Global Drug Delivery Devices Market By Product Type (Biocides & Disinfectants, Personal Protective Equipment (PPE), Detection & Monitoring Equipment, Decontamination Systems, and Others), by Application (Agriculture, Healthcare, Food Industry, Defense & Military, and Others), By End-User (Government & Regulatory Bodies, Healthcare Institutions, Agricultural Sector, Research & Academia, and Private & Commercial Sectors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 19228

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

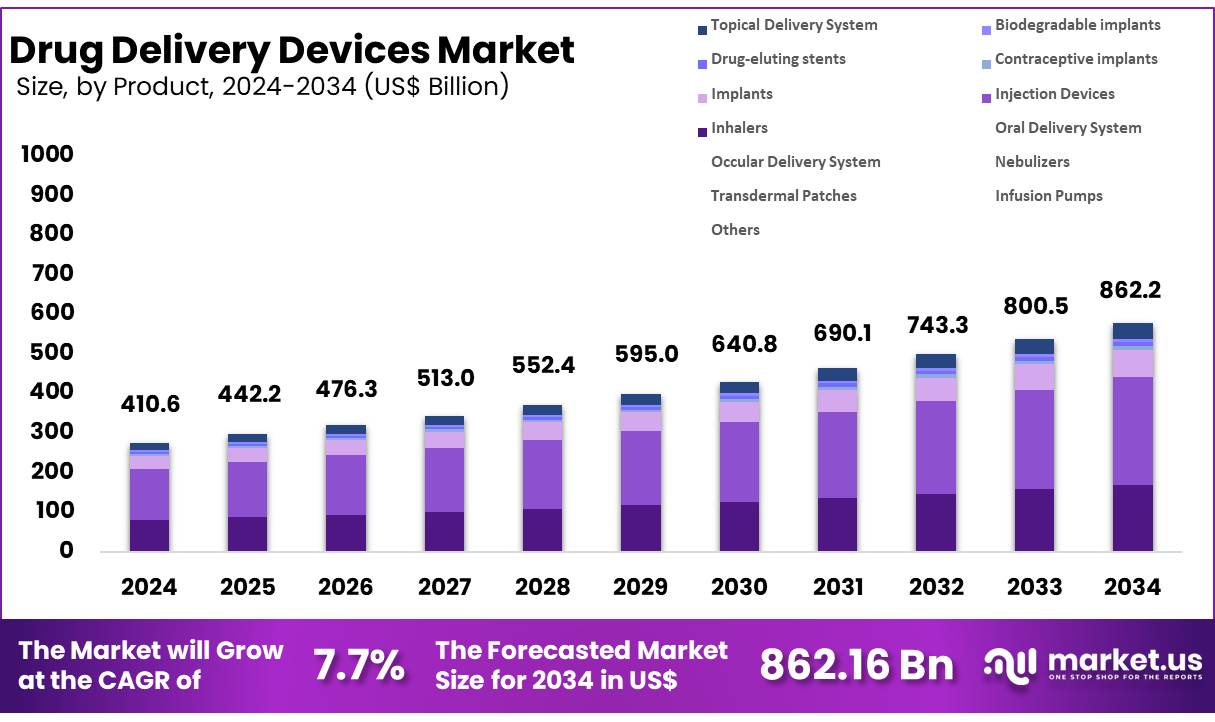

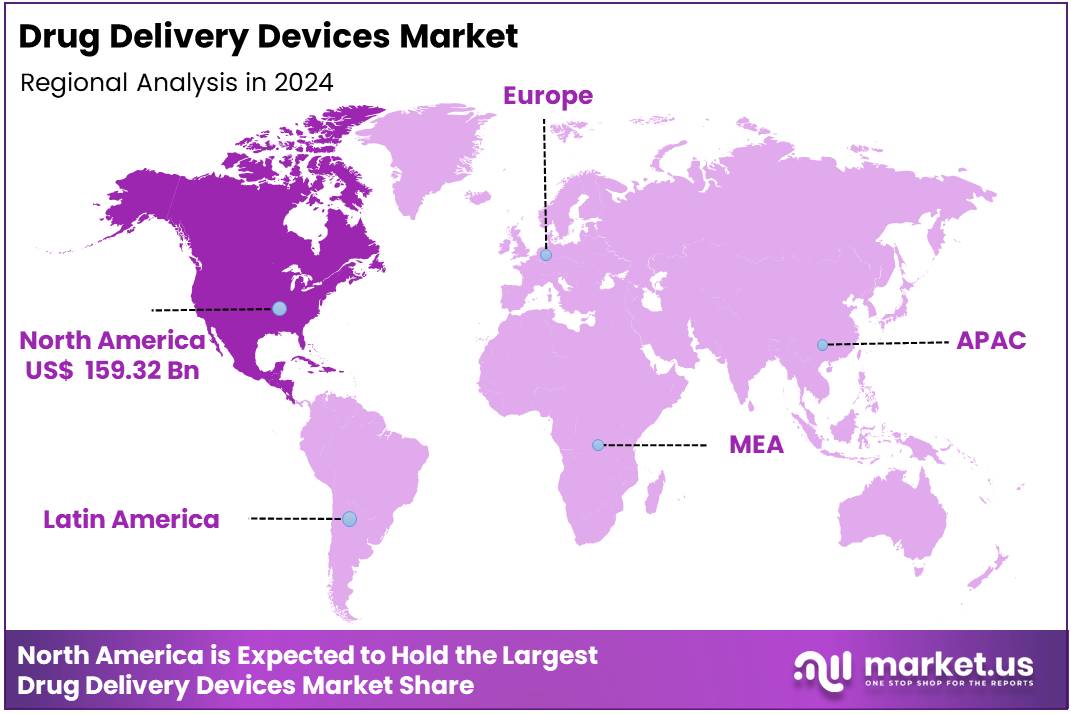

Global Drug Delivery Devices Market size is expected to be worth around US$ 862.16 Billion by 2034 from US$ 410.61 Billion in 2024, growing at a CAGR of 7.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 159.32 Billion.

Sales of weight management medications, particularly glucagon-like peptide-1s (GLP-1s) like Wegovy (semaglutide, Novo Nordisk) and Zepbound (tirzepatide, Eli Lilly), have witnessed a significant rise, growing from approximately US$40 billion (£31.8 billion) in 2023 to an estimated US$53 billion in 2024. This upward trajectory is projected to persist, with annual growth rates ranging between 16% and 18%.

