Global Dual Chamber Syringe Filling Machine Market Size, Share, Growth Analysis By Type (Automatic, Semi-automatic, Manual), By Application (Industrial Pharmacy, Hospital Pharmacy), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170413

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

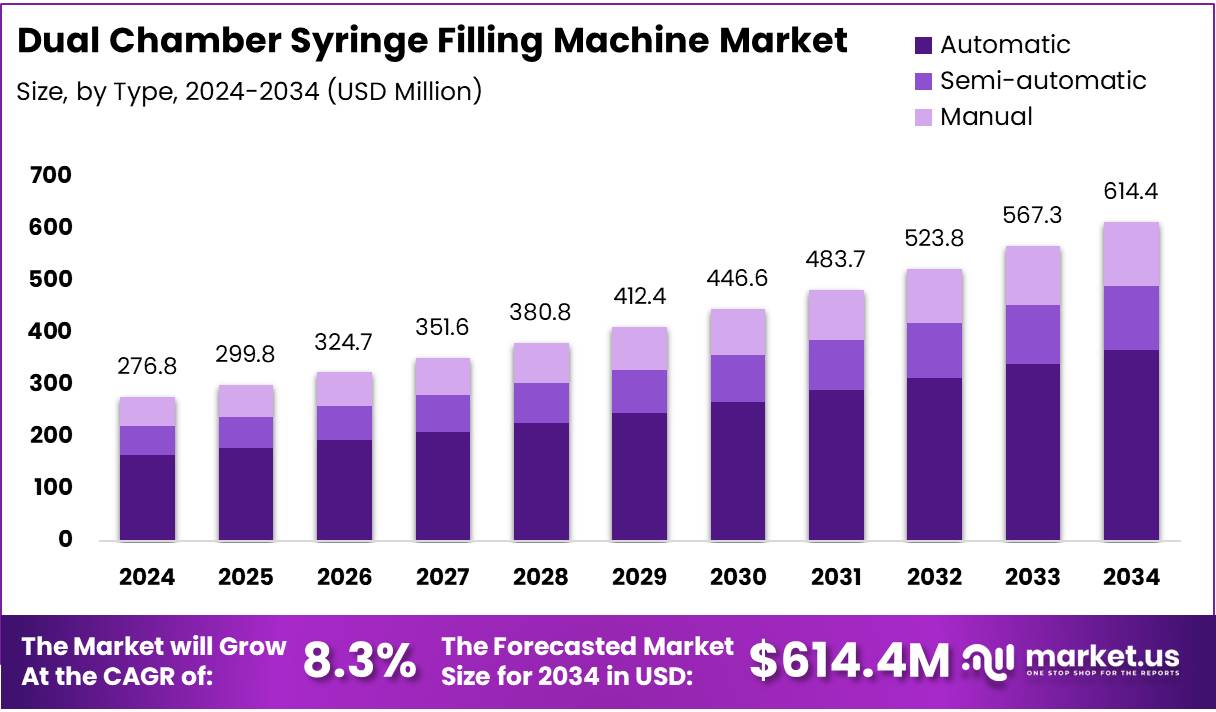

The Global Dual Chamber Syringe Filling Machine Market size is expected to be worth around USD 614.4 Million by 2034, from USD 276.8 Million in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The dual chamber syringe filling machine market addresses pharmaceutical manufacturing needs through specialized equipment designed for precise, sterile filling operations. These automated systems handle complex drug formulations requiring separate storage of active ingredients and reconstitution solutions. Manufacturers increasingly adopt these technologies to enhance production efficiency while maintaining stringent quality standards across biopharmaceutical applications.

Market growth accelerates as pharmaceutical companies prioritize patient safety and operational excellence. Dual chamber syringes reduce medication preparation complexity, enabling healthcare providers to deliver treatments faster and more accurately. This technology proves particularly valuable for biologics, vaccines, and emergency medications where immediate reconstitution becomes critical for therapeutic effectiveness.

