Global Dragon Fruit Market By Type(Hylocereus Undatus, Hylocereus Costaricensis, Hylocereus Megalanthus), By Product Type(Red Dragon Fruit, Yellow Dragon Fruit), By Form(Powder, Puree), By Nature(Organic, Conventional), By Application(Direct Consumption, Jams, Sauce, Ice cream, Salad, Others), By Distribution Channel(Supermarkets/ Hypermarkets, Convenience Stores, Online Platforms), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 73101

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

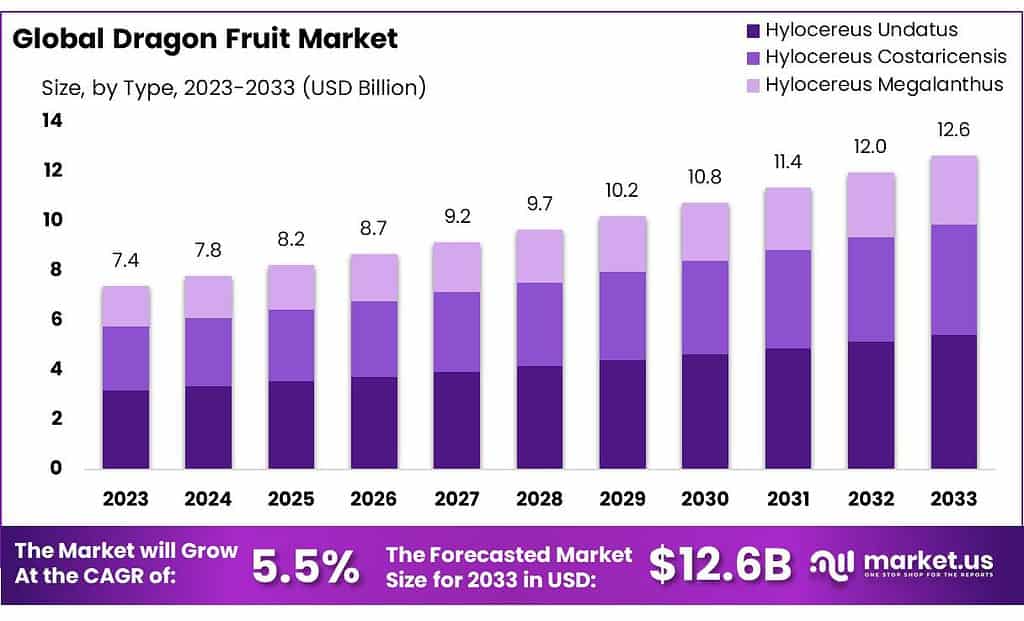

The global Dragon Fruit Market size is expected to be worth around USD 12.6 billion by 2033, from USD 7.4 billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2023 to 2033.

The Dragon Fruit Market refers to the global industry and commerce surrounding the cultivation, distribution, and sale of dragon fruit, also known as pitaya. This exotic fruit, native to Central America but now grown in several countries across the world, including Vietnam, Thailand, Israel, and Colombia, is known for its vibrant skin, unique texture, and nutritional benefits. The market encompasses fresh dragon fruit, as well as processed forms such as juices, smoothies, and dietary supplements that utilize the fruit’s extract.

The demand in the Dragon Fruit Market is driven by the fruit’s growing popularity among health-conscious consumers, attributed to its high vitamin, mineral, and antioxidant content. Additionally, dragon fruit is gaining traction in the culinary world for its versatility in both sweet and savory dishes. The market’s growth is influenced by factors such as global dietary trends, agricultural innovations that improve yield and fruit quality, and international trade dynamics.

Stakeholders in the Dragon Fruit Market include farmers, wholesalers, retailers, and companies involved in the processing and packaging of dragon fruit products. As consumer interest in exotic and nutritious fruits continues to rise, the Dragon Fruit Market is poised for further expansion, offering opportunities for innovation in product development and distribution channels.

