Global Entertainment Content and Goods Market Size, Share, Growth Analysis By Type (Digital Content, Live Content, Physical Goods), By Platform (Mobile, Console, Desktop, Smart TV), By Age Group (Adults, Seniors, Teenagers), By End User (Individual, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155409

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

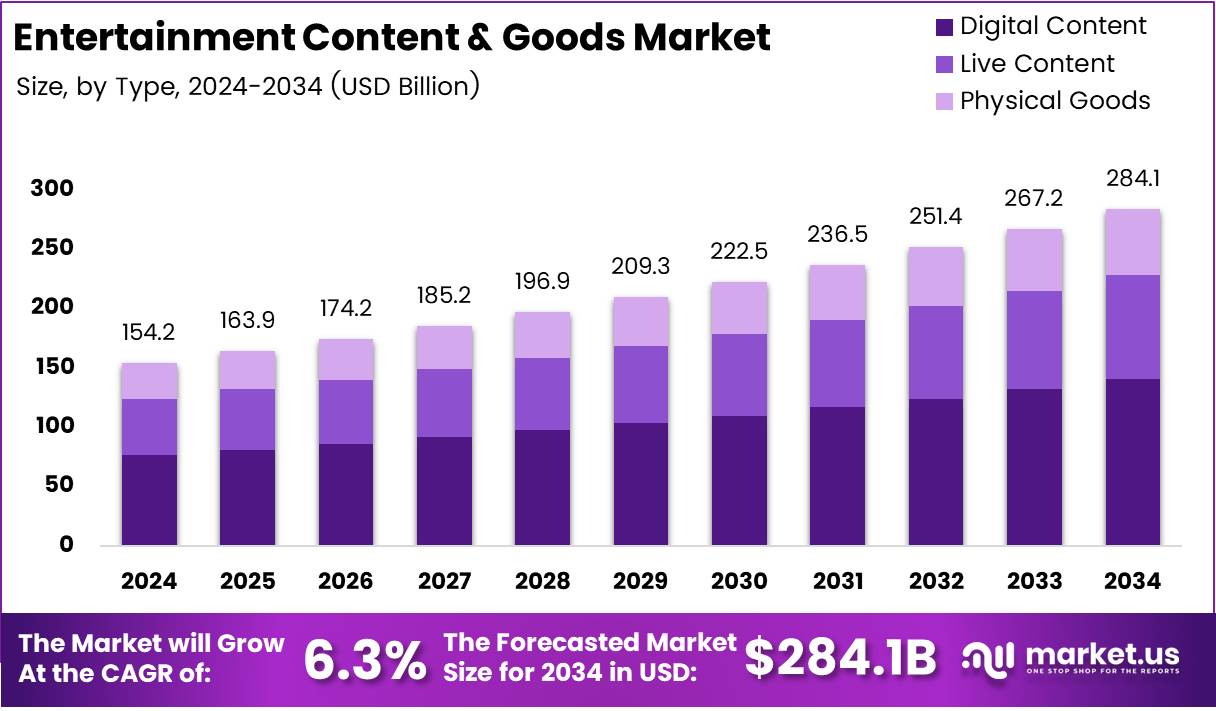

The Global Entertainment Content and Goods Market size is expected to be worth around USD 284.1 Billion by 2034, from USD 154.2 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Entertainment Content and Goods Market is a dynamic sector that encompasses a wide range of products and services aimed at providing leisure, enjoyment, and cultural engagement. This market includes streaming platforms, movies, live shows, music, merchandise, and digital content, all of which contribute to the broader entertainment ecosystem. With technological advancements and increasing consumer demand, the market continues to grow exponentially.

In recent years, the market has experienced significant shifts due to the rise of streaming platforms. This shift has revolutionized how consumers access movies, television shows, and other content. Streaming services are now the primary source of entertainment for a global audience. In fact, according to stats, 83% of U.S. and UK respondents in 2025 reported that movies are their most-watched content on streaming platforms, highlighting the continued dominance of film within the entertainment space.

