Global Edge Computing Market By Component (Hardware, Software, and Services), By Application (Industrial Internet of Things, Smart Cities, Content Delivery, Remote Monitoring, Augmented Reality & Virtual Reality, and Other Applications), By Industry Verticals (Energy and Utilities, Manufacturing, Telecommunications, and Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2023

- Report ID: 99739

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

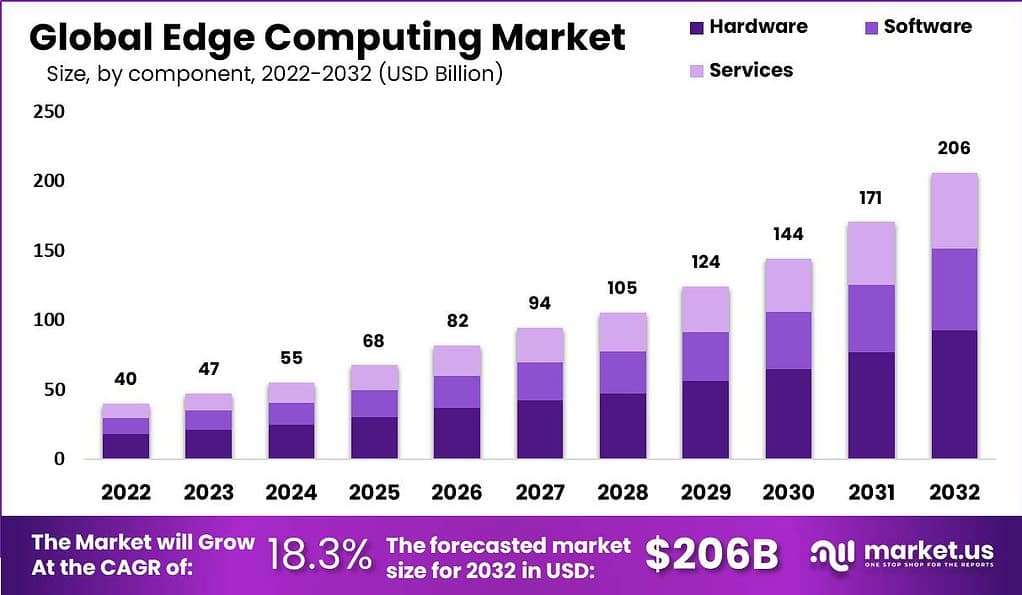

The global edge computing market size is expected to be worth around USD 206 billion by 2032 from USD 47 billion in 2023, growing at a CAGR of 18.3% during the forecast period from 2023 to 2032.

Edge computing is a distributed computing paradigm that brings computation and data storage closer to the location where it is needed, aiming to improve response times and save bandwidth. This technology enables data to be processed by the device itself or by a local computer or server, rather than being transmitted to a data center. Edge computing is particularly beneficial in scenarios where speed and efficient data processing are critical, such as in IoT devices, self-driving cars, and smart cities.

The edge computing market has been rapidly growing, fueled by several key factors. Firstly, the exponential growth of data generated by devices, sensors, and IoT systems has created a demand for faster and more efficient processing methods. Edge computing addresses this need by enabling data to be processed and analyzed in real-time, without the delays associated with transferring data to distant cloud servers. This is particularly crucial for applications that require low latency and immediate response, such as autonomous vehicles, industrial automation, and smart cities.

Secondly, the advent of 5G networks has played a significant role in driving the edge computing market. 5G technology offers high-speed, low-latency connectivity, and edge computing complements it by bringing computation capabilities closer to the network edge. This combination allows for faster data processing, enabling applications such as augmented reality, virtual reality, and immersive gaming. The ability to process data at the edge also reduces network congestion and enhances overall network performance.

While the edge computing market offers immense potential, it also faces certain challenges. Implementing and managing edge computing infrastructures can be complex, requiring distributed computing resources, edge servers, and robust networking capabilities. Additionally, ensuring data security and privacy at the edge is a critical concern that needs to be effectively addressed to build trust and adoption.

Despite these challenges, the edge computing market presents significant opportunities for growth and innovation. Organizations across various industries are recognizing the value of real-time data processing and analysis, and the demand for edge computing solutions is expected to rise. Hardware manufacturers, software providers, cloud service providers, and network operators have the opportunity to develop and offer tailored edge computing solutions that address specific industry needs and drive digital transformation.

