Global Energy and Power Plant Insurance Market Size, Share, Industry Analysis Report By Power Plant Type (Conventional Thermal Power Plants, Renewable Energy Plants, Nuclear Power Plants, Others), By Coverage Type (Property Damage Insurance, Business Interruption Insurance, Machinery Breakdown Insurance, Liability Insurance), By End-User (Power Generation Companies, Utility Companies, Independent Power Producers, Others), By Distribution Channel (Insurance Brokers, Direct Sales, Reinsurance Companies), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166379

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Market and Asset Breakdown

- Adoption Rate and Usage Statistics

- Key Risks and Trends

- Role of Generative AI

- Investment and Business Benefits

- China Market Size

- Power Plant Type Analysis

- Coverage Type Analysis

- End-User Analysis

- Distribution Channel Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

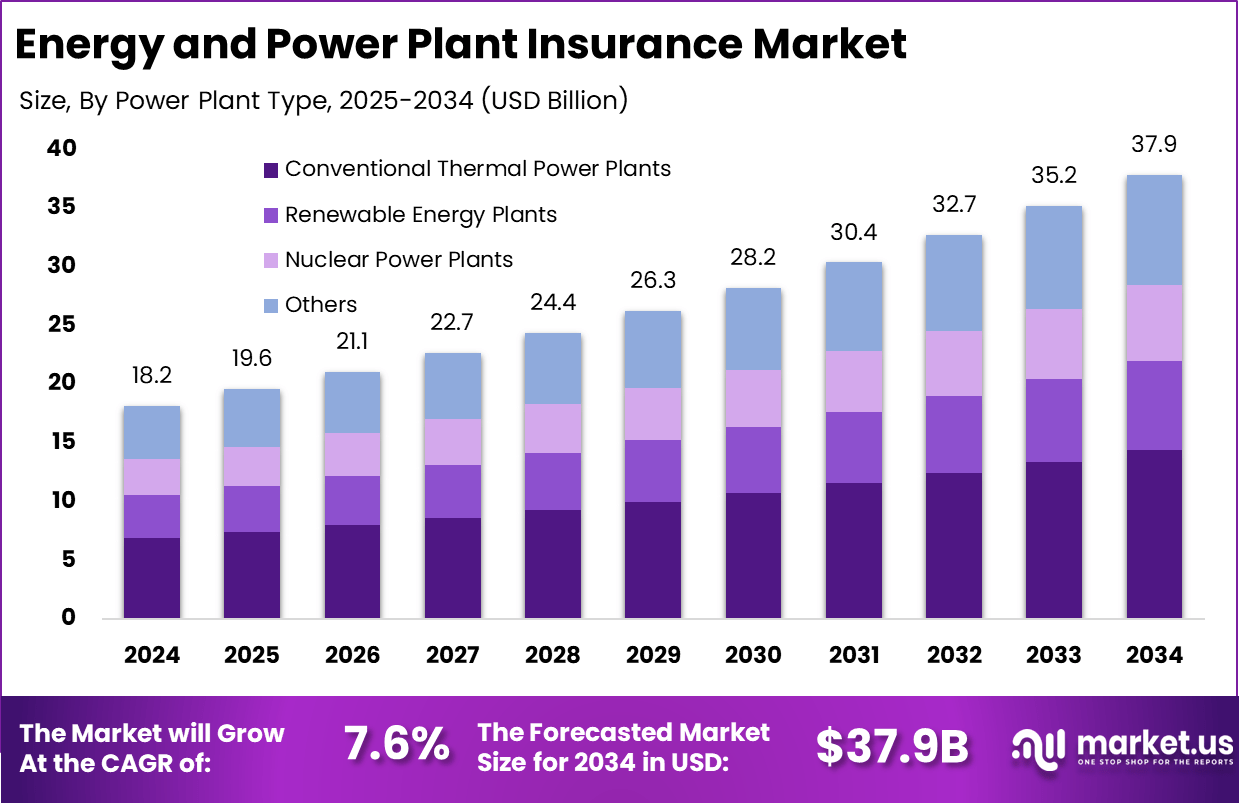

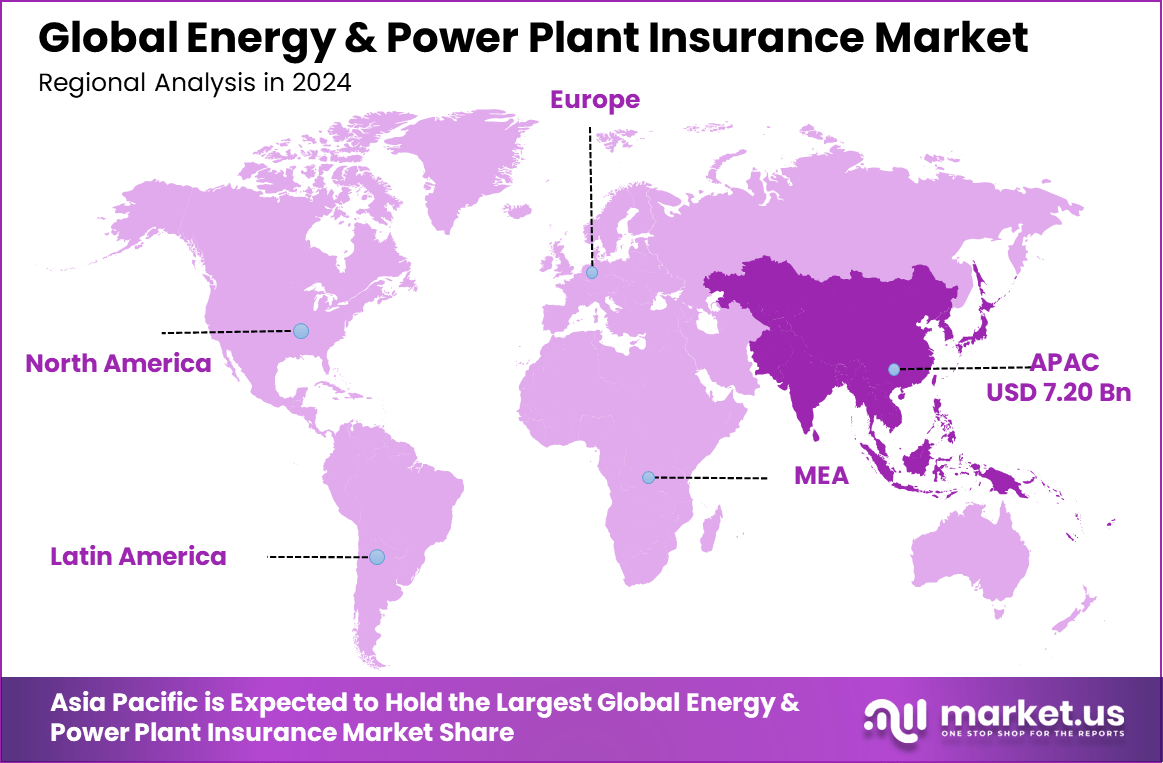

The Global Energy and Power Plant Insurance Market size is expected to be worth around USD 37.9 billion by 2034, from USD 18.2 billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 39.6% share, holding USD 7.20 billion in revenue.

The energy and power plant insurance market has expanded as utility operators, independent power producers and industrial facilities seek specialised coverage for high value assets and operational risks. Growth reflects the increasing complexity of energy infrastructure, broader adoption of renewable generation and heightened exposure to natural disasters, equipment failures and regulatory liabilities. Insurance products tailored for power plants have become essential components of risk management across the global energy sector.

The growth of the market can be attributed to rising demand for reliable power generation, aging infrastructure in many regions and greater exposure to weather related disruptions. The shift toward renewable energy has introduced new technical risks that require specialised coverage. Increasing regulatory requirements for environmental protection and operational safety also strengthen the need for comprehensive insurance solutions.

For instance, in October 2025, Zurich Insurance Group launched a modular insurance product specifically for agrivoltaic systems, which combine agriculture with solar power. The coverage protects against risks unique to these hybrid setups, such as damage to crops and delays in photovoltaic system repairs.