In February 2024, Novo Holdings (Dartford, UK) made a headline-grabbing acquisition of Catalent for US$16.5 billion, shaking up the drug delivery market due to the saturation of fill-finish and injection device manufacturing capacity. Although this trend shows no immediate signs of slowing, a significant shift is anticipated as the core patents for semaglutide expire in various countries by 2026.

Closed-loop insulin systems continue to evolve, with the Omnipod 5 (Insulet, Acton, MA, US) pump now able to integrate seamlessly with either the FreeStyle Libre 2 (Abbott Diabetes Care, Chicago, IL, US) or Dexcom G6 (DexCom, San Diego, CA, US) continuous glucose sensors. Similarly, the t:slim X2 (Tandem Diabetes, San Diego, CA, US) integrates with the FreeStyle Libre 2. On the other hand, the demand for large-volume injection devices, such as 5 mL autoinjectors, is rising, alongside continued high demand for ophthalmic injector development, although details on the latest projects in this space remain confidential.

The drug delivery devices market has experienced significant growth in recent years, driven by advancements in technology, the increasing prevalence of chronic diseases, and the rising demand for biologic drugs. These devices are essential in ensuring the safe, efficient, and controlled delivery of medications, with applications spanning across injectables, oral, transdermal, and inhalation drug delivery systems.

