Global Dry Local Scrubber Market Size, Share, Growth Analysis By Type (Adsorption-Type, Catalytic-Type, Thermal Oxidizer-Based, Plasma-Based, and Others), By Application (Semiconductor Manufacturing, Chemical Processing, Pharmaceuticals, Electronics Assembly, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171427

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

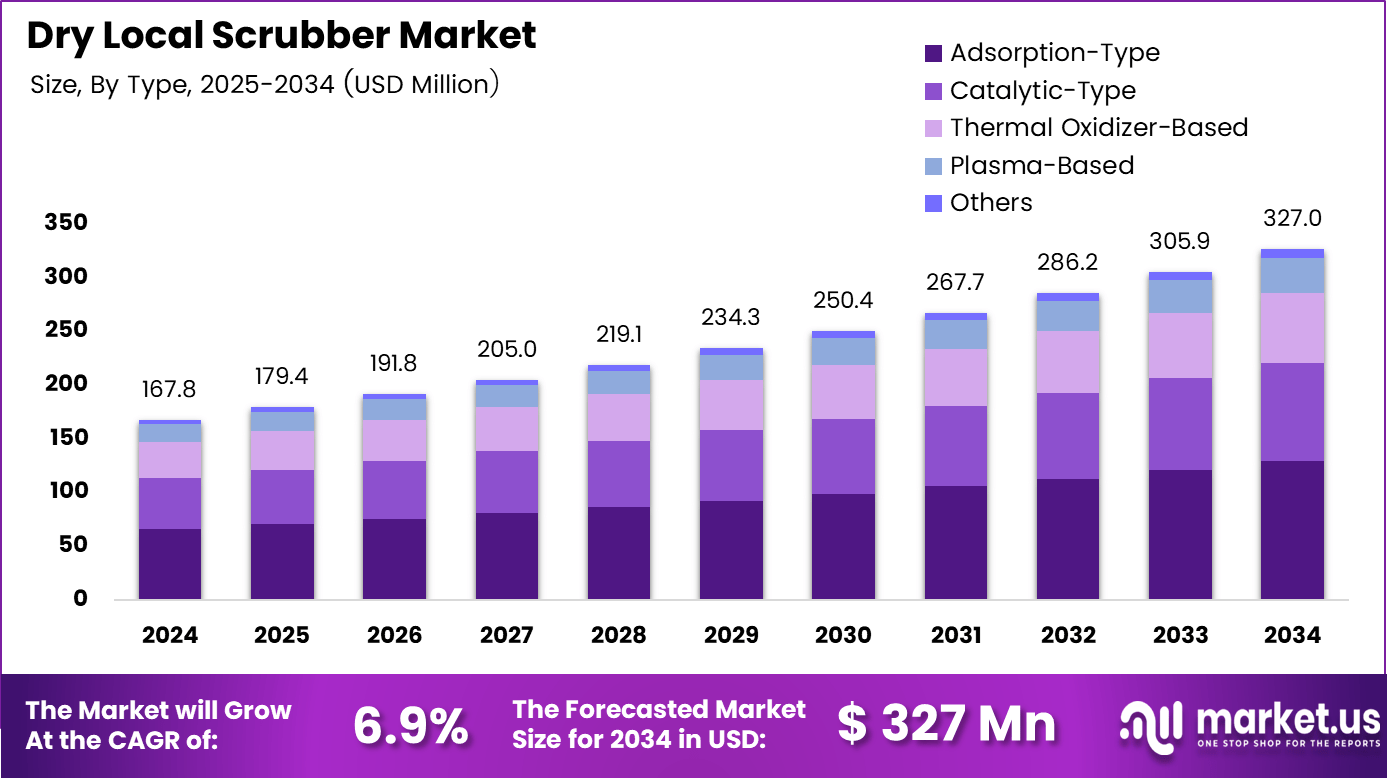

The Global Dry Local Scrubber Market size is expected to be worth around USD 327 million by 2034, from USD 167.8 million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Stricter air quality regulations across industries strongly support the adoption of dry local scrubbers. Environmental authorities increasingly require factories to control emissions directly at the source, especially for acidic gases and toxic fumes. Dry local scrubbers help industries meet compliance targets without installing large centralized systems, making them practical for regulated operations.