Key Takeaway

- In 2024, the Conventional Thermal Power Plants segment held a leading position, accounting for 38.1% of the Global Energy and Power Plant Insurance Market.

- In 2024, the Property Damage Insurance segment dominated with a 63.8% share, reflecting strong demand for coverage against asset damage and operational risks.

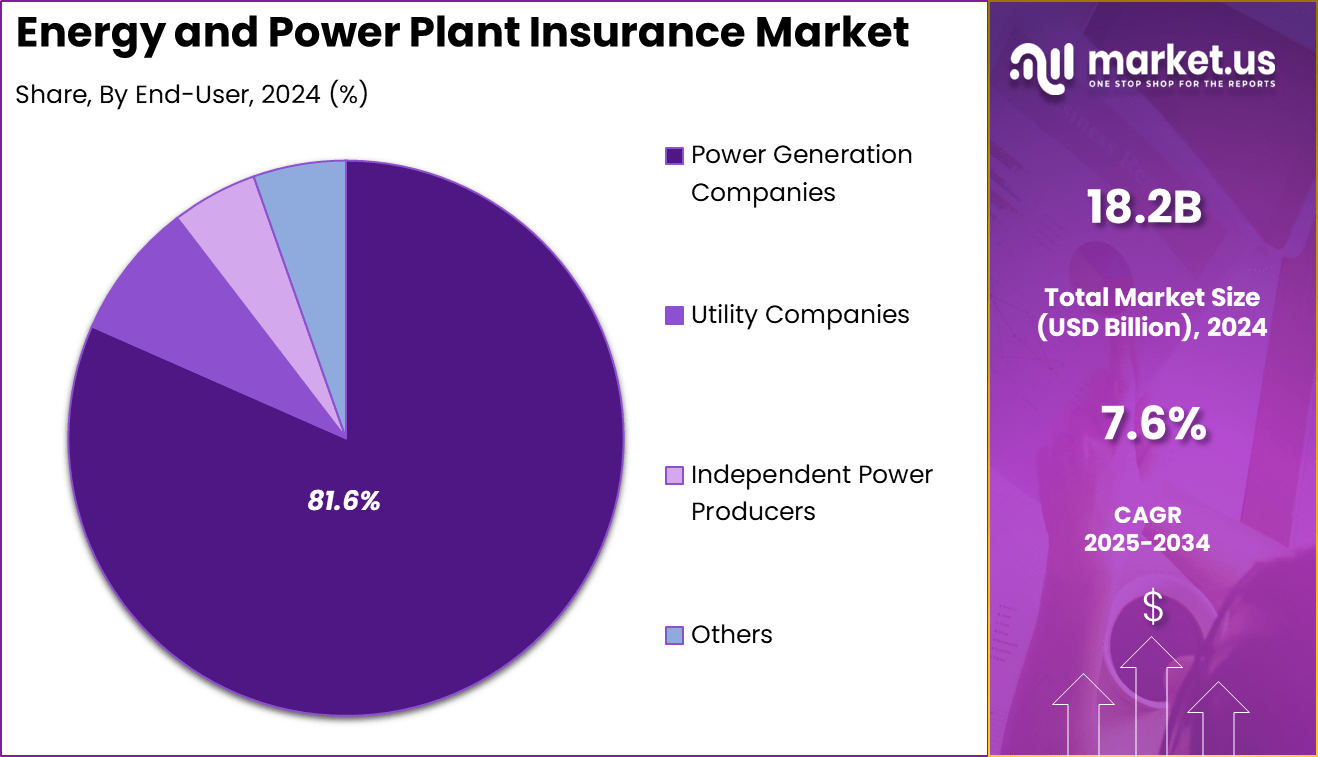

- The Power Generation Companies segment captured 81.6% of the market in 2024, highlighting its role as the primary buyer of energy and power plant insurance solutions.

- The Direct Sales segment held a dominant 91.7% share in 2024, supported by strong insurer–client relationships and specialized underwriting needs.