At the same time, the integration of artificial intelligence (AI) in content creation presents both challenges and opportunities. According to a survey , 43% of U.S. and UK respondents are comfortable with AI-generated content. However, there is generational variation, with 41% of younger Americans (aged 18–24) expressing discomfort towards AI-generated entertainment. This indicates a growing skepticism among younger generations about the authenticity and quality of AI-driven content.

The live show segment has also experienced remarkable growth. With the rise of social media influencers, podcasters, and authors, ticket sales for live events surged by nearly 500% in 2025 compared to 2024. This surge is largely driven by the increasing popularity of influencers and content creators who engage directly with their audience. The market for live shows continues to expand, driven by digital platforms that foster greater audience engagement.

Government investment and regulations play a key role in shaping the market landscape. Various governments have introduced policies aimed at supporting local content production, fostering innovation, and addressing issues related to copyright and intellectual property. These regulations ensure that content creators and distributors comply with international standards while promoting market sustainability.

Key Takeaways

- Global Entertainment Content and Goods Market size is projected to reach USD 284.1 Billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034.

- Digital Content holds a dominant market share of 49.3% in the By Type Analysis segment in 2024, driven by the rise of streaming platforms and on-demand services.

- Mobile leads the By Platform Analysis segment with a 43.2% share in 2024, reflecting the prevalence of smartphones and tablets in entertainment consumption.

- Adults represent 61.8% of the market share in the By Age Group Analysis segment in 2024, driven by their disposable income and diverse entertainment interests.

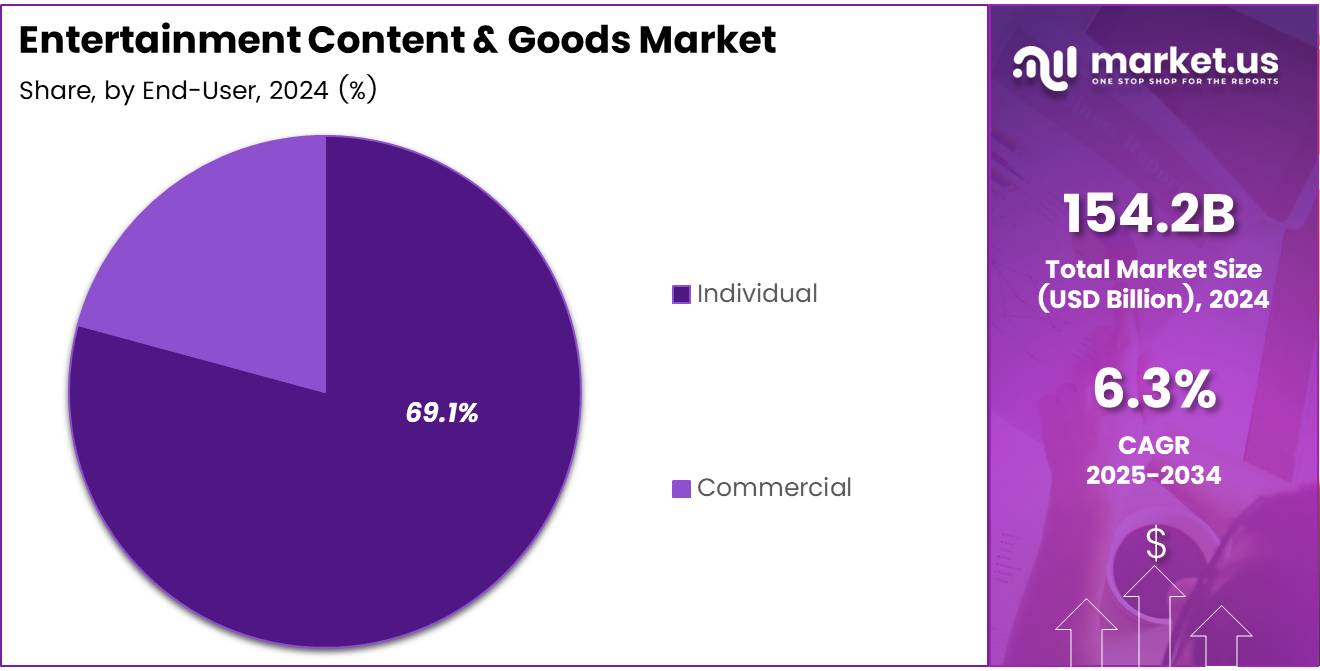

- Individual accounts for 69.1% of the market share in the By End User Analysis segment in 2024, highlighting the personal nature of entertainment consumption.