Regulatory frameworks worldwide increasingly mandate advanced filling technologies to minimize contamination risks. Government bodies recognize that precision engineering reduces human error in drug preparation, consequently supporting investments in automated filling infrastructure. Healthcare authorities across developed and emerging markets establish guidelines favoring closed-system processing, driving pharmaceutical manufacturers toward sophisticated filling solutions.

Investment opportunities expand as biotechnology sectors demand higher production capacities. Semi-automatic systems processing approximately 400-800 containers hourly suit smaller batch requirements, while fully automatic inline configurations achieve 1,000-3,000 containers hourly for large-scale operations. High-end models reach impressive speeds of 400 syringes per minute, translating to 24,000 units hourly, demonstrating substantial throughput advantages for commercial manufacturing.

Clinical evidence strengthens market adoption through measurable safety improvements. Studies document a 32% reduction in dosing errors when utilizing dual-chamber devices compared to traditional vial-and-syringe methods. Furthermore, these systems enable rapid mixing of therapeutic agents with sterile solutions, reducing treatment initiation time by 65% compared to conventional preparation techniques. Such performance metrics underscore the technology’s value proposition across emergency medicine and critical care settings.

Key Takeaways

- The Global Dual Chamber Syringe Filling Machine Market is expected to grow from USD 276.8 Million in 2024 to USD 614.4 Million by 2034.

- The market is projected to grow at a CAGR of 8.3% during the forecast period from 2025 to 2034.

- Automatic systems dominate the market by type segment with 59.9% share due to superior efficiency and precision capabilities.

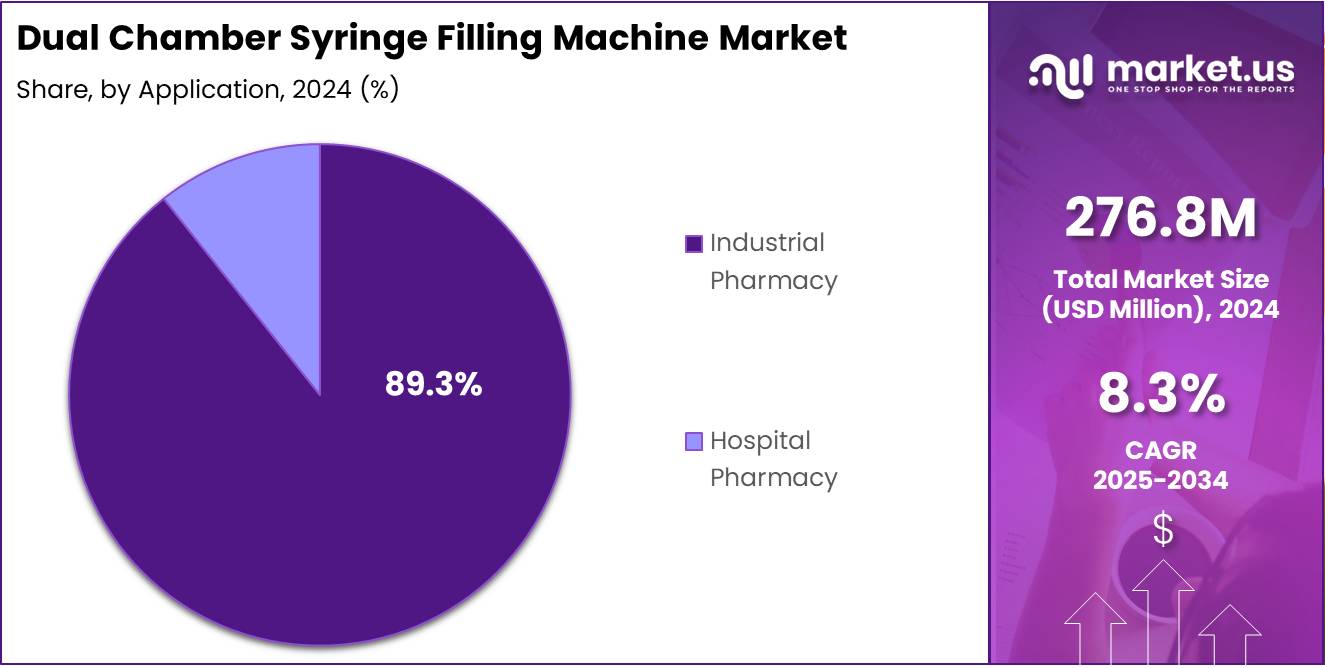

- Industrial Pharmacy holds the largest market share in the application segment at 89.3%, driven by large-scale production requirements.

