Global Dosimetry Market By Product Type (Electronic Personal Dosimeter (EPD), Film Badge, Thermoluminescent Dosimeter (TLD), Direct Ion Storage & DIS-OSL and Optically Stimulated Luminescence (OSL)), By Technology (Semiconductor, Scintillator-based, Solid-State Passive, Gas-filled GM / Proportional and Bubble / Superheated-Drop), By Application (Active and Passive), By End-User (Healthcare, Oil & Gas, Nuclear Power and Fuel Cycle, Mining & Metals, Industrial NDT / Manufacturing and Defence & Security), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175957

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

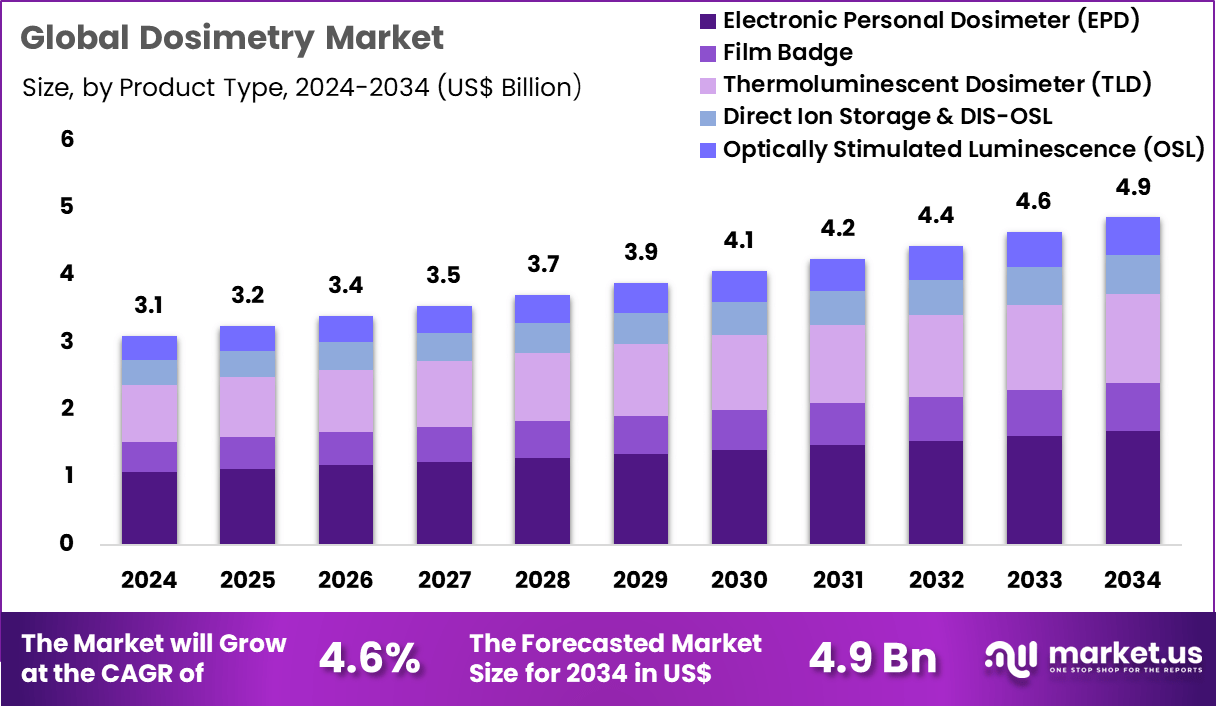

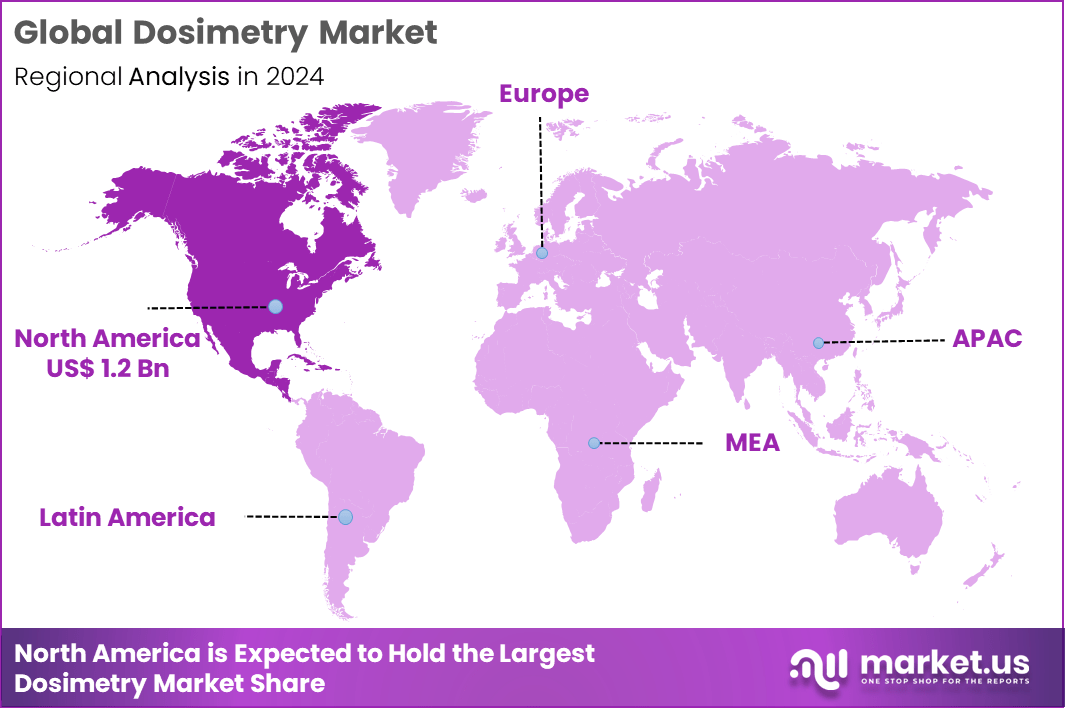

Global Dosimetry Market size is expected to be worth around US$ 4.9 Billion by 2034 from US$ 3.1 Billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 1.2 Billion.

Rising adoption of advanced radiation therapies compels healthcare providers to prioritize dosimetry solutions that ensure precise dose delivery and patient safety in oncology treatments. Radiation oncologists increasingly utilize thermoluminescent dosimeters and optically stimulated luminescence dosimeters to verify delivered doses during external beam radiotherapy, confirming alignment with planned targets for tumors in the brain, lung, and prostate.

These systems support in-vivo dosimetry by placing detectors on or within patients, measuring actual absorbed doses in real time to detect deviations from prescribed values in intensity-modulated and stereotactic body radiotherapy. Medical physicists apply radiochromic film dosimetry to assess complex dose distributions in brachytherapy implants, validating high-dose-rate treatments for cervical and prostate cancers.