Key Takeaways

- Market Growth: Dragon Fruit Market is projected to reach USD 12.6 billion by 2033, with a 5.5% CAGR from 2023.

- Consumer Preference: Red Dragon Fruit dominates with over 69.7% market share in 2023.

- Product Form: Powder form leads, holding over 65.5% market share in 2023.

- Nature Preference: Organic dragon fruit captures more than 67.8% market share in 2023.

- Application Focus: Direct consumption leads, capturing over 32.5% market share in 2023.

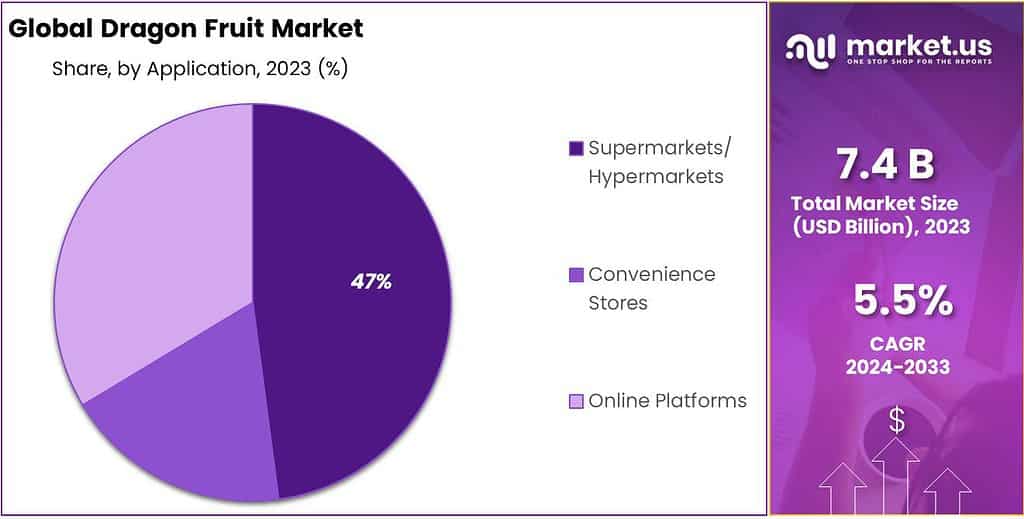

- Distribution Channels: Supermarkets/hypermarkets hold over 47.5% market share in 2023.