Injectable devices, particularly auto-injectors and syringes, dominate the market due to their widespread use in chronic disease management, including diabetes and rheumatoid arthritis. Oral drug delivery devices, including smart pill dispensers, are gaining traction as patient compliance remains a critical factor in treatment success. The market is expected to grow significantly, fueled by the increasing adoption of biologics, which require specialized delivery systems for optimal efficacy.

Additionally, the shift toward home healthcare and self-administration devices is opening new growth avenues, particularly for injectable and transdermal solutions. The integration of digital technologies into drug delivery systems, such as sensors and connectivity for real-time monitoring, is also transforming the market by improving medication adherence and patient outcomes.

Key Takeaways

- In 2024, the market for Drug Delivery Devices generated a revenue of US$ 410.61 billion, with a CAGR of 7.7%, and is expected to reach US$ 862.16 billion by the year 2034.

- The product segment is divided into Inhalers, Injection Devices, Implants, Contraceptive implants, Drug-eluting stents, Biodegradable implants, Topical Delivery System, Oral Delivery System, Occular Delivery System, Nebulizers, Transdermal Patches, Infusion Pumps, and Others with Injection Devices taking the lead in 2024 with a market share of 31.4%.

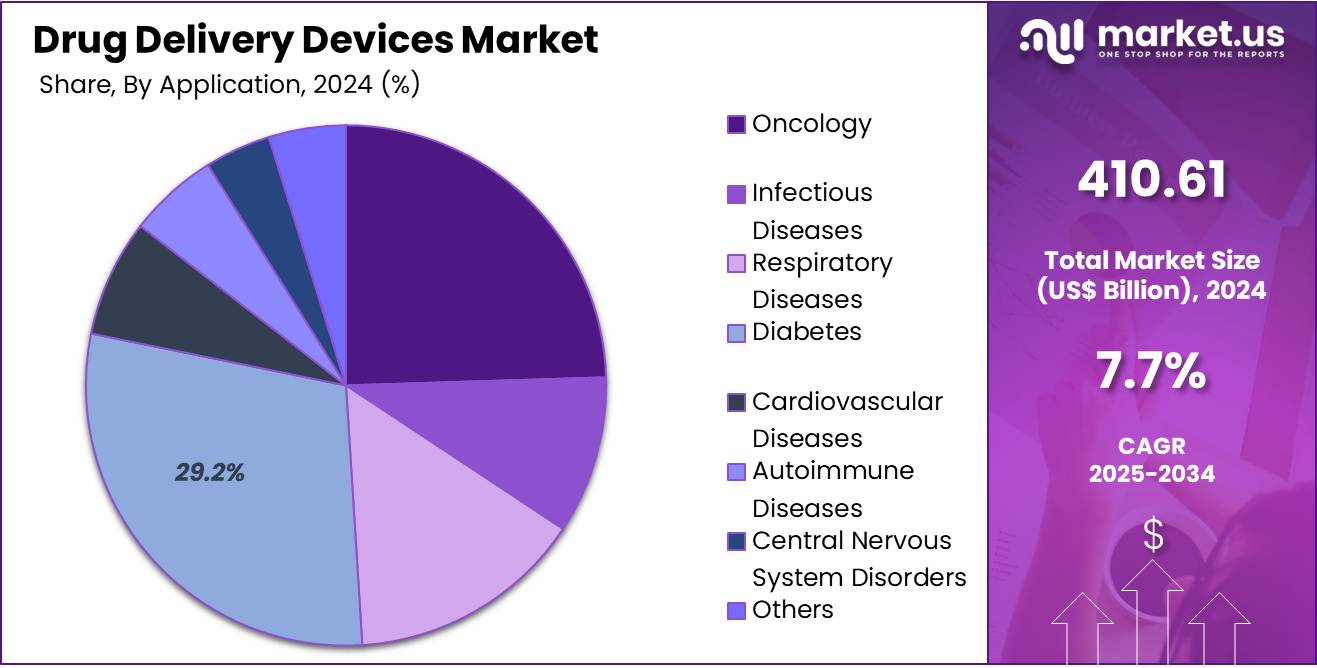

- By Application, the market is bifurcated into Oncology, Infectious Diseases, Respiratory Diseases, Diabetes, Cardiovascular Diseases, Autoimmune Diseases, Central Nervous System Disorders, and Others with Oncology leading the market with 29.2% of market share.

