Global ESD Protection Devices Market By Material(Silicon, Ceramic), By Technology (Transient Voltage Suppressor Diodes (TVS), Multilayer Varistors (MLV)), By Directionality (Uni-directional, Bi-directional), By Protection (Data-line, Power-line), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 61097

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

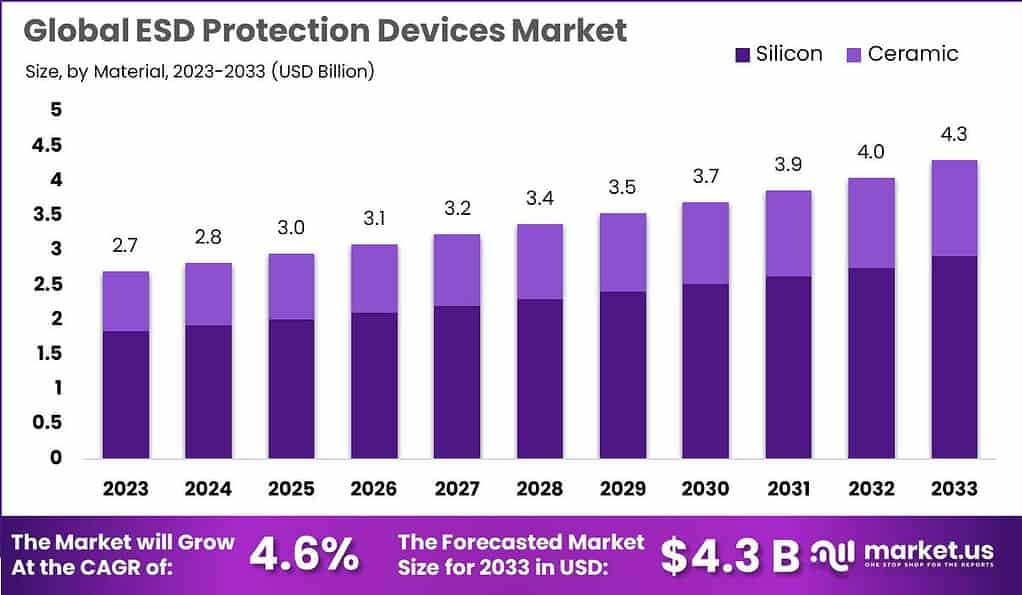

The Global ESD Protection Devices Market size is expected to be worth around USD 4.3 Billion by 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2024 to 2033.

ESD (Electrostatic Discharge) protection devices play a crucial role in safeguarding electronic components and systems from the damaging effects of electrostatic discharge events. ESD occurs when there is a sudden flow of static electricity between two objects with different electrical potentials. This discharge can cause significant damage to sensitive electronic devices, leading to malfunctions, data loss, or even complete failure.

The ESD protection devices market has witnessed substantial growth due to the increasing demand for reliable and robust protection solutions in various industries. As electronic devices become smaller, more complex, and operate at higher speeds, they become more vulnerable to ESD events. ESD protection devices, such as transient voltage suppressors (TVS diodes), varistors, and ESD protection ICs, are designed to divert and absorb the excess electrical energy caused by ESD, preventing it from reaching sensitive components.

Manufacturers of ESD protection devices focus on developing solutions that can be integrated into a wide range of products, from smartphones and laptops to advanced medical equipment and automotive electronics. The market is characterized by continuous innovation, with companies investing in research and development to offer more efficient, cost-effective, and compact protection solutions.

The growth of emerging technologies like autonomous vehicles, 5G networks, and wearable devices, the demand for ESD protection devices is expected to rise. The integration of ESD protection features into system-on-chip (SoC) designs and the development of application-specific ESD protection solutions offer avenues for innovation and customization. Moreover, the increasing focus on sustainability and environmental concerns has led to the development of ESD protection devices with reduced power consumption and improved reliability.

In 2024, the aerospace and defense sectors are poised for a significant uptick in the adoption of ESD protection devices, with an expected increase of 10% compared to 2023. This forecast, as reported by PowerElectronicsWorld, highlights the growing recognition of the critical role that ESD protection plays in ensuring the reliability and longevity of sophisticated aerospace and defense electronics.

The increased use of these devices in such applications underscores the importance of safeguarding sensitive components against electrostatic discharge, which can compromise mission-critical systems and equipment. Similarly, the renewable energy sector is on the brink of a remarkable growth phase in ESD protection device adoption, projected to surge by 22% in 2024. This projection, also courtesy of PowerElectronicsWorld, mirrors the industry’s concerted push towards sustainable energy solutions.

