Global Ems & Odm Market Size, Share, Growth Analysis By Type (EMS, ODM), By Application (Consumer Electronics, Communications, Automotive & Transportation, Industrial, Medical, Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165566

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

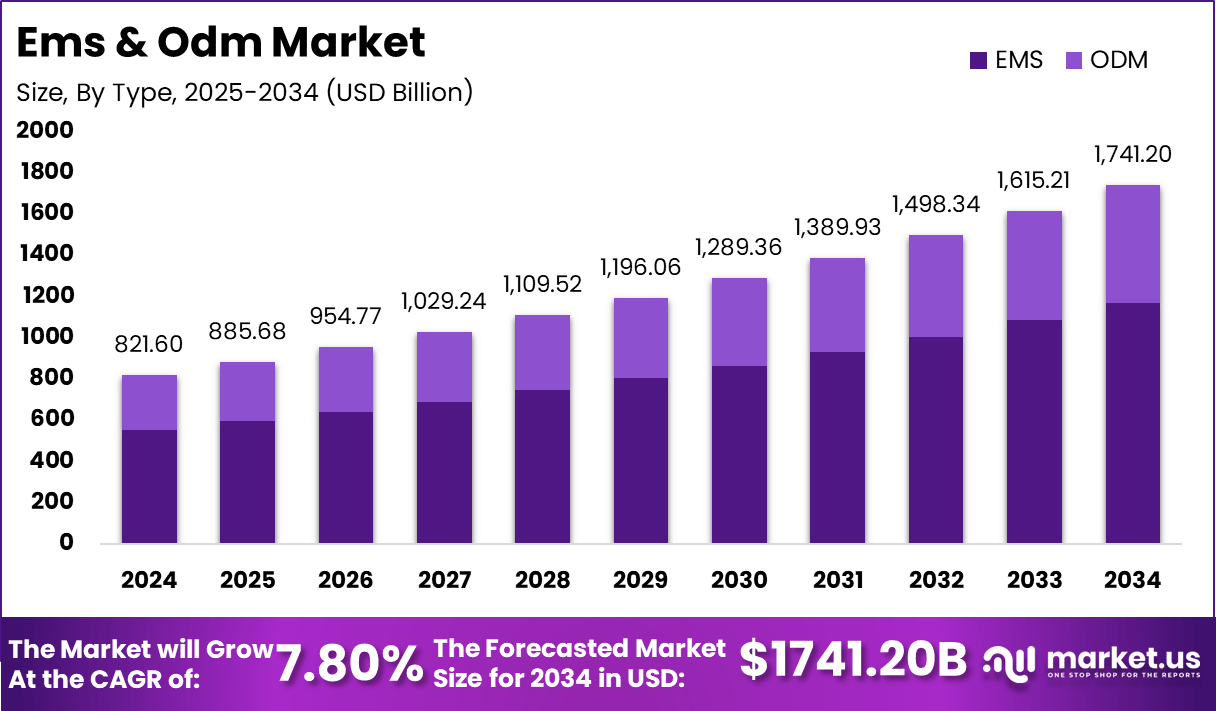

The EMS & ODM market is projected to expand strongly from USD 821.6 billion in 2024 to USD 1,741.2 billion by 2034, advancing at a CAGR of 7.80%. This growth is expected to stem from rising outsourcing of electronics manufacturing, deeper penetration of smart devices, and increased reliance on design-led manufacturing ecosystems across consumer electronics, automotive, industrial automation, and telecom sectors.

Companies continue to shift toward flexible, scalable production models, further accelerating contract manufacturing demand. Continuous advancements in PCB assembly, semiconductor packaging, and automation-driven assembly lines are anticipated to strengthen the global EMS & ODM outlook during the forecast period.

