Global Elastomeric Coating Market Size, Share, And Industry Analysis Report By Type (Acrylic, Polyurethane, Silicone, Butyl, Others), By Application (Building and Construction, Roof, Wall, Floor, Bridges, Others, Automotive and Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176905

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

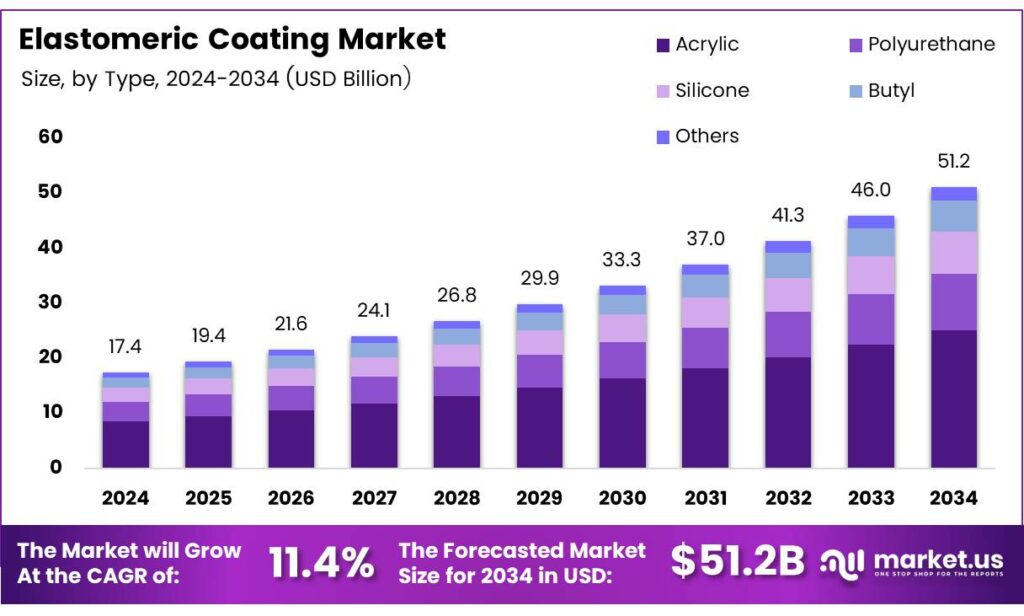

The Global Elastomeric Coating Market size is expected to be worth around USD 51.2 billion by 2034, from USD 17.4 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034.

The elastomeric coating market represents a growing niche within advanced protective materials, helping buildings, industrial assets, and infrastructure achieve stronger waterproofing and durability. These flexible coatings form seamless membranes that resist cracks, UV exposure, and temperature fluctuations. As construction volumes rise globally, elastomeric systems gain traction due to their longevity and lower maintenance needs.

The demand strengthens as governments emphasize energy-efficient building envelopes and sustainable refurbishment practices. By enhancing insulation and reducing heat transfer, elastomeric coatings support compliance with updated energy codes and green‐construction guidelines. Consequently, the industry experiences structural growth as regulatory bodies push for improved environmental performance in residential, commercial, and industrial sectors.

- Advanced research highlights performance improvements in fire-resistant elastomeric coatings. Organophosphorus flame retardants reduced heat release rate (HRR) by over 50%, achieving 211.4 kW/m² and lowering pHRR by 55%, reaching 538.3 kW/m². A dual-retardant system (RDP/TCPP 10:5) improved fire resistance while maintaining mechanical strength, supporting adoption in roof-system protection.

Opportunities arise from large-scale renovation programs, public infrastructure upgrades, and retrofit schemes promoting protective coatings for roofs and façades. As developing nations expand urban corridors, builders increasingly adopt elastomeric solutions for moisture protection, crack bridging, and extended lifecycle performance. These trends collectively stimulate consistent procurement across OEMs, applicators, and construction service providers.

Key Takeaways

- The Global Elastomeric Coating Market is projected to reach USD 51.2 billion by 2034, up from USD 17.4 billion in 2024, at a CAGR of 11.4% from 2025 to 2034.

- Acrylic emerged as the leading type segment with a 49.4% market share in 2025.