As renewable energy systems like solar panels and wind turbines become increasingly prevalent, the demand for ESD protection devices to secure the electronics within these systems escalates. This growth is indicative of the sector’s commitment to enhancing the durability and operational efficiency of renewable energy technologies.

By 2023, it is estimated that over 80% of ESD protection devices will cater specifically to advanced CMOS (Complementary Metal-Oxide-Semiconductor) technologies, according to Semiconductor Engineering. This trend reflects the technological evolution within the semiconductor industry, where advanced CMOS technologies dominate due to their superior performance and efficiency.

Key Takeaways

- The ESD Protection Devices Market is estimated to reach USD 4.3 billion by 2033.

- It demonstrates a strong Compound Annual Growth Rate (CAGR) of 4.6% throughout the forecast period.

- Silicon-based ESD protection devices hold a dominant market position, capturing over 68% share.

- Transient Voltage Suppressor Diodes (TVS) are the preferred technology, holding more than 59% share.

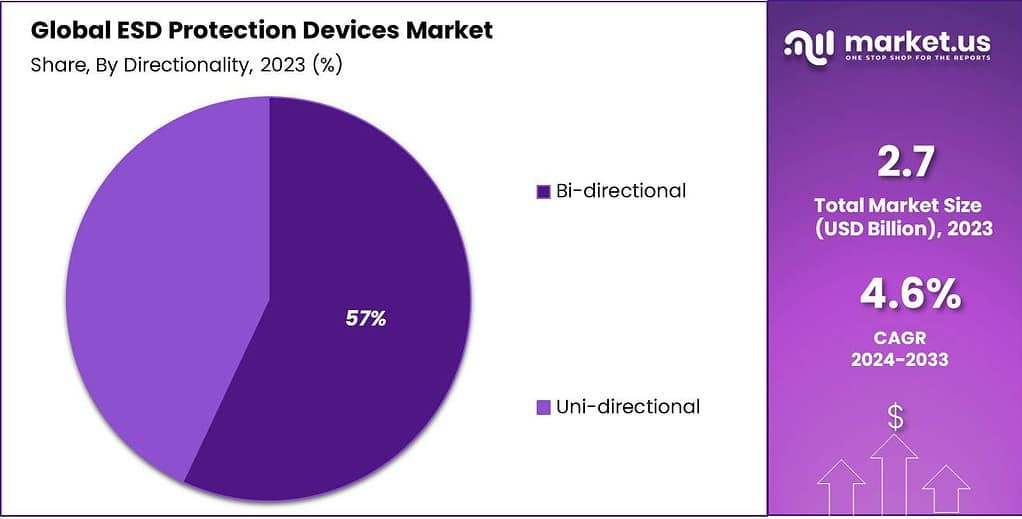

- Bi-directional devices hold a dominant position, capturing over 57% share.

- Data-line protection is favored, holding over 53% share due to its critical role in safeguarding communication lines.

