Global Endoscopy Fluid Management Systems Market Analysis By Product (Endoscopy Fluid Management Systems, Consumables and accessories), By Application (Laparoscopy, Hysteroscopy, Arthroscopy, Gastroenterology, Others), By End-User (Hospitals, Specialty clinics, Ambulatory surgical centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167149

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

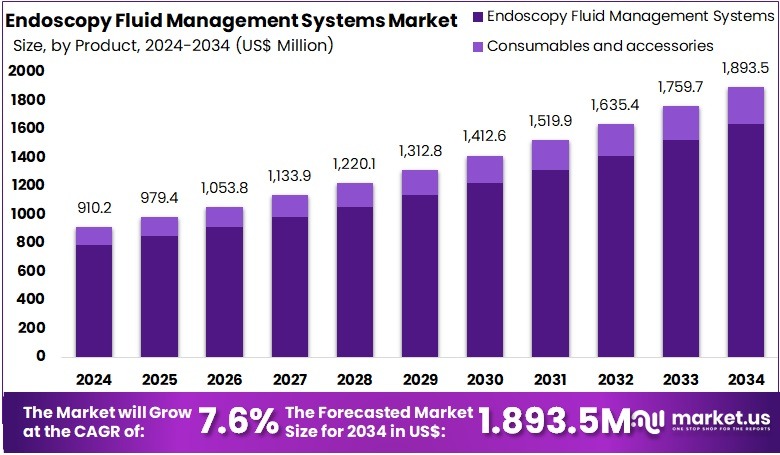

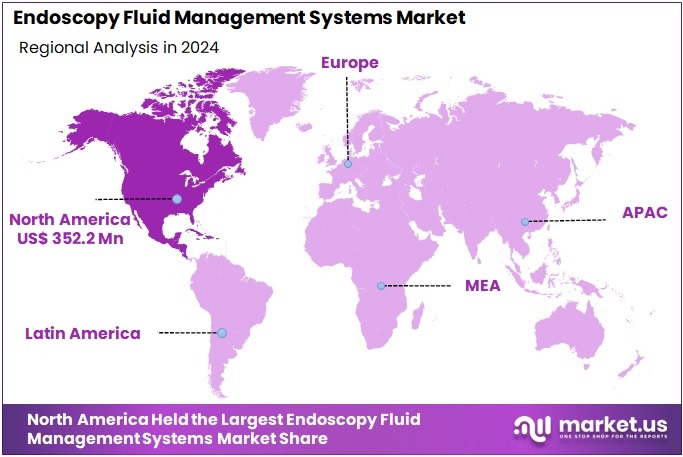

The Global Endoscopy Fluid Management Systems Market size is expected to be worth around US$ 1893.5 Million by 2034, from US$ 910.2 Million in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.7% share and holds US$ 352.2 Million market value for the year.

Endoscopy fluid management systems are used to maintain clear visualization, stable pressure, and controlled irrigation during minimally invasive procedures. These systems support safe navigation of instruments in fields such as gastroenterology, urology, gynecology, and orthopedics. Their importance has increased as healthcare facilities adopt advanced endoscopy suites and emphasize standardization and safety. According to clinical guidelines, consistent fluid control reduces complications and improves procedural efficiency.

The rising burden of gastrointestinal diseases has contributed significantly to market expansion. Many patients require diagnostic and therapeutic endoscopy for early detection and treatment. According to global cancer statistics, around 4.8–5 million new gastrointestinal cancer cases were reported in 2020, with 3.4–3.5 million related deaths. Study by healthcare institutions also shows that GERD affects 10–20% of adults in Western countries, with rising prevalence in Asia. These disease patterns increase the need for reliable fluid management.

Growing procedural volume is another strong driver. Endoscopic examinations are performed widely across healthcare systems, and the numbers continue to rise. For example, the United States performs about 18 million endoscopy procedures every year, while France conducts around 2 million annually. For instance, China increased its digestive endoscopy procedures from 28.8 million to 44.5 million between 2012 and 2019. Hospitals respond by adopting automated systems for continuous irrigation and suction.

