Global Drone Market Size, Share Analysis Report By Type (Fixed-Wing Drone, Rotary Wing Drone), By Application (Consumer, Commercial (Construction, Agriculture, Oil & Gas, Mining, Public Safety & Law Enforcement, Others), Military), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 66999

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Drone Statistics

- Analysts’ Viewpoint

- Impact of AI on Drone

- APAC Market Size

- Type Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

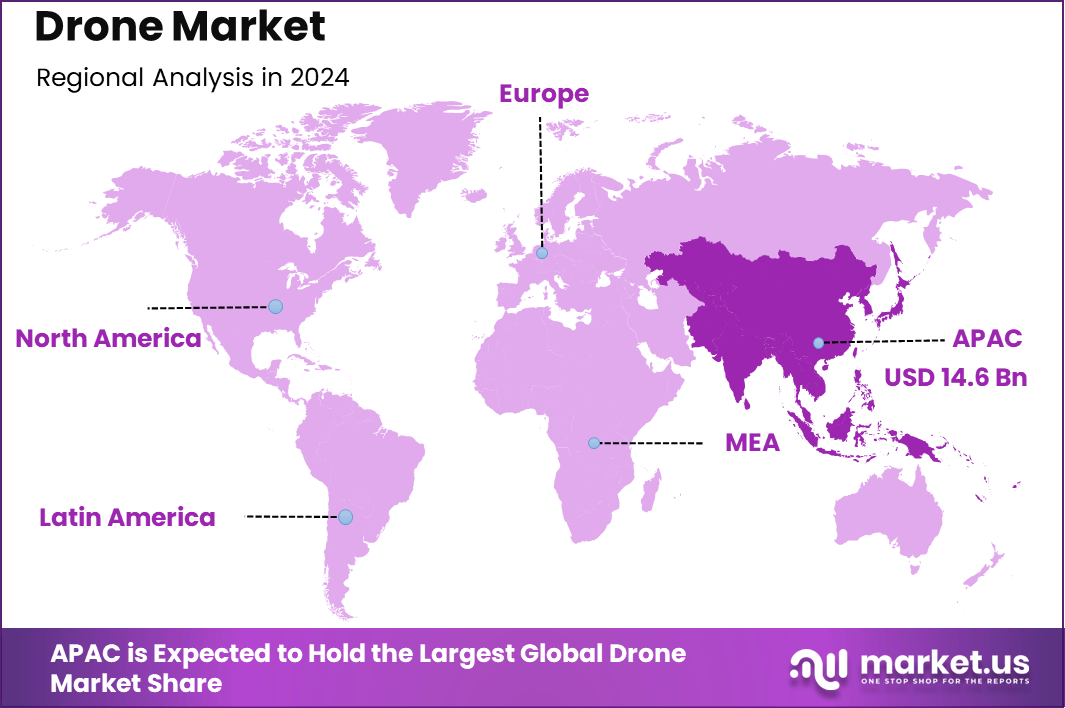

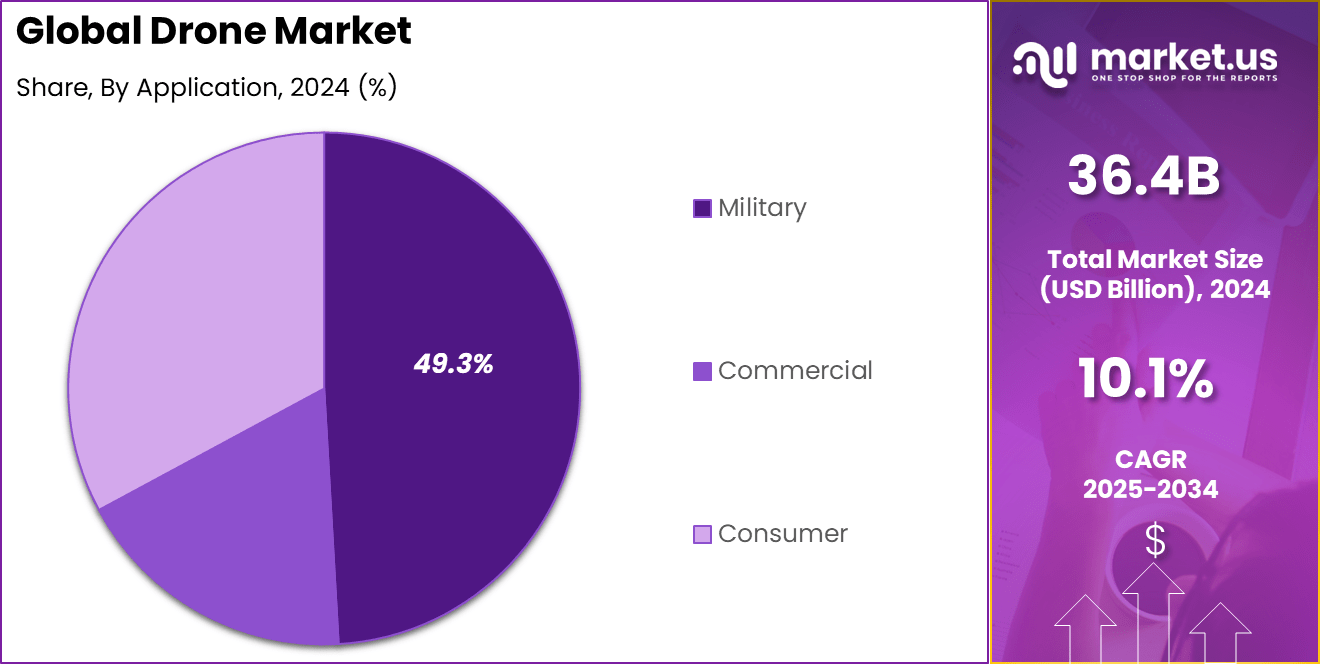

The Global Drone Market size is expected to be worth around USD 95.4 Billion by 2034, from USD 36.4 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 40.2% share, holding USD 14.63 Billion revenue.

The drone market encompasses the manufacturing and operations of drones across various sectors including military, commercial, and recreational segments. The market is characterized by its rapid growth due to increasing adoption for a variety of applications such as aerial photography, surveillance, agriculture, and logistics.

The primary driving factors for the drone market include technological advancements that enhance the performance and functionality of drones, such as improved battery life and autonomous flying capabilities. Additionally, the expansion of drone applications in commercial sectors such as agriculture, real estate, and media, as well as their increasing use in public safety and emergency response, significantly contribute to market growth.

Key Takeaways

- The Global Drone Market is projected to reach an impressive value of USD 95.4 Billion by 2034, growing from USD 36.4 Billion in 2024 at a steady CAGR of 10.1% over the forecast period from 2024 to 2033. This significant growth highlights the increasing demand for drones across various industries worldwide.

