Global ESG-Linked Insurance Market Size, Share, Industry Analysis Report By Type (ESG-Linked Life Insurance, ESG-Linked Property Insurance, ESG-Linked Investment Insurance, Green Energy Insurance, Others), By Application (Corporate ESG Compliance, Green Investments, Renewable Energy Projects, Sustainable Supply Chains, Others), By Distribution Channel (Direct Sales, Brokers and Agents), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167115

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

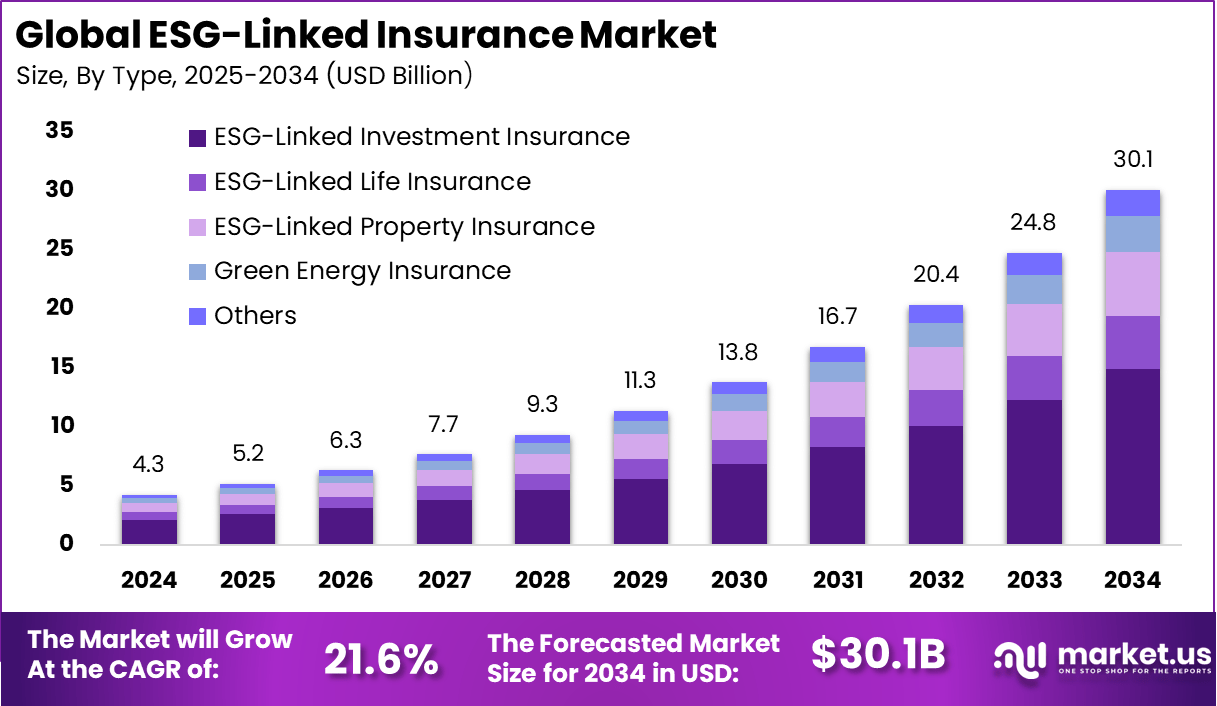

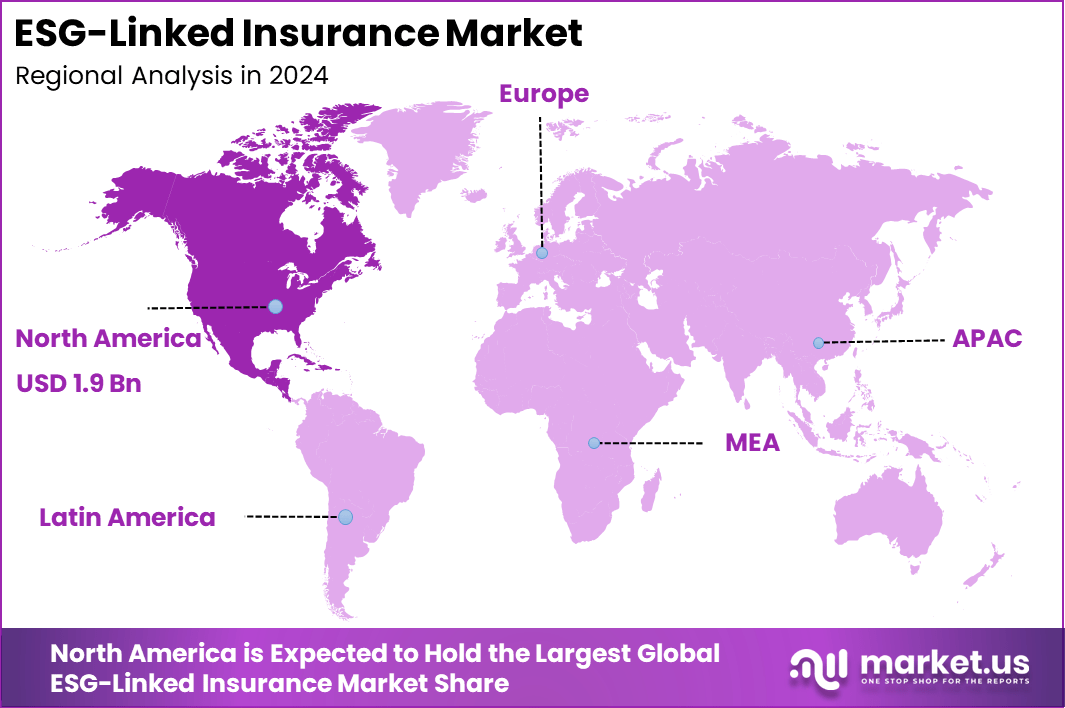

The Global ESG-Linked Insurance Market generated USD 4.3 billion in 2024 and is predicted to register growth from USD 5.2 billion in 2025 to about USD 30.1 billion by 2034, recording a CAGR of 21.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 45% share, holding USD 1.9 Billion revenue.

The ESG linked insurance market has expanded as insurers embed environmental, social and governance criteria into underwriting, pricing and risk assessment. Growth reflects rising investor expectations, corporate sustainability commitments and the broader transition toward responsible financial products. The market now includes policies that reward sustainable behaviour, incentivise climate risk mitigation and support socially responsible operations across industries.

The growth of the market can be attributed to increasing regulatory pressure on climate disclosure, rising demand for sustainable financial products and higher awareness of climate related risks. Organisations seek insurance solutions that align with their sustainability strategies and demonstrate responsible risk management. Strong interest in decarbonisation, ethical labour practices and governance transparency further accelerates market adoption.

Quick Market Facts

- ESG-Linked Investment Insurance led the market with a 49.6% share, reflecting strong interest in insurance products tied to sustainable investment performance and responsible portfolio strategies.

