Global Drone Package Delivery Market By Component (Hardware, Software, and Services), By Drone Type (Multi-rotor Wing, Fixed Wing, and Hybrid Wing), By Package size (Less than 2 Kg,2 Kg to 5 Kg,More than 5 Kg ), By Duration, By Operation Mode (Remotely Piloted, Partially Autonomous and Fully Autonomous), By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 73454

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component Analysis

- By Drone Type Analysis

- By Package Size Analysis

- By Duration Analysis

- By Operation Mode Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Latest Trends

- Geopolitical and Recession Impact Analysis

- Regional Analysis

- Market Share and Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

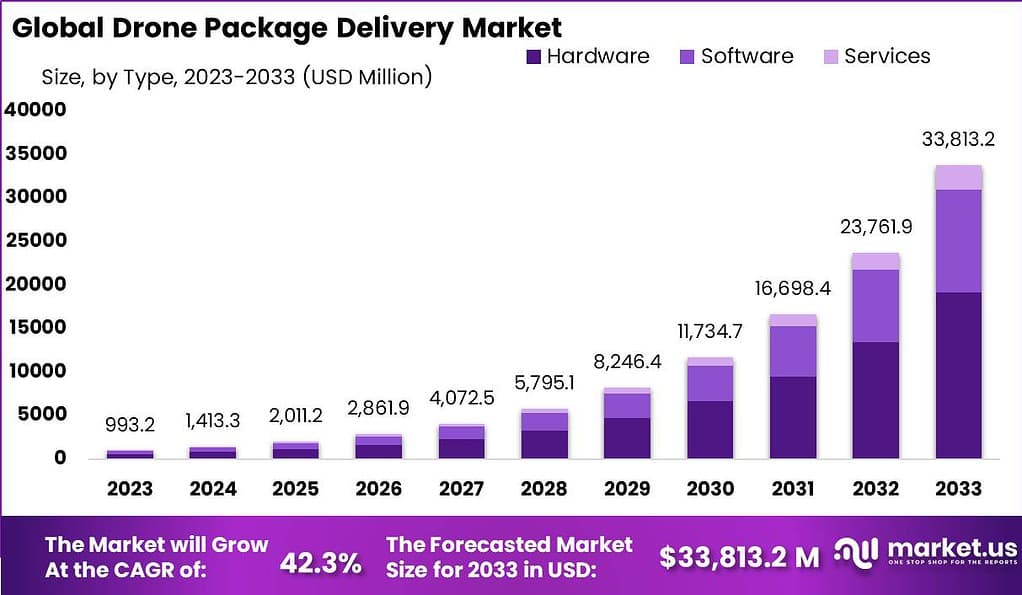

The Global Drone Package Delivery Market size is expected to be worth around USD 33,813.2 Million by 2033, from USD 993.2 Million in 2023, growing at a CAGR of 42.3% during the forecast period from 2024 to 2033.

Drone package delivery refers to the use of unmanned aerial vehicles (UAVs), commonly known as drones, for delivering packages to customers’ locations. This innovative delivery method has gained significant attention in recent years due to its potential to revolutionize the logistics and transportation industry. Drones offer numerous advantages, including faster delivery times, reduced costs, and enhanced accessibility to remote or hard-to-reach areas.

The drone package delivery market is witnessing substantial growth driven by various factors. Firstly, advancements in drone technology have made them more efficient, reliable, and capable of carrying heavier payloads. Improved battery life and navigation systems enable drones to cover longer distances, expanding their delivery capabilities. Additionally, the increasing demand for quick and efficient last-mile deliveries, particularly in urban areas, has led to the exploration of alternative delivery methods like drones.

By 2024, significant advancements in the logistics sector are expected with over 60% of major companies integrating drone delivery into their operations, as per DHL. This technological shift is also gaining momentum among e-commerce retailers, with Amazon Prime Air projecting a 45% increase in adoption from 2022 to 2024.

