Downhole Tools Market Report By Tool Type (Drilling Tools , Handling Tools , Flow & Pressure Tools , Control Tools , Others), By Application (Drilling , Completion , Intervention , Production , Formation & Evaluation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 61247

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

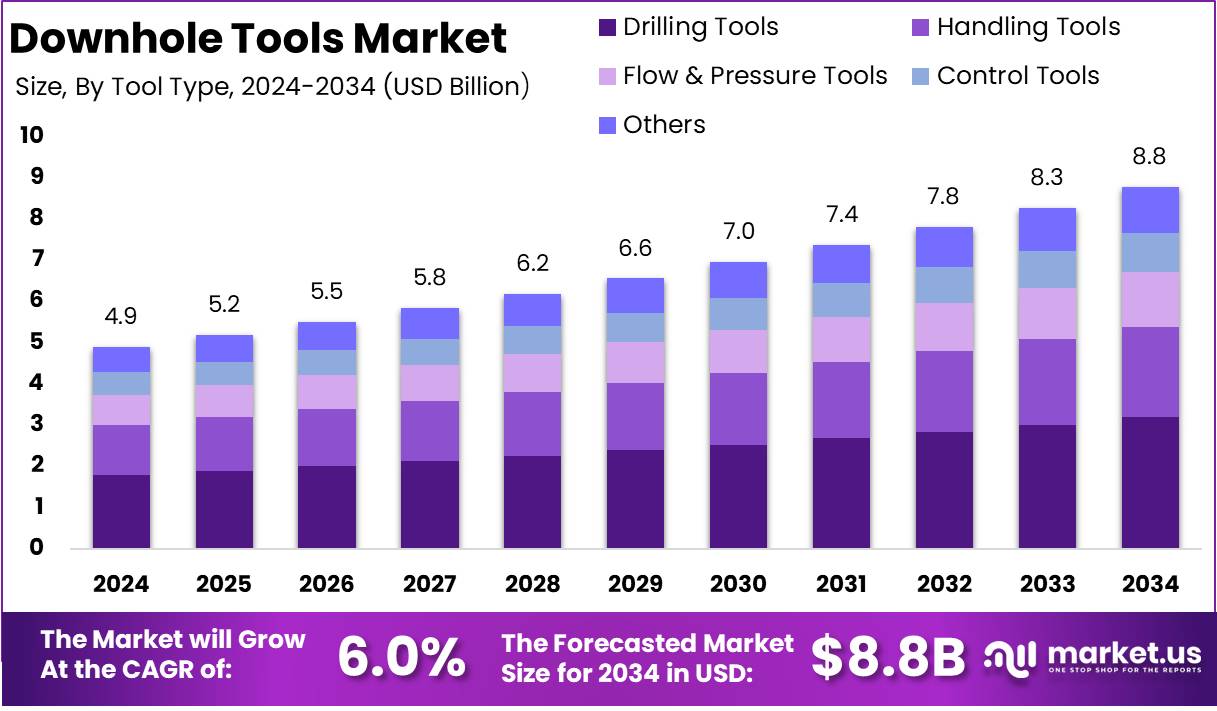

The Global Downhole Tools Market size is expected to be worth around USD 8.8 Billion by 2034 from USD 4.9 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Downhole tools refer to a specialized category of equipment utilized in oil and gas exploration and production operations, particularly within the wellbore. These tools are engineered to perform a variety of critical tasks such as drilling, well intervention, logging, well completion, and maintenance activities.

Designed to withstand extreme downhole conditions including high pressure, elevated temperatures, and corrosive environments, downhole tools contribute significantly to operational efficiency, safety, and precision. They encompass a broad range of instruments including drilling jars, shock tools, reamers, fishing tools, and tubular tools, among others. The performance and reliability of these tools directly impact the success of drilling campaigns and overall production lifecycle management.

The downhole tools market encompasses the global industry landscape involved in the manufacturing, distribution, and deployment of equipment used for downhole operations in oil and gas wells. This market forms a vital segment of the upstream oilfield services sector and includes both onshore and offshore applications. It is characterized by significant technological advancements, strategic collaborations, and a focus on operational optimization.

Market participants range from multinational oilfield service providers to specialized tool manufacturers, collectively driving innovation to meet the rising complexities of hydrocarbon extraction. The market’s growth trajectory is shaped by drilling activities, field redevelopment efforts, and the increasing focus on enhancing recovery from mature reservoirs.

