Global ESG Software Market Size, Share, Industry Analysis Report By Type (Environmental Management Software, Social Management Software, Governance Management Software, Others), By Organization Size (Small and Medium-sized Enterprises(SMEs), Large Enterprises), By Deployment (On-premise, Cloud), By Industry Vertical (BFSI, Energy and Utilities, Manufacturing, Healthcare, Retail, IT and Telecommunications, Government and Public Sector, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158866

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Review

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- By Type

- By Organization

- By Deployment

- By Industry Vertical

- Key Market Segments

- Emerging Trends

- Growth Factors

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Review

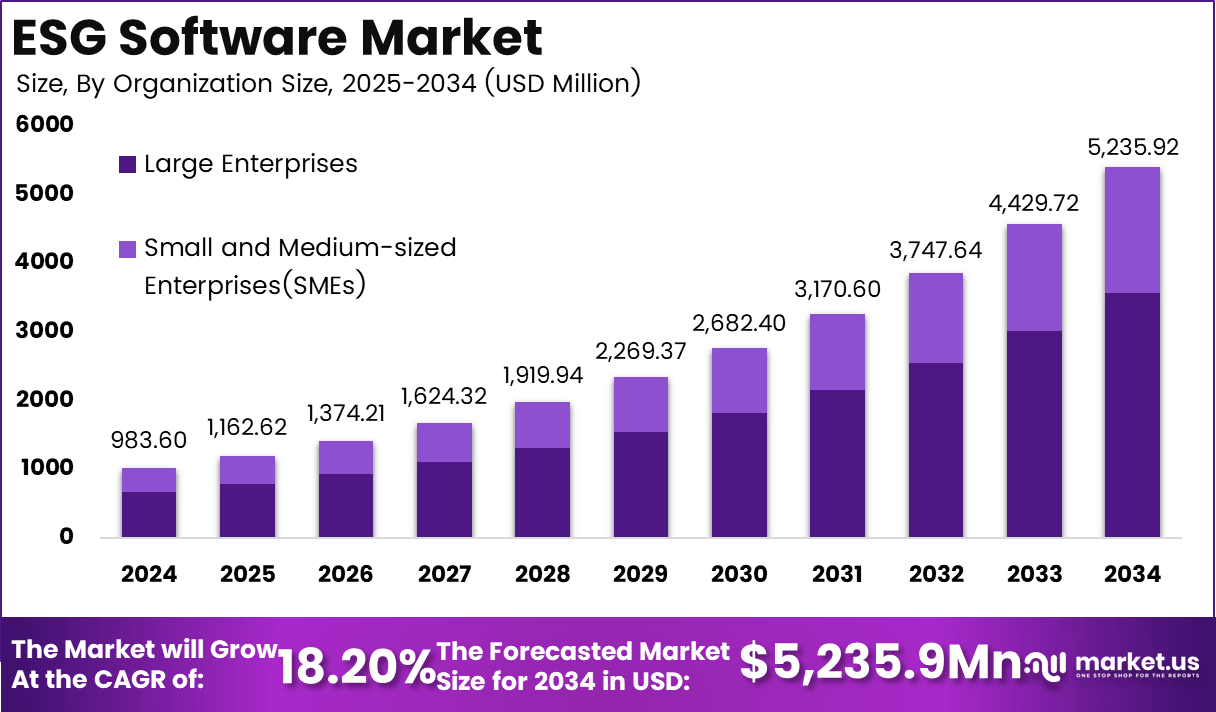

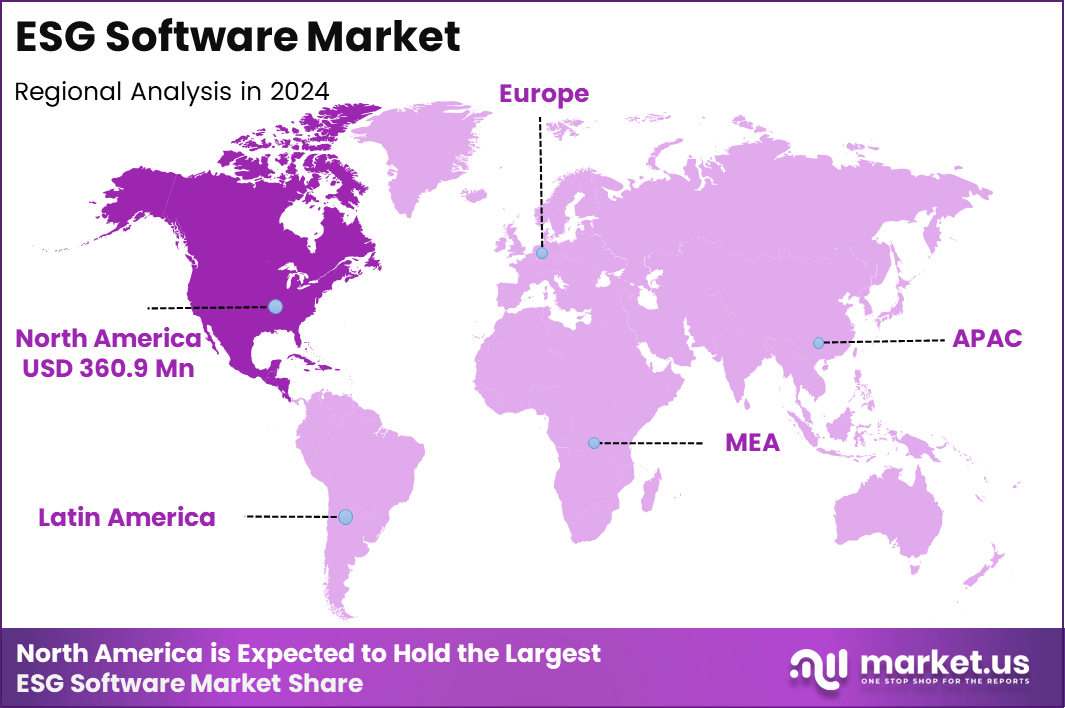

The Global ESG Software Market size is expected to be worth around USD 5,235.9 Million By 2034, from USD 983.6 Million in 2024, growing at a CAGR of 18.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36.7% share, holding USD 360.9 Million revenue.

The ESG Software Market includes software systems and platforms designed to help organizations measure, monitor, analyze, report, and manage environmental, social, and governance (ESG) data. These tools support tasks such as emissions tracking, supply chain risk assessment, stakeholder reporting, compliance with sustainability standards, scenario analysis, and data assurance.