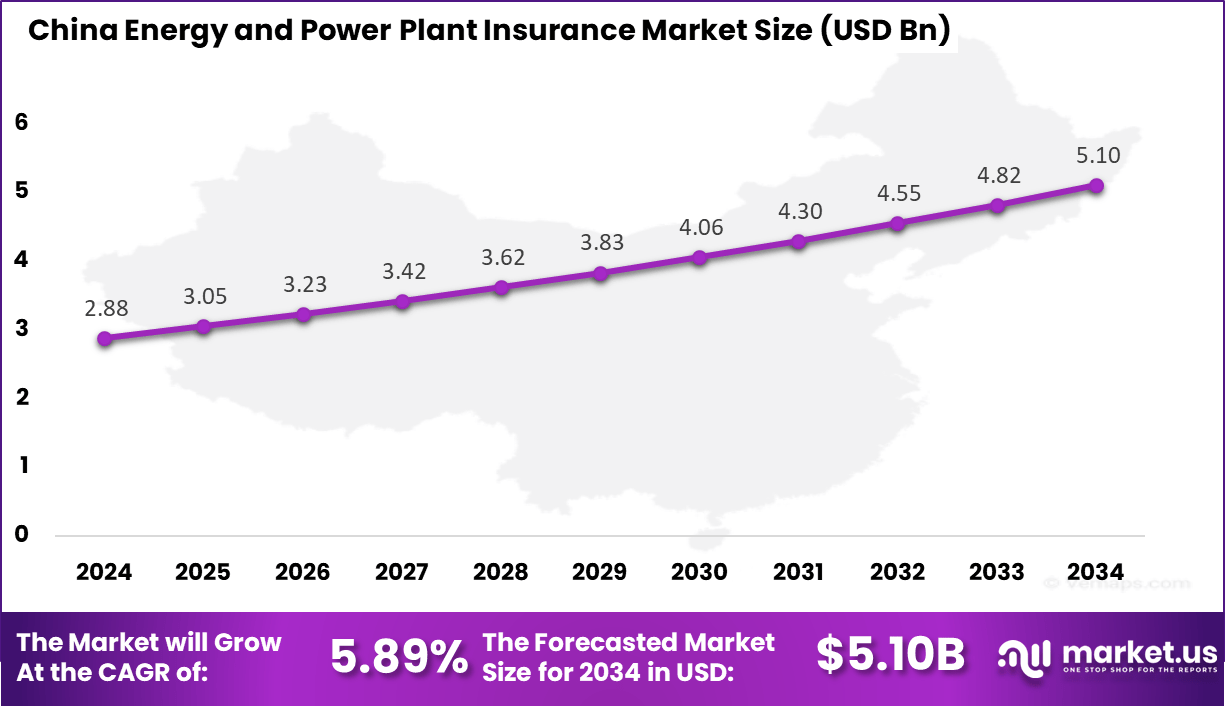

- The China Energy and Power Plant Insurance Market reached USD 2.88 billion in 2024, growing at a robust 5.89% CAGR.

- In 2024, the Asia Pacific region led the global market with a 39.6% share, supported by expanding infrastructure investments and rising energy demand.

Market and Asset Breakdown

- Power generation: Represents 39% of insured energy assets in 2023, with more than 82,000 sites covered. Common policies include steam boiler failure and blackout liability.

- Energy infrastructure: Accounts for 27% of policy volumes and covers over 5.6 million km of high-voltage transmission lines. Key risks include structural collapse, sabotage, and conductor degradation.

- Oil and gas: A major segment where liability insurance is the primary coverage type, addressing risks such as spills, fires, and equipment failure.

- Renewables: Holds 19% of policy count in 2023, covering more than 980,000 solar, wind, and hybrid installations.

- Utilities: Represents 11% of policies, including coverage for electricity and gas service providers, smart meters, and control centers.

Adoption Rate and Usage Statistics

Policy Types

- Property insurance: Represents over 44% of energy insurance contracts, providing coverage for physical damage caused by fire, floods, mechanical failure, and other operational hazards.

- Liability insurance: Accounts for about 32% of the market and covers third-party claims such as environmental damage and public liability incidents.