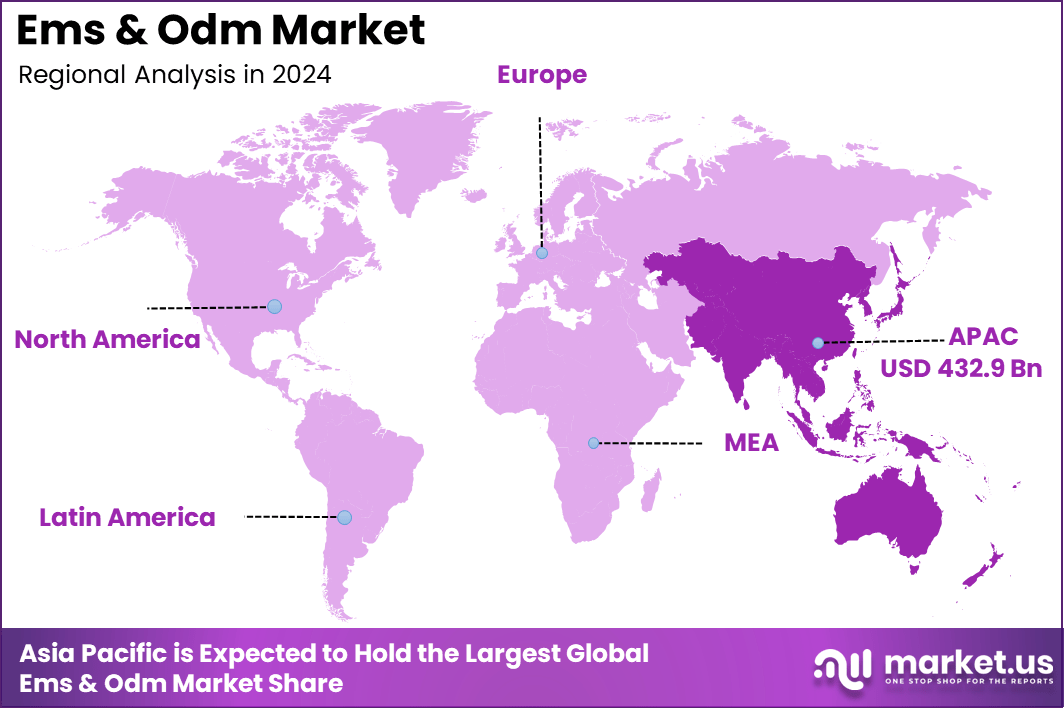

Asia Pacific dominates the global industry with 52.7% market share in 2024, representing USD 432.9 billion, underpinned by its vast supplier base, cost-efficient labor pools, and strong policy frameworks supporting electronics manufacturing.

