Global Endoscopic Closure Systems Market Analysis By Type (Endoscopic clips/Endoclips (Over-the-scope Clips), Overstitch endoscopic suturing system, Cardiac septal defect occluders, Endoscopic vacuum assisted closure systems, Others), By Application (Hospitals, Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 30133

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

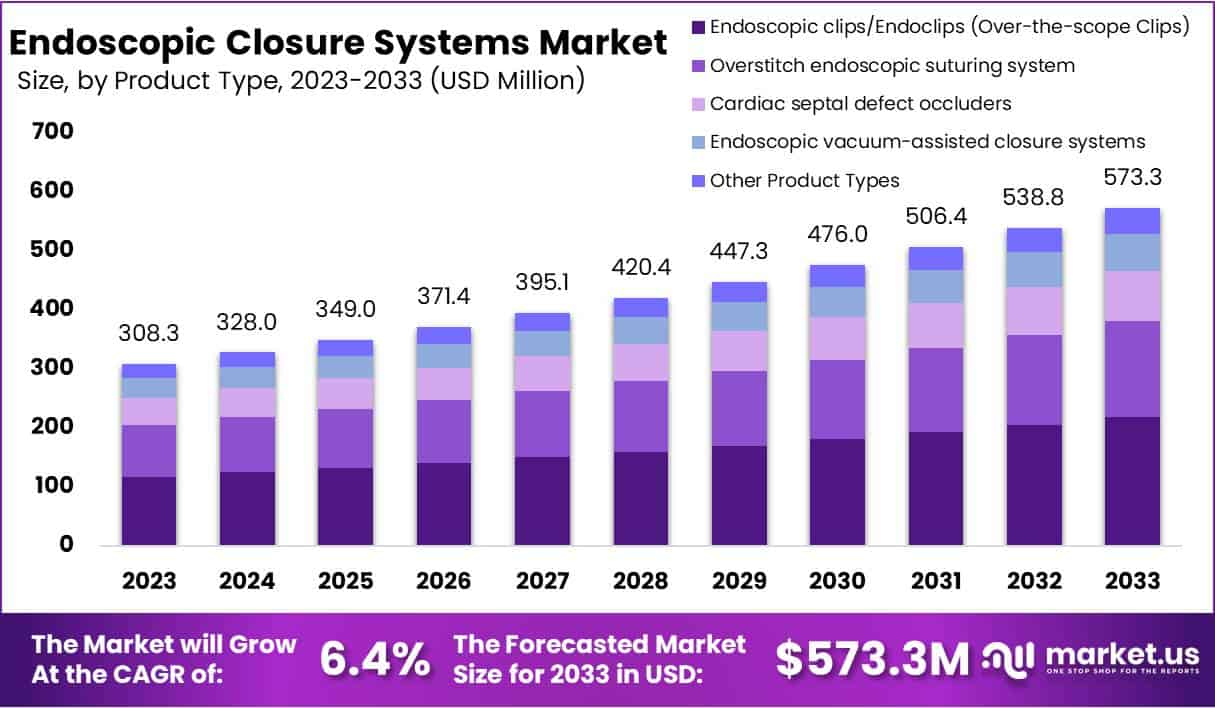

Global Endoscopic Closure Systems Market size is expected to be worth around USD 573.3 Million by 2033, from USD 308.3 Million in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

Endoscopic Closure Systems (ECS) are pivotal medical devices engineered for minimally invasive surgeries, particularly in the gastrointestinal (GI) tract. These systems are designed to close perforations, fistulas, and leaks, offering a significant advantage over traditional surgical methods by reducing patient recovery time and enhancing procedural outcomes. As the healthcare industry shifts towards less invasive treatments, the market for ECS is witnessing substantial growth, underscored by technological advancements and the rising demand for efficient, patient-friendly medical interventions.