- Equipment breakdown insurance: Holds over 23%, offering essential protection for aging assets like turbines, transformers, and critical electrical equipment.

Renewable Energy Adoption

- The renewable energy insurance segment is expanding quickly, with insured projects rising across solar and wind operations. More than 980,000 wind turbine and solar units were insured in Q1 2024, indicating strong growth in clean energy coverage.

Emerging Coverage

- Cyber liability extensions are included in over 52% of new energy insurance policies as cyberattacks increasingly target power generation and grid infrastructure.

- Parametric insurance is gaining traction, offering rapid payouts based on predefined weather indicators such as wind speed or rainfall, making it well suited for climate-related risks.

Key Risks and Trends

- Mega losses: Events exceeding USD 30 million are increasing in frequency, and the average claim size continues to rise.

- Natural catastrophes: Losses linked to severe weather and natural hazards show a similar upward trend.

- Cyberattacks: Cyber incidents and data breaches are listed among the top risks for energy insurers.

- Operational risks: Operational loss ratios have increased compared with earlier years.

- Climate change: Climate-driven risks continue to strengthen the demand for renewable energy insurance and resilience-focused products.

Role of Generative AI

Generative AI is changing how energy and power plant insurance works by automating routine tasks like policy renewals, endorsements, and compliance checks. This automation helps reduce costs and speed up processing. AI also helps create custom insurance policies by analyzing risk data from sensors, weather models, and past claims. This means companies get policies that fit their exact needs, improving the accuracy of pricing and coverage.

Generative AI is also improving risk assessments by simulating different disaster scenarios and potential damages. These AI models can reduce error rates in underwriting by up to 40%, helping insurers decide on coverage more confidently. AI supports fraud detection and speeds up ESG reporting, making the insurance process faster and smarter. Together, these advances build a more responsive and flexible insurance market for energy and power plants.

Investment and Business Benefits

Investment Opportunities in this sector arise from the growing energy storage market, renewable infrastructure expansion, and digital transformation in risk assessment. Investments in battery storage and smart grid projects are particularly attractive as they require new insurance products to address distinct risks while supporting the renewable energy transition.

Specialized underwriting services focusing on microgrids, hydrogen facilities, and utility-scale batteries offer niche growth avenues. Governments’ incentives and stricter environmental standards also open further prospects for insurance companies to innovate and capture the energy insurance market.

Business Benefits of Energy & Power Plant Insurance include mitigating financial losses from unforeseen events, ensuring compliance with environmental and safety regulations, and improving operational resilience. Insurance coverage reassures investors and lenders by protecting project continuity against risks such as natural disasters, equipment breakdowns, or contractual disputes.

China Market Size

The market for Energy & Power Plant Insurance within China is growing tremendously and is currently valued at USD 2.88 billion, the market has a projected CAGR of 5.89%. This growth is mainly driven by the rapid expansion of China’s energy infrastructure, including both conventional and renewable power projects. The country’s push towards clean energy, combined with industrial growth and increasing power demand, fuels the need for robust insurance solutions.

Additionally, growing awareness of operational risks and stricter regulations on environmental and safety standards are increasing insurance adoption. The rising complexity of energy projects and the need to manage risks related to extreme weather events further contribute to market growth. This dynamic market evolution is supported by both domestic insurers and international reinsurers expanding their presence.

For instance, in March 2025, Allianz China announced a 12.5% rate increase for its SME energy insurance offerings, citing rising operational and inflationary costs in the energy sector. Allianz continues to strengthen its position as a key insurer for energy assets in China, supporting growth in renewables and conventional power plants.

In 2024, Asia Pacific held a dominant market position in the Global Energy & Power Plant Insurance Market, capturing more than a 39.6% share, holding USD 7.20 billion in revenue. This leadership stems from rapid industrialization and the expansion of energy infrastructure across the region. Many countries in the Asia Pacific are investing heavily in both conventional and renewable energy projects, which drives the demand for specialized insurance products that mitigate operational and environmental risks.

