Global Energy Retrofit Systems Market; By Product(Envelope, LED Retrofit Lighting, HVAC Retrofit, Appliances), By Type(Quick Win Retrofit, Deep Retrofit), By Application(Residential, Non-Residential) as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2024-2033

- Published date: Jan 2024

- Report ID: 13820

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

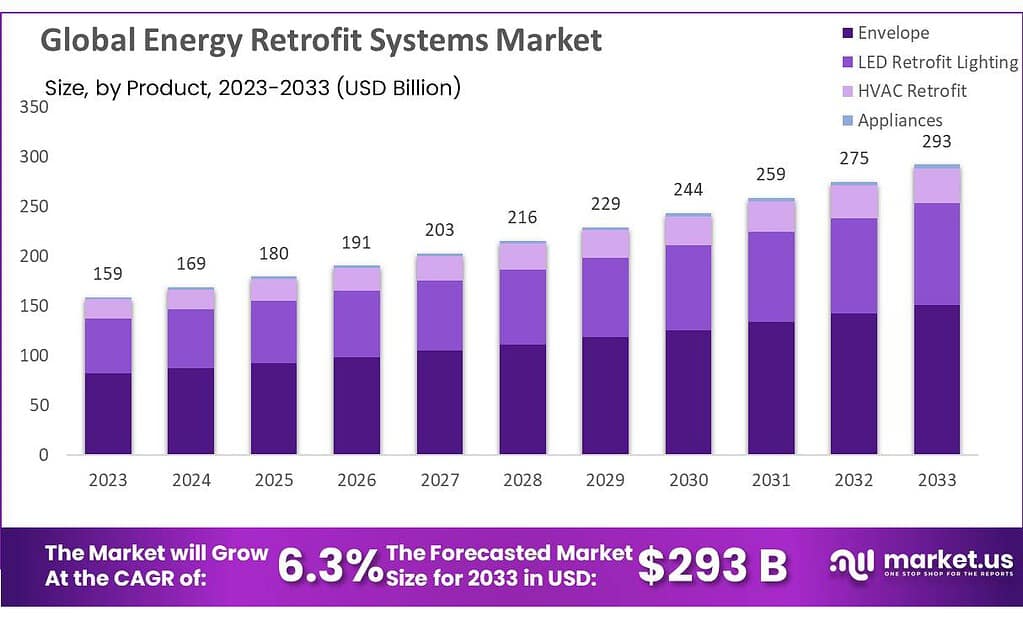

The Energy Retrofit Systems Market size is expected to be worth around USD 293 billion by 2033, from USD 159 Bn in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2033.

Energy retrofit systems refer to a set of technologies, processes, and modifications implemented in existing buildings or industrial facilities to enhance energy efficiency, reduce energy consumption, and lower overall environmental impact. These systems encompass a range of upgrades, such as improved insulation, energy-efficient lighting, HVAC (heating, ventilation, and air conditioning) upgrades, smart building technologies, and renewable energy integration.

The goal of energy retrofit systems is to optimize the performance of existing structures, making them more sustainable, cost-effective, and environmentally friendly by aligning with modern energy efficiency standards and practices. These retrofits contribute to achieving energy conservation goals, minimizing greenhouse gas emissions, and fostering sustainable practices in various sectors, including commercial buildings, residential structures, and industrial facilities.

Key Takeaways

- Market Growth Projection: The Energy Retrofit Systems Market is anticipated to grow from USD 159 billion in 2023 to USD 293 billion by 2033, with a robust CAGR of 6.3%.

- Envelope Dominance: Envelope retrofitting led in 2023 with over 51.54% market share, emphasizing the focus on enhancing building structures for energy efficiency.

- Quick Win Retrofit Preference: Quick Win Retrofit dominated with over 56.3% market share in 2023, indicating a preference for immediate, cost-effective retrofit solutions for instant energy efficiency gains.

