Global Education Cyber Security Market Size, Industry Analysis Report By Offering (Hardware, Software, Services), By Security (Endpoint Security, Cloud Security, Network Security, Application Security, Data Security), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, SMEs), By Solution (Unified Threat Management (UTM), Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Data Loss Prevention (DLP), Identity and Access Management (IAM), Security Information and Event Management (SIEM), DDoS, Risk and Compliance Management, Others), By Sector (Preschool, K-12, Higher Education, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157734

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business benefits

- US Market Size

- Emerging Trends

- Growth Factors

- Top Use Cases

- Offering: Hardware (62.7%)

- Security: Endpoint Security (34.6%)

- Deployment: On-premises (70.3%)

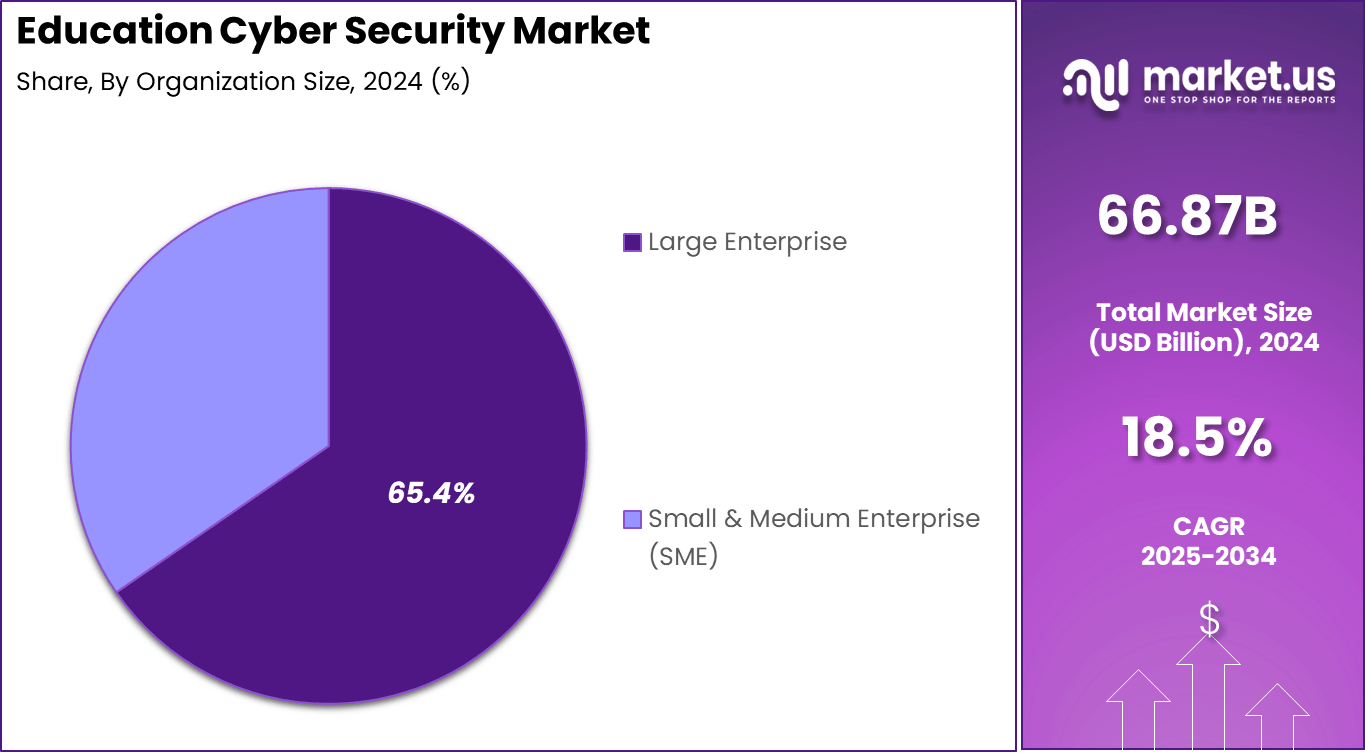

- Organization Size: Large Enterprises (65.4%)

- Solution: UTM (23.5%)

- Sector: Higher Education (40.6%)

