Global Egg White Powder Market Size, Share and Report Analysis By Source (Chicken, Duck, Quail, Others), By Form (Instant Powder, Spray Dried Powder, Liquid Egg White), By Application (Food Processing, Cosmetics And Personal Care, Pharmaceuticals, Dietary Supplements, Beverage Processing, Others), By Sales Channel (Online Retail Stores, Hypermarkets and Supermarkets, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175783

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

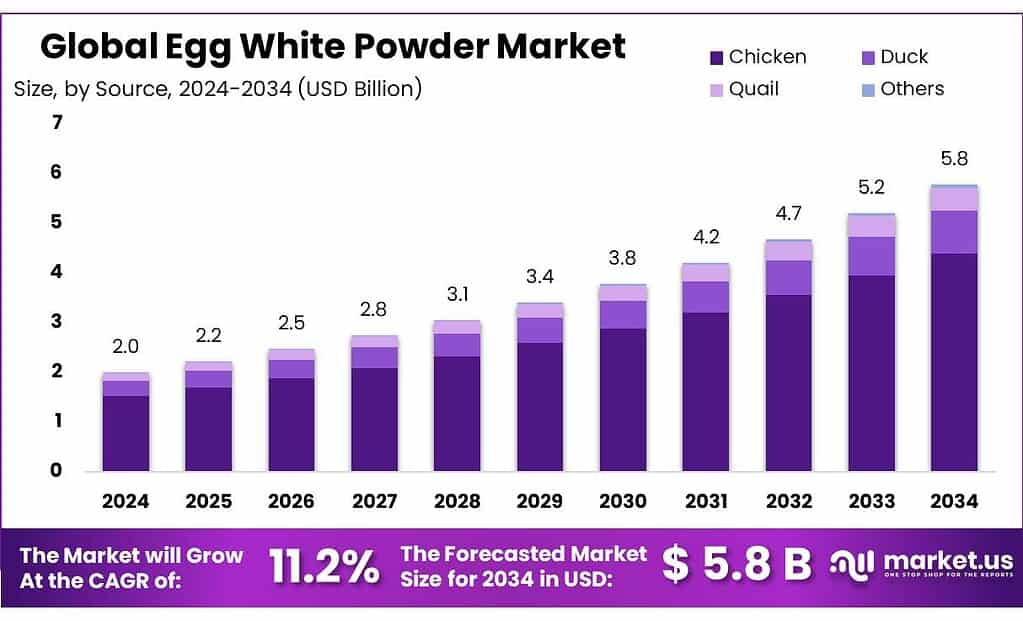

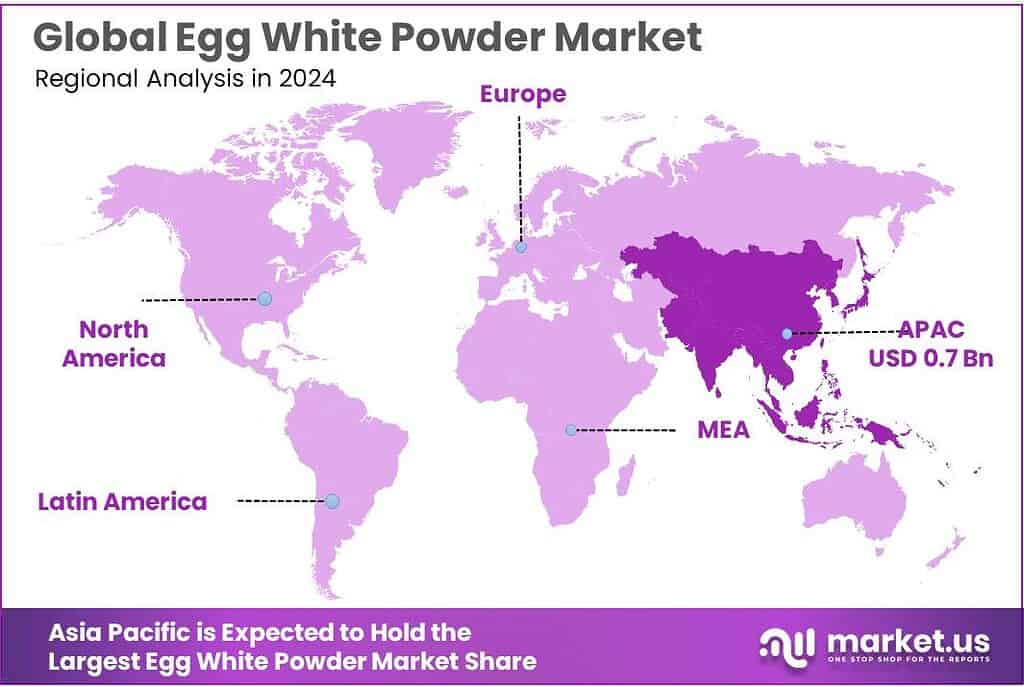

Global Egg White Powder Market size is expected to be worth around USD 5.8 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 36.7% share, holding USD 0.7 Billion in revenue.

