Global Enterprise Intellectual Property (IP) Management Software Market Size, Share and Analysis Report By Deployment Model (Cloud-Based, On-Premises, Hybrid), By End User (Corporations, Law Firms, Government Agencies, Research Institutions, Others), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Functionality (Patent Management, Trademark Management, Copyright Management, Trade Secret Management, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173983

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Deployment Model

- By End User

- By Organization Size

- By Functionality

- By Region

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Emerging Trends

- Opportunity

- Challenge

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

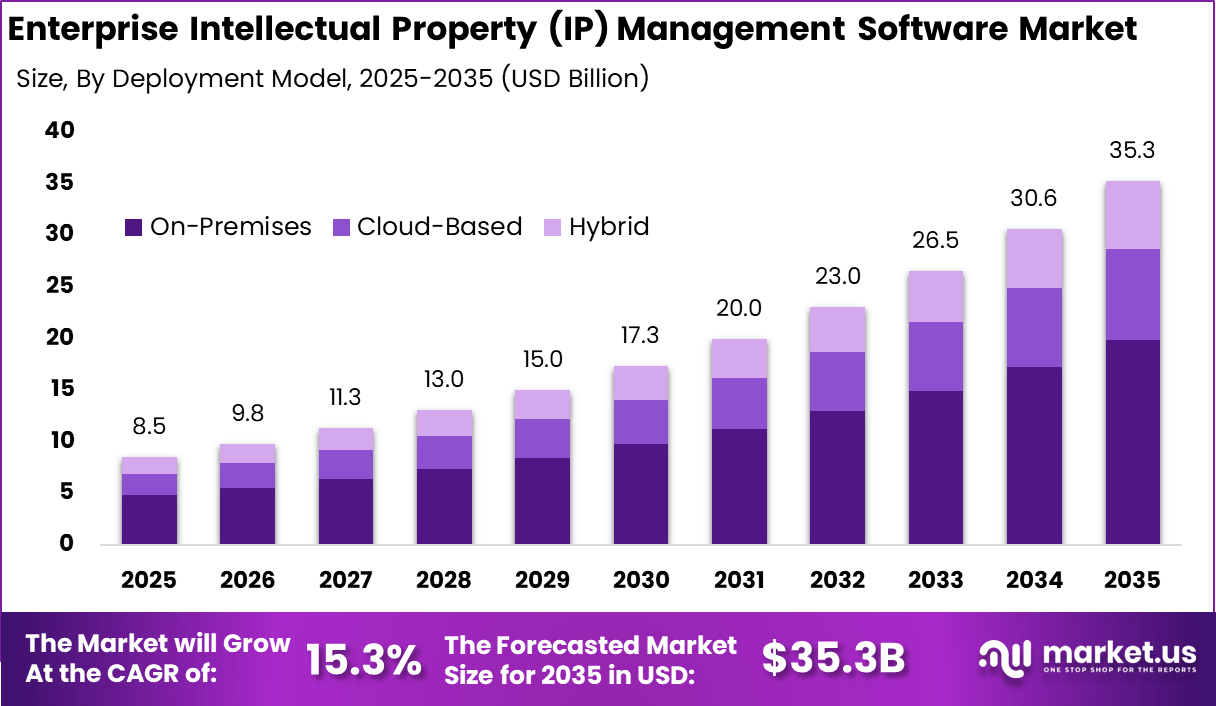

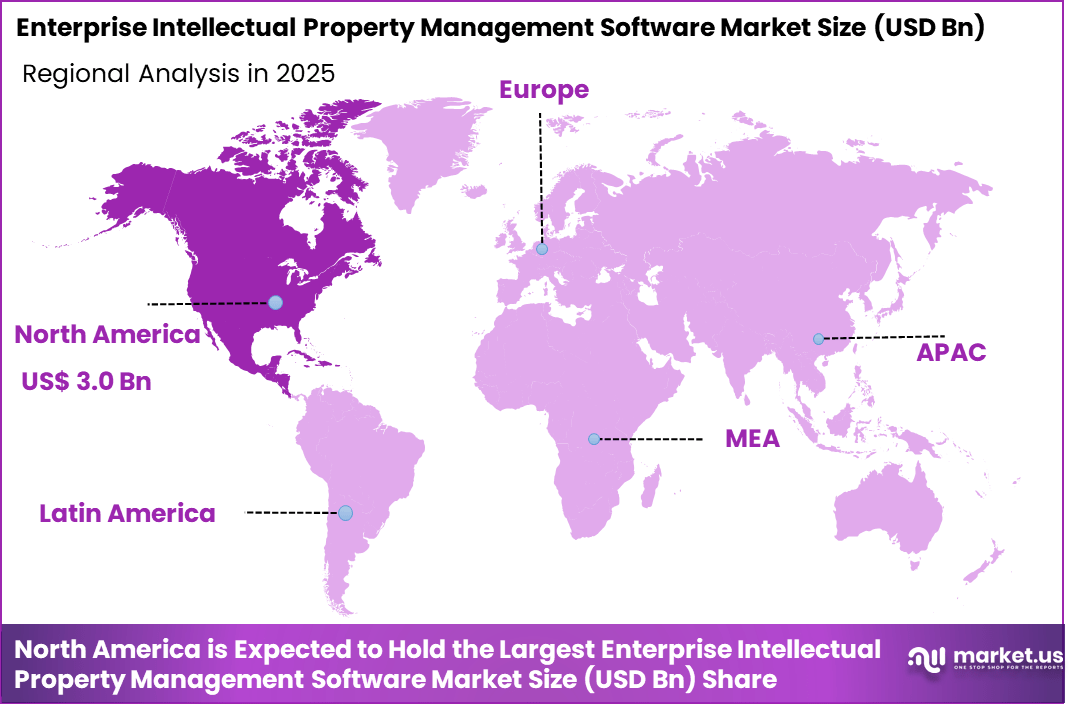

The Global Enterprise Intellectual Property Management Software Market size is expected to be worth around USD 35.3 Billion By 2035, from USD 8.5 billion in 2025, growing at a CAGR of 15.3% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 36.3% share, holding USD 3.0 Billion revenue.

The enterprise intellectual property (IP) management software market refers to technology solutions that help organizations capture, track, protect, and optimise their intellectual property portfolios. These platforms support management of patents, trademarks, copyrights, trade secrets, licensing agreements, and IP related workflows. Enterprise IP management software centralises data, automates docketing and renewals, tracks global filings, and enables collaboration across legal, R&D, and business units.

Adoption spans corporations, universities, research institutions, and law firms seeking structured oversight of intangible assets. Market growth has been influenced by rising investment in innovation, expanding global patent filings, and heightened competition for technological leadership. As organisations generate increasing volumes of proprietary knowledge, tools that ensure accurate tracking, compliance, and strategic insight have become essential.

One major driving factor of the enterprise IP management software market is the growing complexity of global intellectual property landscapes. Organisations often maintain portfolios across multiple jurisdictions with differing rules, timelines, and renewal requirements. Manual tracking introduces risk of missed deadlines, inconsistent documentation, and compliance issues. IP management platforms centralise workflows, automate alerts, and ensure uniform process controls across international portfolios.

Demand for enterprise IP management software is shaped by expanding research and development investments across industries such as technology, pharmaceuticals, manufacturing, and consumer goods. Sectors with intensive innovation cycles generate large volumes of patentable subject matter, trademarks, and associated rights. These organisations require solutions that scale with complexity and support multi stakeholder collaboration. This growth in innovation activity underpins strong enterprise demand.

Top Market Takeaways

- On premises deployment led adoption with a 56.2% share, reflecting enterprise preference for tighter data control, internal security policies, and direct integration with legal and R and D systems.