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

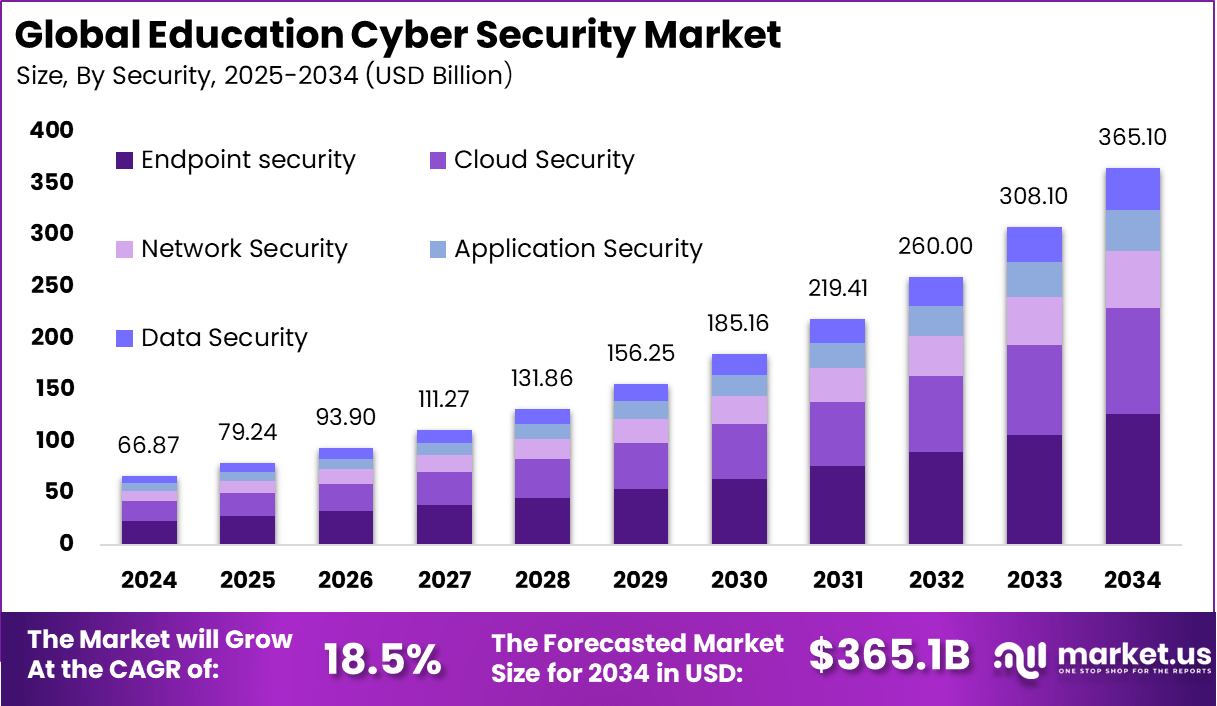

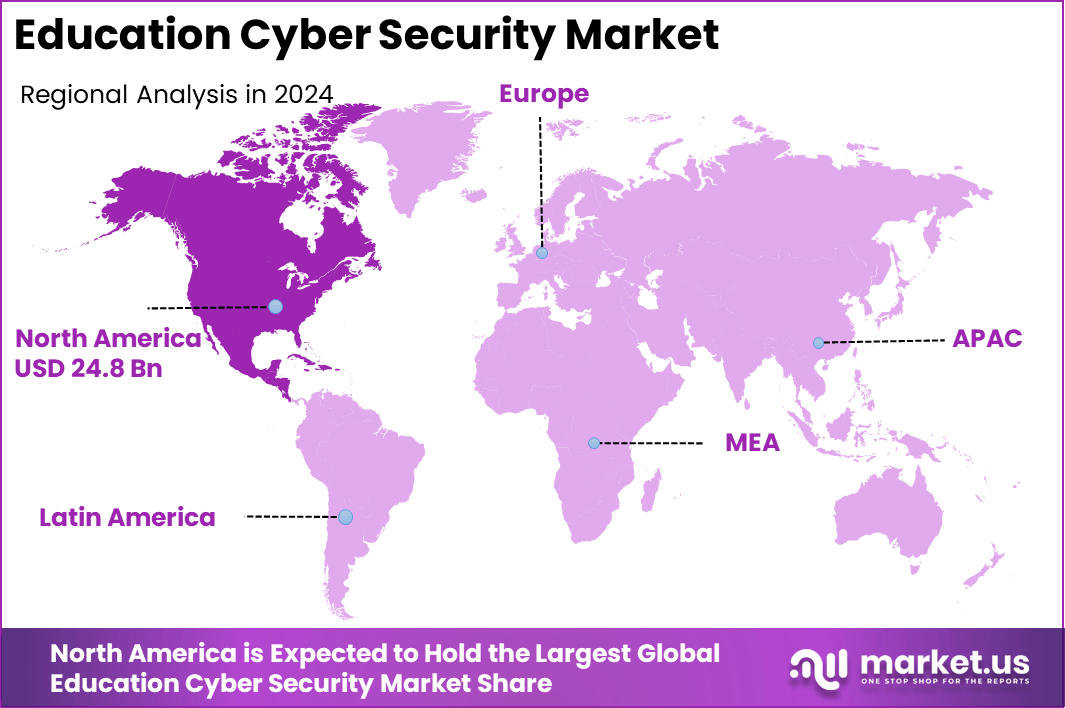

The Global Education Cyber Security Market size is expected to be worth around USD 365.10 Billion By 2034, from USD 66.87 billion in 2024, growing at a CAGR of 18.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 37.2% share, holding USD 24.87 Billion revenue.

The Education Cyber Security Market consists of solutions, services, and technologies that protect digital infrastructure, data, and networks within educational institutions. These systems safeguard sensitive information such as student records, faculty data, academic research, and financial transactions. The market includes endpoint protection, firewalls, identity and access management, threat detection systems, encryption tools, and incident response services.

The rise in cyber threats targeting educational institutions is a major driver of this market. Schools and universities have increasingly become prime targets due to the valuable data they store and often limited security infrastructure. The rapid shift to digital classrooms, remote learning, and cloud-based tools has expanded the attack surface. In response, educational administrators are prioritizing investments in cybersecurity to ensure operational continuity and protect stakeholder trust.

According to Varonis, between January 2023 and June 2024 at least 83 ransomware attacks targeting U.S. school districts were disclosed, with 21 incidents in the first half of 2024. Education was identified as the second most affected sector for backup compromise, with a 71% success rate for attackers. The MOVEit hack alone impacted over 2,600 organizations, many within the education sector, leading to estimated global damages of USD 15 billion.

The sector has also faced serious past breaches. In April 2018, the Chegg breach affected 40 million subscribers and exposed 5.1 million .edu email addresses. The average cost of a data breach in education reached USD 3.65 million in 2023. A notable case was the Minneapolis Public Schools attack, where nearly 200,000 sensitive files were stolen and leaked online, highlighting the sector’s ongoing vulnerability to sophisticated cyberattacks.

Key Insight Summary

- By offering, Hardware dominated with a 62.7% share.

- By security type, Endpoint Security led the market, holding 34.6% share.

- On-premises deployment was preferred, capturing 70.3% share.

- By organization size, Large Enterprises accounted for 65.4% share.

- Among solutions, Unified Threat Management (UTM) held 23.5% share.

- By sector, Higher Education was the largest adopter, representing 40.6% share.

- Regionally, North America secured 37.2% share of the global market.