The ECS market serves a diverse range of end-use industries, including hospitals, clinics, ambulatory surgical centers, and gastroenterology practices. According to the FDA, the agency’s regulatory framework for medical devices, including ECS, involves a rigorous premarket approval (PMA) process, where a device must demonstrate its safety and efficacy before being marketed. In recent years, the FDA has approved a substantial number of endoscopic devices, reflecting the growing importance and technological advancement within this sector. For instance, in the fiscal year 2020, the FDA’s Center for Devices and Radiological Health (CDRH) approved numerous applications for endoscopic devices, underscoring a continued commitment to innovation and patient safety.

Similarly, the EMA plays a crucial role in the regulation of medical devices in Europe, adhering to the European Union’s Medical Device Regulation (MDR) 2017/745, which came into full effect in May 2021. This regulation enhances the transparency and traceability of medical devices, including ECS, across the EU, ensuring a high level of protection for human health.

The demand for ECS is underscored by their critical role in diagnosing and treating gastrointestinal diseases, a prevalent health concern worldwide. According to the World Gastroenterology Organisation (WGO), gastrointestinal diseases affect millions globally, with colorectal cancer alone accounting for over 1.8 million new cases and 881,000 deaths in 2018. The increasing prevalence of gastrointestinal diseases has led to a corresponding rise in the demand for endoscopic procedures, thereby driving the ECS market.

A notable driver for the ECS market is the escalating prevalence of GI diseases. According to the World Health Organization (WHO), chronic GI diseases account for approximately 4.4 million deaths annually, highlighting the critical need for effective treatment modalities like ECS. Furthermore, the market is buoyed by the growing geriatric population, which is more prone to GI disorders, thereby amplifying the demand for ECS.

Key Takeaways

- Market growth: Projected market worth of USD 573.3 Mn by 2033, with a CAGR of 6.4% from 2024-2033.

- Dominant Type: Endoscopic clips hold over 38% market share in 2023 due to versatility and effectiveness.