In many firms, ESG software is integrated into corporate performance management, risk management, and investor relations workflows. For instance, In September 2024, SAP and Thomson Reuters integrated OneSource Statutory Reporting with SAP’s Sustainability Control Tower, providing enterprises with a unified ESG reporting solution. This move reflects rising demand for tools that address complex regulations and stakeholder expectations.

One major driver is regulatory pressure: governments and regulators in Europe, the U.S., and many other regions are introducing mandatory ESG or sustainability disclosure requirements. Organizations face fines, reputational risk, or exclusion from investment if they fail to report accurately.

Another driver is investor and stakeholder demand: institutional investors, asset managers, and shareholders increasingly evaluate ESG metrics and require transparent data. A third factor is digital transformation: many companies are automating ESG processes to reduce manual work, improve data quality, and scale reporting across multiple business units.

According to Market.us, The Global Environmental, Social and Governance (ESG) Consulting Market is expected to reach USD 39 billion by 2034, up from USD 8.12 billion in 2024, registering a CAGR of 16.90% between 2025 and 2034. In 2024, North America dominated the market with over 42.15% share, accounting for USD 3.4 billion in revenue.

Key Takeaways

- By type, Environmental Management Software accounted for 36.6%, showing its importance in monitoring and managing sustainability performance.

- By organization size, Large Enterprises led with 68.1%, reflecting higher adoption among corporates with structured ESG strategies and reporting needs.