Chemical and pharmaceutical plants continue to adopt localized contamination capture to protect sensitive processes. These facilities handle hazardous vapors that demand immediate neutralization. Dry local scrubbers offer targeted removal, reducing the spread of contaminants and maintaining clean production zones, which supports consistent product quality.

Worker safety remains a major concern in industrial environments dealing with corrosive or toxic gases. Dry local scrubbers reduce airborne exposure at emission points, improving indoor air conditions. This approach supports occupational safety programs and lowers health related risks for operators.

Looking at market opportunities, portable and modular dry local scrubbers are gaining traction among small and mid scale manufacturing units. According survey, dry scrubber efficiencies reach up to 99.9%, with handling capacities ranging from 50 to 30,000 CFM. Portable dry scrubbers also achieve efficiencies up to 99.9%, supporting compact capacities between 100 and 300 CFM.

Regulatory support further strengthens long term market potential. According to the Survey, dry scrubber processes can achieve approximately 95% SO2 removal efficiency. Due to this high performance, the Ca:S ratio remains lower at 1.2–1.5, improving reagent utilization and overall operating economics compared to sorbent injection systems.

According to studies, spray dry scrubbers typically deliver SO2 removal efficiency between 90 and 95, making them the second most widely used SO2 control process. Dry local scrubbers, constructed using MS powder coated steel, SS 304, and SS 316, therefore offer a balanced solution combining durability, efficiency, and regulatory compliance.

Key Takeaways

- The Global Dry Local Scrubber Market is projected to grow from USD 167.8 million in 2024 to USD 327 million by 2034, expanding at a CAGR of 6.9% during 2025 to 2034.

- Adsorption-Type systems dominate the market by type, accounting for a leading share of 39.4% due to their suitability for localized and low temperature emission control.