Regulatory focus on infection prevention has also shaped market demand. Reviews of endoscopy-related infections indicate the need for high-quality reprocessing systems and protected fluid pathways. CDC guidance highlights the importance of leak-resistant and well-monitored irrigation technologies. The FDA regulates these devices as Class II equipment and requires safety testing for leakage and backflow. As a result, healthcare settings shift from manual irrigation to integrated platforms with closed tubing and disposable sets.

Advancements in training and accreditation have reinforced this trend. National and international bodies emphasize quality indicators and standardized procedures. For example, teaching hospitals increasingly use state-of-the-art systems so that trainees learn under stable pressure and consistent visibility conditions. This practice enhances familiarity with advanced platforms and increases long-term adoption across new facilities. These combined factors create a stable base for industry growth.

Market Dynamics and Future Outlook

The expansion of endoscopy capacity in developing regions continues to support long-term market growth. Many low- and middle-income countries are increasing investment in diagnostic infrastructure. According to an assessment in Eastern Africa, only 106 procedures per 100,000 people per year were available, indicating substantial unmet needs. For example, China has increased both trained endoscopists and endoscopy-capable hospitals, yet workloads remain high. Such trends encourage procurement of complete endoscopy towers with advanced fluid controls.

The shift toward minimally invasive and outpatient care has strengthened the role of fluid management systems. Healthcare systems now prefer techniques that shorten hospital stays and reduce recovery times. Study by endoscopy networks shows a 14% rise in annual endoscopy volume per hospital between 2019 and 2023. For instance, new operating rooms incorporate integrated imaging, documentation, and device coordination where fluid management acts as a connected component. This integration supports better workflow and consistent clinical pathways.

Environmental sustainability is emerging as a new influence on system design and adoption. Endoscopy generates significant waste from single-use consumables. Recent studies on carbon footprints highlight the need to optimize irrigation volumes and streamline waste collection. For example, systems that offer precise volume tracking and closed waste handling are being favored. These features help reduce contamination, improve waste segregation, and align with “green endoscopy” objectives.

Continuous device innovation remains a core market driver. Manufacturers are required to upgrade safety features in response to surveillance reports, including those listed in the FDA’s MAUDE database. For instance, new systems incorporate advanced alarms, better leakage detection, and improved control of distension pressure for hysteroscopy or urology. This replacement cycle supports stable demand as facilities transition from basic pumps to integrated digital platforms.

Unmet clinical and workflow needs continue to shape future opportunities. Reviews of infection control practices frequently identify gaps in reprocessing and equipment management. Hospitals seek systems that are easier to clean, reduce misconnections, and support faster room turnover. According to quality benchmarks, stable pressure and reduced fluid absorption improve patient outcomes. As patients and payers expect high procedural quality, these systems are viewed as essential components of modern endoscopy services.

Key Takeaways

- The market is projected to reach about US$ 1,893.5 million by 2034, rising from US$ 910.2 million in 2024, supported by a steady 7.6% CAGR.

- Endoscopy fluid management systems accounted for over 86.4% of the product segment in 2024, reflecting strong adoption across diagnostic and therapeutic endoscopic procedures.

- Laparoscopy represented more than 38.0% of the application segment in 2024, illustrating its widespread utilization across minimally invasive surgical interventions.