The Consumer Technology Association indicates that around 50% of consumers will be comfortable with drone deliveries by the end of 2024. Furthermore, Wing forecasts that over 65% of drone delivery operations will utilize autonomous drones equipped with sophisticated navigation and obstacle avoidance features

Key Takeaways

- In 2023, the Global Drone Package Delivery Market was valued at USD 993.2 Million.

- The market is estimated to register the highest CAGR of 42.3% between 2023 and 2032.

- Increasing demand for remote delivery services and growing environmental consciousness are driving the growth of the market.

- A complex regulatory framework for drone operations can restrict the growth of the market.

- Increasing technological advancements in drone technology are expected to create many lucrative opportunities in the market over the forecast period.

- Integration of AI and ML in drones for delivery operations are trending in the market.

- Based on Component, hardware leads the market with a major revenue share of 56.8%.

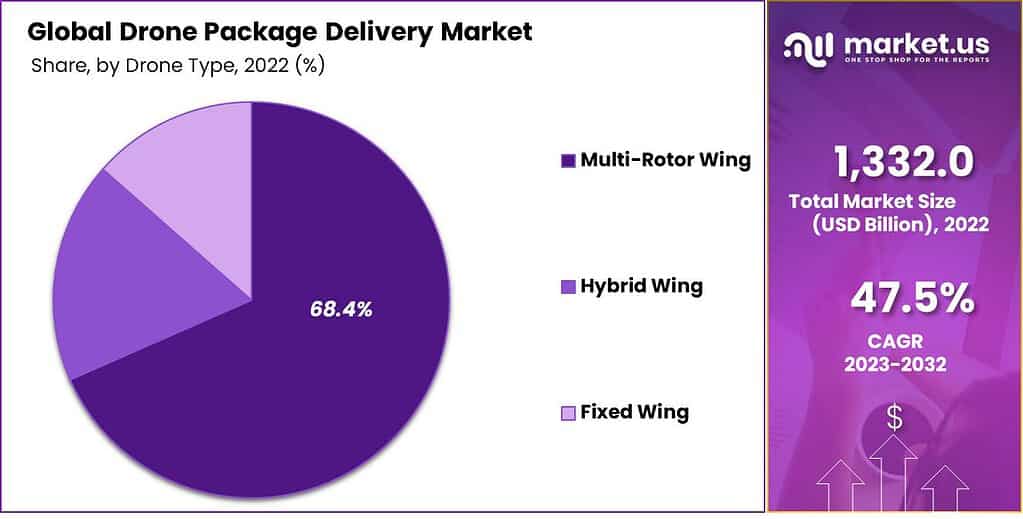

- Based on Drone Type, multi-rotor wing drones dominate the market by holding a major revenue share of 68.4%.

- Based on Package Size, less than 2 kg dominates the market with a major revenue share of 44.6%.

- Based on Duration, less than 30 minutes leads the market with a major revenue share of 60.4%.

- Based on Operation Mode, remotely piloted drones secure a major revenue share of 52.6% to lead the market.

- Based on End-Use, food delivery dominates the market with a major revenue share of 38.6%.

- Geopolitical tensions between countries and economic downturns can negatively affect the market.