Egg white powder is a dehydrated, pasteurized albumen ingredient designed for industrial food manufacturing where high protein, long shelf life, and repeatable functionality matter. Processors use it to deliver reliable foaming, gelling, binding, and emulsifying effects in bakery mixes, confectionery, ready-to-drink/high-protein beverages, and nutrition formats where liquid eggs are harder to store and standardize. FAO highlights how large the upstream base has become: world eggs production reached 100 million tonnes in 2024, with hen eggs accounting for 94% of that volume.

The industrial scenario for egg white powder is closely tied to the size and stability of the upstream egg supply chain. In 2023, global hen egg production reached about 91 million tonnes (around 1.7 trillion eggs), indicating a very large raw-material base that supports industrial egg processing into liquid, frozen, and dried formats. At the same time, eggs are not a “fully local” commodity: FAO notes that only about 2.2 million tonnes are typically traded internationally, so regional price spikes and supply shocks can quickly influence processors’ costs and contracting strategies. For example, the EU produced an estimated 98.6 billion eggs for consumption in 2024, with 91% coming from farms above 5,000 laying hens—an indicator of scale that favors contract processing and ingredient-grade batch consistency.

Key demand drivers are operational resilience and industrial standardization. Powder formats reduce spoilage risk and help manufacturers manage seasonal price swings and supply shocks. Trade and pricing signals reinforce why processors like dried formats: USDA’s Egg Markets Overview (January 23, 2026) last quoted dried whole egg at $6.52 per lb (and dried yolk at $6.75 per lb), reflecting how tight supplies and strong procurement cycles can move egg-product economics.

In the United States, USDA’s Economic Research Service estimates the value of U.S. egg production at USD 21.0 billion in 2024, which indirectly underpins investment in processing capacity, QA systems, and product upgrades that benefit dried egg formats. On the demand side, a major driver is manufacturers’ preference for standardized, safe ingredients that reduce handling risk and production variability. In the United States alone, egg production during the year ending November 30, 2024 totaled 109 billion eggs, showing the scale of industrial supply available for downstream processing.

In the EU, Regulation (EC) No 853/2004 sets specific hygiene rules for foods of animal origin, including requirements around egg products and acceptable raw materials, which pushes processors toward better segregation, sanitation, and validated heat-treatment steps.

Key Takeaways

- Egg White Powder Market size is expected to be worth around USD 5.8 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 11.2%.

- Chicken held a dominant market position, capturing more than a 76.4% share in the Egg White Powder Market.

- Spray Dried Powder held a dominant market position, capturing more than a 48.6% share.

- Food Processing held a dominant market position, capturing more than a 38.5% share.

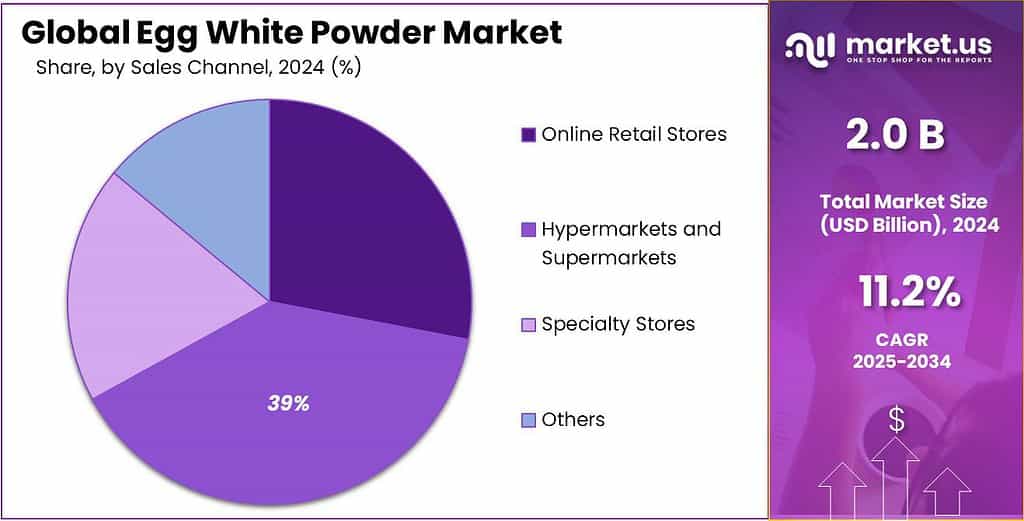

- Hypermarkets and Supermarkets held a dominant market position, capturing more than a 39.3% share.

