Global E-Commerce Buy Now Pay Later Market Size, Share, Industry Analysis Report By Product Type (Fashion Accessories, Mobiles and Laptops, Electronics Appliances, Others), By Repayment Model (Manual Repayment Schedules, Automatic Repayment), By End User (Gen Z (21-25), Millennials (26-40), Gen X (41-55), Baby Boomers (56-75)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161935

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- BNPL Usage By Income

- Usage and demographics

- Consumer and Retailer Trends

- Role of Generative AI

- Investment and Business benefits

- US Market Size

- Emerging Trends

- Growth Factors

- By Product Type

- By Repayment Model

- By End User

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

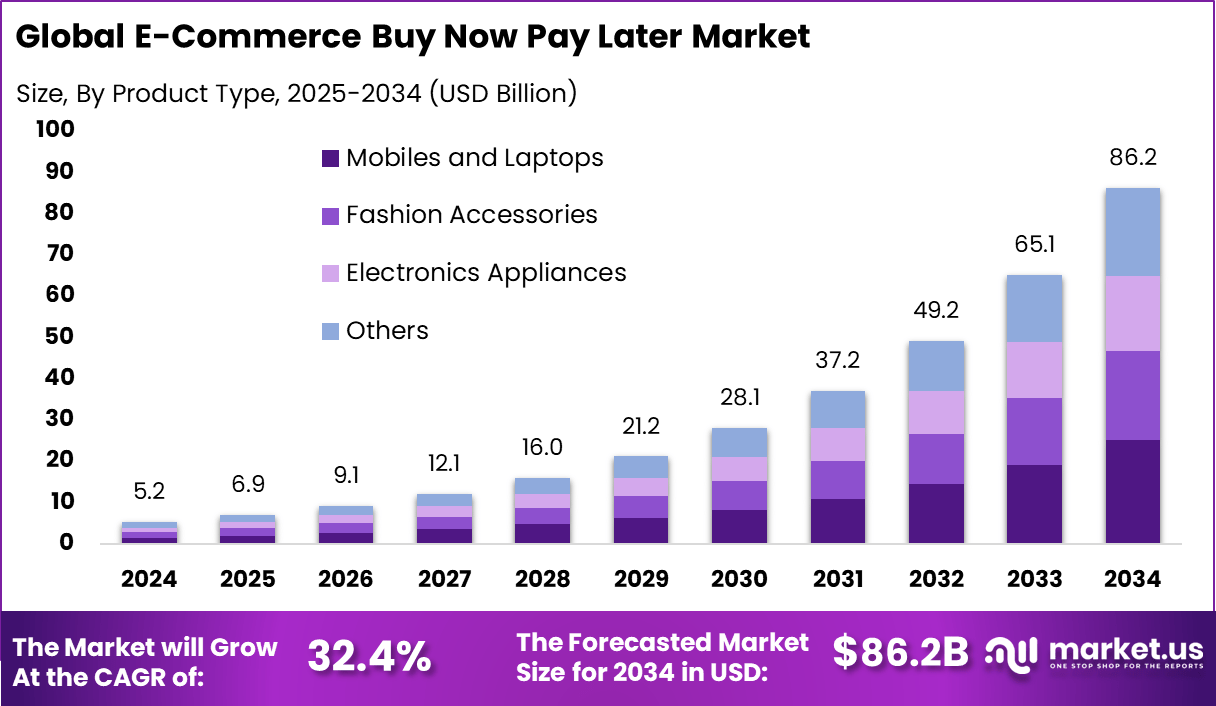

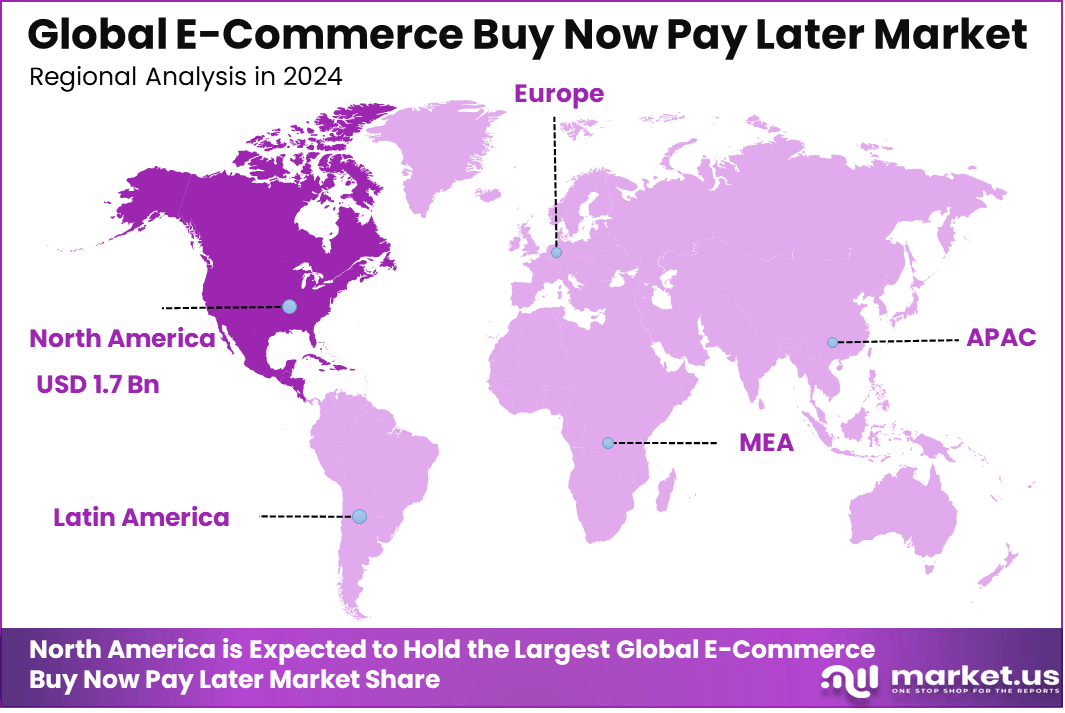

The Global E-Commerce Buy Now Pay Later Market generated USD 5.2 billion in 2024 and is predicted to register growth from USD 6.9 billion in 2025 to about USD 86.2 billion by 2034, recording a CAGR of 32.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 34.6% share, holding USD 1.7 Billion revenue.

The e-commerce buy now pay later market involves digital payment services that allow consumers to purchase goods online and pay in installments over time, often with no immediate interest charges. These platforms integrate with online retail checkouts or mobile apps and manage credit assessment, payment scheduling, and transaction processing. Retailers, marketplaces, and direct-to-consumer brands use BNPL solutions to increase order volume and reduce cart abandonment.

