Global Electric Power Steering Market Size, Share, Growth Analysis By Components (Steering Column, Sensors, Steering Gear, Mechanical Rack & Pinion, Electronic Control Unit, Electric Motor, Bearing), By Electric Motor (Brush Motor, Brushless Motor), By Application (Passenger Cars, Commercial Vehicles), By Off Highway Application (Construction Equipment, Agricultural Equipment), By Electric Vehicle (BEV, PHEV, FCEV), By EV Gear Type (Worm Gear, Ball Screw), By Type (Rack Assist Type, Column Assist Type, Pinion Assist Type), By Mechanism (Rigid, Collapsible), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176966

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Components Analysis

- Electric Motor Analysis

- Application Analysis

- Off Highway Application Analysis

- Electric Vehicle Analysis

- EV Gear Type Analysis

- Type Analysis

- Mechanism Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Report Overview

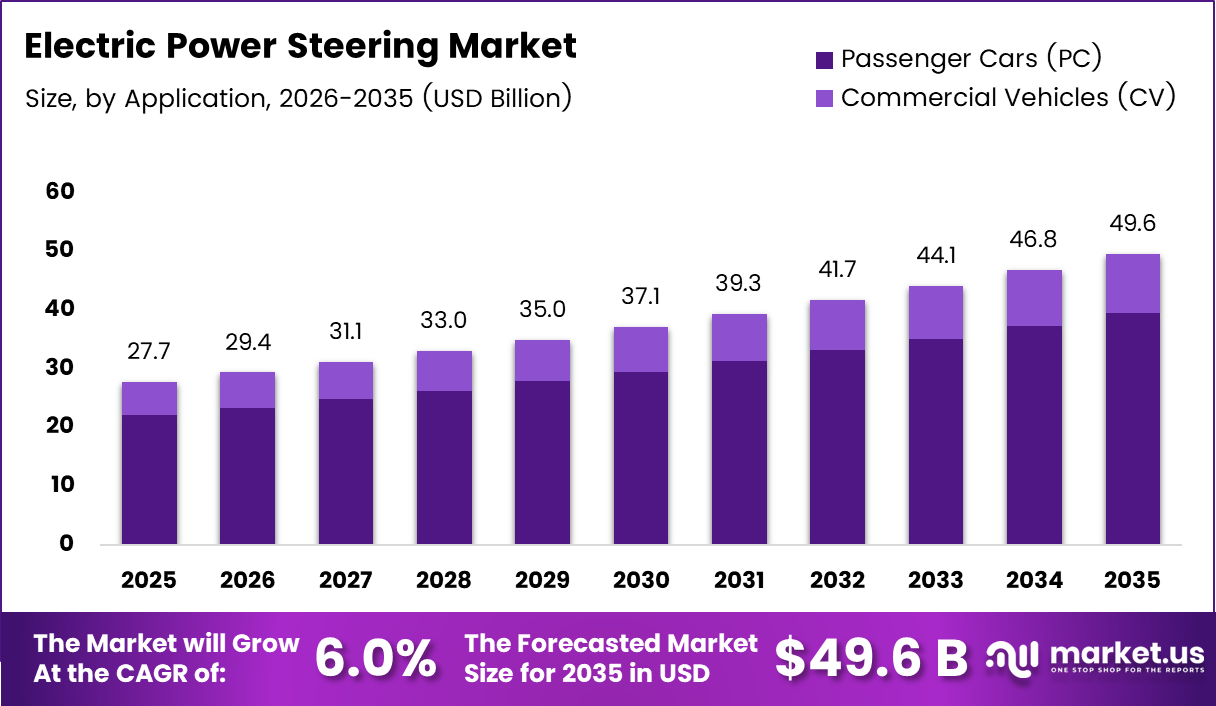

Global Electric Power Steering Market size is expected to be worth around USD 49.6 Billion by 2035 from USD 27.7 Billion in 2025, growing at a CAGR of 6% during the forecast period 2026 to 2035.