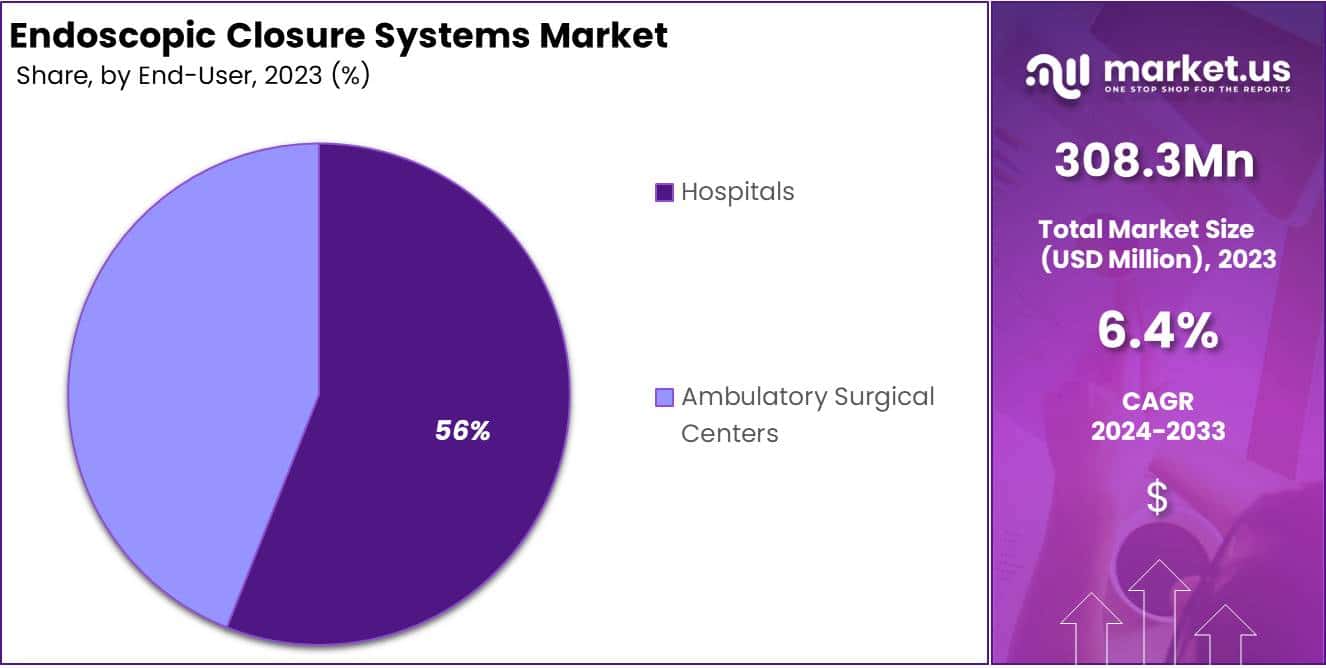

- Top end-user: Hospitals hold more than 56% market share in 2023, driven by extensive endoscopic procedure adoption.

- Disease prevalence: Gastrointestinal diseases affect over 4.4 M annually, driving demand for minimally invasive interventions.

- Cost barrier: High procedure and equipment costs hinder market expansion, particularly in regions with limited resources.

- Technological opportunities: Innovations like magnetic systems expand endoscopic capabilities, improving patient outcomes.

- Minimally invasive surgery trend: Over 80% of US surgeries are minimally invasive, boosting demand for closure systems.

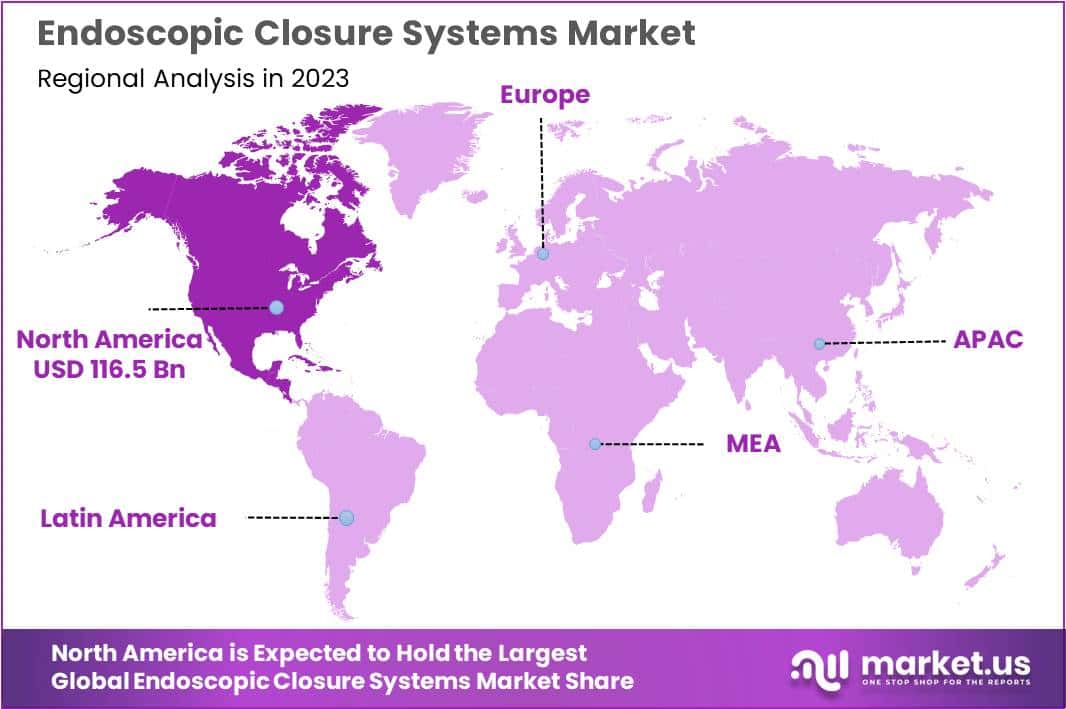

- Regional dominance: North America leads with 37.8% market share in 2023, followed by Europe and Asia-Pacific.

Type Analysis

In 2023, the Endoscopic clips/Endoclips (Over-the-scope Clips) segment held a dominant market position in the Type Segment of the Endoscopic Closure Systems Market, capturing more than a 38% share. This prominence can be attributed to the extensive application of these devices in the management of gastrointestinal bleeds, perforations, and for securing the placement of endoluminal devices. The effectiveness, safety, and versatility of endoscopic clips have bolstered their adoption in clinical practices across the globe.