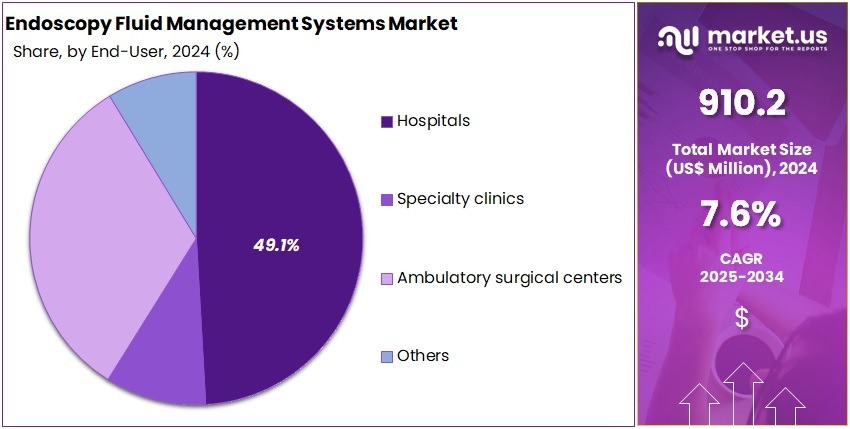

- Hospitals contributed over 49.1% of the end-user share in 2024, driven by higher procedure volumes and advanced infrastructure for endoscopic treatments.

- North America generated over 38.7% of total revenue in 2024, reaching US$ 352.2 million due to established healthcare systems and strong technological uptake.

Product Analysis

In 2024, the ‘Endoscopy Fluid Management Systems’ held a dominant market position in the Product Segment of the Endoscopy Fluid Management Systems Market, and captured more than an 86.4% share. Strong demand was driven by the rising use of endoscopic surgeries. Hospitals adopted advanced systems to improve fluid control and procedure accuracy. Better visibility for clinicians supported wider use across gastrointestinal and urology procedures. The growing shift toward minimally invasive treatments also strengthened adoption rates worldwide.

Growth in this segment was supported by continuous upgrades in pump and pressure-control technology. Automated systems allowed stable inflow and outflow management. This improved patient safety and reduced procedure risks. Digital interfaces enhanced ease of use. Real-time monitoring improved workflow efficiency during surgeries. Clinics preferred compact units for routine procedures, while hospitals invested in high-performance models. Increased usage in orthopedic and gynecology procedures also contributed to the sustained market leadership of the segment.

Demand increased in emerging markets due to rising investments in endoscopy infrastructure. Specialty centers expanded their procedural capacity, which boosted system adoption. Improvements in imaging quality supported consistent usage across diverse applications. The segment continued to act as the primary revenue contributor to the overall market. Strong replacement demand also supported growth. The wider focus on minimally invasive care stimulated long-term adoption. Overall, the segment maintained a positive outlook with steady usage in high-volume clinical environments.

Application Analysis

In 2024, the ‘Laparoscopy’ held a dominant market position in the Application Segment of the Endoscopy Fluid Management Systems Market, and captured more than a 38.0% share. Its demand was supported by the strong shift toward minimally invasive surgery. The use of advanced fluid control improved visibility. Hospitals adopted these systems to enhance accuracy. Faster recovery times increased procedure volume. These factors strengthened the leading role of laparoscopy across high-demand clinical settings.

Hysteroscopy maintained stable growth due to rising gynecological disorders. The use of fluid management systems improved clarity in diagnostic and operative procedures. This improvement supported safer outcomes. Arthroscopy advanced because of increasing sports injuries. Surgeons relied on controlled fluid pressure for better visualization. This reliance improved joint examination accuracy. The segment gained traction in orthopedic centers. Demand grew in facilities focusing on rapid recovery and reduced surgical trauma.

Gastroenterology recorded consistent expansion as screening programs increased. Fluid systems enhanced visualization in complex digestive procedures. This capability supported higher diagnostic precision. Other applications such as urology, ENT, and general surgery also expanded. Their growth was driven by the broad adoption of minimally invasive approaches. Facilities upgraded equipment to improve procedure efficiency. The overall market advanced steadily. The trend was supported by technology upgrades and the global shift toward high-precision endoscopic interventions.