A key driver is the demand for flexible payment options, especially among younger shoppers and consumers without access to traditional credit. The rise of mobile commerce, digital wallets, and one-click checkout systems has supported rapid adoption. Retailers use BNPL to boost conversion rates and average order values. Economic uncertainty and household budget management have also encouraged deferred payment use in various regions.

According to Market.us, the global e-commerce market is set to grow from USD 28.29 trillion in 2024 to nearly USD 151.5 trillion by 2034 at a CAGR of 18.29%. The APAC region led in 2024 with 45.7%, generating USD 12.8 trillion in revenue driven by rapid digital adoption and high consumer spending.

The AI in e-commerce market is forecast to climb from USD 5.79 billion in 2023 to USD 50.98 billion by 2033, at a 24.3% CAGR. North America held 38.6% of this market in 2023 with revenues of USD 2.23 billion, reflecting strong investment in personalization, automation, and data-driven retail solutions.

The Buy Now Pay Later market is projected to increase from USD 16 billion in 2023 to roughly USD 115 billion by 2032, growing at a 25.3% CAGR, while North America captured over 32% in 2022 with about USD 4.6 billion in revenue. In parallel, AI agents in e-commerce are expected to surge from USD 3.6 billion in 2024 to USD 282.6 billion by 2034 at a 54.7% CAGR, with North America leading in 2024 at 38.5% and USD 1.3 billion in revenue.

Top Market Takeaways

- Mobiles and laptops made up 29.3% of total BNPL purchases, showing strong demand for high-value electronics through flexible payments.

