Global Embedded Multimedia Card (eMMC) Market Size, Share, Industry Analysis Report By Density (2GB-4GB, 8GB-16GB, 32GB-64GB, 128GB-256GB), By Application (Smartphones, Digital Cameras, GPS System, Medical Devices, Others), By End-User (Automotive, Aerospace and Defense, Consumer Electronics, Industrial, Healthcare, Public, IT and Telecom, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156667

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Role of Generative AI

- China eMMC Market Size

- Density Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Top Use Cases

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

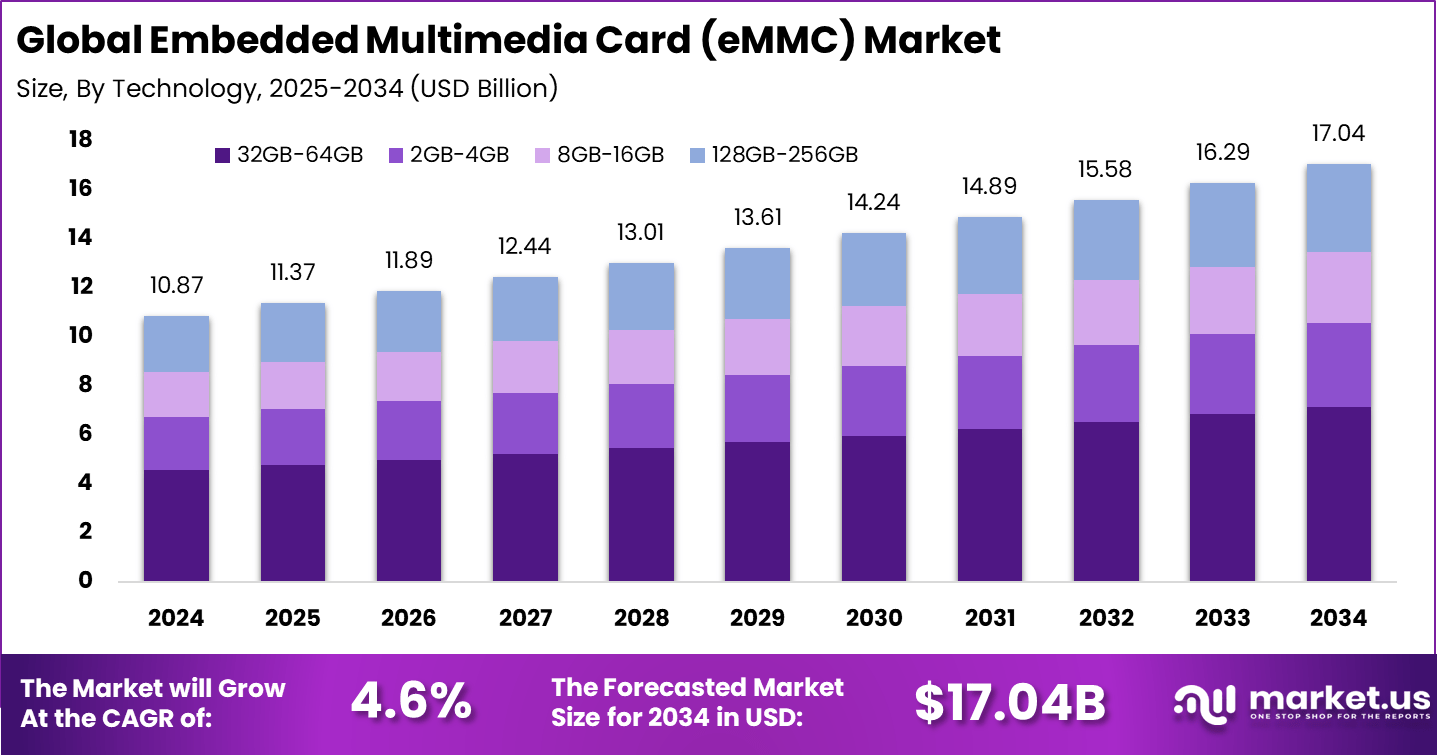

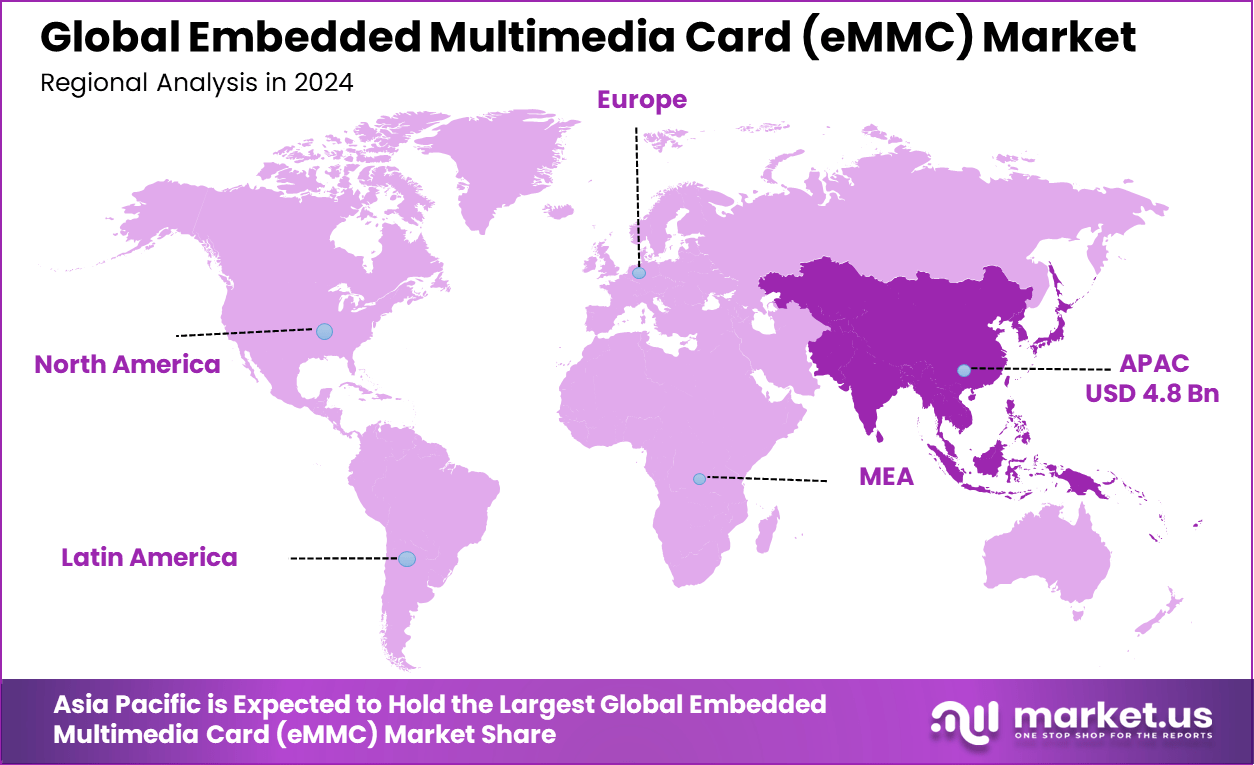

The Global Embedded Multimedia Card (eMMC) Market size is expected to be worth around USD 17.04 billion by 2034, from USD 10.87 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 45% share, holding USD 4.8 billion in revenue.

The market comprises storage components that integrate flash memory, control circuitry, and buffering into a single package, which is soldered directly onto device boards. eMMC remains a practical choice in devices that require modest performance and compact, cost‑effective storage solutions. Demand continues across sectors such as consumer electronics, automotive systems, industrial control, and IoT devices, where its integration simplicity and low power requirements align with design constraints

One of the top driving factors for the eMMC market is the growing demand for compact, cost-effective, and high-performance storage in consumer electronics and automotive sectors. The rise of smart devices, connected cars, and IoT ecosystems pushes the need for embedded memory solutions that can handle navigation data, infotainment content, and real-time updates.

