Global Edge Data Center Market By Component (Solution and Services), By Enterprise Size (SMEs and Large Enterprises), By Industry Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Government & Public Sector, Automotive, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 105342

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

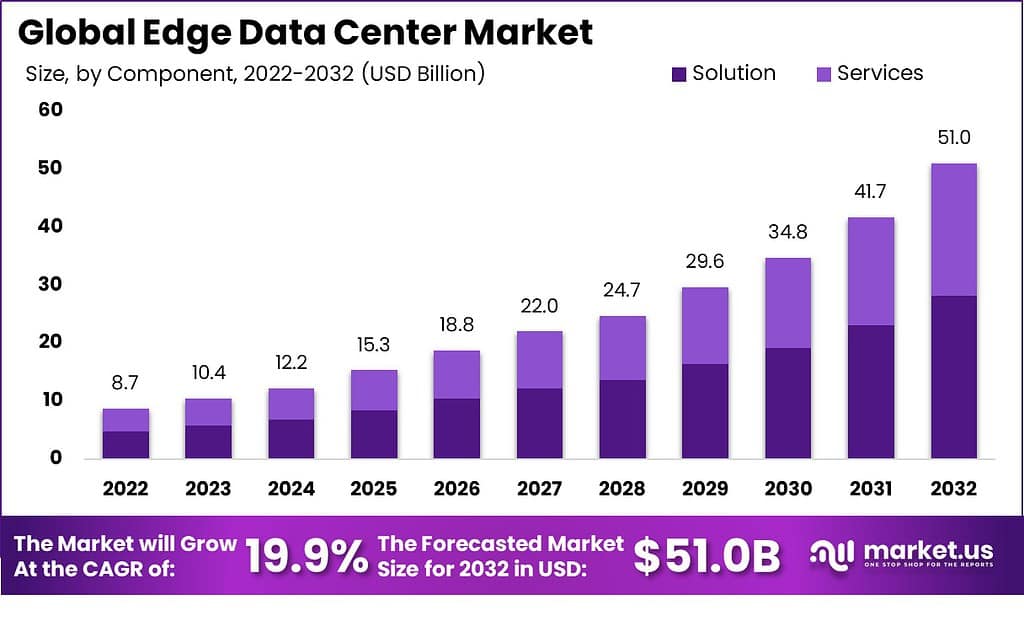

The Global Edge Data Center Market size is expected to be worth around USD 51.0 Billion By 2032, from USD 10.4 Billion in 2023, growing at a CAGR of 19.9% during the forecast period from 2024 to 2033.

An edge data center is a small-scale facility strategically located near the edge of a network, designed to bring computing resources closer to where data is generated, consumed, and processed. These centers aim to reduce latency, improve data processing speeds, and enable real-time applications and services. The edge data center market is experiencing rapid growth as organizations recognize the benefits of distributed computing and the need for localized data processing.

The Edge Data Center Market is experiencing rapid growth due to the increasing demand for faster data processing and reduced latency. Edge data centers are smaller facilities located closer to end-users and devices, enabling quicker data handling and improved performance for applications like IoT, autonomous vehicles, and real-time analytics. This market is driven by the rising need for efficient data management as the volume of data generated by connected devices continues to surge.

One of the key drivers of the edge data center market is the increasing adoption of IoT devices and the massive amounts of data they generate. With the proliferation of connected devices, it becomes crucial to process and analyze data closer to the source to minimize latency and bandwidth requirements. Edge data centers provide the necessary infrastructure and computing resources to handle data processing and storage at the edge of the network.

Another factor fueling the growth of the edge data center market is the rise of latency-sensitive applications. Technologies such as autonomous vehicles, augmented reality, and real-time analytics require immediate data processing and low latency to deliver optimal performance. By deploying edge data centers in close proximity to end-users or IoT devices, organizations can achieve the low-latency data processing necessary for these applications.

