Global Drone Analytics Market By Deployment (On-Demand and On-premise), By Application (Thermal Detection, Geolocation Tagging, Aerial Monitoring, Ground Exploration, Volumetric Calculations, 3D Modelling, Other Applications), By Industry (Transportation & Logistics, Construction & Infrastructure, Power & Utility, Agriculture, Oil & Gas, Other Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 59963

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

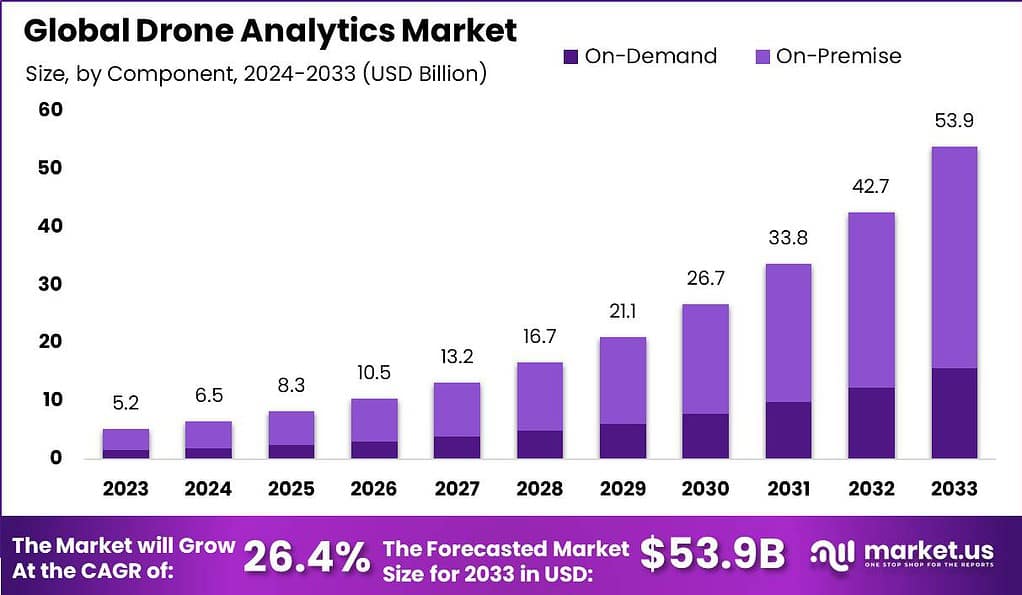

The global Drone Analytics Market is anticipated to be USD 53.9 billion by 2033. It is estimated to record a steady CAGR of 26.4% in the Forecast period 2024 to 2033. It is likely to total USD 5.2 billion in 2023.

Drone analytics is the process of capturing data, analyzing, and then the interpretation of data collected by drones to gather insights and make better decisions and enhance operations in a variety of industries. Drones, sometimes referred to as UAVs (also known as unmanned aircrafts (UAVs) are outfitted with cameras and sensors which record videos, images and other types of data during their flight. Drone analytics entails extracting important information from these data using sophisticated software and algorithms.

The drone analytics market encompasses the industry involved in developing and providing software platforms, tools, and services for analyzing drone-captured data. This market serves a wide range of sectors, including agriculture, construction, infrastructure inspection, surveying and mapping, environmental monitoring, and public safety.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Size: The Global Drone Analytics Market is expected to reach USD 53.9 billion by 2033 with a compound annual growth rate (CAGR) of 26.4% during its forecast period.

- Deployment: The market is divided into On-Demand and On-Premise segments. On-Premise solutions dominate with over 71% market share due to the need for in-house data management and security, while On-Demand solutions offer flexibility and scalability.