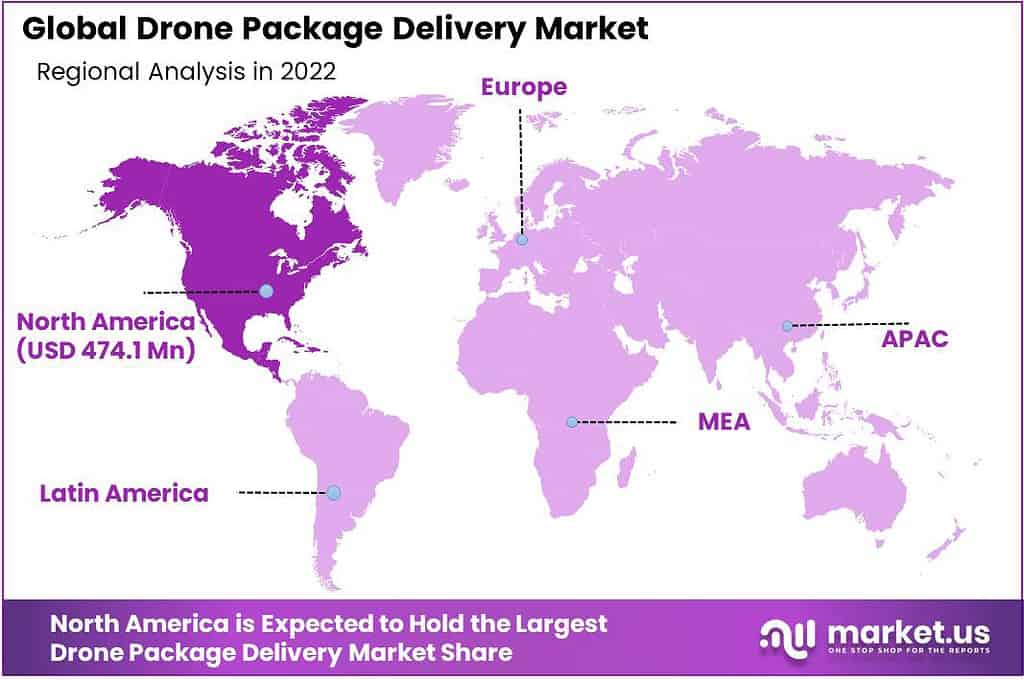

- Based on Region, North America leads the market with a major revenue share of 35.6%.

- Some key players in the market are Alphabet Inc., DHL, FedEx, UPS, Amazon, and others.

By Component Analysis

Hardware Leads the Market with a Major Revenue Share of 56.8%.

Based on component, the market is classified into hardware, software, and services. Among these components, hardware dominates the market with a major revenue share of 56.8%. This exponential growth of hardware is owing to its fundamental role in enabling drone operations.

The hardware component encompasses drones, including their physical structures, propulsion systems, sensors, and communication devices. These elements are the core foundation of any drone delivery system, directly influencing its capabilities, range, payload capacity, and reliability.

As drone technology evolves, hardware innovations continuously improve flight performance and safety, which are critical factors in the delivery industry. Hardware investments also tend to be more substantial due to the need for robust, durable, and technologically advanced drones, further solidifying its dominant revenue share in the market.

By Drone Type Analysis

Multi-Rotor Wing Drones Dominate the Market by Holding a Major Revenue Share of 68.4%.

On the basis of drone type, the market is classified into multi-rotor wing, fixed wing, and hybrid wing. From these drone types, multi-rotor wing holds the major revenue share of 68.4% to lead the market. This growth is due to their versatility and suitability for urban and short-range deliveries. Their ability to take off and land vertically makes them well-suited for congested urban environments, where space for conventional runways is limited.

Multi-rotor drones offer precise maneuverability, enabling deliveries to exact locations, including rooftops and small courtyards. They excel at quick deliveries, meeting the demand for fast e-commerce and last-mile logistics. Additionally, multi-rotor drones are relatively easier to operate and maintain, reducing operational complexities and costs.

Note: Actual Numbers Might Vary In Final Report

By Package Size Analysis

Less than 2 Kg Dominates the Market with a Major Revenue Share of 44.6%.

On the basis of package size, the market is classified into less than 2 kg, 2 kg to 5 kg, and more than 5 kg. From these package sizes, less than 2 kg leads the market with a major revenue share of 44.6%. The dominance of packages less than 2 kg in the market is driven by their alignment with the growing demand for swift, cost-effective, and versatile delivery solutions. Smaller packages are prevalent in sectors like e-commerce, pharmaceuticals, and food delivery, where rapid deliveries are paramount.