- Automatic repayment models accounted for 72.7%, reflecting user preference for convenience and reduced payment defaults.

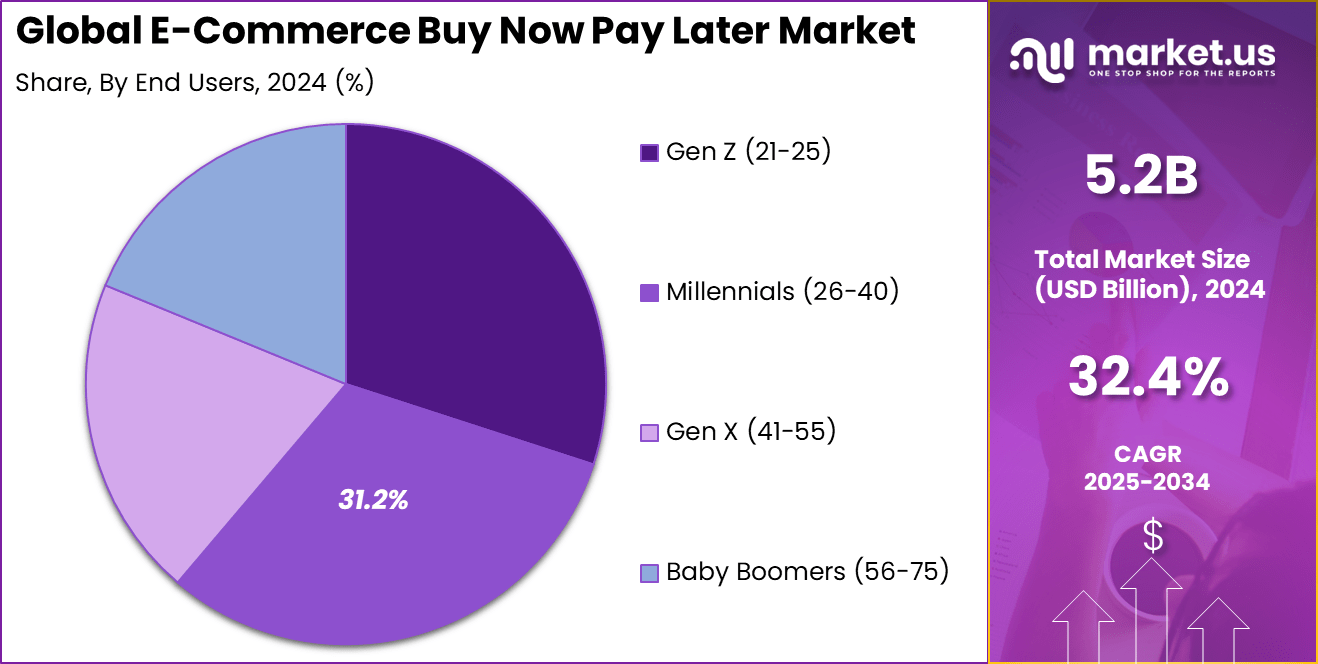

- Millennials aged 26-40 contributed 31.2% of usage, making them the most active demographic in BNPL adoption.

- North America held 34.6% of the market, supported by mature digital payment infrastructure and high online spending.

- The US market alone reached USD 1.62 Billion with a rapid 29.3% CAGR, driven by strong e-commerce penetration and consumer credit demand.

Quick Market Facts

Demand analysis shows that as more retailers integrate BNPL options into their online checkout, conversion rates improve by roughly 20-30%. These flexible payments encourage larger purchases and reduce cart abandonment. Moreover, sectors like consumer electronics, fashion, and home improvement see higher usage since buyers can afford pricier items through installments.

The ability to accommodate installment payments both online and increasingly in physical retail environments creates a broader customer base embracing BNPL solutions. Increasing adoption technologies center around AI and machine learning, which enable real-time credit assessments and personalized repayment plans. These technologies reduce approval friction at checkout by instantly evaluating risk and creditworthiness, even for consumers with limited credit history.