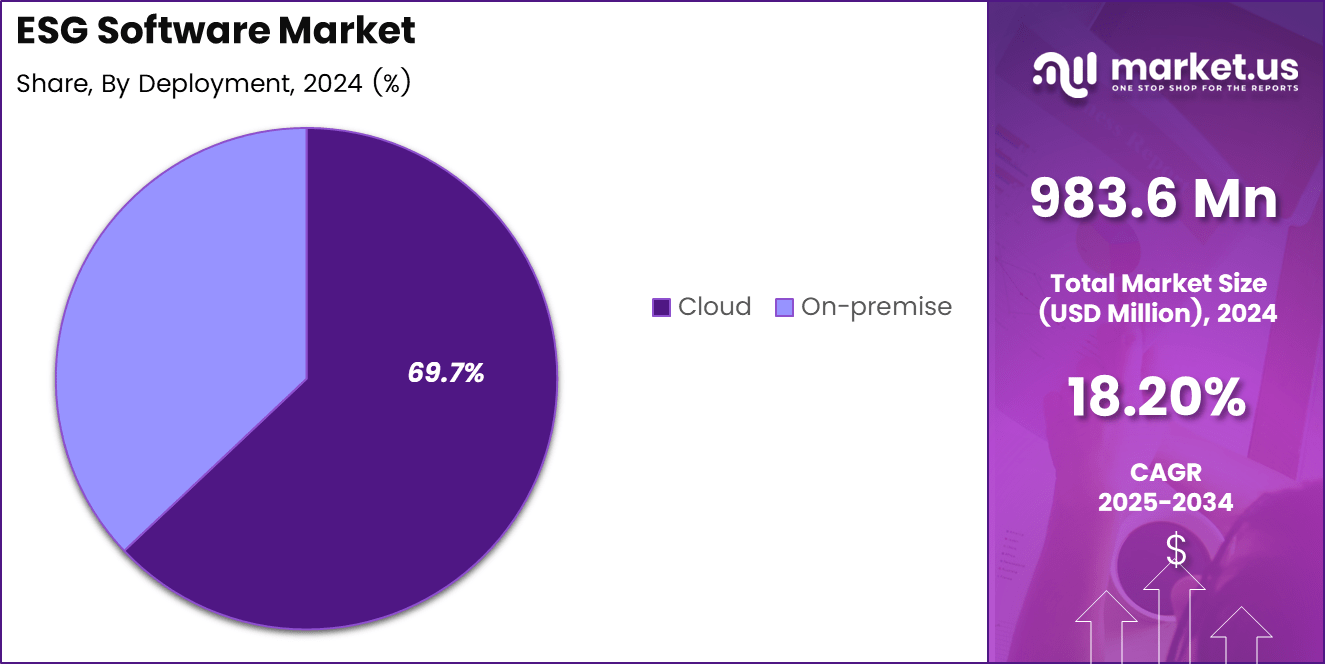

- By deployment, the Cloud segment dominated with 69.7%, highlighting the growing reliance on scalable and flexible cloud platforms for ESG data management.

- By industry vertical, BFSI held 19.7%, underscoring the sector’s focus on regulatory compliance and sustainable finance practices.

- Regionally, North America captured 36.7% of the market, supported by strong regulatory frameworks and corporate responsibility initiatives.

