Global Edge Security Market By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail and E-commerce, Healthcare, Manufacturing, Government and Defense Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 121279

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Industrial Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Evolving Cybersecurity Threats

- Growth Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

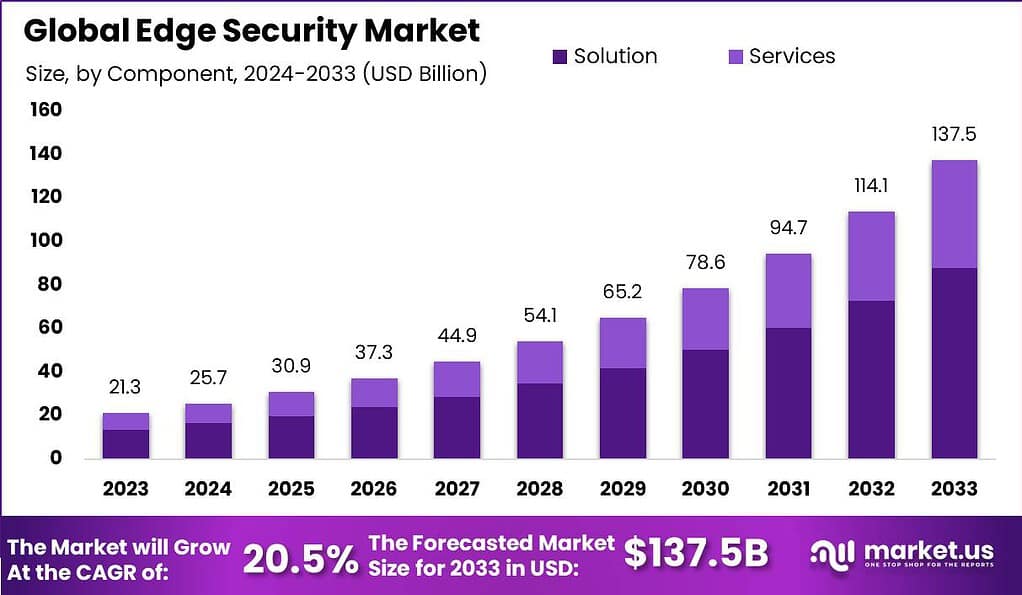

The Global Edge Security Market size is expected to be worth around USD 137.5 Billion By 2033, from USD 21.3 Billion in 2023, growing at a CAGR of 20.5% during the forecast period from 2024 to 2033.

Edge security refers to the protective measures and technologies designed to safeguard data and operations at the “edge” of an enterprise network – where data is collected, processed, and analyzed close to its source, rather than being transmitted to a centralized data center or cloud. This concept is particularly relevant with the rise of the Internet of Things (IoT), mobile computing, and decentralized networks, where traditional security perimeters are no longer sufficient.

The edge security market focuses on protecting data and resources at the outermost points of a network. As edge computing and the Internet of Things (IoT) continue to expand, ensuring strong security at the edge is becoming increasingly important. This article provides an introduction to the edge security market, including the growth factors, challenges, and opportunities associated with it.

The edge security market has experienced significant growth due to the increasing adoption of edge computing and the proliferation of IoT devices. Many industries, such as manufacturing, healthcare, transportation, and smart cities, are embracing edge computing to process data closer to its source, enabling faster decision-making and reducing delays. This trend has created a surge in demand for robust edge security solutions.

However, the growth of the edge security market also brings its fair share of challenges. Securing a distributed network of edge devices, gateways, and sensors can be complex. These devices often have limited processing power, memory, and built-in security features, making them vulnerable to attacks. Additionally, managing and maintaining security across the entire network can be challenging due to the large-scale deployment of edge devices and their diverse nature.

Despite the challenges, the edge security market offers significant opportunities for growth and innovation. Security vendors and startups are actively developing advanced products and services to address the unique security needs of edge environments. These solutions encompass access control mechanisms, encryption techniques, authentication protocols, intrusion detection systems, firewalls, and secure communication channels. By implementing these measures, organizations can enhance the security of their edge infrastructure and protect sensitive data from unauthorized access and cyber threats.