End-User Analysis

In 2024, the Hospitals held a dominant market position in the End-User segment of the Endoscopy Fluid Management Systems Market and captured more than a 49.1% share. This leadership was supported by high procedure volumes in advanced care settings. Hospitals used integrated systems to improve accuracy and safety. The adoption of minimally invasive methods increased demand for efficient fluid control. Growth in complex gastrointestinal and urological cases strengthened consumption patterns. Rising investment in surgical infrastructure also supported wider deployment.

Specialty clinics recorded a stable share in the market. Their growth was driven by the expansion of outpatient endoscopy units. Clinics preferred compact systems that improved workflow efficiency. Rising volumes of diagnostic procedures supported stronger adoption. Ambulatory surgical centers also showed steady demand. These centers favored user-friendly devices that reduced surgical time. The increase in day-care interventions encouraged broader system utilization across outpatient care settings. This trend strengthened overall penetration in emerging service models.

The Others segment included diagnostic centers and independent endoscopy units. This category showed gradual expansion during the period. Adoption increased as procedure volumes rose in non-hospital environments. Facilities invested in modern imaging and surgical tools to improve service quality. The demand for reliable fluid handling supported system upgrades. Growth was further influenced by the shift toward decentralized care delivery. Continuous improvements in equipment availability encouraged broader market participation. This momentum supported stable long-term growth.

Key Market Segments

By Product

- Endoscopy Fluid Management Systems

- Consumables and accessories

By Application

- Laparoscopy

- Hysteroscopy

- Arthroscopy

- Gastroenterology

- Others

By End-User

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Others

Drivers

Supply-Chain And Resource-Stewardship Pressures Sparking Innovation

The rising pressure on healthcare systems to optimize resource use has been strengthening the demand for advanced endoscopy fluid management systems. The driver is rooted in increasing attention on supply-chain resilience and responsible resource stewardship. Hospitals are being encouraged to reduce waste, improve tracking, and prevent unnecessary consumption of consumables. These expectations have been creating the need for solutions that can precisely control irrigation and suction levels. The adoption of automated fluid-regulation platforms has been viewed as a strategic response to growing operational constraints.

Greater scrutiny on fluid utilization has further amplified this trend. According to industry observations, clinical departments are focusing on lowering consumable volumes to meet cost-containment requirements. Efficient fluid management is becoming essential because it supports predictable procedure planning and minimizes variability. As a result, demand has been shifting toward systems that offer real-time monitoring and automated adjustments. These capabilities help ensure consistent pressure control while also reducing the likelihood of excessive fluid deployment during endoscopic procedures.

Evidence from clinical research has provided additional momentum for innovation. A study by the Mayo Clinic examined 6,155 endoscopic urology procedures performed between January and September 2024. The analysis reported that four procedure categories required high irrigation volumes. For example, prostate enucleation used 26.6 liters per case. For instance, transurethral resection of the prostate used 16.7 liters, while percutaneous nephrolithotomy used 12.4 liters. These procedures collectively represented only 17% of cases yet accounted for 42% of total irrigation fluid consumption.

Such findings have highlighted significant inefficiencies and reinforced the importance of technology-enabled solutions. The data demonstrated that a small set of procedure types drives disproportionate fluid usage. This has encouraged healthcare facilities to adopt systems capable of automatic measurement, flow regulation, and integrated suction control. According to market assessments, solutions that support fluid optimization are increasingly preferred because they align with sustainability targets. The shift is expected to support hospitals facing both rising procedure volumes and tightening supply-chain limitations.

Restraints

Large Intra-Operative Variability In Fluid Absorption And Volume Complicates Device Standardisation

The market has been restrained by the high unpredictability of intra-operative fluid absorption during endoscopic procedures. Fluid uptake varies widely among patients, and even small changes in absorbed volume can alter intra-operative stability. This variability requires fluid-management systems to operate across broad safety thresholds. The need for wide operational margins increases system complexity. As a result, development cycles become longer, and certification requirements become stricter. This situation limits rapid innovation and slows the overall adoption of advanced endoscopy fluid-management solutions.