The growth of the downhole tools market can be attributed to the resurgence of drilling activities driven by the stabilization of crude oil prices and increasing energy demand across emerging economies. Technological advancements such as rotary steerable systems, measurement-while-drilling (MWD), and logging-while-drilling (LWD) tools are reshaping drilling efficiencies and reducing non-productive time, thereby accelerating market adoption.

Demand for downhole tools remains robust, underpinned by increasing exploration and production (E&P) activities, both in established oil-producing regions and emerging hydrocarbon basins. The heightened need for precision and real-time data acquisition during complex drilling operations has bolstered the uptake of intelligent and autonomous downhole tools.

Significant opportunities are emerging within the downhole tools market due to the industry’s transition toward digital oilfield initiatives and the increased prioritization of well integrity management. Market players have the potential to capitalize on the development of hybrid and multi-functional tools that consolidate various functions into a single unit, thereby reducing rig time and enhancing cost-efficiency.

According to Noble Corporation, the Downhole Tools Market is anticipated to witness substantial consolidation and strategic investment, as evidenced by Noble’s definitive agreement to acquire Diamond Offshore Drilling, Inc. in a stock-plus-cash deal. Under the terms, Diamond shareholders will receive 0.2316 shares of Noble and $5.65 per share in cash, reflecting an 11.4% premium over June 7, 2024, closing prices. Following the transaction, Diamond stakeholders will collectively hold approximately 14.5% of Noble’s outstanding equity.

This merger reflects ongoing optimization in offshore drilling operations and signals increased capital flow into high-performance downhole tool technologies, driven by the need for enhanced drilling efficiency, reduced non-productive time, and cost-effective exploration in deepwater basins.

According to Understand Energy Learning Hub, drilling operations generally span 50–60 days, while the completion phase crucial for reservoir connectivity ranges between 1 to 5 weeks.

Key Takeaways

- Global Downhole Tools Market is projected to grow from USD 4.9 billion in 2024 to USD 8.8 billion by 2034, at a CAGR of 6.0% during 2025–2034.

- Drilling Tools led the market with over 36.4% share, driven by rising demand for efficient drilling operations.