According to market research analysis by Market.us, the global edge computing market is projected to experience substantial growth, with an estimated worth of approximately USD 206 billion by 2032. This represents a significant increase from its value of USD 40 billion in 2022, with a compounded annual growth rate (CAGR) of 18.3% predicted during the forecast period from 2023 to 2032. These figures highlight the growing significance and adoption of edge computing solutions in various industries.

A survey conducted by Edgegap revealed that an overwhelming 97% of online gamers face latency issues during their gaming experiences. This emphasizes the need for low-latency solutions provided by edge computing, as gamers increasingly demand seamless and real-time interactions in their gaming environments.

Moreover, China is expected to play a prominent role in the edge computing landscape, with approximately 26% of all network edge sites projected to be located in the country by 2026. This highlights China’s position as a key market for edge computing infrastructure and its commitment to expanding and embracing this technology.

Investments in edge data center infrastructure are anticipated to exceed $15 billion by 2025, further underlining the significant market growth and potential in this sector. Furthermore, it is estimated that by 2023, half of the new enterprise IT infrastructure deployed will be at the edge, rather than in traditional corporate data centers. This shift signifies the increasing recognition of the benefits offered by edge computing solutions in terms of improved efficiency, reduced latency, and enhanced data processing capabilities.

The projected connection of over 1 billion smart devices to edge networks by 2025 highlights the expanding ecosystem of edge computing and the increasing integration of edge devices in various industries. This trend further strengthens the demand for edge data centers to support the processing and storage requirements of these connected devices.

Key Takeaways

- The Global Edge Data Center Market is projected to reach approximately USD 51.0 billion by 2032, increasing from USD 10.4 billion in 2023, with a compound annual growth rate (CAGR) of 19.9% during the forecast period from 2024 to 2033.

- In 2022, the Solution segment dominated the Edge Data Center market, securing a share of more than 81.2%.

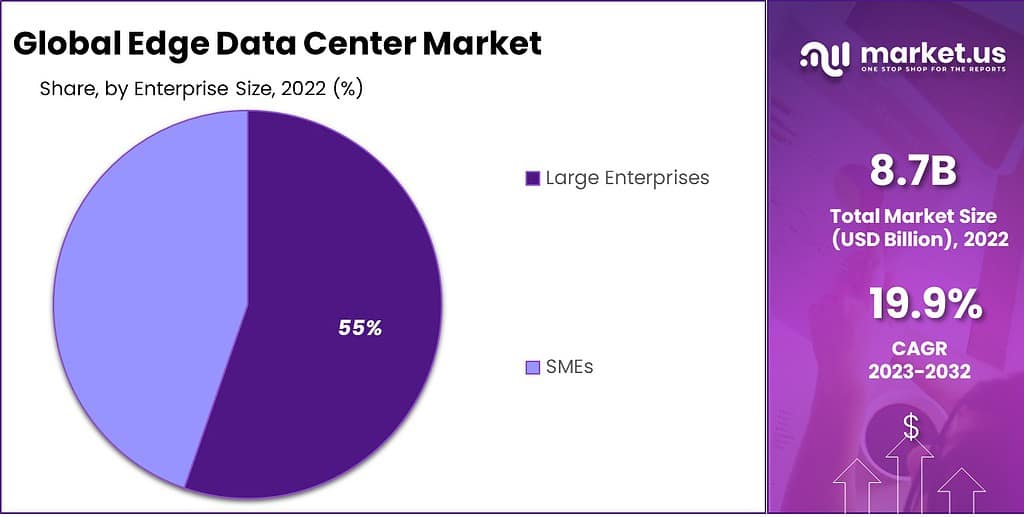

- In 2022, the Large Enterprises segment held a significant market position in the Edge Data Center market, capturing a notable share.

- In 2022, the IT & Telecom segment was the leading sector within the Edge Data Center market, holding a market share exceeding 36.7%.