POS and API integrations with payment gateways and ERP systems ensure smooth transaction processing, returns, and installment tracking. Furthermore, mobile apps and digital wallets incorporating BNPL options facilitate easier user experience, encouraging ongoing use and loyalty. Key reasons for adopting BNPL include its ability to drive sales growth by lowering immediate financial barriers and allowing customers to spread out payments interest-free or with minimal fees.

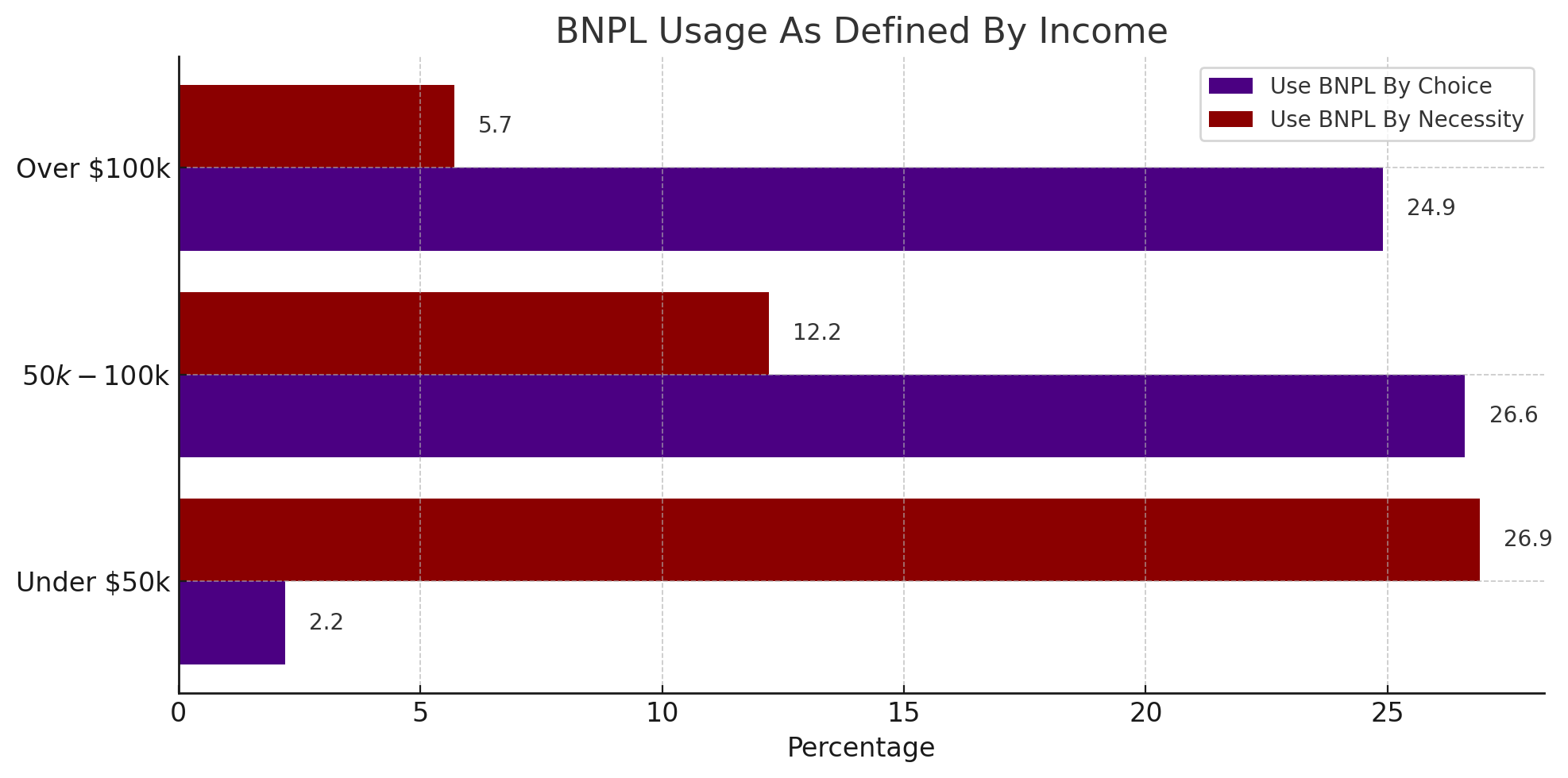

BNPL Usage By Income

According to DigitalSilk, 86.5 million Americans used Buy Now, Pay Later services in 2024 across different retail segments. During the 2024 holiday season alone, shoppers spent $18.2 billion through BNPL platforms. Looking ahead, 69% of users say they would consider using BNPL for additional financial services. At the same time, 63% of borrowers are managing more than one BNPL plan simultaneously, indicating deeper reliance on these payment options.