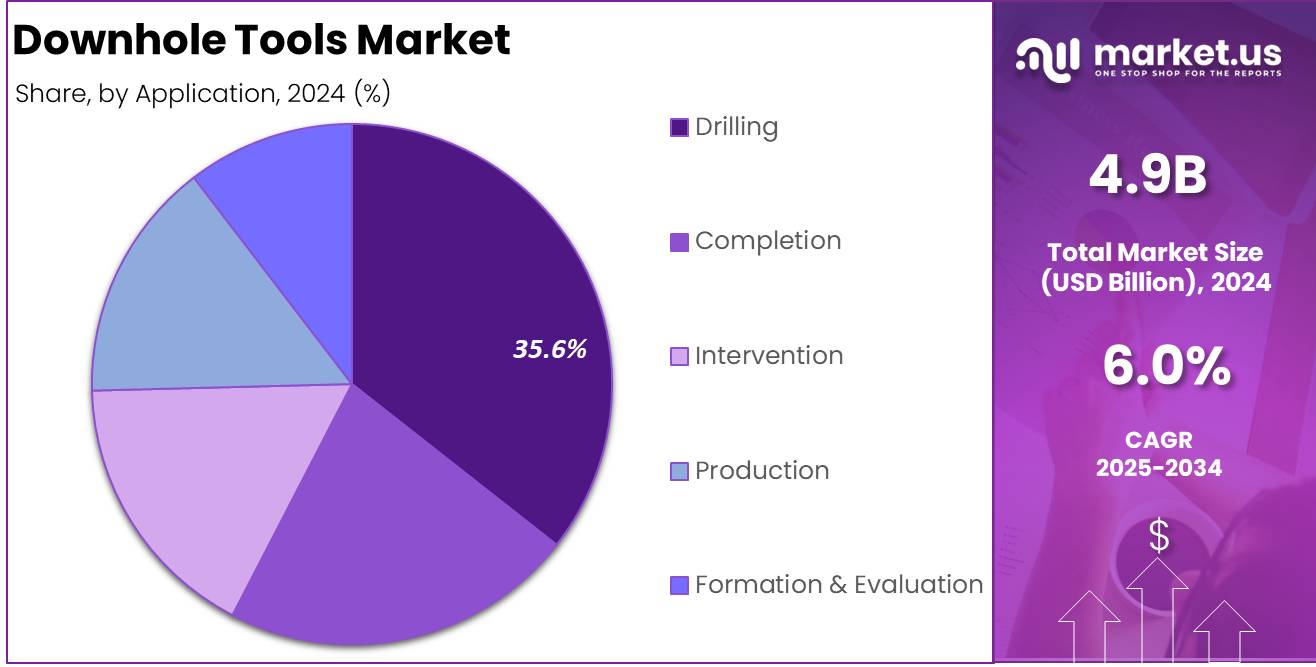

- Drilling applications dominated with more than 35.6% share, supported by ongoing exploration activities.

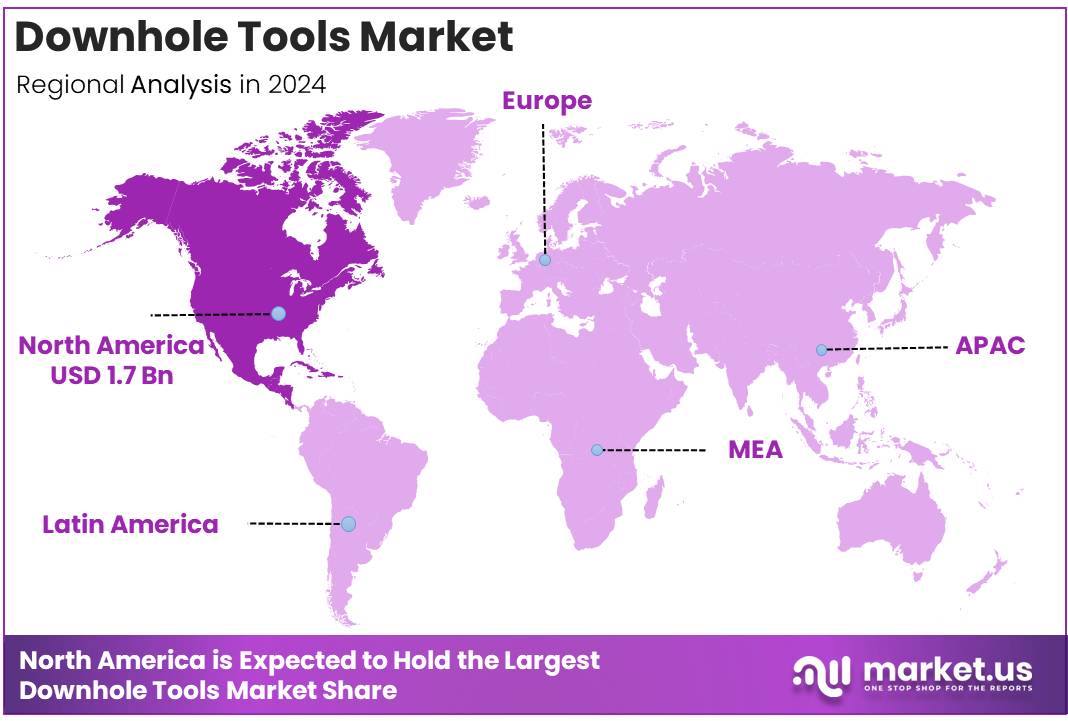

- North America accounted for the largest share at 36.3% in 2024, valued around USD 1.7 billion, due to strong shale and deepwater activity.

By Tool Type Analysis

Drilling Tools dominated the Downhole Tools Market by securing a market share exceeding 36.4%.

In 2024, Drilling Tools secured a dominant position in the By Tool Type segment of the Downhole Tools Market, capturing more than 36.4% of the total market share. This significant share is primarily driven by the extensive use of drilling tools in both onshore and offshore oil and gas exploration activities. The rising number of drilling operations, particularly in unconventional reserves such as shale formations, has increased demand for reliable and high-performance tools. Components like drill bits, jars, and hammers have witnessed strong uptake due to their critical role in borehole creation and well development.

The market expansion is further supported by technological advancements that improve tool durability, efficiency, and depth capacity. Innovations in rotary steerable systems and downhole motors are enhancing drilling precision and operational control, particularly in complex wellbore conditions. Additionally, increasing investments in deepwater and ultra-deepwater exploration, coupled with favorable regulatory support in hydrocarbon extraction, continue to reinforce the demand for drilling tools globally.