The growth of the market has been further limited because manufacturers must incorporate additional algorithms, hardware safeguards, and real-time monitoring functions to address inconsistent fluid behaviour. These adjustments create higher engineering costs and increase regulatory scrutiny. According to industry assessments, device makers face elevated design risks when absorption patterns cannot be predicted. The expanded risk pool often raises investment barriers. This situation leads to slower commercialisation timelines and makes device standardisation more challenging across different endoscopic specialties.

A study by a peer-reviewed medical journal in 2006 reported that fluid absorption of approximately 1–2 litres occurred in nearly 5–10% of patients undergoing endoscopic procedures. This finding highlighted the clinical uncertainty associated with fluid dynamics inside the operative field. For example, sudden shifts in fluid volume can compromise patient safety if the system is not calibrated for extreme variations. These facts continue to influence current regulatory frameworks, as inconsistent absorption trends create difficulties in defining uniform device specifications.

The persistence of these variations has reinforced the need for conservative regulatory pathways. For instance, manufacturers are often required to validate performance in a wider range of operative conditions, increasing testing burdens. According to ongoing clinical evaluations, intra-operative fluid unpredictability remains a key concern, as it contributes to inconsistent system performance outcomes. These requirements increase cost structures and complicate market entry strategies. As a result, the adoption of next-generation endoscopy fluid-management systems may remain slower than anticipated.

Opportunities

Frameworks For Irrigation Fluid Stewardship Enabling Differentiated System Features

The opportunity for advanced endoscopy fluid management systems is expanding because hospitals are under pressure to conserve irrigation fluids during procedures. Clinical teams face challenges in predicting usage, managing shortages, and maintaining workflow efficiency. This has increased demand for systems that support accurate monitoring, controlled consumption, and improved procedural planning. The growth of this opportunity can be attributed to rising case volumes, stricter resource-use policies, and the need for real-time visibility during endoscopic interventions. These drivers are increasing interest in digital, data-centric fluid management technologies.

Value can be created by integrating smart features into fluid management systems. Real-time tracking of bag status, automated alerts when thresholds are reached, and digital logging for audits can improve operational performance. According to clinical feedback, teams often experience delays when fluid bags deplete unexpectedly. For instance, automated notifications can support staff in replacing bags proactively. This enables safer, more efficient procedures and reduces wastage. The demand for such capabilities is expected to grow as hospitals shift toward connected operating room solutions.

Evidence from clinical literature reinforces the need for structured fluid stewardship. Study by AUA Journals highlighted a stewardship framework designed to optimise irrigation fluid consumption during shortages. It proposed a three-tier fluid use and three-tier urgency matrix for prioritising cases. These guidelines emphasised controlling bag usage, confirming the need before opening additional bags, and maintaining accurate logs. For example, the principles advocated spiking only one irrigation bag initially to reduce unnecessary consumption. These recommendations underline the value of systems that support disciplined resource management.

The Mayo Clinic findings present a direct opportunity for vendors. According to the study, structured stewardship can reduce waste and improve procedure scheduling. This opens space for fluid management systems with embedded intelligence, such as usage analytics and sustainability reporting tools. For example, data-logging features can help hospitals document compliance with stewardship protocols. The adoption of these differentiated capabilities is expected to strengthen product positioning, create competitive advantages, and address the growing emphasis on resource efficiency in endoscopy departments.

Trends

Growing Awareness And Research Into Fluid Absorption Risks And Targeted Monitoring Systems

The increasing focus on patient safety and intraoperative precision has driven a shift toward advanced monitoring within endoscopy fluid management systems. The trend is shaped by the rising need to quantify fluid absorption and physiological responses during procedures. This development has encouraged the integration of analytical capabilities into traditional irrigation and suction platforms. The growth of this trend can be attributed to heightened awareness of fluid-related complications and the demand for systems that support clinical decision-making through real-time data visibility.