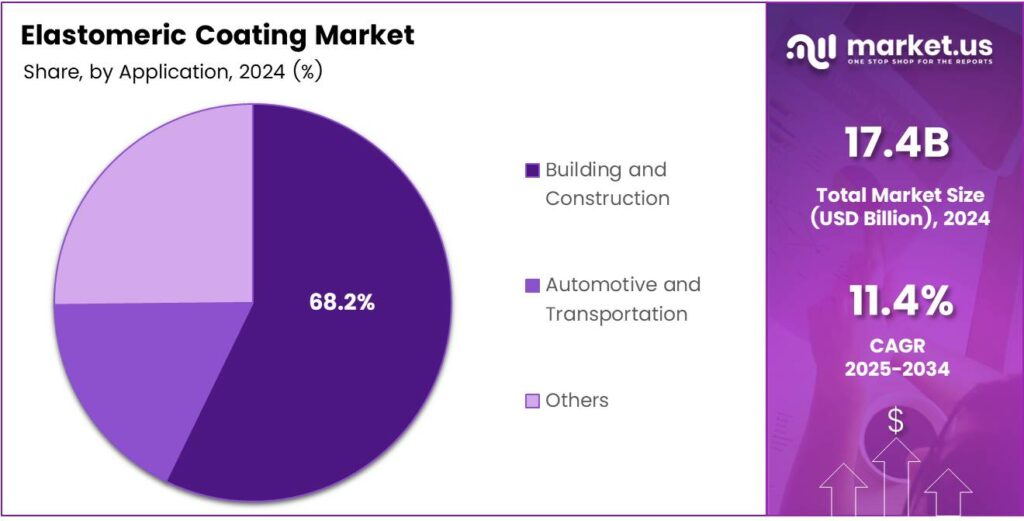

- Building and Construction dominated the application segment with a 68.2% share in 2025.

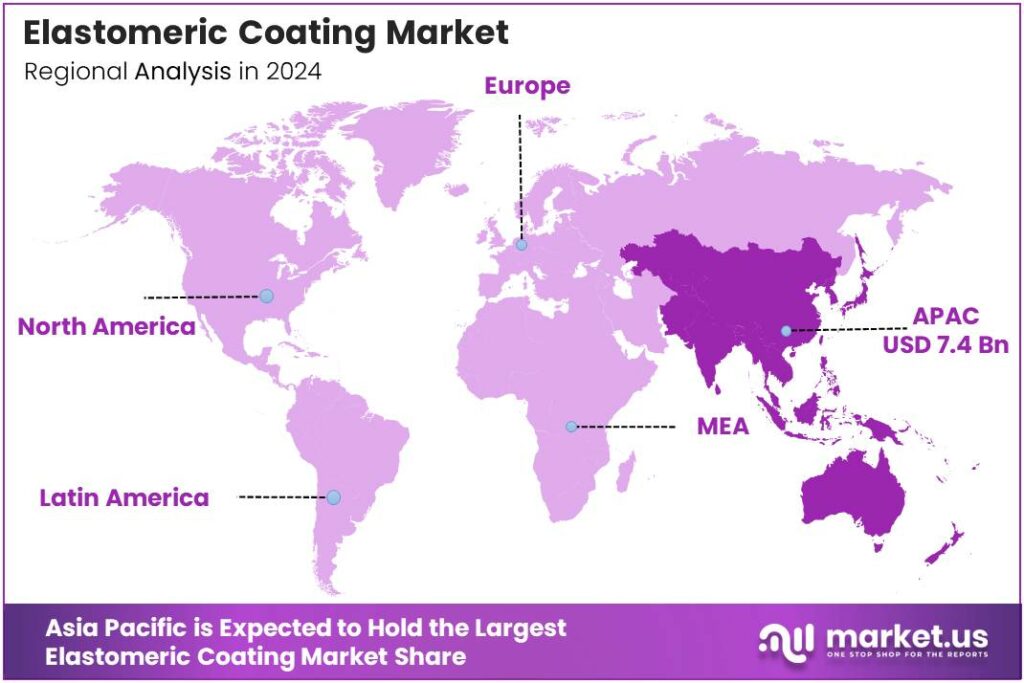

- Asia Pacific led the global market with a 42.6% share, valued at USD 7.4 billion.

By Type Analysis

Acrylic dominates with 49.4% due to its durability and broad compatibility.

In 2025, ‘Acrylic’ held a dominant market position in the ‘By Type’ Analysis segment of the Elastomeric Coating Market, with a 49.4% share. This segment leads as acrylic coatings provide strong adhesion, UV resistance, and cost efficiency. Additionally, they support long-term weather protection, making them a preferred choice across industries.