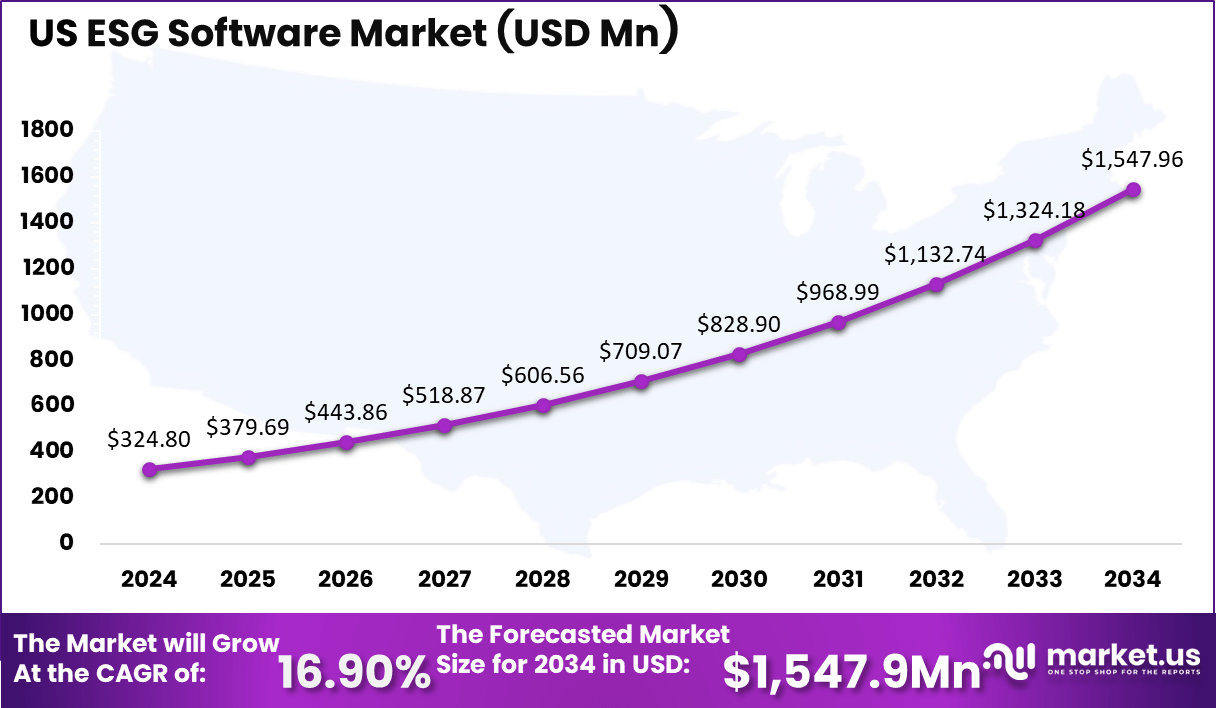

- Within the region, the U.S. market generated USD 324.8 million, expanding at a healthy CAGR of 16.9%, positioning it as a key growth driver globally.

Analysts’ Viewpoint

ESG software is increasingly incorporating technologies such as artificial intelligence and machine learning for anomaly detection, trend forecasting, and data gap filling. Blockchain or distributed ledger elements are explored to ensure auditability and traceability of sustainability data.

Natural language processing is used to extract structured ESG metrics from text disclosures or corporate reports. Cloud deployment is dominant, enabling scalable, multi-user access and real time collaboration across locations.

Organizations adopt ESG software to reduce the complexity of collecting, validating, and consolidating ESG data from disparate systems and units. A unified platform helps ensure data consistency, reduces errors, and increases audit readiness. It supports more credible and transparent reporting to regulators, investors, and other stakeholders.

Role of Generative AI

Generative AI is playing an increasingly critical role in ESG software by automating the integration and analysis of vast and often fragmented ESG data. It helps reduce manual errors, accelerates reporting speed, and enhances the accuracy of disclosures. Recent insights reveal that more than 80% of organizations expect to intensify their use of AI workflows, including generative AI, in ESG reporting over the next two years.

These AI tools automate real-time risk detection, regulatory compliance updates, and create tailored reports for various stakeholders, transforming ESG from a compliance burden into a strategic asset. By enabling executives to track ESG performance continuously and receive predictive insights, generative AI supports better decision-making and stakeholder trust in 2025.

Investment and Business Benefits

Investment opportunities in the ESG software space are significant, driven by regulatory enforcement timelines, rising digital maturity of organizations, and growing focus on sustainability-linked financial products. Vendors providing modular, scalable platforms that support multiple reporting standards and industries find rising demand.