Usage and demographics

Category Details User Adoption Global BNPL users expected to exceed 900 million by 2027. In the U.S., users projected to grow from 86.5 million in 2024 to 91.5 million in 2025. Generational Drivers Gen Z and Millennials are the main users of BNPL services. Payment Behavior BNPL is now used for everyday items like clothing, groceries, and electronics, not just big purchases. Income Levels Most BNPL users have lower to mid-range incomes, with a majority earning under $75,000 annually. Consumer and Retailer Trends

Aspect Details Increased Spending BNPL drives stronger engagement at checkout and raises average order value. Consumers spend about 10% more using BNPL than traditional payment methods. Popularity Among Younger Consumers Adoption is highest among Gen Z and Millennials who prefer flexible, interest-free payment options over credit cards. Small Ticket Items In 2024, purchases below $300 made up the biggest share of BNPL transactions, showing its growing use for everyday spending. Merchant Costs BNPL boosts sales and customer acquisition but comes with higher fees for retailers, typically 4% to 8%, compared to 1.5% to 3% for credit cards. Role of Generative AI

The role of generative AI in e-commerce Buy Now Pay Later (BNPL) solutions is becoming increasingly crucial. Generative AI helps analyze vast amounts of customer data, creating personalized product recommendations that improve shopping experiences.

It can tailor offers to individual preferences, boosting conversion rates by up to 30%. This technology also powers content creation, enabling businesses to generate targeted marketing materials that speak directly to consumer needs, which leads to higher engagement and brand loyalty. By adapting to customer behavior in real-time, generative AI helps BNPL platforms reduce cart abandonment and increase effective sales.

In addition, generative AI supports product customization and on-demand design, enhancing user satisfaction in the BNPL space. For example, AI-driven systems can suggest tailored product styles or payment plans that suit the buyer’s financial situation and preferences. These innovations elevate customer trust and make BNPL services more appealing.

Investment and Business benefits

Investment opportunities in the BNPL space arise from its growth potential, especially in emerging markets and sectors integrating cloud-based and AI-powered financial solutions. Investors find BNPL appealing because it diversifies risk across many consumer demographics and income levels while generating returns from transaction fees and interest on installment payments.

Expansion in B2B BNPL solutions also opens new avenues for funding working capital for small- and medium-sized enterprises. Business benefits include increased sales conversion rates, higher loyalty through enhanced customer experience, and expanded customer reach by tapping into segments reluctant to use traditional credit.

BNPL also simplifies cash flow for buyers by easing upfront payment pressure and reduces merchants’ risk exposure as financing providers typically take on collection risk. These factors combine to make BNPL a powerful strategy to boost revenue and customer satisfaction.