Moreover, advancements in technology improving memory density and data transfer speeds contribute significantly to its wider acceptance. The automotive industry’s move towards advanced driver assistance systems and telematics also strongly fuels the demand for embedded memory that withstands stringent environmental conditions.

eMMC continues to see robust adoption in smartphones, where more than 70% of mid-tier devices use this technology as primary storage. In the automotive sector, its integration into infotainment and safety systems grows steadily, exceeding 85% penetration in modern vehicles. Other sectors, including healthcare and industrial IoT, increasingly rely on eMMC for secure, high-reliability data storage in compact form factors.

For instance, in June 2025, Micron Technology unveiled plans to invest approximately $200 billion in expanding its U.S. manufacturing and R&D facilities. This significant investment is expected to bolster Micron’s capacity to meet the growing demand for advanced memory solutions, including eMMC products, across various industries.

Key Takeaway

- The 32GB–64GB segment held a dominant share of 42%, making it the leading storage capacity category.

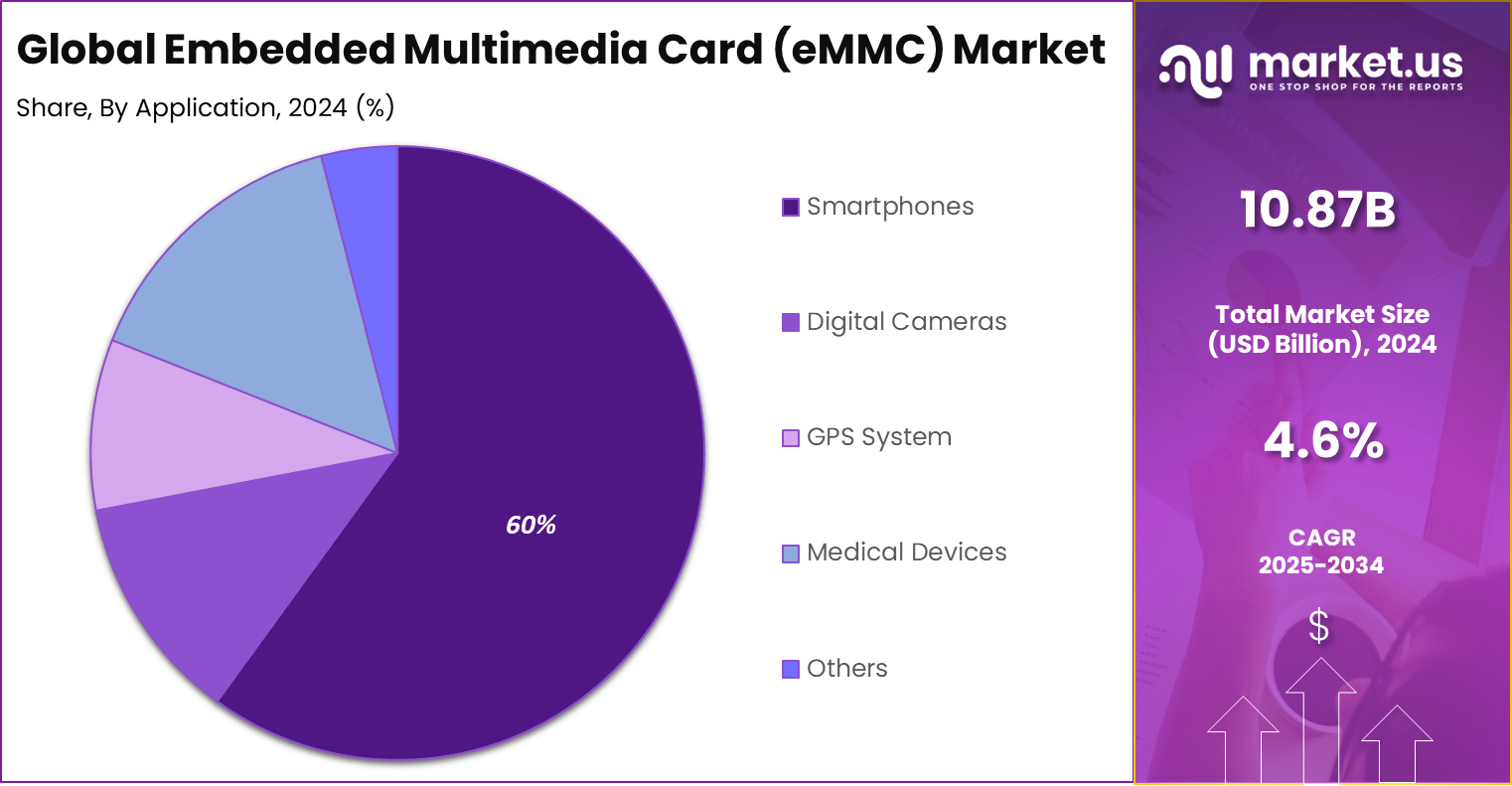

- The Smartphones segment captured a commanding 60% share, reflecting the widespread integration of eMMC in mobile devices.

- The Consumer Electronics segment accounted for 56%, underscoring its strong role in powering multimedia devices, tablets, and portable gadgets.