The region’s growth is further fueled by technological advancements, government initiatives supporting sustainable energy, and increasing adoption of digital risk management tools by insurers and power companies. Strong market presence in China, India, Japan, and Southeast Asia underpins the expanding footprint of energy insurance, making the Asia Pacific a key global hub for energy sector risk coverage.

For instance, in November 2025, Swiss Re highlighted the $26 billion insurance potential from clean energy globally, with Asia Pacific and Europe driving growth. Swiss Re’s report projects renewable energy capacity nearly doubling by 2030, reshaping the insurance landscape with a shift to long-term operational protection for renewable assets in the APAC region.

Power Plant Type Analysis

In 2024, the Conventional Thermal Power Plants segment held a dominant market position, capturing a 38.1% share of the Global Energy & Power Plant Insurance Market. These plants are typically driven by coal, natural gas, or oil, and carry a range of operational risks that demand specific coverage. Insurance for these plants often focuses on protecting the physical assets and minimizing the impact of disruptions caused by equipment failure or natural events.

Thermal plants remain integral to global energy supply despite rising renewable investments. Their age and complexity contribute to the need for robust insurance solutions to cover potential damage and operational downtime effectively. This segment’s prevalence reflects ongoing reliance on conventional power sources in many regions.

For Instance, in July 2025, Chubb reversed its earlier stance against coal by reinsuring a coal-fired power plant in Vietnam, highlighting a complex market dynamic for thermal power insurance despite environmental considerations.

Coverage Type Analysis

In 2024, the Property Damage Insurance segment held a dominant market position, capturing a 63.8% share of the Global Energy & Power Plant Insurance Market. This type of insurance safeguards the physical infrastructure of power plants against damage from fires, explosions, floods, mechanical breakdowns, and other hazards. Given the high capital investment in energy production facilities, property damage insurance is essential for risk management and financial stability.

The predominance of property damage coverage highlights the priority insurers and plant operators place on protecting critical assets. This coverage type often forms the backbone of broader insurance packages that may include machinery breakdown and liability components tailored to the complex risks faced by power plants.

For instance, in August 2025, Zurich Insurance launched modular insurance for agrivoltaic systems that covers installation, electronics, and power loss risks, showing innovation in property damage insurance covering complex hybrid energy systems.

End-User Analysis

In 2024, The Power Generation Companies segment held a dominant market position, capturing an 81.6% share of the Global Energy & Power Plant Insurance Market. These companies operate large-scale power plants that require comprehensive coverage to manage risks related to asset damage, business interruptions, and liability.

The sector’s extensive infrastructure and high stakes underscore the critical need for insurance products that address diverse operational exposures. This dominant share illustrates the direct relationship between the scale of power generation operations and insurance uptake. Companies in this segment prioritize risk transfer to protect financial performance and maintain an uninterrupted power supply amid potential hazards.

For Instance, in July 2025, Liberty Specialty Markets strengthened its power and renewable insurance team, reflecting the growing demands of power generation companies for advanced underwriting expertise in the face of evolving risk exposures.

Distribution Channel Analysis

In 2024, The Direct Sales segment held a dominant market position, capturing a 91.7% share of the Global Energy & Power Plant Insurance Market. This reflects the specialized nature of energy and power plant insurance, where bespoke coverage needs often require direct negotiation and tailored policy structuring. Direct relationships between insurers and power operators facilitate better risk assessment and customized solutions.

The dominance of direct sales channels indicates the complexity and significance of the insured assets. This approach allows insurers to align coverage closely with operational risk profiles, ensuring robust protection and timely claims management.

For Instance, in February 2025, Liberty Mutual updated its cyber risk resolution products specifically for energy sector clients, enhancing risk management services offered directly to insured companies, which underscores the importance of direct sales and client partnerships in tailoring insurance coverage.

Emerging trends

A major trend is the growing use of insurance products for renewable energy assets, such as wind and solar farms. Around 45% of premiums now come from large renewable projects, showing a shift from traditional fossil fuel coverage. New products are being designed for risks in emerging technologies like energy storage and smart grids. Insurers are also focusing more on cyber insurance as power grids face increasing cyber threats.