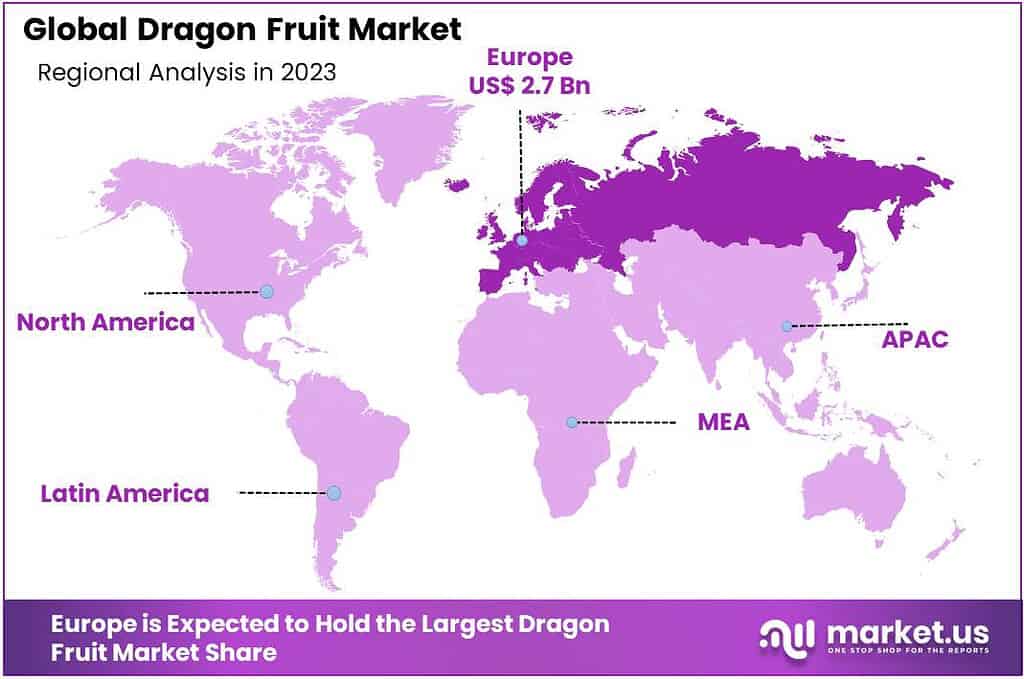

- Regional Dominance: Europe leads, holding 37% market share with USD 2.7 billion value in 2023.

By Type

In 2023, Hylocereus undatus held a dominant market position in the Dragon Fruit Market, capturing more than a 43.3% share. Known for its white flesh and pink to red skin, this variety is favored for its sweet taste and substantial size, making it highly popular among consumers and a staple in supermarkets and fruit markets worldwide. Its adaptability to various climates and soils contributes to its widespread cultivation and availability.

Following closely, Hylocereus Costaricensis, with its distinctive red flesh and great taste, has carved out a significant niche in the market. This variety is sought after for its unique visual appeal and antioxidant properties, appealing to health-conscious consumers and those looking to add color and nutrition to their meals.

Hylocereus Megalanthus, although holding a smaller market share, is notable for its yellow skin and white flesh. Known as the yellow dragon fruit, it stands out for its sweetness and is considered a delicacy in many parts of the world. Despite its lesser prevalence compared to the other varieties, its high demand in niche markets underscores its potential for growth and increased market penetration.

Each of these dragon fruit varieties caters to different consumer preferences and culinary applications, with Hylocereus Undatus leading due to its broad appeal and versatility. As the Dragon Fruit Market continues to expand, the diversity of available varieties enriches the consumer experience and opens up new avenues for culinary exploration and health-focused consumption.

By Product Type

In 2023, Red Dragon Fruit held a dominant market position, capturing more than a 69.7% share in the Dragon Fruit Market. This variety, characterized by its vibrant red skin and either white or red flesh, is prized for its unique taste, nutritional benefits, and versatility in culinary applications. Its popularity is attributed to its wide availability and the growing consumer awareness of its antioxidant properties and health benefits, making it a preferred choice for both fresh consumption and use in juices, smoothies, and desserts.

Yellow Dragon Fruit, while holding a smaller portion of the market, stands out for its yellow skin and sweet, white flesh. This variety is highly valued for its exceptional sweetness and is often considered a premium product. Despite its lesser market share compared to red dragon fruit, the yellow variety has a loyal consumer base and commands higher prices in the market, reflecting its perceived quality and taste superiority.

Both red and yellow dragon fruits play significant roles in meeting the diverse preferences of consumers, with Red Dragon Fruit leading the market due to its broad appeal and health benefits. As the Dragon Fruit Market continues to grow, the distinct qualities of each product type cater to various consumer tastes and nutritional needs, enriching the global fruit market landscape.

By Form

In 2023, Powder form held a dominant market position in the Dragon Fruit Market, capturing more than a 65.5% share. This popularity is largely due to the convenience and versatility of dragon fruit powder, which allows for easy storage and incorporation into a variety of products, including dietary supplements, smoothies, and even cosmetics. Its concentrated nutrient content and extended shelf life make it a preferred choice for consumers looking to enjoy the health benefits of dragon fruit in a more accessible and flexible format.

Puree form, while holding a smaller market share, is highly valued for its application in food and beverage manufacturing, particularly in the production of juices, desserts, and baby food. The puree retains much of the fruit’s natural flavor and nutritional profile, making it an attractive option for creating products that highlight the exotic taste and vibrant color of dragon fruit.