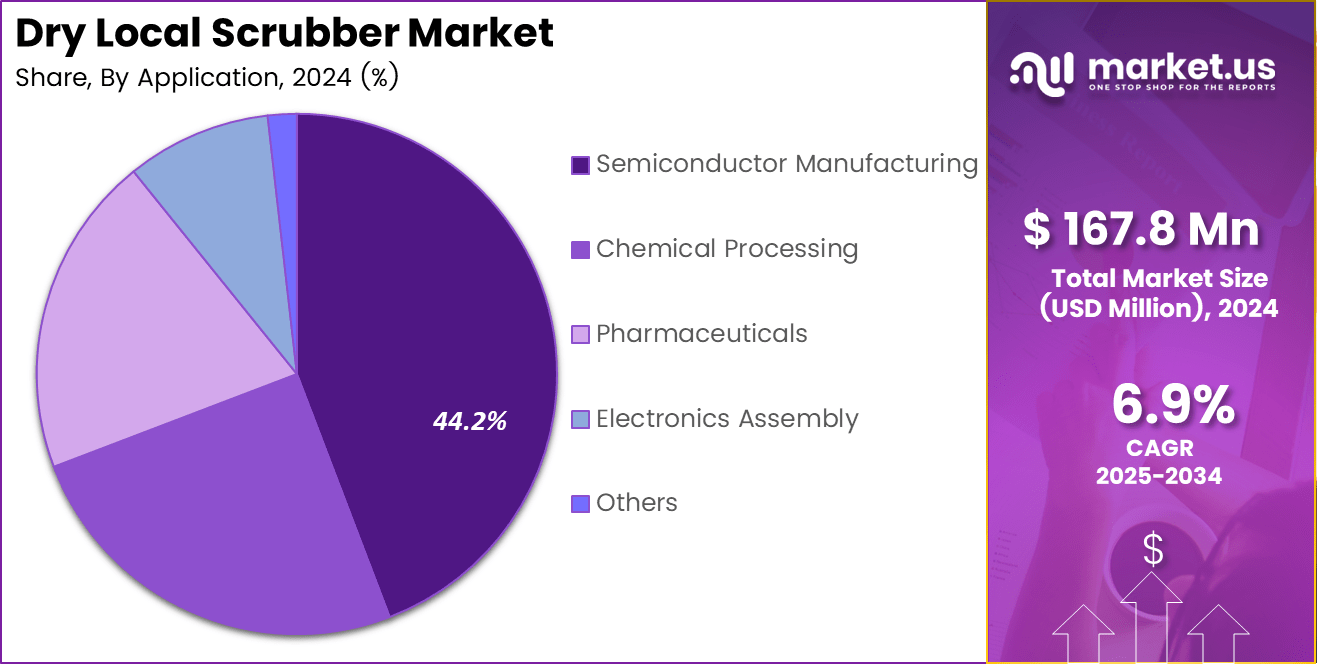

- Semiconductor Manufacturing represents the largest application segment, holding a dominant share of 44.2% driven by stringent contamination control requirements.

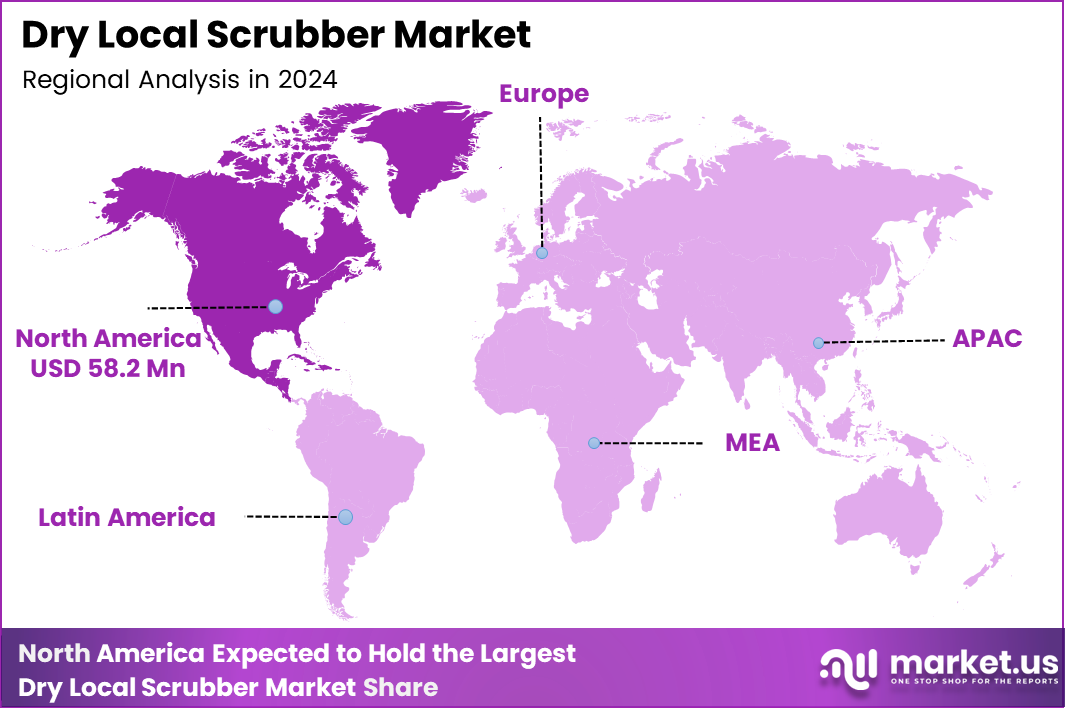

- North America leads the global market with a share of 34.7%, with the regional market valued at USD 58.2 Million in 2024.

- Asia Pacific is emerging as a high growth regional market, supported by rapid expansion of semiconductor, electronics, and pharmaceutical manufacturing facilities.