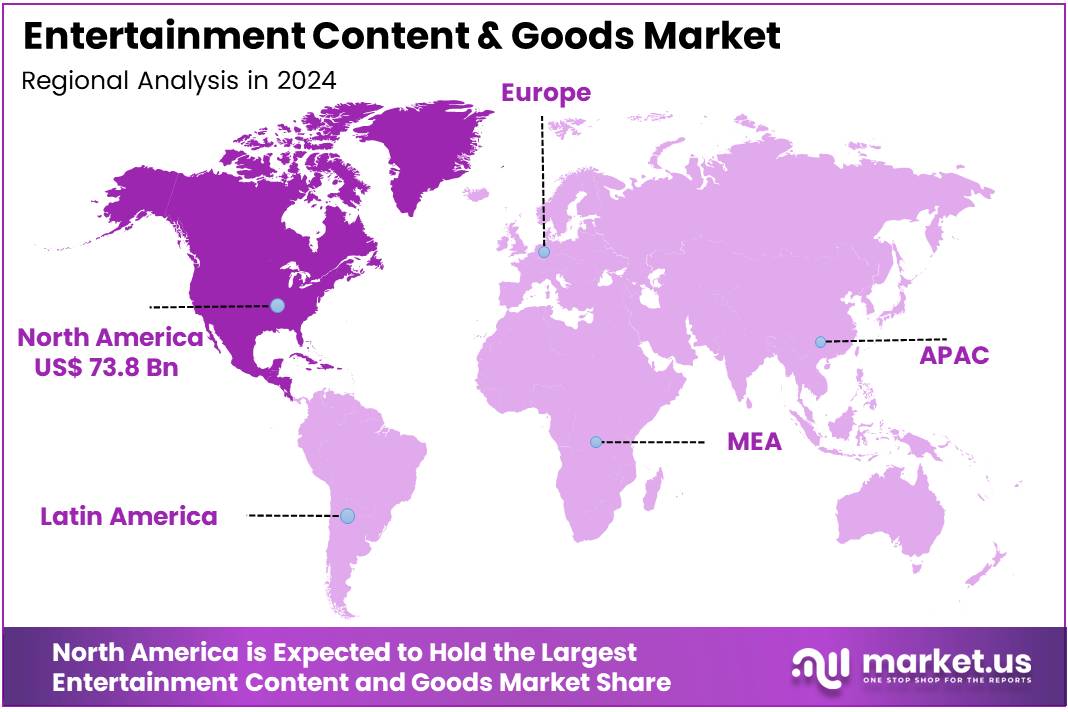

- North America dominates the Entertainment Content and Goods Market with 47.9% share, valued at USD 73.8 Billion in 2024, fueled by high consumer spending and a tech-savvy audience.

Type Analysis

Digital Content dominates with 49.3% due to its accessibility and streaming convenience.

In 2024, Digital Content held a dominant market position in By Type Analysis segment of Entertainment Content and Goods Market, with a 49.3% share. This significant market leadership reflects the widespread consumer shift toward streaming platforms, downloadable content, and on-demand entertainment services.

The digital transformation has fundamentally reshaped how consumers access and consume entertainment. Digital Content’s dominance stems from its instant accessibility, cost-effectiveness, and diverse content libraries that cater to varied consumer preferences. Streaming services, digital games, e-books, and downloadable media have become integral to modern entertainment consumption patterns.

Live Content represents the second-largest segment, capturing audiences who seek real-time experiences and interactive entertainment. This category includes live streaming, sports events, concerts, and gaming broadcasts that offer immediate engagement and community participation.

Physical Goods, while maintaining a presence in the market, face ongoing challenges from digitalization trends. However, this segment continues to serve collectors, premium product enthusiasts, and consumers who prefer tangible entertainment merchandise.

Platform Analysis

Mobile dominates with 43.2% due to its portability and widespread smartphone adoption.