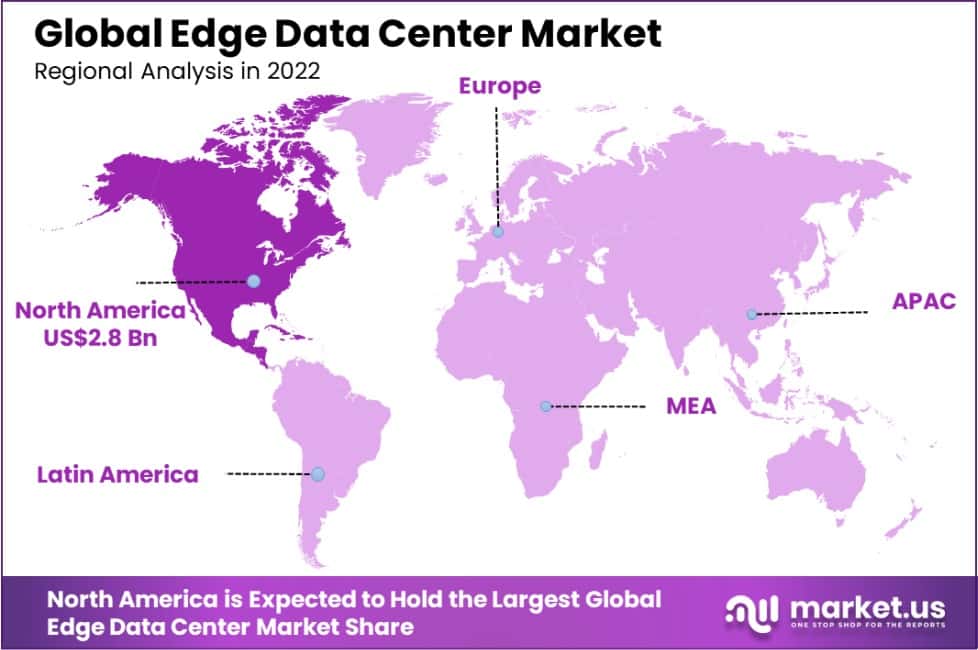

- In 2022, North America led the Edge Data Center market, achieving a dominant market position with a share of over 32.3% and generating a revenue of USD 2.8 billion.

By Component Analysis

In 2022, the Solution segment held a dominant position in the Edge Data Center market, capturing more than an 81.2% share. This substantial market share is primarily attributed to the increasing demand for advanced IT infrastructure solutions that are capable of processing data closer to the source of generation.

As businesses continue to generate vast amounts of data from diverse locations, the need for immediate, reliable, and efficient data processing and storage solutions has become critical. Edge data centers address these requirements by facilitating faster processing and reducing latency, thereby enhancing the overall efficiency of data management systems.

The leading role of the Solution segment is also reinforced by its integral role in supporting IoT, AI, and machine learning applications, all of which require robust, real-time processing capabilities that are geographically dispersed. Solutions such as modular data centers are becoming increasingly popular for their scalability and flexibility, enabling businesses to expand their data processing capabilities efficiently.

Furthermore, as the adoption of digital technologies and cloud services continues to rise across various industries, the demand for solutions that can support these technologies at the edge of the network is expected to grow, thereby maintaining the segment’s dominance in the market. This trend towards decentralized data processing and the ongoing innovations in edge computing technologies suggest a continued growth trajectory for the Solution segment in the Edge Data Center market.

Businesses are likely to invest heavily in solutions that optimize data traffic and streamline connectivity between end-users and data centers, ensuring that the Solution segment remains at the forefront of market demand.

By Enterprise Size Analysis

In 2022, the Large Enterprises segment held a dominant market position in the Edge Data Center market, capturing a significant share. This leadership is largely due to the high data demands and complex IT requirements typical of large enterprises, which necessitate robust and scalable data processing facilities.