Enhanced monitoring solutions are gaining prominence as they allow clinicians to detect fluid imbalance earlier and intervene more effectively. The adoption of these technologies has been supported by improvements in digital sensors and data-processing algorithms. These tools enable precise measurement of absorbed volumes and related changes in patient status. According to industry observations, next-generation platforms are expected to combine automated control with diagnostic insights, creating more intelligent and responsive systems. This evolution aligns with the sector’s transition toward safer and more efficient surgical workflows.

A study by PubMed Central in 2020 demonstrated this shift by developing an endoscopic surgical monitoring system designed to measure fluid absorption and blood loss non-invasively. The system illustrated how real-time data capture can support clinicians during urological endoscopic procedures. For instance, continuous monitoring of patient parameters allowed early detection of abnormal absorption levels. This example highlights how integrating monitoring technologies into fluid management systems enhances transparency and supports better intraoperative decision-making.

The increasing use of such monitoring platforms signals a broader transformation of endoscopy fluid management systems. For example, the incorporation of sensors and analytics is expected to strengthen surgical outcomes by reducing risks linked to excessive absorption. According to emerging research, systems that merge physiological tracking with equipment control will likely dominate future product landscapes. The trend therefore reflects a movement toward intelligent, data-driven solutions that support clinicians, reduce complications, and optimize the overall efficiency of minimally invasive procedures.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.7% share and holding a market value of US$ 352.2 million for the year. The region benefited from strong demand for minimally invasive procedures. Adoption grew in hospitals and outpatient centers. Increased awareness of early diagnosis supported procedure volumes. Advanced endoscopy systems gained steady acceptance. Strong clinical infrastructure reinforced the region’s leadership. This trend continued across major care settings.

Growth in North America has been driven by rising investments in endoscopic technologies. Healthcare providers adopted systems that improved fluid control during procedures. Automated platforms supported workflow efficiency and consistent pressure regulation. Screening programs for gastrointestinal and urological disorders increased procedure frequency. Higher patient awareness encouraged early consultation. Outpatient facilities expanded rapidly and strengthened system usage. Advancements in imaging integration created stronger demand. These factors supported steady expansion across clinical environments.

The market position of North America has been reinforced by favorable reimbursement structures. Coverage for endoscopic interventions supported higher adoption rates. Providers gained confidence in using advanced systems due to predictable payment frameworks. Skilled professionals enabled smooth use of integrated fluid management platforms. Training programs improved competency and reduced procedural delays. Ambulatory centers played a major role in expanding access. Short procedure times increased throughput. These conditions strengthened system penetration across diverse practice settings.

Technological improvements have contributed significantly to the region’s dominance. Clinical centers adopted systems with enhanced pressure control and improved visualization. These features supported precision during diagnostic and therapeutic interventions. Facilities upgraded existing platforms to ensure consistent performance. Interoperability with imaging tools increased system value. Demand rose in gastrointestinal, gynecological, and arthroscopic procedures. Hospitals and outpatient centers integrated automated modules to reduce manual errors. This progression supported greater efficiency and encouraged wider clinical acceptance.

The overall dominance of North America has been supported by strong infrastructure and rising clinical demand. Increased procedure volumes have created sustained need for fluid regulation systems. Healthcare providers favored solutions that ensured stability, safety, and strict control. Adoption grew in specialty clinics due to high patient turnover. Continuous technology upgrades strengthened system reliability. The region benefited from strong implementation capacity. These elements combined to maintain leadership and support ongoing growth in endoscopy fluid management adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market is shaped by established medical device manufacturers that offer integrated, high-performance fluid management technologies. Their systems support better visualization, controlled pressure, and safe fluid balance during minimally invasive procedures. Arthrex Inc., Stryker Corporation, and Smith & Nephew Plc are recognized for strong positions in arthroscopy. Their systems are widely adopted in sports medicine and orthopedic centers. These companies benefit from integrated towers, advanced pumps, and strong surgeon training programs that increase customer loyalty and long-term use.