- In 2024, the APAC region stood out with a dominant market position, capturing over 40.2% of the market share. This translated to a revenue of USD 14.63 Billion, driven by the rapid adoption of drones in countries like China, Japan, and India for both commercial and military applications.

- The Rotary Wing Drone segment also led the market in 2024, holding a commanding 61.1% share.

- Fixed-Wing Drones are gaining market share, increasing from 31.7% in 2019 to 38.9% in 2024, indicating growing adoption in long-range and endurance-based applications.

- On the application front, the Military segment accounted for the largest portion of the market, securing 48.8% of the total share in 2024. The growing use of drones for defense, border security, and intelligence has contributed to this dominant position, reflecting the strategic importance of drones in modern military operations.

According to SeedScientific, the Chinese company DJI dominates the drone market, holding about 80% of the American market and 60% of the global market. DJI is recognized as a pioneer in the industry and the largest player in drone manufacturing. Drone business statistics indicate that businesses and government agencies spent a total of $13 billion on drones.

The Federal Aviation Administration (FAA) has registered 855,860 drones in the United States as of 2024, with 96% of drone owners being men and only 4% being women. Additionally, 853,857 drones are registered, and 270,183 individuals have obtained their remote pilot certification. By 2025, the drone industry is projected to create 103,776 jobs.