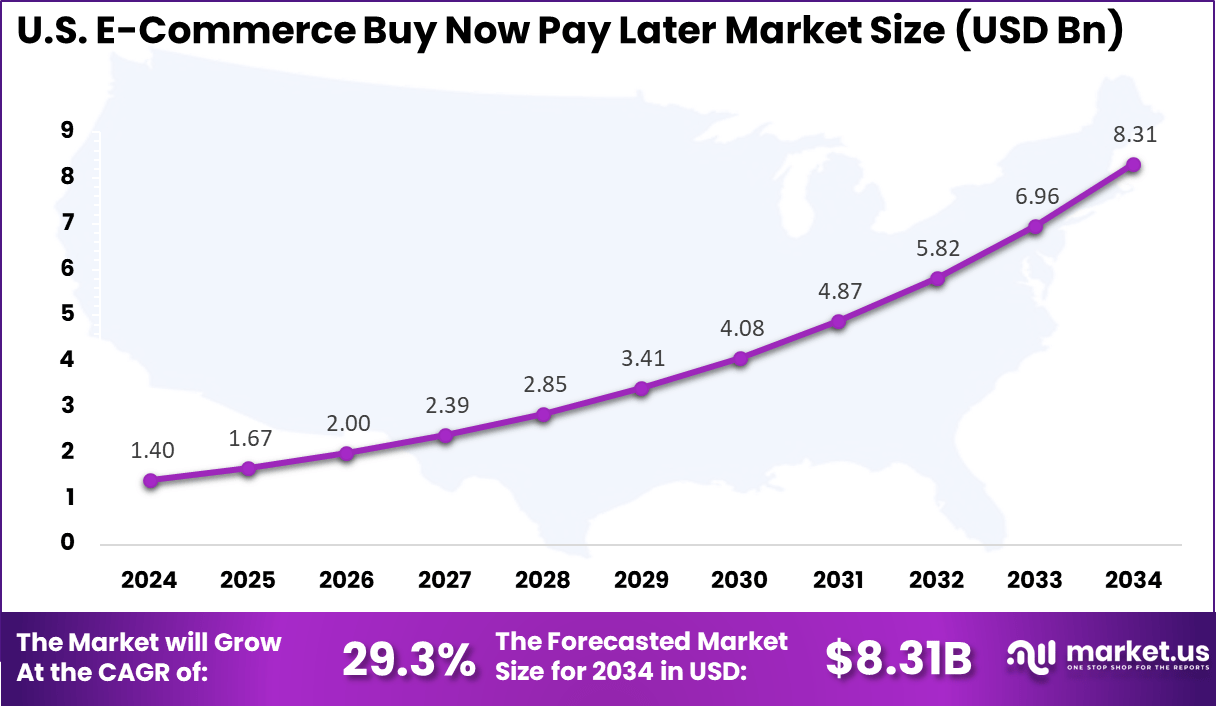

US Market Size

Within North America, the US stands out with its adoption, contributing significantly to the regional market value and growth trajectory. Its CAGR of 29.3% reflects a robust and expanding BNPL ecosystem, with a market size that is projected to grow steadily. The rising trend of online shopping, coupled with increasing merchant acceptance, fuels the US market’s rapid expansion.

The popularity of BNPL in the US also stems from its ability to attract consumers who may avoid traditional credit systems, including those with limited or no credit history. This demographic trend supports the long-term potential of BNPL as a mainstream payment choice in the US economy, which continues to innovate and adapt to consumer preferences.

In North America, the BNPL market holds a strong share, accounting for 34.6% of the regional market. The United States alone contributed approximately USD 1.62 billion in 2024 and is experiencing a substantial CAGR of 29.3%. The rising adoption of digital wallets and the increasing preference for flexible payment options are key drivers in this region.

The large e-commerce ecosystem and high smartphone penetration foster a smooth transition towards BNPL solutions, which are now integrated into most major online retail platforms. Consumer demand for quick, convenient, and interest-free installment payments continues to push growth, especially among younger buyers who prefer digital-first shopping experiences.

Emerging Trends

Emerging trends in the e-commerce BNPL sector show a shift towards integrating AI-powered fraud detection and credit risk assessment models. These technologies help providers approve more customers swiftly while minimizing default rates. Usage of AI in fraud prevention has reduced fraudulent transactions by over 40% in some markets.

Another trend is the rise of flexible repayment options driven by data insights from AI analytics, allowing users to choose installment plans that fit their cash flow, improving satisfaction and repayment compliance. Additionally, younger consumers with a preference for mobile payments are pushing the adoption of BNPL embedded directly into digital wallets and social commerce platforms.

Reports show that 60% of BNPL users are aged between 18 and 35, and this demographic influences product innovation and platform integration. This has led to BNPL becoming a standard feature in mobile-first shopping environments, driving more frequent usage and deeper engagement from digitally native buyers.

Growth Factors

Growth factors for the BNPL market include increasing e-commerce penetration globally, with over 70% of online shoppers opting for flexible payment options where available. The uptake is particularly strong in regions with low traditional credit card penetration, as BNPL provides easy access to credit without heavy paperwork.