In 2024, Mobile held a dominant market position in By Platform Analysis segment of Entertainment Content and Goods Market, with a 43.2% share. This commanding market presence underscores the ubiquitous nature of smartphones and tablets in modern entertainment consumption.

Mobile platforms have revolutionized entertainment accessibility by enabling content consumption anywhere, anytime. The proliferation of high-speed internet, improved mobile processing power, and optimized mobile applications has made smartphones the preferred entertainment device for millions of consumers globally.

Console gaming maintains a strong position by delivering high-quality gaming experiences and exclusive titles that attract dedicated gaming communities. These platforms continue to innovate with advanced graphics, immersive gameplay, and social gaming features.

Desktop platforms serve professional content creators, serious gamers, and users requiring enhanced processing capabilities for complex entertainment applications. Smart TV represents the connected home entertainment hub, facilitating family viewing experiences and large-screen content consumption.

Age Group Analysis

Adults dominate with 61.8% due to their purchasing power and diverse entertainment preferences.

In 2024, Adults held a dominant market position in By Age Group Analysis segment of Entertainment Content and Goods Market, with a 61.8% share. This substantial market dominance reflects adults’ significant disposable income, diverse entertainment interests, and active participation across multiple entertainment categories.

Adults represent the primary consumer base with established spending habits and preferences spanning movies, music, gaming, live events, and digital content subscriptions. Their market leadership is reinforced by their role as decision-makers for household entertainment purchases and their willingness to invest in premium entertainment experiences.

Seniors constitute an increasingly important market segment, driven by growing digital literacy and leisure time. This demographic shows particular interest in streaming services, digital books, and nostalgia-driven content that resonates with their generational preferences.

Teenagers, while smaller in market share, represent a highly engaged and trend-setting demographic with strong influence on entertainment trends. Their preferences often drive viral content, social media entertainment, and emerging platform adoption patterns across the broader market.

End User Analysis

Individual dominates with 69.1% due to personal entertainment consumption and direct purchasing decisions.

In 2024, Individual held a dominant market position in By End User Analysis segment of Entertainment Content and Goods Market, with a 69.1% share. This overwhelming market leadership reflects the personal nature of entertainment consumption and individual purchasing preferences across diverse entertainment categories.

Individual consumers drive market growth through personal subscriptions, content purchases, gaming investments, and entertainment device acquisitions. This segment’s dominance is supported by the increasing personalization of entertainment experiences, individual streaming accounts, and private consumption patterns that prioritize personal preferences and convenience.

The Individual segment encompasses personal entertainment spending across all demographics, from casual content consumption to enthusiast-level investments in premium entertainment products and services. Social media integration and personalized recommendation systems further strengthen individual consumption patterns.

Commercial represents businesses, educational institutions, and organizations that purchase entertainment content and goods for public spaces, employee engagement, customer entertainment, and educational purposes. While smaller in market share, this segment maintains steady demand for bulk licensing, commercial entertainment systems, and corporate entertainment solutions.

Key Market Segments

By Type

- Digital Content

- Live Content

- Physical Goods

By Platform

- Mobile

- Console

- Desktop

- Smart TV

By Age Group

- Adults

- Seniors

- Teenagers

By End User

- Individual

- Commercial

Drivers

Increasing Demand for Digital and Streaming Content Drives Market Growth

The entertainment industry is experiencing unprecedented growth driven by several key factors. The surge in digital and streaming content consumption has fundamentally changed how people access entertainment. Consumers now prefer on-demand platforms over traditional media, creating massive opportunities for content providers and streaming services.

Growing investment in virtual and augmented reality experiences is opening new revenue streams. Companies are developing immersive entertainment solutions that offer unique user experiences, attracting tech-savvy consumers willing to pay premium prices for cutting-edge entertainment.

The expansion of subscription-based business models has created predictable revenue streams for entertainment companies. This model allows consumers to access vast content libraries for affordable monthly fees, increasing customer retention and lifetime value.

Rising disposable income and increased consumer spending on leisure activities further fuel market expansion. As economies recover and living standards improve, people allocate more budget toward entertainment, creating sustained demand for diverse content and entertainment goods across all demographic segments.

