Global Downforce Control Systems Market Size, Share, Growth Analysis By Component (Sensors, Actuators, Control Units, Software), By Vehicle Type (Passenger Cars, Commercial Vehicles, Racing Cars, Off-road Vehicles), By Application (Automotive, Motorsport, Aerospace, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172813

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

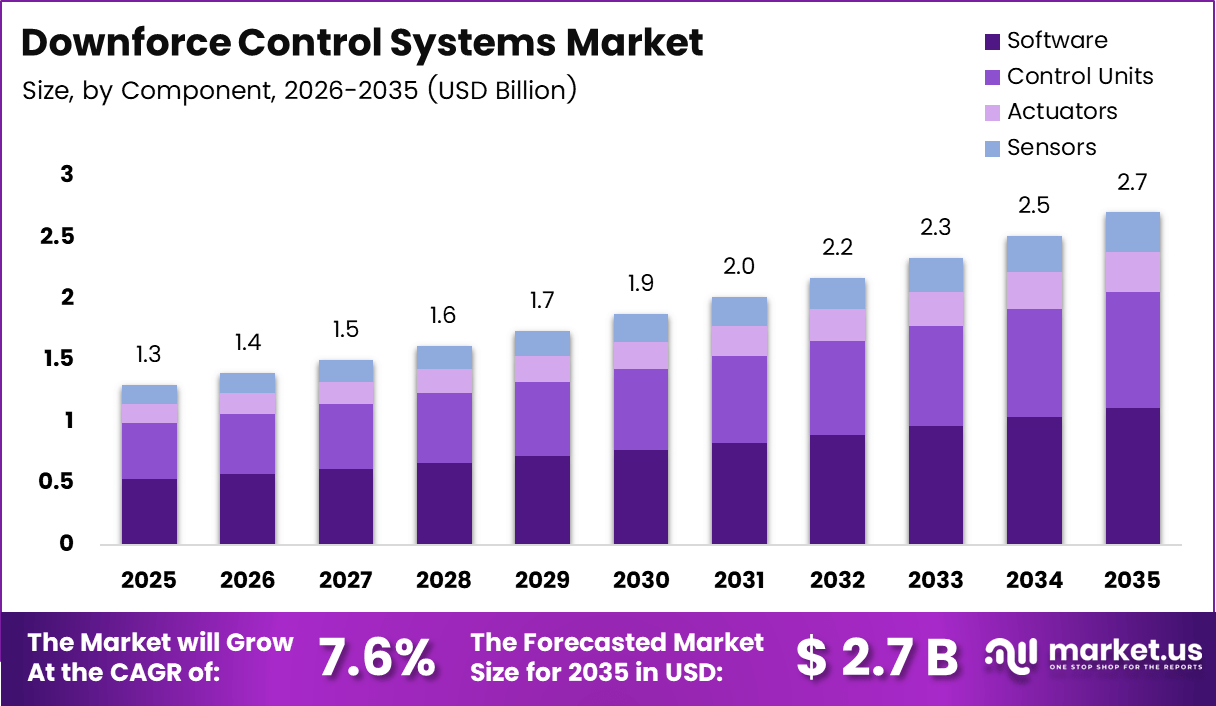

The Global Downforce Control Systems Market size is expected to be worth around USD 2.7 billion by 2035, from USD 1.3 billion in 2025, growing at a CAGR of 7.6% during the forecast period from 2026 to 2035.

The Downforce Control Systems Market refers to precision mechanical and electronic solutions that regulate applied force on ground engaging implements. These systems support consistent soil contact, depth accuracy, and operational efficiency. Consequently, demand is rising across precision agriculture, smart farming equipment, and digitally controlled planting platforms worldwide.

Downforce Control Systems represent a shift toward data driven field operations and outcome based equipment performance. Moreover, farmers increasingly prioritize uniform seed placement, reduced rework, and optimized yields. Therefore, adoption aligns closely with broader precision agriculture investments and equipment automation strategies.