The growth of this segment is further supported by continuous innovations and product enhancements aimed at improving the precision, ease of use, and success rates of endoscopic procedures. Manufacturers are focusing on developing clips with enhanced flexibility, superior closure capabilities, and increased deployment accuracy, which are critical factors in complex gastrointestinal procedures.

Furthermore, the rising prevalence of gastrointestinal diseases, coupled with the growing preference for minimally invasive surgical interventions, has significantly contributed to the expansion of the endoscopic clips market. The increasing number of endoscopic surgeries being performed worldwide is a testament to the shifting paradigm in surgical practices, from traditional open surgeries to more advanced, less invasive techniques.

Market analysis indicates a sustained interest in research and development activities within this sector. Key industry players are investing in technological advancements to expand the applicability of endoscopic clips, not only in gastroenterology but also in other fields such as pulmonology and urology. This expansion is expected to open new avenues for growth and application of endoscopic closure systems.

Moreover, the adoption of endoscopic closure systems, particularly endoscopic clips, is being facilitated by the growing emphasis on patient safety and the reduction of post-operative complications. The ability of these devices to provide rapid and reliable closure of tissue defects without the need for additional surgical intervention underscores their importance in current medical practices.

Application Analysis

In 2023, the Hospitals segment held a dominant market position in the End-user Segment of the Endoscopic Closure Systems Market, capturing more than a 56% share. This significant market share can be attributed to the extensive utilization of endoscopic closure systems in hospital settings, driven by the increasing number of endoscopic surgeries and procedures conducted in these facilities. Hospitals, being primary healthcare centers, are equipped with advanced medical technologies and staffed by skilled professionals, which facilitates the adoption and efficient use of endoscopic closure systems for a variety of procedures, including gastrointestinal surgeries, bariatric surgeries, and other minimally invasive interventions.

The predominance of the Hospitals segment is further bolstered by the growing emphasis on patient safety and the reduction of post-operative complications, which endoscopic closure systems directly contribute to. Their ability to provide immediate closure of perforations or incisions minimizes the risk of infection and promotes faster recovery, aligning with the healthcare industry’s shift towards enhancing patient outcomes and operational efficiencies.

Furthermore, strategic initiatives by healthcare institutions to upgrade and expand their endoscopic capabilities have led to the integration of cutting-edge endoscopic closure technologies. Investments in training healthcare professionals and the acquisition of the latest endoscopic equipment are indicative of the sector’s commitment to adopting innovative solutions that improve surgical outcomes and patient care.

Key Market Segments

Type

- Endoscopic clips/Endoclips (Over-the-scope Clips)

- Overstitch endoscopic suturing system

- Cardiac septal defect occluders

- Endoscopic vacuum-assisted closure systems

- Others

Application

- Hospitals

- Ambulatory Surgical Centers

Drivers

Increasing Prevalence of Gastrointestinal Diseases

The escalation in the prevalence of gastrointestinal diseases stands as a pivotal driver for the global endoscopic closure systems market. Notably, the World Health Organization (WHO) and leading healthcare institutions highlight a significant uptick in gastrointestinal conditions, including perforations, leaks, and fistulas, which underpin the surge in demand for minimally invasive treatment alternatives.

For instance, the incidence of gastrointestinal perforations is estimated to affect approximately 10 per 100,000 individuals annually, underscoring a critical need for effective intervention strategies. Endoscopic closure systems, renowned for their minimally invasive nature, offer a compelling solution by enabling quicker patient recovery and minimizing the risks associated with traditional surgical procedures.

This shift towards less invasive treatments is further necessitated by the global rise in gastrointestinal disorders, propelled by aging demographics and lifestyle-related health challenges. Consequently, this burgeoning demand underscores the endoscopic closure systems market’s growth trajectory, as healthcare practitioners increasingly adopt these innovative devices to improve patient outcomes and efficiency in managing gastrointestinal ailments.