According to the Flexera 2022 State of the Cloud Report, 89% of surveyed entities reported embracing a multi-cloud strategy, indicating a widespread adoption of cloud technologies that span across various platforms. This trend underlines the critical importance of edge computing security solutions, as multi-cloud environments often involve complex data traffic and varying security protocols, heightening the risk of unauthorized access and cyber-attacks

For instance, In April 2023, a strategic collaboration between Accenture plc (Ireland) and Palo Alto Networks, Inc. (U.S.) was established to deliver a joint Secure Access Service Edge (SASE) solution. This solution, branded as AI-powered Prisma SASE, is designed to enhance organizational cyber resilience and expedite business transformation initiatives. The solution integrates advanced artificial intelligence capabilities to streamline complexity and enhance visibility across IT networks, addressing critical challenges in cybersecurity management.

Key Takeaways

- The global edge security market size was valued at USD 21.3 billion in the year 2023 and is estimated to reach USD 137.4 billion in the year 2033 with a CAGR of 20.5% during the forecast period.

- Based on the component, the solution segment has dominated the market with a share of 64% in the year 2023.

- Based on the cloud based segment has dominated the market with a share of 67.5% in the year 2023.

- Based on the organization size, the large enterprise segment has dominated the market with a share of 68.3% in the year 2023.

- Based on the Industrial Vertical, the IT and Telecommunications segment has dominated the market with a share of 25.4% in the year 2023.

- In 2023, North America held a dominant market position in the edge security market, capturing more than a 36.1% share.

Component Analysis

In 2023, the Solution segment held a dominant market position within the edge security market, capturing more than a 64% share. This leadership can be primarily attributed to the increasing deployment of edge computing technologies across various sectors such as healthcare, retail, and manufacturing.

Solutions in edge security, including firewalls, intrusion detection systems, and encryption protocols, are critical for protecting data at its point of generation and transfer, making them essential as the volume of data handled at the edge continues to surge. These solutions are designed to directly address the security vulnerabilities that come with the widespread adoption of IoT devices and the decentralized nature of edge computing.

The prominence of the Solution segment is also bolstered by the ongoing advancements in technology that enhance the effectiveness and efficiency of security measures. Innovations in machine learning and behavior analytics have significantly improved the capability of security solutions to predict, detect, and respond to potential threats in real time.

Moreover, as organizations increasingly focus on data integrity and compliance with regulatory standards, the demand for comprehensive security solutions that can offer robust protection against a wide range of cyber threats is expected to remain strong. Furthermore, the growing sophistication of cyber-attacks and the rising concerns about data privacy have compelled businesses to invest heavily in security solutions.

These investments are aimed not only at safeguarding sensitive information but also at maintaining consumer trust and meeting compliance requirements, which further drives the demand in the Solution segment. With the evolution of 5G and its deployment enhancing the capabilities of edge devices, the need for advanced security solutions is projected to grow, ensuring the continued dominance of this segment in the edge security market.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position in the edge security market, capturing more than a 68% share. This substantial market share is largely driven by the flexibility, scalability, and cost-efficiency that cloud-based solutions offer. As businesses continue to embrace digital transformation, the integration of cloud technologies has become crucial for managing the security of expansive networks that include numerous edge devices and remote access points.

Cloud-based edge security solutions provide the advantage of centralized security management, enabling organizations to implement consistent security policies and updates across all connected devices efficiently. The leadership of the Cloud-Based segment is further reinforced by its ability to offer real-time threat detection and response capabilities, which are essential in today’s dynamic threat landscape.

The cloud infrastructure allows for the seamless integration of advanced security technologies such as artificial intelligence (AI) and machine learning (ML), which can analyze large volumes of data for anomalies, thereby enhancing the overall security posture without the heavy upfront costs associated with traditional on-premise solutions.

Additionally, the ongoing expansion of remote work and the increasing number of IoT devices generate vast amounts of data at the edge, necessitating immediate and robust security measures. Cloud-based security services meet these needs by providing businesses with scalable solutions that can adapt to fluctuating data loads and evolving security threats. This adaptability, coupled with reduced operational costs and improved compliance capabilities, continues to drive the dominance of the cloud-based segment in the edge security market, ensuring its pivotal role in shaping future security strategies for organizations worldwide.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the edge security market, capturing more than a 68.3% share. This significant market share can be attributed to the complex network architectures and vast data transactions handled by large enterprises, necessitating robust and comprehensive edge security solutions.