Cloud-based delivery models appeal to a broad range of companies, including mid-market and small enterprises, increasing market penetration. The infusion of AI and IoT capabilities creates additional value, positioning ESG software as not only a compliance tool but also a strategic asset. Market growth is particularly rapid in regions with newly implemented or expanding ESG regulations, such as Europe and Asia Pacific.

Business benefits from ESG software include improved regulatory compliance through automated, standardized reporting, which helps avoid fines and legal risks. Companies gain better visibility into their environmental and social impacts, enabling targeted sustainability initiatives that can reduce costs, such as energy savings or waste reduction.

ESG software fosters transparency that enhances investor confidence and customer loyalty, offering a competitive advantage. Furthermore, it supports risk identification and scenario planning that increases organizational resilience against climate and social risks. Overall, ESG software contributes to long-term value creation by aligning business strategies with evolving socio-environmental expectations

US Market Size

The U.S. ESG Software Market was valued at USD 324.8 Million in 2024 and is anticipated to reach approximately USD 1,547.9 Million by 2034, expanding at a compound annual growth rate (CAGR) of 16.9% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 36.7% share and generating USD 360.9 million in revenue in the ESG software market. The region’s leadership is driven by the rapid adoption of sustainability reporting frameworks and the strong demand for transparency in corporate governance.

Companies in the United States and Canada are increasingly using ESG software to track carbon footprints, manage compliance with environmental regulations, and meet the rising expectations of investors who prioritize socially responsible practices. This proactive approach has positioned North America as the leading contributor to global market revenues.

The dominance of North America is further reinforced by strict regulatory requirements and growing pressure from stakeholders for greater accountability. Initiatives such as the SEC’s focus on climate-related disclosures in the U.S. have compelled organizations to invest in advanced ESG platforms that ensure accurate reporting and risk management.

By Type

In 2024, Environmental management software accounted for 36.6% of the ESG software market. This category is increasingly adopted by organizations aiming to monitor, reduce, and report their environmental footprint. The software helps track carbon emissions, manage energy consumption, and ensure compliance with environmental regulations, which is becoming a central part of sustainability reporting.

The growth in this segment is also supported by stakeholder expectations, as investors and consumers show greater interest in companies’ environmental practices. Businesses are integrating such tools to demonstrate transparency and align with global sustainability goals. This is making environmental management software the foundational layer of ESG technology adoption.

By Organization

In 2024, Large enterprises made up 68.1% of the demand for ESG software. Their adoption is driven by stricter disclosure requirements and the complexity of measuring sustainability across multiple regions and business units. These organizations need advanced systems to consolidate vast data across supply chains, facilities, and markets.

With greater public visibility, larger corporations face pressing pressure to disclose non-financial performance in structured and measurable ways. ESG software offers them scalable tools to minimize risks, reinforce governance frameworks, and respond to investor scrutiny more effectively than smaller organizations.

By Deployment

In 2024, Cloud-based deployment held 69.7% share in the ESG software market. The preference for cloud stems from its flexibility, scalability, and cost-effectiveness. Organizations prefer cloud models to manage ESG reporting frameworks centrally while enabling simple integrations with other enterprise systems like ERP, HR, and compliance platforms.

Adoption is also reinforced by the need for real-time data collection and analytics. Cloud ESG software offers continuous updates and seamless collaboration across geographies, which is particularly valuable for multinational companies aiming to unify their sustainability reporting processes.

By Industry Vertical

In 2024, The BFSI sector contributed 19.7% of market share. Banks, insurance providers, and financial institutions are under strong pressure from regulators and investors to monitor ESG risks in portfolios and lending practices. They rely on ESG software to conduct climate risk assessments, track sustainable finance initiatives, and ensure compliance with new reporting standards.

For this sector, ESG performance is tied not just to internal operations but also to investment decisions. By integrating ESG software, BFSI players enhance risk mitigation, align with sustainable finance frameworks, and improve trust among regulators and stakeholders.