In 2024, Handling Tools accounted for a notable share of the Downhole Tools Market by tool type. These tools are essential for managing and supporting equipment during drilling, well completion, and intervention processes. The segment’s growth can be attributed to the increased emphasis on safety and efficiency in wellbore handling operations. Tools such as elevators, slips, tongs, and spinners form the backbone of this category and are extensively utilized in rig operations for their robustness and reliability.

With the expansion of global drilling activities and a focused drive to minimize operational risks, handling tools have become increasingly vital in promoting worker safety and operational uptime. Moreover, the growing adoption of automation in rig systems has driven the development of ergonomically enhanced handling tools. These advanced solutions contribute to operational precision, reduce manual fatigue, and ultimately support market growth through improved efficiency and safety compliance.

In 2024, Flow & Pressure Tools held a considerable share of the Downhole Tools Market, serving as a vital element in managing wellbore conditions. These tools comprising valves, circulating subs, and deployment systems are integral to controlling fluid dynamics and pressure levels throughout the drilling and production cycle. Their demand is influenced by the increasing complexity of well architectures and the operational necessity for effective pressure regulation in extreme subsurface environments.

The rise of advanced drilling techniques, including managed pressure drilling and underbalanced drilling, has further stimulated the need for flow and pressure tools. The segment continues to benefit from innovations in real-time monitoring technologies and remote-controlled operations. These advancements enable precise adjustment of downhole flow parameters, thereby enhancing reservoir productivity and enabling safer and more efficient resource extraction.

In 2024, Control Tools represented a substantial portion of the Downhole Tools Market by tool type. These tools are crucial for regulating downhole variables such as trajectory, torque, and mechanical vibrations during both drilling and completion stages. The segment includes devices such as stabilizers, reamers, and centralizers, which are indispensable for directional drilling and maintaining structural integrity in wellbores.

The segment’s upward trajectory is driven by the increasing deployment of horizontal and deviated drilling methodologies. These approaches demand precise control solutions capable of maneuvering complex geological formations. Continued advancements in sensor-based tools and telemetry systems are enabling enhanced control, real-time decision-making, and optimized drilling performance, thereby positioning control tools as a critical segment in evolving drilling landscapes.

In 2024, the Others category within the Downhole Tools Market occupied a moderate share, encompassing a range of auxiliary tools that provide critical support across various drilling and completion activities. This segment includes fishing tools, wellbore cleaning equipment, and diagnostic instruments, which play a significant role in maintaining operational integrity, particularly in complex and mature fields.

The growth of this segment is largely associated with the rising need for customized and field-specific tool solutions. As global oil and gas infrastructure ages, the reliance on such tools for equipment recovery, performance diagnostics, and enhanced oil recovery initiatives is increasing. Their relevance in plug and abandonment processes and mature field management further underscores the strategic importance of this segment in sustaining long-term production and ensuring operational efficiency.

By Application Analysis

Drilling dominated the Downhole Tools Market by securing a market share exceeding 35.6%.

In 2024, Drilling held a dominant market position in the Downhole Tools Market by Application, capturing more than 35.6% of the total share. This segment covers a wide range of tools used to support the drilling process in oil and gas wells, including drill bits, stabilizers, and drilling motors. The growing number of new exploration projects and increasing investments in deep and ultra-deepwater drilling have driven demand for these tools.

The need for improved drilling efficiency, better penetration rates, and reduced operational risks has further contributed to the strong adoption of drilling tools. Additionally, the increasing shift toward directional and horizontal drilling techniques requires advanced downhole equipment, further reinforcing the dominance of this segment in global operations.

The Completion segment plays a crucial role in finalizing wells for production. Completion tools, such as packers, liner hangers, and safety valves, are used to prepare wells for production by ensuring proper isolation and well integrity. The demand for these tools is growing as more wells transition from drilling to production phases.

The increasing complexity of modern well designs, along with the need for effective zonal isolation, has made advanced completion tools essential. Additionally, the rising investments in unconventional resources, especially in shale formations, have spurred the need for high-performance and customized completion solutions, a trend expected to continue.

The Intervention segment is vital for maintaining and enhancing well production throughout its life cycle. Intervention tools, such as fishing tools, wireline tools, and coiled tubing tools, are used during well servicing and workover operations. These tools are essential for restoring or improving well performance and extending well life.