- Furthermore, concerning the End-User segment, the market is segregated into Hospitals, Diagnostic Centers, Ambulatory Surgery Centers/Clinics, Home Care Settings, and Others. The Hospitals stands out as the dominant segment, holding the largest revenue share of 44.8% in the Drug Delivery Devices market.

- North America led the market by securing a market share of 38.8% in 2024.

Product Type Analysis

Injection Devices dominated the market with 31.4% revenue share due to their widespread use in the management of diseases such as diabetes, cancer, and rheumatoid arthritis. Devices like syringes, insulin pens, and auto-injectors allow for precise dosage control and easy self-administration, increasing patient compliance. The rise of biologic drugs, which often require injectable delivery, has significantly contributed to the expansion of this segment.

Additionally, the growing prevalence of chronic diseases that require regular injections, such as diabetes, further supports the growth of this segment. For example, in June 2021, BD (Becton, Dickinson and Company), a prominent global medical technology firm, has announced the receipt of pandemic orders for 2 billion needles and syringes to aid in worldwide COVID-19 vaccination initiatives.

This new milestone highlights commitments from governments worldwide, including those in the United States, Australia, Brazil, Canada, France, Germany, India, the Philippines, Saudi Arabia, South Africa, Spain, the United Kingdom, and numerous others, as well as non-governmental organizations working to ensure vaccine distribution in developing nations.

Inhalers represent another dominant segment, especially for the treatment of respiratory diseases like asthma and chronic obstructive pulmonary disease (COPD). Metered-dose inhalers (MDIs) and dry powder inhalers (DPIs) are widely used due to their ability to deliver drugs directly to the lungs, ensuring rapid and effective treatment.

The increasing incidence of respiratory diseases, coupled with the shift towards personalized medicine and patient-friendly devices, has driven the demand for inhalers. This segment is expected to continue expanding as both disease prevalence and the need for non-invasive drug delivery solutions grow.

In February 2022, Aptar Pharma, a global leader in drug delivery systems, services, and active material science solutions, unveiled HeroTracker® Sense, an innovative digital respiratory health solution that transforms a standard metered dose inhaler (pMDI) into a smart, connected healthcare device.

HeroTracker® Sense is designed to enhance the lives of patients worldwide suffering from chronic respiratory conditions such as asthma, COPD, cystic fibrosis, and respiratory issues caused by COVID-19. The device enables users to track their MDI usage and promotes better adherence to prescribed therapies.

Application Analysis

Oncology is a leading application area due to the growing prevalence of cancer globally which accounted for 29.2% revenue share. Cancer treatments, particularly chemotherapy and targeted therapies, often require injectable or infusion-based drug delivery systems. The complexity and potency of cancer medications necessitate precision in dosage and timing, which injectable devices like infusion pumps and autoinjectors provide.

The increasing adoption of biologics and immunotherapies in oncology also contributes to the demand for specialized drug delivery systems, helping ensure the effective and controlled release of treatments. The market for drug delivery devices in oncology is expected to continue expanding as cancer incidence rises and new treatment modalities emerge. Diabetes is another dominant application, largely driven by the widespread need for insulin delivery and the growing global diabetes epidemic.

Injectable devices, such as insulin pens and pumps, are essential for diabetes management, offering convenience and precise control over blood sugar levels. In February 2022, Aptar Pharma, a global leader in drug delivery systems, services, and active material science solutions, unveiled HeroTracker Sense, an innovative digital respiratory health solution that transforms a standard metered dose inhaler (pMDI) into a smart, connected healthcare device.