Another important trend is the rise of parametric insurance, which pays out based on specific triggers like hurricane wind speeds rather than actual claims. This speeds the claims process, especially after natural disasters. Data analytics and AI are playing a bigger role in pricing and risk evaluation. Regulations around environmental risks are driving insurers to develop stricter policies, especially for fossil fuel plants.

Growth Factors

The increasing demand for energy worldwide is pushing growth in insurance for power infrastructure. As energy projects become larger and more complex, companies seek risk protection against operational and environmental hazards. Growing concern over climate change pushes investments in insurance that covers natural disasters and environmental liability.

Regulatory pressure is another big growth factor. Stricter rules on emissions and safety mean companies must invest more in compliance and insurance. Advances in technology, like AI and better data models, help insurers make faster and more accurate decisions. These improvements enable better risk transfer and support the growth of the insurance market.

Key Market Segments

By Power Plant Type

- Conventional Thermal Power Plants

- Renewable Energy Plants

- Nuclear Power Plants

- Others

By Coverage Type

- Property Damage Insurance

- Business Interruption Insurance

- Machinery Breakdown Insurance

- Liability Insurance

By End-User

- Power Generation Companies

- Utility Companies

- Independent Power Producers

- Others

By Distribution Channel

- Insurance Brokers

- Direct Sales

- Reinsurance Companies

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Renewable Energy

The energy and power insurance market is strongly driven by the rising demand for renewable energy projects, such as solar and wind power. As countries and companies invest more in green energy to meet sustainability goals, the need for specialized insurance products to cover these complex and evolving technologies increases significantly. This growth in renewable projects creates new opportunities for insurers to offer tailored coverage that addresses the unique risks of these assets.

This trend is bolstered by increasing regulatory support and global energy transition policies, encouraging rapid expansion of renewable infrastructure. Insurance providers are adapting to cover emerging risks, including technology failures and environmental factors, making renewable energy demand a key growth engine for the insurance sector. This dynamic supports broader market growth and innovation in risk management solutions.

For instance, in November 2025, Swiss Re highlighted a $26 billion insurance potential from the clean energy sector, noting that global renewable energy capacity is expected to almost double by 2030. They emphasize growing investments in renewables and the resulting need for insurance solutions tailored to the energy transition, especially in Asia-Pacific and Europe.

Restraint

Limited Long-term Risk Data for New Technologies

A major restraint in the energy and power plant insurance market is the limited availability of long-term risk data, particularly for newer renewable energy technologies like floating solar farms, hydrogen storage, and offshore wind systems. These technologies have only recently become commercially widespread, leaving insurers with insufficient historical loss data to accurately assess risks and price policies.

Without robust data, underwriters face higher uncertainty, leading to cautious coverage strategies, higher premiums, or exclusions for such assets. This uncertainty slows insurance penetration and inhibits product customization, making it difficult for insurers to expand offerings on next-generation energy technologies effectively.

For instance, in December 2024, Munich Re’s strategy acknowledges the challenges in underwriting newer energy technologies like floating wind farms and green hydrogen due to limited long-term data. They are cautious about insuring these emerging risks and have committed to reducing exposure to coal-related projects while exploring gradual shifts towards renewables.

Opportunities

Growth of Specialized Insurance for Smart Energy Systems

The rapid adoption of smart grids and technologically advanced energy infrastructure presents a significant opportunity for the energy insurance market. Insurance providers can develop innovative products, such as cyber risk insurance and parametric coverage, to support these digital and interconnected systems. As the energy sector becomes more complex, demand for specialized risk management solutions grows.

This opportunity is further supported by increasing investments in emerging markets, especially in the Asia-Pacific, where energy infrastructure is expanding quickly. With regulatory requirements tightening regarding safety and environmental standards, insurers who develop expertise in these areas can capture growing market segments and improve their competitive positioning.

For instance, in October 2025, Chubb appointed Nick Clay as head of their Renewable Energy & Alternative Fuels Industry Practice for the UK and Ireland to lead multi-line insurance solutions for both construction and operational phases of renewable energy projects. This move targets increased specialization in smart, low-carbon energy systems insurance.