According to research analysis, the Global Edge Data Center Market is projected to reach a value of approximately USD 51.0 billion by 2032, exhibiting a remarkable growth rate with a CAGR of 19.9% during the forecast period from 2024 to 2033. This significant expansion is anticipated from the market’s current worth of USD 10.4 billion in 2023.

A recent survey conducted by Edgegap highlighted the prevalence of latency issues among online gamers, with an astonishing 97% reporting encountering such problems during their gaming experiences. This finding underscores the importance of addressing latency concerns to enhance user satisfaction in the gaming industry.

China is expected to play a significant role in the development of network edge sites, with approximately 26% of all edge sites projected to be located in the country by 2026. This demonstrates China’s growing influence in the expansion of edge computing infrastructure.

The number of network edge data centers is estimated to reach just under 1,200 by 2026, indicating a substantial increase in these facilities to meet the rising demand for edge computing capabilities. Telcos are anticipated to invest around USD 11.6 billion annually by 2027, highlighting their commitment to advancing edge computing technologies and infrastructure.

According to Worldmetrics, the implementation of edge computing can reduce latency by up to 90%, significantly enhancing data processing speed and user experience. By 2024, it is expected that 50% of new infrastructure deployments will be in edge locations rather than corporate data centers, a substantial increase from less than 10% today. Energy and utility companies stand to benefit immensely, potentially reducing data processing costs by up to 70% with edge computing.

Key Takeaways

- The global edge computing market is projected to reach USD 206 billion by 2032, growing from USD 47 billion in 2023 at a CAGR of 18.3% during the forecast period from 2023 to 2032.

- In 2022, the Hardware segment held a dominant position in the edge computing market, capturing more than a 45% share.

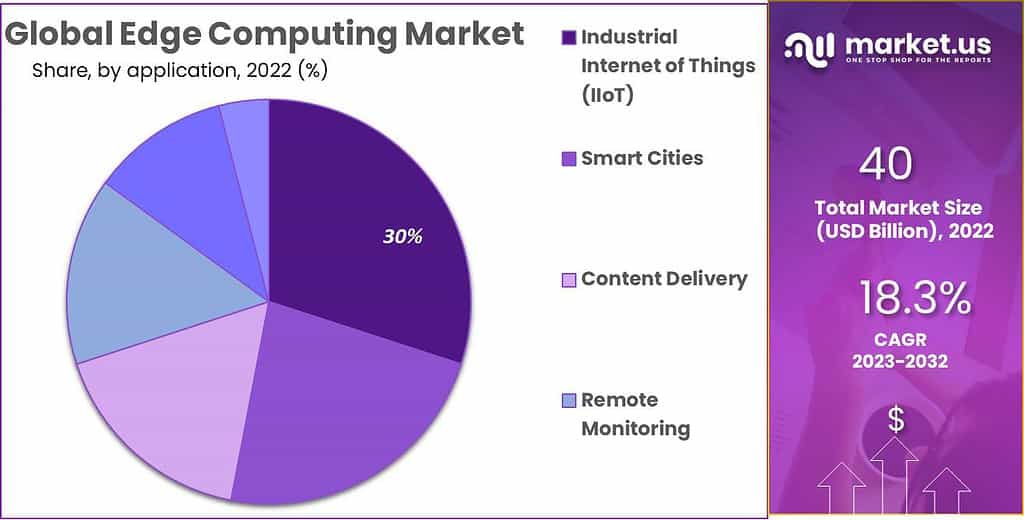

- By 2022, the Industrial Internet of Things (IIoT) segment emerged as a market leader within the edge computing market, securing over a 30% share.

- In 2022, the Energy and Utilities segment maintained a leading market position, accounting for more than a 16% share.