- Asia Pacific leads the Egg White Powder Market in 2024, holding a dominant position with a market share of 36.7% and a value of 0.7 Bn.

By Source Analysis

Chicken dominates the segment with 76.4% share, supported by strong commercial egg production networks.

In 2024, Chicken held a dominant market position, capturing more than a 76.4% share in the Egg White Powder Market by Source. This dominance is mainly due to the vast global supply of chicken eggs, which remain the most efficient and commercially scalable raw material for egg white powder processing. Chicken eggs account for nearly the entire industrial egg stream, enabling processors to maintain steady production volumes, consistent protein quality, and predictable functional performance across bakery, confectionery, and nutrition applications.

By Form Analysis

Spray Dried Powder leads the market with 48.6% share, supported by its superior stability and wide industrial use.

In 2024, Spray Dried Powder held a dominant market position, capturing more than a 48.6% share in the Egg White Powder Market by Form. This leadership comes from its strong functional performance, long shelf life, and high suitability for industrial-scale food manufacturing. Spray drying preserves the natural whipping, foaming, and binding properties of egg whites, making it the preferred choice for bakeries, confectionery producers, ready-meal manufacturers, and sports nutrition brands.

By Application Analysis

Food Processing leads the segment with 38.5% share, driven by strong industrial adoption across bakery and packaged foods.

In 2024, Food Processing held a dominant market position, capturing more than a 38.5% share in the Egg White Powder Market by Application. This leadership is rooted in the heavy reliance of large-scale food manufacturers on egg white powder for its foaming, binding, emulsifying, and protein-enhancing properties. Food processors prefer the powder format because it ensures consistent quality, longer shelf life, and easier handling compared with fresh or liquid egg whites.

By Sales Channel Analysis

Hypermarkets and Supermarkets lead the segment with 39.3% share, supported by strong consumer reach and product visibility.

In 2024, Hypermarkets and Supermarkets held a dominant market position, capturing more than a 39.3% share in the Egg White Powder Market by Sales Channel. This leadership is driven by their wide geographic presence, large customer footfall, and ability to stock multiple brands and pack sizes. These retail formats offer consumers easy access to egg white powder for home baking, protein supplementation, and culinary use, making them the most preferred purchase point.

Key Market Segments

By Source

- Chicken

- Duck

- Quail

- Others

By Form

- Instant Powder

- Spray Dried Powder

- Liquid Egg White

By Application

- Food Processing

- Cosmetics & Personal Care

- Pharmaceuticals

- Dietary Supplements.

- Beverage Processing

- Others

By Sales Channel

- Online Retail Stores

- Hypermarkets and Supermarkets

- Specialty Stores

- Others

Emerging Trends

High-protein becomes mainstream in 2025, lifting everyday use of egg white powder in snacks, baking mixes, and convenient foods

A clear latest trend in egg white powder is its shift from a “sports nutrition only” ingredient into a mainstream, everyday protein add-on for packaged foods. This is closely tied to how consumers now think about protein. In the IFIC 2025 survey work, 70% of Americans said they are trying to consume protein in 2025. In the same 2025 results, 23% of Americans reported following a high-protein eating pattern in 2025, up from 20% in 2024.

This is where egg white powder fits the trend in a practical way. It offers protein plus functionality, so it can help a product hold structure, whip, foam, or bind while also supporting a higher-protein label. That dual role is why manufacturers keep leaning on dried egg whites in bakery mixes, coatings, batters, meringues, and frozen desserts. In many factories, the “latest trend” is not just using egg white powder, but using it more strategically—standardizing recipes around dry ingredients to reduce variability and simplify production planning across multiple SKUs.

Another visible part of this trend is product and process preference moving toward dried egg formats because they travel and store better than liquid. Food safety guidance also reinforces the industrial norm that dried egg products are commonly produced as “egg solids,” and that they are typically spray dried to remove moisture.