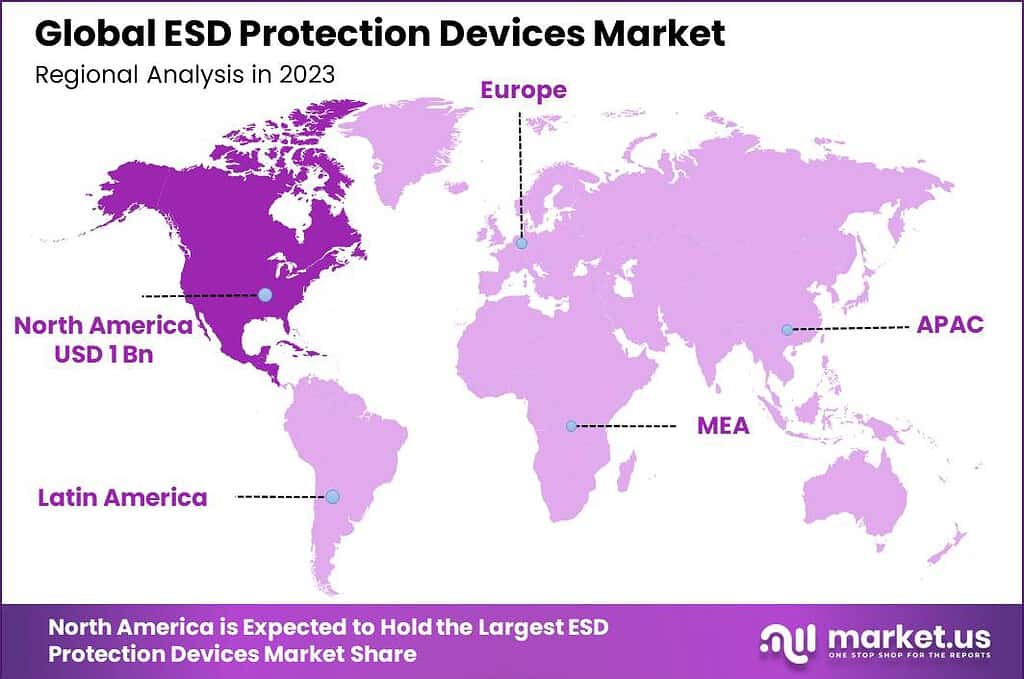

- In 2023, North America held a dominant market position in the ESD Protection Devices market, capturing more than a 40.6% share.

- 25% of all electronic components are returned due to ESD damage, highlighting the critical need for effective ESD protection solutions to enhance product reliability.

- It is estimated that over 90% of semiconductor devices will require ESD protection by 2023, underscoring the growing sensitivity of modern electronics to electrostatic discharges.

- The Automotive Industry is projected to account for 25% of global ESD Protection demand in 2024, reflecting the sector’s increasing reliance on sophisticated electronic systems.

- By 2023, the use of silicon-based ESD protection devices is expected to decline by 5% as manufacturers shift towards adopting wide-bandgap semiconductor materials, offering superior performance.

- In 2024, the global semiconductor industry is anticipated to consume over 2 billion units of ESD protection devices, indicating a significant uptick in demand.

- The demand for ESD protection devices in 5G telecommunications infrastructure is projected to increase by 30% in 2023 compared to 2022, driven by the expansion of 5G networks.

- There’s a 20% year-over-year increase in the adoption of ESD protection devices in wearable electronics, mirroring the growth of the wearable tech market.

- Over 60% of ESD protection devices are expected to be designed for system-level protection (rather than chip-level protection) by 2023, showing a shift towards more comprehensive ESD protection strategies.

- A 15% growth in the adoption of ESD protection devices for industrial automation and control systems is anticipated in 2024, highlighting the importance of ESD protection in supporting the reliability of automated processes.

- A 25% increase in demand for ESD protection devices in data centers and cloud infrastructure by 2023 reflects the surge in digital services and the critical need to protect these infrastructures from ESD damage.

- It is estimated that over 70% of ESD protection devices will be designed for input/output (I/O) interfaces by 2023, indicating a focus on safeguarding the critical points of interaction in electronic systems.

Material Analysis

In 2023, the Silicon segment held a dominant market position in the ESD Protection Devices market, capturing more than a 68% share. This leadership can be attributed to silicon’s intrinsic properties, including its excellent electrical conductivity, reliability, and ability to be easily integrated into various semiconductor technologies.

Silicon-based ESD protection devices are favored for their efficiency in dissipating unwanted electrostatic charges, thereby safeguarding sensitive electronic components from potential damage. Their widespread adoption across multiple industries, especially in consumer electronics, automotive, and telecommunications, underscores the material’s pivotal role in the market.

Silicon’s dominance is further reinforced by its compatibility with existing manufacturing processes, making it a cost-effective choice for producers of ESD protection devices. Additionally, the ongoing advancements in silicon technology have enabled the development of increasingly sophisticated and miniaturized protection components. These enhancements have not only improved the performance of silicon-based ESD protection devices but have also expanded their application range, further solidifying silicon’s leading position in the market.

Technology Analysis

In 2023, the Transient Voltage Suppressor Diodes (TVS) segment held a dominant market position in the ESD Protection Devices market, capturing more than a 59% share. This leading position can be largely attributed to the effectiveness of TVS diodes in providing immediate and robust protection against voltage spikes and electrostatic discharge.

TVS diodes are highly valued for their fast response time to transient voltages, ensuring that sensitive electronic components remain secure from sudden electrical surges. Their ability to absorb significant amounts of transient energy and to revert to a non-conductive state once the voltage drops below a certain level makes them an ideal choice for a wide range of applications, from consumer electronics to automotive and industrial systems.