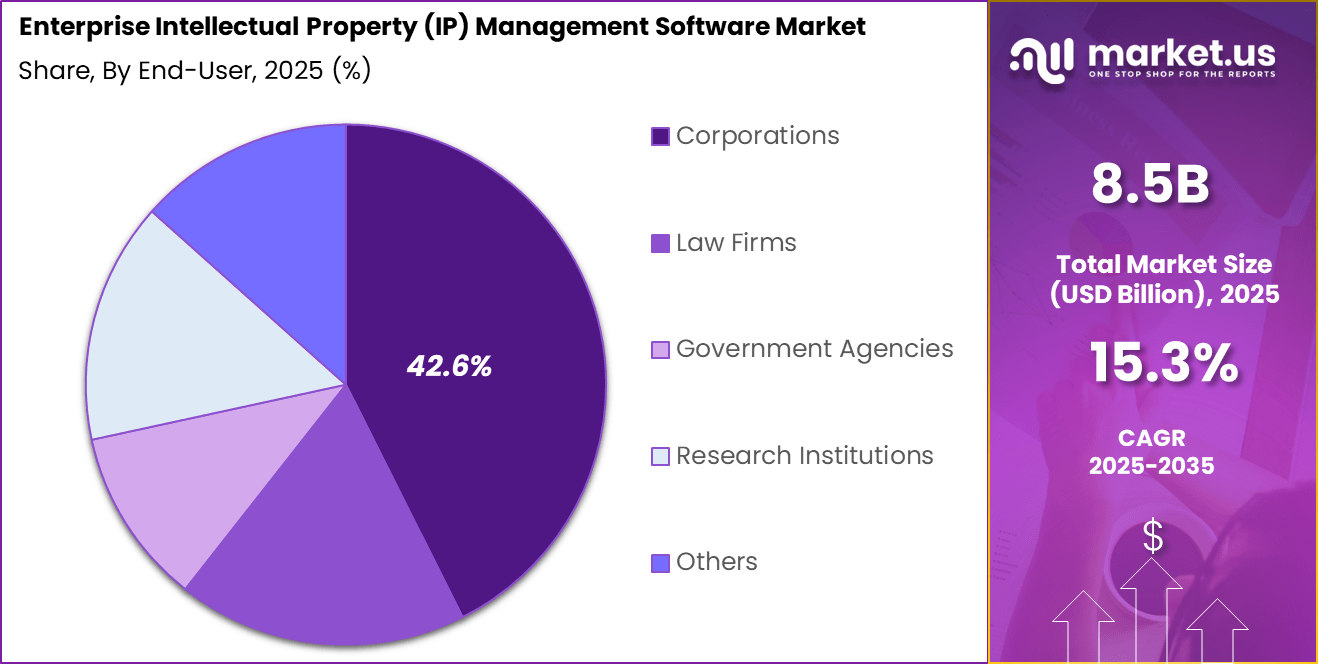

- Corporations represented the largest end user group with a 42.6% share, driven by growing patent portfolios, brand protection needs, and rising litigation and compliance requirements.

- Large enterprises dominated with a 74.4% share, supported by complex IP assets, global filing activities, and higher investment capacity for specialized IP management platforms.

- Patent management functionality accounted for 38.3% share, highlighting strong demand for tools that support filing, renewal tracking, prior art management, and lifecycle monitoring.

- North America held a 36.3% share, backed by high innovation intensity, strong intellectual property enforcement frameworks, and widespread enterprise software adoption.