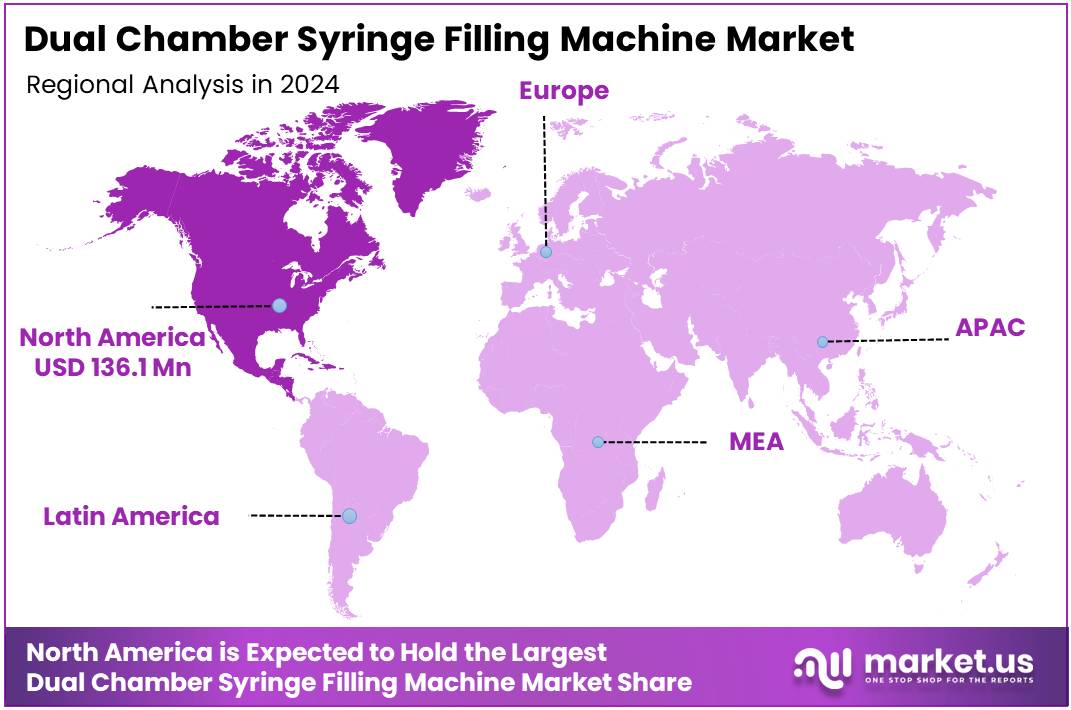

- North America leads the regional market with 49.2% share, valued at USD 136.1 Million, supported by robust pharmaceutical infrastructure.

By Type Analysis

Automatic systems dominate with 59.9% due to their superior efficiency and precision capabilities.

In 2024, Automatic held a dominant market position in the By Type Analysis segment of Dual Chamber Syringe Filling Machine Market, with a 59.9% share. These systems deliver exceptional speed and accuracy, significantly reducing human error while maximizing throughput. Manufacturers increasingly prefer automatic machines as they ensure consistent quality control and minimize contamination risks. Furthermore, these systems seamlessly integrate with existing production lines, offering advanced features like real-time monitoring and automated quality checks that enhance operational efficiency.