The preference for TVS diodes stems not only from their protective capabilities but also from their versatility and integration ease within various circuit designs. Manufacturers and designers favor TVS diodes for their compact form factor, which is crucial in the miniaturization trend dominating the electronics industry.

Furthermore, ongoing advancements in TVS technology have enhanced their performance and reliability, broadening their applicability across more sophisticated and high-demand environments. This technological evolution, coupled with the growing need for durable and reliable ESD protection solutions, underscores the segment’s significant market share and its pivotal role in the overall growth of the ESD protection devices market.

Directionality Analysis

In 2023, the Bi-directional segment held a dominant market position in the ESD Protection Devices market, capturing more than a 57% share. This substantial market share can be attributed to the segment’s versatility and effectiveness in protecting electronic components from electrostatic discharge from both directions.

Bi-directional devices are increasingly preferred in various applications, including sensitive electronic equipment, telecommunications, and automotive electronics, where the need for comprehensive protection is paramount. Their ability to safeguard against bidirectional transient voltages makes them indispensable in modern electronic designs, contributing to their leading position in the market.

The preference for Bi-directional ESD protection devices stems not only from their protective capabilities but also from their role in enhancing the reliability and longevity of electronic products. These devices are engineered to mitigate the risks associated with ESD events, which can cause immediate or latent damage to electronic components.

As electronic devices become more sophisticated and integrated, the demand for effective and efficient ESD protection solutions has surged, further bolstering the market share of the Bi-directional segment. This trend is supported by ongoing technological advancements and the growing incorporation of electronics in everyday devices, underlining the critical role of Bi-directional ESD protection devices in contemporary electronic applications.

Protection Analysis

In 2023, the Data-line segment held a dominant market position in the ESD Protection Devices market, capturing more than a 53% share. This leadership can be largely attributed to the critical role that data-line protection plays in safeguarding the integrity and functionality of communication lines within electronic devices.

As the volume of data being transmitted increases alongside the proliferation of high-speed internet and digital communication technologies, the demand for robust ESD protection solutions for data lines has surged. Data-line ESD protection devices are integral to preventing damage caused by electrostatic discharges, which can compromise data integrity, disrupt communication, and even lead to the failure of electronic components.

The leading position of the Data-line segment is also reinforced by the expansion of digital infrastructure and the Internet of Things (IoT), where a multitude of devices are interconnected and continuously exchanging data. These developments necessitate advanced ESD protection mechanisms to ensure reliable operation and longevity of devices in various applications, including consumer electronics, automotive systems, and industrial equipment.

The adoption of data-line ESD protection devices is further driven by the increasing complexity of electronic circuits, which require more sophisticated protection strategies to handle the delicate nature of high-speed data transmission.

Key Market Segments

By Material

- Silicon

- Ceramic

By Technology

- Transient Voltage Suppressor Diodes (TVS)

- Multilayer Varistors (MLV)

By Directionality

- Uni-directional

- Bi-directional

By Protection

- Data-line

- Power-line

Driver

Expansion of IoT and Connected Devices

The proliferation of the Internet of Things (IoT) and connected devices represents a significant driver for the ESD Protection Devices market. As the world becomes increasingly digital, the number of devices connected to the internet is skyrocketing, encompassing everything from consumer electronics and home appliances to industrial machinery and healthcare equipment.

These devices often communicate over data lines and require power-line connections, making them susceptible to electrostatic discharges that can damage sensitive electronic components, disrupt service, or degrade device performance over time.

The critical need to protect these devices from ESD-related damage is driving the demand for advanced ESD protection solutions, contributing to market growth. Manufacturers and designers are continuously seeking effective ESD protection devices to ensure the reliability and longevity of their products, further propelling market expansion.

Restraint

Complexity in Designing for Advanced Technologies

A primary restraint in the ESD Protection Devices market is the complexity involved in designing protection solutions for advanced technologies. As electronic devices become more sophisticated, incorporating smaller components and faster data transfer rates, designing ESD protection devices that can safeguard these complex systems without interfering with their performance becomes increasingly challenging.

This complexity requires significant research and development efforts and expertise in materials science and electrical engineering. Additionally, the need to comply with various international standards for ESD protection complicates the design process further. These challenges can delay product development, increase costs, and limit the ability of manufacturers to quickly respond to market demands, acting as a restraint on the growth of the ESD Protection Devices market.

Opportunity

Advancements in Electronics Manufacturing

Advancements in electronics manufacturing techniques present a substantial opportunity for the ESD Protection Devices market. Emerging technologies such as 5G communication, artificial intelligence, and flexible electronics are creating new applications for electronic devices, driving the need for more sophisticated ESD protection solutions.