Market growth is supported by rising mechanization, labor shortages, and pressure to improve per acre productivity. Additionally, OEMs integrate active downforce modules with sensors, controllers, and software dashboards. As a result, systems deliver measurable agronomic value while supporting traceability, compliance, and operational transparency across variable field conditions.

Opportunities expand as farms transition toward connected equipment ecosystems and real time agronomic decision making. Furthermore, integration with GPS, variable rate technology, and machine learning enhances responsiveness. Thus, downforce control solutions increasingly function as core components within intelligent planting and seeding architectures across diverse crop systems.

Government investments and regulations further support adoption through incentives for precision farming and soil conservation. In addition, regulatory emphasis on sustainable land use encourages consistent planting depth and reduced compaction. Therefore, compliant equipment incorporating downforce control aligns with conservation programs, smart agriculture policies, and productivity focused subsidies.

Operational relevance strengthens as systems adapt to dynamic field variability caused by compaction, residue, and soil texture. According to research, maintaining consistent seed depth directly influences emergence uniformity. Hence, properly selected downforce systems improve planting accuracy across heterogeneous fields without excessive manual adjustment.

In practical use, weight is monitored on row unit gauge wheels 200 times per second to ensure consistency, according to equipment engineering studies. Moreover, active systems are designed to operate within a 97% performance margin for proper planting. These thresholds adjust dynamically based on field conditions.

Depth requirements vary by crop, reinforcing system value in multi crop operations. According to university agronomy guidelines, corn planting depth typically ranges from 1.5 to 2 inches, while soybeans require 1 to 1.5 inches. Consequently, adaptive downforce management supports yield stability and operational confidence.

Key Takeaways

- The global Downforce Control Systems Market is projected to grow from USD 1.3 billion in 2025 to USD 2.7 billion by 2035, registering a CAGR of 7.6%.

- By component, Control Units dominate the market with a share of 41.2%, highlighting their critical role in system intelligence and coordination.