Restraints

High Cost of Endoscopic Procedures and Equipment

The elevated costs associated with endoscopic procedures and equipment stand as a formidable barrier in the global market for endoscopic closure systems. This includes not only the purchase price of the devices, which can be substantial, but also the investment in training healthcare professionals to use these sophisticated systems effectively.

Data from the American Society for Gastrointestinal Endoscopy (ASGE) suggest that the average cost of endoscopic systems ranges from $75,000 to $100,000, with additional training expenses potentially increasing initial costs by up to 20%. Such high expenditures significantly restrict access, particularly in regions with limited financial resources and in healthcare facilities operating on tight budgets, thereby stifacing market growth.

The situation is further complicated by the varied landscape of reimbursement and insurance coverage across different countries, making the financial feasibility of adopting endoscopic closure technologies even more challenging. As a result, the high costs associated with endoscopic procedures and equipment emerge as a critical restraint, impeding the widespread adoption and development of the endoscopic closure systems market.

Opportunities

Technological Advancements and Innovation

The endoscopic closure systems market is brimming with opportunity, driven by continuous advancements and innovation. According to a 2023 report by the American Society for Gastrointestinal Endoscopy (ASGE), minimally invasive procedures are rapidly growing, with over 60 million endoscopic procedures performed annually in the US alone. This surge in demand is fueling research and development, leading to the creation of more sophisticated closure systems.

Innovations like magnetic anastomosis systems, over-the-scope clips, and novel suturing devices are expanding the capabilities of endoscopic procedures. These advancements enable minimally invasive treatment for a wider range of conditions, improving patient outcomes and satisfaction. As healthcare providers seek to adopt the latest technologies to enhance care quality and efficiency, the market for endoscopic closure systems is poised for significant growth.

Trends

Rising Adoption of Minimally Invasive Surgeries

The growing popularity of minimally invasive surgeries (MIS) is a key trend driving the endoscopic closure systems market. According to a 2021 report by the American College of Surgeons (ACS), over 80% of all surgeries performed in the US are now minimally invasive. This shift is fueled by numerous advantages of MIS, including reduced pain, shorter hospital stays (by an average of 2 days), faster recovery times, and minimal scarring.

Endoscopic closure systems play a crucial role in these procedures, enabling secure and effective closure of internal wounds and perforations. This rising demand for MIS, coupled with patient preference for less invasive options and healthcare systems’ focus on cost-effective care, is expected to significantly boost the demand for endoscopic closure systems in the coming years.

Regional Analysis

In 2023, North America held a dominant market position in the Endoscopic Closure Systems Market, capturing more than a 37.8% share and holding a market value of USD 116.5 million for the year. This significant market share can be attributed to several factors, including the advanced healthcare infrastructure, the high adoption rate of minimally invasive surgeries, and the presence of leading medical device manufacturers in the region. Moreover, the increasing prevalence of gastrointestinal diseases, obesity, and colorectal cancer has further propelled the demand for endoscopic closure systems in North America.

The European market, following North America, is characterized by a robust healthcare system, favorable reimbursement policies, and a growing geriatric population, which is more prone to gastrointestinal diseases. These factors collectively contribute to the region’s substantial market share. Additionally, the presence of key market players and ongoing clinical trials to evaluate the efficacy of new endoscopic closure devices are expected to drive the market growth in Europe.

The Asia-Pacific region is anticipated to witness the fastest growth rate during the forecast period, driven by the improving healthcare infrastructure, rising healthcare expenditure, and increasing awareness about minimally invasive procedures among patients and healthcare providers. Countries such as China, Japan, and India are at the forefront of this growth, leveraging advancements in healthcare technology and increasing government initiatives to reduce the burden of gastrointestinal diseases.