As wells mature, intervention becomes increasingly important to sustain production and minimize downtime. The segment benefits from technological advancements that allow for more precise, less invasive interventions, particularly in offshore and remote locations. The continued focus on cost-effective solutions to maintain production efficiency further supports growth in this segment.

The Production segment focuses on optimizing the extraction of hydrocarbons from wells. Production tools, including artificial lift systems, gas lift valves, and flow control devices, are used to ensure the safe and continuous flow of hydrocarbons to the surface. This segment is seeing increased demand as operators focus on maximizing well output and improving recovery rates, particularly in mature fields.

With a growing emphasis on reducing environmental impact while maintaining production efficiency, there is a rising demand for advanced production tools. Additionally, the integration of smart technologies into production systems is gaining traction, contributing to the segment’s ongoing development and value.

The Formation & Evaluation segment is responsible for providing critical data regarding subsurface formations. Tools such as logging tools and measurement-while-drilling (MWD) systems are used to assess reservoir characteristics and inform drilling and production decisions. These tools are essential for accurate formation analysis, which is increasingly important as exploration targets become more complex.

As geological formations grow more intricate, the need for precise evaluation tools has risen significantly. The integration of real-time data collection and advanced analytics enhances decision-making and risk management, making formation evaluation a key aspect of high-efficiency drilling and resource planning.

Key Market Segments

By Tool Type

- Drilling Tools

- Handling Tools

- Flow & Pressure Tools

- Control Tools

- Others

By Application

- Drilling

- Completion

- Intervention

- Production

- Formation & Evaluation

Driver

Surge in Horizontal Drilling and Unconventional Resource Development

The rapid growth of horizontal drilling, coupled with the increased exploitation of unconventional hydrocarbon resources such as shale gas and tight oil, has significantly driven the demand for downhole tools in 2024. These complex drilling activities require specialized equipment capable of operating in extreme subsurface conditions.

As horizontal wellbores often exceed several thousand meters, precise and durable downhole tools including mud motors, drill bits, and stabilizers are essential for directional drilling and well completion. The need for enhanced efficiency, reduced drilling time, and maximized hydrocarbon recovery has further prompted the adoption of advanced downhole tools, which directly supports market growth.

Furthermore, increased exploration and production (E&P) activities across regions such as North America, the Middle East, and Asia-Pacific have intensified the demand for performance-optimized downhole solutions. With shale oil production in the United States surpassing 9 million barrels per day in early 2024, operators are focusing on deploying tools that provide superior control, monitoring, and reliability during complex well trajectories.

The integration of real-time data analytics and mechanical robustness in modern downhole tools has not only improved wellbore stability but also contributed to lower operational costs. This trend is expected to persist as operators continue to pursue efficiency gains, thereby reinforcing the market expansion of downhole tools.

Restraint

High Operational Costs and Tool Failures in Harsh Environments

Despite the market’s upward momentum, one of the major restraints limiting the widespread deployment of downhole tools is their high operational cost, particularly in extreme drilling environments such as ultra-deepwater and high-pressure, high-temperature (HPHT) wells. These tools are often subjected to intense mechanical stress, corrosive fluids, and elevated thermal gradients, which can lead to premature wear and tool failures.

The capital-intensive nature of acquiring, maintaining, and replacing specialized downhole tools adds a considerable financial burden on operators, especially smaller exploration companies with limited budgets. This challenge becomes even more pronounced when tool failures result in unplanned downtime and expensive fishing operations to retrieve damaged equipment.

Additionally, the cost associated with technological advancements such as the integration of smart sensors and telemetry systems—further raises the price of next-generation downhole tools. While these innovations are vital for enhancing performance, they also increase the risk of component malfunction in rugged drilling conditions.

The limited lifespan and reparability of certain electronic downhole components pose a challenge for long-term asset utilization. As a result, cost-sensitive operators may delay or limit the deployment of high-end tools, especially in marginal or exploratory wells. These economic and technical constraints collectively act as a barrier to more aggressive market penetration, particularly in emerging economies and fluctuating oil price scenarios.

Opportunity

Digitalization and Remote Monitoring for Real-Time Decision Making

The integration of digital technologies into downhole operations has unlocked a transformative opportunity for the global downhole tools market in 2024. The advent of intelligent drilling systems that leverage sensors, telemetry, and data analytics has enabled real-time decision-making and improved operational accuracy.