Dosimetry tools also enable quality assurance in proton therapy, where range verification and Bragg peak monitoring prevent under- or over-dosing in pediatric and adult patients. In February 2025, Shland, a prominent supplier of gafchromicTM film–based dosimetry technologies and specialty materials, introduced a new in-vivo dosimetry system. The solution is designed to improve precision in radiation therapy delivery by enabling more accurate dose verification during treatment.

Manufacturers seize opportunities to develop wireless, real-time dosimetry systems that integrate with treatment planning software, expanding applications in adaptive radiotherapy where daily plan modifications require immediate dose validation. Developers advance nanoparticle-based dosimeters that enhance sensitivity for low-dose monitoring in diagnostic imaging and interventional radiology procedures.

These innovations facilitate point-of-care dosimetry in resource-limited settings, supporting safe delivery of palliative radiation for metastatic disease. Opportunities emerge in AI-enhanced dosimetry platforms that predict dose discrepancies and automate verification, streamlining workflows in high-volume centers performing volumetric modulated arc therapy.

Companies invest in hybrid film-electronic detectors that combine spatial resolution with temporal data, improving accuracy in craniospinal irradiation and total body irradiation. Recent trends emphasize patient-specific dosimetry models that incorporate anatomical variations, elevating treatment personalization and reducing normal tissue complications across diverse radiation oncology indications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.1 Billion, with a CAGR of 4.6%, and is expected to reach US$ 4.9 Billion by the year 2034.

- The product type segment is divided into electronic personal dosimeter (EPD), film badge, thermoluminescent dosimeter (TLD), direct ion storage & DIS-OSL and optically stimulated luminescence (OSL), with electronic personal dosimeter (EPD) taking the lead with a market share of 34.8%.