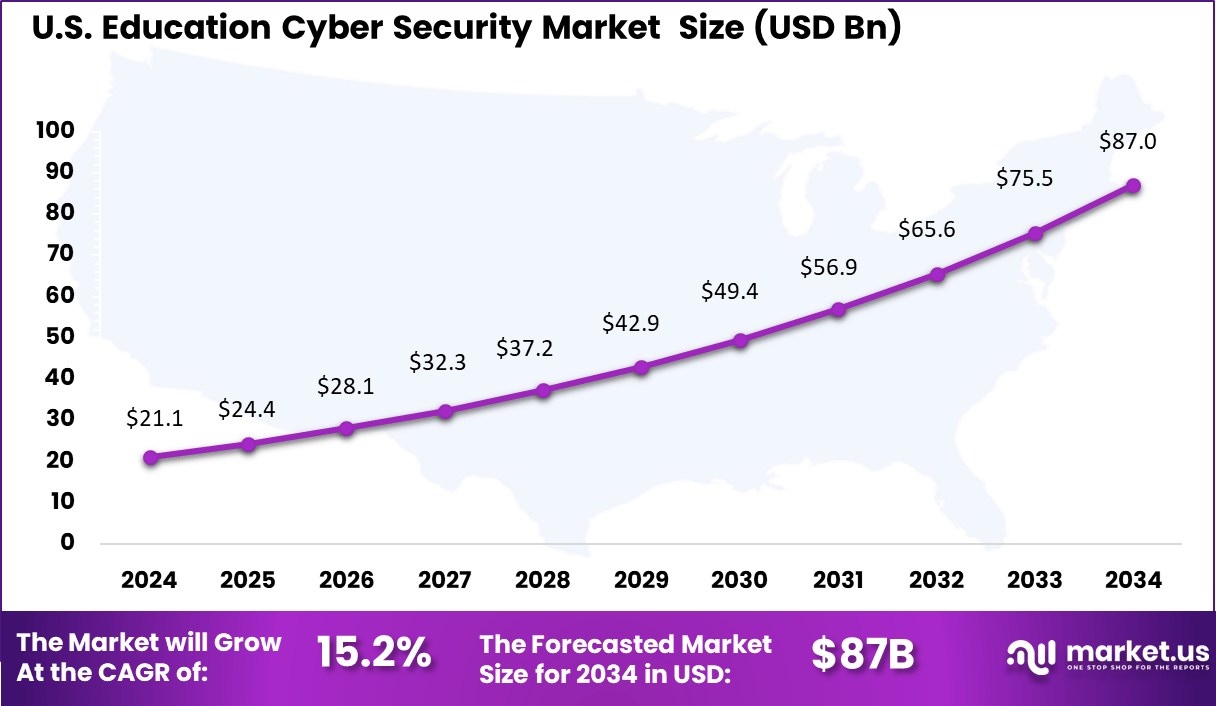

- The U.S. market was valued at USD 21.14 Billion, expanding at a robust 15.2% CAGR.

Analysts’ Viewpoint

Demand is growing steadily across both public and private educational sectors. Institutions are investing in advanced threat prevention tools and staff training programs to reduce vulnerabilities. Online learning platforms, which rely heavily on data integrity and continuous availability, are also key users of cybersecurity solutions.

University research centers and administrative systems handling sensitive funding and payroll data are adopting security layers to prevent intrusion. The market sees increasing adoption of technologies like artificial intelligence and machine learning for threat detection and response. Cloud-based security platforms are favored for their scalability and economic benefits, while hardware security solutions remain critical to protect a growing number of digital access points.

Encryption, endpoint security, and intrusion detection systems have become foundational. Key reasons for adopting these technologies include the need to protect against data breaches, maintain privacy compliance, and support the increasingly digital nature of education. Growing reliance on online classrooms and digital resources means that institutions cannot risk downtime or loss of sensitive data.

Role of Generative AI

Key Points Description Predictive Threat Modeling AI generates potential attack scenarios helping cybersecurity teams prepare or test defenses. Enhanced Threat Detection AI creates models to identify unusual patterns indicating cyber threats for faster responses. Automated Security Tasks AI automates routine security tasks, freeing teams to focus on complex threats. Phishing Detection AI analyzes email patterns to detect sophisticated phishing attacks often missed by traditional tools. Synthetic Data for Privacy AI creates synthetic data to train models while preserving real data privacy. Investment and Business benefits

Investment opportunities abound as governments and private sectors continue to acknowledge digital security as a critical infrastructure element. Funding programs and incentives aimed at improving cybersecurity in education are becoming common, especially in developed regions. Emerging markets show demand for affordable, scalable solutions, creating space for innovative companies.

Opportunities also include expanding cybersecurity training and awareness programs for educators and students to reduce human error. Business benefits from enhancing cybersecurity in education include protecting institutional assets, minimizing disruptions from cyber incidents, and building trust with stakeholders.

Schools with strong cybersecurity measures can assure data privacy, comply with regulations, and avoid costly penalties and lawsuits. Moreover, a cyber-aware culture among employees and students strengthens the overall resilience of the institution against threats.

The regulatory environment significantly influences this market. Laws like FERPA and GDPR force educational entities to take concrete actions regarding data security and privacy. Stricter regulations globally are pushing institutions toward comprehensive cybersecurity frameworks, often backed by government mandates and funding.