By Type Analysis

Adsorption-Type dominates with 39.4% due to its operational flexibility and strong suitability for point-of-use emission control.

In 2024, Adsorption-Type held a dominant market position in the By Type Analysis segment of Dry Local Scrubber Market, with a 39.4% share. This segment benefits from simple system design and effective removal of acid gases at low temperatures. It supports continuous operations and aligns well with cleanroom environments. Industries favor it for predictable performance and reduced maintenance complexity.

Catalytic-Type scrubbers maintain relevance due to their ability to treat specific hazardous exhaust streams efficiently. These systems support lower energy consumption by enabling reactions at reduced temperatures. Adoption continues in facilities requiring consistent conversion efficiency. Their integration with advanced process controls improves compliance reliability and operational stability.

Thermal Oxidizer-Based systems address high-concentration exhaust streams through controlled oxidation. These units perform well under demanding industrial conditions and support destruction of complex compounds. Facilities with elevated thermal tolerance prefer this approach. However, higher energy input requirements influence selective deployment decisions.

Plasma-Based scrubbers gain attention for advanced abatement needs requiring rapid reaction kinetics. They support compact installation and handle variable exhaust compositions effectively. Adoption remains selective due to system complexity. Ongoing technology refinements continue to improve scalability and operational consistency.

Other scrubber types serve niche requirements across specialized industrial setups. These solutions address unique chemical profiles or space constraints. Their role remains supportive within the broader market. Customization and application-specific design drive their continued utilization.

By Application Analysis

Semiconductor Manufacturing dominates with 44.2% driven by stringent contamination control and advanced fabrication requirements.

In 2024, Semiconductor Manufacturing held a dominant market position in the By Application Analysis segment of Dry Local Scrubber Market, with a 44.2% share. This dominance reflects rising wafer fabrication complexity and strict air quality standards. Localized exhaust treatment ensures tool-level emission control. Continuous capacity expansion further strengthens adoption.

Chemical Processing applications rely on dry local scrubbers to manage corrosive and toxic gas releases. These systems support safer handling of reactive exhausts. Facilities value their integration with existing production lines. Compliance-driven upgrades sustain steady demand across this segment.

Pharmaceutical manufacturing adopts dry local scrubbers to protect controlled environments and ensure operator safety. Precision exhaust treatment supports regulatory adherence. These systems align with cleanroom protocols. Growth remains tied to facility modernization and capacity additions.

Electronics Assembly facilities utilize scrubbers to control fumes generated during soldering and surface treatment. Compact designs suit space-limited production floors. Emission consistency supports product quality goals. Automation trends reinforce gradual adoption.

Other applications include research laboratories and specialty manufacturing units. These users require flexible and scalable abatement solutions. Demand remains project-driven. Custom engineering and compliance needs sustain this segment’s presence.

Key Market Segments

By Type

- Adsorption-Type

- Catalytic-Type

- Thermal Oxidizer-Based

- Plasma-Based

- Others

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceuticals

- Electronics Assembly

- Others

Drivers

Escalating Industrial Air Quality Regulations Drive Market Growth

Stricter air quality regulations across industries strongly support the adoption of dry local scrubbers. Environmental authorities increasingly require factories to control emissions directly at the source, especially for acidic gases and toxic fumes. Dry local scrubbers help industries meet compliance targets without installing large centralized systems, making them practical for regulated operations.

Chemical and pharmaceutical plants continue to adopt localized contamination capture to protect sensitive processes. These facilities handle hazardous vapors that demand immediate neutralization. Dry local scrubbers offer targeted removal, reducing the spread of contaminants and maintaining clean production zones, which supports consistent product quality.

Worker safety remains a major concern in industrial environments dealing with corrosive or toxic gases. Dry local scrubbers reduce airborne exposure at emission points, improving indoor air conditions. This approach supports occupational safety programs and lowers health related risks for operators.

Retrofit projects further accelerate demand as industries upgrade older plants. Compact dry scrubbers fit easily into existing layouts, allowing facilities to improve emission control without major structural changes.