Both powder and puree forms of dragon fruit cater to different segments of the market, with Powder leading due to its broader application potential and consumer convenience. As the Dragon Fruit Market evolves, the diverse product forms available are expected to meet the varied needs of consumers and industries, driving further growth and innovation in the market.

By Nature

In 2023, Organic dragon fruit held a dominant market position, capturing more than a 67.8% share. This strong preference for organic dragon fruit stems from increasing consumer awareness and demand for natural, pesticide-free produce that supports both health and environmental sustainability. Organic dragon fruit, cultivated without the use of synthetic fertilizers or chemicals, appeals to health-conscious consumers looking for nutrient-rich fruits that align with their lifestyle choices and dietary preferences.

Conventional dragon fruit, while holding a smaller portion of the market, continues to be significant due to its accessibility and affordability. It caters to a broad audience, including markets where organic produce is less available or cost-prohibitive. Despite its smaller share, conventional dragon fruit plays a crucial role in meeting the global demand for this exotic fruit, offering consumers a wider range of purchasing options.

Both organic and conventional dragon fruits are integral to the market, with Organic leading due to a growing consumer trend towards cleaner and more sustainable eating habits. As the Dragon Fruit Market progresses, the demand for organic produce is expected to rise, driven by a deeper consumer focus on health, quality, and environmental impact.

By Application

In 2023, Direct Consumption held a dominant market position in the Dragon Fruit Market, capturing more than a 32.5% share. This is primarily because of the fruit’s growing popularity as a nutritious and exotic snack among health-conscious consumers. Its unique taste and texture, coupled with its nutritional benefits such as high vitamin and antioxidant content, make it a favored choice for people looking to enrich their diet with fresh, whole fruits.

Jams and sauces made from dragon fruit have also carved out a significant niche, appealing to consumers looking to add an exotic twist to their meals. These products harness the fruit’s vibrant color and flavor, offering a delightful way to enjoy dragon fruit’s taste in various culinary applications.

Ice cream and salads represent other important applications, with dragon fruit adding a refreshing and tropical flair. The fruit’s use in ice cream offers a novel dessert option, while its incorporation into salads brings a burst of color and a unique taste profile, enhancing the appeal of healthy meals.

With Direct Consumption leading due to the rising trend of healthy eating, dragon fruit’s diverse applications highlight its versatility and growing appeal in the global market, promising continued growth and innovation in how it is enjoyed.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position in the Dragon Fruit Market, capturing more than a 47.5% share. This channel’s popularity is due to its wide reach and the convenience it offers consumers by providing a vast array of products, including exotic fruits like dragon fruit, under one roof. Shoppers appreciate the ability to see and select the fruit firsthand, ensuring quality and freshness.

Convenience Stores also play a significant role, especially in urban and densely populated areas where quick and easy access to food items is essential. While their market share is smaller compared to supermarkets/hypermarkets, convenience stores offer the advantage of proximity and extended hours, catering to the needs of consumers looking for immediate purchases.

Online Platforms have emerged as a growing distribution channel for dragon fruit, appealing to the tech-savvy and time-constrained consumer. This channel offers the convenience of home delivery and often provides access to a wider variety of dragon fruit, including both organic and conventional options. Despite being a relatively newer channel, online platforms are rapidly gaining traction, fueled by the increasing consumer preference for online shopping.

With Supermarkets/Hypermarkets leading due to their extensive product range and consumer reach, all three distribution channels play crucial roles in making dragon fruit accessible to a broad audience, each catering to different consumer needs and shopping preferences.