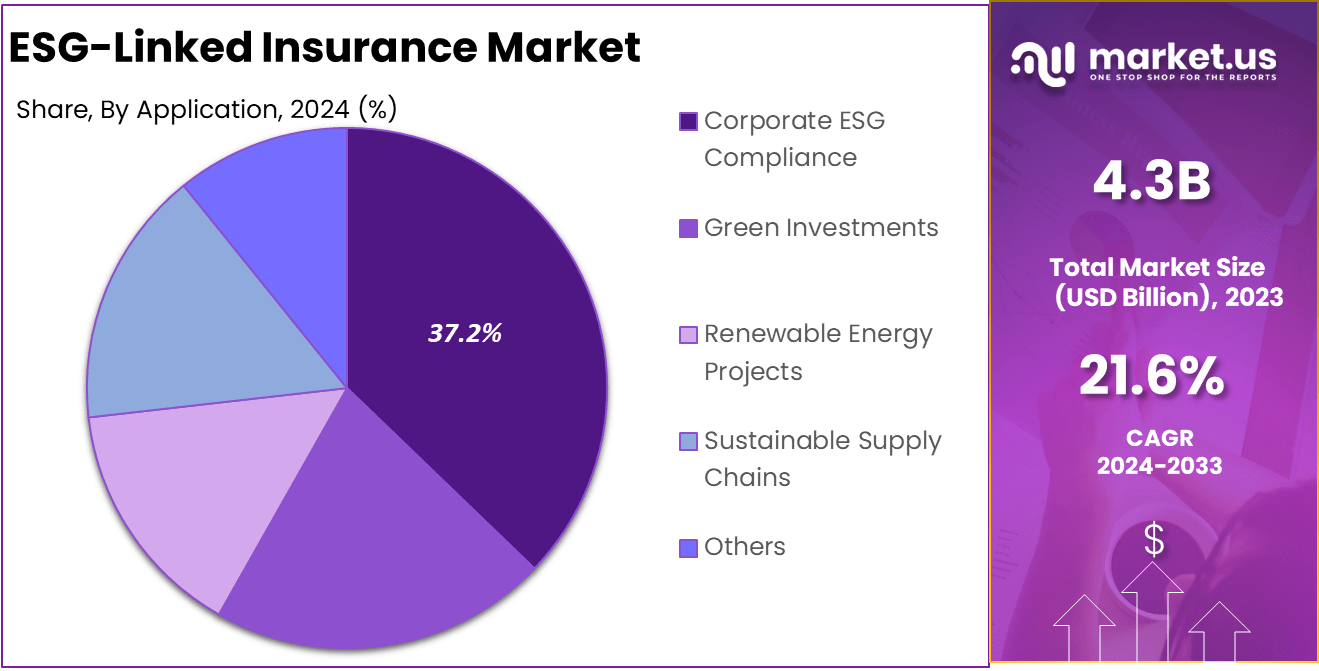

- Corporate ESG Compliance accounted for 37.2%, driven by rising regulatory expectations and the need for organizations to insure against ESG-related operational and disclosure risks.

- The Direct Sales channel dominated with 72.3%, indicating that businesses prefer direct engagement with insurers for specialized, compliance-focused ESG products.

- North America captured 45% of global demand, supported by advanced sustainability frameworks and strong adoption of ESG-aligned financial instruments.