US Market Size

The U.S. Education Cyber Security Market was valued at USD 21.1 Billion in 2024 and is anticipated to reach approximately USD 87 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 15.2% during the forecast period from 2025 to 2034.

In 2024, the United States held a leading position in the education cyber security market due to its highly digitized learning ecosystem and early adoption of advanced security frameworks. The rapid integration of online learning platforms, cloud-based educational tools, and connected devices has increased the need for strong cyber protection across schools and universities.

The strong regulatory environment in the U.S. has further supported this leadership. Laws such as the Family Educational Rights and Privacy Act (FERPA) and state-specific data protection mandates require strict compliance from educational institutions, creating a higher demand for reliable solutions. Additionally, the presence of advanced technology providers and ongoing federal funding for school security initiatives have ensured faster adoption of innovative tools.

In 2024, North America held a dominant market position, capturing more than 37.2% share and generating USD 24.87 billion in revenue in the education cyber security market. The region’s leadership is primarily due to the rapid digitalization of academic institutions and the widespread adoption of online learning platforms.

Schools, colleges, and universities in the United States and Canada increasingly rely on cloud-based systems and digital tools for learning management, making them prime targets for cyber threats. This exposure has driven strong demand for advanced cyber security solutions to safeguard sensitive student records, research data, and financial information.

The dominance of North America is also reinforced by strict regulatory requirements surrounding data privacy and security in the education sector. Frameworks such as the Family Educational Rights and Privacy Act (FERPA) in the United States mandate stringent protection of academic and personal data, compelling institutions to adopt robust cyber defense systems.

Emerging Trends

Key Trends Description Hands-on Learning via Simulations Increased use of practical exercises and gamified cybersecurity training for skill building. Integration of AI and ML Growing use of artificial intelligence and machine learning in threat detection and response. Micro-credentials and Modular Certifications Shift to targeted, stackable certifications for faster career growth in cybersecurity. Collaboration with Industry Leaders Partnerships with companies to include real-world case studies and expert lectures in curricula. Focus on Soft Skills Emphasis on communication, collaboration, and critical thinking alongside technical education. Growth Factors

Key Growth Factors Description Increasing Cyber Threats Targeting Education Rising attacks on schools and universities due to valuable sensitive data stored. Growing Adoption of Online and Hybrid Learning More connected devices and remote access increase vulnerability and need for cyber defense. Government and Regulatory Pressure Compliance requirements push institutions to strengthen cybersecurity measures. Rising Awareness of Cybersecurity Importance Recognition of security risks drives investment in education cybersecurity training and tech. Expanding Cybersecurity Training Market Demand for skilled cybersecurity professionals fuels growth in educational programs. Top Use Cases

Top Use Cases Description Protecting Student and Staff Data Securing personally identifiable information and academic records from breaches. Ransomware Defense Preventing or mitigating ransomware attacks targeting educational institutions. Phishing Attack Prevention Detection and blocking of phishing emails targeting education staff and students. Device Security Management Securing laptops, tablets, and other devices used in hybrid and remote learning. Offering: Hardware (62.7%)

The hardware segment represents a dominant share of 62.7% in the Education Cyber Security Market. This includes devices such as firewalls, intrusion detection systems, and endpoint protection devices designed specifically to protect educational institutions’ networks and data systems.

The prominence of hardware solutions stems from the critical need to secure physical and network infrastructures against increasing cyber threats targeting schools and universities. Educational institutions are investing heavily in robust cyber security hardware to fortify their defenses against attacks like ransomware and phishing, which have become more prevalent with increased digital learning.

Hardware solutions often serve as the first line of defense, providing essential protection for sensitive information related to students, faculty, and research. The continued adoption of advanced hardware technologies is expected to maintain this segment’s significant market share as integration with software solutions enhances overall security postures.

Security: Endpoint Security (34.6%)

Endpoint security holds a sizeable 34.6% share in the Education Cyber Security market. It focuses on securing endpoint devices such as laptops, tablets, and smartphones used by students and staff to access educational platforms. With the widespread use of personal devices and the rise of remote learning, endpoint security has become a critical concern for institutions aiming to prevent unauthorized access and data breaches.