Electric Power Steering represents an advanced automotive technology that replaces conventional hydraulic systems with electronic controls and electric motors. This system provides steering assistance through sensors and electronic control units, eliminating the need for hydraulic pumps and fluid. Consequently, it offers superior fuel efficiency and precise vehicle control.

The market demonstrates robust expansion driven by automotive electrification and stricter emission standards worldwide. Moreover, consumer preferences for enhanced driving comfort and vehicle maneuverability continue strengthening demand. Therefore, automotive manufacturers increasingly integrate EPS systems across passenger vehicle and commercial vehicle segments to meet regulatory requirements.

Government initiatives promoting electric vehicle adoption significantly boost market growth prospects. Additionally, investments in autonomous driving technologies necessitate advanced steering solutions with precise electronic control capabilities. However, manufacturers focus on developing lightweight, energy-efficient architectures that align with sustainability objectives and reduce overall vehicle weight.

The technology delivers substantial operational advantages over traditional hydraulic systems. According to Brogene Vsolution, the servo motor only operates when steering assistance is needed, reducing fuel consumption by 3-5%. This efficiency improvement addresses growing environmental concerns and regulatory pressures facing the automotive industry.

Advanced EPS configurations demonstrate impressive performance capabilities across vehicle categories. According to ZF, systems can provide up to 8000Nm output torque and achieve steering forces of up to 8.5 kNm in regular configurations. These specifications enable applications ranging from compact cars to heavy commercial vehicles with varying assistance requirements.

Regional markets exhibit varying adoption patterns influenced by automotive production volumes and electrification rates. Furthermore, emerging economies witness accelerated EPS integration as manufacturers expand production facilities and localize component sourcing. Therefore, the competitive landscape intensifies with established suppliers and new entrants developing innovative steering solutions.

Technological advancements continue reshaping market dynamics through steer-by-wire systems and software-defined platforms. Additionally, artificial intelligence integration enables adaptive steering responses that enhance driver experience. Consequently, the market evolves toward increasingly sophisticated solutions that support autonomous driving capabilities and connected vehicle ecosystems.

Key Takeaways

- Global Electric Power Steering Market projected to reach USD 49.6 Billion by 2035 from USD 27.7 Billion in 2025