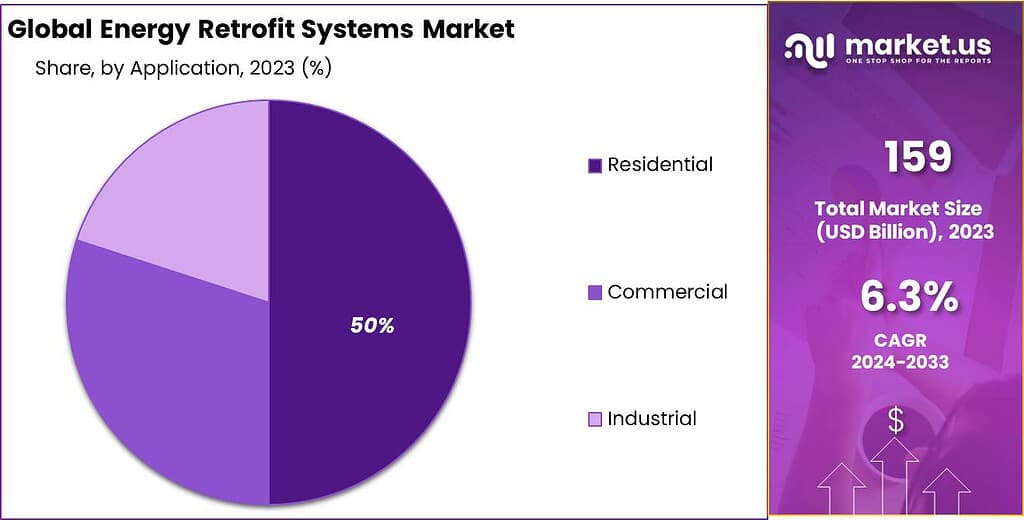

- Commercial Applications Lead: Commercial applications held a dominant market position in 2023, securing a substantial share exceeding 50.73%, emphasizing the adoption of energy retrofit solutions in commercial buildings.

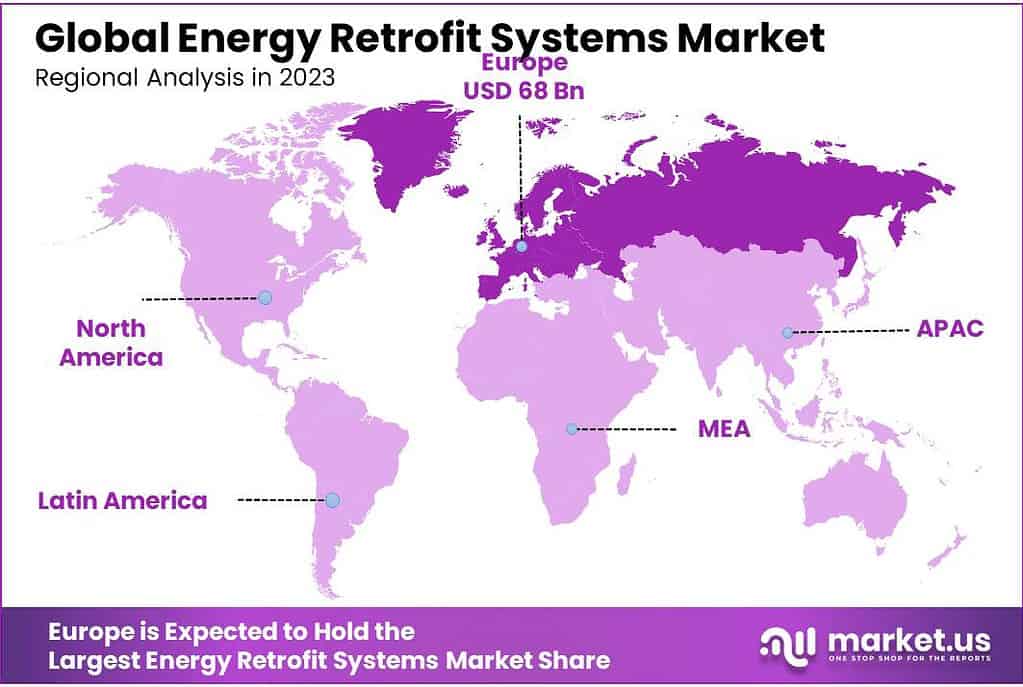

- North America Regional Leadership: North America led with over 43% revenue share in 2023, driven by increasing demand for reliable, efficient, and custom-made retrofit solutions from various industries.