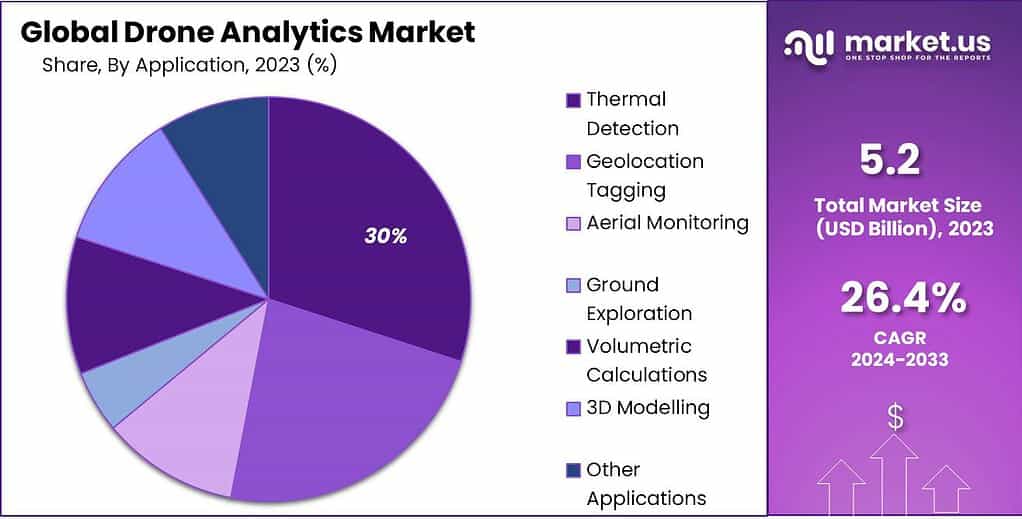

- Application: Key application segments include Thermal Detection, Geolocation Tagging, Aerial Monitoring, Ground Exploration, Volumetric Calculations, 3D Modelling, and Other Applications.

- Industry: Industries served by drone analytics include Transportation & Logistics, Construction & Infrastructure, Power & Utility, Agriculture, Oil & Gas, and Others. The Power & Utility sector holds a significant share, focusing on tasks like power line inspections and infrastructure monitoring.

- Driving Factors:Drone analytics enhance operational efficiency by providing real-time data collection and reducing manual labor.

- Restraining Factors: Regulatory Challenges – Stringent aviation regulations and privacy concerns can limit drone use.

- Growth Opportunities: Industry-Specific Applications – Customizing drone analytics for various industries presents growth opportunities.

- Key Market Trends: Automated Inspections – Drones use automation and machine learning for inspections.

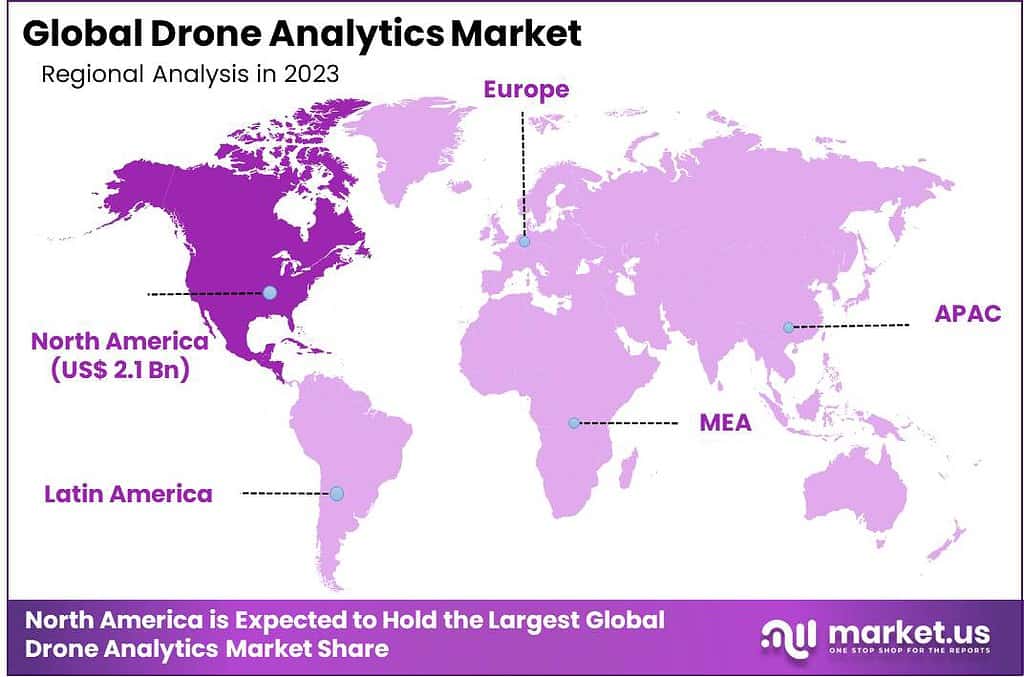

- Regional Analysis: North America leads the market with a share of over 42%, driven by a mature regulatory framework and widespread drone technology adoption.