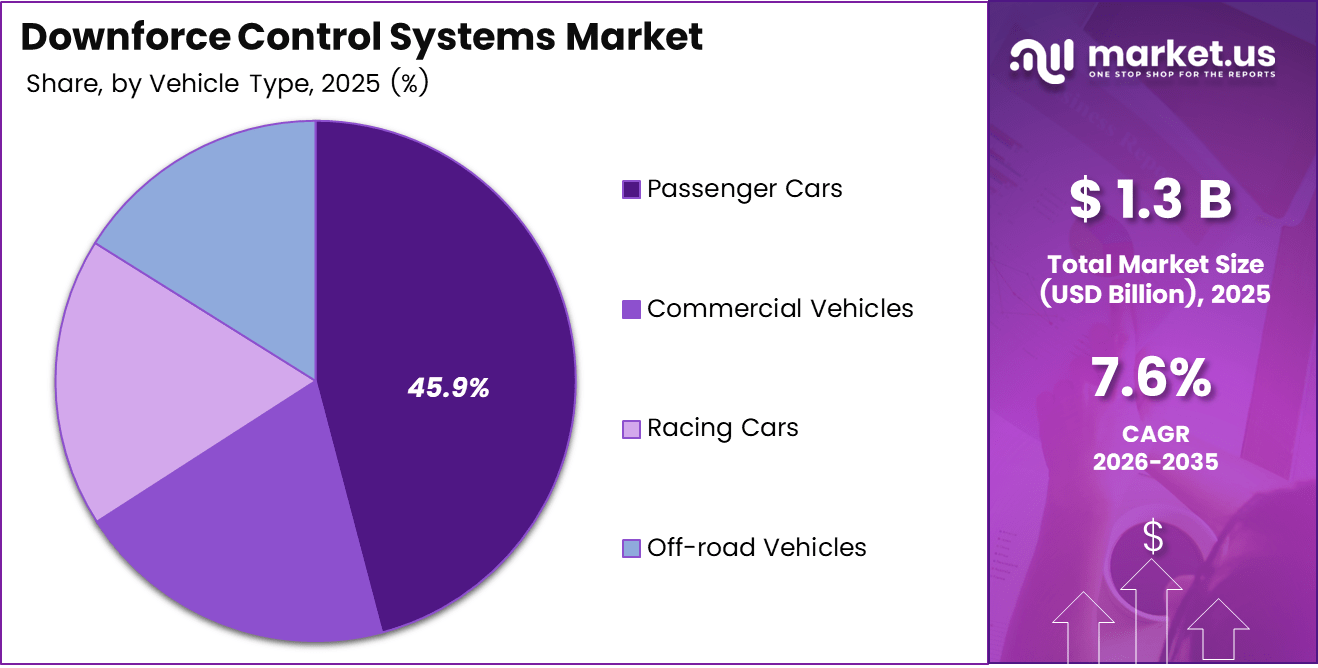

- By vehicle type, Passenger Cars lead with a market share of 45.9%, driven by demand for enhanced stability and efficiency.

- By application, Automotive remains the largest segment, accounting for 61.8% of the overall market.

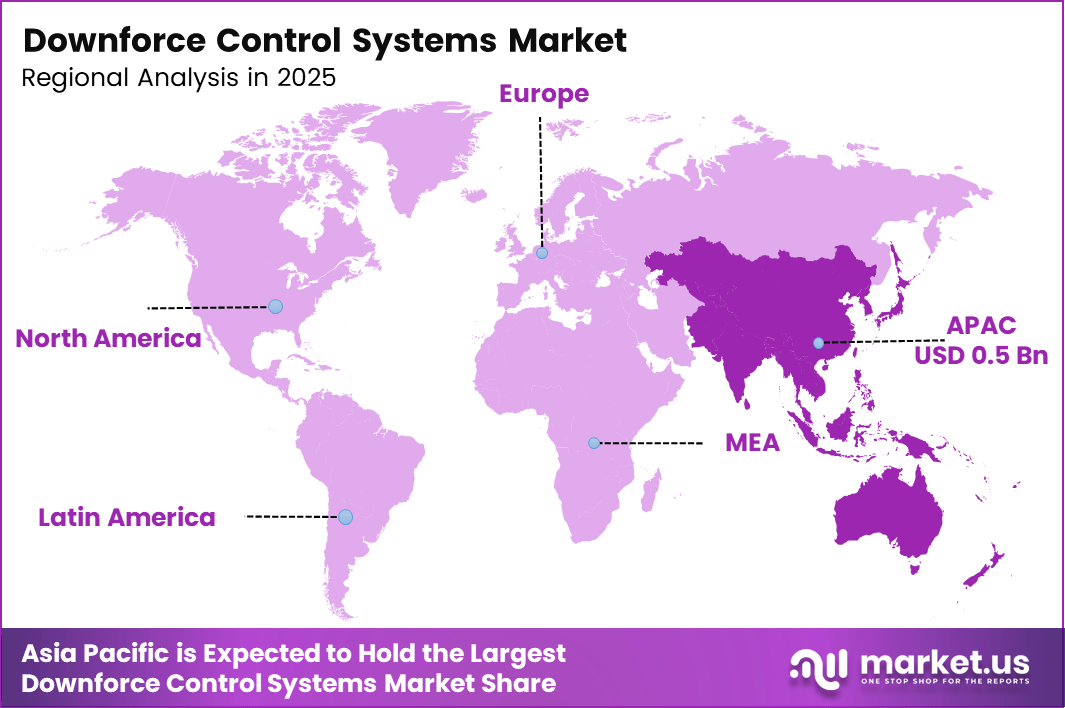

- Asia Pacific emerges as the leading region with a market share of 39.7%, representing a value of USD 0.5 billion.

By Component Analysis

In 2025, Control Units held a dominant market position in the By Component Analysis segment of Downforce Control Systems Market, with a 41.2% share.

In 2025, Sensors played a critical role in enabling real time data capture for downforce adjustment. These components continuously monitor parameters such as load, speed, and surface conditions. As a result, sensors support responsive system behavior and help ensure consistent performance across varying operating environments.

