Global Drilling Fluids Market By Fluid Type (Water-based, Oil-based, Synthetic, and Other Types), By Well Type (Conventional Wells and High-pressure High-Temperature Wells), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 38274

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

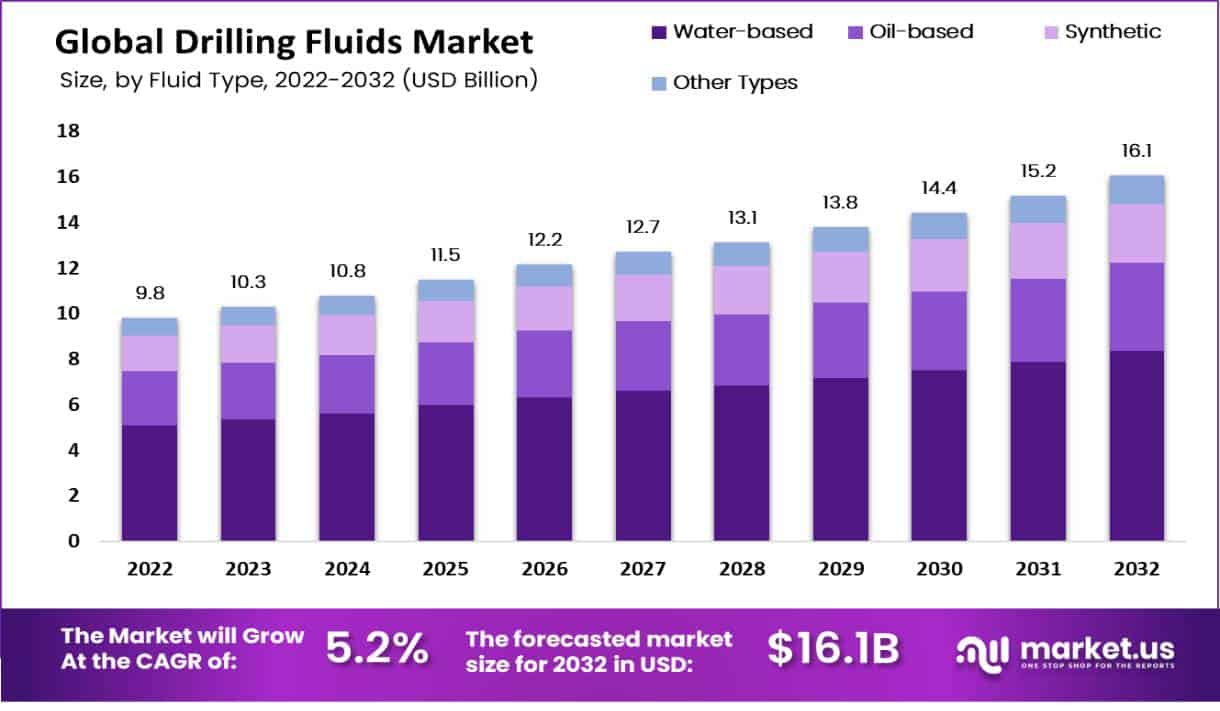

In 2022, the global drilling fluids market accounted for USD 9.8 billion. This market is estimated to reach USD 16.1 billion in 2032 at a CAGR of 5.2% between 2023 and 2032. The global drilling fluids industry is a highly dynamic & competitive industry that provides vital support to the oil exploration and production sector.

Drilling fluids, also known as drilling muds, are used to cool and lubricate the drill bit during drilling operations, transport cuttings to the surface, and stabilize the wellbore. The global oil & gas market is a major driver of the drilling fluids market. This is due to the increase in exploration and production activities. In addition, low-cost and environmentally friendly water-based drilling liquids are the most common type of drilling fluids market.

Key Takeaways

- Market Growth: The global drilling fluids market was valued at USD 9.8 billion in 2022, and it is projected to reach USD 16.1 billion by 2032, with a compound annual growth rate (CAGR) of 5.2% between 2023 and 2032.

- Industry Overview: The drilling fluids industry plays a vital role in supporting the oil exploration and production sector. Drilling fluids, also known as drilling muds, serve multiple functions, including cooling and lubricating drill bits, transporting cuttings to the surface, and stabilizing wellbores.

- Driving Factors: Increasing Demand for Oil and Gas The primary driver of the drilling fluids market is the rising global demand for oil and gas, leading to increased exploration and production activities. Technological Advances Technological developments have led to the creation of environmentally friendly, high-performance drilling fluids. Offshore Drilling Growth in offshore drilling activities, particularly in ultra-deepwater and deepwater areas, contributes to the demand for specialized drilling fluids.