Challenges

Rising Claim Costs and Regulatory Complexity

The energy and power plant insurance market faces challenges from rising claim costs, driven by more frequent natural disasters and increased underwriting losses. For example, in recent years, natural catastrophes have contributed to a significant proportion of claims, creating volatility for insurers and pushing premiums higher. This situation forces insurers to limit coverage or increase rates, complicating risk management for energy companies.

Additionally, navigating complex and evolving regulatory requirements across different regions adds to the challenge. Energy insurers must comply with strict environmental safety laws and adapt products to changing carbon emission targets, often under intense scrutiny. This regulatory complexity pressures profit margins and requires continual adjustments, making it harder for insurers to maintain stable business growth.

For instance, in January 2024, Allianz reported evolving claims patterns due to the shift to renewables, with claims increasing in volume and complexity. They face regulatory challenges requiring net-zero commitments and exclusion of certain fossil fuel risks, forcing ongoing adaptation of underwriting approaches amid rising claim costs.

Key Players Analysis

Munich Re, Swiss Re, AIG, Allianz, and Zurich Insurance Group hold a leading position in the energy and power plant insurance market. Their portfolios cover property damage, machinery breakdown, and operational liability for large power infrastructure. These companies focus on risk modeling, advanced catastrophe analytics, and comprehensive underwriting frameworks. Strong expertise in high-value industrial assets supports consistent demand.

Chubb, AXA XL, Liberty Mutual, Berkshire Hathaway, and Travelers contribute to market depth with specialized solutions for conventional and renewable energy facilities. Their strategies emphasize equipment protection, cyber-risk coverage, and business interruption insurance. These providers use detailed engineering assessments to reduce exposure and support long-term plant reliability. Growing diversification in solar, wind, and hybrid power systems continues to expand their role.

Generali, Tokio Marine, Sompo International, RenaissanceRe, Starr International, and others enhance the competitive landscape with tailored policies for regional utilities and independent power producers. Their offerings include construction-phase coverage, environmental liability, and grid-failure protection. These companies support emerging markets where power infrastructure expansion is accelerating.

Top Key Players in the Market

- Munich Re

- Swiss Re

- AIG

- Allianz

- Zurich Insurance Group

- Chubb

- AXA XL

- Liberty Mutual

- Berkshire Hathaway

- Travelers

- Generali

- Tokio Marine

- Sompo International

- RenaissanceRe

- Starr International

- Others

Recent Developments

- In September 2025, AXA XL emphasized the growing corporate trend toward energy independence with innovative insurance solutions covering solar, battery storage, nuclear, and emerging technology risks. They also provide comprehensive risk engineering services to help manage energy facility hazards.

- In October 2025, Zurich Insurance Group launched a modular insurance product specifically for agrivoltaic systems, which combine agriculture with solar power. The coverage protects against risks unique to these hybrid setups, such as damage to crops and delays in photovoltaic system repairs.

Report Scope

Report Features Description Market Value (2024) USD 18.2 Bn Forecast Revenue (2034) USD 37.9 Bn CAGR(2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Power Plant Type (Conventional Thermal Power Plants, Renewable Energy Plants, Nuclear Power Plants, Others), By Coverage Type (Property Damage Insurance, Business Interruption Insurance, Machinery Breakdown Insurance, Liability Insurance), By End-User (Power Generation Companies, Utility Companies, Independent Power Producers, Others), By Distribution Channel (Insurance Brokers, Direct Sales, Reinsurance Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Munich Re, Swiss Re, AIG, Allianz, Zurich Insurance Group, Chubb, AXA XL, Liberty Mutual, Berkshire Hathaway, Travelers, Generali, Tokio Marine, Sompo International, RenaissanceRe, Starr International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy & Power Plant Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Energy & Power Plant Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Munich Re

- Swiss Re

- AIG

- Allianz

- Zurich Insurance Group

- Chubb

- AXA XL

- Liberty Mutual

- Berkshire Hathaway

- Travelers

- Generali

- Tokio Marine

- Sompo International

- RenaissanceRe

- Starr International

- Others