Drone Statistics

- The drone market is experiencing remarkable growth globally and in the United States. 853,857 drones are already registered in the US, demonstrating the rising interest in both recreational and commercial uses. Out of this, 73% of drones are used for recreational purposes, but the commercial sector is steadily expanding. With 270,183 certified remote pilots, drone operation has become more professional, supporting a variety of industries.

- The global drone revenue is forecasted to hit $63.6 billion by 2025, reflecting strong market potential. In the US, over 40 companies are actively competing, with DJI holding a dominant 77% market share, far ahead of Intel at 3.7%. Drones are becoming indispensable in agriculture, with 80% of usage predicted to come from this sector in the near future.

- By 2030, the number of non-military drones in operation is estimated to exceed 13 million, and the drone delivery market is expected to reach $27.4 billion. With an average drone pilot earning around $77,101 per year, the industry is also a significant source of employment, projected to create over 100,000 new jobs in the US by 2025.

- The efficiency drones bring to tasks like infrastructure inspection, which is set to grow by 50% in the next five years, and field mapping, which has been reduced from weeks to hours, highlights their technological impact. The US military also operates over 10,000 drones, underscoring the broad application of this technology.

Analysts’ Viewpoint

From an investment perspective, the drone market presents substantial opportunities due to the continuous evolution of drone technologies and their expanding range of applications. Analysts emphasize the importance of monitoring technological advancements, regulatory environments, and market entries of new players.

Investment in drones is seen as strategically advantageous for stakeholders across multiple sectors, particularly as regulations evolve to better facilitate commercial and private drone operations. The ability to navigate these factors effectively will be crucial for capitalizing on the growth potential within the drone market.

Incorporating drones into business operations offers numerous benefits including reduced operational costs, enhanced data collection, and the ability to access difficult or unsafe locations. Drones also contribute to significant improvements in work efficiency and safety, particularly in industries such as construction, agriculture, and logistics.

Impact of AI on Drone

The integration of artificial intelligence (AI) into drone technology is significantly reshaping multiple industries by enhancing operational capabilities and creating new opportunities.

Here are five key impacts of AI on drone technology:

- Enhanced Autonomy and Decision Making: AI has enabled drones to operate with higher levels of autonomy, allowing them to perform complex tasks independently. These tasks range from aerial surveying to delivering packages and inspecting infrastructure, without the need for continuous human supervision.

- Increased Operational Efficiency: AI algorithms improve the efficiency of drones by optimizing flight paths and reducing the need for manual control. This advancement is particularly beneficial in industries like agriculture and logistics, where drones can be used for crop monitoring or streamlined delivery processes, ultimately leading to significant cost savings and operational efficiencies.

- Advanced Surveillance and Monitoring: In military and security applications, AI-powered drones provide enhanced surveillance capabilities. They can autonomously patrol large areas, using real-time data analysis to identify threats or anomalies.

- Improved Data Collection and Analysis: Drones equipped with AI can collect and process large volumes of data more effectively. This is crucial for environmental monitoring, infrastructure maintenance, and agricultural management, where detailed, accurate data is essential for making informed decisions.

- Regulatory and Ethical Challenges: The rapid advancement and deployment of AI in drones also bring forth significant regulatory and ethical challenges. Issues such as privacy, data security, and the ethical use of autonomous systems are at the forefront of discussions.

APAC Market Size

In 2024, the Asia-Pacific region held a dominant market position, accounting for more than 40.2% of the global share and generating USD 14.63 billion in revenue. This leadership reflects the region’s strong investment in drone manufacturing, rapid adoption across agriculture, logistics, and surveillance, and government initiatives that encourage technological innovation

In 2024, APAC economies recorded around 4.5% growth, higher than the global average. Countries such as China, India, and Indonesia contributed strongly through rising domestic consumption and resilient exports in sectors like electronics and clean energy products. This consistent pace of growth has allowed the region to maintain momentum and secure a larger global market share.