‘Polyurethane’ maintained steady demand within the segment due to its excellent flexibility and abrasion resistance. It is widely adopted for surfaces requiring high-impact strength. Furthermore, polyurethane coatings support enhanced chemical resistance, making them suitable for challenging industrial environments that require reliable surface protection.

‘Silicone’ also contributed significantly as its heat resistance and waterproofing benefits continued gaining traction. Silicone coatings perform well in extreme temperature variations, ensuring longer service life for roofs and facades. Moreover, their ability to withstand moisture makes them suitable for high-humidity regions.

‘Butyl’ captured a niche share in the segment, benefiting from its strong water-vapor barrier properties. It is mostly used in roofing and sealing applications. Additionally, butyl coatings contribute to improved structural insulation performance, supporting specialized construction needs.

By Application Analysis

Building and Construction dominates with 68.2%, driven by rising infrastructure upgrades.

In 2025, ‘Building and Construction’ held a dominant market position in the ‘By Application’ Analysis segment of the Elastomeric Coating Market, with a 68.2% share. This segment benefits from increasing construction activities and demand for long-lasting exterior protection. Furthermore, elastomeric coatings support crack-bridging, waterproofing, and energy-efficient building solutions.

‘Automotive and Transportation’ ensured notable growth as manufacturers adopt coatings for corrosion protection and surface durability. These coatings enhance structural resilience under harsh operational conditions. Moreover, elastomeric materials help improve vehicle component longevity, contributing to better performance outcomes.

‘Others’ included smaller application areas such as industrial equipment and specialty infrastructure. These coatings are chosen for their elasticity, chemical resistance, and stress endurance. Additionally, niche sectors rely on elastomeric coatings to extend equipment lifespan and reduce maintenance needs.

Key Market Segments

By Type

- Acrylic

- Polyurethane

- Silicone

- Butyl

- Others

By Application

- Building and Construction

- Roof

- Wall

- Floor

- Bridges

- Others

- Automotive and Transportation

- Others

Emerging Trends

Rising Adoption of Eco-Friendly Coatings Shapes Market Trends

One major trend in the elastomeric coating market is the shift toward environmentally friendly materials. Customers increasingly prefer low-VOC and water-based coatings to meet green building requirements. The growing use of elastomeric coatings in roof restoration.

- These coatings provide durability, weatherproofing, and energy savings, making them a popular replacement for expensive roof repairs. Code and standards references commonly point to minimum aged solar reflectance around 0.55 and minimum aged thermal emittance around 0.75 for low-sloped roofs, as seen in compiled codes and standards resources used by the cool-roof community.

Digital tools are also influencing the market. Contractors and builders are adopting software for surface evaluation, coating selection, and application planning, improving project accuracy. Product innovation is accelerating. Manufacturers are developing coatings with enhanced elasticity, longer lifespan, and better resistance to UV and moisture.

Drivers

Rising Demand for Long-Lasting Protective Coatings Drives Market Growth

The elastomeric coating market is growing because more industries want coatings that last longer and protect surfaces from harsh weather. These coatings offer strong resistance against cracking, peeling, and moisture, making them suitable for buildings in both hot and cold climates.

- Code and standards references commonly point to minimum aged solar reflectance around 0.55 and minimum aged thermal emittance around 0.75 for low-sloped roofs, as seen in compiled codes and standards resources used by the cool-roof community.

Elastomeric coatings help reduce heat absorption, which lowers energy use. This benefit is attracting construction companies, commercial facility managers, and homeowners who want sustainable solutions. The rapid expansion of the construction sector also supports market growth. With more urban development and infrastructure upgrades, the demand for coatings that extend building life continues to rise.

Restraints

High Application Costs Limit Market Expansion

One major restraint for the elastomeric coating market is the high cost of application. These coatings require skilled labor and specific equipment, increasing overall project expenses for users. Since elastomeric coatings are thicker than traditional paints, projects may require more time, especially in humid regions, which slows down adoption in fast-paced construction environments.

- The U.S. Department of Energy notes that a conventional dark roof can reach around 150°F on a sunny summer afternoon, which pushes heat into the building and raises cooling needs. Fluctuating raw material prices also affect the market.