The trend is also shaped by supply chain realities, especially the way egg trade and pricing have behaved recently. FAO highlighted that global hen egg production reached 91 million tonnes in 2023, and noted that only about 2.2 million tonnes are typically traded—yet that traded volume nearly doubled in 2024, with egg price volatility still described as an issue. When volatility rises, manufacturers often look for shelf-stable ingredients and longer procurement windows. That dynamic supports more contracting for dried egg ingredients, and encourages buyers to keep inventory in stable formats that reduce last-minute sourcing pressure.

Drivers

High-protein eating habits are pushing manufacturers toward shelf-stable egg proteins like egg white powder

One major driving factor for egg white powder is the steady rise in high-protein food formulation, especially in everyday packaged foods. When more consumers actively look for protein, brands respond by adding protein to familiar products—bakery mixes, snacks, beverages, and meal kits—where a neutral-tasting, functional protein is easier to manage than fresh ingredients. In the U.S., the International Food Information Council reported that the share of consumers trying to consume protein increased to 71% in 2024. That shift matters commercially because it influences what retailers stock and what food companies reformulate at scale.

On the supply side, egg white powder benefits from a very large and organized egg production base, which gives processors the confidence to invest in drying capacity and long-term contracts. FAO reported world egg production reached 100 million tonnes in 2024, and about 94% was hen eggs, showing how strongly chicken eggs dominate the global raw material pool needed for albumen ingredients.

In the United States alone, egg production during the year ending November 30, 2024 totaled 109 billion eggs, which supports consistent industrial sourcing for liquid egg and dried formats. In the EU, an estimated 98.6 billion eggs were produced for consumption in 2024, and 91% came from farms with more than 5,000 laying hens—an indicator of large-scale farming that typically supports stable collection, grading, and processing flows.

Government-backed reporting and sector monitoring also add confidence for buyers that rely on transparent production data and food safety oversight. For example, India’s official Basic Animal Husbandry Statistics (BAHS) report lists total egg production at 142.77 billion (numbers) and notes India’s global ranking using FAO as a reference. This type of public reporting supports investment decisions by improving visibility on supply strength, productivity, and sector direction.

Restraints

Egg Allergy and Food Safety Concerns Slow Down Egg White Powder Adoption

One significant factor restraining the egg white powder market is the concern around egg allergies and food safety risks, which make some consumers and manufacturers cautious about wider use of this ingredient. While egg white powder offers high-quality protein and functional benefits, its source — egg albumen — contains proteins that can trigger allergic reactions in a portion of the population. Food allergy authorities note that about 2% of children may have an egg allergy, and even very small amounts of egg protein can provoke symptoms ranging from mild hives to more severe reactions like anaphylaxis in susceptible individuals.

For consumers with dietary sensitivities or preferences, the allergy concern is more than theoretical. Egg proteins like ovomucoid and ovalbumin are known allergenic components in egg whites, and for people with egg allergies, even trace amounts in processed foods can be dangerous.

This has led regulators like the U.S. Food and Drug Administration to emphasize clear allergen labeling and precautionary statements on products that contain egg proteins, including egg white powder ingredients. As a result, some food manufacturers steer clear of egg white powder in products targeted at children’s snacks, school meals, or allergy-friendly labels, shrinking the potential usage footprint for the ingredient.

The safety and allergy issues also influence how egg white powder is marketed. Brands must often invest in extensive consumer education, allergen management programs, and third-party certification if they want to reassure buyers about food safety. Retailers may restrict shelf placement or require separate labeling for products that contain egg proteins, which can reduce product visibility or accessibility in stores.

From a public health perspective, government food agencies in many countries maintain lists of priority allergens — and egg protein is consistently included — requiring clear disclosure in ingredient lists. This regulatory posture, while vital for consumer protection, also raises barriers for egg white powder’s broader acceptance compared with proteins that are less regulated from an allergen standpoint.

Opportunity

Expanding protein-forward packaged foods and institutional meal programs create a clear runway for egg white powder

A major growth opportunity for egg white powder is the widening “protein-first” product pipeline in mainstream packaged foods—well beyond sports nutrition. When consumers actively look for protein, manufacturers tend to respond with reformulation that adds protein without changing taste or production flow. In the U.S., the International Food Information Council (IFIC) reported that 71% of consumers said they were trying to consume protein in 2024, and the figure stayed high at 70% in 2025.