The region also plays a critical role in global supply chains because of its dominance in raw material exports. APAC supplied about 18% of global primary resources and over 50% of non-ferrous metals in recent years. Australia remains a major source of lithium and iron ore, Indonesia leads in nickel and palm oil, while China controls aluminum, tin, lead, and rare earth exports.

Type Analysis

In 2024, the Rotary Wing Drone segment held a dominant market position, capturing more than a 61.1% share. This significant market share is largely due to the versatility and maneuverability of rotary wing drones, which include widely recognized quadcopters.

These drones are particularly valued for their ability to perform vertical take-offs and landings (VTOL), making them ideally suited for operations in confined or urban spaces where fixed-wing drones would be impractical.

The leading status of the rotary wing drone segment can be attributed to several factors. Firstly, these drones are incredibly user-friendly and relatively affordable, which appeals to a broad range of users, from hobbyists to professionals utilizing them for tasks like surveillance, photography, and detailed inspections.

Drone Market Share, By Type Analysis, 2019-2024 (%)

Type 2019 2020 2021 2022 2023 2024 Fixed-Wing Drone 31.7% 33.1% 34.6% 36.0% 37.7% 38.9% Rotary Wing Drone 68.3% 66.9% 65.4% 64.0% 62.3% 61.1% The ease of control and stability in the air also makes rotary wing drones popular for a variety of applications, enhancing their adoption rate across sectors. Furthermore, rotary wing drones are indispensable in scenarios requiring precise hovering and agile movements, such as disaster management, where they provide critical real-time data for search and rescue operations.

Their ability to hover and perform meticulous movements is crucial for delivering aid and assessing damage without the need for extensive clear space. Additionally, ongoing advancements in drone technology, such as improvements in battery life, payload capacity, and integrated camera technologies, continue to enhance the capabilities and efficiency of these drones, solidifying their position in the market

Application Analysis

In 2024, the Military segment of the drone market held a dominant market position, capturing more than a 48.8% share. This leadership is largely due to the indispensable role that unmanned aerial vehicles (UAVs) play in modern defense strategies across the globe.

Military drones are crucial for intelligence, surveillance, reconnaissance, and targeting (ISRT), making them vital assets for national security and defense operations. The substantial share held by the Military segment can be attributed to several factors.

First, the increasing use of drones reduces the risk to human life by performing potentially dangerous missions autonomously. This aspect is particularly valuable in modern warfare, where the ability to conduct operations remotely at lower risk and cost is a significant advantage.

Drone Market Share, By Application Analysis, 2019-2024 (%)

Application 2019 2020 2021 2022 2023 2024 Consumer 16.6% 16.4% 16.3% 16.1% 15.9% 15.7% Commercial 34.3% 34.6% 34.8% 35.0% 35.3% 35.5% Construction 55.2% 55.5% 55.8% 56.1% 56.6% 56.7% Agriculture 7.8% 8.0% 8.1% 8.2% 8.4% 8.5% Oil & Gas 5.9% 5.8% 5.7% 5.6% 5.5% 5.3% Mining 3.1% 3.0% 2.9% 2.8% 2.8% 2.7% Public Safety & Law Enforcement 15.5% 15.4% 15.3% 15.2% 15.0% 15.1% Others 12.5% 12.3% 12.2% 12.0% 11.7% 11.7% Military 49.1% 49.0% 48.9% 48.9% 48.8% 48.8% Military drones are equipped with advanced sensors and technology that allow for precise operations, from monitoring hostile territories to engaging targets effectively. Additionally, technological advancements in drone capabilities have greatly enhanced their effectiveness.

Innovations such as improved battery life, enhanced payloads, and advanced navigational systems enable these drones to perform longer missions with greater accuracy and reliability. The integration of artificial intelligence and machine learning has further propelled the efficacy of military drones, allowing for more complex and autonomous operations.

Furthermore, geopolitical tensions and the need for continuous surveillance and quick response capabilities have driven the adoption of military drones. They are increasingly used not just for traditional combat operations but also for border security, anti-terrorism efforts, and peacekeeping missions.