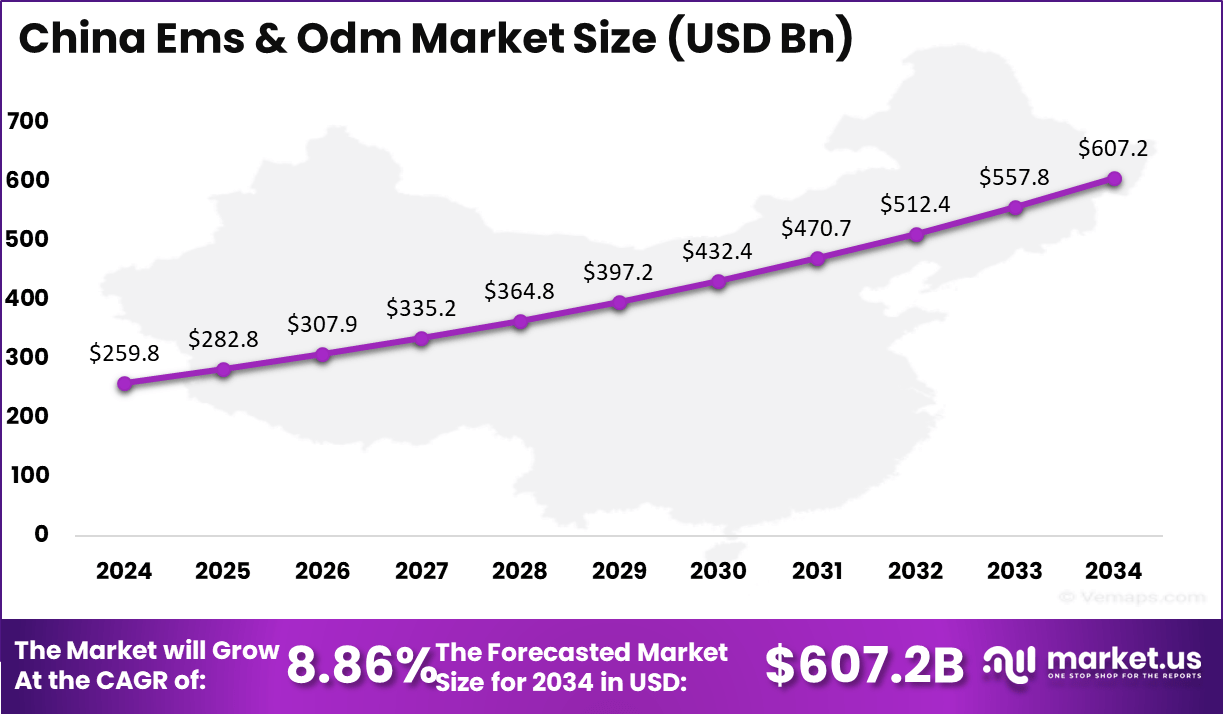

Within this region, China leads as the core manufacturing hub with a USD 259.8 billion valuation in 2024, projected to reach USD 607.2 billion by 2034 at a robust 8.86% CAGR. This expansion is anticipated to be driven by accelerated semiconductor investments, rapid adoption of automation technologies, and government initiatives enhancing supply chain localization, positioning China as the central engine of EMS & ODM market growth.

The EMS & ODM industry plays a central role in the global electronics value chain by providing end-to-end design, engineering, manufacturing, and supply-chain services for brands across consumer electronics, automotive, telecommunications, healthcare, and industrial sectors. Electronics Manufacturing Services (EMS) focus on high-volume production, testing, and logistics support, enabling companies to scale rapidly without expanding their internal manufacturing footprint.

Original Design Manufacturing (ODM), on the other hand, goes a step further by offering product conceptualization, prototyping, design engineering, and turnkey manufacturing, allowing brands to launch products faster and at reduced development costs. Together, they help companies respond to shorter product lifecycles, higher customization needs, and increased pressure for cost efficiency.

The market is driven by rising demand for smart devices, IoT modules, 5G infrastructure, advanced automotive electronics, and medical devices. OEMs increasingly outsource to EMS and ODM partners to access specialized capabilities such as semiconductor integration, precision assembly, robotics-driven manufacturing, and advanced testing systems.

Asia Pacific remains the global manufacturing hub due to its mature supplier ecosystem, competitive cost structures, and government-backed electronics initiatives. Continuous technological innovations, such as automated assembly, AI-powered quality inspection, and digital twins, are expected to further elevate the efficiency and competitiveness of the EMS & ODM sector globally.

Recent developments in the EMS and ODM sectors have been marked by significant numerical growth and strategic moves. In 2025 alone, more than 15 major acquisitions and mergers were recorded globally, focusing on expanding capabilities in IoT, smart home, and automotive electronics.

For example, a key EMS provider acquired an ODM firm with a design team of over 200 engineers specializing in smart devices, boosting its total headcount by 12%. Strategic partnerships increased by approximately 20% year-over-year in 2025, especially in electric vehicle systems and 5G infrastructure projects.

Manufacturing footprint diversification grew notably, with more than 35% of EMS companies adopting a “China+1” model, adding production sites in countries like India, Vietnam, and Mexico. Digital factory transformations involving automation and real-time monitoring systems were implemented by roughly 45% of top-tier EMS/ODM providers in 2025, resulting in productivity gains estimated at 18-22%. OEM collaborations have expanded to include over 40% of EMS partners engaged in co-development projects spanning hardware, firmware, and cloud ecosystems.

Further, more than 60% of new product launches in 2025 from these providers integrated multiple advanced technologies such as AI-enabled components and 5G modem designs. These numeric indicators show not just expanding but also rapidly evolving EMS and ODM landscape, focusing on agility, technology integration, and geographic risk management.