Semi-automatic filling machines represent a balanced solution between cost and functionality. These systems require minimal operator intervention while maintaining reasonable production speeds. They particularly appeal to mid-sized pharmaceutical manufacturers seeking upgraded capabilities without substantial capital investment. Additionally, semi-automatic machines offer flexibility in handling various batch sizes and formulation requirements, making them suitable for companies transitioning from manual to fully automated processes.

Manual filling machines continue serving niche applications despite technological advances. These systems remain relevant for small-scale operations, research facilities, and specialized production runs requiring meticulous oversight. Manual machines provide cost-effective entry points for startups and enable precise control during developmental phases. However, their limited throughput and higher labor dependency restrict widespread adoption in large-scale commercial manufacturing environments.

By Application Analysis

Industrial Pharmacy dominates with 89.3% due to large-scale production requirements and stringent quality standards.

In 2024, Industrial Pharmacy held a dominant market position in the By Application Analysis segment of Dual Chamber Syringe Filling Machine Market, with an 89.3% share. This sector drives substantial demand as pharmaceutical companies manufacture high-volume injectable medications requiring dual-chamber technology. Industrial facilities prioritize automated filling solutions that comply with regulatory standards while ensuring sterility and precision. Moreover, increasing global demand for biologics and combination therapies necessitates advanced filling equipment capable of handling complex formulations efficiently and reliably.

Hospital Pharmacy applications represent a specialized yet growing market segment. These facilities utilize dual chamber syringe filling machines for preparing customized medication dosages and compounding specialized treatments. Hospital pharmacies focus on smaller-batch production with emphasis on patient-specific formulations and immediate availability. Consequently, these institutions typically invest in compact, versatile filling systems that accommodate diverse therapeutic requirements while maintaining strict aseptic conditions and adhering to hospital-grade quality protocols.

Key Market Segments

By Type

- Automatic

- Semi-automatic

- Manual

By Application

- Industrial Pharmacy

- Hospital Pharmacy

Drivers

Rising Chronic Disease Burden and Precision Manufacturing Investments Drive Dual Chamber Syringe Filling Machine Market

The global healthcare landscape is witnessing a significant surge in chronic diseases such as diabetes, cardiovascular disorders, and autoimmune conditions. These complex health issues often require multi-component therapies where two separate drugs must be mixed before administration. Dual chamber syringes provide an ideal solution, directly fueling demand for advanced filling machines.

Medication errors remain a critical concern in pharmaceutical manufacturing. Precision filling technologies integrated into dual chamber syringe machines significantly reduce human error by automating dosage accuracy and ensuring consistent component separation. These systems employ advanced sensors that maintain exact fill volumes, minimizing waste and enhancing patient safety.

The pharmaceutical industry is embracing smart manufacturing and Industry 4.0 principles. Modern dual chamber syringe filling machines now feature IoT connectivity, real-time monitoring, and predictive maintenance capabilities. These technological advancements improve operational efficiency, reduce downtime, and ensure compliance with stringent quality standards, making them attractive investments for pharmaceutical manufacturers.

Restraints

Regulatory Compliance Complexities in Multi-Compartment Drug Filling Standards

The dual chamber syringe filling machine market faces significant restraints due to stringent regulatory requirements. Manufacturers must comply with multiple international standards including FDA, EMA, and other regional authorities. Each regulatory body has specific guidelines for multi-compartment drug packaging, creating a complex compliance landscape. The approval process is time-consuming and expensive, requiring extensive testing and documentation.

Ensuring sterility and preventing cross-contamination presents major technical challenges. Dual chamber systems require precise control to keep ingredients separate until administration. Any contamination between chambers can compromise drug efficacy and patient safety. Manufacturers must implement advanced monitoring systems, cleanroom protocols, and specialized filling technologies.

These technical demands increase production costs significantly. The risk of product recalls due to contamination concerns makes pharmaceutical companies cautious about adopting new filling technologies, slowing market growth and limiting innovation in the sector.