- Market growing at CAGR of 6% during forecast period 2026-2035

- Brushless Motor segment dominates with 78.2% market share in 2025

- Passenger Cars application holds 79.6% share of total market

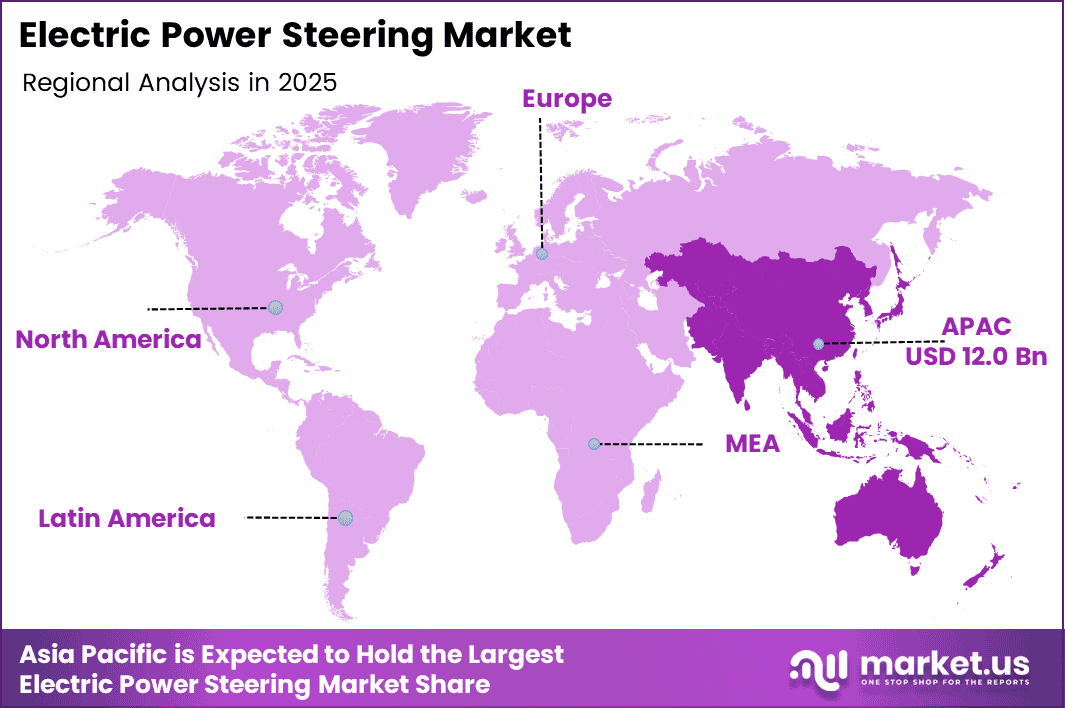

- Asia Pacific leads regional market with 43.6% share valued at USD 12.0 Billion

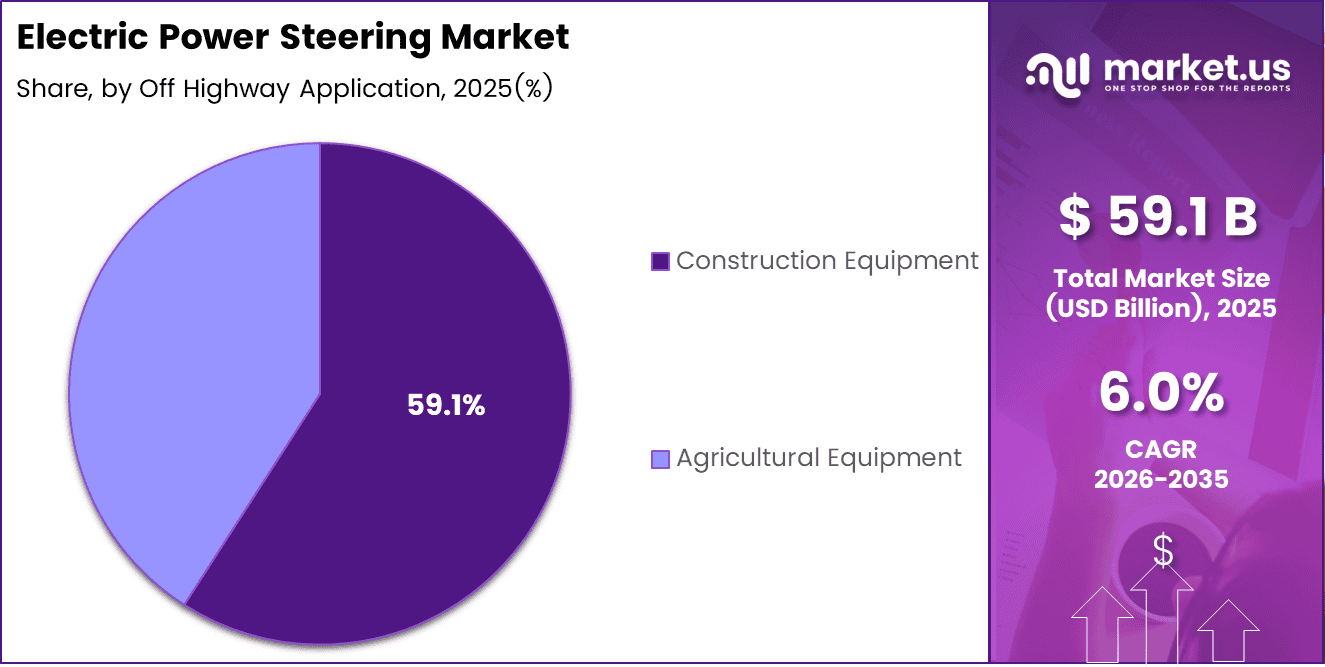

- Construction Equipment dominates off-highway application with 59.1% share

- BEV segment captures 58.9% of electric vehicle EPS market

- Collapsible mechanism type holds 66.8% market share

Components Analysis

Steering Column dominates with 29.3% due to its critical role in transmitting driver input and housing essential electronic components.