Large enterprises often operate across multiple geographical locations and manage a higher volume of endpoint devices, making them prime targets for sophisticated cyber threats. Consequently, the demand for advanced security measures that can scale across large infrastructures and provide deep visibility into every edge of the network is particularly high in this segment.

The leadership of the Large Enterprises segment is further supported by their substantial IT budgets, which allow for the adoption of cutting-edge security technologies. These enterprises are more likely to invest in integrated security solutions that include automation capabilities, advanced analytics, and real-time monitoring to protect against potential threats.

Additionally, large enterprises typically have the resources to implement and maintain comprehensive security policies and recovery plans, enhancing their ability to respond to incidents and mitigate risks effectively. Moreover, the growing reliance on cloud services and the expansion of IoT devices in industrial operations drive the need for stringent security measures at the network edge.

Large enterprises are increasingly focusing on securing their edge environments to ensure data integrity and maintain operational continuity. This focus is driving the continued investment in edge security solutions, further solidifying the dominant position of large enterprises in the market. As they continue to lead the way in adopting new technologies, large enterprises not only contribute to the development of more sophisticated security products but also set the standards for industry-wide best practices in edge security.

Industrial Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position in the edge security market, capturing more than a 25.4% share. This leading position is driven by the critical nature of robust security in these industries, where data breaches can result in significant disruptions and high costs. The IT and telecommunications sectors are at the forefront of adopting cutting-edge technologies, including IoT, cloud computing, and mobile services, which significantly increase the attack surface and potential security vulnerabilities at the network’s edge.

As these industries continue to expand their digital infrastructure to meet rising consumer demands for fast, reliable services, the necessity for effective edge security systems intensifies. The dominance of the IT and Telecommunications segment is also underpinned by the need to maintain service continuity and protect sensitive customer information, which are paramount in these sectors.

With the increasing instances of cyber threats and sophisticated attacks targeting network vulnerabilities, these industries prioritize investments in security solutions that offer real-time threat intelligence, intrusion detection, and proactive risk management. The deployment of edge security measures helps mitigate potential threats directly at the source of data generation and transmission, thereby enhancing overall network resilience.

Moreover, regulatory compliance plays a significant role in shaping the security strategies of IT and telecommunications companies. Regulations such as GDPR in Europe and various data protection laws across the globe require these companies to adopt stringent security measures to protect consumer data.

The focus on compliance not only drives the adoption of advanced security solutions but also encourages ongoing investment in technology upgrades to keep pace with regulatory changes and emerging security challenges. As a result, the IT and Telecommunications segment continues to lead the edge security market, with a strong emphasis on innovation and compliance to safeguard their expansive and increasingly complex network ecosystems.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail and E-commerce

- Healthcare

- Manufacturing

- Government and Defense

- Other Industry Verticals

Driver

Growth of Remote Workforce and Cloud Services

The surge in the remote workforce and the adoption of cloud services are prominent drivers for the edge security market. With more organizations transitioning to work-from-home models, the necessity to secure remote access and protect data across distributed environments has intensified.

Additionally, the reliance on cloud-based platforms and services has escalated, demanding robust edge security solutions to secure access to these platforms and ensure data integrity and privacy. This driver is crucial as businesses continue to expand their digital footprints and adopt flexible working arrangements, necessitating more sophisticated security measures at the network’s edge.

Restraint

Complexity of Securing Diverse and Decentralized Environments

One of the primary restraints in the edge security market is the complexity involved in securing increasingly diverse and decentralized IT environments. As organizations deploy more IoT devices and expand their use of cloud and edge computing, managing security across numerous devices and platforms becomes significantly challenging. This complexity not only increases the risk of security gaps but also demands specialized skills and resources to ensure comprehensive protection, thereby posing a significant barrier to effective edge security deployment.

Opportunity

Integration with Multi-cloud and Hybrid Environments

The ongoing shift towards multi-cloud and hybrid cloud strategies presents substantial opportunities for the edge security market. Organizations are looking to optimize performance, scalability, and resilience by integrating various cloud services, which requires consistent and robust security policies across all platforms.