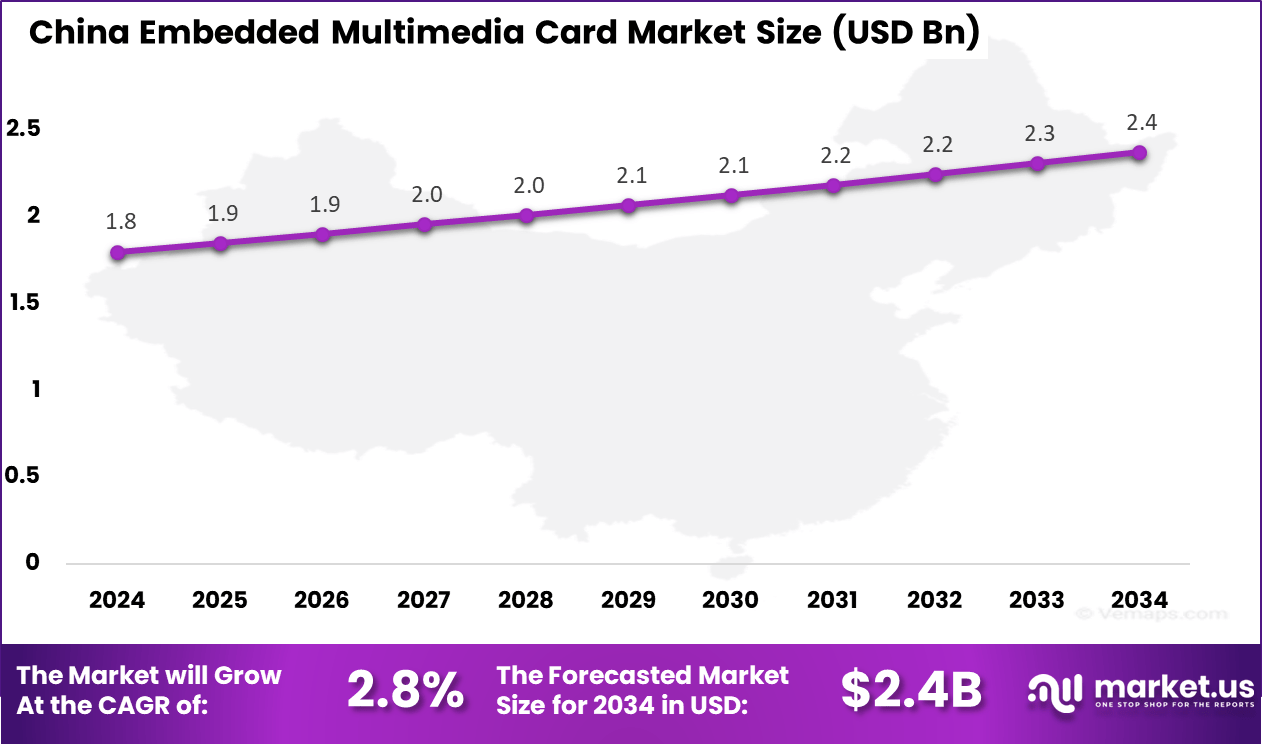

- The China eMMC Market reached USD 1.8 Billion, supported by a steady CAGR of 2.8%.

- North America dominated globally, with a market share exceeding 45%, driven by high adoption in advanced consumer and enterprise devices.

Analysts’ Viewpoint

Investors find compelling opportunities in the eMMC market due to its presence across diverse fast-growing industries and the steady demand for embedded memory solutions. The ongoing technological evolution, coupled with emerging applications in connected cars, smart healthcare devices, and industrial automation, promises sustained market expansion.

Investment in manufacturing capabilities, R&D for higher-capacity and more durable modules, and strategic partnerships within automotive and consumer electronics segments offer potential for substantial returns driven by increasing adoption worldwide.

Businesses adopting eMMC benefit from reduced device complexity, lower manufacturing costs, and faster time-to-market. The integrated design combining flash memory and controller reduces the overall component count, simplifying supply chains. Its proven reliability and durability enhance end-product quality, while competitive pricing enables cost advantage especially in price-sensitive markets.

The regulatory environment governing the eMMC market emphasizes compliance with global standards related to electronic component safety, environmental impact, and data integrity. Regulations ensure that eMMC modules meet quality, reliability, and performance requirements necessary for sectors like automotive and healthcare, where data resilience is critical.

Role of Generative AI

Key points Description Enhancing Storage Optimization Generative AI algorithms optimize eMMC storage usage by predicting data access patterns and managing memory allocation efficiently, improving device performance. Accelerating AI-Driven Applications eMMC provides reliable embedded storage supporting AI workloads such as object detection, facial recognition, and real-time analytics on edge devices. Enabling On-Device AI Processing Compact, efficient