In 2025, ‘Steering Column’ held a dominant market position in the ‘Components’ segment of Electric Power Steering Market, with a 29.3% share. This component serves as the primary interface between driver and vehicle, integrating torque sensors and electronic control mechanisms. Moreover, advanced steering columns incorporate collapsible safety features and adjustable configurations that enhance driver comfort and crash protection.

Sensors represent crucial components enabling real-time monitoring of steering angle, torque, and vehicle dynamics. These devices provide essential data to electronic control units for precise steering assistance calculation. Additionally, sensor technology advancements improve system responsiveness and enable integration with advanced driver assistance systems for enhanced safety and autonomous driving capabilities.

Steering Gear components translate rotational input into lateral wheel movement with electronic assistance. These assemblies incorporate rack and pinion mechanisms or ball screw configurations depending on vehicle requirements. Furthermore, gear designs optimize force transmission efficiency while minimizing friction and wear for extended operational lifespan across diverse driving conditions.

Mechanical Rack & Pinion systems provide the fundamental mechanical linkage converting steering wheel rotation into wheel angle changes. These components work in conjunction with electric motors to deliver precise steering response. Consequently, rack and pinion designs continue evolving to accommodate higher torque requirements and compact packaging constraints in modern vehicle architectures.

Electronic Control Unit serves as the intelligent brain processing sensor inputs and commanding motor assistance levels. These sophisticated microprocessors execute complex algorithms for optimal steering feel and vehicle stability. Moreover, ECUs enable software customization and over-the-air updates that enhance system performance throughout vehicle lifecycle without hardware modifications.

Electric Motor generates the assistive torque that reduces driver steering effort across various operating conditions. These motors must deliver rapid response times and consistent performance across wide temperature ranges. Additionally, motor efficiency directly impacts overall vehicle energy consumption and contributes to meeting stringent fuel economy and emission reduction regulatory requirements.

Bearing components ensure smooth rotational movement while supporting mechanical loads throughout the steering system. High-quality bearings minimize friction losses and extend component lifespan under continuous operational demands. Furthermore, bearing designs incorporate advanced materials and lubrication technologies that maintain performance reliability across millions of steering cycles and harsh environmental conditions.

Electric Motor Analysis

Brushless Motor dominates with 78.2% due to superior efficiency, reliability, and reduced maintenance requirements compared to traditional brush designs.

In 2025, Brushless Motor held a dominant market position in the Electric Motor segment of Electric Power Steering Market, with a 78.2% share. This technology eliminates mechanical brushes, reducing friction and extending motor lifespan significantly. Consequently, brushless designs deliver consistent performance across wider temperature ranges and operating conditions while minimizing maintenance interventions throughout vehicle ownership.

Brush Motor configurations maintain presence in cost-sensitive applications and entry-level vehicle segments where initial investment considerations outweigh long-term operational benefits. These motors offer simpler construction and lower manufacturing costs compared to brushless alternatives. However, their market share gradually declines as manufacturers prioritize reliability improvements and total ownership cost reductions that justify higher component investments.

Application Analysis

Passenger Cars dominates with 79.6% due to high production volumes and widespread EPS adoption across all vehicle segments globally.

In 2025, ‘Passenger Cars (PC)’ held a dominant market position in the ‘Application’ segment of Electric Power Steering Market, with a 79.6% share. This dominance reflects global automotive trends favoring fuel-efficient technologies and enhanced driving comfort features across compact, mid-size, and luxury segments. Moreover, passenger vehicles benefit from EPS integration with varying assistance levels tailored to specific performance and efficiency requirements.