HeroTracker Sense is designed to enhance the lives of patients worldwide suffering from chronic respiratory conditions such as asthma, COPD, cystic fibrosis, and respiratory issues caused by COVID-19. The device enables users to track their MDI usage and promotes better adherence to prescribed therapies.

End-User Analysis

Hospitals dominated the market with 44.8% market share as they are the primary setting for complex treatments that require specialized drug delivery devices. Hospitals use a wide range of drug delivery systems, such as infusion pumps, injectable devices, nebulizers, and drug-eluting stents, to treat patients with severe conditions like cancer, diabetes, and cardiovascular diseases.

Hospitals are also critical in the administration of biologic drugs, which often necessitate precision delivery systems to ensure accurate dosing. As healthcare systems globally become more reliant on advanced therapies, the demand for these devices in hospitals continues to grow. Furthermore, the increasing complexity of treatments and the need for expert medical supervision contribute to hospitals maintaining their dominance in this segment.

Key Market Segments

By Product

- Inhalers

- Injection Devices

- Implants

- Contraceptive implants

- Drug-eluting stents

- Biodegradable implants

- Topical Delivery System

- Oral Delivery System

- Occular Delivery System

- Nebulizers

- Transdermal Patches

- Infusion Pumps

- Others

By Application

- Oncology

- Infectious Diseases

- Respiratory Diseases

- Diabetes

- Cardiovascular Diseases

- Autoimmune Diseases

- Central Nervous System Disorders

- Others

By End-User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgery Centers/Clinics

- Home Care Settings

- Others

Drivers

Advancements in Biologic Drug Delivery

In recent years, the market for biologic drugs has witnessed exponential growth, leading to the development of advanced drug delivery devices designed to administer complex treatments. Biologics, including monoclonal antibodies, gene therapies, and other biologic agents, require sophisticated delivery mechanisms to ensure precise dosing and patient compliance. This shift has driven demand for devices such as auto-injectors, infusion pumps, and microneedle-based systems.

These technologies not only improve patient experience by enabling self-administration at home but also ensure controlled drug release, enhancing efficacy. The increasing prevalence of chronic diseases, such as cancer and diabetes, and the growing number of biologic drugs in development further drive the adoption of these devices. With biologics expected to dominate the pharmaceutical market, particularly in oncology and immunology, the need for advanced drug delivery solutions will continue to expand, thus propelling market growth.

In September 2024, Nanoform Finland Plc, an innovative company specializing in nanoparticle medicine, and Celanese Corporation, a global leader in specialty materials and chemicals, announced an expansion of their collaboration to include biologic drug delivery. The partnership will integrate Nanoform’s Biologics platform with Celanese’s VitalDose® Drug Delivery platform, aiming to further enhance the controlled release of biologics from long-acting, therapeutic implants.

Restraints

High Manufacturing Costs

The development and manufacturing of advanced drug delivery devices often involve high production costs due to the complexity of the technology, regulatory hurdles, and extensive quality control requirements. Devices like implantable pumps, inhalers, and microneedles require significant research, development, and clinical testing before they can reach the market. These costs are passed on to both manufacturers and consumers, limiting access to such devices, especially in emerging markets with constrained healthcare budgets.

Moreover, the high cost of biologic drugs, combined with the additional expenses of specialized delivery devices, could limit adoption, particularly among cost-sensitive patients and healthcare systems. As a result, the widespread adoption of these devices faces challenges, restricting growth in some market segments. For example, nanodrug manufacturing is generally much more expensive than conventional medicines, both in production costs and in associated development and approval timelines.