Restraints

High Production and Distribution Costs Create Market Challenges

Despite strong growth potential, the entertainment content and goods market faces significant obstacles that limit expansion and profitability. High production and distribution costs represent the primary challenge for industry players, particularly smaller content creators and independent studios.

Creating quality entertainment content requires substantial upfront investment in talent, technology, equipment, and post-production services. These costs continue rising as consumer expectations for high-quality visuals, sound, and storytelling increase. Distribution expenses, including marketing campaigns and platform fees, add additional financial burden.

Intense competition from low-cost and free entertainment platforms creates pricing pressure across the industry. Platforms offering free content supported by advertisements force paid services to justify their value proposition. This competitive landscape makes it difficult for new entrants to establish market presence and for existing players to maintain profit margins.

The proliferation of entertainment options means companies must invest heavily in marketing and promotion to capture audience attention. Consumer attention spans are fragmented across multiple platforms, requiring sophisticated and expensive marketing strategies to build brand awareness and drive subscriber acquisition in an increasingly crowded marketplace.

Growth Factors

Emerging Markets with Growing Entertainment Consumption Present Expansion Opportunities

The entertainment content and goods market presents substantial growth opportunities driven by technological advancement and market expansion. Emerging markets with growing entertainment consumption offer untapped potential as internet penetration increases and middle-class populations expand in developing countries.

Integration of artificial intelligence in content creation and personalization is revolutionizing how entertainment is produced and delivered. AI enables automated content generation, personalized recommendations, and targeted advertising, improving user engagement while reducing operational costs for content providers.

Development of interactive and immersive entertainment formats creates new product categories and revenue streams. Gaming, virtual concerts, interactive storytelling, and augmented reality experiences appeal to younger demographics seeking engaging, participatory entertainment options that traditional media cannot provide.

Collaboration between traditional entertainment companies and tech firms accelerates innovation and market reach. These partnerships combine content expertise with technological capabilities, creating hybrid entertainment products that leverage both industries’ strengths. Such collaborations enable faster market entry, shared development costs, and access to broader distribution networks, maximizing growth potential.

Emerging Trends

Increased Use of Social Media for Content Promotion Shapes Market Dynamics

Current market trends are reshaping the entertainment landscape through digital transformation and changing consumer behaviors. Social media platforms have become essential tools for content promotion, enabling direct audience engagement and viral marketing campaigns that can dramatically impact content success.

The shift toward on-demand content consumption continues accelerating as consumers demand flexibility in when, where, and how they access entertainment. This trend favors streaming platforms and digital content providers while challenging traditional broadcasting models and fixed scheduling approaches.

Popularity of niche and independent content creation is democratizing entertainment production. Social media influencers, independent filmmakers, and content creators can now reach global audiences without traditional gatekeepers, creating diverse entertainment options and new competition for established media companies.

Adoption of sustainability practices in entertainment production reflects growing environmental consciousness among consumers and industry stakeholders. Studios and production companies are implementing eco-friendly practices, using renewable energy, and reducing waste to appeal to environmentally aware audiences and meet corporate responsibility expectations in an increasingly conscious marketplace.

Regional Analysis

North America Dominates the Entertainment Content and Goods Market with a Market Share of 47.9%, Valued at USD 73.8 Billion

In 2024, North America holds a dominant position in the Entertainment Content and Goods Market, with a market share of 47.9%, valued at USD 73.8 billion. The region is driven by robust consumer spending on digital content, movies, streaming services, and live events. The presence of major content platforms and a tech-savvy audience contribute to the region’s market leadership.

Europe Entertainment Content and Goods Market Trends

Europe is a strong player in the market, capturing a significant share driven by its established media industry. With high consumer interest in movies, music, and live performances, the European market is poised for steady growth. Increasing adoption of streaming platforms and diverse content offerings, particularly in countries like the UK and Germany, fuel the region’s expansion.

Asia Pacific Entertainment Content and Goods Market Trends

Asia Pacific is witnessing rapid growth in the Entertainment Content and Goods Market. The region benefits from a large, youthful population and increasing internet penetration. Countries like China, Japan, and India are driving demand for digital content, gaming, and live entertainment, positioning Asia Pacific as a key market with significant growth potential in the coming years.