Commercial Vehicles (CV) demonstrate increasing EPS adoption as manufacturers develop systems capable of handling higher torque requirements for light commercial vans, delivery trucks, and medium-duty applications. These vehicles require robust steering assistance for loaded operations and extended duty cycles. Additionally, commercial fleet operators recognize fuel savings and reduced maintenance costs that improve total ownership economics significantly.

Off Highway Application Analysis

Construction Equipment dominates with 59.1% due to extensive machinery deployments and growing electrification of off-road vehicles.

In 2025, ‘Construction Equipment’ held a dominant market position in the ‘Off Highway Application’ segment of Electric Power Steering Market, with a 59.1% share. This segment includes excavators, loaders, and earthmoving machinery requiring precise steering control in demanding operational environments. Therefore, EPS systems enhance operator comfort during extended work cycles while improving fuel efficiency and reducing hydraulic system maintenance requirements.

Agricultural Equipment increasingly incorporates electric steering systems to improve farming efficiency and reduce operator fatigue during long field operations. These applications include tractors, harvesters, and specialized agricultural machinery operating in varied terrain conditions requiring consistent steering assistance. Furthermore, precision farming technologies integrate with EPS systems for automated guidance capabilities and field management optimization.

Electric Vehicle Analysis

BEV dominates with 58.9% due to rapid battery electric vehicle adoption and inherent compatibility with electric steering architectures.

In 2025, ‘BEV’ held a dominant market position in the ‘Electric Vehicle’ segment of Electric Power Steering Market, with a 58.9% share. Battery electric vehicles naturally integrate EPS systems within their electric powertrains, eliminating parasitic losses from hydraulic pumps entirely. Moreover, BEV platforms optimize energy consumption through intelligent steering assistance calibration that adapts to driving conditions and battery state.

PHEV configurations combine electric and combustion powertrains, maintaining strong EPS adoption for efficiency optimization across multiple operating modes. These vehicles benefit from reduced engine load during electric-only operation and seamless steering assistance transitions between power sources. Additionally, plug-in hybrids represent significant market segments in regions with developing charging infrastructure supporting gradual electrification transitions.

FCEV platforms utilize hydrogen fuel cells with electric drivetrains, incorporating EPS systems similar to battery electric vehicle architectures for consistent steering performance. These vehicles remain niche applications with limited production volumes currently due to infrastructure constraints. However, fuel cell technology advancement and hydrogen refueling network development support gradual market expansion in specific geographic regions and commercial applications.

EV Gear Type Analysis

Worm Gear dominates with 62.4% due to its self-locking characteristics and compact design suitable for electric vehicle applications.

In 2025, ‘Worm Gear’ held a dominant market position in the ‘EV Gear Type’ segment of Electric Power Steering Market, with a 62.4% share. This gear configuration provides inherent mechanical advantage and prevents back-driving forces from reaching the steering wheel, enhancing road feedback characteristics. Consequently, worm gear systems deliver natural steering feel preferred by drivers while maintaining compact packaging suitable for space-constrained vehicle architectures.

Ball Screw mechanisms offer higher efficiency and reduced friction compared to worm gear alternatives in specific high-performance applications. These systems convert rotary motion to linear movement with minimal energy loss and precise control capabilities. Furthermore, ball screw designs enable compact integration in advanced vehicle platforms with demanding performance requirements and energy efficiency optimization priorities throughout operational duty cycles.

Type Analysis

Rack Assist Type dominates with 47.7% due to superior torque capacity and suitability for larger vehicles requiring higher assistance levels.

In 2025, ‘Rack Assist Type (REPS)’ held a dominant market position in the ‘Type’ segment of Electric Power Steering Market, with a 47.7% share. This configuration mounts the electric motor directly on the steering rack, providing maximum assistance force for SUVs, pickup trucks, and larger passenger vehicles. Moreover, REPS systems deliver consistent performance across varying vehicle speeds and loading conditions with superior torque delivery.