Large enterprises often engage in extensive digital transformation initiatives that involve the integration of IoT, AI, big data analytics, and machine learning into their operations. These technologies require substantial real-time data processing capabilities, ideally situated close to the data source, to ensure efficiency and speed, which edge data centers are uniquely positioned to provide.

Moreover, large enterprises typically have the financial resources and strategic vision to invest in cutting-edge infrastructure to maintain competitiveness and support their expansive operational scales. The ability of edge data centers to reduce latency and handle the increasing influx of data from various geographic locations makes them ideal for large corporations with multiple branches or those requiring instant data access and processing across dispersed locations.

As businesses continue to expand their digital footprints and as the proliferation of connected devices and applications grows, the reliance on edge data centers is expected to rise. This trend is particularly pronounced in sectors such as finance, healthcare, and retail, where large enterprises dominate and where data security, privacy, and quick access are critical. Thus, the Large Enterprises segment is likely to maintain its leading position in the Edge Data Center market, driven by ongoing technological advancements and increasing data-centric business practices.

By Industry Vertical Analysis

In 2022, the IT & Telecom segment held a dominant market position in the Edge Data Center market, capturing more than a 36.7% share. This leadership stems from the intrinsic nature of the IT and telecommunications industries, which require massive data transmission and real-time data processing capabilities to manage and distribute vast amounts of data efficiently.

Edge data centers facilitate these needs by providing localized data processing solutions that minimize latency, enhance bandwidth availability, and improve overall network efficiency. These attributes are essential for telecom operators and IT service providers who are increasingly deploying edge data centers to support the surge in mobile connectivity, cloud computing, and the proliferation of IoT devices.

Furthermore, the IT & Telecom segment’s dominance is reinforced by the ongoing expansion of 5G technology, which demands edge computing solutions to deliver its full potential of ultra-low latency and high reliability. As 5G networks continue to roll out globally, the dependency on edge data centers is expected to escalate, given their ability to process data closer to the end-users and devices.

This is particularly crucial in applications such as streaming services, real-time gaming, and other bandwidth-intensive and latency-sensitive applications, which are prevalent in the IT and telecom sectors. The future prospects for the IT & Telecom segment in the Edge Data Center market look increasingly promising as advancements in network technologies continue to evolve.

The rising trend towards distributed IT architectures in the telecom sector, aimed at reducing data hauls to centralized data centers, positions edge data centers as a pivotal component of modern telecom infrastructures. This trend is expected to sustain the growth and dominance of the IT & Telecom segment in the foreseeable future, driven by the need for more efficient data processing and enhanced connectivity solutions.

Key Market Segments

Based on Component

- Solution

- Services

Based on Enterprise Size

- SMEs

- Large Enterprises

Based On Industry Vertical

- IT & Telecom

- Manufacturing

- Government & Public Sector

- Healthcare

- Automotive

- BFSI

- Other Industry Verticals

Driver

Increasing Demand for Real-Time Data Processing and Low Latency

The proliferation of IoT devices and the increasing adoption of real-time applications are key drivers behind the rapid growth of the Edge Data Center market. As businesses integrate more IoT devices into their operations, the volume of data generated at the edge of networks escalates significantly. This surge necessitates immediate processing to extract maximum value, particularly in time-sensitive applications across various industries such as healthcare, automotive, and manufacturing.

Edge data centers cater to this need by processing data locally, reducing the latency that might occur when data is sent to centralized data centers. This localized processing is crucial for applications like autonomous driving and telemedicine, where every millisecond counts, thus driving the market’s expansion.

Restraint

High Initial Investments and Complexity in Infrastructure

A significant restraint in the edge data center market is the high initial capital required for setting up these facilities. The cost includes not only physical infrastructure but also sophisticated technologies such as advanced cooling systems and energy management solutions necessary for efficient operation.

Additionally, the complexity of deploying and maintaining a network of edge data centers adds to the operational challenges. These centers must be strategically located close to the data source, which often leads to logistical and management complexities that can deter deployment, especially by organizations with limited resources.