This digital transition allows operators to gather critical subsurface data, including temperature, pressure, vibration, and borehole geometry, enabling them to respond to unexpected drilling conditions promptly. Enhanced visualization and simulation tools are further aiding in predictive maintenance and optimized tool performance, thereby reducing non-productive time and operational risks.

This opportunity is particularly significant in remote or offshore drilling projects, where logistical constraints and high costs emphasize the need for automation and efficiency. Through remote operations centers, engineers can now monitor and control downhole activities without being physically present at the rig site. This development reduces manpower requirements and enhances safety by minimizing human exposure to hazardous environments.

Moreover, digital downhole tools contribute to environmentally responsible drilling practices by optimizing energy use and reducing waste. The increasing adoption of Industry 4.0 frameworks across the oil and gas value chain is expected to further accelerate the deployment of smart downhole tools, creating a robust opportunity for technological innovation and sustained market growth.

Trends

Shift Towards Multi-Stage Fracturing and Enhanced Recovery Techniques

A prominent trend shaping the downhole tools market in 2024 is the increasing adoption of multi-stage fracturing and enhanced oil recovery (EOR) techniques in both conventional and unconventional wells. Multi-stage fracturing, especially in shale formations, requires the deployment of precise and durable downhole tools such as packers, sliding sleeves, and frac plugs to isolate wellbore sections and facilitate targeted stimulation.

This trend is largely driven by the need to maximize hydrocarbon extraction from low-permeability reservoirs, where single-stage fracturing proves inefficient. The demand for tools that ensure accurate stage placement and optimal reservoir contact is rising, supporting the continued growth of the market.

Simultaneously, advanced EOR techniques including gas injection, thermal recovery, and chemical flooding are being increasingly adopted to extend the productive life of mature fields. These processes require a suite of specialized downhole tools that can withstand chemical interactions and high-pressure environments over prolonged durations. In 2024, with nearly 70% of global oil production coming from mature fields, the focus on boosting extraction rates through EOR is gaining momentum.

This trend not only necessitates reliable and long-life downhole tools but also opens avenues for tool customization and performance enhancement. As operators aim to balance cost-effectiveness with high output, the alignment of downhole tool innovation with recovery-focused techniques is expected to define the market’s trajectory.

Regional Analysis

North America Dominating Region in the Downhole Tools Market with Largest Market Share of 36.3%

The Downhole Tools market is witnessing substantial growth across various regions, with North America holding the largest market share at 36.3% in 2024. Valued at approximately USD 1.7 billion, the region is a key player in the global market, primarily driven by the high demand for oil and gas exploration and production activities.

The strong presence of advanced technologies and significant investments in energy exploration continue to fuel the growth of the market. North America’s dominance is largely attributed to the established infrastructure, technological advancements, and high adoption rate of downhole tools, particularly in the United States and Canada.

Europe is another significant region in the Downhole Tools market, holding a noteworthy portion of the market share. The region benefits from a mature oil and gas industry, especially in countries like the United Kingdom, Norway, and Russia.

Europe’s market growth is driven by the increasing emphasis on efficiency and performance in oil extraction processes, alongside technological advancements in downhole tools. However, its share is smaller compared to North America, as it faces challenges related to stricter regulations and environmental concerns, which could impact the pace of growth.

The Asia Pacific region is experiencing rapid development and is expected to witness significant growth in the coming years. As the demand for energy rises in emerging economies such as China and India, the need for enhanced oil extraction technologies is also increasing. This surge is attributed to the rising oil production activities and technological innovations in the region. The market share of Asia Pacific is projected to grow, though it currently trails behind North America and Europe in terms of market volume and value.

Middle East & Africa is also an essential region for the Downhole Tools market, with the region playing a central role in global oil production. Countries like Saudi Arabia, UAE, and Kuwait are pivotal players in this market, and the demand for advanced downhole tools continues to rise due to large-scale oil and gas operations. However, the region’s market share remains modest compared to North America, as it faces geopolitical uncertainties that could impact market stability.

Latin America is an emerging market for Downhole Tools, with countries such as Brazil and Mexico investing in oil exploration and extraction. While the market share of this region is currently smaller, it holds strong potential for growth, driven by exploration activities in offshore oil reserves. Latin America’s contribution to the overall market is expected to increase as the region continues to develop its energy sector.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

the Global Downhole Tools Market in 2024, the competitive landscape is characterized by a combination of established oilfield service providers and specialized tool manufacturers, with a focus on innovation, reliability, and strategic collaborations. Major players such as National Oilwell Varco (NOV) and Schlumberger have retained dominant positions through expansive product portfolios and global operational footprints.