Edge security solutions that can seamlessly integrate with these diverse environments and enforce uniform security measures offer significant growth potential. This opportunity is particularly pertinent as businesses continue to diversify their cloud usage to achieve operational efficiencies and enhance their cybersecurity posture.

Challenge

Evolving Cybersecurity Threats

The edge security market faces the challenge of rapidly evolving cybersecurity threats. Adversaries are continually developing more sophisticated methods to exploit vulnerabilities in distributed network environments, including those at the edge. This situation demands constant innovation and updates in security technologies and practices. The pace at which cyber threats evolve requires organizations to remain vigilant and proactive in their security strategies, continuously adapting to new threats and ensuring that their security measures are robust enough to withstand future attacks.

Growth Factors

- IoT Expansion: The demand for edge computing solutions has increased due to the quick spread of IoT devices. Large volumes of data are generated by these devices, which necessitate local processing in order to obtain insights and make decisions instantly.

- Adoption of 5G: The development of edge computing has increased with the introduction of 5G technology. Edge computing is required to process data closer to the source, lowering latency and enhancing overall network performance, since 5G networks offer faster speeds and reduced latency.

- Privacy and data security: Instead of sending sensitive data to a centralized data center, edge computing processes it locally, closer to the source, allaying worries about privacy and data security. By using a decentralized architecture, the danger of data breaches during transit is decreased and data privacy is enhanced.

- Low latency requirements: Ultra-low latency is necessary for real-time operations in industries like industrial automation, telemedicine, and autonomous cars. By processing data closer to its source, edge computing reduces latency and guarantees speedy response.

- Cost-Effectiveness: By processing data locally and sending only pertinent information to the cloud or data center, edge computing can lower costs related to data transport and storage. This lowers the amount of bandwidth used and the cost of cloud storage, making edge computing an affordable way to manage massive amounts of data.

Latest Trends

- Adoption of edge AI: The integration of artificial intelligence (AI) capabilities at the edge is becoming more and more common. This enhances responsiveness and efficiency by enabling devices to make intelligent decisions locally without depending on a continuous cloud connection.

- The edge-to-cloud continuum: We often consider edge and cloud computing to be complimentary components of a continuum rather than as two distinct entities. The focus of this trend is on transparent workload distribution and smooth data flow between edge devices and centralized cloud infrastructure.

- Enhancements to edge security: With the amount of data processed at the edge growing, enhancing security protocols requires more attention. This entails putting in place intrusion detection systems appropriate for edge environments, robust encryption mechanisms, and authentication.

- Standardizing Edge Computing: To create uniform frameworks and protocols for Edge Computing, standardization initiatives are being carried out. This trend seeks to facilitate ecosystem growth and innovation by streamlining interoperability across diverse technological devices and platforms.

- Edge-as-a-Service (EaaS): Subscription-based edge computing resources are now available to enterprises thanks to the introduction of EaaS models. Due to this trend, modern infrastructure is becoming more widely accessible, enabling developers and small enterprises to profit from it without having to make large upfront investments.

- Edge in Telecommunications: To support cutting-edge applications like 5G network slicing and mobile edge computing, telecommunications businesses are spending more in edge computing infrastructure. By providing end consumers with high bandwidth and ultra-low latency services, this movement seeks to enhance user experience and create new revenue sources.

Regional Analysis

In 2023, North America held a dominant market position in the edge security market, capturing more than a 36.1% share. This region’s leadership can primarily be attributed to several key factors. Firstly, the high concentration of technology firms and a strong focus on innovations in cybersecurity contribute significantly to the adoption of advanced edge security solutions. North American companies, particularly those in the United States and Canada, have been early adopters of Internet of Things (IoT) technologies, which necessitate robust edge security measures to protect data integrity and prevent breaches.

Moreover, regulatory frameworks in this region, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) compliance requirements for companies dealing with European citizens, drive the need for enhanced security protocols. These regulations mandate strict data security measures, pushing companies to invest in effective edge security solutions. Additionally, the growing incidence of cyber-attacks in North America has made businesses increasingly aware of the vulnerabilities associated with data transactions on edge devices, further bolstering the edge security market.