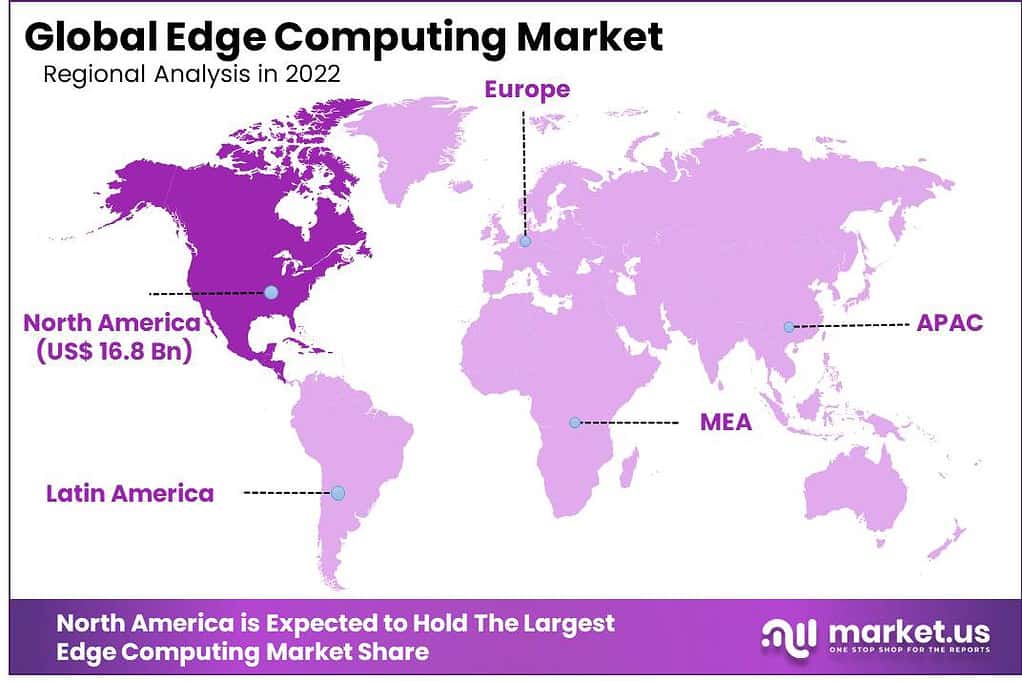

- In the same year, North America dominated the edge computing market, with a commanding 42% share and a revenue of USD 16.8 billion.

Component Analysis

In 2022, the Hardware segment held a dominant position in the Edge Computing market, capturing more than a 45% share. This leadership is largely attributable to the critical role that physical devices, like servers, routers, and switches, play in facilitating edge computing capabilities. As organizations increasingly deploy applications that require real-time computing power and data analysis at or near the source of data generation, the demand for robust edge-specific hardware has surged.

These hardware solutions are designed to withstand the varied environmental conditions often present at edge locations, further driving their adoption. The proliferation of IoT devices and the escalating need for low-latency processing have also bolstered the hardware segment. Edge computing hardware reduces the distance data must travel, thereby minimizing latency and enhancing the performance of real-time applications.

This is essential in industries such as manufacturing, healthcare, and automotive, where immediate data processing can significantly impact operational efficiency and decision-making. Moreover, as the edge computing landscape evolves, hardware innovations continue to emerge, focusing on energy efficiency and enhanced computational power, which are critical for supporting the growing complexity of edge deployments.

In essence, the hardware segment’s lead in the edge computing market is reinforced by the indispensable nature of physical infrastructure in executing the foundational aspects of edge computing. This segment’s growth is driven not only by technological advancements but also by a broadening recognition across various industries of the tangible benefits that edge computing offers in optimizing operational processes and facilitating real-time data analysis.

Application Analysis

In 2022, the Industrial Internet of Things (IIoT) segment held a dominant market position within the Edge Computing market, capturing more than a 30% share. This prominence can be attributed to the IIoT’s transformative impact on industrial operations, where edge computing enables real-time data processing directly at the source of data generation. This capability is crucial in environments such as manufacturing plants, oil rigs, and shipping logistics, where immediate data insights can significantly enhance operational efficiency and predictive maintenance.

The integration of edge computing in the IIoT ecosystem allows businesses to leverage instantaneous data analysis, which is vital for managing complex industrial operations that require high-speed response and minimal latency. For instance, in manufacturing, edge computing helps in monitoring equipment performance and predicting failures before they occur, thus reducing downtime and maintenance costs. Similarly, in energy sectors, real-time data processed through edge devices enables smarter grid management and resource distribution.

Moreover, the adoption of edge computing in IIoT is driven by the need for enhanced security in industrial operations. Processing data locally on edge devices reduces the risks associated with data transmission over long distances, thereby bolstering data security. This aspect is particularly critical in industries where data integrity and security are paramount.