Column Assist Type (CEPS) represents cost-effective solutions for compact and mid-size vehicles with moderate assistance requirements and packaging constraints. These systems integrate motors within the steering column assembly, simplifying installation procedures and reducing overall component count. Additionally, CEPS configurations suit applications where weight reduction priorities and manufacturing cost optimization drive design decisions without compromising essential steering assistance.

Pinion Assist Type (PEPS) positions electric motors at the steering gear pinion location, balancing performance capabilities and packaging efficiency for diverse applications. These systems provide intermediate torque capacity between column and rack assist configurations serving multiple vehicle segments. Furthermore, pinion assist designs enable flexible platform applications with adjustable steering assistance characteristics tailored to specific performance and handling requirements.

Mechanism Analysis

Collapsible dominates with 66.8% due to mandatory safety requirements and crashworthiness standards in modern vehicle designs.

In 2025, ‘Collapsible’ held a dominant market position in the ‘Mechanism’ segment of Electric Power Steering Market, with a 66.8% share. This mechanism incorporates energy-absorbing features that collapse during frontal impacts, protecting vehicle occupants from steering column intrusion injuries. Therefore, collapsible designs meet stringent safety regulations across global automotive markets while maintaining normal operational integrity and steering precision.

Rigid mechanisms maintain structural integrity without collapse features, primarily serving specialized applications, older vehicle platforms, and specific commercial vehicle configurations. These designs offer simpler construction and lower manufacturing complexity compared to collapsible alternatives with reduced component count. However, their market share continues declining progressively as safety standards evolve globally and consumer awareness of crashworthiness and occupant protection increases significantly.

Key Market Segments

By Components

- Steering Column

- Sensors

- Steering Gear

- Mechanical Rack & Pinion

- Electronic Control Unit

- Electric Motor

- Bearing

By Electric Motor

- Brush Motor

- Brushless Motor

By Application

- Passenger Cars (PC)

- Commercial Vehicles (CV)

By Off Highway Application

- Construction Equipment

- Agricultural Equipment

By Electric Vehicle

- BEV

- PHEV

- FCEV

By EV Gear Type

- Worm Gear

- Ball Screw

By Type

- Rack Assist Type (REPS)

- Column Assist Type (CEPS)

- Pinion Assist Type (PEPS)

By Mechanism

- Rigid

- Collapsible

Drivers

Rising Adoption of Advanced Driver Assistance Systems Requiring Precise Steering Control Drives Market Growth

Automotive manufacturers increasingly integrate advanced driver assistance systems requiring precise electronic steering control for lane-keeping, parking assistance, and collision avoidance features. Moreover, these systems demand millisecond-level response times and continuous steering adjustments that hydraulic systems cannot deliver. Therefore, EPS technology becomes essential infrastructure supporting autonomous driving development and deployment.

Consumer demand for enhanced driving comfort and superior vehicle maneuverability continues strengthening across global markets. Additionally, electric power steering eliminates traditional hydraulic system vibrations and provides customizable steering feel through software calibration. Consequently, manufacturers differentiate vehicle models through programmable steering characteristics that adapt to driving conditions and personal preferences automatically.

Stricter global fuel efficiency and emission reduction regulations compel automotive OEMs toward lightweight, energy-efficient vehicle architectures. Furthermore, electric power steering reduces parasitic engine losses and overall vehicle weight compared to hydraulic alternatives. This efficiency improvement contributes significantly toward meeting increasingly stringent corporate average fuel economy standards worldwide.

Restraints

High Initial Integration and Calibration Costs Limit Market Adoption in Price-Sensitive Segments

Electric power steering systems require substantial upfront investment in electronic components, sensors, and software development compared to conventional hydraulic alternatives. Moreover, system calibration demands extensive testing across diverse operating conditions and vehicle configurations. Therefore, cost-sensitive manufacturers and entry-level vehicle segments sometimes delay EPS adoption despite long-term operational benefits.