Actuators represent the mechanical execution layer within downforce control architectures. They translate electronic signals into physical force adjustments with high precision. Consequently, actuators contribute directly to system responsiveness, durability, and reliability, especially under high speed or dynamically changing load conditions.

In 2025, Control Units held a dominant market position in the By Component Analysis segment of Downforce Control Systems Market, with a 41.2% share. These units process sensor inputs and coordinate actuator responses. Therefore, they function as the intelligence core, enabling closed loop control and system optimization.

Software supports calibration, diagnostics, and adaptive learning within downforce control systems. Moreover, software enables integration with vehicle networks and user interfaces. As a result, software driven enhancements improve system flexibility, update capability, and long term performance management.

By Vehicle Type Analysis

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Downforce Control Systems Market, with a 45.9% share.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Downforce Control Systems Market, with a 45.9% share. This dominance reflects growing demand for stability, comfort, and efficiency in high performance and premium passenger vehicles.

Commercial Vehicles increasingly adopt downforce control solutions to enhance stability under varying load conditions. Consequently, these systems support improved safety and tire performance. Adoption aligns with fleet operators focusing on durability, predictable handling, and reduced operational variability.

Racing Cars rely heavily on advanced downforce control to optimize speed and cornering performance. These vehicles act as technology incubators, where rapid feedback and precision control matter most. Therefore, racing applications continue to influence innovation and system refinement.

Off-road Vehicles benefit from downforce control by maintaining traction across uneven and low grip surfaces. As terrain variability increases, controlled force distribution improves maneuverability. Thus, adoption supports reliability and operator confidence in challenging environments.

By Application Analysis

In 2025, Automotive held a dominant market position in the By Application Analysis segment of Downforce Control Systems Market, with a 61.8% share.

In 2025, Automotive held a dominant market position in the By Application Analysis segment of Downforce Control Systems Market, with a 61.8% share. This leadership reflects broad integration across passenger and commercial vehicles to improve handling, efficiency, and safety.

Motorsport applications emphasize extreme precision and rapid system response. Downforce control enables teams to fine tune vehicle behavior under competitive conditions. As a result, motorsport continues to drive performance benchmarks and technical advancements.

Aerospace applications utilize downforce and force control concepts to support stability during ground operations and testing. Although niche, this segment values high reliability and accuracy. Therefore, adoption remains selective but technologically significant.

Other applications include specialized industrial and experimental platforms requiring controlled force management. These use cases focus on adaptability and system customization. Hence, they contribute to incremental market diversification.

By Sales Channel Analysis

In 2025, OEM held a dominant market position in the By Sales Channel Analysis segment of Downforce Control Systems Market, with a 71.1% share.

In 2025, OEM held a dominant market position in the By Sales Channel Analysis segment of Downforce Control Systems Market, with a 71.1% share. OEM integration enables system level optimization during vehicle design and manufacturing stages.

The Aftermarket segment serves replacement, upgrade, and customization demand. Customers seek enhanced performance or retrofitting capabilities. Consequently, aftermarket offerings focus on compatibility, ease of installation, and performance tuning flexibility.

Key Market Segments

By Component

- Sensors

- Actuators

- Control Units

- Software

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Racing Cars

- Off-road Vehicles

By Application

- Automotive

- Motorsport

- Aerospace

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Adoption of Active Aerodynamics in High-Performance and Electric Vehicles Drives Market Growth

The Downforce Control Systems Market is increasingly supported by the rising adoption of active aerodynamics in high performance and electric vehicles. Automakers focus on adaptive aerodynamic elements to balance speed, efficiency, and safety. As performance expectations rise, dynamic downforce management becomes essential rather than optional.

At the same time, vehicle stability and handling at high speeds receive stronger attention from both manufacturers and regulators. Downforce control systems help vehicles maintain grip during acceleration, cornering, and braking. Therefore, these systems directly support safer driving experiences in demanding conditions.

Advancements in sensor fusion and real time vehicle dynamics control further strengthen market momentum. Sensors continuously analyze speed, load, and road conditions. As a result, downforce adjustments happen instantly, allowing vehicles to respond smoothly to changing driving environments.