The ongoing advancements in edge computing technologies, aimed at improving reliability and computational power, continue to fuel the growth of the IIoT segment. As industries increasingly focus on digital transformation strategies, the role of edge computing in enabling such innovations becomes indispensable, ensuring the IIoT segment’s sustained leadership in the market.

Industry Verticals Analysis

In 2022, the Energy and Utilities segment held a dominant market position in the Edge Computing market, capturing more than a 16% share. This leadership is largely driven by the critical need for real-time data processing and management in energy systems, where edge computing plays a pivotal role. With the increasing integration of renewable energy sources and the rise of smart grids, edge computing devices provide essential analytics and control capabilities at the site of energy production and distribution.

This local processing reduces latency, enhances the reliability of energy systems, and supports the dynamic balancing of supply and demand. Moreover, edge computing facilitates advanced monitoring and predictive maintenance within the utilities sector. By processing data directly at the source, utilities can detect and address potential issues before they lead to system failures or outages, significantly improving service reliability and operational safety.

This capability is crucial in environments where equipment failures can result in significant disruptions and high remedial costs. The adoption of edge computing technologies in this sector is also encouraged by regulatory pressures and the growing need for cybersecurity, as processing data locally minimizes the exposure to cyber threats.

The continuous evolution of IoT technologies and the expansion of smart infrastructure have further propelled the Energy and Utilities segment to the forefront of the edge computing market. As these technologies become more embedded in operational practices, the demand for edge computing solutions that can process large volumes of data efficiently and securely continues to grow. This trend is expected to sustain the dominance of the Energy and Utilities segment in the edge computing landscape, as stakeholders increasingly recognize the benefits of immediate data processing and reduced network strain.

Key Market Segments

Based on Component

- Hardware

- Software

- Services

Based on Application

- Industrial Internet of Things

- Smart Cities

- Content Delivery

- Remote Monitoring

- Augmented Reality and Virtual Reality

- Other Applications

Based on Industry Verticals

- Energy and Utilities

- Manufacturing

- Telecommunications

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Transportation and Logistics

- Government and Defence

- Media and Entertainment

- Other Industry Verticals

Driver

Rising Demand for Low-Latency Processing and Real-Time Decision-Making

The Edge Computing market is driven significantly by the increasing demand for low-latency processing and real-time automated decision-making solutions. This need is especially pronounced in sectors that rely on quick data processing to optimize operations, such as manufacturing and healthcare. With the expansion of IoT devices and smart technologies, industries require swift data analysis to improve responsiveness and operational efficiency, promoting the adoption of edge computing technologies.

Restraint

Initial Capital Expenditure for Infrastructure

A major restraint facing the edge computing market is the substantial initial capital expenditure required for infrastructure development. Setting up edge computing involves significant investments in hardware, software, and networking capabilities. This upfront cost can be a barrier, particularly for small and medium enterprises (SMEs) that might lack the financial resources to invest heavily in such advanced technologies.

Opportunity

Deployment of 5G Networks

The rollout of 5G networks presents a significant opportunity for the edge computing market. 5G technology promises high-speed internet connectivity and lower latency, which can enhance the performance of edge computing solutions. The increased bandwidth and faster transmission speeds allow for more efficient data handling at the edge, opening up new possibilities for applications in autonomous vehicles, smart cities, and more. This advancement is expected to drive further innovations and adoption of edge computing solutions across various sectors.

Challenge

Integration and Cybersecurity Issues

One of the key challenges in the edge computing market is the complexity associated with integrating edge computing solutions with existing cloud architectures. Additionally, cybersecurity remains a critical concern, as edge devices often process sensitive data and require robust security measures to prevent breaches. These integration and security challenges can hinder the deployment and scalability of edge computing systems, requiring continuous improvements in technology and security practices.

Regional Analysis

In 2022, North America held a dominant market position in the Edge Computing market, capturing more than a 42% share with a revenue of USD 16.8 billion. This leading stance is primarily due to the region’s advanced technological infrastructure and the rapid adoption of IoT technologies across various industries. North America is home to numerous technology giants and startups that are continually innovating in the IoT and edge computing spaces, which drives significant investment and deployment in edge technologies.

The region’s focus on enhancing data processing capabilities and reducing latency in critical applications such as autonomous vehicles, smart cities, and healthcare also contributes to its dominant position. For instance, the deployment of edge computing solutions in healthcare for real-time patient monitoring and in automotive sectors for improving vehicle communication systems are pivotal developments bolstering the market growth.