eMMC storage facilitates the deployment of generative AI models on-device, reducing latency and dependency on cloud computing. Improving Data Compression Generative AI techniques improve compression algorithms, increasing effective storage capacity and speeding up data transfer within eMMC modules. Supporting Next-Gen Embedded Systems AI-enabled enhancements in eMMC help power complex infotainment, ADAS, and IoT systems in automotive and consumer electronics markets. China eMMC Market Size

The market for Embedded Multimedia Card (eMMC) within China is growing tremendously and is currently valued at USD 1.8 billion, the market has a projected CAGR of 2.8%. The market is growing tremendously due to the rapid expansion of the consumer electronics industry, particularly smartphones, tablets, and IoT devices.

As the demand for affordable yet efficient storage solutions increases, eMMC is becoming the preferred choice due to its cost-effectiveness and reliability. Additionally, China’s growing automotive and industrial sectors, which require embedded storage for connected systems and machinery, further contribute to the rising adoption of eMMC technology across various applications.

For instance, in April 2024, Foresee showcased its innovative memory and storage solutions, including eMMC products, at Embedded World 2024. This reflects the growing adoption of embedded storage solutions in China, driven by the expansion of consumer electronics, automotive, and industrial applications.

In 2024, Asia Pacific held a dominant market position in the Global Embedded Multimedia Card (eMMC) Market, capturing more than a 45% share, holding USD 4.8 billion in revenue. The dominance is due to its robust manufacturing capabilities and high demand for consumer electronics like smartphones, tablets, and IoT devices.

Countries such as China, South Korea, and Japan are central to electronics production, driving the need for cost-effective and reliable storage. The region also benefits from expanding automotive production, government initiatives for digital transformation, and smart infrastructure.