Opportunity

Expansion into Emerging Markets

Emerging markets present significant opportunities for the growth of the Edge Data Center market. These regions are experiencing rapid digital transformation, characterized by increasing internet penetration and mobile device usage. However, the lack of adequate central data center infrastructure can impede this digital growth.

Edge data centers can bridge this gap by facilitating local data processing, thereby enhancing the user experience and supporting the widespread adoption of digital technologies. Furthermore, as governments in these regions push for digitalization, there is a heightened demand for localized, efficient, and low-latency data processing facilities, offering a lucrative growth avenue for edge data center providers.

Challenge

Ensuring Security and Sustainability in Distributed Networks

One of the primary challenges facing the Edge Data Center market is ensuring the security and sustainability of these distributed facilities. Edge data centers, by their nature, are spread across multiple locations, often in less secure and environmentally controlled settings compared to traditional data centers.

This dispersal poses significant security risks, including physical and cyber threats, which require innovative solutions to mitigate. Additionally, managing the environmental impact of widespread facilities remains a challenge. As the number of edge data centers grows, so does the need for sustainable practices to manage energy consumption, cooling requirements, and overall environmental impact effectively.

Regional Analysis

In 2022, North America held a dominant market position in the Edge Data Center market, capturing more than a 32.3% share with a revenue of USD 2.8 billion. This leadership is attributed to several factors, including the region’s advanced technological infrastructure and the high adoption rates of cloud services and IoT technologies among businesses and consumers alike.

The presence of major tech companies and a robust telecommunications sector further drive the deployment of edge data centers to manage the immense data traffic generated by mobile and IoT devices efficiently. Moreover, North America is a pioneer in implementing new technologies such as 5G, AI, and machine learning, which require substantial data processing power at the edge of the network to function optimally.

The push towards digital transformation across industries such as healthcare, retail, and automotive in this region necessitates real-time data processing to improve operational efficiency and customer experiences. These factors collectively contribute to the robust growth and expansion of the edge data center market in North America.

Additionally, regulatory support for data privacy and security in countries like the United States and Canada plays a crucial role in the region’s market dominance. Stringent data regulations prompt companies to invest in local data processing facilities to comply with data sovereignty laws, further boosting the growth of the edge data center market in North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving Edge Data Center market, several key players have established their dominance through innovative solutions and strategic global expansions. IBM Corporation stands out with its robust offerings in IT infrastructure and cloud services, specifically designed to support edge computing. NVIDIA Corporation enhances the market with its advanced GPU technologies that are crucial for AI and machine learning applications at the edge, directly addressing the need for high-performance computing.

Dell Technologies is noted for its comprehensive range of edge solutions that include storage, networking, and servers, making it a one-stop-shop for edge data center components. Cisco Systems Inc. brings its expertise in networking equipment and software, providing essential technology for managing data traffic in edge environments. Fujitsu Limited contributes with its cutting-edge server and connectivity solutions, tailored for robust edge data center operations.

Eaton Corporation Plc is another vital player, offering power management solutions that are critical for the energy efficiency and reliability of edge data centers. 365 Data Centers Service, LLC specializes in colocation services, which are increasingly important for edge data center deployment across various regions. Huawei Technologies Co, Ltd. integrates its telecommunications expertise to enhance edge data processing capabilities, particularly in emerging markets.

Schneider Electric SE and Vertiv Group Corp both provide essential infrastructure technologies, including cooling systems and uninterruptible power supplies, that ensure the operational integrity of edge data centers. These companies, along with other key players in the market, are pivotal in shaping the future of edge computing, driving innovations that cater to the growing demand for real-time data processing and AI capabilities at the network edge.

Top Key Players in the Market

- IBM Corporation

- NVIDIA Corporation

- Dell Technologies

- Cisco Systems Inc.