Growth Factors

Rising Adoption of Bi-Dose and Combination Drug Delivery Systems

The dual chamber syringe filling machine market is experiencing strong growth opportunities driven by increasing demand for combination therapies. Pharmaceutical companies are developing more bi-dose formulations that require separate storage of active ingredients. The trend toward personalized medicine is accelerating adoption of dual chamber technology across therapeutic areas.

Contract Development and Manufacturing Organizations (CDMOs) are rapidly expanding their capabilities in specialized filling services. These organizations are investing in dual chamber filling equipment to serve pharmaceutical clients who lack in-house manufacturing capacity. This outsourcing trend creates sustained demand for advanced filling machines.

Integration of smart technologies presents significant opportunities for equipment manufacturers. IoT-enabled filling machines offer real-time monitoring, predictive maintenance, and data analytics capabilities. These features reduce downtime, improve operational efficiency, and ensure consistent product quality. The digital transformation of manufacturing processes is creating new revenue streams for equipment suppliers who can offer connected, intelligent filling solutions.

Emerging Trends

Shift Toward Modular and Flexible Production Line Configurations

The dual chamber syringe filling machine market is witnessing a clear shift toward modular production systems. Manufacturers are moving away from fixed production lines to flexible configurations that can handle multiple product formats. This modular approach allows pharmaceutical companies to quickly adapt to changing market demands and product portfolios.

Personalized medicine and small batch production are reshaping manufacturing strategies. Dual chamber filling machines now need to efficiently handle smaller production runs without compromising quality or economics. This requirement is driving innovation in quick-changeover systems and automated cleaning processes that minimize downtime between batches.

Strategic collaborations between equipment manufacturers and pharmaceutical companies are becoming more common. OEMs are working directly with drug developers to create customized filling solutions tailored to specific product requirements. These partnerships enable co-development of machinery that addresses unique formulation challenges. Such collaborations accelerate technology adoption and help both parties gain competitive advantages through shared expertise and resources.

Regional Analysis

North America Dominates the Dual Chamber Syringe Filling Machine Market with a Market Share of 49.2%, Valued at USD 136.1 Million

North America maintains a commanding position in the dual chamber syringe filling machine market, accounting for 49.2% of the global market share with a valuation of USD 136.1 million. The region’s dominance is driven by its robust pharmaceutical and biotechnology sectors, stringent FDA regulatory standards, and significant investments in advanced drug delivery systems. The growing demand for combination therapies and the expansion of contract manufacturing organizations specializing in sterile injectables continue to fuel market growth in this region.

Europe Dual Chamber Syringe Filling Machine Market Trends

Europe represents a significant market for dual chamber syringe filling machines, supported by its well-established pharmaceutical industry and strong focus on biologics production. Leading countries such as Germany, Switzerland, and France are driving adoption through stringent EMA quality standards and substantial investments in manufacturing infrastructure. The rising geriatric population and increasing demand for lyophilized drug delivery systems continue to propel market expansion across the region.

Asia Pacific Dual Chamber Syringe Filling Machine Market Trends

The Asia Pacific region is experiencing rapid growth, emerging as a key manufacturing hub for pharmaceutical production. Countries like China, India, Japan, and South Korea are witnessing substantial sector expansion driven by favorable government initiatives, cost-effective manufacturing, and growing healthcare expenditure. The increasing prevalence of chronic diseases and the region’s position as a global generic drug production center are creating significant opportunities for dual chamber syringe filling machine adoption.

Middle East and Africa Dual Chamber Syringe Filling Machine Market Trends

The Middle East and Africa region presents emerging opportunities with healthcare infrastructure undergoing significant modernization, particularly in the UAE, Saudi Arabia, and South Africa. Governments are prioritizing pharmaceutical manufacturing capabilities and establishing regulatory frameworks aligned with international standards. While the market faces challenges related to technical expertise and capital constraints, growing healthcare investments and rising disease burden are expected to gradually drive adoption of advanced filling systems.