Drones optimized for payloads under 2 kg are more economical and subject to less stringent regulatory restrictions, expediting operational approvals. Furthermore, as technology advances, drones in this category continue to enhance their range, efficiency, and reliability, solidifying their leadership position in catering to the evolving needs of businesses and consumers for lightweight, frequent, and timely deliveries.

By Duration Analysis

Less than 30 minutes Leads the Market with a Major Revenue Share of 60.4%.

Based on duration, the market is divided into less than 30 minutes and more than 30 minutes. Out of these duration’s, less than 30 minutes leads the market with a major revenue share of 60.4%. The dominance of duration’s less than 30 minutes in the market is driven by the focus on ultra-fast, on-demand deliveries. This duration aligns perfectly with the need for swift delivery services in e-commerce, food delivery, and healthcare sectors, where the timely arrival of goods is crucial.

Shorter delivery times enhance customer satisfaction and can be a competitive advantage. Moreover, regulatory approvals are typically more accessible for shorter-duration flights, simplifying compliance and operational logistics. The technology and infrastructure for sub-30-minute deliveries are also more mature, making it the preferred choice for businesses and consumers looking for rapid and convenient delivery solutions.

By Operation Mode Analysis

Remotely Piloted Drones Secures Major Revenue Share of 52.6% to Lead the Market.

Based on operation mode, the market is classified into remotely piloted, partially autonomous, and fully autonomous. Among these operation modes, remotely piloted holds the major revenue share of 52.6% to lead the market. This growth is attributed to the assurance of human control and oversight. Businesses and regulatory bodies prioritize safety and compliance, often requiring real-time human intervention. Remotely piloted drones offer this crucial feature, instilling confidence in both operators and the public.

Additionally, this operation mode is well-established, with mature technology and streamlined regulatory processes. It’s a cost-effective choice, as it doesn’t demand the advanced autonomous systems of fully autonomous drones. Moreover, in complex or rapidly changing environments, remote piloting allows for adaptability and quick decision-making, making it the preferred choice for many businesses seeking reliable and responsible delivery solutions.

By End-Use Analysis

Food Delivery Dominates the Market with a Major Revenue Share of 38.6%.

Based on end-use, the market is classified into food delivery, retail goods delivery, postal delivery, medical aid delivery, and other end-use. Among these end-uses, food delivery leads the market by covering the major revenue share of 38.6%.

This dominance can be attributed to the increasing consumer demand for fast and contactless food deliveries, especially in urban areas. Drones offer a swift and efficient solution for delivering meals from restaurants to customers’ doorsteps, reducing delivery times and ensuring food freshness. Moreover, during the COVID-19 pandemic, the demand for contactless food deliveries further amplified the role of drones in this sector.

Key Market Segments

Component

- Hardware

- Software

- Services

Drone Type

- Multi-rotor Wing

- Fixed Wing

- Hybrid Wing

Package Size

- Less than 2 Kg

- 2 Kg to 5 Kg

- More than 5 Kg

Duration

- Less than 30 minutes

- More than 30 minutes

Operation Mode

- Remotely Piloted

- Partially Autonomous

- Fully Autonomous

End-Use

- Food delivery

- Retail goods delivery

- Postal delivery

- Medical aids delivery

- Other End-Uses

Driving Factor

Increasing Demand for Remote Delivery Services and Growing Environmental Consciousness is Driving the Growth of the Market.

The drones offer the potential for swifter and more cost-effective deliveries, especially in remote or congested areas. Their ability to bypass traditional infrastructure limitations is particularly valuable in the face of rising e-commerce and parcel delivery demands. Environmental consciousness and sustainability considerations have increased the appeal of drone package delivery services. Drones generally leave smaller carbon footprints than traditional delivery methods, fitting well with global efforts to curb greenhouse gas emissions.