For instance, In February 2021, Silicon Motion Technology Corp. invested NT$4 billion in a new Taiwan facility to boost production of advanced storage solutions, including eMMC, reflecting its focus on growing demand across smartphones, automotive, and consumer electronics in Asia Pacific.

Density Analysis

The 32GB-64GB density segment holds a significant share in the embedded multimedia card market, accounting for 42% of the market. This segment benefits from the rising demand for mid-range storage capacity that effectively supports a variety of devices requiring ample space for high-definition media, applications, and software.

The 32GB to 64GB range is increasingly favored for its balance between capacity and cost, making it suitable for devices that need reliable and versatile storage without the premium cost of ultra-high capacities. This density tier is widely appreciated, especially in industries such as consumer electronics and telecommunications, where moderate to high storage is essential.

Growing adoption of HD content, multimedia applications, and richer user experiences drive the proliferation of the 32GB-64GB eMMC category. Devices such as smartphones, tablets, and some IoT applications utilize this mid-density segment to enable better performance and enhanced user functionality.

Application Analysis

Smartphones dominate the application segment of the eMMC market, commanding around 60% market share. This dominance stems from the growing global smartphone user base and the continuous upgrades in mobile operating systems and applications, which require larger and faster storage solutions.

Embedded multimedia cards in smartphones provide essential internal storage for operating systems, applications, multimedia files, and user data. The cost-effectiveness and compact design of eMMC make it an attractive choice for smartphone manufacturers, especially in mid-tier and budget devices.

The smartphone segment’s growth is fueled by the ongoing demand for enhanced device capabilities and consumer expectations for higher performance and storage capacity. Despite the rise of alternatives like UFS storage, eMMC maintains strong relevance in a large portion of the smartphone market due to its proven reliability and economic benefits.

For instance, in July 2024, Kingston Technology announced a global distribution partnership with DigiKey, aimed at expanding the availability of its memory and storage solutions, including eMMC products. This collaboration is particularly relevant for the smartphone sector, where demand for reliable and cost-effective storage continues to grow.

End-User Analysis

Consumer electronics is the leading end-user segment for eMMC, representing 56% of the market share. This sector includes a wide range of devices such as smart TVs, digital cameras, tablets, wearable devices, and other multimedia gadgets that utilize eMMC for efficient and affordable embedded storage.

The mass production of consumer electronics drives the demand since these devices require reliable memory solutions that support various multimedia functions, software, and applications while keeping costs manageable. The prominence of consumer electronics as an end-user is also reflective of the sector’s rapid innovation and the increasing integration of smart technologies in daily-use devices.

Manufacturers favor eMMC for its compatibility, durability, and sufficient capacity to meet the average storage demands of consumer gadgets. As advancements in display technology and content consumption grow, the need for efficient storage solutions in this sector will continue to propel eMMC adoption

For Instance, in January 2024, Greenliant expanded its eMMC NANDrive™ portfolio, introducing high-endurance solutions tailored for demanding applications. This development is particularly significant for the consumer electronics segment, as devices like smartphones, tablets, and wearables increasingly require reliable and durable storage solutions.

Emerging Trends

Key Trends Description Growing Use in Automotive Applications Increased use in infotainment systems, ADAS, connected cars drives demand for high-reliability and high-density eMMC solutions. Rising Adoption in Consumer Electronics Smartphones, tablets, and IoT devices increasingly integrate eMMC for cost-effective, compact, and reliable storage. Enhanced Memory Density & Speed Continuous improvements in eMMC capacities and data transfer rates enable support for data-intensive applications. Expansion in Industrial IoT Market Use in robotics, industrial automation, and control systems expands due to need for durable, compact storage solutions. Regional Market Growth Strong uptake in Asia-Pacific due to smartphone production, and growth in North America and Europe supported by automotive and electronics sectors. Growth Factors