Key Takeaways

- The global EMS & ODM market is valued at USD 821.6 billion in 2024, projected to reach USD 1,741.2 billion by 2034 at a CAGR of 7.80%.

- Asia Pacific dominates the market with a 52.7% share, accounting for USD 432.9 billion in 2024.

- China leads regional growth with a USD 259.8 billion valuation in 2024, expected to reach USD 607.2 billion by 2034 at a strong 8.86% CAGR.

- By type, EMS holds the largest share at 67.2% due to rising demand for large-scale electronics production and testing services.

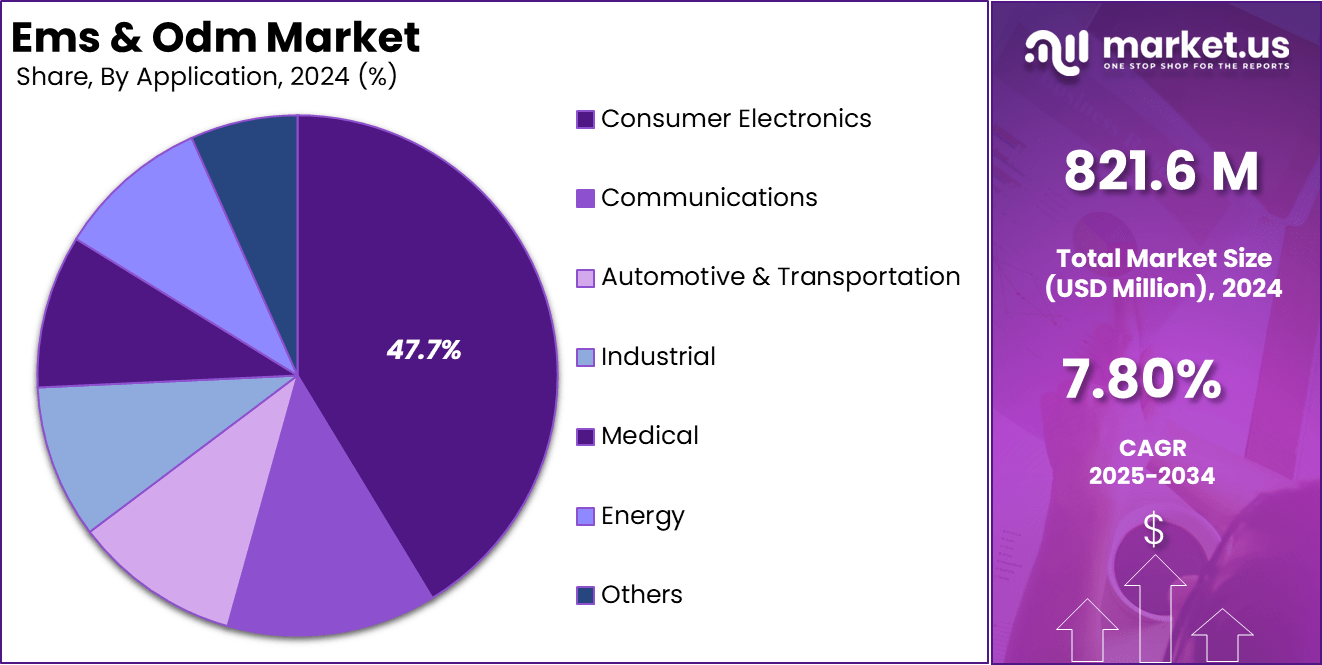

- By application, consumer electronics account for 47.7%, driven by smartphones, smart wearables, home appliances, and connected devices.

Role Of Technology

Technology plays a pivotal role in accelerating growth and operational efficiency across the EMS & ODM industry, transforming how products are designed, manufactured, tested, and delivered. Advanced automation systems, including robotics and smart assembly lines, are increasingly integrated to enhance speed, precision, and consistency in high-volume production.