- Key Players: The market features numerous international and local players. Key players include 3DR, AeroVironment Inc., Delair, Delta Drone SA, DroneDeploy, and others.

- Recent Developments: AgEagle enhanced technology features for Measure Ground Control in May 2022.

Deployment Insights

In 2023, the Drone Analytics market saw the On-Premise segment firmly establish its dominant market position, commanding an impressive share of over 71.0%. This significant lead can be attributed to several factors, including the preference for in-house data management and security among enterprises and government agencies utilizing drone analytics.

On-premise solutions provide increased oversight of data storage, processing, and security, crucial considerations when handling sensitive aerial data. Moreover, sectors like defense, agriculture, and infrastructure development frequently demand instant access to real-time insights, making on-site deployments the preferred option for meeting these stringent requirements.

On the other hand, the On-Demand segment, while representing a smaller portion of the market, caters to organizations seeking flexibility and scalability in their drone analytics operations. On-demand solutions offer cloud-based analytics services, eliminating the need for extensive in-house infrastructure and providing users with the convenience of accessing data and insights remotely. This segment is gaining traction among businesses looking to reduce operational costs and quickly scale their drone analytics capabilities.

Application Insights

In 2023, the Drone Analytics market witnessed the Thermal Detection segment firmly establish its dominant market position, capturing an impressive share of over 30%. This substantial lead can be attributed to the critical role that thermal detection plays across a wide range of industries. Drones equipped with thermal imaging cameras are extensively used for applications such as infrastructure inspections, search and rescue operations, and precision agriculture. These applications benefit from the ability of thermal detection to identify temperature variations and anomalies, enabling rapid decision-making and enhanced safety measures.

Furthermore, the Geolocation Tagging segment, while representing a significant portion of the market, provides essential spatial data that supports various industries like urban planning, environmental monitoring, and disaster management. Aerial Monitoring and Ground Exploration segments cater to the needs of industries such as forestry, mining, and environmental conservation, facilitating efficient data collection and analysis.

Volumetric Calculations and 3D Modelling applications are gaining prominence in construction, mining, and surveying sectors, allowing for precise measurements and accurate representations of physical spaces. Additionally, the market includes other specialized applications that address unique industry needs, reflecting the versatility and expanding utility of drone analytics in diverse sectors.

Note: Actual Numbers Might Vary In Final Report

Industry Insights

In 2023, the Drone Analytics market saw the Power & Utility segment secure a dominant market position, capturing an impressive share of over 29%. This substantial lead can be attributed to the critical role that drone analytics plays in the power and utility sector. Drones equipped with advanced analytics capabilities are extensively employed for tasks such as power line inspections, infrastructure monitoring, and vegetation management. These applications help power and utility companies enhance operational efficiency, minimize downtime, and ensure the reliability and safety of their networks.

Meanwhile, the Transportation & Logistics segment, although representing a substantial portion of the market, focuses on applications like traffic monitoring, cargo tracking, and supply chain optimization. The Construction & Infrastructure sector leverages drone analytics for site surveys, progress monitoring, and quality control, contributing to improved project management and cost-efficiency. Agriculture benefits from drone analytics for precision farming, crop monitoring, and yield optimization, while the Oil & Gas industry deploys drones for pipeline inspections and environmental assessments.

The market also encompasses other industries that harness the capabilities of drone analytics to address unique needs, showcasing the versatility and expanding utility of these technologies. In summary, the Drone Analytics market caters to a diverse array of industries, with the Power & Utility segment taking the lead in 2023, reflecting the critical importance of efficient data collection and analysis in ensuring the integrity and reliability of power and utility networks.