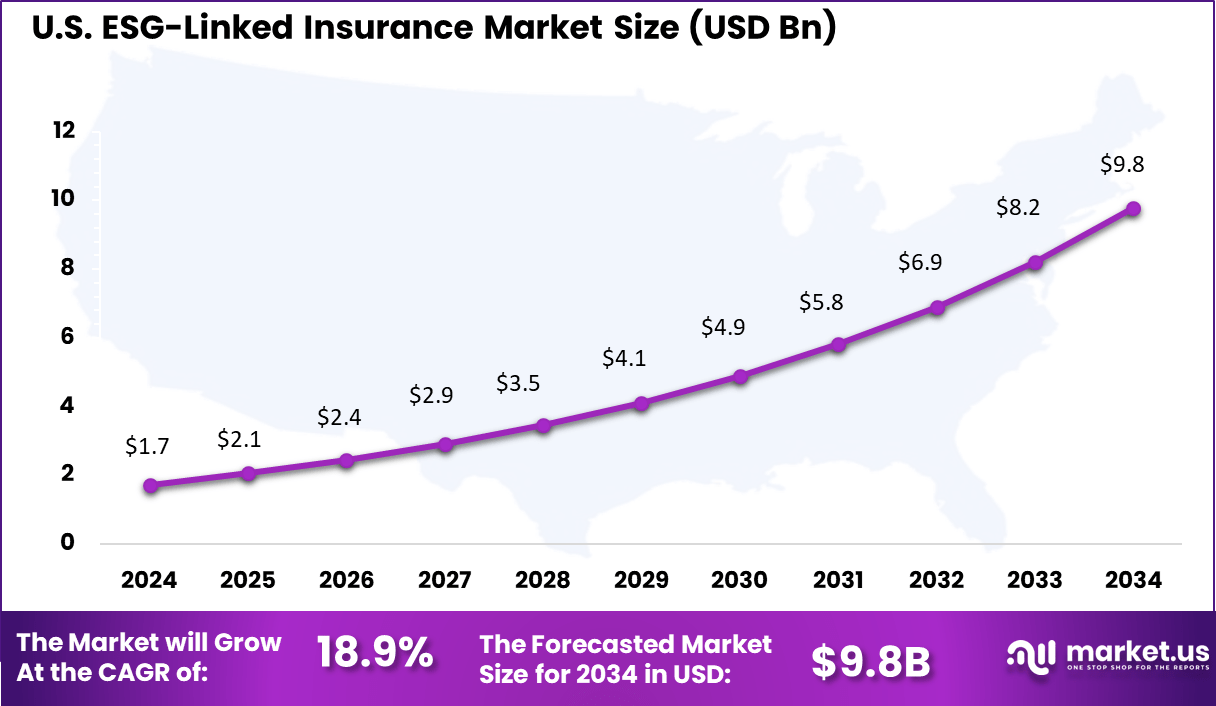

- The U.S. market reached USD 1.73 billion in 2024, expanding at a robust 18.9% CAGR, reflecting increasing corporate commitments to sustainability and risk mitigation across ESG dimensions.

Key Statistics

Stakeholder and Regulatory Influence

- Investor Expectations: Around 79% of investors consider ESG risks in their investment decisions, and nearly half are prepared to divest from companies that fail to address ESG concerns.

- Customer Behavior: About 76% of consumers are willing to stop buying from companies that mistreat workers, communities, or the environment.

- Regulatory Pressure: Global ESG regulations have increased by 155% over the past decade. Regulatory bodies such as the NAIC and IRDAI are introducing mandatory climate-risk disclosure requirements and governance frameworks aligned with the TCFD.

Business Impact and Strategic Alignment

- Industry Awareness: Around 85% of global insurers acknowledge that ESG considerations will affect every function of their business. The most affected areas include investments (91%), risk and internal audit (90%), and underwriting (88%).

- Financial Impact: Roughly 44% of insurance CEOs believe that effective ESG programs contribute to improved financial performance.

- Strategic Focus: Only 35% of global insurers report that their corporate strategy is strongly aligned with all three ESG pillars.

US Market Size

The US ESG-linked insurance market, valued at approximately USD 1.73 billion, is experiencing a rapid growth trajectory with a compound annual growth rate (CAGR) of 18.9%. This growth is propelled by increasing corporate demand for insurance products that align with ESG compliance and sustainability goals.

The robust CAGR highlights a dynamic market environment where regulatory momentum, rising climate change awareness, and investor interest in sustainable finance converge to drive innovation and adoption of ESG-centric insurance offerings. Insurers are evolving their products and distribution methods to meet this growing demand, making the US a hotspot for sustainable insurance development within North America.

In 2024, North America holds a commanding 45% share of the ESG-linked insurance market, reflecting its significant influence and leadership in this sector. The region’s market strength is driven by advanced insurance infrastructure, strong regulatory support, and a heightened focus on integrating environmental, social, and governance (ESG) factors into underwriting and investment decisions.

This sizable share underscores North America’s pivotal role in advancing sustainable insurance practices that help organizations manage ESG risks effectively. The US, as the largest contributor, plays a key part in this, supported by proactive regulations and collaborative efforts among insurers, regulators, and sustainability-focused stakeholders.

By Type

In 2024, ESG-linked investment insurance takes the lead, making up around 49.6% of the market, showing how insurers are increasingly weaving ESG factors into their investment strategies. This type of insurance reflects the industry’s drive to not only protect against traditional risks but also promote investments that support sustainable and responsible business practices.

Insurers adopting this approach align their portfolios with companies and projects that meet high environmental, social, and governance standards, helping them manage future risks linked to climate change, social issues, and governance challenges. This type of investment insurance benefits both investors and companies by encouraging more responsible capital allocation.

Insurers are actively divesting from assets that do not meet ESG criteria, while increasing investments in green and socially responsible projects. It reflects a broader trend where sustainability is becoming a key pillar of financial decision-making, offering insurers a way to contribute positively to the environment and society while potentially improving long-term financial returns.

By Application

In 2024, Corporate ESG compliance accounts for about 37.2% of the market. Insurance products in this segment are tailored to help companies meet their evolving ESG obligations and standards. These products support businesses in managing ESG risks by offering coverage that reflects their sustainability practices and regulatory compliance efforts.

As ESG regulations tighten, such insurance helps companies stay ahead of legal requirements while demonstrating their commitment to sustainable operations to stakeholders, including investors, customers, and regulators. Incorporating ESG compliance into insurance policies also incentivizes businesses to improve their environmental and social impact.