Effective endpoint security solutions provide real-time threat detection, malware protection, and device control, helping institutions contain risks originating from vulnerable devices. The segment’s growth is fueled by the increasing number of endpoints connecting to educational networks and the need for centralized control to manage the expanding attack surface.

Deployment: On-premises (70.3%)

On-premises deployment dominates the Education Cyber Security Market with a 70.3% share, reflecting many institutions’ preference for keeping security infrastructures within their own facilities. On-premises solutions offer direct control over cybersecurity systems, which is crucial for educational bodies handling sensitive data and complying with stringent regulations such as FERPA.

The preference for on-premises deployment is also influenced by the need for customized security architectures and concerns over cloud vulnerabilities. While cloud-based security is gradually gaining traction, many educational institutions prioritize on-premises setups to achieve tailored protection, faster incident responses, and compliance assurance.

Organization Size: Large Enterprises (65.4%)

Large enterprises constitute 65.4% of the Education Cyber Security Market, showing their leading role in cybersecurity investments within the education sector. Large universities and research institutions demand comprehensive security solutions to protect large-scale digital assets, sensitive research data, and extensive user endpoints.

These organizations typically have extensive IT resources and budgets, enabling deployment of sophisticated cybersecurity measures including threat analytics, unified threat management, and incident response.

Their complex infrastructure and regulatory compliance needs drive the adoption of advanced cyber defense systems. The sizeable investment by large enterprises highlights the critical importance of robust cybersecurity to safeguard educational continuity and intellectual property.

Solution: UTM (23.5%)

Unified Threat Management (UTM) holds a 23.5% share in the market, offering an integrated approach to cybersecurity by combining multiple security features such as firewall, intrusion detection, antivirus, and content filtering into a single solution.

Educational institutions benefit from UTM by simplifying security management while ensuring broad protection coverage against diverse cyber threats. UTM solutions are particularly attractive to education providers looking for cost-effective, scalable security systems that reduce complexity.

They effectively address the variety of attack vectors present in educational environments, balancing performance with comprehensive threat mitigation. The adoption of UTM demonstrates institutions’ shifting preference to consolidated security platforms that streamline operations while maintaining rigorous defense standards.

Sector: Higher Education (40.6%)

Higher education comprises 40.6% of the Education Cyber Security Market, driven by universities and colleges’ increasing reliance on digital resources and online learning platforms. This sector faces unique cybersecurity challenges such as protecting sensitive research data, intellectual property, and large populations of students and staff with diverse access needs.

Higher education institutions invest in multi-layered security strategies that include hardware, software, and policy frameworks to guard against cyber risks. The sector is also impacted by strict regulatory standards for data privacy and frequent targeted attacks. This significant market share reflects the prioritization of cyber protection in higher education as digital transformation continues to evolve campus environments globally.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Security

- Endpoint security

- Cloud Security

- Network Security

- Application Security

- Data Security

By Deployment

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Solution

- Unified Threat Management (UTM)

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Data Loss Prevention (DLP)

- Identity and Access Management (IAM)

- Security Information and Event Management (SIEM)

- DDoS

- Risk and Compliance Management

- Others

By Sector

- Preschool

- K-12

- Higher Education

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increased Adoption of Remote Learning

The rapid shift to remote learning has been a major driver for the education cybersecurity market. As schools and universities moved online, the reliance on digital platforms and virtual classrooms grew significantly. This transformation created more entry points for cybercriminals, exposing sensitive student and institutional data to risks such as unauthorized access and data theft.

The need to protect these digital learning environments and the confidentiality of academic records has increased demand for advanced cybersecurity solutions tailored to the education sector. Furthermore, the pandemic accelerated this adoption, making digital education the norm rather than the exception. With more devices connected and more data flowing online, educational institutions became prime targets for cyberattacks.

Restraint Analysis

Limited Budget and Resource Constraints

One of the main restraints facing education cybersecurity is limited budget availability within educational institutions. Many schools, especially in the K-12 segment, and smaller colleges operate with tight financial resources. These budgetary constraints compel decision-makers to prioritize essential expenses such as staff salaries and educational materials over cybersecurity investments.

This financial limitation directly impacts the ability to deploy and maintain up-to-date security measures. Without sufficient funding, institutions may lack advanced protection against sophisticated cyber threats, leaving them vulnerable to breaches. This restraint slows down market adoption of comprehensive security solutions, despite the growing need for them to secure sensitive data and comply with regulations.