Opportunities

Growing Demand for Home-based Healthcare Solutions

A significant opportunity lies in the increasing demand for home-based healthcare solutions, driven by the rising burden of chronic diseases, the need for ongoing treatment, and the preference for convenience among patients. According to the CDC, there were 11,400 home health agencies in 2020. Of these, 83.5% operated under for-profit ownership. During the same year, approximately 3.0 million patients received and completed care through these agencies.

Drug delivery devices such as auto-injectors, insulin pens, and wearable patches enable patients to manage their conditions at home without frequent hospital visits. As healthcare systems globally move towards home healthcare models to reduce hospital admissions and improve patient outcomes, the drug delivery devices market stands to benefit.

The development of user-friendly, efficient, and non-invasive devices tailored to home care is expected to drive market expansion. Additionally, the rise of telemedicine and remote monitoring systems further complements this trend, creating a holistic ecosystem for patient-centric care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as inflation, economic recessions, and shifts in healthcare spending play a pivotal role in shaping the demand for drug delivery devices. Economic downturns often lead to budget cuts in healthcare systems, reducing the availability of funds for advanced medical technologies, including drug delivery devices.

Conversely, economic growth, particularly in emerging markets, can increase healthcare spending and demand for more efficient and accessible drug delivery systems. Additionally, the rising cost of raw materials due to inflation may increase the production costs of these devices, which can affect pricing and market accessibility.

Geopolitical factors, such as trade policies, tariffs, and international relations, also affect the global supply chain of drug delivery devices. Trade tensions and tariffs can disrupt the manufacturing and distribution of components, leading to delays and higher costs. Furthermore, geopolitical instability in regions like the Middle East or Eastern Europe can hinder the adoption of advanced healthcare technologies, including drug delivery devices, due to limited access to healthcare infrastructure.

Latest Trends

Integration of Digital Technologies and Smart Drug Delivery Systems

The integration of digital technologies with drug delivery devices is a growing trend that is transforming patient care. Smart drug delivery systems, equipped with sensors, mobile connectivity, and data analytics, allow real-time tracking of dosage and patient compliance. For example, connected inhalers or insulin pens transmit data to mobile apps, enabling patients and healthcare providers to monitor medication usage and make timely adjustments.

These devices not only improve medication adherence but also provide actionable insights into treatment efficacy. The growing emphasis on personalized medicine further amplifies this trend, as digital tools allow for individualized treatment plans based on real-time data. As the healthcare industry shifts towards more data-driven, patient-centered care, the demand for smart, connected drug delivery devices is expected to rise, driving both market growth and innovation.

Smart injectables, which include electronic auto-injectors, wearable injectors, and microneedle patches, are designed to reduce pain, automate dosing schedules, and enhance patient compliance. A notable example is Stevanato Group’s Vertiva 10-mL On-Body Delivery System, unveiled in October 2024 at CPHI Milan.

This prefilled, preloaded wearable platform is specifically designed to support highly viscous biologics and can be programmed for various motor-driven dosing profiles, ranging from micro-precision basal delivery to full-content bolus injections. Its versatility makes it ideal for administering a broad range of therapies for cardiovascular, metabolic, oncological, immunological, and pain-related conditions.

Regional Analysis

North America is leading the Drug Delivery Devices Market

North America led the global drug delivery devices market, capturing a significant share due to several factors. The region benefits from a well-established healthcare infrastructure, which includes advanced medical facilities, widespread insurance coverage, and substantial healthcare spending. This robust system supports the demand for effective drug delivery solutions.

Additionally, the high prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses further drives the market. Technological advancements, particularly in connected and wearable drug delivery devices, have improved patient compliance and treatment outcomes. Furthermore, key players like BD, Medtronic, and Gerresheimer, who have a strong presence in North America, contribute to the market’s growth through continuous innovation and expansion.