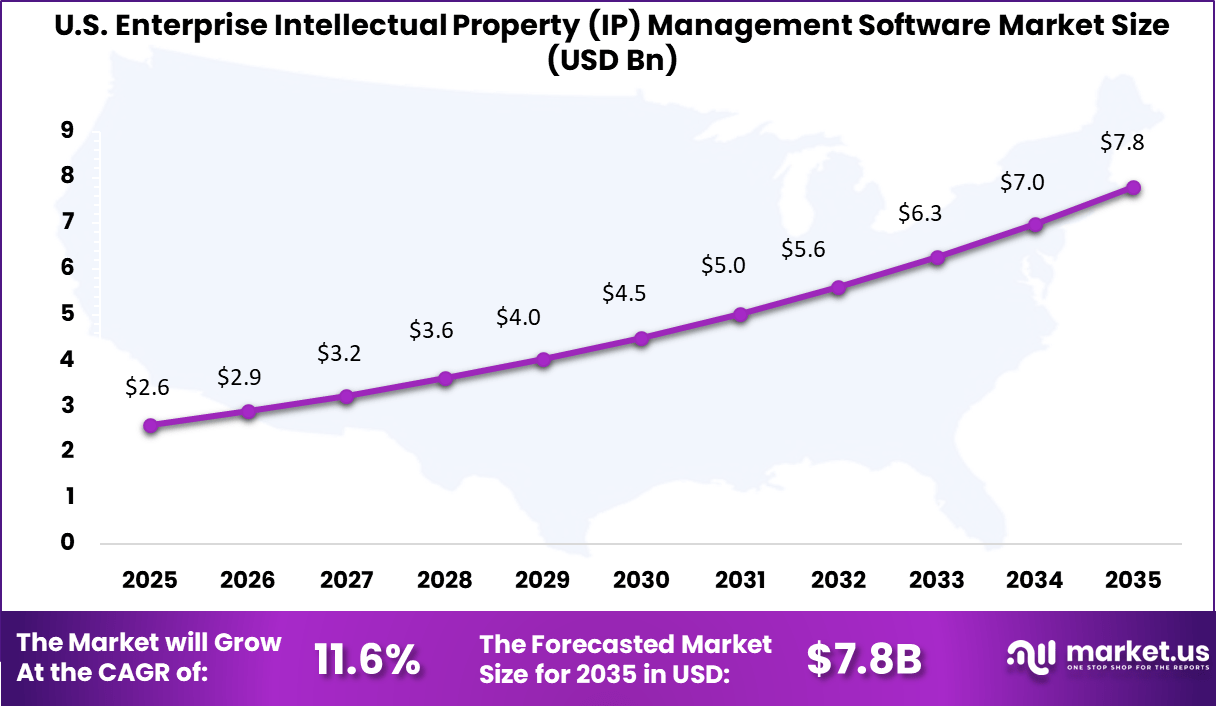

- The United States remained a central market with activity valued at USD 2.66 billion, expanding at a steady 11.6% growth pace due to continued growth in patent filings and digital transformation of legal operations.

Key Insights

- AI integration reached a mature stage by early 2026, as around 85% of the broader intellectual property ecosystem adopted AI in some form. Within IP management software platforms specifically, AI feature adoption stood at 60%, reflecting steady integration into core workflows.

- Deployment preferences shifted clearly toward the cloud, with cloud based solutions accounting for more than 68% share by early 2026. Cloud infrastructure moved from an optional model to the standard approach for IP data storage, collaboration, and lifecycle management.

- Enterprise adoption remained led by large organizations, which held a 64.4% share of total usage. At the same time, SMEs emerged as the fastest growing group, expanding at a 20.7% growth pace due to simplified filing tools, guided workflows, and mobile friendly interfaces.

- Strategic use cases dominated AI enabled IP software adoption. Competitive intelligence accounted for 37% of usage, followed closely by research and discovery at 36%, and patentability and validity analysis at 35%.

- Operational efficiency improved significantly, as AI powered drafting assistants reduced patent preparation time by up to 60%. This allowed legal and R and D teams to handle higher filing volumes without proportional increases in staffing.

- Industry specific usage remained strongest in IT and telecom, which generated 23.8% of revenue share due to rapid innovation cycles and large patent portfolios. Healthcare and life sciences recorded the fastest growth at 18.5%, driven by complex patent structures linked to AI enabled drug discovery.

- Legal industry priorities shifted toward governance and risk management, as about 65% of attorneys identified privacy and liability as their main concerns when using AI embedded IP software. This reinforced demand for transparent, auditable, and compliant AI features within enterprise platforms.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth in patent filings Rising innovation output across industries ~4.1% Global Short Term Increasing IP litigation risk Need for centralized IP control and tracking ~3.6% North America, Europe Short to Mid Term Digital transformation of legal departments Shift from manual IP processes to software platforms ~3.1% Global Mid Term Globalization of IP portfolios Multi jurisdiction compliance management ~2.7% Global Mid Term Emphasis on IP monetization Strategic use of patents and trademarks ~1.8% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security concerns Exposure of sensitive IP records ~3.9% Global Short Term High switching costs Migration complexity from legacy systems ~3.2% Global Mid Term Regulatory variation Differences in IP laws across regions ~2.7% Global Mid Term Vendor lock in Dependence on proprietary platforms ~2.1% Global Long Term Limited user adoption Resistance from legal teams ~1.6% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High implementation cost Enterprise scale software deployment ~4.4% Emerging Markets Short to Mid Term Integration challenges Compatibility with ERP and legal tools ~3.5% Global Mid Term Customization complexity Diverse IP workflows across industries ~2.8% Global Mid Term Limited SME adoption Cost and complexity barriers ~2.2% Emerging Markets Long Term Training requirements Need for specialized user skills ~1.7% Global Long Term By Deployment Model

On-premises deployment accounts for 56.2%, showing a strong preference for locally managed IP systems. Organizations choose on-premises setups to retain full control over sensitive intellectual property data. This deployment model supports strict security and compliance requirements. Legal and R&D teams value predictable system performance. Local infrastructure also allows tailored configurations.

The dominance of on-premises deployment is driven by data confidentiality concerns. IP records often include patents, trade secrets, and legal documents. Organizations prefer internal governance over access and storage. On-premises systems integrate with existing enterprise tools. This sustains continued adoption.

By End User

Corporations account for 42.6%, making them the largest end-user group. These organizations manage extensive IP portfolios across regions. IP management software helps track filings, renewals, and compliance. Centralized platforms improve coordination between legal and business units. Accurate records reduce legal risk.