- Fujitsu Limited

- Eaton Corporation Plc

- 365 Data Centers Service, LLC

- Huawei Technologies Co, Ltd.

- Schneider Electric SE

- Vertiv Group Corp

- Other Key Players

Recent Developments

- January 2024: IBM partnered with American Tower to accelerate the deployment of a hybrid, multi-cloud computing platform at the edge. This collaboration aims to expand American Tower’s Access Edge Data Center ecosystem to include IBM Hybrid Cloud capabilities and Red Hat OpenShift, enabling advanced edge applications across various industries.

- February 2024: Dell Technologies introduced a new series of edge gateways designed to provide secure and scalable solutions for edge data processing. These gateways are expected to enhance the deployment of edge computing in industries such as manufacturing, healthcare, and retail.

- October 2023: NVIDIA launched its new Grace Hopper Superchip, designed to bring enhanced performance to edge data centers by combining CPU and GPU capabilities in a single package. This development aims to support AI and machine learning applications at the edge, providing faster data processing and analytics.

- March 2023: Cisco announced the acquisition of Opsani, a company specializing in AI-driven optimization of cloud applications. This acquisition is expected to enhance Cisco’s edge computing solutions by integrating AI to optimize performance and efficiency in edge data centers.

- July 2023: Huawei launched its new edge computing platform, Edge AI, which integrates AI capabilities directly into edge devices. This platform aims to improve real-time data processing and analytics, catering to sectors like smart cities, autonomous vehicles, and industrial automation.

Report Scope

Report Features Description Market Value (2023) US$ 10.4 Bn Forecast Revenue (2032) US$ 51.0 Bn CAGR (2023-2032) 19.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution and Services) By Enterprise Size (SMEs and Large Enterprises), By Industry Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Government & Public Sector, Automotive, and Other Industry Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, NVIDIA Corporation, Dell Technologies, Cisco Systems Inc., Dell Inc., Fujitsu Limited, Eaton Corporation Plc, 365 Data Centers Service, LLC, Huawei Technologies Co., Ltd., Schneider Electric SE, Vertiv Group Corp, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Edge Data Center Market?The Edge Data Center market refers to the sector focused on providing data processing and storage capabilities closer to the location where data is generated. Edge Data Centers facilitate low-latency processing, enabling efficient and real-time data analysis for applications that require immediate insights and decision-making.

How big is the Edge Data Market?The Global Edge Data Center Market is anticipated to achieve a value of roughly USD 51.0 Billion by 2032, a substantial rise from its 2023 value of USD 10.4 Billion. This progress is expected to unfold at a compound annual growth rate (CAGR) of 19.9% during the projection period from 2023 to 2032.

What is the growth in Edge Data Centers?The growth in Edge Data Centers is significant, primarily driven by the increasing adoption of IoT devices, the demand for faster data processing, the rise of 5G technology, and the necessity for localized data storage and analysis. This expansion is expected to continue as more organizations recognize the benefits of decentralized data processing and storage.

What is the difference between Hyperscale and Edge Data Centers?Hyperscale data centers are large-scale facilities built to accommodate massive data storage and processing requirements, usually serving a broader geographical region. In contrast, Edge Data Centers are smaller, decentralized facilities located closer to the point of data generation, enabling low-latency computing and faster data analysis for specific localities or regions.

Who owns Leading Edge Data Centers?Leading Edge Data Centers are owned by various companies and organizations operating in the data center and telecommunications industry. The market includes a diverse range of players, from large corporations to specialized data center providers and telecommunication firms, each contributing to the expansion and development of Edge Data Centers.

-

-

- IBM Corporation

- NVIDIA Corporation

- Dell Technologies

- Cisco Systems Inc.

- Fujitsu Limited

- Eaton Corporation Plc

- 365 Data Centers Service, LLC

- Huawei Technologies Co, Ltd.

- Schneider Electric SE

- Vertiv Group Corp

- Other Key Players