This opportunity becomes more practical because the upstream egg economy is large enough to support industrial scale. FAO’s Food Outlook notes global hen egg production reached 91 million tonnes in 2023, with China contributing 38%, followed by India and the United States at about 8% and 7% respectively. The same FAO update also points out that while only 2.2 million tonnes of eggs are typically traded, traded volume nearly doubled in 2024, highlighting how international movement of egg products can accelerate quickly when buyers need reliable supply.

International trade data reinforces the export-side upside for dried egg proteins. In 2023, global trade of dried egg whites (HS 350211) reached $382 million, indicating an established cross-border market where new capacity, better specs, and stronger certifications can win share. In practical terms, this points to growth opportunities in upgrading to higher-functionality spray-dried grades for bakery and beverage applications, expanding private-label and foodservice packs for retail and institutional buyers, and building compliance-led differentiation through audit-ready allergen controls and microbial safety programs.

Regional Insights

Asia Pacific dominates the Egg White Powder Market with a market share of 36.7%, valued at 0.7 Bn.

Asia Pacific leads the Egg White Powder Market in 2024, holding a dominant position with a market share of 36.7% and a value of 0.7 Bn. This strength is closely linked to the region’s massive egg production base and its fast-moving food processing ecosystem. FAO highlights that global hen egg production reached 91 million tonnes in 2023, and China alone contributed 38%—a scale advantage that supports steady raw material availability for egg ingredient processors across the region.

Government-published Basic Animal Husbandry Statistics reports India’s total egg production at 142.77 billion in 2023–24, and a PIB release notes this level and highlights long-term growth compared with earlier years, reinforcing the expanding base for egg processing and value-added egg ingredients. This supply depth supports wider use of egg white powder in bakery mixes, confectionery, ready meals, and protein-enriched packaged foods, where albumen’s functional properties—foaming, binding, and texture building—help manufacturers maintain consistency.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kewpie, one of Japan’s largest egg processors, uses more than 200,000 tonnes of eggs annually across its ingredient and food businesses. Its egg-related operations contribute significantly to its consolidated revenue, which reached JPY 558.8 billion in FY 2024. The company’s advanced protein-separation technologies and strong Asian distribution network enable consistent production of high-functionality egg white powders.

NOW Health Group, a major U.S. natural products company, operates with 1,500+ employees and distributes to over 60 countries. The company exceeded $650 million in revenue in recent years, supported by strong sports nutrition and clean-label ingredient demand. Its egg white powder offerings align with the company’s high-protein supplement strategy, contributing to continuous growth in its functional foods segment.

Taiyo Kagaku, headquartered in Japan, operates 10+ global facilities and supports annual sales exceeding JPY 40 billion. Known for functional ingredients, Taiyo utilizes advanced drying and formulation technology to enhance egg-derived proteins. Its research-focused approach and partnerships with food manufacturers strengthen its role in supplying high-performance egg white powders for bakery, snacks, and ready-mix applications.

Top Key Players Outlook

- HiMedia Laboratories Pvt. Ltd.

- Kewpie Corporation

- NOW Health Group, Inc.

- Taiyo Kagaku Co. Ltd.

- Sanovo

- IGRECA

- JW Nutritional, LLC

- Rembrandt Foods

- Rose Acre Farms

Recent Industry Developments

November 30, 2024 Kewpie posted JPY 483.99 billion in net sales, up 6.35% over its JPY 455.09 billion in 2023, reflecting solid demand in its core food and ingredient businesses.

By 2025, Taiyo Kagaku continued diversification with single-digit growth in segments like Nutrition (reaching 15.09 billion JPY) and Interface Solutions (14.01 billion JPY), supporting its ability to innovate and serve broader food industry needs including egg protein formats.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Bn Forecast Revenue (2034) USD 5.8 Bn CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Chicken, Duck, Quail, Others), By Form (Instant Powder, Spray Dried Powder, Liquid Egg White), By Application (Food Processing, Cosmetics And Personal Care, Pharmaceuticals, Dietary Supplements, Beverage Processing, Others), By Sales Channel (Online Retail Stores, Hypermarkets and Supermarkets, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HiMedia Laboratories Pvt. Ltd., Kewpie Corporation, NOW Health Group, Inc., Taiyo Kagaku Co. Ltd., Sanovo, IGRECA, JW Nutritional, LLC, Rembrandt Foods, Rose Acre Farms Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HiMedia Laboratories Pvt. Ltd.

- Kewpie Corporation

- NOW Health Group, Inc.

- Taiyo Kagaku Co. Ltd.

- Sanovo

- IGRECA

- JW Nutritional, LLC

- Rembrandt Foods

- Rose Acre Farms