Key Market Segments

By Organization Size

- Small and Medium-sized Enterprises(SMEs)

- Large Enterprises

By Deployment

- On-premise

- Cloud

By Industry Vertical

- BFSI

- Energy and Utilities

- Manufacturing

- Healthcare

- Retail

- IT and Telecommunications

- Government and Public Sector

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

One of the strongest trends in ESG software is the move toward cloud-based platforms, which offer scalability and real-time compliance advantages. Cloud solutions hold over 57% market share currently, expected to grow further due to increasing regulatory complexities.

Social and governance reporting tools are gaining momentum alongside traditional environmental modules, reflecting a broader view of ESG beyond just climate metrics. AI-driven analytics and automation, especially for Scope 3 emissions tracking, alongside blockchain for supply chain transparency, are shaping the future landscape.

Growth Factors

The primary growth drivers for ESG software include tightening regulations worldwide, investor demand for transparent sustainability metrics, and the need for companies to manage complex ESG risks efficiently. For instance, regulatory mandates like the Corporate Sustainability Reporting Directive in Europe require detailed ESG disclosures, impacting approximately 50,000 companies.

Investor emphasis on ESG considerations is strong, with over 75% of institutional investors integrating ESG metrics into their decision-making. Furthermore, the banking and financial sectors alone hold nearly 28% market share of ESG software users, highlighting the demand from heavily regulated industries. The integration of AI and automation to improve reporting accuracy also fuels adoption.

Top 5 Use Cases

- Sustainability tracking for regulatory compliance: This use case is expected to account for 25-30% of the market, driven by increasing regulatory demands for sustainability reporting and transparency.

- Governance reporting in large enterprises: Governance reporting is projected to hold 20-25% of the market share, particularly as large enterprises prioritize compliance with governance regulations.

- Carbon footprint management through real-time analytics: Real-time carbon footprint management is expected to represent 15-20% of the market, as organizations seek efficient ways to track and reduce their environmental impact.

- Data analytics for ESG performance improvement: The use of data analytics for ESG performance improvement is anticipated to comprise 18-22% of the market, with businesses focusing on optimizing sustainability efforts and making data-driven decisions.

- Supplier engagement for sustainability compliance: Supplier engagement in sustainability is expected to make up 12-15% of the market, driven by increasing demands for responsible sourcing and supply chain transparency.

Driver Analysis

Regulatory Pressure and Compliance

One key factor driving the ESG software market is the increasing regulatory pressure from governments and regulatory bodies worldwide. Organizations are now required to disclose detailed environmental, social, and governance data to comply with new standards such as the SEC climate disclosure rules in the U.S. and the Corporate Sustainability Reporting Directive (CSRD) in Europe.

These rules push companies to replace manual, fragmented reporting methods with digital ESG software platforms that automate data collection, enhance transparency, and improve compliance. For instance, firms use these tools to map their operations against recognized frameworks like GRI and SASB, reducing the risk of penalties and boosting investor confidence.

This regulatory push is compelling companies across sectors to invest in ESG software despite potential costs. It helps them meet compliance deadlines and respond to investor demands for verifiable and auditable sustainability practices. The pressure is particularly strong in regions like North America and Europe, where regulatory mandates are more rigorous, driving market growth significantly.

Restraint Analysis

High Implementation Costs

A major restraint restricting wider ESG software adoption is the high cost associated with implementing and maintaining these solutions. Small and medium enterprises, in particular, find it difficult to justify the upfront investment in ESG platforms, which can include licensing fees, integration expenses, and ongoing support.

The complexity of integrating ESG software with existing enterprise resource planning and governance systems adds to these costs. For example, aligning ESG metrics with fragmented data sources often requires customization and niche expertise, which raises expenses further. This cost barrier slows the pace at which some organizations transition from manual or spreadsheet-based tracking to sophisticated digital platforms.

Many organizations are hesitant to adopt ESG software without clear short-term returns, especially if they lack internal expertise in ESG matters. The restraint highlights a divide in adoption rates between larger businesses with dedicated sustainability budgets versus smaller firms that struggle to absorb additional costs.