These technologies reduce manual errors, improve throughput, and support the mass manufacturing of complex electronic devices. Digital twins, IoT-enabled machinery, and AI-driven predictive maintenance further strengthen production efficiency by enabling real-time monitoring, reducing downtime, and optimizing resource utilization.

On the design and development front, technologies such as 3D modeling, rapid prototyping, simulation tools, and CAD/CAE platforms help ODM players create highly customized and innovative products with shorter development cycles. Semiconductor advancements, miniaturization, and advanced packaging technologies also play a crucial role in enabling compact and energy-efficient designs.

Cloud-based supply chain platforms enhance coordination between suppliers, manufacturers, and distributors, ensuring agility and transparency. Meanwhile, AI-powered quality inspection systems and automated testing enhance product reliability and compliance with global standards. Collectively, these technologies empower EMS & ODM providers to deliver faster turnaround, higher quality, and cost-efficient solutions, making technology integration a core strategic driver for competitiveness in the global electronics manufacturing ecosystem.

Industry Adoption

Industry adoption of EMS & ODM solutions has expanded rapidly as companies across sectors prioritize flexibility, speed, and cost efficiency in their product development and manufacturing processes. Consumer electronics brands remain the largest adopters due to fast product refresh cycles, high demand for customization, and the need for large-scale, high-precision production capabilities.

As device complexity increases, brands increasingly rely on EMS partners for PCB assembly, semiconductor integration, testing, and global distribution support. ODM adoption also continues to rise among startups and mid-sized firms that require end-to-end design, engineering, and prototyping expertise without bearing the cost of in-house R&D infrastructure.

Automotive, telecom, healthcare, and industrial automation sectors are also accelerating their adoption of EMS & ODM services. The rise of connected vehicles, 5G infrastructure, IoT devices, and medical electronics has created a strong need for specialized manufacturing, reliable component sourcing, and advanced quality assurance systems.

Companies adopt these services to handle supply chain uncertainties, shorten lead times, and access cutting-edge technologies such as robotics, digital twins, and AI-enabled inspection. Additionally, the push for sustainability and regulatory compliance drives industries to partner with EMS providers offering energy-efficient production systems and responsible sourcing practices. This widespread adoption is expected to intensify as global electronics demand continues to grow.

Emerging Trends

Emerging trends in the EMS & ODM market reflect the rapid transformation of the global electronics ecosystem, driven by technological innovation, evolving consumer expectations, and shifting manufacturing strategies. One of the most significant trends is the accelerating transition toward automation and smart factories, where robotics, AI-driven inspection, and IoT-connected equipment enhance production precision, reduce defects, and optimize workflows.

Another major trend is the rise of miniaturization and advanced semiconductor packaging, which enables compact consumer devices, wearables, automotive electronics, and industrial sensors. EMS and ODM providers are increasingly adopting advanced packaging techniques, such as system-in-package (SiP) and chiplet architectures, to support next-generation design requirements.

Sustainability is also emerging as a critical focus, with manufacturers integrating energy-efficient production systems, recyclable materials, and circular-economy principles to meet global environmental regulations. The reshoring and nearshoring trend is gaining momentum as brands seek to reduce supply chain risk and bring production closer to end markets.

Additionally, the expansion of EVs, smart home devices, healthcare electronics, and 5G infrastructure is shaping new revenue streams for EMS and ODM firms. Cloud-based supply chain orchestration, digital twins, and simulation tools are further improving design-to-production processes, making these trends pivotal in driving competitiveness and long-term growth across the EMS & ODM landscape.

China Market Size

China’s EMS & ODM market, valued at USD 259.8 billion in 2024, stands as the largest and most advanced manufacturing ecosystem globally, supported by deeply integrated supply chains, strong government incentives, and a mature electronics supplier base. The country’s expansive ecosystem of component manufacturers, PCB producers, semiconductor foundries, and assembly facilities provides unmatched scale and cost efficiency.

Leading global brands continue to rely on China for high-volume production due to its advanced automation capabilities, skilled workforce, and robust export infrastructure. These factors collectively reinforce China’s dominant position in electronics manufacturing and design services, making it a critical hub for global OEMs.