NOV continues to capitalize on its integrated tool systems and robust manufacturing capabilities, while Schlumberger leverages its advanced data analytics and wellbore technologies to maintain technological leadership. Similarly, Baker Hughes and Weatherford contribute significantly to market dynamics by offering digitally enabled downhole solutions aimed at increasing drilling efficiency and reservoir recovery rates.

Hunting PLC, Core Laboratories, and TechnipFMC are enhancing their market positions by focusing on niche tool segments and reservoir characterization services, addressing the industry’s growing demand for precision and customization. Hunting PLC’s high-performance perforating systems and Core Laboratories’ reservoir optimization services have seen increased adoption in unconventional oil plays.

TechnipFMC’s integrated approach to drilling and completion tools offers added value through seamless operations. Companies like APS Technology Inc. and United Drilling Tools Ltd are gaining relevance in emerging markets due to their cost-effective solutions and technical adaptability, especially in regions focused on domestic energy security.

Furthermore, Rival Downhole Tools, Flotek Industries, Inc., and RPC, Inc. are investing in R&D to develop chemistry-driven tools and real-time wellbore monitoring systems, catering to the demand for enhanced operational intelligence. Schoeller-Bleckmann Sales, with its precision engineering and tool customization capabilities, continues to serve high-specification drilling projects globally. Overall, the 2024 landscape is marked by strategic partnerships, increased digital integration, and geographic expansion as players adapt to evolving drilling challenges and market volatility.

Top Key Players in the Market

- National Oilwell Varco

- Schlumberger

- Weatherford

- Baker Hughes

- Hunting PLC

- Core Laboratories

- TechnipFMC

- APS Technology Inc.

- United Drilling Tools Ltd

- Rival Downhole Tools

- Flotek Industries, Inc.

- RPC, Inc.

- Schoeller-Bleckmann Sales

Recent Developments

- In 2024, AIQ and Halliburton’s Landmark partnered to offer the RoboWell autonomous well control solution through the iEnergy hybrid cloud. This step is aimed at boosting the use of AI-powered systems in oil production, helping companies manage wells more efficiently and safely with less human intervention.

- In 2024, Epiroc introduced three electric Pit Viper drills—models 271 XC E, 275 XC E, and 291 E. These drills run without fuel, produce no emissions, and are designed to deliver strong performance while supporting greener mining operations.

- In 2024, Sandvik presented its new curved thread top hammer tool system to the public during MINExpo INTERNATIONAL®. The unique design spreads stress over a larger surface area, making the tools more durable and allowing rigs to use full drilling power more safely and effectively.

- In 2024, Noble Corporation revealed its plan to acquire Diamond Offshore Drilling through a mix of stock and cash. Diamond shareholders are set to receive new Noble shares and a cash payment, reflecting a deal value higher than the last market price. The merger is expected to enhance Noble’s position in the offshore drilling sector.

- In 2025, Drilling Tools International Corp. completed the acquisition of Titan Tools Services Ltd., a UK-based company known for renting downhole tools. This move supports DTI’s strategy to grow internationally and strengthen its offering for both offshore and onshore drilling services.

- In 2024, Dril-Quip Inc. finalized its merger with Innovex Downhole Solutions. The combined company will offer a broader range of tools and services, supporting oil and gas operators across upstream activities in both offshore and onshore markets.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Billion Forecast Revenue (2034) USD 8.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tool Type (Drilling Tools , Handling Tools , Flow & Pressure Tools , Control Tools , Others), By Application (Drilling , Completion , Intervention , Production , Formation & Evaluation) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape National Oilwell Varco, Schlumberger, Weatherford, Baker Hughes, Hunting PLC, Core Laboratories, TechnipFMC, APS Technology Inc., United Drilling Tools Ltd, Rival Downhole Tools, Flotek Industries, Inc., RPC, Inc., Schoeller-Bleckmann Sales Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- National Oilwell Varco

- Schlumberger

- Weatherford

- Baker Hughes

- Hunting PLC

- Core Laboratories

- TechnipFMC

- APS Technology Inc.

- United Drilling Tools Ltd

- Rival Downhole Tools

- Flotek Industries, Inc.

- RPC, Inc.

- Schoeller-Bleckmann Sales