As manufacturing processes evolve to produce smaller, more efficient, and higher performing components, the demand for ESD protection devices that can safeguard these innovations grows. The opportunity lies in developing new materials and designs for ESD protection devices that are compatible with cutting-edge manufacturing technologies.

By leveraging advancements in nanotechnology, materials science, and semiconductor fabrication, manufacturers of ESD protection devices can create products that meet the evolving needs of the electronics industry, opening new markets and applications.

Challenge

Rapid Technological Evolution

The rapid pace of technological evolution poses a significant challenge to the ESD Protection Devices market. As electronic devices become more advanced, with increased functionality and complexity, ensuring effective ESD protection becomes more difficult.

The challenge lies in continuously adapting and innovating ESD protection solutions to meet the requirements of emerging technologies, such as the integration of IoT capabilities, the transition to 5G networks, and the development of ultra-thin electronic devices. These advancements often push the boundaries of current ESD protection capabilities, requiring ongoing research, development, and testing to ensure new devices are adequately protected.

Staying ahead of these technological trends requires significant investment in R&D and a deep understanding of the future direction of electronics, making it challenging for manufacturers to maintain their competitive edge in the market.

Growth Factors

- Rapid Advancement in Electronics: The continuous innovation and advancement in electronics, including the development of more compact, sophisticated, and high-speed devices, have heightened the need for effective ESD protection solutions. As electronic components become smaller and more complex, their sensitivity to ESD damage increases, fueling the demand for advanced ESD protection devices.

- Expansion in Consumer Electronics: The burgeoning consumer electronics market, characterized by smartphones, tablets, wearables, and other smart devices, significantly contributes to the demand for ESD protection devices. These devices require robust ESD protection to ensure reliability and longevity, driving market growth.

- Automotive Sector’s Evolution: The automotive industry’s shift towards electric and autonomous vehicles has escalated the use of electronic components in cars. ESD protection is crucial for the safety and performance of these components, thereby propelling the market forward.

- Global Regulations and Standards: Increasingly stringent global standards and regulations regarding electronic device safety and durability have mandated the incorporation of effective ESD protection mechanisms, further stimulating market growth.

- Technological Innovation: Continuous research and development efforts aimed at creating more efficient, reliable, and cost-effective ESD protection solutions are pivotal growth factors. Innovations in materials and technologies used in ESD protection devices are expanding their applications and effectiveness.

Top Emerging Trends

- Integration of ESD Protection in Chip Design: There is a growing trend towards integrating ESD protection mechanisms directly into chip designs, offering a more streamlined and efficient approach to safeguarding electronics against ESD damage.

- Development of Low-Capacitance ESD Protectors: The need for high-speed data transmission in applications such as 5G networks is driving the development of low-capacitance ESD protectors, which minimize signal degradation.

- Adoption of Nanomaterials for Improved ESD Protection: The use of nanomaterials in ESD protection devices is emerging as a trend, offering enhanced protection capabilities due to their unique electrical and physical properties.

- Focus on Sustainability in ESD Protection: There is an increasing emphasis on developing eco-friendly ESD protection solutions, including recyclable materials and energy-efficient manufacturing processes, aligning with global sustainability goals.

- Customization and Personalization of ESD Protection Solutions: As electronic applications become more diverse, there is a trend towards customizing ESD protection devices to meet specific requirements, offering tailored protection for unique applications.

Regional Analysis

In 2023, North America held a dominant market position in the ESD Protection Devices market, capturing more than a 40.6% share. This leading status is primarily due to the region’s robust electronics manufacturing sector, coupled with the presence of major technology companies and advanced research and development facilities. The demand for ESD Protection Devices in North America was valued at USD 1.0 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America’s emphasis on innovation and the rapid adoption of new technologies have made it a critical market for ESD protection devices. The region’s consumer electronics, automotive, and telecommunications sectors, in particular, have shown significant demand for advanced ESD protection solutions, driven by the need to ensure the reliability and longevity of electronic components and systems.

The North American market benefits from stringent regulatory standards regarding electronic device safety and performance, which necessitate the use of high-quality ESD protection devices. Additionally, the increasing trend towards miniaturization in electronics has further propelled the demand for sophisticated ESD protection solutions that can be integrated into smaller, more complex devices.