Driving Factors

- Increased Efficiency: Drone analytics enhance operational efficiency across industries by providing real-time data collection, reducing manual labor, and enabling rapid decision-making, thereby driving their adoption.

- Cost Savings: Drones equipped with analytics capabilities help organizations reduce operational costs by minimizing downtime, optimizing resource allocation, and preventing costly errors and accidents.

- Safety Improvements: Drone analytics contribute to improved safety in sectors like infrastructure and energy by allowing remote inspections of hazardous areas, reducing the risk to human workers.

- Data-Driven Insights: The ability to collect, process, and analyze vast amounts of data provides valuable insights for businesses, enabling them to make informed decisions, improve planning, and enhance overall performance.

Restraining Factors

- Regulatory Challenges: Stringent aviation regulations and restrictions on drone operations in certain areas can limit their use and hinder market growth.

- Data Privacy Concerns: The collection and storage of sensitive data during drone operations raise privacy concerns, necessitating robust data protection measures and compliance with data regulations.

- Technical Challenges: Ensuring the accuracy and reliability of data collected by drones, especially in adverse weather conditions or complex environments, presents technical challenges for drone analytics.

- Cost of Implementation: The initial cost of acquiring and implementing drone analytics technology, including drones themselves and necessary software, can be a barrier for some organizations.

Growth Opportunities

- Industry-Specific Applications: Customizing drone analytics solutions to meet the unique needs of various industries, such as agriculture, mining, and insurance, presents significant growth opportunities.

- Integration with IoT and AI: Integrating drone analytics with IoT sensors and artificial intelligence technologies allows for more advanced data analysis and predictive maintenance, expanding market potential.

- Emerging Markets: Untapped markets in developing regions with expanding infrastructure and agriculture sectors offer opportunities for drone analytics providers to expand their footprint.

- Environmental Monitoring: Increasing demand for environmental monitoring and sustainability initiatives can drive the adoption of drone analytics for applications like pollution assessment and wildlife conservation.

Challenges

- Air Traffic Management: Managing drone traffic in urban areas and ensuring safety in shared airspace with traditional aircraft poses challenges for regulators and industry players.

- Data Storage and Processing: Managing the vast amounts of data generated by drone analytics requires efficient storage and processing solutions, which can be complex and costly.

- Security Risks: Protecting drones from hacking, ensuring secure data transmission, and safeguarding sensitive information are critical challenges in the drone analytics market.

- Limited Battery Life: Drone flight time is limited by battery capacity, which can restrict the range and duration of data collection missions.

Key Market Trends

- Automated Inspections: Automation and machine learning algorithms empower drones to independently carry out inspections and identify anomalies, minimizing the necessity for human involvement.

- Advanced Sensors: The incorporation of cutting-edge sensors, such as LiDAR and multispectral cameras, elevates the capabilities of drones, enabling more precise data collection and analysis.

- Edge Computing: Processing data on the drone itself (edge computing) enables real-time analysis and reduces the need for extensive data transmission and storage.

- Drone-as-a-Service (DaaS): The rise of DaaS providers offers organizations access to drone analytics capabilities without the need for significant upfront investments, promoting market accessibility.

Key Market Segments

Deployment

- On-Demand

- On-Premise

Application

- Thermal Detection

- Geolocation Tagging

- Aerial Monitoring

- Ground Exploration

- Volumetric Calculations

- 3D Modelling

- Other Applications

Industry

- Transportation & Logistics

- Construction & Infrastructure

- Power & Utility

- Agriculture

- Oil & Gas

- Other Industries

Regional Analysis

In 2023, North America asserted its dominant position in the Drone Analytics market, capturing an impressive market share of over 42%. This commanding lead can be attributed to several factors, including the region’s robust technological infrastructure, significant investments in drone technology, and a mature regulatory framework that supports the safe and extensive use of drones. The demand for Drone Analytics in North America was valued at USD 2.1 billion in 2023 and is anticipated to grow significantly in the forecast period.

North American industries, ranging from agriculture and infrastructure to energy and defense, have wholeheartedly embraced drone analytics for applications like crop monitoring, infrastructure inspections, and security surveillance. Moreover, a thriving ecosystem of drone technology providers and service companies has flourished, contributing to the region’s leadership in the market.