Key Market Segments

By Type

- Hylocereus Undatus

- Hylocereus Costaricensis

- Hylocereus Megalanthus

By Product Type

- Red Dragon Fruit

- Yellow Dragon Fruit

By Form

- Powder

- Puree

By Nature

- Organic

- Conventional

By Application

- Direct Consumption

- Jams

- Sauce

- Ice cream

- Salad

- Others

By Distribution Channel

- Supermarkets/ Hypermarkets

- Convenience Stores

- Online Platforms

Drivers

Health and Wellness Trend Fuels Dragon Fruit Market Growth

A major driver propelling the growth of the Dragon Fruit Market is the escalating global trend towards health and wellness. In recent years, consumers have become increasingly aware of the importance of a healthy diet and the role of fruits and vegetables in promoting overall well-being. Dragon fruit, with its unique nutritional profile, has emerged as a popular choice among health-conscious individuals. Known for its high antioxidant content, vitamins, minerals, and fiber, dragon fruit is credited with numerous health benefits, including boosting the immune system, aiding digestion, and helping to regulate blood sugar levels.

This trend is further amplified by the growing demand for natural and organic food products, with dragon fruit fitting perfectly into this category. Its exotic appeal, combined with its health benefits, has made it a staple in diets that focus on clean eating and natural ingredients. The rise of social media and health influencers has also played a significant role in popularizing dragon fruit, showcasing its versatility in various culinary creations, from smoothie bowls and salads to exotic desserts.

Moreover, the global fitness and wellness movement, emphasizing a holistic approach to health, has led to an increase in the consumption of foods that support active lifestyles. Dragon fruit’s energy-boosting properties make it a favored ingredient in pre-workout meals and recovery snacks. Additionally, its hydrating qualities and refreshing taste appeal to consumers looking for nutritious hydration options.

The agricultural sector’s response to this growing demand has been to increase the cultivation of dragon fruit, especially in regions with favorable climatic conditions, further facilitating its availability in global markets. Advances in storage and transportation technologies have also enabled fresh dragon fruit to reach consumers in regions far from its cultivation sites, expanding its presence in international markets.

Restraints

Limited Awareness and High Production Costs: Key Restraints in the Dragon Fruit Market

One of the major restraints facing the Dragon Fruit Market is the limited consumer awareness outside of its native regions and the high costs associated with its production and distribution. Despite its growing popularity among health-conscious consumers and culinary enthusiasts, dragon fruit remains relatively unknown to a significant portion of the global population. This lack of awareness can be attributed to its exotic nature and the fact that it is not a staple in many diets, especially in Western countries where it is often perceived as a novelty rather than a regular dietary component. The unfamiliarity with how to prepare and consume dragon fruit also contributes to its limited penetration in various markets.

Moreover, the cultivation of dragon fruit presents its own set of challenges. Being a tropical and subtropical cactus species, dragon fruit requires specific climatic conditions to thrive, limiting its agricultural production to certain regions. This geographical constraint not only affects the volume of production but also leads to higher prices due to the costs associated with creating suitable growing conditions, including greenhouse cultivation in non-native areas. Additionally, the perishable nature of the fruit necessitates efficient and rapid transport to prevent spoilage, further escalating costs.

High production and distribution costs inevitably affect the retail price, making dragon fruit more expensive compared to more common fruits. This price disparity can deter budget-conscious consumers from purchasing dragon fruit regularly, restricting its market growth. Furthermore, the reliance on favorable weather conditions and susceptibility to pests and diseases add to the production risk, potentially leading to supply shortages and price volatility.

To overcome these restraints, efforts are being made to increase consumer awareness through marketing campaigns and educational initiatives that highlight the nutritional benefits and versatility of dragon fruit. Advances in agricultural technology and practices are also being explored to reduce production costs and extend the fruit’s growing range. Additionally, developing more robust varieties that can withstand pests and adverse weather conditions could help stabilize production and supply.

Opportunity

Expansion into New Markets: A Significant Opportunity for the Dragon Fruit Market

A major opportunity for the Dragon Fruit Market lies in its potential expansion into new geographic and demographic markets. As global awareness of health and wellness continues to rise, the demand for exotic fruits like dragon fruit, known for their nutritional benefits, is set to increase.