Restraints

High Upfront Investment Limits Market Expansion

The cost of installing dry local scrubbers can restrict adoption, particularly for customized configurations. Each industrial process generates different pollutants, requiring tailored designs that increase initial capital spending. Small facilities often delay investments due to budget constraints.

Performance limitations also act as restraints. Dry local scrubbers show reduced effectiveness when handling high moisture or sticky particulate emissions. In such cases, wet systems or hybrid solutions may deliver better results, limiting dry scrubber suitability for certain applications.

Maintenance complexity further challenges market growth. Sorbent handling, replacement, and disposal require trained personnel and proper waste management practices. These ongoing operational demands add to lifecycle costs and discourage adoption in resource limited settings.

Growth Factors

Expansion in Electronics Manufacturing Creates New Opportunities

Semiconductor and electronics manufacturing presents strong growth opportunities for dry local scrubbers. These facilities require precise control of corrosive and toxic gases used in etching and cleaning processes. Localized dry systems help protect cleanroom environments and sensitive equipment.

Small and mid scale industrial units increasingly seek affordable emission control solutions. Dry local scrubbers offer localized treatment without the cost of centralized infrastructure, making them suitable for workshops and specialty manufacturing units.

Advances in filtration media also create opportunity. New sorbents enhance removal of multiple pollutants simultaneously, improving system efficiency and expanding application scope across industries.

Emerging economies with tightening emission norms further support market growth. As compliance standards strengthen, localized dry scrubbers become attractive for rapid and cost effective upgrades.

Emerging Trends

Shift Toward Modular Designs Shapes Market Trends

Modular and skid mounted dry scrubber designs are gaining attention due to easy installation and scalability. These systems reduce setup time and support phased capacity expansion, which appeals to dynamic industrial operations.

Sorbent innovation also shapes trends. Low waste and regenerable materials reduce disposal volumes and operating costs, aligning with sustainability goals and stricter waste regulations.

Digital integration continues to influence the market. IoT based monitoring enables real time tracking of emissions and system performance. This trend improves operational visibility, supports preventive maintenance, and helps facilities maintain consistent regulatory compliance.

Regional Analysis

North America Dominates the Dry Local Scrubber Market with a Market Share of 34.7%, Valued at USD 58.2 Million

North America accounted for a dominant 34.7% share of the Dry Local Scrubber Market, with the regional market valued at USD 58.2 Million, driven by strict industrial air emission regulations and widespread enforcement of point source pollution control standards. Strong adoption across semiconductor fabrication, chemical processing, and pharmaceutical manufacturing facilities continues to support demand for localized exhaust treatment solutions. The region also benefits from high retrofit activity in legacy industrial plants, where compact dry scrubber systems are preferred due to space and energy efficiency considerations.

Europe Dry Local Scrubber Market Trends

Europe represents a mature yet steadily advancing market, supported by stringent environmental compliance frameworks focused on workplace safety and hazardous gas exposure reduction. The presence of advanced manufacturing clusters across chemicals, specialty materials, and electronics drives consistent deployment of dry local scrubbers at emission points. Ongoing investments in industrial decarbonization and cleaner production processes are expected to sustain stable regional demand.

Asia Pacific Dry Local Scrubber Market Trends

Asia Pacific is emerging as a high-growth region due to rapid expansion of semiconductor manufacturing, electronics assembly, and pharmaceutical production hubs. Increasing regulatory scrutiny around industrial air quality, particularly in urban manufacturing zones, is accelerating adoption of localized scrubbing solutions. Cost-effective installation and scalability make dry local scrubbers attractive for both new facilities and phased capacity expansions.

Middle East and Africa Dry Local Scrubber Market Trends

The Middle East and Africa market is gradually expanding, supported by growth in petrochemical processing, specialty chemicals, and emerging pharmaceutical manufacturing. Industrial safety regulations and rising awareness of occupational health risks are encouraging adoption of point source emission control systems. Demand is largely concentrated in industrial zones with new facility development and modernization initiatives.