Key Market Segments

By Type

- Fixed-Wing Drone

- Rotary Wing Drone

By Application

- Consumer

- Commercial

- Construction

- Agriculture

- Oil & Gas

- Mining

- Public Safety & Law Enforcement

- Others

- Military

Driver

Technological Advancements in Drone Technology

Innovations such as improved battery life, enhanced imaging sensors, and AI-powered autonomous systems are pushing the boundaries of what drones can achieve. These advancements are not only enhancing the capabilities of drones but are also expanding their applications across various sectors, from military operations to commercial and recreational uses.

The integration of 5G technology and cloud computing is further empowering drones to perform more complex tasks with greater efficiency and speed, thereby increasing their value and utility in operations like surveying, delivery, and environmental monitoring. The evolution of drone technology is pivotal in transforming industries by enabling more precise, efficient, and cost-effective solutions.

Restraint

Regulatory Challenges

Drone operations are heavily regulated across different regions, with strict guidelines that govern their usage, particularly in airspace shared with manned aircraft. The complexity of regulatory compliance imposes considerable costs and operational delays, affecting the scalability and speed at which drone technologies can be deployed.

Approval processes for drone flights can be lengthy, sometimes taking more than a month, and in some cases, even longer, which hampers rapid deployment and testing of new drone applications. This situation underscores the need for a more streamlined regulatory approach that can keep pace with technological advancements while ensuring safety and privacy.

Opportunity

Expansion into Emerging Markets

The drone market presents vast opportunities for expansion into emerging markets, especially within the Asia-Pacific region, which is expected to experience the fastest growth. This expansion is largely fueled by the increasing industrialization, urbanization, and digital transformation in these regions.

Drones offer substantial benefits in sectors like agriculture, where they can help maximize yield and efficiency, and in infrastructure, where they can aid in monitoring and maintenance. Additionally, the growing demand for drones in entertainment, media, and delivery services in these markets offers new avenues for businesses to explore and capitalize on.

Challenge

Cybersecurity and Public Perception

A major challenge facing the drone industry is cybersecurity. Drones, especially those used in critical applications such as military and infrastructure, are susceptible to hacking and other cyber threats, which can lead to information theft or operational sabotage. Ensuring the cybersecurity of drones is paramount to maintaining operational integrity and trust.

Moreover, public perception of drones varies significantly; issues such as privacy concerns, noise, and safety can lead to resistance against drone operations in populated areas. Addressing these challenges requires continuous technological improvements, robust security protocols, and effective public communication strategies to enhance the acceptance and safe integration of drones into daily life and operations.

Growth Factors

The drone market is experiencing robust growth, driven by several key factors that enhance the capabilities and applications of drone technology. One significant growth driver is the advancement in drone technology itself, including improvements in battery life, propulsion systems, and onboard sensors, which expand the operational range and duration of drone missions.

This technological progression has opened up new possibilities for drones in various sectors, such as agriculture for crop monitoring, infrastructure for detailed inspections, and even in public safety for search and rescue operations. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) with drone systems has revolutionized how drones operate, making them smarter and more autonomous.

AI capabilities enable drones to perform complex tasks such as real-time data processing, object recognition, and autonomous flight planning, which are critical for applications ranging from traffic management to environmental monitoring.

Additionally, the expansion of the commercial drone sector, fueled by increasing adoption in industries such as delivery services, photography, and surveying, has significantly contributed to the market’s growth. The ongoing regulatory developments that aim to integrate drones safely into the airspace also support this growth by providing a clearer framework for commercial drone operations.

Emerging Trends

Emerging trends in the drone market reflect the dynamic nature of this technology and its integration into societal functions. One prominent trend is the increasing use of drones in logistics and delivery services, where companies are leveraging drones to optimize last-mile deliveries, significantly reducing delivery times and costs.

Another trend is the rise of drone-as-a-service (DaaS), where companies offer drone operations as a service for industries that require but do not possess in-house drone capabilities. The adoption of green technology in drones, such as electric and hydrogen fuel cells, represents another trend, providing longer flight times and less environmental impact compared to traditional battery-powered systems.