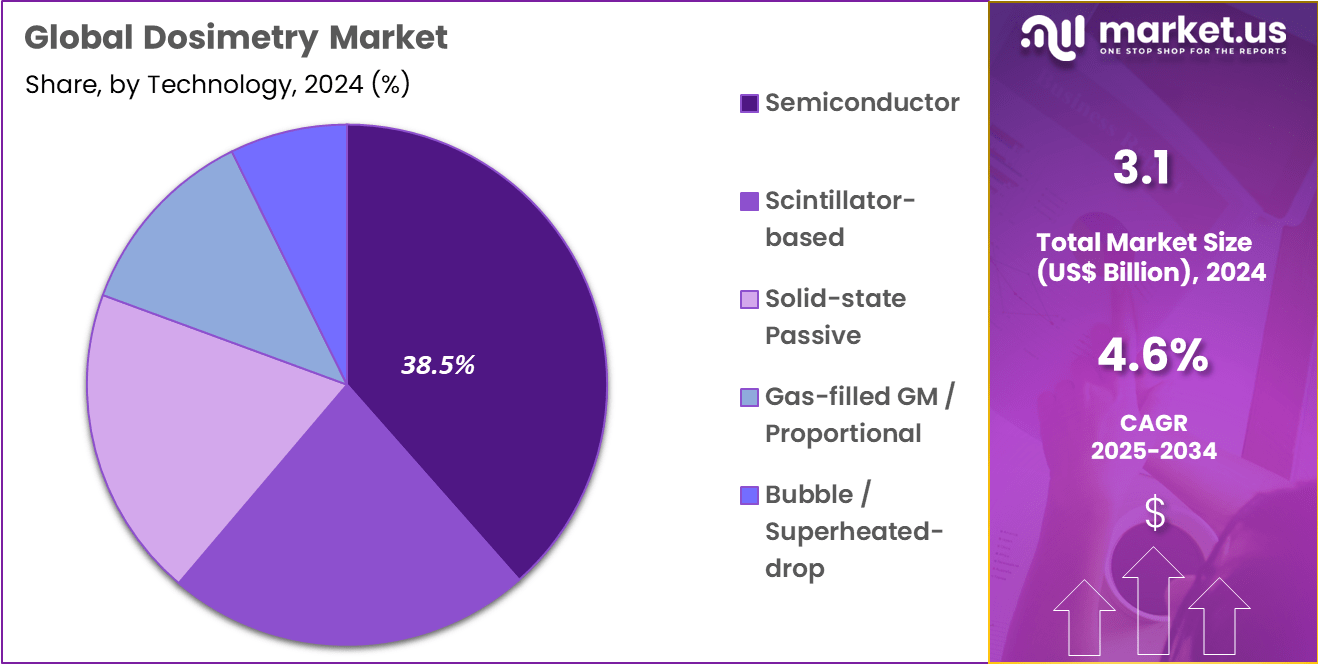

- Considering technology, the market is divided into semiconductor, scintillator-based, solid-state passive, gas-filled GM / proportional and bubble / superheated-drop. Among these, semiconductor held a significant share of 38.5%.

- Furthermore, concerning the application segment, the market is segregated into active and passive. The active sector stands out as the dominant player, holding the largest revenue share of 9% in the market.

- The end-user segment is segregated into healthcare, oil & gas, nuclear power and fuel cycle, mining & metals, industrial NDT / manufacturing and defence & security, with the healthcare segment leading the market, holding a revenue share of 41.6%.

- North America led the market by securing a market share of 39.3%.

Product Type Analysis

Electronic personal dosimeters contributed 34.8% of growth within product type and led the dosimetry market due to rising demand for real-time radiation monitoring across regulated work environments. Healthcare staff, nuclear technicians, and industrial workers increasingly rely on EPDs because they provide instant dose readouts and audible alerts that support on-the-job safety decisions.

Organizations prioritize EPD adoption as regulatory agencies emphasize continuous exposure tracking rather than periodic dose assessment. Growing awareness of occupational radiation risks strengthens procurement across hospitals and high-risk industrial facilities.

Technological improvements further support growth through compact designs, wireless data transfer, and integration with centralized monitoring systems. Employers value EPDs because automated data logging simplifies compliance reporting and workforce management.