Consumer preference for interest-free installment plans has also stimulated growth, with around 75% of BNPL users citing this as a key reason for adoption. Another factor contributing to BNPL’s growth is the shift in retailer strategies focusing on offering seamless checkout experiences that reduce cart abandonment rates by up to 20%.

Merchants partner with BNPL providers to improve affordability for customers and boost average order values. The ability of BNPL to target younger buyers, who represent nearly half of all online shoppers, further accelerates market expansion given their high engagement with flexible payment options.

By Product Type

In 2024, Mobiles and laptops represent the largest product category in the Buy Now Pay Later (BNPL) market, capturing a significant 29.3% share. Consumers increasingly prefer spreading the cost of high-value electronics over time without upfront payment, which makes BNPL an attractive option for these purchases.

The rise in remote work and digital lifestyle trends is driving sustained demand for such devices, as buyers seek flexible financial options to upgrade their tech gadgets while managing cash flow better. This segment is also influenced by rapid advancements and frequent product releases in mobile and laptop categories.

Buyers expect to stay updated with the latest technology but hesitate due to the high one-time costs. BNPL services bridge this gap by enabling interest-free or low-interest installment payments, helping consumers maintain purchasing power while avoiding credit card debt burdens. This financing approach encourages wider access and higher conversion rates for electronics e-commerce.

By Repayment Model

In 2024, The automatic repayment model dominates with an overwhelming 72.7% share in BNPL repayment options. This model simplifies repayment by automatically deducting installments from users’ accounts on scheduled dates, reducing the risk of missed payments.

It offers peace of mind and convenience, which has helped many consumers trust BNPL services as a reliable financial tool, especially among those managing multiple monthly payments. Automatic repayments also reduce administrative costs and default rates for BNPL providers, enabling better scalability and service improvements.

For users, this model encourages responsible spending habits by ensuring payments are timely without additional effort. The ease-of-use makes BNPL accessible and widely accepted, contributing substantially to the adoption of BNPL in e-commerce.

By End User

In 2024, Millennials aged 26 to 40 lead BNPL usage with a 31.2% share, reflecting this demographic’s preference for digital-first financial solutions. This group values flexibility and transparency in payments, often avoiding traditional credit to manage budgets effectively.

Millennials’ comfort with mobile apps and e-commerce platforms further supports BNPL’s popularity among them. They tend to use BNPL particularly for mid-range purchases like electronics, fashion, and home goods.

The financial behavior of millennials, shaped by experiences like student debt and financial crises, results in cautious borrowing but a strong desire for convenience. BNPL offers them a way to access products without immediate full payment, aligning with their preference for interest-free options and short-term financing. This makes millennials a crucial segment fueling continuous growth in the BNPL market.

Key Market Segments

By Product Type

- Fashion Accessories

- Mobiles and Laptops

- Electronics Appliances

- Others

By Repayment Model

- Manual Repayment Schedules

- Automatic Repayment

By End User

- Gen Z (21-25)

- Millennials (26-40)

- Gen X (41-55)

- Baby Boomers (56-75)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growth of Online Shopping

The expanding popularity of online shopping is a significant driver for the Buy Now Pay Later (BNPL) market in e-commerce. Consumers enjoy the convenience of shopping at any place and time, which boosts the demand for flexible payment options like BNPL.

These interest-free installment plans make purchasing easier and more affordable, directly increasing sales and conversion rates on e-commerce platforms. In the US, for example, online retail sales grew by more than 8% in 2024, highlighting this trend’s strength.

BNPL appeals especially to younger shoppers who prefer manageable payments over large upfront costs. Retailers are eager to adopt BNPL because it enhances customer satisfaction and increases average order size. This convenience and flexibility act as a clear growth catalyst, expanding BNPL’s footprint in online commerce worldwide.

Restraint

Rising Regulatory Pressure

Increasing regulatory scrutiny is a major restraint facing BNPL services. As concerns mount about consumer debt and financial risks, governments are introducing stricter rules to protect shoppers. Many countries are shifting BNPL closer to traditional credit frameworks, requiring clearer disclosures and affordability checks. This results in higher compliance costs and operational challenges for providers.