Europe, following North America, also presents significant growth in the edge security market, driven by increasing data protection regulations and the rising adoption of cloud-based technologies. The European market is keenly focused on protecting consumer data, as evidenced by stringent GDPR enforcement, which supports the demand for edge security solutions to ensure compliance and safeguard against data breaches.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The edge security market is characterized by intense competition among key players who drive innovation and market growth. Leading the pack is Cisco Systems, Inc., renowned for its comprehensive edge security solutions that integrate seamlessly with cloud and networking technologies, providing robust protection across multiple endpoints.

Palo Alto Networks, Inc. is another dominant force, specializing in advanced firewalls and cloud-based security services. Their AI-powered Prisma SASE solution exemplifies their commitment to enhancing cyber resilience and simplifying network security management.

Fortinet, Inc. is highly regarded for its high-performance network security appliances, which are crucial for protecting network edges against sophisticated cyber threats. Similarly, Check Point Software Technologies Ltd. offers multi-level security architecture, focusing on cloud and mobile security, which makes them a preferred choice for many organizations.

Top Key Players in the Market

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- McAfee, LLC

- Zscaler, Inc.

- F5, Inc.

- Juniper Networks, Inc.

- Akamai Technologies, Inc.

- Forcepoint

- Other Key Players

Recent Developments

- In January 2024, Palo Alto Networks launched Prisma Access 4.0, enhancing its cloud-delivered security platform with new AI-powered capabilities for better threat detection and response. This update also includes improved integration with IoT and 5G environments to secure edge computing applications.

- In October 2023, Fortinet released FortiOS 7.5, its flagship operating system, which includes new features for zero trust network access (ZTNA) and secure access service edge (SASE). These enhancements are aimed at improving security for edge environments and hybrid workforces.

- In November 2023, Check Point acquired Odo Security, a start-up specializing in secure remote access. This acquisition is expected to enhance Check Point’s SASE offerings by integrating Odo Security’s zero trust capabilities into its existing solutions.

- In December 2023, McAfee introduced MVISION Edge, a new security service designed to protect edge devices and applications. MVISION Edge integrates AI and machine learning to provide real-time threat detection and response.

Report Scope

Report Features Description Market Value (2023) USD 21.3 Bn Forecast Revenue (2033) USD 137.5 Bn CAGR (2024-2033) 20.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail and E-commerce, Healthcare, Manufacturing, Government and Defense Other Industry Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Cisco Systems Inc., Palo Alto Networks Inc., Fortinet Inc., Check Point Software Technologies Ltd., Broadcom Inc., McAfee LLC, Zscaler Inc., F5 Inc., Juniper Networks Inc., Akamai Technologies Inc., Forcepoint, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Edge Security Market?The Edge Security Market encompasses solutions and services designed to protect data, applications, and networks at the edge of an organization's IT infrastructure. This includes securing edge devices, IoT endpoints, and localized processing systems.

How big is Edge Security Market?The Global Edge Security Market size is expected to be worth around USD 137.5 Billion By 2033, from USD 21.3 Billion in 2023, growing at a CAGR of 20.5% during the forecast period from 2024 to 2033.

Which region has the highest market share in the Edge Security Market?North America holds the highest market share in the Edge Security Market, driven by significant investments in edge data centers and advanced technologies like AI, IoT, and cloud computing.

What are the key drivers of the Edge Security Market?Key drivers include the need to secure remote workforces, the adoption of IoT devices, the integration of 5G networks, and the growing threat of cyberattacks.

What are the major challenges in the Edge Security Market?Challenges include managing highly distributed environments, the skills shortage of professionals to deploy and manage complex security solutions, and ensuring regulatory compliance across diverse geographies.

Who are the major players in the Edge Security Market?Major players include Cisco Systems Inc., Palo Alto Networks Inc., Fortinet Inc., Check Point Software Technologies Ltd., Broadcom Inc., McAfee LLC, Zscaler Inc., F5 Inc., Juniper Networks Inc., Akamai Technologies Inc., Forcepoint, Other Key Players

-

-

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- McAfee, LLC

- Zscaler, Inc.

- F5, Inc.

- Juniper Networks, Inc.

- Akamai Technologies, Inc.

- Forcepoint

- Other Key Players