By 2034, China’s EMS & ODM market is projected to reach USD 607.2 billion, registering a strong 8.86% CAGR driven by the rapid adoption of automation, AI-enabled quality control, and smart factory technologies across production lines. Government initiatives focused on semiconductor self-reliance, such as the National Integrated Circuit Industry Investment Fund, are expected to expand local capabilities in chip packaging, testing, and advanced electronics development.

The growing demand for smartphones, EV components, telecom equipment, and smart home devices continues to fuel ODM innovation. Additionally, China’s emphasis on supply chain localization and digital industrial transformation positions the country as a long-term growth engine for the global EMS & ODM industry.

By Type

EMS accounts for 67.2% of the market, making it the dominant type due to its ability to support large-scale, high-precision, and cost-efficient electronics manufacturing. Companies rely on EMS providers for PCB assembly, component sourcing, testing, and end-to-end logistics, reducing the need for capital-intensive in-house facilities. The surge in consumer electronics, automotive electronics, telecom equipment, and industrial automation has intensified the demand for reliable, high-volume manufacturing partners.

EMS players are also integrating robotics, automated inspection, AI-driven quality control, and digital supply-chain platforms to improve yield accuracy and reduce production downtime. With product lifecycles becoming shorter and design complexity rising, EMS continues to play a central role in scaling global electronics output rapidly and efficiently.

ODM adoption is expanding as brands seek turnkey design-to-manufacturing support to accelerate product launches and reduce R&D costs. ODM firms offer concept development, industrial design, prototyping, and engineering expertise, enabling faster commercialization of devices across smartphones, wearables, smart home systems, EV components, and IoT modules.

The shift toward customized electronics, vertical-specific smart devices, and rapid prototyping strengthens ODM relevance. As companies increasingly prioritize differentiated product features and faster innovation cycles, ODM capabilities are expected to gain momentum, complementing the extensive manufacturing strength of EMS providers within the global EMS & ODM ecosystem.

By Application

Consumer electronics hold 47.7% of the EMS & ODM market, making it the largest application segment due to constant product upgrades, high global demand, and rapid innovation cycles. Smartphones, laptops, wearables, tablets, smart TVs, gaming devices, and home appliances require high-volume, precision-driven manufacturing, which EMS providers deliver efficiently.

ODM partners contribute heavily by designing differentiated, cost-effective products tailored to brand requirements, enabling faster time-to-market. As miniaturization, advanced semiconductor integration, and smart connectivity increase, consumer electronics continue to anchor the industry’s growth. Rising adoption of 5G devices, AI-enabled gadgets, and IoT-based home systems further reinforces the dominance of this segment.

Communications applications continue to expand with the proliferation of 5G infrastructure, network equipment, data centers, and IoT connectivity hardware. Automotive and transportation electronics are accelerating due to EV adoption, ADAS systems, infotainment modules, and battery management electronics. Industrial applications benefit from automation systems, robotics, sensors, and control equipment that require reliable EMS support.

Medical electronics, from diagnostic devices to patient monitoring systems, are growing rapidly as healthcare modernization advances. The energy sector is increasingly incorporating smart meters, solar inverters, battery systems, and grid electronics. The “others” category, which includes aerospace, defense, and smart city technologies, reflects rising demand for specialized, high-reliability manufacturing services across emerging industries.

Key Market Segments

By Type

- EMS

- ODM

By Application

- Consumer Electronics

- Communications

- Automotive & Transportation

- Industrial

- Medical

- Energy

- Others

Regional Analysis

Asia Pacific dominates the global EMS & ODM market with a commanding 52.7% share in 2024, valued at USD 432.9 billion, supported by its extensive manufacturing ecosystem, competitive production costs, and deep supply-chain integration. China remains the core engine, offering unrivaled scale in component sourcing, PCB fabrication, semiconductor packaging, and high-volume assembly.

Government initiatives promoting electronics self-sufficiency, smart manufacturing, and semiconductor development further strengthen China’s leadership. Meanwhile, countries such as Vietnam, Malaysia, Taiwan, and South Korea are rapidly expanding their electronics clusters, attracting global investments as companies diversify production away from single-market dependency.