Moreover, the regulatory environment in North America, which often supports technological advancements and data privacy, provides an additional layer of security to industries implementing edge computing solutions, thus encouraging further adoption. Furthermore, North America’s robust network infrastructure, capable of supporting extensive edge computing deployments, along with significant investments in 5G technology, are critical factors that sustain its leadership in the global market.

These technological advancements not only enhance the efficiency of edge computing applications but also ensure their scalability across multiple sectors. The strategic collaborations between tech companies and industry leaders in the region to integrate edge computing into various verticals are expected to keep North America at the forefront of the edge computing market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The prominent players in the market are concentrated on developing innovative collaboration software to gain a competitive edge and attract a more extensive customer base. For instance, in February 2022, Asana’s work management platform released Asana Flow. It is a complete range of solutions that businesses can use to run, enhance, and build their workflow.

The rising number of such offerings is estimated to favor the market’s growth over the forecast period. A few major players in the market are AT&T Inc., Siemens AG, Amazon.com Inc., Arrow Electronics Inc., ClearBlade Inc., EdgeConneX Inc., FogHorn Systems Inc., Cisco Systems Inc., Alphabet Inc., ADLINK Technology Inc., and other key companies. Listed below are some of the most prominent edge computing market players.

Top Key Players in the Market

- ABB Ltd.

- Atos

- General Electric Company

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Honeywell International Inc.

- Intel Corporation

- Microsoft Corporation

- Other Key Players

Recent Developments

- Atos: In June 2023, Atos launched a new suite of edge computing solutions specifically designed for industrial applications. These solutions focus on automation and data processing, aiming to enhance operational efficiency and productivity in industrial environments.

- Huawei Technologies Co., Ltd.: Huawei introduced its Intelligent EdgeFabric 3.0 in November 2023, a comprehensive edge computing solution designed to support smart manufacturing and industrial IoT applications. This platform enhances data processing capabilities and security features at the edge.

- Intel Corporation: Intel, in collaboration with AT&T, launched a new edge computing solution in August 2023, focusing on enhancing network edge capabilities for 5G applications. This solution aims to support the growing demand for edge computing in telecommunications and IoT.

- Honeywell International Inc.: In October 2023, Honeywell announced a strategic partnership with Microsoft to integrate Honeywell Forge, an enterprise performance management solution, with Microsoft’s Azure Digital Twins. This integration aims to enhance edge computing capabilities for industrial applications.

Report Scope

Report Features Description Market Value (2023) US$ 47 Bn Forecast Revenue (2032) US$ 206 Bn CAGR (2023-2032) 18.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component- Hardware, Software, and Services; By Application- Industrial Internet of Things, Smart Cities, Content Delivery, Remote Monitoring, Augmented Reality & Virtual Reality, and Other Applications; By Industry Verticals- Energy & Utilities, Manufacturing, Telecommunications, Retail & Consumer Goods, Healthcare & Life Sciences, Transportation & Logistics, Government & Defence, Media & Entertainment, and Other Industry Verticals. Regional Analysis North America – The U.S. and Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Atos, General Electric Company, Cisco Sysyems, Inc., Hewlett Packard Enterprise Development, IBM Corporation, Huawei Technologies Co., Ltd., Honeywell International Inc., Intel Corporation, Microsoft Corporation, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the study period of Edge Computing Market?The Edge Computing Market is studied from 2017-2030.

What is the growth rate of Edge Computing Market?The Edge Computing Market is growing at a CAGR of 38.24% over the next 9 years.

Which region has highest growth rate in Edge Computing Market?Asia Pacific and North America is growing at the highest CAGR over 2018-2032.

Which region has largest share in Edge Computing Market?North America holds highest share in 2022.

Who Are The Leading Key Players In Edge Computing Market Industry ?ABB Ltd., Atos, General Electric Company, Cisco Systems, Inc., Hewlett Packard Enterprise Development, IBM Corporation, Huawei Technologies Co., Ltd., Honeywell International Inc., Intel Corporation, Microsoft Corporation, Other Key Players

-

-

- ABB Ltd.

- Atos

- General Electric Company

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Honeywell International Inc.

- Intel Corporation

- Microsoft Corporation

- Other Key Players