Expanding use of mobile diagnostic imaging and interventional procedures raises monitoring frequency in healthcare settings. Large infrastructure projects involving radiation sources also increase field deployment. The segment is projected to maintain leadership as safety standards tighten and real-time monitoring becomes a baseline requirement.

Technology Analysis

Semiconductor technology accounted for 38.5% of growth within technology and dominated the dosimetry market due to its high sensitivity, fast response time, and suitability for compact devices. Semiconductor-based detectors support accurate dose measurement across a wide energy range, which appeals to medical and industrial users.

Manufacturers adopt this technology because it enables lightweight and wearable dosimeters that improve worker comfort. Semiconductor sensors also support digital integration, which aligns with modern safety management systems.

Growth accelerates as healthcare and nuclear facilities modernize monitoring infrastructure with connected devices. Semiconductor solutions reduce calibration complexity compared to legacy systems, lowering operational burden. Their reliability under continuous operation strengthens adoption in high-usage environments.

Integration with analytics platforms enhances exposure trend analysis and workforce optimization. The segment is anticipated to expand steadily as industries prioritize precision, portability, and digital compatibility in radiation monitoring solutions.

Application Analysis

Active dosimetry generated 56.9% of growth within application and emerged as the dominant segment due to increasing emphasis on real-time exposure awareness. Organizations favor active systems because instant alerts allow workers to respond immediately to unsafe radiation levels.

Healthcare environments rely on active monitoring during fluoroscopy and radiotherapy procedures where exposure fluctuates rapidly. Industrial and nuclear operators also depend on live feedback to enforce safety protocols during critical operations.

The segment benefits from stricter occupational safety enforcement and rising accountability for exposure incidents. Digital recordkeeping associated with active dosimetry improves audit readiness and regulatory transparency.

Growing deployment of wearable safety devices aligns closely with active monitoring systems. Workforce safety programs increasingly incorporate continuous tracking as a standard practice. Active dosimetry is projected to remain dominant as prevention-focused safety models gain traction across industries.

End-User Analysis

Healthcare contributed 41.6% of growth within end-user and dominated the dosimetry market due to expanding use of radiation-based diagnostics and therapies. Hospitals and diagnostic centers increase dosimeter deployment as imaging volumes rise across CT, fluoroscopy, and interventional cardiology procedures.

Medical professionals rely on accurate exposure tracking to meet occupational safety standards and internal risk management goals. Growth in cancer treatment facilities further elevates monitoring needs for clinical staff.

Regulatory oversight in healthcare strengthens demand for compliant and traceable dosimetry solutions. Hospitals invest in modern systems that integrate exposure data with staff management platforms. Training programs emphasize radiation safety awareness, reinforcing routine dosimeter usage.

Expansion of outpatient imaging centers broadens the user base beyond large hospitals. The healthcare segment is expected to remain the leading growth driver as diagnostic intensity and patient volumes continue to increase.

Key Market Segments

By Product Type

- Electronic Personal Dosimeter (EPD)

- Film Badge

- Thermoluminescent Dosimeter (TLD)

- Direct Ion Storage & DIS-OSL

- Optically Stimulated Luminescence (OSL)

By Technology

- Semiconductor

- Scintillator-based

- Solid-State Passive

- Gas-filled GM / Proportional

- Bubble / Superheated-Drop

By Application

- Active

- Passive

By End-User

- Healthcare

- Oil & Gas

- Nuclear Power and Fuel Cycle

- Mining & Metals

- Industrial NDT / Manufacturing

- Defence & Security

Drivers

Increasing demand for radiotherapy is driving the market.

The escalating global requirement for radiotherapy treatments has substantially propelled the dosimetry market, as precise dose measurement is essential for effective cancer management. Enhanced cancer incidence rates necessitate advanced dosimetry solutions to ensure patient safety and treatment efficacy.

In 2022, approximately 12.8 million new patients worldwide required radiotherapy, based on an estimated utilization rate of 64 percent that accounts for re-treatment scenarios. This figure stems from comprehensive epidemiological data, highlighting the critical role of dosimetry in radiation oncology. Healthcare facilities are increasingly adopting sophisticated dosimetry systems to optimize therapeutic outcomes.

The association between rising cancer diagnoses and the need for accurate dose verification further stimulates market growth. National cancer control programs emphasize quality assurance in radiotherapy, supporting dosimetry integration.