Europe follows closely behind North America with an advanced aerospace industry and growing adoption of drone technology, with Europe holding an increasing share in the global drone analytics landscape. APAC region, led by agriculture and logistics growth sectors, is quickly emerging as a significant player on this landscape; Latin America, Middle East and Africa all also contribute towards market expansion through unexploited potential in sectors like mining, oil & gas and environmental monitoring.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market is highly fragmented with many international and local players. The market’s key players are working hard to improve their offerings by focusing on technical and cost differentiation. To improve their existing portfolios, companies investing in advanced technologies are also leading. In order to provide sophisticated analytical solutions specific to their industry to end-users, companies have formed partnerships.

Top Player’s Company Profiles

- 3DR

- AeroVironment Inc.

- Delair

- Delta Drone SA

- DroneDeploy

- Huvrdata

- Kespry Inc.

- Optelos LLC

- Pix4D SA

- PrecisionHawk

- Other Key Players

Recent Developments

- In May 2022, AgEagle unveiled enhanced technology features and capabilities for Measure Ground Control. These improvements aim to support enterprise customers and professional drone service providers across various sectors, enabling them to extract greater value from autonomous drone operations.

- In June 2022, AeroVironment announced the receipt of a firm-fixed-price contract award totaling USD 6,166,952. The contract is for Puma™ 3 AE small unmanned aircraft systems (SUAS) and spares, designated for the US Marine Corps. Anticipated delivery is expected to be completed by the end of 2022.

Report Scope

Report Features Description Market Value (2023) US$ 5.2 Bn Forecast Revenue (2033) US$ 53.9 Bn CAGR (2023-2033) 26.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (On-Demand and On-premise), By Application (Thermal Detection, Geolocation Tagging, Aerial Monitoring, Ground Exploration, Volumetric Calculations, 3D Modelling, Other Applications), By Industry (Transportation & Logistics, Construction & Infrastructure, Power & Utility, Agriculture, Oil & Gas, Other Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape 3DR, AeroVironment Inc., Delair, Delta Drone SA, DroneDeploy, Huvrdata, Kespry Inc., Optelos LLC, Pix4D SA, PrecisionHawk, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is drone analytics?Drone analytics refers to the process of collecting, analyzing, and interpreting data captured by drones. It involves using advanced software and algorithms to extract valuable insights from the data for informed decision-making and operational optimization across various industries.

What is the market demand for drones?The market demand for drones is significant and continues to grow. Drones are sought after for applications in industries such as agriculture, construction, infrastructure inspection, surveying, mapping, environmental monitoring, and public safety due to their ability to provide efficient data collection, cost-effectiveness, and increased safety.

How big is Drone Analytics Market?The global Drone Analytics Market is anticipated to be USD 53.9 billion by 2033. It is estimated to record a steady CAGR of 26.4% in the Forecast period 2024 to 2033. It is likely to total USD 6.5 billion in 2024.

What is the trend in the drone market?The drone market is witnessing a trend of increased adoption across diverse sectors. There's a focus on technological advancements, such as automation, artificial intelligence, and advanced sensors, to enhance drone capabilities. Additionally, the market is experiencing a rise in demand for drone services and analytics.

What is AI in drones?AI in drones involves the integration of artificial intelligence technologies, such as machine learning algorithms, to enhance drone capabilities. AI enables drones to perform tasks autonomously, make real-time decisions, and analyze data more efficiently, contributing to improved overall performance.

How do drones collect data?Drones collect data using onboard sensors and cameras during their flights. These sensors, including LiDAR and multispectral cameras, capture images, videos, and other data, which are then processed and analyzed to derive meaningful insights.

What is drone data used for?Drone data is used for various purposes, including surveying and mapping, monitoring agriculture crops, inspecting infrastructure, assessing environmental conditions, enhancing public safety, and conducting efficient data-driven analyses in multiple industries.

-

-

- 3DR

- AeroVironment Inc.

- Delair

- Delta Drone SA

- DroneDeploy

- Huvrdata

- Kespry Inc.

- Optelos LLC

- Pix4D SA

- PrecisionHawk

- Other Key Players