Companies with strong ESG performance may qualify for better insurance terms and pricing. This mutually beneficial setup encourages continuous improvement in corporate sustainability efforts while providing businesses with the protection they need against risks associated with ESG factors, such as climate-related damages or social governance lapses.

By Distribution Channel

In 2024, Direct sales dominate the distribution channel, making up 72.3% of the market share. This channel allows insurers to have a direct relationship with customers, enabling more customized and transparent ESG insurance offerings. Through direct interaction, insurers can better understand client needs related to ESG risks and compliance, tailoring products that meet those specific requirements.

Modern digital tools and platforms also facilitate direct sales, making it easier and faster to provide ESG-linked insurance products. This approach fosters trust and education, as clients receive clear information on how ESG factors impact their insurance policies.

By selling directly, insurers can respond quickly to changing ESG trends and regulations, creating a more agile market. For corporate clients and individuals focused on sustainability, direct sales channels provide a simpler and more effective way to access insurance solutions closely aligned with their values and ESG commitments.

Emerging Trends

Key Trends Description Climate Risk Modeling Advancements Insurers are adopting advanced climate risk models using AI and satellite data to better assess and price insurance risks related to natural disasters. This helps companies prepare for escalating climate threats and tailor ESG-linked products effectively. ESG-Linked Product Expansion There is a growing variety of insurance products that reward sustainable behaviors or link premiums and coverage to ESG performance, including green property insurance, sustainable investment insurance, and renewable energy project coverage. Regulatory ESG Integration Insurance regulators worldwide are tightening requirements to include ESG factors in risk management and disclosures. This drives insurers to update frameworks and improve transparency to meet sustainability mandates. Increasing Focus on Social and Governance Factors Insurers are expanding emphasis on social responsibility and governance, addressing issues such as community resilience, diversity, and ethical business practices within policies and investment decisions. Digital Tools Driving ESG Insights Use of digital platforms and AI tools to monitor ESG risk and measure impact is growing rapidly. These technologies help insurers assess exposures dynamically and support more accurate, ESG-compliant underwriting. Growth Factors

Key Factors Description Rising Customer Demand for ESG Products More customers are seeking insurance policies that match their sustainability values. This growing preference increases demand for innovative ESG-linked insurance offerings. Increasing Regulatory Pressure Governments and financial regulators are enforcing stricter ESG disclosure and risk-integration requirements. This pushes insurers to strengthen sustainable practices and update product frameworks. Insurers’ Commitment to Net-Zero Many insurers are pledging net-zero emissions across their portfolios. This alignment with sustainability goals accelerates ESG-focused product development and modern risk-management approaches. Expansion in Emerging Markets Rising ESG awareness in Asia Pacific and Europe is driving higher insurance demand linked to renewable energy, green infrastructure, and socially responsible development. Advances in AI and Analytics Improved AI and analytics capabilities support more accurate ESG risk evaluation and tailored insurance pricing, boosting market adoption and operational efficiency. Key Market Segments

By Type

- ESG-Linked Investment Insurance

- ESG-Linked Life Insurance

- ESG-Linked Property Insurance

- Green Energy Insurance

- Others

By Application

- Corporate ESG Compliance

- Green Investments

- Renewable Energy Projects

- Sustainable Supply Chains

- Others

By Distribution Channel

- Direct Sales

- Brokers and Agents

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising demand for ESG accountability

Growing attention on environmental and social responsibility has increased the demand for insurance products that reward strong ESG performance. Governments, investors and large enterprises are placing stricter expectations on companies to show transparent ESG actions. This shift has encouraged insurers to align their offerings with measurable sustainability practices.

As a result, ESG-linked insurance has gained momentum because it helps clients demonstrate responsible behavior while improving their access to coverage. The growth of sustainability reporting across industries supports this driver by pushing more organizations to seek insurance solutions that match their ESG commitments.

Restraint

Limited quality and consistency of ESG data

The market faces a strong restraint due to inconsistent ESG data and the absence of uniform reporting rules. Insurers often rely on fragmented metrics that vary widely between industries and countries. This inconsistency makes it difficult to evaluate ESG performance accurately during underwriting.