This presents a significant opportunity for producers and distributors to introduce dragon fruit into regions where it is currently less known or consumed. Targeting these new markets not only diversifies the consumer base but also helps stabilize demand throughout the year, mitigating the effects of seasonality and regional consumption patterns.

Currently, the primary consumers of dragon fruit are located in Asia and, to a lesser extent, in North America and Europe. However, untapped markets in other parts of the world, including Africa and the Middle East, show promising potential for dragon fruit consumption due to their growing middle classes and increasing interest in healthy eating. Furthermore, expanding into countries with climates suitable for dragon fruit cultivation could reduce production costs and make the fruit more accessible to local populations.

The rise of online shopping and global logistics also plays a crucial role in this opportunity. E-commerce platforms and improved shipping methods make it easier than ever to introduce dragon fruit to new consumers, allowing them to discover and purchase the fruit regardless of their location. This digital expansion, coupled with targeted marketing campaigns that educate potential consumers about the fruit’s taste, use, and health benefits, can significantly boost global demand.

Moreover, the versatility of dragon fruit in food and beverage applications—from smoothies and desserts to savory dishes—provides another avenue for market expansion. Collaborating with chefs, food influencers, and product developers to create new dragon fruit-based recipes and products can stimulate interest and demand across various culinary segments.

Trends

The Rise of Functional Foods and Beverages: A Trend Shaping the Dragon Fruit Market

A pivotal trend currently shaping the Dragon Fruit Market is the increasing consumer shift towards functional foods and beverages, where dragon fruit is emerging as a star ingredient. This trend is largely driven by the growing awareness among consumers of the importance of diet in health and wellness, alongside a rising preference for natural and nutrient-rich foods that offer additional health benefits beyond basic nutrition.

Dragon Fruit, with its high antioxidant content, vitamins, minerals, and unique bioactive compounds, fits perfectly into this category, making it an attractive addition to a variety of functional food and beverage products.

The integration of dragon fruit into functional foods is being fueled by its perceived health benefits, including improved digestion, a stronger immune system, and potential anti-inflammatory properties. Its visually appealing vibrant color and distinctive taste also make dragon fruit a popular choice for enhancing the aesthetic and flavor profile of these products. From dragon fruit-infused waters and smoothies to yogurts, energy bars, and even desserts, the incorporation of dragon fruit aligns with consumer desires for foods that are not only healthful but also enjoyable to eat.

Similarly, in the beverage sector, dragon fruit is making its mark in the growing market for natural and functional drinks. Energy drinks, detox waters, and herbal teas are incorporating dragon fruit for its refreshing taste and health-promoting properties, appealing to consumers looking for hydrating and nutritious beverage options that support an active and health-conscious lifestyle.

Moreover, the trend towards clean labeling and transparency in food production is further enhancing the appeal of dragon fruit in the functional food and beverage market. Consumers are increasingly seeking products made with simple, recognizable ingredients, and dragon fruit’s natural origin and health benefits are perfectly aligned with this demand.

As the functional food and beverage market continues to expand, the role of dragon fruit is expected to grow correspondingly. Its adaptability to various product formulations, combined with its nutritional profile and consumer appeal, positions dragon fruit as a key ingredient in the development of new and innovative functional products.

Regional Analysis

In 2023, Europe emerges as a leading force in the Dragon Fruit Market, holding a commanding market share of 37% with a market value of USD 2.7 billion. This impressive share is fueled by the soaring popularity of dragon fruit among European consumers, driven by a surge in health consciousness and a growing acceptance among the younger population.

Reports from the Council of Europe indicate that 12% of individuals in the European Union now include dragon fruit in their diets, showcasing a significant shift towards viewing this exotic fruit as a nutritious and convenient snacking option. The blend of Europe’s rich cultural heritage with shifting consumer tastes plays a pivotal role in driving the dragon fruit market’s expansion within the region. North America stands out as another pivotal market for dragon fruit, marked by its substantial market share.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Dragon Fruit Market is characterized by a dynamic and competitive landscape, with several key players contributing to its growth through innovative cultivation techniques, marketing strategies, and product development. These companies range from specialized agricultural firms to multinational food and beverage corporations, each playing a vital role in the supply chain of dragon fruit from farm to table. Here’s an analysis of some of the notable players in the Dragon Fruit Market

Market Key Players

- A Natural Farm

- Bai Brands (Dr Pepper Snapple Group, Inc.)