OEMs also demand improved energy efficiency through drag and lift optimization. Controlled aerodynamics reduce unnecessary resistance while maintaining stability. Consequently, downforce control systems support longer driving range in electric vehicles and improved fuel efficiency in performance focused platforms.

Restraints

High System Integration and Calibration Complexity Restrains Market Expansion

One major restraint in the Downforce Control Systems Market is high system integration and calibration complexity. These systems must interact with braking, suspension, and steering technologies. As complexity increases, development timelines extend and technical risks become more challenging to manage.

Elevated development and manufacturing costs further limit adoption. Active aerodynamic components require precision engineering and durable materials. Therefore, production costs remain higher compared to passive aerodynamic solutions, impacting overall vehicle pricing strategies.

Reliability concerns under extreme temperature and road conditions also affect buyer confidence. Moving aerodynamic elements must perform consistently in heat, cold, rain, and debris. Any failure can directly impact safety and vehicle performance.

Limited penetration in mass market and low cost vehicle segments restricts volume growth. Budget focused vehicles prioritize affordability over advanced aerodynamics. As a result, adoption remains concentrated in premium and performance oriented categories.

Growth Factors

Expansion of Downforce Control Systems in Autonomous Vehicles Creates New Opportunities

Growth opportunities emerge as downforce control systems expand into autonomous and semi autonomous vehicles. These vehicles rely on predictable handling and stability. Therefore, automated platforms benefit strongly from adaptive aerodynamic control integrated with driving algorithms.

The growing use of active aerodynamics in motorsports derived road vehicles also supports opportunity creation. Performance inspired consumer models adopt racing technologies. Consequently, downforce control systems transition from niche innovation to broader commercial use.

Integration with software defined vehicle architectures opens new value paths. Over the air updates allow continuous system optimization. Thus, manufacturers can enhance aerodynamic performance without physical modifications.

Increasing adoption in premium SUVs and performance oriented electric cars further strengthens growth potential. These vehicles require both stability and efficiency. As expectations rise, adaptive downforce becomes a differentiating feature.

Emerging Trends

Shift Toward Fully Active and AI-Assisted Aerodynamic Control Systems Shapes Market Trends

A key trend in the Downforce Control Systems Market is the shift toward fully active and AI assisted aerodynamic control. Artificial intelligence enables predictive adjustments rather than reactive responses. Therefore, systems deliver smoother and more efficient performance outcomes.

Lightweight materials adoption for movable aerodynamic elements also gains momentum. Manufacturers aim to reduce added weight while maintaining strength. As a result, downforce systems become more efficient and compatible with electric vehicle design goals.

Convergence of downforce control with braking and suspension systems represents another important trend. Integrated vehicle dynamics improve coordination across multiple systems. This integration enhances safety, comfort, and driving precision.

Rising collaboration between OEMs and motorsport technology suppliers further accelerates innovation. Motorsport environments validate advanced concepts quickly. Consequently, proven solutions move faster into commercial vehicle applications.

Regional Analysis

Asia Pacific Dominates the Downforce Control Systems Market with a Market Share of 39.7%, Valued at USD 0.5 Billion

Asia Pacific leads the Downforce Control Systems Market, holding a dominant share of 39.7% and a market value of USD 0.5 billion. This dominance is driven by rapid vehicle production growth, rising adoption of advanced vehicle dynamics technologies, and strong demand for performance and electric vehicles. Additionally, increasing investments in smart mobility and manufacturing automation support regional expansion.

North America Downforce Control Systems Market Trends

North America represents a mature and innovation-driven market for downforce control systems. The region benefits from strong demand for high-performance vehicles and advanced safety technologies. Moreover, regulatory focus on vehicle efficiency and stability encourages OEMs to integrate active aerodynamic solutions across premium and electric vehicle platforms.

Europe Downforce Control Systems Market Trends

Europe demonstrates steady growth supported by stringent emission regulations and engineering-led vehicle design. Automakers emphasize aerodynamic efficiency to meet efficiency targets while maintaining performance. Consequently, downforce control systems gain traction across performance-oriented passenger cars and emerging electric vehicle architectures.