Latin America Dual Chamber Syringe Filling Machine Market Trends

Latin America is witnessing steady growth in the dual chamber syringe filling machine market, led by Brazil and Mexico with their expanding pharmaceutical manufacturing activities. The region’s focus on strengthening domestic production capabilities and meeting international quality standards is driving market development. Rising prevalence of chronic diseases requiring combination therapies presents favorable opportunities, though economic volatility and regulatory complexities remain challenges to widespread technology adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dual Chamber Syringe Filling Machine Company Insights

Syntegon Technology continues to dominate the global dual chamber syringe filling machine market in 2024, leveraging its extensive expertise in pharmaceutical packaging solutions and advanced automation capabilities. The company’s robust portfolio of filling technologies, combined with its commitment to innovation and regulatory compliance, positions it as a preferred partner for biopharmaceutical manufacturers seeking precision and reliability in dual chamber syringe applications.

Prosys Servo Filling Systems has established itself as a significant player through its specialized servo-driven filling technologies that offer enhanced accuracy and flexibility for dual chamber applications. The company’s focus on customizable solutions and integration capabilities addresses the growing demand for versatile filling equipment that can accommodate various product viscosities and fill volumes in the pharmaceutical sector.

Dara Pharmaceutical Packaging maintains a competitive position in the market by providing comprehensive filling solutions tailored to the unique requirements of dual chamber syringe systems. Their emphasis on user-friendly operation and maintenance, coupled with adherence to stringent pharmaceutical manufacturing standards, makes them a reliable choice for companies seeking efficient production capabilities.

TurboFil Packaging Machine contributes to the market landscape with its innovative approach to high-speed filling technologies designed specifically for complex pharmaceutical delivery systems. The company’s expertise in developing equipment that ensures product integrity and sterility throughout the filling process appeals to manufacturers prioritizing quality and contamination control in dual chamber syringe production.

Top Key Players in the Market

- Syntegon Technology

- Prosys Servo Filling Systems

- Dara Pharmaceutical Packaging

- TurboFil Packaging Machine

- Dymax Corporation

- Ashby Cross

- Wenzhou Zhonguan Packaging Machinery

- Optima Machinery Corporation

- Mutual Corporation

- Shanghai Packaging Machinery

Recent Developments

- In December 2025, Radiant Industries showcased its Automatic Dual Chamber Syringe Filling & Stoppering Machine (Liquid+Liquid) & (Powder+Liquid). This demonstrates ongoing innovation in dual-chamber syringe filling technology for pharmaceutical manufacturing.

- In April 2025, Syntegon launched the MLD Advanced filling machine for RTU syringes, processing up to 400 syringes per minute with 100% IPC. This advancement enhances high-speed filling capabilities with quality assurance in prefilled syringe production.

- In March 2024, SCHOTT Pharma opened a new prefillable syringe manufacturing facility in Wilson, North Carolina. This expansion supports growing demand for prefilled syringes, particularly for GLP-1 therapies and dual-chamber delivery systems.

- In October 2024, Syntegon acquired Telstar, integrating freeze-dryers and loading systems for complete DCS line solutions. This merger strengthens end-to-end capabilities for lyophilized pharmaceuticals and dual-chamber syringe manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 276.8 Million Forecast Revenue (2034) USD 614.4 Million CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Automatic, Semi-automatic, Manual), By Application (Industrial Pharmacy, Hospital Pharmacy) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Syntegon Technology, Prosys Servo Filling Systems, Dara Pharmaceutical Packaging, TurboFil Packaging Machine, Dymax Corporation, Ashby Cross, Wenzhou Zhonguan Packaging Machinery, Optima Machinery Corporation, Mutual Corporation, Shanghai Packaging Machinery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dual Chamber Syringe Filling Machine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Dual Chamber Syringe Filling Machine MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Syntegon Technology

- Prosys Servo Filling Systems

- Dara Pharmaceutical Packaging

- TurboFil Packaging Machine

- Dymax Corporation

- Ashby Cross

- Wenzhou Zhonguan Packaging Machinery

- Optima Machinery Corporation

- Mutual Corporation

- Shanghai Packaging Machinery