- Biourah Herbal (M) Sdn. Bhd.

- Great Sun Pitaya Farm Sdn. Bhd.

- Hoang Hau Dragon Fruit Farm Co. Ltd.

- Hybrid Herbs

- J & C Tropicals

- Light Cellar

- Madam Sun Sdn.Bhd

- Miami Fruit

- Moonland Produce Inc

- Nam Viet Foods & Beverage Co., Ltd.

- Pitaya Plus

- Raw Nice

- Unicorn Superfoods

- Welch Foods Inc.

- Wilderness Poets

Recent Development

In 2024 A Natural Farm, this company further solidified its position in the dragon fruit sector, with continued investments in research and development to improve crop yields and develop new varieties.

In 2024, Bai Brands sustained its growth trajectory in the dragon fruit sector, with further product diversification and expansion into new markets.

Report Scope

Report Features Description Market Value (2023) USD 7.4 Bn Forecast Revenue (2033) USD 12.6 Bn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Hylocereus Undatus, Hylocereus Costaricensis, Hylocereus Megalanthus), By Product Type(Red Dragon Fruit, Yellow Dragon Fruit), By Form(Powder, Puree), By Nature(Organic, Conventional), By Application(Direct Consumption, Jams, Sauce, Ice cream, Salad, Others), By Distribution Channel(Supermarkets/ Hypermarkets, Convenience Stores, Online Platforms) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape A Natural Farm, Bai Brands (Dr Pepper Snapple Group, Inc.), Biourah Herbal (M) Sdn. Bhd., Great Sun Pitaya Farm Sdn. Bhd. , Hoang Hau Dragon Fruit Farm Co. Ltd., Hybrid Herbs, J & C Tropicals, Light Cellar, Madam Sun Sdn.Bhd, Miami Fruit, Moonland Produce Inc, Nam Viet Foods & Beverage Co., Ltd., Pitaya Plus, Raw Nice, Unicorn Superfoods, Welch Foods Inc., Wilderness Poets Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Dragon Fruit Market?Dragon Fruit Market size is expected to be worth around USD 12.6 billion by 2033, from USD 7.4 billion in 2023

What CAGR is projected for the Dragon Fruit Market?The Dragon Fruit Market is expected to grow at 5.5% CAGR (2023-2032).Name the major industry players in the Dragon Fruit Market?A Natural Farm, Bai Brands (Dr Pepper Snapple Group, Inc.) , Biourah Herbal (M) Sdn. Bhd., Great Sun Pitaya Farm Sdn. Bhd. , Hoang Hau Dragon Fruit Farm Co. Ltd., Hybrid Herbs , J & C Tropicals, Light Cellar , Madam Sun Sdn.Bhd, Miami Fruit, Moonland Produce Inc, Nam Viet Foods & Beverage Co., Ltd., Pitaya Plus , Raw Nice , Unicorn Superfoods , Welch Foods Inc., Wilderness Poets

-

-

- A Natural Farm

- Bai Brands (Dr Pepper Snapple Group, Inc.)

- Biourah Herbal (M) Sdn. Bhd.

- Great Sun Pitaya Farm Sdn. Bhd.

- Hoang Hau Dragon Fruit Farm Co. Ltd.

- Hybrid Herbs

- J & C Tropicals

- Light Cellar

- Madam Sun Sdn.Bhd

- Miami Fruit

- Moonland Produce Inc

- Nam Viet Foods & Beverage Co., Ltd.

- Pitaya Plus

- Raw Nice

- Unicorn Superfoods

- Welch Foods Inc.

- Wilderness Poets