Leading suppliers are enhancing product portfolios to meet this surging clinical demand. This driver fosters technological investments across medical institutions globally. Ultimately, the radiotherapy demand sustains vigorous expansion in dosimetry applications.

Restraints

High development costs are restraining the market.

The significant financial commitment needed for innovating dosimetry technologies restricts market progression and accessibility for smaller entities. Sophisticated sensor integration and validation processes contribute to substantial expenditure in product creation. Mirion Technologies reported research and development expenses of $35.0 million for the fiscal year ended December 31, 2024, up from $30.3 million in 2022.

This increase illustrates the ongoing fiscal demands placed on manufacturers in this sector. Regulatory approvals require extensive testing, further escalating overall costs. In environments with limited funding, these expenses limit upgrades to existing dosimetry equipment.

Providers often maintain legacy systems to avoid high replacement investments. This restraint affects scalability in public health and industrial settings. Collaborative efforts seek to share development burdens, yet challenges persist. Consequently, cost management is vital for alleviating this market impediment.

Opportunities

Expansion of nuclear power in Asia-Pacific is creating growth opportunities.

The accelerated buildup of nuclear facilities in the Asia-Pacific region provides avenues for dosimetry deployment in radiation monitoring and safety protocols. Governmental commitments to energy security drive reactor constructions, necessitating reliable dose measurement tools.

As of mid-2024, China had 27 nuclear reactors under construction, representing 46 percent of the global total. This concentration underscores the region’s leadership in nuclear expansion and associated dosimetry needs. Local regulations mandate stringent radiation protection, enhancing demand for advanced systems. Alliances with regional operators facilitate tailored dosimetry solutions for new plants.

The large-scale projects address energy demands in populous nations, amplifying market potential. Training for safety personnel promotes standardized dosimetry practices. This opportunity allows international firms to establish footholds in growing economies. Overall, nuclear proliferation aligns with requirements for enhanced monitoring infrastructure.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the dosimetry market through capital spending, healthcare budgets, and industrial safety investments that leaders track closely. Inflation and elevated interest rates pressure hospital procurement teams and nuclear operators, which slows replacement cycles for personal and area monitoring devices. Geopolitical tensions disrupt global supplies of sensors, semiconductors, and specialty materials used in dosimeters, which adds lead time risk and complicates planning.

Current US tariffs on imported electronic components and finished instruments increase landed costs for manufacturers and distributors, tightening margins and nudging prices upward. These pressures challenge smaller suppliers and can delay rollouts in price-sensitive markets. On the upside, tariffs and trade friction accelerate nearshoring, supplier diversification, and investment in US-based assembly and calibration services.

Regulatory emphasis on radiation safety in healthcare, energy, and defense sustains demand and justifies spend even in cautious cycles. With disciplined sourcing, automation, and product innovation, the market can convert today’s constraints into stronger, more resilient growth.

Latest Trends

Enhancement of dosimetry calibration networks is a recent trend in the market.

In recent years, international efforts have focused on strengthening calibration infrastructures to improve dosimetry accuracy in medical and occupational settings. Collaborative networks ensure consistent standards for ionization chamber calibrations across laboratories. Between 2022 and 2023, the IAEA/WHO Network of Secondary Standards Dosimetry Laboratories calibrated 134 ionization chambers and issued 269 calibration certificates to entities in 39 countries.

This activity reflects a commitment to elevating global radiation metrology capabilities. Enhanced traceability supports reliable dose assessments in diverse applications. Regulatory bodies prioritize these networks to minimize measurement uncertainties. The trend facilitates knowledge transfer through technical cooperation projects.

Participating laboratories benefit from updated protocols and equipment benchmarks. These developments address gaps in dosimetry proficiency worldwide. Overall, network enhancements promote safer utilization of ionizing radiation.

Regional Analysis

North America is leading the Dosimetry Market

North America possesses a 39.3% share of the global Dosimetry market, demonstrating notable growth in 2024 due to advancements in radiation therapy and nuclear medicine technologies. Leading companies like Mirion Technologies and Landauer have introduced advanced dosimetry systems, enhancing accuracy in radiation exposure monitoring for healthcare and industrial applications.

The region’s strong emphasis on occupational safety has driven demand for personal dosimeters among workers in nuclear facilities and medical centers. Substantial government investments in radiation research have supported this expansion, facilitating the development of innovative dosimetry solutions. The rise in cancer incidences has boosted the use of dosimetry in radiotherapy planning and patient safety.