Adoption among corporations is driven by innovation activity. Companies invest in protecting proprietary technologies. Software supports lifecycle management of IP assets. Reporting tools aid strategic decision-making. This maintains strong corporate demand.

By Organization Size

Large enterprises represent 74.4%, highlighting their dominant role in adoption. These organizations handle high volumes of patents and trademarks. Managing complexity requires robust software platforms. Large enterprises prioritize scalability and reliability. Governance features are essential.

The preference among large enterprises is driven by global operations. Multiple jurisdictions increase compliance needs. IP software standardizes processes across units. Automation reduces administrative workload. This sustains strong enterprise-level usage.

By Functionality

Patent management accounts for 38.3%, making it the leading functionality. This includes tracking filings, deadlines, and renewals. Accurate patent management supports legal protection. Centralized visibility improves portfolio oversight. Timely actions reduce lapse risks.

Growth in patent management is driven by rising patent activity. Organizations focus on protecting innovations. Software tools improve accuracy and efficiency. Alerts and workflows support compliance. This keeps patent management central.

By Region

North America accounts for 36.3%, supported by strong corporate innovation activity. The region has mature legal and IP frameworks. Enterprises invest in digital tools to manage IP assets. Technology adoption supports market growth. The region remains influential.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Strong corporate IP enforcement culture 36.3% USD 3.10 Bn Advanced Europe Harmonization of IP regulations 28.1% USD 2.40 Bn Advanced Asia Pacific Rapid growth in patent filings 25.7% USD 2.19 Bn Developing to Advanced Latin America Corporate IP formalization 5.6% USD 0.48 Bn Developing Middle East and Africa Early IP digitization initiatives 4.3% USD 0.37 Bn Early

The United States reached USD 2.66 Billion with a CAGR of 11.6%, reflecting steady expansion. Growth is driven by corporate R&D investment. IP protection remains a strategic priority. Software adoption improves efficiency and compliance. Market momentum remains stable.

Investment Opportunities

Investment opportunities in the enterprise IP management software market exist in analytics and decision support modules that integrate financial and market data with IP portfolios. Platforms that offer predictive valuation, risk scoring, and commercialisation forecasting can attract strong interest from IP intensive organisations. Tools that help quantify portfolio value and guide monetisation strategies support higher enterprise adoption.

Another opportunity lies in cross functional integration with enterprise systems such as product lifecycle management, research data repositories, and contract management software. Seamless interoperability enhances data flow and reduces duplication of effort across functions. Investors may focus on solutions that provide modular but connected frameworks to serve broad enterprise requirements. Integrated solutions deliver operational efficiency and strategic value.

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large enterprises Very High ~74.4% Protection of large IP portfolios Platform wide deployment Corporations High ~42.6% Risk mitigation and IP valuation Long term licensing Law firms and IP consultancies Moderate ~11% Client portfolio management Subscription based Government and public bodies Moderate ~8% National IP registry modernization Program driven SMEs Low to Moderate ~6% Cost efficient IP tracking Selective adoption Business Benefits

Adoption of enterprise IP management software improves operational efficiency by automating administrative tasks and centralising document repositories. Teams spend less time on manual tracking and more time on high value analysis and strategy. Standardised workflows reduce errors and support consistent organisational practices. These efficiencies contribute to lower operational costs and better risk mitigation.

Enterprise IP management platforms also support informed decision making and strategic planning. With integrated dashboards and analytics, leaders can assess portfolio performance, identify gaps, and prioritise resources. This visibility strengthens alignment between IP activity and business strategy. Better insight into asset value and risk supports long term competitiveness.

Regulatory Environment

The regulatory environment for the enterprise IP management software market includes national and international intellectual property laws that govern filing, enforcement, and rights protection. IP management solutions must support compliance with diverse regulations such as PCT procedures, trademark classifications, and patent renewal rules. Compliance functionalities built into software help organisations adhere to jurisdictional requirements.

Data protection and privacy regulations also influence how sensitive IP related data is stored, accessed, and shared. Platforms must implement secure access controls, encryption, and audit trails to align with regional privacy laws. Additionally, governance frameworks such as SOX and ISO standards may affect documentation and reporting practices. Regulatory alignment builds trust, reduces legal risk, and supports sustained enterprise adoption of IP management technologies.