Product Insights

In 2023, the Energy Retrofit Systems Market saw Envelope emerge as a frontrunner, securing a dominant market position with an impressive share exceeding 51.54%. This signifies the significant demand for retrofits focused on enhancing the building envelope, including insulation and structural components, reflecting the industry’s commitment to improving energy efficiency in existing structures.

LED Retrofit Lighting also played a substantial role, capturing a notable market share. The widespread adoption of energy-efficient lighting solutions underscored the importance of enhancing lighting systems to reduce energy consumption and operational costs for both residential and commercial applications.

HVAC Retrofit showcased considerable presence in the market, maintaining a substantial market share. As heating, ventilation, and air conditioning systems are major contributors to energy consumption, retrofitting these systems with more efficient components and technologies gained traction in 2023.

Appliances contributed significantly to the overall market landscape, encompassing retrofits for various energy-consuming devices. The demand for energy-efficient appliances continued to drive the market, aligning with consumer preferences for sustainability and cost savings.

By Type

In 2023, the Energy Retrofit Systems Market saw Quick Win Retrofit take a prominent lead, securing a dominant market position with an impressive share exceeding 56.3%. This highlights the significant preference for swift and cost-effective retrofit solutions, emphasizing the industry’s focus on achieving immediate energy efficiency gains in existing structures.

Deep Retrofit also played a substantial role, maintaining a noteworthy market share. The demand for comprehensive retrofit solutions that involve substantial modifications to enhance long-term energy performance contributed to the market landscape.

The diverse distribution between Quick Win Retrofit and Deep Retrofit showcases the varied approaches in addressing energy efficiency. Quick Win Retrofit solutions offer immediate benefits, while Deep Retrofit solutions focus on comprehensive and long-lasting improvements, catering to the evolving needs of the market and promoting sustainability in existing buildings and facilities.

Application Analysis

In 2023, the Energy Retrofit Systems Market showcased the dominance of Commercial applications, securing a leading market position with a substantial share exceeding 50.73%. This emphasizes the significant adoption of energy retrofit solutions in commercial buildings, reflecting the industry’s commitment to improving energy efficiency and sustainability in the business sector.

Residential applications also played a substantial role, maintaining a noteworthy market share. The demand for energy-efficient solutions in homes contributed to the overall market landscape, driven by the increasing awareness and preferences for sustainable living.

Industrial applications contributed significantly, encompassing retrofit solutions for various industrial facilities. The emphasis on optimizing energy consumption in manufacturing and processing industries reflected the market’s commitment to fostering sustainability and cost-effectiveness in industrial operations.

Key Market Segments

By Product

- Envelope

- LED Retrofit Lighting

- HVAC Retrofit

- Appliances

By Type

- Quick Win Retrofit

- Deep Retrofit

By Application

- Residential

- Non-Residential

Drivers

The adoption of energy retrofit systems is becoming crucial in the construction sector, aimed at enhancing a building’s energy performance. This approach not only reduces energy consumption but also lessens the need for constructing new buildings. Such strategies align with sustainability goals, making them a driving force in this market.

Notably, government initiatives, like the Biden Administration’s plan to upgrade millions of buildings, accelerate this trend, promising affordable, resilient, and energy-efficient structures across the U.S. Moreover, investments, like the U.S. Department of Energy’s funding for energy-efficient technologies, further boost this momentum, aiming for net-zero carbon emissions by 2050.

Government regulations and frameworks play a pivotal role in propelling the growth of energy retrofit systems. Various policies and financial models incentivize the adoption of these systems in residential and commercial buildings, aiming to save considerable energy—around 10-40%. Programs like the Mayor’s Energy of Londoner’s retrofit accelerator and initiatives backed by the European Regional Development Fund emphasize reducing carbon emissions and curbing energy bills through effective retrofitting solutions.

Additionally, countries like the Netherlands implementing strict legislation mandating buildings to meet performance levels drive substantial growth in this sector. The EU Emissions Trading’s support for building renovation also fosters a conducive market landscape for energy retrofit systems, leveraging private investments for sustainable building improvements.