The combination of these factors has positioned North America at the forefront of the drug delivery devices market, making it the leading region globally. For instance, in May 2023, the U.S. Food and Drug Administration has approved the Beta Bionics iLet ACE Pump and iLet Dosing Decision Software for individuals aged six and older with type 1 diabetes. These devices, when paired with a compatible FDA-cleared integrated continuous glucose monitor (iCGM), will create the iLet Bionic Pancreas system. This innovative automated insulin dosing (AID) system utilizes an algorithm to calculate and manage insulin delivery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Drug Delivery Devices market includes Medtronic, Johnson & Johnson, Novartis, Becton, Dickinson and Company (BD), Mylan N.V., Baxter International Inc., 3M Health Care, Gerresheimer AG, Sandoz (a Novartis division), Bayer AG, GlaxoSmithKline, Eli Lilly and Company, and Others.

Medtronic is a leader in developing and manufacturing innovative drug delivery devices. Its portfolio includes advanced insulin pumps, infusion systems, and patient monitoring solutions, particularly for diabetes and other chronic conditions. Medtronic focuses on improving patient outcomes through integrated solutions that enable personalized, efficient drug delivery in home and clinical settings.

Johnson & Johnson is a prominent player in the drug delivery devices market, offering a broad range of products, including needle-free injection systems and innovative biologic drug delivery technologies. The company aims to enhance patient compliance and treatment effectiveness through advanced delivery systems designed for various therapeutic areas like diabetes, oncology, and immunology.

Novartis develops drug delivery devices tailored to enhance the administration of biologics and other complex therapies. Its portfolio includes devices for injectable treatments, particularly in oncology and autoimmune diseases.

Top Key Players

- Medtronic

- Johnson & Johnson

- Novartis

- Becton, Dickinson and Company (BD)

- Mylan N.V.

- Baxter International Inc.

- 3M Health Care

- Gerresheimer AG

- Sandoz (a Novartis division)

- Bayer AG

- GlaxoSmithKline

- Eli Lilly and Company

- Others

Recent Developments

- In June 2024, Aptar Digital Health announced a collaboration with SHL Medical to integrate its Software as a Medical Device (SaMD) platform into SHL’s connected device technologies. This partnership aims to optimize the patient experience with self-injectable therapies.

- In May 2025, PCI Pharma Services completed the acquisition of Ajinomoto Althea, a U.S.-based sterile fill-finish contract development and manufacturing organization (CDMO). This acquisition strengthens PCI’s capabilities in aseptic filling of prefilled syringes and cartridges, supporting the growing demand for biologic drug delivery.

- In September 25, 2024, PCI Pharma Services announced an investment exceeding $365 million in facilities across the U.S. and Europe. This expansion supports clinical and commercial-scale assembly of drug-device combination products, with a focus on injectable formats.

Report Scope

Report Features Description Market Value (2024) US$ 410.61 Billion Forecast Revenue (2034) US$ 862.16 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Inhalers, Injection Devices, Implants, Contraceptive implants, Drug-eluting stents, Biodegradable implants, Topical Delivery System, Oral Delivery System, Occular Delivery System, Nebulizers, Transdermal Patches, Infusion Pumps and Others), By Application (Oncology, Infectious Diseases, Respiratory Diseases, Diabetes, Cardiovascular Diseases, Autoimmune Diseases, Central Nervous System Disorders and Others), By End User (Hospitals, Diagnostic Centers, Ambulatory Surgery Centers/Clinics, Home Care Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic, Johnson & Johnson, Novartis, Becton, Dickinson and Company (BD), Mylan N.V., Baxter International Inc., 3M Health Care, Gerresheimer AG, Sandoz (a Novartis division), Bayer AG, GlaxoSmithKline, Eli Lilly and Company, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Drug Delivery Devices MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Drug Delivery Devices MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Johnson & Johnson

- Novartis

- Becton, Dickinson and Company (BD)

- Mylan N.V.

- Baxter International Inc.

- 3M Health Care

- Gerresheimer AG

- Sandoz (a Novartis division)

- Bayer AG

- GlaxoSmithKline

- Eli Lilly and Company

- Others