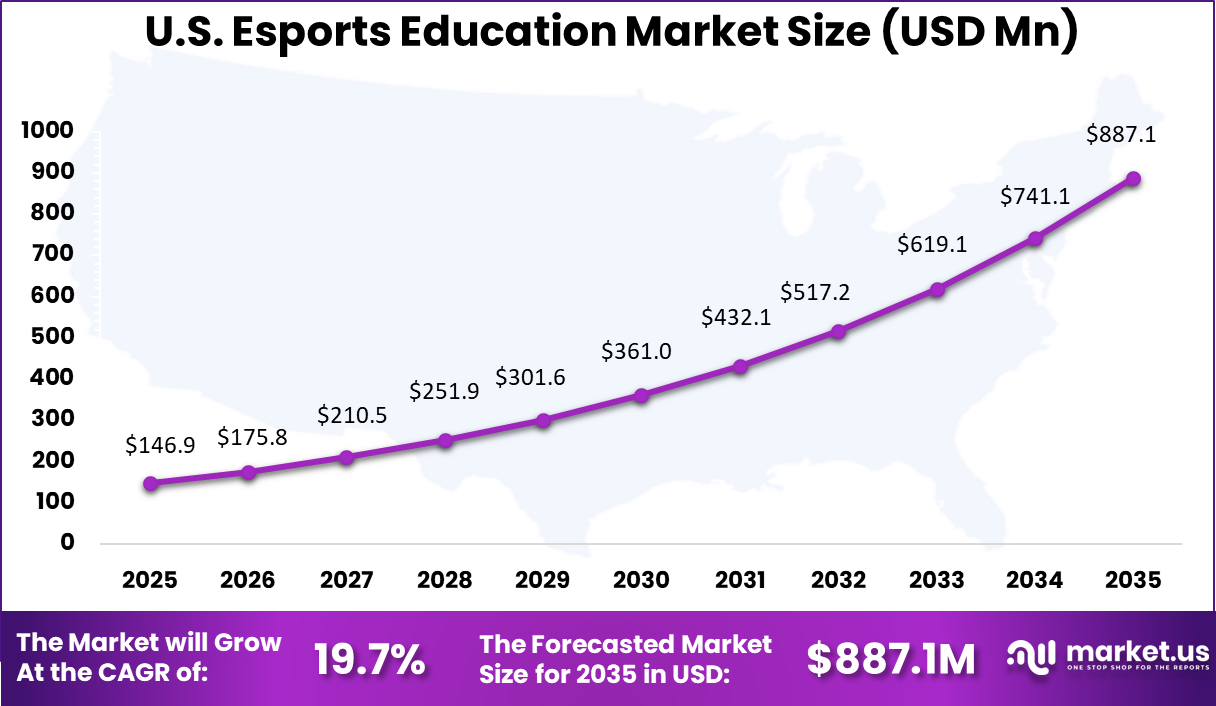

- In the US, the Esports Education Market reached USD 146.9 million and recorded a CAGR of 19.7%, driven by rising institutional support and career focused programs.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rapid professionalization of esports and competitive gaming +5.8% North America, Europe Short to medium term Growing demand for structured esports training and certification +4.6% North America, Asia Pacific Medium term Expansion of esports programs in universities and colleges +4.1% North America, Europe Medium term Rising career opportunities in esports management and production +3.5% Global Medium term Increased youth engagement in gaming and digital content creation +3.4% Asia Pacific, North America Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Limited standardization of esports curricula -3.1% Global Medium term Perceived career risk and lack of long-term job security -2.7% Global Short to medium term High infrastructure and technology setup costs -2.4% Emerging Markets Medium term Limited institutional funding in developing regions -2.0% Asia Pacific, Latin America Medium term Regulatory uncertainty around esports recognition -1.6% Europe Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook EdTech and digital learning platforms Very High Medium North America, Europe Strong subscription-based growth Universities and academic institutions High Low to Medium Global Strategic curriculum expansion Esports organizations and training academies High Medium North America, Asia Pacific Talent pipeline development Private equity firms Medium Medium North America, Europe Scalable education platform plays Venture capital investors High High North America Early-stage esports learning innovation Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Online learning platforms and LMS for esports education +4.9% Remote skill development Global Short term Game analytics and performance tracking tools +4.2% Player improvement and coaching North America, Asia Pacific Medium term AI-driven coaching and gameplay analysis +3.6% Personalized training Global Medium term Virtual and augmented reality training environments +2.9% Immersive learning North America, Europe Medium to long term Cloud-based collaboration and tournament simulation tools +2.3% Team strategy development Global Long term By Course Type

Professional player training accounts for 42.6% of overall adoption in the Esports Education Market. This dominance reflects strong interest among aspiring players who seek structured coaching to improve competitive performance. Training programs focus on game mechanics, strategy development, and reaction optimization.

The demand for professional player training is also driven by the increasing visibility of esports as a viable career path. Organized tournaments and league structures encourage players to pursue formal skill development. Education providers respond by offering specialized curricula aligned with competitive standards.

Professional training programs further emphasize discipline and performance consistency. Coaching frameworks include mental conditioning and teamwork practices. These elements support sustained demand for this course type.

By Learning Mode

In person training represents 54.8% of total adoption by learning mode. This preference is influenced by the hands on nature of esports coaching. Face to face interaction allows real time feedback and supervised practice sessions.

In person environments also support access to specialized equipment and training facilities. Dedicated gaming setups improve learning outcomes through controlled conditions. This enhances skill acquisition and performance assessment.

Social interaction further strengthens the appeal of in person learning. Team based drills and peer competition contribute to motivation and engagement. These factors maintain the dominance of in person training.