Business Benefits

Drones offer myriad business benefits that make them an invaluable asset across various sectors. In industries such as agriculture, drones provide precision agriculture tools that help farmers monitor crop health, optimize water usage, and increase crop yields.

For infrastructure, drones play a pivotal role in the inspection and maintenance of structures, allowing for more frequent and thorough checks that help prevent accidents and extend the lifespan of assets. In terms of operational efficiency, drones reduce the need for human intervention in dangerous or hard-to-reach areas, thereby enhancing safety and reducing operational costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Global Drone Market is intensely competitive, with several key players driving innovation through strategic initiatives such as acquisitions, new product launches, and mergers.

DJI, as a leading player in the market, continues to expand its dominance through innovative product launches. Recently, DJI introduced advanced models that incorporate enhanced imaging and flight stabilization technologies, reaffirming its commitment to setting industry standards.

Furthermore, DJI has strategically acquired smaller tech firms to integrate cutting-edge AI and machine learning capabilities into its drones, enhancing their functionalities for both consumer and industrial applications.

Draganfly Inc. is another prominent participant, known for its pioneering efforts in operational efficiency and technological advancements. In 2023, Draganfly announced the acquisition of an AI company to boost its navigation systems, making its drones more autonomous and capable of complex operations. Additionally, Draganfly launched a new multirotor drone designed for precision agriculture, showcasing its commitment to diversifying application areas.

EHang, a leader in autonomous aerial vehicles, has recently merged with a major aerospace manufacturer to enhance its production capabilities and expand its global footprint. This strategic move is aimed at accelerating the commercialization of its passenger-grade drones. EHang has also launched a new line of cargo drones, which are expected to revolutionize logistics, particularly in urban environments.

Top Key Players in the Drone Market

- DJI

- Delair

- Aeronavics Ltd.

- Autel Robotics

- Dragonfly Inc.

- Ehang

- Yuneec International

- Denel Dynamics

- Parrot

- Aerovironment Inc.

- Teledyne FLIR LLC

- SenseFly SA, an AgEagle company

- Skydio

- Wingtra

- Flyability

Recent Developments

- In January 2025, SZ DJI Technology Co., Ltd. introduced the DJI Flip, a lightweight and foldable drone designed for content creators. Resembling a mini unicycle, this compact drone weighs 249 grams and is optimized for portability. Equipped with a 1/1.3-inch 48MP CMOS sensor, it records 4K HDR videos at 60 fps and offers 100 fps slow-motion capability.

- Also in January 2025, Pix4D and Freefly Systems announced a strategic partnership focused on integrating photogrammetry software with advanced drone technology. The collaboration enhances aerial data collection by combining Pix4D’s software expertise with Freefly’s high-performance drones.

- In January 2024, Autel Robotics introduced the Dragonfish series, a lineup of advanced Vertical Takeoff and Landing (VTOL) drones designed for professional aerial applications. The series includes models such as the Lite, Standard, and Pro, each tailored to meet diverse operational needs, including mapping, surveying, public safety, and environmental monitoring.

Report Scope

Report Features Description Market Value (2024) USD 36.4 Bn Forecast Revenue (2034) USD 95.4 Bn CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Fixed-Wing Drone, Rotary Wing Drone), By Application (Consumer, Commercial (Construction, Agriculture, Oil & Gas, Mining, Public Safety & Law Enforcement, Others), Military) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DJI, Delair, Aeronavics Ltd., Autel Robotics, Dragonfly Inc., Ehang, Yuneec International, Denel Dynamics, Parrot, Aerovironment Inc., Teledyne FLIR LLC, SenseFly SA, an AgEagle company, Skydio, Wingtra, Flyability. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DJI

- Delair

- Aeronavics Ltd.

- Autel Robotics

- Dragonfly Inc.

- Ehang

- Yuneec International

- Denel Dynamics

- Parrot

- Aerovironment Inc.

- Teledyne FLIR LLC

- SenseFly SA, an AgEagle company

- Skydio

- Wingtra

- Flyability