Restraints

Insufficient information and inadequate infrastructure pose significant hurdles to the growth of the energy retrofit systems market. In the European Union, the residential sector accounts for a substantial portion of energy consumption and CO2 emissions. Despite the EU’s policies and investment strategies aimed at renovating residential structures by 2050, achieving optimal energy efficiency remains challenging.

The gap between investment opportunities and actual implementation persists due to behavioral habits among residential consumers. Studies highlight this gap, citing behavioral explanations, measurement errors, and a lack of awareness about the benefits and possibilities of energy-efficient practices as obstacles hindering market growth.

Additionally, structural changes present challenges to the energy retrofit market. Implementing energy retrofit systems into buildings containing heritage or archaeological sites poses risk. Inappropriate methods or technologies might inadvertently harm these valuable assets.

The use of unproven techniques or instruments further complicates the adoption of energy retrofit systems, creating reluctance and potential risks to historically significant structures. These challenges in information dissemination, behavioral patterns, and risks associated with heritage sites act as restraining factors for the energy retrofit systems market, impacting its expansion and adoption.

Opportunities

The energy retrofit systems market holds promising opportunities amid the global push for sustainability and energy efficiency. With increasing focus on reducing carbon footprints and optimizing energy usage, the demand for retrofitting existing structures is on the rise. This trend offers a significant opportunity for market growth, as retrofit systems play a vital role in upgrading buildings to meet modern energy efficiency standards.

Technological advances and innovation in retrofitting solutions create invaluable opportunities. The creation of more advanced, cost-effective, and efficient retrofitting systems meets varying building requirements and drives market expansion. Integrating smart technologies like IoT-enabled energy management systems further expands market by providing enhanced control capabilities as well as cost savings capabilities.

Government initiatives and regulations geared towards energy conservation provide a favorable landscape for the market. Subsidies, incentives, and funding programs by governments to encourage energy retrofitting in buildings create a conducive environment for market growth. Additionally, collaborations between public and private sectors for large-scale retrofit projects offer substantial opportunities for market players.

The emphasis on improving indoor air quality and occupant comfort is another emerging opportunity. Retrofit systems that enhance air filtration, ventilation, and overall indoor environment quality are in demand. This trend presents avenues for innovative solutions catering to health-conscious building owners and occupants.

Overall, rising demand for sustainable solutions, technological innovations, supportive government policies, and improving indoor environments present many opportunities for the energy retrofit systems market to flourish and expand its footprint.

Challenges

Navigating the energy retrofit systems market comes with a set of challenges that hinder its growth and adoption. One significant hurdle is the reluctance or slow pace in adopting new technologies and retrofitting solutions. Many building owners and stakeholders may resist change due to factors like cost concerns, lack of awareness about the benefits, or uncertainty about the effectiveness of retrofitting methods.

The complexity of retrofitting historical or heritage buildings poses another challenge. Implementing retrofit systems in these structures requires careful consideration to preserve their architectural integrity. Unproven or improper methods might inadvertently damage these culturally significant assets, creating reluctance to adopt retrofitting solutions.

Financial barriers and cost constraints also impede market growth. Despite potential long-term cost savings from energy-efficient solutions, the upfront investment required for retrofitting can be a deterrent for building owners or managers, particularly in cases where returns on investment are not immediately evident or guaranteed.

Regional Analysis

North America held the highest revenue share at over 43% in 2023. Russia was the top-earning country in Europe, in terms of revenues in 2021. Due to growing concerns about GHG emissions and stringent regulations to reduce carbon footprints, this regional market is driven primarily by greater product adoption levels. Market growth is expected to be bolstered by growing population figures and the increasing demand for clean and efficient energy.

Europe is also active in R&D efforts to produce clean, efficient energy, which in turn has supported the market growth. Regional market growth has been aided by the availability of financing from the European Union for energy conservation projects and energy efficiency projects. The Asia Pacific will, however, be the region with the highest CAGR over the forecast period.