Latin America Dry Local Scrubber Market Trends

Latin America shows moderate growth, driven by expanding chemical processing and electronics manufacturing service activities in select countries. Regulatory emphasis on industrial emissions control and worker exposure reduction is strengthening the adoption outlook for dry local scrubbers. Gradual industrial modernization and increasing compliance enforcement are expected to support steady market progression across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dry Local Scrubber Company Insights

In the competitive landscape of the global Dry Local Scrubber Market in 2024, several industry participants are demonstrating strong capabilities in innovation, product reliability, and tailored solutions for diverse industrial requirements.

Ebara Corporation continues to build on its engineering legacy by offering robust dry scrubber systems known for their durability and precision control. Their solutions are increasingly sought after in sectors where emission standards are stringent and operational continuity is critical.

Another noteworthy contender, Global Standard Technology, has distinguished itself through a focused approach to customizable local scrubbing applications. By aligning product development closely with client-specific process needs, the company has enhanced its relevance among manufacturers seeking flexible, space-efficient emission control systems. Their emphasis on responsive technical support further reinforces their market position.

In the same vein, UNISEM is gaining recognition for effectively integrating advanced material science into scrubber components, resulting in systems that deliver consistent performance and lower maintenance intervals. Their proactive engagement with emerging industry requirements positions them well as end users increasingly prioritize lifecycle value and total cost of ownership in procurement decisions.

Meanwhile, Kanken Techno Co., Ltd. has solidified its presence through its commitment to sustainability-driven design principles. Emphasizing energy-efficient operation and compliance with evolving environmental regulations, their product portfolio addresses both current and anticipated performance criteria. This orientation not only aligns with global trends toward cleaner production but also provides a platform for long-term customer partnerships.

Collectively, these key players are shaping the Dry Local Scrubber Market by investing in technological refinement and customer-centric strategies. Their varied strengths—from engineering excellence and customization to material innovation and sustainability—underscore a dynamic market environment that rewards adaptability and forward-looking product development.

Top Key Players in the Market

- Ebara Corporation

- Global Standard Technology

- UNISEM

- Kanken Techno Co., Ltd.

- GnBS Eco

- CS Clean Solution

- Triple Cores Technology

- Air Water Mechatronics, Inc.

- Taiyo Nippon Sanso Corporation

- Shareway Environment Technology

Recent Developments

- November 2025, Ebara announced the construction of its second dry vacuum pump overhaul plant in Pyeongtaek, South Korea, representing a strategic expansion of its after-sales and lifecycle service infrastructure. The facility is designed to address the increasing service intensity and uptime requirements of nearby semiconductor fabrication plants.

- In May 2025, UNISEM announced through its R&D division the development of regenerable media for dry scrubber systems, designed to reduce the frequency of hazardous waste disposal associated with spent resin canisters. This advancement supports lower operating costs, improved sustainability performance, and stronger alignment with green manufacturing and ESG objectives within semiconductor fabrication facilities.

Report Scope

Report Features Description Market Value (2024) USD 167.8 million Forecast Revenue (2034) USD 327.0 million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Adsorption-Type, Catalytic-Type, Thermal Oxidizer-Based, Plasma-Based, and Others), By Application (Semiconductor Manufacturing, Chemical Processing, Pharmaceuticals, Electronics Assembly, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ebara Corporation, Global Standard Technology, UNISEM, Kanken Techno Co., Ltd., GnBS Eco, CS Clean Solution, Triple Cores Technology, Air Water Mechatronics, Inc., Taiyo Nippon Sanso Corporation, Shareway Environment Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ebara Corporation

- Global Standard Technology

- UNISEM

- Kanken Techno Co., Ltd.

- GnBS Eco

- CS Clean Solution

- Triple Cores Technology

- Air Water Mechatronics, Inc.

- Taiyo Nippon Sanso Corporation

- Shareway Environment Technology