Middle East and Africa Downforce Control Systems Market Trends

The Middle East and Africa market shows gradual adoption, primarily within premium and high-speed vehicle segments. Demand is influenced by growing interest in advanced automotive technologies and performance vehicles. However, adoption remains selective due to cost sensitivity and limited large-scale manufacturing presence.

Latin America Downforce Control Systems Market Trends

Latin America reflects an emerging market landscape for downforce control systems. Growth is supported by gradual modernization of the automotive sector and rising awareness of vehicle safety and handling technologies. Nevertheless, adoption remains concentrated in higher-end vehicle categories due to pricing considerations.

U.S. Downforce Control Systems Market Trends

The U.S. market shows consistent demand driven by performance vehicles, electric mobility expansion, and technology-focused consumers. Emphasis on vehicle stability, handling, and efficiency supports integration of adaptive downforce solutions. Additionally, ongoing innovation in vehicle dynamics systems sustains long-term market relevance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Downforce Control Systems Company Insights

Honeywell International Inc. plays a strategic role in the global Downforce Control Systems Market through its deep expertise in control technologies, sensors, and integrated systems. The company focuses on high-reliability solutions that support precise force management, real-time responsiveness, and system redundancy. Its engineering strength aligns well with safety-critical and performance-driven applications.

Rockwell Collins, Inc. contributes to the market by leveraging its background in advanced control electronics and system integration. The company emphasizes robust control architectures that support stability and responsiveness under dynamic operating conditions. Its approach reflects a strong focus on precision, system validation, and seamless integration with broader vehicle and platform control ecosystems.

Moog Inc. holds a strong position due to its specialization in motion control, actuators, and high-precision systems. In the Downforce Control Systems Market, Moog’s capabilities support accurate force modulation and rapid response requirements. The company’s focus on durability and performance makes its solutions suitable for demanding, high-load environments.

Parker Hannifin Corporation strengthens the market through its expertise in electromechanical and fluid control technologies. Its solutions emphasize efficiency, reliability, and modular design, supporting scalable downforce control architectures. The company’s engineering depth allows it to address both performance optimization and long-term operational stability.

Beyond these leaders, other participants such as BAE Systems plc, Safran S.A., Liebherr Group, Meggitt PLC, Woodward, Inc., and General Electric Company collectively reinforce the market landscape. These organizations contribute advanced control logic, aerospace-grade reliability standards, and system integration expertise. Together, they shape innovation trends, accelerate technology maturation, and expand application potential across automotive, aerospace, and high-performance mobility platforms.

Top Key Players in the Market

- Honeywell International Inc.

- Rockwell Collins, Inc.

- Moog Inc.

- Parker Hannifin Corporation

- BAE Systems plc

- Safran S.A.

- Liebherr Group

- Meggitt PLC

- Woodward, Inc.

- General Electric Company

Recent Developments

- In June 2024, USD 4.2 million funding round led by Equator VC, In date, Equator VC led a USD 4.2 million funding round for Downforce Technologies, supporting the scale-up of its soil organic carbon measurement and prediction capabilities. The funding reflects rising investor focus on climate technologies that deliver measurable, data-driven sustainability impact.

Report Scope

Report Features Description Market Value (2025) USD 1.3 billion Forecast Revenue (2035) USD 2.7 billion CAGR (2026-2035) 7.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Sensors, Actuators, Control Units, Software), By Vehicle Type (Passenger Cars, Commercial Vehicles, Racing Cars, Off-road Vehicles), By Application (Automotive, Motorsport, Aerospace, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Honeywell International Inc., Rockwell Collins, Inc., Moog Inc., Parker Hannifin Corporation, BAE Systems plc, Safran S.A., Liebherr Group, Meggitt PLC, Woodward, Inc., General Electric Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Downforce Control Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Downforce Control Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Rockwell Collins, Inc.

- Moog Inc.

- Parker Hannifin Corporation

- BAE Systems plc

- Safran S.A.

- Liebherr Group

- Meggitt PLC

- Woodward, Inc.

- General Electric Company