Opportunity Analysis

Integration of AI and Advanced Analytics

There is a significant opportunity in the ESG software market through the incorporation of artificial intelligence and advanced analytics. AI-powered tools can automate ESG data anomaly detection, forecast emissions trajectories, and assess supplier risks in real time. For instance, companies are leveraging AI models to predict environmental impacts and optimize resource use, turning ESG data into actionable insights beyond simple compliance.

Further technological advances such as blockchain offer transformative potential by creating immutable, transparent records of sustainability data that enhance stakeholder trust. The demand for real-time data and predictive analytics is growing, providing software developers with avenues to innovate and differentiate their offerings. This opportunity meets the rising corporate need for scalable, intelligent solutions that improve ESG performance and facilitate sustainable growth.

Challenge Analysis

Lack of Standardized ESG Metrics

A key challenge facing the ESG software market is the absence of universal standards for measuring and reporting ESG factors. Different organizations may use varied frameworks, definitions, and data collection methodologies, leading to inconsistent reports that confuse investors and regulators.

For example, firms may report carbon emissions differently or vary in social responsibility metrics, making it difficult to benchmark sustainability performance across industries. This lack of standardization limits ESG software’s ability to deliver fully comparable and reliable data across companies and regions. It complicates integration efforts and undermines user confidence in the data’s accuracy.

Organizations must often invest significant effort in data cleansing and alignment before meaningful analysis is possible. This challenge reflects broader industry fragmentation and the need for coordinated global ESG guidelines to unlock the full potential of ESG reporting technologies.

Key Players Analysis

In the ESG software market, EcoVadis, Datamaran, Sustainalytics, and TruValue Labs are recognized as key players. Their platforms specialize in assessing environmental, social, and governance risks, offering companies actionable insights to strengthen compliance and sustainability strategies.

Other leading providers such as NAVEX Global, OneTrust, Refinitiv, and SAS Institute expand the market with broader governance, risk, and compliance solutions. Their platforms integrate ESG metrics into enterprise reporting and analytics, enabling companies to align with global standards and regulatory frameworks.

Additional contributors including Verisk 3E and Wolters Kluwer provide niche solutions tailored to regulatory compliance, environmental health, and sustainability reporting. Their expertise supports businesses in meeting strict disclosure requirements while minimizing operational risks.

Top Key Players

- Datamaran

- EcoVadis

- NAVEX Global, Inc.

- OneTrust, LLC

- Refinitiv

- SAS Institute Inc.

- Sustainalytics

- TruValue Labs

- Verisk 3E

- Wolters Kluwer N.V.

- Other

Recent Developments

- In June 2025, Datamaran launched a new product called Core, designed to help companies automate ESG risk assessments and improve compliance with global regulations. This platform is built to streamline ESG reporting, reduce manual work, and integrate ESG into strategic business decisions with audit-ready workflows.

- In May 2025, EcoVadis updated its assessment methodology to set higher transparency and documentation requirements with a more competitive medal system. It added a new AI-powered watch tool called 360 Watch, which scans public sources for ESG-related news, impacting company scores for extended periods.

Report Scope

Report Features Description Market Value (2024) USD 983.6 Mn Forecast Revenue (2034) USD 5,235.9 Mn CAGR(2025-2034) 18.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Environmental Management Software, Social Management Software, Governance Management Software, Others), By Organization Size (Small and Medium-sized Enterprises(SMEs), Large Enterprises), By Deployment (On-premise, Cloud), By Industry Vertical (BFSI, Energy and Utilities, Manufacturing, Healthcare, Retail, IT and Telecommunications, Government and Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datamaran, EcoVadis, NAVEX Global, Inc. , OneTrust, LLC, Refinitiv, SAS Institute Inc., Sustainalytics, TruValue Labs, Verisk 3E, Wolters Kluwer N.V., Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Datamaran

- EcoVadis

- NAVEX Global, Inc.

- OneTrust, LLC

- Refinitiv

- SAS Institute Inc.

- Sustainalytics

- TruValue Labs

- Verisk 3E

- Wolters Kluwer N.V.

- Other