Governments worldwide are gradually opening airspace for commercial drone operations, allowing companies to expand their delivery services using drones. As regulations become more accommodating, businesses take advantage of this shift and expand their drone delivery services accordingly. Continuous technological innovations, such as advances in drone design, battery life, and autonomous navigation systems, are also driving market growth by improving drone delivery efficiency, safety, and reliability. Collectively, these drivers contribute to an exponential market expansion.

Restraining Factor

Complex Regulatory Framework for Drones Operation Can Restrict the Growth of Market.

While regulatory frameworks are evolving to accommodate drone operations, they remain complex and subject to change. Navigating these regulations can be a cumbersome and costly process for businesses, often requiring extensive paperwork, permits, and adherence to safety standards. Differing regulations across regions and countries further complicate global drone delivery operations, creating a barrier to seamless cross-border logistics. Privacy concerns represent another restraint, as using drones for deliveries raises potential data collection and surveillance issues. Striking the right balance between innovation and safeguarding individuals’ privacy remains a delicate challenge for the industry.

Growth Opportunity

Increasing Technological Advancements in Drone Technology are Expected to Create Many Lucrative Opportunities in the Market over the Forecast Period.

During the pandemic, the rising demand for rapid, contactless deliveries in e-commerce and healthcare has accelerated market growth. The advancements in drone technology, including increased payload capacity and extended flight ranges, expand the range of possible delivery applications. Urban air mobility (UAM) infrastructure development, such as vertiports and charging stations, offers a framework for seamless drone operations in urban areas. Moreover, environmental sustainability and the potential for reduced carbon emissions compared to traditional delivery methods provide a compelling incentive for further market expansion.

Latest Trends

Integration of AI and ML in Drones for Delivery Operations is Trending in the Market.

Drones equipped with advanced AI and machine learning capabilities are becoming capable of autonomous flight, navigation, and delivery operations. This trend streamlines the delivery process, reducing human intervention and operational costs. It also enhances delivery efficiency, particularly in remote or challenging terrains. Additionally, integrating real-time tracking and monitoring systems ensures greater accuracy and security. Autonomous delivery aligns with the demand for faster and contactless deliveries, positioning it as a prominent trend shaping the future of the global drone package delivery market, offering enhanced speed, efficiency, and convenience to customers and businesses alike.

Geopolitical and Recession Impact Analysis

Geopolitical tensions between countries and economic downturns can negatively affect the market.

Geopolitically, the drone package delivery market faces challenges related to airspace regulations and international trade disputes. Varying regulations and restrictions can hinder cross-border drone deliveries and global market expansion. Additionally, geopolitical tensions may affect the supply chain of critical drone components, impacting production and distribution. Recessionary periods can have a dual impact. Conversely, cost-conscious consumers and businesses may seek more economical and efficient delivery options, driving demand for drone package delivery services. However, economic downturns can also lead to reduced corporate investments and a slowdown in the adoption of emerging technologies, potentially constraining market growth.

Regional Analysis

North America Leads the Market with a Major Revenue Share of 35.6%.

The North America region leads the market by holding a major revenue share of 35.6%. This growth of the North America region is owing to the region being home to a robust ecosystem of drone manufacturers, technology innovators, and delivery service providers, fostering rapid market growth. North America has relatively favorable regulatory frameworks facilitating drone operations supporting industry expansion. A strong focus on e-commerce and the demand for rapid, on-demand deliveries in densely populated urban areas aligns with the capabilities of drone delivery systems. Moreover, substantial investments in drone technology and infrastructure further solidify North America’s leadership position in the market.