Latin America and the Middle East & Africa regions, while holding smaller shares of the global market, are expected to experience gradual growth. This growth is primarily due to the increasing investments in healthcare infrastructure, the rising prevalence of diseases requiring endoscopic procedures, and the growing demand for advanced medical treatments. However, the high cost of endoscopic closure systems and lack of skilled professionals in these regions may restrain market growth to some extent.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Endoscopic Closure Systems Market showcases a dynamic environment, where established contenders and emerging entities strive for market dominance. CooperSurgical Inc., a prominent global medical device company, boasts a diverse range of endoscopic closure systems, bolstered by over-the-scope clips and sutures. Their solid brand presence and extensive distribution network firmly establish their market standing. US Endoscopy, specializing in innovative endoscopic devices, particularly closure systems, stands out with its focused R&D efforts and niche expertise, positioning it as a formidable player.

Another significant player, Life Partners Europe, concentrates on delivering minimally invasive surgical solutions, including a variety of endoscopic closure products. Their emphasis on strategic partnerships and penetration into emerging markets augments their growth trajectory. Ovesco Endoscopy AG, a key player in Europe, offers a comprehensive array of endoscopic devices, including closure systems, backed by a reputation for quality and innovation. Additionally, various other companies contribute to the competitive landscape, catering to specific market needs and fostering innovation in the evolving realm of endoscopic closure systems.

Market Key Players

- CooperSurgical Inc.

- US Endoscopy

- Life Partners Europe

- Ovesco Endoscopy AG

- Apollo Endosurgery Inc.

- St. Jude Medical Inc. (Abbott)

Recent Developments

- In October 2023, Apollo Endosurgery Inc. introduced the latest iteration of its Apollo ORBIT Endoscopic Vessel Sealing System. This new system aims to enhance surgical efficiency and ultimately improve patient outcomes in both laparoscopic and robotic surgeries.

- In August 2023, St. Jude Medical Inc. (Abbott) made waves with the global launch of its OccluSaver® Heart Hemostasis System. This novel endoscopic clip is specifically designed to facilitate efficient bleeding control during minimally invasive cardiac surgeries, promising advancements in patient care within the field.

- In July 2023, Ovesco Endoscopy AG secured FDA 510(k) clearance for its OverStitch® S Endo Suture System. This clearance marks a significant milestone for the company, as it expands its line of innovative endoscopic suturing devices for the US market.

Report Scope

Report Features Description Market Value (2023) USD 308.3 Million Forecast Revenue (2033) USD 573.3 Million CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Endoscopic clips/Endoclips (Over-the-scope Clips), Overstitch endoscopic suturing system, Cardiac septal defect occluders, Endoscopic vacuum assisted closure systems, Others), By Application (Hospitals, Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape CooperSurgical Inc., US Endoscopy, Life Partners Europe, Ovesco Endoscopy AG, Apollo Endosurgery Inc., St. Jude Medical Inc. (Abbott), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Endoscopic Closure Systems market in 2023?The Endoscopic Closure Systems market size is USD 308.3 million in 2023.

What is the projected CAGR at which the Endoscopic Closure Systems market is expected to grow at?The Endoscopic Closure Systems market is expected to grow at a CAGR of 6.4% (2024-2033).

List the segments encompassed in this report on the Endoscopic Closure Systems market?Market.US has segmented the Endoscopic Closure Systems market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Endoscopic clips/Endoclips (Over-the-scope Clips), Overstitch endoscopic suturing system, Cardiac septal defect occluders, Endoscopic vacuum assisted closure systems, Others. By Application the market has been segmented into Hospitals, Ambulatory Surgical Centers.

List the key industry players of the Endoscopic Closure Systems market?CooperSurgical Inc., US Endoscopy, Life Partners Europe, Ovesco Endoscopy AG, Apollo Endosurgery Inc., St. Jude Medical Inc. (Abbott), Other Key Players

Which region is more appealing for vendors employed in the Endoscopic Closure Systems market?North America is expected to account for the highest revenue share of 37.8% and boasting an impressive market value of USD 116.5 million. Therefore, the Endoscopic Closure Systems industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Endoscopic Closure Systems?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Endoscopic Closure Systems Market.

Endoscopic Closure Systems MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Endoscopic Closure Systems MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- CooperSurgical Inc.

- US Endoscopy

- Life Partners Europe

- Ovesco Endoscopy AG

- Apollo Endosurgery Inc.

- St. Jude Medical Inc. (Abbott)