The region’s commitment to developing and implementing cutting-edge technologies, including the expansion of 5G networks and the growth of the Internet of Things (IoT), underscores the critical need for effective ESD protection, ensuring North America’s continued dominance in the global market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The ESD Protection Devices market is characterized by the presence of several key players who play a crucial role in shaping the industry’s landscape through innovation, research and development, and strategic market initiatives. These companies are instrumental in driving technological advancements, ensuring product quality, and meeting the diverse needs of the global electronics market. A focus on the analysis of these key players reveals insights into the competitive dynamics and strategic directions within the market.

Top Market Leaders

- Murata Manufacturing

- STMicroelectronics

- Texas Instruments Inc.

- Nexperia

- Littlefuse Inc.

- Bourns Inc.

- Semtech Corporation

- ROHM Semiconductor

- ProTek Devices

- Infineon Technologies

Recent Developments

- In January 2023, Mechnano and Tethon3D embarked on a collaborative endeavor to innovate within the realm of electrostatic discharge (ESD) materials. Together, they developed a groundbreaking high-temperature, rigid ESD material named C-Lite. This material is poised to revolutionize the market by offering enhanced durability and ESD protection for various applications, particularly in sectors that demand high precision and reliability under extreme conditions.

- Samsung, a leading name in the electronics industry, entered into an ESD research partnership in 2023. The specifics regarding the scope and objectives of this collaboration remain under wraps. This partnership underscores Samsung’s commitment to advancing ESD protection solutions, potentially setting new standards for the electronics sector and ensuring greater device longevity and reliability.

- Freudenberg Materials, a pioneer in materials technology, unveiled an innovative packing textile in 2023. Designed to bolster ESD protection, this textile represents a significant leap forward in safeguarding electronic components during transportation and storage. Its introduction is a testament to Freudenberg’s dedication to enhancing material solutions across industries, contributing to safer and more efficient handling of sensitive electronic parts.

- In 2023, TDK, a globally recognized manufacturer of electronic components, launched a new series of TVS (Transient Voltage Suppression) diodes. These diodes are meticulously engineered to protect USB-C interfaces, a crucial development given the widespread adoption of USB-C in a myriad of devices. TDK’s innovation addresses the urgent need for reliable protection against voltage spikes, ensuring device safety and integrity across numerous applications.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Bn Forecast Revenue (2033) USD 4.3 Bn CAGR (2024-2033) 4.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material(Silicon, Ceramic), By Technology (Transient Voltage Suppressor Diodes (TVS), Multilayer Varistors (MLV)), By Directionality (Uni-directional, Bi-directional), By Protection (Data-line, Power-line) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Murata Manufacturing, STMicroelectronics, Texas Instruments Inc., Nexperia, Littlefuse Inc., Bourns Inc., Semtech Corporation, ROHM Semiconductor, ProTek Devices, Infineon Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are ESD protection devices?ESD (Electrostatic Discharge) protection devices are electronic components designed to prevent damage to sensitive electronic circuits and components from electrostatic discharge events.

How big is ESD Protection Devices Market?The Global ESD Protection Devices Market size is expected to be worth around USD 4.3 Billion by 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2024 to 2033.

Who are the key players in ESD Protection Devices Market?Murata Manufacturing, STMicroelectronics, Texas Instruments Inc., Nexperia, Littlefuse Inc., Bourns Inc., Semtech Corporation, ROHM Semiconductor, ProTek Devices, Infineon Technologies are the major companies operating in the ESD Protection Devices Market.

Which region has the biggest share in ESD Protection Devices market?In 2023, North America held a dominant market position in the ESD Protection Devices market, capturing more than a 40.6% share.

What factors contribute to the growth of the ESD protection devices market?The increasing integration of electronic components in various applications, rising demand for smaller and more powerful electronic devices, stringent industry standards for ESD protection, and the growing awareness of ESD-related risks are key factors driving the growth of the ESD protection devices market.

What challenges does the ESD protection devices market face?Challenges in the ESD protection devices market include the development of more effective protection solutions for advanced semiconductor technologies, addressing the unique requirements of emerging applications such as IoT and 5G, and ensuring compatibility with evolving industry standards and regulations.

ESD Protection Devices MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

ESD Protection Devices MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Murata Manufacturing

- STMicroelectronics

- Texas Instruments Inc.

- Nexperia

- Littlefuse Inc.

- Bourns Inc.

- Semtech Corporation

- ROHM Semiconductor

- ProTek Devices

- Infineon Technologies