A second group of influential participants includes B. Braun Melsungen AG, ConMed Corporation, and STERIS plc. Their portfolios cover a wide range of surgical specialties. These companies offer irrigation pumps, suction systems, and related accessories that support stable intraoperative performance. Their strong service networks and consumables portfolios help maintain recurring revenue. Broad geographic reach and established hospital relationships have strengthened their competitive advantage. Their systems are widely used across ambulatory surgery centers, outpatient clinics, and large hospitals.

The market also includes major endoscopy and imaging leaders that provide integrated solutions for gastrointestinal, gynecologic, and ENT procedures. Olympus Corporation, KARL STORZ SE & Co. KG, and Richard Wolf GmbH fall within this group. Their systems support consistent flow regulation and improved visualization. Their long-standing presence in GI and OR suites strengthens their adoption. Medtronic Plc contributes specialized ENT irrigation platforms that enhance procedural safety. Together, these companies support multi-specialty use and help drive overall adoption across global endoscopy practices.

Additional key contributors operate in focused clinical segments and provide niche but important technologies. Hologic Inc. leads in hysteroscopy with advanced fluid regulation platforms designed for uterine procedures. Endomed Systems supports a broad range of surgical applications with cost-effective pumps suitable for hospitals and emerging markets. Johnson & Johnson, through Ethicon, offers multifunctional devices that integrate suction and irrigation. These companies add depth to the competitive landscape and support growing demand for efficient, safe, and procedure-specific fluid management solutions.

Market Key Players

- Arthrex Inc.

- B. Braun Melsungen AG

- STERIS plc

- Stryker Corporation

- ConMed Corporation

- Endomed Systems

- Hologic Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic Plc

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew Plc

Recent Developments

- In January 2024: Planned divestiture of endoscopic vacuum therapy assets to Boston Scientific: Brazil’s Administrative Council for Economic Defense (CADE) disclosed that it would review a transaction under which Boston Scientific would acquire specific endoscopic vacuum therapy assets (Endo-SPONGE®, Eso-SPONGE® and related accessories) from B. Braun Surgical and Aesculap AG. The deal covers endoscopic vacuum products used to manage GI leaks and perforations, representing a targeted portfolio reshaping of B. Braun’s endoscopy-related assets and capital reallocation toward other strategic areas.

- In April 2023: Guidance on evolving endoscope reprocessing and pass-thru workflows: STERIS published a knowledge-center article titled “Endoscopy Reprocessing Standards are Evolving,” summarizing updated ANSI/AAMI ST91 and AORN guidance on unidirectional and pass-thru room designs for flexible endoscope reprocessing. The article promotes pass-thru AERs, drying/storage systems, and pass-thru windows as best practice to prevent re-contamination, and directs users to STERIS solutions such as the ADVANTAGE PLUS™ Pass-Thru AER and ENDODRY™ Drying and Storage System. This represents a strategic positioning of STERIS’s endoscopy reprocessing and fluid-handling infrastructure around new standards.

Report Scope

Report Features Description Market Value (2024) US$ 910.2 Million Forecast Revenue (2034) US$ 1893.5 Million CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Endoscopy Fluid Management Systems, Consumables and accessories), By Application (Laparoscopy, Hysteroscopy, Arthroscopy, Gastroenterology, Others), By End-User (Hospitals, Specialty clinics, Ambulatory surgical centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Arthrex Inc., B. Braun Melsungen AG, STERIS plc, Stryker Corporation, ConMed Corporation, Endomed Systems, Hologic Inc., Johnson & Johnson, KARL STORZ SE & Co. KG, Medtronic Plc, Olympus Corporation, Richard Wolf GmbH, Smith & Nephew Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Endoscopy Fluid Management Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Endoscopy Fluid Management Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arthrex Inc.

- B. Braun Melsungen AG

- STERIS plc

- Stryker Corporation

- ConMed Corporation

- Endomed Systems

- Hologic Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic Plc

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew Plc