- Restraining Factors: Oil Price Volatility The volatility of oil prices can limit market growth, as low oil prices lead to reduced exploration and production activities. Shift to Renewable Energy The increasing focus on renewable energy sources may decrease the demand for traditional drilling fluids. Environmental Impact The environmental impact of drilling fluids can be a restraint, especially if they do not meet regulatory requirements.

- Fluid Type Analysis: Water-Based Fluids Water-based drilling fluids dominate the market with a market share of 52%. They are cost-effective and environmentally friendly. Oil-Based Fluids Oil-based drilling fluids are used when water-based fluids are not suitable, offering excellent lubrication and performance. Synthetic-Based Fluids Synthetic-based oil-based fluids provide improved environmental performance.

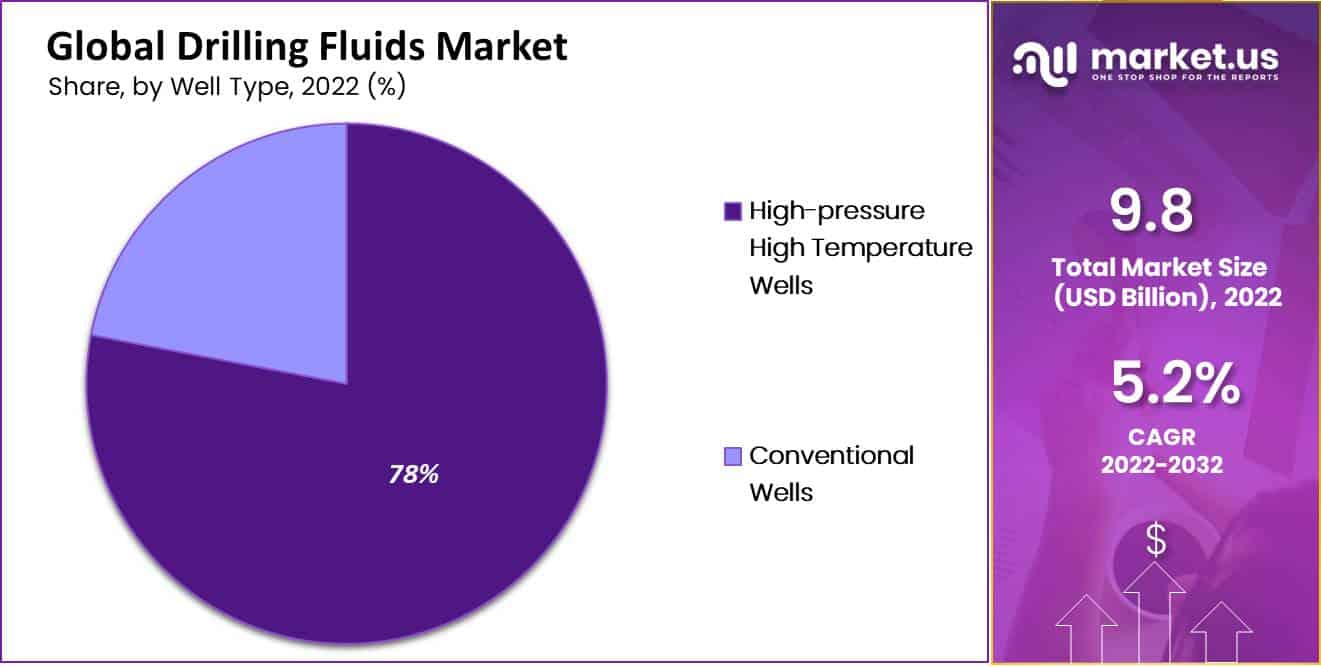

- Well Type Analysis: High-Pressure High-Temperature Wells (HPHT) HPHT wells are a dominant segment with a market share of about 78%. They are used in challenging conditions, such as deep offshore reservoirs. Conventional Wells Conventional wells are typically used in formations with lower pressure and temperature, requiring water-based or oil-based mud.

- Application Analysis: Onshore: Onshore drilling involves drilling wells on land and uses drilling fluids designed for lubrication, cooling, and hole-cleaning. Offshore Offshore drilling presents unique challenges, such as harsh environmental conditions and deepwater drilling, necessitating specialized drilling fluids.

- Regional Analysis: North America is the dominant market with a 30% market share, driven by high demand for oil and gas and the shale-gas boom.

Driving Factors

The Main Driver Is Increasing Demand for Oil And Gas.

The global drilling fluids industry is driven by a variety of factors that drive its growth and expansion. The main driving factor is the increasing demand for oil & gas. As the demand for gas & oil increases continually, there is a need for production, exploration, and other activities increases. This, in turn, drives the demand for drilling liquids. The technological advances in the drilling fluids sector are another important factor. Technological development has led the industry to develop environmentally friendly, high-performance drilling fluids.