Key Factors Description Increasing Demand for Embedded Storage Growing need for compact, reliable storage in portable electronics and automotive systems fuels market growth. Advances in eMMC Technology Innovations like increased memory density, faster transfer rates, and power efficiency improve eMMC appeal and adoption. Expansion of IoT and Smart Devices Proliferation of connected devices with embedded storage requirements drives eMMC demand. Automotive Industry Digitalization ADAS, infotainment, telematics, and connected car technologies boost integrated storage solutions adoption. Cost-Effectiveness Compared to Alternatives eMMC offers a balance of performance, reliability, and low cost compared to other embedded storage options, attracting OEMs. Key Market Segments

By Density

- 2GB-4GB

- 8GB-16GB

- 32GB-64GB

- 128GB-256GB

By Application

- Smartphones

- Digital Cameras

- GPS System

- Medical Devices

- Others

By End-User

- Automotive

- Aerospace and Defense

- Consumer Electronics

- Industrial

- Healthcare

- Public

- IT and Telecom

- Others

Drivers

Increasing Demand for Smartphones and Consumer Electronics

The growing use of smartphones, tablets, and other portable devices is significantly boosting the demand for compact, high-performance storage solutions like eMMC. As these devices become more advanced, the need for higher storage capacities is increasing.

eMMC offers a cost-effective way to meet these demands by providing reliable storage in a small, efficient form factor, making it an ideal solution for budget-friendly and mid-range consumer electronics, driving its widespread adoption across various product categories.

For instance, in July 2025, Samsung reported a surge in demand for its new foldable smartphones in India, a trend indicative of the growing adoption of advanced mobile devices globally. As smartphones become more sophisticated, the need for compact, high-performance storage solutions like eMMC has grown.

Restraint

Competition from Other Storage Technologies

eMMC faces significant competition from other memory technologies, particularly UFS (Universal Flash Storage) and SSDs (Solid State Drives). UFS offers superior data transfer speeds and better endurance, making it a preferred choice for higher-end smartphones and devices that demand faster performance.

As technology continues to advance, eMMC may struggle to keep pace with these alternatives, limiting its application in premium devices and posing a challenge to its continued dominance in the embedded storage market.

For instance, In August 2025, Samsung advanced Universal Flash Storage (UFS) technology with faster data transfer, higher energy efficiency, and larger capacity, making it the preferred option for premium smartphones, tablets, and connected devices as demand for reliable high-speed storage grows.

Opportunities

Development of Higher-Capacity eMMC Versions

The development of higher-capacity and faster eMMC versions opens up new growth opportunities for manufacturers. As technology advances, manufacturers are increasingly developing eMMC solutions with higher storage capacities and faster speeds. These improvements offer a promising opportunity for eMMC to expand its use beyond basic consumer electronics.

Enhanced eMMC versions can cater to a wider range of applications, such as gaming consoles, high-performance tablets, and enterprise data storage, ensuring their relevance in markets that require both affordability and improved performance in compact, embedded storage solutions.

For instance, in July 2025, Frontgrade introduced the industry’s highest-density space-grade managed NAND with an eMMC 5.1 interface, offering significantly enhanced storage capacity and reliability for space and aerospace applications. This new development marks a major step in the evolution of eMMC storage, addressing the growing demand for higher-capacity memory solutions in critical environments.

Challenges

Price Fluctuations and Supply Chain Constraints

The eMMC market is vulnerable to price fluctuations and disruptions in the supply chain, particularly due to factors like semiconductor shortages. The volatility in memory chip prices can affect manufacturing costs and product availability, potentially delaying production schedules or increasing final product prices.

These supply chain challenges pose a significant risk to the stability of the eMMC market, making it difficult for manufacturers to predict costs and maintain consistent supply, especially during periods of high demand or global supply disruptions.

For instance, In July 2025, TSMC raised prices for advanced chip manufacturing due to strong demand and currency fluctuations, a move expected to affect the semiconductor industry and increase costs for eMMC components, which may lead to higher device prices.