Opportunity Analysis

Emphasis on Data Privacy and Compliance

Growing regulatory focus on data privacy offers a significant opportunity for the education cybersecurity market. Governments worldwide are enacting stricter data protection laws, such as FERPA in the United States and GDPR in Europe, which mandate secure handling of student data by educational institutions.

This regulatory push drives demand for cybersecurity solutions that help schools and universities meet compliance requirements effectively. Educational institutions must implement robust security controls to avoid costly fines and legal issues associated with data breaches. This compliance need encourages the adoption of advanced cybersecurity tools and services tailored for education.

Additionally, there is an opportunity to develop training and awareness programs that educate students and faculty on best practices for data protection. Institutions that proactively address privacy concerns can enhance their reputation and trustworthiness, further propelling market expansion.

Challenge Analysis

Shortage of Skilled Cybersecurity Professionals

A key challenge in the education cybersecurity market is the shortage of skilled professionals to implement and manage security systems. Educational institutions often lack the technical expertise needed to keep pace with the evolving threat landscape and sophisticated attack methods.

Hiring qualified cybersecurity staff is difficult due to high demand across industries and limited talent supply. This skills gap hampers effective deployment and maintenance of cybersecurity frameworks within schools and universities. Without expert personnel, institutions struggle to conduct regular risk assessments, respond quickly to incidents, and optimize security configurations.

This challenge can result in delayed or inadequate security responses, increasing vulnerability to attacks. Bridging this workforce gap with training and targeted recruitment is essential for the education sector to strengthen its cybersecurity posture and support market growth.

Competitive Analysis

In the education cyber security market, Fortinet, IBM, and Microsoft stand out with strong capabilities in network security, cloud protection, and identity management. Their global reach and partnerships with schools and governments help address rising threats like phishing and ransomware. Their leadership is reinforced by continuous investment in scalable solutions tailored for academic institutions.

Companies such as BAE Systems, Broadcom, and Centrify focus on defense-grade security and compliance support for schools and research bodies. Their solutions include monitoring, access control, and endpoint protection. By adapting enterprise and defense technologies for education, they provide trusted frameworks that ensure the safety of sensitive student and faculty data.

Specialist vendors like Check Point, Palo Alto Networks, Proofpoint, and Sophos strengthen digital classrooms with email security, threat detection, and real-time monitoring. Their solutions support remote learning, collaboration tools, and adaptive protection. Alongside other emerging players, they help institutions create layered defense strategies and maintain digital trust across the education sector.

Top Key Players in the Market

- Fortinet, Inc.

- IBM Corporation

- Microsoft

- BAE Systems Plc

- Broadcom, Inc.

- Centrify Corporation

- Check Point Software Technology Ltd.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Others

Recent Developments

- In early 2025, Fortinet launched an education-focused cybersecurity curriculum in Australia and a free security awareness training service tailored for educational institutions. These initiatives aim to build foundational cyber awareness among students and faculty, strengthening digital resilience in education.

- IBM introduced a generative AI-powered Cybersecurity Assistant in August 2024 designed to enhance threat detection and response capabilities for clients, including those in education. Built on the watsonx AI platform, the assistant helps reduce manual investigation times by 48%, speeding up responses to critical threats in complex environments such as educational institutions.

Report Scope

Report Features Description Market Value (2024) USD 66.87 Bn Forecast Revenue (2034) USD 365.10 Bn CAGR(2025-2034) 18.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Security (Endpoint Security, Cloud Security, Network Security, Application Security, Data Security), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, SMEs), By Solution (Unified Threat Management (UTM), Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Data Loss Prevention (DLP), Identity and Access Management (IAM), Security Information and Event Management (SIEM), DDoS, Risk and Compliance Management, Others), By Sector (Preschool, K-12, Higher Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fortinet, Inc., IBM Corporation, Microsoft, BAE Systems Plc, Broadcom, Inc., Centrify Corporation, Check Point Software Technology Ltd., Palo Alto Networks, Inc., Proofpoint, Inc., Sophos Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Education Cyber Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Education Cyber Security MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fortinet, Inc.

- IBM Corporation

- Microsoft

- BAE Systems Plc

- Broadcom, Inc.

- Centrify Corporation

- Check Point Software Technology Ltd.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Others