Because insurers depend on reliable inputs to build pricing models, the lack of standardised data slows down product expansion. Many firms struggle to integrate ESG indicators into traditional risk systems, which reduces operational efficiency and affects the scalability of ESG-linked offerings.

Opportunity

Development of outcome-based ESG insurance

A clear opportunity exists for insurers to launch products that encourage measurable improvements in sustainability performance. Companies are increasingly looking for insurance solutions that support emissions reduction, stronger governance practices and better social impact outcomes. ESG-linked products can help clients meet transition targets while lowering their long-term risk exposure.

This opportunity also allows insurers to enter emerging sustainability-focused segments where demand is rising quickly. By designing innovative products tied to ESG outcomes, insurers can attract new customers, strengthen retention and create a competitive advantage in a developing market.

Challenge

Integrating ESG risks into underwriting decisions

The integration of ESG factors into underwriting remains a significant challenge because these risks are complex and long-term in nature. Climate transition exposures, supply chain vulnerabilities and governance failures do not fit easily into traditional actuarial models. This creates uncertainty when insurers try to quantify and price ESG-related risks.

Another challenge comes from growing scrutiny around the credibility of ESG claims. Insurers must ensure that their ESG-linked products show realistic and verifiable impact. If not managed carefully, the risk of being viewed as overstating ESG benefits can harm trust and discourage market adoption.

Competitive Analysis

Allianz, AXA, Swiss Re, and Munich Re lead the ESG-linked insurance market with strong underwriting frameworks that integrate environmental, social, and governance metrics. Their products focus on climate-aligned coverage, sustainable risk assessment, and incentives for responsible corporate behavior. These companies use advanced analytics to evaluate carbon exposure, climate vulnerability, and operational resilience.

Zurich, Generali, Chubb, AIG, Liberty Mutual, Hartford, Sompo, and Tokio Marine strengthen the competitive landscape with ESG-driven policies across property, casualty, and specialty lines. Their offerings include green building coverage, renewable-energy project insurance, and socially responsible underwriting programs. These insurers prioritize transparent reporting, climate-risk modeling, and compliance with international sustainability frameworks.

SCOR, Beazley, RenaissanceRe, and other participants expand the market through niche ESG-linked reinsurance and innovative risk-transfer solutions. Their products address climate-related catastrophe exposure, biodiversity risks, and workforce-safety commitments. These companies focus on adaptive pricing models, parametric triggers, and long-term resilience planning.

Top Key Players in the Market

- Allianz

- AXA

- Swiss Re

- Munich Re

- Zurich Insurance Group

- Generali

- Chubb

- AIG

- Liberty Mutual

- Hartford

- Sompo

- Tokio Marine

- SCOR

- Beazley

- RenaissanceRe

- Others

Recent Developments

- October 2025: Generali reported strong growth in direct written premiums from insurance products with ESG components, with a notable €2,820 million attributed to the environmental sphere. Generali’s internal working group on ESG consistently monitors regulatory changes while designing new solutions to promote responsible investor and client behavior.

- October 2025: Ping An received an MSCI AAA ESG rating, with green insurance premium income reaching a bold RMB 55.279 billion in the first nine months of 2025. The company continued to refine its responsible investing policies, enhancing exclusion lists and stakeholder disclosures, and signing key international ESG alliances to reinforce its leadership in green finance.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Bn Forecast Revenue (2034) USD 30.1 Bn CAGR(2025-2034) 21.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (ESG-Linked Life Insurance, ESG-Linked Property Insurance, ESG-Linked Investment Insurance, Green Energy Insurance, Others), By Application (Corporate ESG Compliance, Green Investments, Renewable Energy Projects, Sustainable Supply Chains, Others), By Distribution Channel (Direct Sales, Brokers and Agents) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz, AXA, Swiss Re, Munich Re, Zurich Insurance Group, Generali, Chubb, AIG, Liberty Mutual, Hartford, Sompo, Tokio Marine, SCOR, Beazley, RenaissanceRe, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  ESG-Linked Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

ESG-Linked Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz

- AXA

- Swiss Re

- Munich Re

- Zurich Insurance Group

- Generali

- Chubb

- AIG

- Liberty Mutual

- Hartford

- Sompo

- Tokio Marine

- SCOR

- Beazley

- RenaissanceRe

- Others