Top Use Cases

Use Cases Description Smartphones & Mobile Devices Primary embedded storage for mid-range smartphones and tablets for apps, media, and OS data. Automotive Infotainment Systems Storage for navigation, entertainment, ADAS, and telematics in modern vehicles. Industrial Automation & Robotics Data storage in control units and automated systems requiring durable embedded memory. IoT Devices & Wearables Reliable compact storage in connected sensors, smart appliances, and wearable devices. Consumer Electronics Use in digital cameras, smart TVs, set-top boxes, and other portable electronics that require non-volatile memory. Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Embedded Multimedia Card (eMMC) market is shaped by the presence of established global memory and storage companies. Samsung Electronics, SK Hynix, and Micron Technology hold a strong role through advanced memory solutions and deep investment in semiconductor innovation. Their expertise in scaling production capacity and delivering high-density storage solutions continues to position them at the forefront of technological adoption.

Another important group includes Toshiba Corporation, Western Digital, and Kingston Technology. These companies maintain strong global distribution networks and diversified product offerings that help address demand across consumer and industrial devices. Their focus on balancing affordability and performance has enabled wider adoption of eMMC in mid-range devices.

Niche innovators such as Delkin Devices, Greenliant Systems, Silicon Motion, and Phison Electronics play a vital role in specialized applications. These companies focus on controller design, embedded solutions, and industrial-grade memory products that cater to automotive, aerospace, and defense sectors. Alongside them, ADATA Technology and Transcend Information offer consumer-oriented solutions, serving diverse segments from portable devices to IoT systems.

Top Key Players in the Market

- Delkin Devices Inc.

- Greenliant Systems Inc

- Kingston Technology Company Inc.

- Micron Technology Inc

- Phison Electronics Corporation

- Samsung Electronics Co. Ltd

- Silicon Motion Technology Corporation

- SK Hynix Inc.

- Transcend Information Inc

- Western Digital Corporation

- Toshiba Corporation

- ADATA Technology Co., Ltd.

- Other Key Players

Recent Developments

- In February 2025, Samsung Electronics began mass production of its 256GB eUFS 3.1 chips, achieving continuous write speeds approximately three times faster than conventional 512Gb eUFS 3.0 chips. This advancement underscores Samsung’s commitment to leading in high-performance embedded storage solutions, including eMMC technology.

- In November 2024, SK hynix began mass production of the world’s first 321-layer NAND flash, aiming to expand the application of its high-density products to meet the demands of emerging AI technologies. This milestone positions SK hynix at the forefront of advanced memory solutions, impacting the eMMC market.

Report Scope

Report Features Description Market Value (2024) USD 10.87 Bn Forecast Revenue (2034) USD 17.04 Bn CAGR(2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Density (2GB-4GB, 8GB-16GB, 32GB-64GB, 128GB-256GB), By Application (Smartphones, Digital Cameras, GPS System, Medical Devices, Others), By End-User (Automotive, Aerospace and Defense, Consumer Electronics, Industrial, Healthcare, Public, IT and Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Delkin Devices Inc., Greenliant Systems Inc., Kingston Technology Company Inc., Micron Technology Inc., Phison Electronics Corporation, Samsung Electronics Co., Ltd, Silicon Motion Technology Corporation, SK Hynix Inc., Transcend Information Inc., Western Digital Corporation, Toshiba Corporation, ADATA Technology Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Embedded Multimedia Card (eMMC) MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Embedded Multimedia Card (eMMC) MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Delkin Devices Inc.

- Greenliant Systems Inc

- Kingston Technology Company Inc.

- Micron Technology Inc

- Phison Electronics Corporation

- Samsung Electronics Co. Ltd

- Silicon Motion Technology Corporation

- SK Hynix Inc.

- Transcend Information Inc

- Western Digital Corporation

- Toshiba Corporation

- ADATA Technology Co., Ltd.

- Other Key Players