Performance limitations emerge under extreme load conditions and heavy-duty vehicle applications requiring maximum steering assistance force. Additionally, current EPS technology faces challenges delivering consistent performance with fully loaded commercial vehicles on demanding terrain. Consequently, some heavy-duty applications maintain hydraulic systems until electric motor technology advances sufficiently.

Integration complexity increases vehicle development timelines as manufacturers optimize EPS performance with chassis dynamics and electronic control systems. Furthermore, aftermarket service requirements demand specialized diagnostic equipment and technician training investments. These implementation challenges particularly affect smaller automotive manufacturers with limited engineering resources and development budgets.

Growth Factors

Expanding Penetration of Electric and Hybrid Vehicles Accelerates Market Expansion Globally

Electric and hybrid vehicle production surges across global markets, creating inherent demand for compatible electric power steering systems. Moreover, battery electric platforms eliminate traditional engine-driven hydraulic pumps entirely, necessitating electronic steering solutions. Therefore, automotive electrification trends directly correlate with accelerating EPS market growth and technology advancement.

Increasing EPS adoption in compact, mid-segment, and entry-level passenger cars expands addressable market opportunities significantly. Additionally, manufacturing scale economies reduce component costs, making electric steering economically viable across broader vehicle segments. Consequently, technology penetration rates improve steadily as price premiums diminish and consumer awareness increases.

Integration of steer-by-wire and software-defined vehicle platforms represents transformative growth opportunities for advanced steering technologies. Furthermore, these systems eliminate mechanical linkages entirely, enabling flexible interior packaging and autonomous driving capabilities. Growing automotive production in emerging economies provides substantial expansion potential through localized manufacturing and rising vehicle ownership rates.

Emerging Trends

Transition Toward Column-Assist and Dual-Pinion EPS Configurations Reshapes Product Landscape

Automotive manufacturers increasingly favor column-assist and dual-pinion electric power steering configurations for optimal performance and packaging efficiency. Moreover, these advanced architectures deliver superior torque capacity while maintaining compact designs suitable for diverse vehicle platforms. Therefore, product development focuses on modular systems adaptable across multiple vehicle segments.

Artificial intelligence integration enables adaptive steering feel and response that automatically adjusts to driving conditions and individual preferences. Additionally, machine learning algorithms optimize steering assistance based on road surface, vehicle speed, and driver behavior patterns. Consequently, next-generation systems provide increasingly sophisticated personalization capabilities enhancing overall driving experience.

Rising adoption of over-the-air software updates allows manufacturers to refine steering characteristics and deploy new features without physical service interventions. Furthermore, increased focus on redundancy and functional safety compliance ensures systems meet ISO 26262 standards for autonomous driving applications. These trends position electric power steering as critical enablers for connected and autonomous vehicle ecosystems.

Regional Analysis

Asia Pacific Dominates the Electric Power Steering Market with a Market Share of 43.6%, Valued at USD 12.0 Billion

Asia Pacific commands the dominant market position with 43.6% share valued at USD 12.0 Billion, driven by extensive automotive production in China, Japan, and South Korea. Moreover, the region hosts major EPS manufacturers and benefits from aggressive electric vehicle adoption policies. Therefore, localized supply chains and manufacturing capabilities support continued regional market leadership.

North America Electric Power Steering Market Trends

North America demonstrates robust EPS adoption across passenger and commercial vehicle segments, supported by stringent fuel efficiency regulations and consumer preference for advanced technologies. Additionally, the region’s automotive manufacturers increasingly integrate electric steering in SUV and pickup truck platforms. Furthermore, growing electric vehicle production facilities strengthen regional market demand.

Europe Electric Power Steering Market Trends

Europe maintains strong market presence driven by aggressive emission reduction targets and premium vehicle segment concentration. Moreover, European manufacturers pioneer advanced EPS technologies including steer-by-wire systems and autonomous driving applications. Therefore, the region represents critical innovation hub influencing global technology development trajectories.