Due to tighter credit checks and compliance burdens, some users face more rejections, and providers may alter terms or limit services. This can reduce BNPL’s attractiveness and hurt merchant adoption since fewer customers get approved to use these plans. Regulation aims to balance consumer safety with industry growth but currently challenges BNPL’s expansion.

Opportunity

AI-Driven Personalization

Artificial intelligence (AI) presents a big opportunity to enhance BNPL offerings through personalized credit assessments and repayment plans. AI powered tools can analyze customer purchasing behavior and creditworthiness in real time, offering tailored credit limits and flexible payment schedules. This improves access for more consumers, even those with limited credit history, while lowering fraud risks.

This level of personalization helps increase consumer trust and merchant conversion rates, creating a better user experience. As AI becomes more integral, BNPL providers can differentiate themselves with innovative, customer-focused solutions that tap into growing digital payment trends.

Challenge

Rising Operational Costs

Rising borrowing costs and operational expenses pose a key challenge for BNPL firms. Increasing interest rates have made it more expensive for providers to finance upfront merchant payments. This forces BNPL companies to tighten credit approval standards or raise fees, which may reduce customer approvals and demand.

For smaller merchants especially, higher BNPL fees cut into profit margins and may discourage offering these payment options. Additionally, managing chargebacks and defaults adds complexity, requiring more advanced risk and cost controls. The once straightforward BNPL model now demands more strategic management to maintain profitability and market share.

Competitive Analysis

The E-Commerce BNPL Market is led by major fintech companies such as Affirm Holdings Inc., Klarna Bank, PayPal, and Zip Co Limited. These providers offer installment-based payment options integrated directly into online checkout systems, enabling consumers to divide purchases into manageable payments without traditional credit checks. Their partnerships with retailers and e-commerce platforms have accelerated BNPL adoption across global markets.

Emerging and regionally focused players such as Splitit Payments Ltd, Sezzle Inc., Laybuy Holdings Limited, and Payright Limited contribute by targeting niche consumer segments and offering flexible repayment models. These companies emphasize responsible lending practices, customer-centric payment plans, and frictionless user experiences to support online retail growth in North America, Europe, and Asia-Pacific.

Additional participants including Bread Financial, QuickFee Group LLC, and other market players support industry expansion through white-label BNPL solutions, B2B financing, and merchant-integrated payment platforms. Their offerings help retailers improve conversion rates, increase average order values, and expand customer reach, positioning BNPL as a key component of modern e-commerce payment ecosystems.

Top Key Players in the Market

- Klarna Bank

- Splitit Payments Ltd

- Bread Financial

- Payright Limited

- Affirm Holdings Inc.

- Laybuy Holdings Limited

- PayPal

- Sezzle Inc.

- QuickFee Group LLC

- Zip co limited

- Others

Recent Developments

- October, 2025 – Klarna Bank launched a flexible debit card and digital wallet in the UK after gaining regulatory approval in July 2025. This move allows Klarna to expand beyond BNPL into more traditional banking services, aiming to deepen customer engagement and compete with established banks.

- May, 2025 – Payright Limited secured its position with required Australian Credit Licence compliance amid new regulatory standards for BNPL providers in Australia. The company is also committed to responsible lending and customer vulnerability considerations, preparing to maintain regulatory compliance while scaling operations.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Bn Forecast Revenue (2034) USD 86.2 Bn CAGR(2025-2034) 32.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Fashion Accessories, Mobiles and Laptops, Electronics Appliances, Others), By Repayment Model (Manual Repayment Schedules, Automatic Repayment), By End User (Gen Z (21-25), Millennials (26-40), Gen X (41-55), Baby Boomers (56-75)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Commerce Buy Now Pay Later MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

E-Commerce Buy Now Pay Later MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Klarna Bank

- Splitit Payments Ltd

- Bread Financial

- Payright Limited

- Affirm Holdings Inc.

- Laybuy Holdings Limited

- PayPal

- Sezzle Inc.

- QuickFee Group LLC

- Zip co limited

- Others