The global drilling fluids industry is also growing due to the increase in offshore drilling activities. This is due to an increase in ultra-deepwater & deepwater drilling activities, which require the use of drilling fluids. The increasing production of shale gases has also led to an increase in drilling fluids as it requires complex operations. The market is also growing due to strict environmental regulations. Companies are looking for environmentally friendly drilling fluids with a smaller impact on the environment.

Restraining Factors

Changing prices of oil.

The main restraining factor of the drilling fluids market is the volatility of oil prices. Oil prices are low, and oil and gas companies reduce their exploration and production, resulting in lower demand for drilling fluids.

The second potential factor that could limit the growth of drilling fluids is the increased focus on renewable sources of energy. The demand for natural gas and oil decreases as the world moves towards cleaner and more sustainable energy sources. This could lead to a reduced demand for drilling fluids.

The environmental impact of drilling liquids could also restrain the growth of the market, especially if companies are not able to develop and use environmentally friendly drilling fluids that meet regulatory requirements.

By Fluid Type Analysis

Water-based fluids are dominant in the market with a market share of 52%.

Based on the fluid type, the market for global drilling fluids is segmented into water-based, oil-based, synthetic, and other types. Among these fluid types, water-based fluids are dominant in the market, with a market share of 52%. They are cost-effective, and they perform well in most drilling applications. They do not contain any toxic chemicals; hence they are environmentally friendly.

Oil-based drilling fluids can be used when water-based fluids do not work. They have excellent lubrication and are useful for drilling through difficult formations such as shale or sandstone. Synthetic-based oil-based liquids offer improved environmental performance.

By Well Type Analysis

The high-pressure high-temperature well (HPHT) is a dominant segment with a market share of about 78%.

Based on the good type, the market is divided into conventional wells and high-pressure, high-temperature wells. The high-pressure high-temperature well (HPHT) is a dominant segment, with a market share of about 78%. HPHT wells are drilled in formations with high pressure and temperature, such as deep offshore reservoirs. Such wells require special drilling fluids which can withstand extreme conditions, like high pressure, high temperature, and high salinity.

Conventional wells are typically drilled in formations with low to moderate pressure and temperature. The drilling fluid used in conventional wells is typically water-based or oil-based mud, depending on the formation being drilled. These fluids are designed to provide good lubrication, cooling, and hole-cleaning properties, while also preventing formation damage and controlling wellbore stability.

By Application Analysis

Based on the application, the applications of global drilling fluids involve onshore and offshore applications. Onshore drilling involves drilling wells on land. Drilling fluids used in onshore applications typically include water-based or oil-based fluids, depending on the formation being drilled.

Onshore drilling fluids are designed to provide good lubrication, cooling, and hole-cleaning properties, while also preventing formation damage and controlling wellbore stability. Offshore drilling involves drilling wells in bodies of water, such as oceans or seas. Offshore drilling presents unique challenges, such as harsh environmental conditions, deepwater drilling, and wellbore stability.

Market Key Segments

Based on Fluid Type

- Water-based

- Oil-based

- Synthetic

- Other Types

Based on Well Type

- Conventional Wells

- High-pressure High-Temperature Wells

Based on Application

- Onshore

- Offshore

Growth Opportunity

Increase in the demand for oil and natural gas.

The global drilling fluids industry offers several growth opportunities to companies in the industry. One of the major growth opportunities is the increasing demand for oil and natural gas. This will, in turn, lead to an increase in the demand for drilling fluids. The market can also grow due to technological advancements. The production of advanced drilling fluids which are cost-effective, efficient, and environmentally friendly helps the companies gain an advantage and capture a large share of the market.

The growth of the shale-gas industry is another opportunity for drilling fluids. Shale gas drilling is complex and often requires the use of specialized fluids. The demand for drilling fluids will also increase as the production of shale gases continues to grow. The growing focus on environmental sustainability has also led to the development of eco-friendly drilling liquids. This can create new opportunities for companies that are able to meet these regulatory requirements.

In regions like the Gulf of Mexico or the North Sea, there is significant growth of offshore drilling, which is a major opportunity for growth. As more companies shift to deepwater and ultra-deepwater drilling, demand for specialized fluids will likely increase.

Latest Trends

Focus on sustainability

Global drilling fluids are undergoing a number of the latest trends that are shaping this industry. Focus on sustainability is one of the major trends. This is because of increasing awareness about the importance of sustainability & need to reduce drilling’s environmental impact. There is an increasing demand for environmentally friendly, biodegradable, and less harmful drilling fluids.

Water-based drilling fluids are another important trend on the market. As water-based fluids have several advantages over oil-based fluids, they are becoming more popular. These include lower costs, a reduced environmental impact, and improved drilling performance. Many companies invest in research and development to improve the performance of water-based drill fluids.