Academic and industry partnerships have led to breakthroughs in real-time dosimetry devices, improving efficiency and compliance with regulations. Additionally, stringent standards from the Nuclear Regulatory Commission have encouraged adoption of state-of-the-art dosimetry tools. The U.S. Department of Energy allocated $19.5 million for low-dose radiation research projects in 2024, highlighting the commitment to advancing dosimetry capabilities.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts predict significant advancement in the radiation monitoring sector across the Asia Pacific during the forecast period, as nations prioritize healthcare modernization and industrial safety. China and India lead this progress by allocating resources to expand nuclear power plants and medical facilities, increasing the need for precise dose measurement tools.

Private enterprises collaborate with governments to develop cost-effective technologies, catering to diverse applications in oncology and environmental monitoring. Educational institutions receive grants to train specialists in radiation protection, fostering a skilled workforce for market expansion. International organizations like the IAEA provide technical assistance, enhancing regional capabilities in dose assessment.

Economic development in Southeast Asia enables higher investments in safety equipment, driving innovation in wearable devices. Strategic partnerships with global leaders transfer knowledge and accelerate product localization. The IAEA dedicated €462,750 to a project improving radiation medicine quality in the region between 2022 and 2024, underscoring support for sector growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Dosimetry market accelerate growth by advancing sensor accuracy, expanding digital monitoring platforms, and aligning product roadmaps with tightening radiation safety standards across healthcare, nuclear, and industrial environments. They invest aggressively in software-driven analytics, real-time monitoring capabilities, and regulatory-compliant services that strengthen long-term customer contracts.

Strategic acquisitions help firms broaden geographic reach and add specialized radiation expertise without diluting operational focus. Partnerships with hospitals, nuclear facilities, and research laboratories anchor recurring demand and reinforce credibility in high-compliance settings.

Mirion Technologies stands out as a global radiation safety and measurement company with a diversified portfolio spanning medical, nuclear power, defense, and research applications. The company drives scale through continuous innovation, a strong service-led revenue model, and a disciplined approach to serving mission-critical radiation monitoring needs worldwide.

Top Key Players

- Landauer Inc.

- Mirion Technologies

- Thermo Fisher Scientific

- Radiation Detection Company

- Chiyoda Technol Corporation

- Fuji Electric Co., Ltd.

- Panasonic Holdings Corporation

- PTW Freiburg GmbH

- IBA Dosimetry

- Tracerco

Recent Developments

- In April 2024, Mirion Dosimetry Services, part of Mirion Medical, launched the Instadose®VUE wireless dosimeter for commercial availability. This next-generation wearable X-ray badge allows users to monitor radiation exposure with greater speed, accuracy, consistency, and user-level control compared to conventional monitoring devices.

- In January 2025, Thermo Fisher Scientific reported quarterly revenue of USD 11.40 billion and completed its acquisition of Olink. Within the same period, the company’s Analytical Instruments segment generated USD 7.463 billion in revenue for full-year 2024, reflecting strong performance across its measurement and analytical solutions portfolio.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 Billion Forecast Revenue (2034) US$ 4.9 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electronic Personal Dosimeter (EPD), Film Badge, Thermoluminescent Dosimeter (TLD), Direct Ion Storage & DIS-OSL and Optically Stimulated Luminescence (OSL)), By Technology (Semiconductor, Scintillator-based, Solid-State Passive, Gas-filled GM / Proportional and Bubble / Superheated-Drop), By Application (Active and Passive), By End-User (Healthcare, Oil & Gas, Nuclear Power and Fuel Cycle, Mining & Metals, Industrial NDT / Manufacturing and Defence & Security) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Landauer Inc., Mirion Technologies, Thermo Fisher Scientific, Radiation Detection Company, Chiyoda Technol Corporation, Fuji Electric Co., Ltd., Panasonic Holdings Corporation, PTW Freiburg GmbH, IBA Dosimetry, Tracerco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Landauer Inc.

- Mirion Technologies

- Thermo Fisher Scientific

- Radiation Detection Company

- Chiyoda Technol Corporation

- Fuji Electric Co., Ltd.

- Panasonic Holdings Corporation

- PTW Freiburg GmbH

- IBA Dosimetry

- Tracerco