Emerging Trends

In the enterprise intellectual property management software market, one trend is the integration of centralised repositories for patents, trademarks, copyrights, and trade secrets. Organisations are moving from spreadsheets and siloed files to systems that store and organise all IP assets in a single place. This improves visibility and coordination when teams need to review rights, deadlines, or licensing terms.

Another trend is the use of automated alerting and deadline tracking. Modern platforms can notify users when key dates such as patent renewals, filing deadlines, or licence expirations are approaching. These reminders help reduce the risk of missed actions that could jeopardise legal protection or create financial loss for the organisation.

Opportunity

A strong opportunity exists in the development of analytics and insight tools that help organisations understand performance and trends across their IP portfolios. Features that highlight under-utilised assets, forecast renewal costs, or benchmark against industry peers can improve strategic decision making and resource prioritisation.

Another opportunity lies in enhancing integration with external patent offices and legal databases. Software that connects directly to official registration systems and global classification repositories can reduce manual data entry and help ensure that updates are accurate and timely.

Challenge

One challenge for the enterprise IP management software market is ensuring data accuracy and consistency across long-lived asset histories. IP portfolios often extend over many years and may involve multiple authors, inventors, or legal events. Maintaining complete, consistent records requires disciplined governance and ongoing verification.

Another challenge involves balancing security with accessibility. IP information is highly sensitive, and platforms must restrict access appropriately while enabling authorised personnel to work with the data they need. Designing role-based access and secure storage without hindering collaboration requires careful planning.

Key Market Segments

By Deployment Model

- Cloud-Based

- On-Premises

- Hybrid

By End User

- Corporations

- Law Firms

- Government Agencies

- Research Institutions

- Others

By Organization Size

- Small & Medium Enterprise Size (SME’s)

- Large Enterprises

By Functionality

- Patent Management

- Trademark Management

- Copyright Management

- Trade Secret Management

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

The Enterprise Intellectual Property Management Software Market is led by established solution providers such as Anaqua Inc., Clarivate, Questel, and LexisNexis. These players offer end to end platforms covering patent lifecycle management, trademark administration, and portfolio analytics. Their solutions are widely adopted by large enterprises and law firms. Strong data accuracy, workflow automation, and regulatory compliance remain core strengths. Continuous product upgrades support complex global IP portfolios.

Global technology and consulting oriented companies also play an important role in market expansion. Thales and Dennemeyer & Associates S.A. focus on secure IP data handling and cross border portfolio management. Their platforms support enterprise level governance and risk control. Emphasis is placed on data security, cloud deployment, and integration with corporate systems. These offerings are preferred by organizations with strict compliance needs and high value intellectual assets.

Emerging and specialized vendors strengthen innovation and competitive diversity in the market. Companies such as Innovation Asset Group Inc., PatSeer Technologies Pvt. Ltd, Patsnap, and Cardinal Intellectual Property, Inc. focus on analytics driven insights and strategic IP decision support. Their tools enhance patent intelligence and competitive benchmarking. The presence of other niche providers supports customization and adoption across different industry verticals.

Top Key Players in the Market

- Anaqua Inc.

- Questel

- Thales

- Clarivate

- Innovation Asset Group Inc.

- Dennemeyer & Associates S.A.

- LexisNexis

- PatSeer Technologies Pvt. Ltd

- Patsnap

- Cardinal Intellectual Property, Inc.

- Others

Recent Developments

- February, 2025: Nordic Capital finalizes acquisition of Anaqua, injecting capital for IP software enhancements and market expansion.

Report Scope

Report Features Description Market Value (2025) USD 8.5 Bn Forecast Revenue (2035) USD 35.3 Bn CAGR(2026-2035) 15.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Model (Cloud-Based, On-Premises, Hybrid), By End User (Corporations, Law Firms, Government Agencies, Research Institutions, Others), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Functionality (Patent Management, Trademark Management, Copyright Management, Trade Secret Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Anaqua Inc., Questel, Thales, Clarivate, Innovation Asset Group Inc., Dennemeyer & Associates S.A., LexisNexis, PatSeer Technologies Pvt. Ltd., Patsnap, Cardinal Intellectual Property, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Intellectual Property (IP) Management Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Enterprise Intellectual Property (IP) Management Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Anaqua Inc.

- Questel

- Thales

- Clarivate

- Innovation Asset Group Inc.

- Dennemeyer & Associates S.A.

- LexisNexis

- PatSeer Technologies Pvt. Ltd

- Patsnap

- Cardinal Intellectual Property, Inc.

- Others