By End User

Individual learners account for 49.6% of total end user demand in the Esports Education Market. This segment includes students pursuing esports training independently rather than through institutional programs. Personal interest and career ambition drive enrollment.

Individual learners value flexible course structures and personalized coaching. Tailored training plans address specific skill gaps and performance goals. This customization supports higher adoption among individuals.

The growth of online communities and streaming culture also influences this segment. Aspiring players seek education to improve visibility and competitiveness. These trends sustain strong demand from individual end users.

Regional Perspective

North America holds a leading position in the Esports Education Market, accounting for 38% of total activity. The region benefits from a well developed esports ecosystem and high awareness of competitive gaming careers.

Educational programs are increasingly formalized. Strong institutional support and private training academies further reinforce regional adoption. Youth engagement and digital literacy remain high. These factors support North America’s leadership position.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 146.9 Mn and a growth rate of 19.7% CAGR. Expansion is supported by rising participation in organized esports and increased demand for structured training pathways. Education offerings continue to diversify.

Adoption in the U.S. is influenced by media exposure and sponsorship activity. Individual learners and aspiring professionals seek recognized training credentials. These dynamics collectively support strong growth in the U.S. market segment.

Increasing Adoption Technologies

Learning platforms and simulation tools are being widely adopted in esports education programs. Game analytics software, broadcast production tools, and performance tracking systems support practical learning. These technologies allow students to gain hands on experience in real world esports environments. Technology integration improves learning relevance and outcomes.

Online learning technologies are also expanding program reach. Virtual classrooms and remote competition platforms allow institutions to deliver esports education without physical constraints. This flexibility supports global participation and collaboration. Technology adoption enables scalable and inclusive education models.

Institutions adopt advanced technologies to align education with industry practices. Esports careers require familiarity with digital tools and data driven decision making. Practical exposure improves employability and skill readiness. Technology based learning reduces the gap between education and professional application.

Another reason is student engagement. Interactive platforms and real time feedback improve learning motivation. Esports students respond positively to experiential learning models. Technology adoption therefore supports both educational quality and retention.

Investment and Business Benefits

Investment opportunities exist in curriculum development platforms and training infrastructure tailored to esports education. Institutions seek standardized content aligned with industry needs. Investors are focusing on scalable education models that can be deployed across regions. This creates potential for long term growth.

There are also opportunities in certification and credentialing programs. As the esports workforce grows, employers value recognized qualifications. Education providers that offer validated certifications attract strong interest. This segment supports recurring enrollment and institutional partnerships.

For educational institutions, esports programs attract new student segments and diversify academic offerings. These programs increase campus engagement and digital relevance. Institutions also benefit from partnerships with technology and event organizations. Over time, esports education enhances institutional competitiveness.

For students, esports education provides structured career pathways in a growing digital sector. Skills learned extend beyond gaming into media, analytics, and management roles. This improves employability and career flexibility. The value proposition supports sustained participation.

Competitive Analysis

Training and coaching-focused platforms such as Gankster, GamerSensei, and Metafy form the core of the esports education market. These platforms provide structured coaching, skill assessment, and personalized training sessions. AI-driven analytics and performance feedback improve learning outcomes. They are widely adopted by amateur and semi-professional players.

Education and ecosystem builders such as Generation Esports, NASEF, and College Esports League focus on academic integration and structured programs. Esports Training Ground and Esports Academy support curriculum development, tournaments, and certifications. These players work closely with schools and universities. Adoption is supported by rising acceptance of esports within formal education systems.

Infrastructure and content-driven providers such as Nerd Street Gamers, Esports Tower, and Skillshot Media expand access through physical venues and digital content. LeagueSpot and Gameplan add performance tracking and analytics. Other regional players increase competition and specialization. This landscape supports steady growth of structured esports education globally.

Top Key Players in the Market

- Gankster

- Esports Training Ground

- GamerSensei

- Metafy

- Generation Esports

- Esports Entertainment

- Nerd Street Gamers

- LeagueSpot

- NASEF

- Skillshot Media

- Esports Academy

- College Esports League

- Esports Tower

- Gameplan

- Others

Recent Developments

- June, 2025 – Nerd Street Gamers: Nerd Street secured $11.5 million from Founders Fund to build its digital esports platform. Funds go to online camps, leagues, and coaching while venues stay shut.

- June, 2025 – Metafy bought GamerzClass, its rival coaching platform, after raising $25 million in Series A from Tiger Global. This adds more game classes and experts to their lineup. It helps gamers get personalized training faster across titles like League and Valorant.

Key Market Segments

By Course Type

- Professional Player Training

- Coaching & Management

- Game Development

- Broadcasting & Production

- Others

By Learning Mode

- Online Courses

- In-person Training

- Others

By End-User

- Individual

- Esports Organizations

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Report Scope

Report Features Description Market Value (2025) USD 429.6 Mn Forecast Revenue (2035) USD 2,987.1 Mn CAGR(2026-2035) 21.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Course Type (Professional Player Training, Coaching & Management, Game Development, Broadcasting & Production, Others), By Learning Mode (Online Courses, In-person Training, Others), By End-User (Individual, Esports Organizations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Gankster, Esports Training Ground, GamerSensei, Metafy, Generation Esports, Esports Entertainment, Nerd Street Gamers, LeagueSpot, NASEF, Skillshot Media, Esports Academy, College Esports League, Esports Tower, Gameplan, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gankster

- Esports Training Ground

- GamerSensei

- Metafy

- Generation Esports

- Esports Entertainment

- Nerd Street Gamers

- LeagueSpot

- NASEF

- Skillshot Media

- Esports Academy

- College Esports League

- Esports Tower

- Gameplan

- Others