After North America, Asia Pacific is expected to grow at the fastest CAGR during the forecast period. Rapid urbanization, burgeoning e-commerce sector, and densely populated cities are expected to drive the growth of the Asia Pacific region in the upcoming period.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Amazon Prime Air has a substantial market share owing to its extensive testing and regulatory approvals. UPS Flight Forward was making strides with its drone delivery services. Wing is also gaining ground, focusing on partnerships and expanding its operations. However, the market is highly competitive, and new entrants continue to disrupt the landscape, making it essential for existing players to innovate and adapt to maintain their market positions. Some of the key players in the market are Alphabet Inc., DHL, FedEx, UPS, Amazon, Walmart, Uber Eats, Zipline, Matternet, Flytrex, Wingcopter, EHang, Swoop Aero, Manna, Cainiao and Other Key Players.

Top Key Players in the Drone Package Delivery Market

- Alphabet Inc.

- DHL

- FedEx

- UPS

- Amazon

- Walmart

- Uber Eats

- Zipline

- Matternet

- Flytrex

- Wingcopter

- EHang

- Swoop Aero

- Manna

- Cainiao

- Other Key Players

Recent Developments

- In August 2023, Wing and Apian, a UK healthcare drone services firm, united to introduce medical drone deliveries in Ireland and explore UK prospects together.

- In August 2023, Wing and Walmart collaborated on drone delivery in Dallas-Fort Worth for a wide product selection, from meals to groceries and medicines.

Report Scope

Report Features Description Market Value (2023) US$ 993.2 Mn Forecast Revenue (2033) US$ 33,813.2 Bn CAGR (2024-2033) 42.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, and Services), By Drone Type (Multi-rotor Wing, Fixed Wing, and Hybrid Wing), By Package size (Less than 2 Kg,2 Kg to 5 Kg,More than 5 Kg ), By Duration, By Operation Mode (Remotely Piloted, Partially Autonomous and Fully Autonomous), By End-Use Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alphabet Inc., DHL, FedEx, UPS, Amazon, Walmart, Uber Eats, Zipline, Matternet, Flytrex, Wingcopter, EHang, Swoop Aero, Manna, Cainiao and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is drone package delivery?Drone package delivery is a method of transporting goods or packages from one location to another using unmanned aerial vehicles (drones).

How big is the drone package delivery market?The Global Drone Package Delivery Market revenue reached USD 1332.0 billion in 2022. Sales of Drone Package Delivery are estimated to total USD 1,964.7 billion in 2023. Between 2023 and 2032, the market is poised to grow at 47.5% CAGR. Revenue will likely reach USD 64,926.9 billion by 2032.

Which company uses drones for delivery?A number of companies are using drones for delivery, including Amazon, Alphabet (Wing), United Parcel Service (UPS), FedEx, DHL, Walmart, Zipline, Matternet, Flytrex, Drone Delivery Canada, and Flirtey.

What are the benefits of drone package delivery?Drone package delivery offers numerous advantages over more conventional delivery methods, such as:

- Speed: Drones offer much faster delivery of packages than traditional methods such as trucks or vans due to being able to fly directly towards their destinations without encountering traffic congestion issues.

- Cost-Effectiveness: Drone delivery services may be more cost-efficient for short distance deliveries compared to traditional methods due to not requiring fuel or drivers for delivery.

- Convenience: Drone package delivery offers customers more convenience by bringing packages directly to their homes or businesses without needing to visit a pick-up location.

- Reducing emissions: Drone package delivery can help lower emissions by producing no tailpipe emissions themselves.

Who are the key players in the drone package delivery market?The key players in the drone package delivery market include: Alphabet Inc., DHL, FedEx, UPS, Amazon, Walmart, Uber Eats, Zipline, Matternet, Flytrex, Wingcopter, EHang, Swoop Aero, Manna, Cainiao and Other Key Players.

Drone Package Delivery MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Drone Package Delivery MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alphabet Inc.

- DHL

- FedEx

- UPS

- Amazon

- Walmart

- Uber Eats

- Zipline

- Matternet

- Flytrex

- Wingcopter

- EHang

- Swoop Aero

- Manna

- Cainiao

- Other Key Players