Latin America Electric Power Steering Market Trends

Latin America experiences gradual EPS adoption as automotive production recovers and localized manufacturing capabilities expand. Additionally, cost-sensitive market dynamics influence technology penetration rates across vehicle segments. Furthermore, improving economic conditions and rising vehicle ownership support steady market growth prospects.

Middle East & Africa Electric Power Steering Market Trends

Middle East and Africa demonstrate emerging EPS demand driven by expanding automotive assembly operations and technology transfer initiatives. Moreover, premium vehicle imports and growing SUV segment popularity contribute to market development. Therefore, infrastructure investments and economic diversification efforts support gradual technology adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

JTEKT Corporation maintains leadership position through comprehensive EPS product portfolio spanning column, pinion, and rack-assist configurations serving global automotive manufacturers. The company leverages advanced bearing technology expertise and integrated manufacturing capabilities to deliver cost-effective steering solutions. Moreover, strategic partnerships with major OEMs strengthen market presence across passenger and commercial vehicle segments globally.

Denso Corporation demonstrates technological excellence developing compact, high-efficiency electric power steering systems for hybrid and electric vehicles. Their innovative thermal management solutions enhance system reliability under demanding operating conditions. Additionally, the company’s extensive automotive electronics expertise enables seamless integration with advanced driver assistance systems and autonomous driving platforms.

Robert Bosch GmbH pioneers next-generation steering technologies including steer-by-wire systems and software-defined architectures supporting autonomous vehicle development. The company’s comprehensive sensor and electronic control unit capabilities provide competitive advantages in integrated system solutions. Furthermore, global manufacturing footprint and extensive R&D investments position Bosch as innovation leader shaping industry transformation.

Nexteer Automotive specializes in modular electric power steering platforms adaptable across diverse vehicle segments and global markets. Their recent modular pinion-assist system expansion demonstrates commitment to cost-effective, scalable solutions. Moreover, the company’s focus on customizable steering feel and performance characteristics addresses manufacturer differentiation requirements effectively.

Key Players

- JTEKT Corporation

- Denso Corporation

- GKN Automotive Limited

- Hitachi Astemo, Ltd.

- Hyundai Mobis

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- thyssenkrupp AG

Recent Developments

- January 2026 – ZF Steering Gear Subsidiary acquired two factory premises for electrical division manufacturing expansion, strengthening production capacity to meet growing global demand for electric power steering components and systems across passenger and commercial vehicle segments.

- August 2024 – Nexteer Automotive announced its Modular Pinion-Assist Electric Power Steering (mPEPS) system, expanding the company’s cost-effective modular EPS offerings to include both Single-Pinion and Dual-Pinion systems for enhanced vehicle platform flexibility and market coverage.

Report Scope

Report Features Description Market Value (2025) USD 27.7 Billion Forecast Revenue (2035) USD 49.6 Billion CAGR (2026-2035) 6.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Components (Steering Column, Sensors, Steering Gear, Mechanical Rack & Pinion, Electronic Control Unit, Electric Motor, Bearing), By Electric Motor (Brush Motor, Brushless Motor), By Application (Passenger Cars, Commercial Vehicles), By Off Highway Application (Construction Equipment, Agricultural Equipment), By Electric Vehicle (BEV, PHEV, FCEV), By EV Gear Type (Worm Gear, Ball Screw), By Type (Rack Assist Type, Column Assist Type, Pinion Assist Type), By Mechanism (Rigid, Collapsible) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape JTEKT Corporation, Denso Corporation, GKN Automotive Limited, Hitachi Astemo Ltd., Hyundai Mobis, Mitsubishi Electric Corporation, Nexteer Automotive, NSK Ltd., Robert Bosch GmbH, ZF Friedrichshafen AG, thyssenkrupp AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Power Steering MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Electric Power Steering MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- JTEKT Corporation

- Denso Corporation

- GKN Automotive Limited

- Hitachi Astemo, Ltd.

- Hyundai Mobis

- Mitsubishi Electric Corporation

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- thyssenkrupp AG