In the market for drilling fluids, advanced technologies like artificial intelligence and machine learning are also on the rise. These technologies are used to increase productivity, decrease costs and improve drilling efficiency. Nowadays, companies are using predictive analytics such as optimize the performance of drilling fluids, which result in improved drilling efficiency and significant cost saving.

The COVID-19 epidemic has also accelerated the trend toward remote and digital operations within the drilling industry. Digital technologies are being used by many companies to monitor and control their drilling operations remotely. This can help reduce costs, increase safety and efficiency.

Regional Analysis

North America is the dominant market with a market share of 30%.

North America is the dominant region in the drilling fluids market; this is due to the high demand for oil & gas in the region. The market share for North America is 30%. The US is the largest region and accounts for a significant portion of the global market. The shale-gas boom in North America also contributed to the growth. Europe is also a significant market for drilling liquids due to the presence of major oil and gas-producing countries such as Norway and the UK. The region is expected to grow moderately in the next few years due to the growing energy demand and the increasing focus on sustainability.

Due to the growing demand for oil and gas in China and India, the Asia Pacific region is expected to grow at a high growth rate in the global drilling liquids market. The region is also experiencing a rise in investments in exploration and production which is driving demand for drilling fluids. Latin America is also an important market for drilling liquids due to the presence of major oil-producing nations such as Brazil and Mexico. Due to an increase in energy demand & increased investments in oil & gas exploration, the region is expected to grow moderately in the next few years.

Middle East & Africa, due to the presence of major oil-producing nations such as Saudi Arabia and UAE, is a major drilling fluids market. Africa & Middle East is expected to grow moderately in upcoming years due to growing investment and increasing demand.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global drilling fluids market is highly competitive with only a few major players accounted the maximum share of the market. The key players present in the market are engaged in several strategic initiatives such as partnership, collaboration, and merger and acquisition to expand the product portfolio and strengthen the market position.

Market Key Players

- National Oilwell Varco

- Schlumberger Limited

- Baker Hughes Incorporated

- Anchor Drilling Fluids USA, LLC

- Gumpro Drilling Fluids Pvt. Ltd.

- Halliburton Company

- CES Energy Solutions Corp

- Newpark Resources Inc

- Weatherford International Plc

- Other Key Players

Recent Developments

- In 2021- Schlumberger introduced a new drilling fluid technology called EcoScope that can help reduce environmental impact and increase drilling efficiency.

- In 2020- Halliburton announced the launch of the BaraOmni hybrid separation system, which can help operators achieve optimal fluid performance in various drilling applications.

Report Scope

Report Features Description Market Value (2022) USD 9.8 Bn Forecast Revenue (2032) USD 16.1 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Fluid Type-Water-based, Oil-based, Synthetic, and Other Types; By Well Type-Conventional Wells and High-pressure High-Temperature Wells; By Application; Onshore, and Offshore Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape National Oilwell Varco, Schlumberger Limited, Baker Hughes Incorporated, Anchor Drilling Fluids USA LLC, Gumpro Drilling Fluids Pvt. Ltd, Halliburton Company, CES Energy Solutions Corp, Newpark Resources Inc, Weatherford International Plc, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Drilling Fluids Market?In 2022, the global Drilling Fluids Market was valued at USD 9.8 billion.

What will be the market size for Drilling Fluids Market in 2032?In 2032, the Drilling Fluids Market will reach USD 16.1 billion.

What CAGR is projected for the Drilling Fluids Market?The Drilling Fluids Market is expected to grow at 5.2% CAGR (2023-2032).

List the segments encompassed in this report on the Drilling Fluids Market?Market.US has segmented the Drilling Fluids Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Fluid Type, market has been segmented into Water-based, Oil-based, Synthetic and Other Types. By Well Type, the market has been further divided into Conventional Wells and High-pressure High-Temperature Wells.

Which segment dominate the Drilling Fluids industry?With respect to the Drilling Fluids industry, vendors can expect to leverage greater prospective business opportunities through the Water-based Fluids segment, as this dominate this industry.

Name the major industry players in the Drilling Fluids Market.National Oilwell Varco, Schlumberger Limited, Baker Hughes Incorporated, Anchor Drilling Fluids USA, LLC, Gumpro Drilling Fluids Pvt. Ltd. and Other Key Players are the main vendors in this market.

-

-

- National Oilwell Varco

- Schlumberger Limited

- Baker Hughes Incorporated

- Anchor Drilling Fluids USA, LLC

- Gumpro Drilling Fluids Pvt. Ltd.

- Halliburton Company

- CES Energy Solutions Corp

- Newpark Resources Inc

- Weatherford International Plc

- Other Key Players