Middle East and Africa Entertainment Content and Goods Market Trends

The Middle East and Africa region is developing at a rapid pace within the Entertainment Content and Goods Market. Despite its smaller market share, it is characterized by rising disposable incomes and an increasing appetite for Western entertainment, alongside local cultural content. The region’s young population and growing infrastructure investments are expected to accelerate market growth.

Latin America Entertainment Content and Goods Market Trends

Latin America shows a steady market growth trajectory in the Entertainment Content and Goods Market. With a rising middle class and increased access to digital media, the region sees higher demand for streaming services, sports content, and music. Brazil and Mexico lead the way, though growth is observed in other countries as well. The region’s expanding internet access plays a key role in content consumption trends.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Entertainment Content and Goods Company Insights

The global Entertainment Content and Goods Market in 2024 remains highly competitive, with several key players shaping the industry’s trajectory. Konami Group Corporation continues to stand at the forefront, leveraging its strong presence in gaming and entertainment products. Known for its iconic franchises such as “Metal Gear” and “Castlevania,” Konami is poised for growth with a focus on innovation in both digital gaming and physical merchandise.

Warner Bros. Discovery, Inc. holds a dominant position in the entertainment sector, thanks to its diverse portfolio across film, television, and streaming services. With an emphasis on producing high-quality content like DC films and hit TV shows, the company is rapidly adapting to the changing demands of consumers, especially in the digital and streaming markets.

Bandai Namco Holdings remains a powerhouse in the global entertainment goods market, primarily driven by its gaming division. Known for successful titles like “Tekken” and “Pac-Man,” Bandai Namco is also expanding into toy production, gaming merchandise, and theme parks, thereby diversifying its revenue streams and brand reach across different entertainment sectors.

Banijay Group, a major player in the production and distribution of television content, continues to strengthen its market position through strategic acquisitions and the development of popular global television formats. By expanding its portfolio of content, including reality TV and scripted series, Banijay is well-positioned to capitalize on the growing demand for diverse entertainment options.

Top Key Players in the Market

- Konami Group Corporation

- Warner Bros. Discovery, Inc.

- Bandai Namco Holdings

- Banijay Group

- Comcast Corporation

- DreamWorks Animation LLC

- Electronic Arts

- Fanatics, Inc.

- Hasbro, Inc.

- Legendary Entertainment, LLC

Recent Developments

- In August 2025, AI entertainment startup Dashverse raised $13 million in funding, led by Peak XV Partners, to further enhance its AI-driven entertainment solutions. The funding aims to support Dashverse’s innovative approach to revolutionizing the entertainment industry with AI technologies.

- In July 2025, Afreximbank launched the US$ 1 Billion Africa Film Fund, aimed at transforming the continent’s creative industry. The fund will support the growth of African filmmakers and contribute to the global competitiveness of African cinema.

- In August 2025, STAN raised USD 8.5 Million in a Series A funding round, with investments from Bandai Namco Entertainment INC, among others. This funding will be used to enhance STAN’s gaming and entertainment platform, focusing on expanding its presence in the industry.

- In April 2025, Creativefuel acquired MissMalini Entertainment from Good Glamm Group for Rs. 6 crore. The acquisition is expected to strengthen Creativefuel’s position in the digital media and influencer-driven entertainment space.

Report Scope

Report Features Description Market Value (2024) USD 154.2 Billion Forecast Revenue (2034) USD 284.1 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Digital Content, Live Content, Physical Goods), By Platform (Mobile, Console, Desktop, Smart TV), By Age Group (Adults, Seniors, Teenagers), By End User (Individual, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Konami Group Corporation, Warner Bros. Discovery, Inc., Bandai Namco Holdings, Banijay Group, Comcast Corporation, DreamWorks Animation LLC, Electronic Arts, Fanatics, Inc., Hasbro, Inc., Legendary Entertainment, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Entertainment Content and Goods MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Entertainment Content and Goods MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Konami Group Corporation

- Warner Bros. Discovery, Inc.

- Bandai Namco Holdings

- Banijay Group

- Comcast Corporation

- DreamWorks Animation LLC

- Electronic Arts

- Fanatics, Inc.

- Hasbro, Inc.

- Legendary Entertainment, LLC