The region benefits from a strong, skilled workforce, advanced automation systems, and large-scale manufacturing parks that support seamless coordination between suppliers and assembly partners. The accelerating demand for smartphones, EV components, wearables, smart home devices, and industrial automation equipment fuels continuous expansion in EMS and ODM activities.

Additionally, Asia Pacific’s export-oriented policies, efficient logistics infrastructure, and integration of AI-driven quality control and robotics enhance production efficiency and reliability. As brands prioritize speed, cost optimization, and engineering depth, Asia Pacific is expected to maintain its leadership position, remaining the most strategic and scalable region for global electronics manufacturing and design outsourcing over the coming decade.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The EMS & ODM market is driven by the rising complexity of electronic products, shorter product lifecycles, and continuous innovation across consumer electronics, automotive, industrial, and telecom sectors. OEMs increasingly outsource manufacturing to reduce operational costs, enhance production flexibility, and accelerate time-to-market.

The rapid expansion of IoT devices, EV components, 5G infrastructure, smart wearables, and home automation systems significantly boosts demand for advanced design and high-precision assembly services. Automation, robotics, and AI-enabled inspection strengthen manufacturing efficiency, making EMS & ODM partnerships more attractive.

Additionally, the push for miniaturization, semiconductor integration, and compact device architecture encourages brands to rely on specialized ODM engineering expertise. Strong manufacturing ecosystems in China and Southeast Asia—backed by government-led electronics policies—further support market expansion. Digital supply-chain platforms and real-time analytics enable faster coordination, enhancing global adoption of EMS & ODM models.

Restraint Factors

Despite strong growth, the EMS & ODM market faces restraints stemming from rising component shortages, supply-chain disruptions, and geopolitical tensions affecting semiconductor availability and cross-border manufacturing. Heavy dependence on specific regions—especially China—for components, PCB fabrication, and high-volume assembly creates concentration risks for global brands.

Intellectual property concerns remain a challenge for companies outsourcing sensitive designs, especially in competitive consumer and industrial electronics categories. Price pressures and shrinking margins in EMS operations limit profitability, particularly as raw material costs fluctuate. Additionally, the initial investment required for automation, smart factory upgrades, and AI-based inspection increases operational overhead for providers.

Strict regulatory compliance in sectors such as medical electronics, automotive safety systems, and telecom infrastructure adds complexity to manufacturing workflows. Workforce skill shortages in advanced electronics and chip packaging also hinder scaling efforts. These factors collectively impact the industry’s ability to maintain stable and predictable production cycles.

Growth Opportunities

Significant growth opportunities emerge from the accelerating demand for EV electronics, ADAS systems, smart home devices, industrial automation equipment, and next-generation telecom hardware. The global shift toward digitalization and electrification fuels the need for advanced PCB assembly, semiconductor packaging, and high-reliability manufacturing, expanding the scope of EMS & ODM providers.

ODM services gain traction as startups and mid-sized brands increasingly seek turnkey design solutions to launch innovative products cost-effectively. The rise of wearables, health monitoring devices, AR/VR equipment, and AI-enabled consumer gadgets presents new design and production avenues. Nearshoring and regional manufacturing diversification create opportunities in India, Vietnam, Mexico, and Eastern Europe as brands seek alternative production bases.

Government incentives in semiconductor manufacturing and electronics localization further support capacity expansion. Smart factories, digital twins, and cloud-based supply-chain platforms offer additional value creation, enabling providers to deliver faster, more flexible, and more sustainable manufacturing solutions.

Trending Factors

Key trends shaping the EMS & ODM market include rapid adoption of automation, robotics, and AI-based quality inspection across production lines to enhance throughput and reduce defects. Smart factory development using IoT-connected machinery, predictive maintenance, and digital twins is becoming mainstream, enabling real-time manufacturing optimization.