Ingredients such as acrylics, polyurethane, and silicone face price volatility, which impacts overall production costs for manufacturers. Environmental regulations create additional hurdles. Some coating formulations must comply with VOC limitations, requiring manufacturers to reformulate products, adding complexity and cost.

Growth Factors

Growing Focus on Energy-Efficient Construction Creates New Opportunities

A major opportunity in the elastomeric coating market comes from rising global interest in energy-efficient buildings. These coatings help reduce heat transfer and improve insulation, which makes them appealing for green construction projects. The increasing number of renovation activities in aging buildings also offers strong potential.

- Elastomeric coatings can restore old surfaces without major structural changes, making them a cost-effective upgrade for property owners. The ENERGY STAR roof products program has long used clear reflectance thresholds—an initial solar reflectance of 0.65, and a requirement to maintain at least 0.50 after aging.

Emerging markets in the Asia-Pacific, Middle East, and Latin America offer further opportunities. Rapid urbanization and higher infrastructure spending create a strong demand for protective coatings in commercial and residential sectors. Technological advancements, such as improved UV resistance and eco-friendly formulations, also open new possibilities.

Regional Analysis

Asia Pacific Dominates the Elastomeric Coating Market with a Market Share of 42.6%, Valued at USD 7.4 Billion

Asia Pacific holds the leading position in the Elastomeric Coating Market, driven by rapid construction growth, large-scale infrastructure upgrades, and expanding residential development. The region’s strong economic activity and rising investments in waterproofing and exterior wall protection continue to elevate demand. With a dominant share of 42.6% and a valuation of USD 7.4 billion, Asia Pacific remains the primary hub for elastomeric coating consumption.

North America shows consistent growth due to increasing renovation activities, adoption of energy-efficient building technologies, and stringent environmental compliance standards. The region benefits from widespread use of advanced coating systems in both commercial and residential structures. Rising focus on durability and climate-resilient construction also supports material demand.

Europe’s market is shaped by sustainability-driven regulations, rising refurbishment projects, and a strong emphasis on long-lasting façade protection. Demand is reinforced by the region’s push toward low-VOC materials and energy-conscious building upgrades. Additionally, government-led modernization initiatives further strengthen coating adoption across urban areas.

Latin America’s market is influenced by improving construction spending, growth in waterproofing applications, and rising adoption in both new builds and maintenance work. Economic recovery in key countries and urban expansion contribute to steady demand. The region continues to explore durable and cost-effective coating solutions for long-term building protection.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Top Key Players in the Market

- BASF SE

- Sherwin-Williams Company

- Dow

- Huntsman Corporation

- Covestro AG

- PPG Industries Inc.

- Versaflex Inc

- Rhino Linings Corporation

- Nukote Coating Systems

- Marvel Industrial Coatings LLC

- Pidilite Industries Ltd

Recent Developments

- In 2025, BASF continues to advance its offerings in elastomeric reflective roof coatings through the BRILLIANCE family of acrylics and additives, which focus on reducing heat absorption in traditional asphalt roofs while providing UV resistance, energy efficiency, and sustainable low-VOC chemistry.

- In 2025, Sherwin-Williams introduced Acrolon 680, a high-solids direct-to-metal polyurethane topcoat that accelerates application with minimal surface preparation, quick dry times, and single-coat coverage for industrial and marine assets. The company offers the SofTop Comfort Elastomeric Systems for flooring, including SofTop Deco Flake BC and SofTop TG, which provide ergonomic, flexible, sound-absorbing, and chemical-resistant finishes.

Report Scope

Report Features Description Market Value (2024) USD 17.4 Billion Forecast Revenue (2034) USD 51.2 Billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Acrylic, Polyurethane, Silicone, Butyl, Others), By Application (Building and Construction, Roof, Wall, Floor, Bridges, Others, Automotive and Transportation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF SE, Sherwin-Williams Company, Dow, Huntsman Corporation, Covestro AG, PPG Industries Inc., Versaflex Inc, Rhino Linings Corporation, Nukote Coating Systems, Marvel Industrial Coatings LLC, Pidilite Industries Ltd Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Elastomeric Coating MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Elastomeric Coating MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Sherwin-Williams Company

- Dow

- Huntsman Corporation

- Covestro AG

- PPG Industries Inc.

- Versaflex Inc

- Rhino Linings Corporation

- Nukote Coating Systems

- Marvel Industrial Coatings LLC

- Pidilite Industries Ltd