The Asia-Pacific region’s quick development of energy modernization systems and the acceptance of these systems by residential and commercial end users are likely to assist in the reduction in the cost of renewable energy and the cost of infrastructure, which will boost market growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Market leaders compete based on their product development capabilities as well as new technologies used in product formulations. Ameresco is one of the most established players in this market. They invest in developing sustainable and innovative solutions to create new and better products.

The major market players are utilizing cutting-edge and advanced technologies to build the market for energy retrofit systems.

Ameresco, for example, announced in June 2021 that it had partnered with Defense Logistics Agency Energy and Cannon Air Force Base to provide USD 19 million in Energy Savings Performance Contracts (ESPC). Ameresco’s project will result in tangible facility improvements as well as recurring reductions in utility costs. The DOE Energy Savings Performance Contracts will be used to help Cannon Air Force Base achieve its mission capabilities, as well as meet its sustainability and energy goals. The following are some major players in the global market for energy retrofit systems:

Market Key Players

- Daikin Industries Ltd.

- Ameresco

- Eaton Corporation Plc

- AECOM

- Johnson Control International

- Orion Energy Systems Inc.

- Siemens AG

- Trane Technologies Inc.

- Other Key Players

Recent Developments

In October 2022, The Greater Toronto Airports Authority (GTAA) selected AECOM, Alectra Energy Solutions (Alectra), and Enwave Energy Corporation to deliver an innovative and comprehensive solution that would meet their decarbonization objectives.

In October 2022, Air Liquide, Chevron Corporation, LyondellBasell and Uniper SE will join forces on an investigation that will assess and potentially accelerate construction of a hydrogen and ammonia production facility on the U.S. Gulf Coast.

In September 2022, AECOM, one of the world’s premier infrastructure consulting firms, and Ferrovial Vertiports – part of global infrastructure operator Ferrovial – announced that a due-diligence framework had been put in place in Florida to identify optimal sites for planned vertiports connecting key points throughout Florida.

Report Scope

Report Features Description Market Value (2022) US$ 159 Bn Forecast Revenue (2032) US$ 293 Bn CAGR (2023-2032) 6.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Envelope, LED Retrofit Lighting, HVAC Retrofit, Appliances), By Type(Quick Win Retrofit, Deep Retrofit), By Application(Residential, Non-Residential) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Daikin Industries Ltd., Ameresco, Eaton Corporation Plc, AECOM, Johnson Control International, Orion Energy Systems Inc., Siemens AG, Trane Technologies Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How much is the energy retrofit systems market worth?The global market size was USD 148.23 billion in 2021 and is projected to surpass USD 233.96 billion by 2032.

At what CAGR is the energy retrofit systems market projected to grow in the forecast period (2023-2032)?Registering a CAGR of 4.2%, the market will exhibit a decent growth rate during the forecast period (2023-2032).

How big is the energy retrofit systems market?The global energy retrofit systems market size was estimated at USD 148.8 billion in 2021 and is expected to reach USD 233.96 billion in 2032.

What is the energy retrofit systems market growth?The global energy retrofit systems market is expected to grow at a compounded annual growth rate of 4.2% from 2023 to 2032 to reach USD 233.96 billion by 2032.

Who are the major players operating in the energy retrofit systems market?The major players operating in the energy retrofit systems market are Trane, Daikin Industries Ltd., Eaton Corporation PLC, Siemens, Ameresco, Johnson Control, Schneider Electric, AECOM Energy, Chevron Energy Solutions, E.ON Energy Services, Orion Energy Systems Inc., Engie SA, Alectra Energy Solutions, General Electric and Signify N.V.

Which region will lead the global energy retrofit systems market?Europe dominated the energy retrofit systems market in 2021 and will lead in the forecast period.

What are the growth factors for the energy retrofit systems market?Growing concerns about Greenhouse Gas emissions, widespread adoption of air conditioning appliances in various industries, and rapid urbanization are major growth factors for the energy retrofit systems market.

Energy Retrofit Systems MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Energy Retrofit Systems MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Daikin Industries Ltd.

- Ameresco

- Eaton Corporation Plc

- AECOM

- Johnson Control International

- Orion Energy Systems Inc.

- Siemens AG

- Trane Technologies Inc.

- Other Key Players