Miniaturization and advanced semiconductor packaging such as SiP, chiplets, and 3D stacking are driving innovations across smartphones, wearables, automotive electronics, and medical devices. Sustainability is gaining prominence, with manufacturers integrating energy-efficient machinery, recyclable materials, and low-emission production processes to meet global ESG requirements.

Diversification of production through nearshoring is another major trend as companies expand beyond China to mitigate geopolitical and supply-chain risks. Additionally, the rise of AI-driven consumer devices, 5G hardware, edge computing modules, and EV power electronics is reshaping ODM design strategies. These trends collectively strengthen competitiveness and accelerate innovation in the global EMS & ODM ecosystem.

Competitive Analysis

The competitive landscape of the EMS & ODM market is defined by a mix of global contract manufacturing giants, regional specialists, and design-focused ODM innovators competing on scale, technology capability, cost efficiency, and supply-chain strength. Leading EMS players leverage extensive global production networks, automated assembly lines, and strong supplier relationships to handle large-volume orders across consumer electronics, automotive systems, telecom equipment, and industrial devices.

Their competitive advantage lies in high production throughput, multi-country manufacturing presence, and advanced testing and quality-assurance systems that support stringent industry requirements. Many of these companies invest heavily in robotics, AI-driven inspection, and smart factory upgrades to enhance yield and maintain pricing competitiveness in a margin-sensitive market.

In contrast, ODM-focused companies differentiate themselves through strong design engineering capabilities, rapid prototyping, and product customization expertise. They work closely with brands to develop turnkey solutions, enabling faster commercialization of innovative devices such as wearables, smart home systems, and connected healthcare equipment.

Competition is further shaped by supply-chain resilience strategies, as manufacturers diversify into Southeast Asia, India, and Mexico to reduce geopolitical exposure. Sustainability initiatives, vertical integration, and semiconductor partnerships also play a growing role in strengthening competitive positioning. As electronic products become more complex, companies offering integrated design-to-delivery solutions continue to gain a strategic edge in the global EMS & ODM market.

Top Key Players in the Market

- Foxconn

- Wistron Corporation

- Flex Limited

- Jabil

- CICOR

- Zollner Elektronik AG

- EOLANE Group

- Lacroix Electronics

- Pegatron Corporation

- AEMTEC GMBH

- Katek Group

- Kappa Optronics GMBH

- Phoenix Contact

- Sanmina Corporation

- Compal Inc.

- New KIMPO Group

- Others

Recent Developments

- August 12, 2025: Foxconn Technology Group announced the expansion of its smart manufacturing lines in Shenzhen, integrating AI-driven optical inspection and automated robotics to enhance high-precision PCB assembly for next-generation consumer electronics.

- July 30, 2025: Flex Ltd. revealed a new fully automated EV electronics assembly facility in Guadalajara, Mexico, designed to support global automakers with advanced battery management systems, power electronics, and high-reliability automotive components.

- July 08, 2025: Wistron Corporation completed the upgrade of its Taiwan ODM design center with advanced digital-twin simulation tools, enabling faster prototyping cycles for IoT devices, smart home systems, and industrial automation hardware.

Report Scope

Report Features Description Market Value (2024) USD 821.6 Billion Forecast Revenue (2034) USD 1741.2 Billion CAGR(2025-2034) 7.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (EMS, ODM), By Application (Consumer Electronics, Communications, Automotive & Transportation, Industrial, Medical, Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Foxconn, Wistron Corporation, Flex Limited, Jabil, CICOR, Zollner Elektronik Ag, EOLANE Group, Lacroix Electronics, Pegatron Corporation, AEMTEC GMBH, Katek Group, Kappa Optronics GMBH, Phoenix Contact, Sanmina Corporation, Compal Inc., New KIMPO Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Foxconn

- Wistron Corporation

- Flex Limited

- Jabil

- CICOR

- Zollner Elektronik Ag

- EOLANE Group

- Lacroix Electronics

- Pegatron Corporation

- AEMTEC GMBH

- Katek Group

- Kappa Optronics GMBH

- Phoenix Contact

- Sanmina Corporation

- Compal Inc.

- New KIMPO Group

- Others