Global Dolce Gusto Market Size, Share, And Enhanced Productivity By Product Type (Machines, Capsules, Accessories), By End User (Residential, Commercial),By Distribution Channel (Store-Based, Non-Store-Based), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175454

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

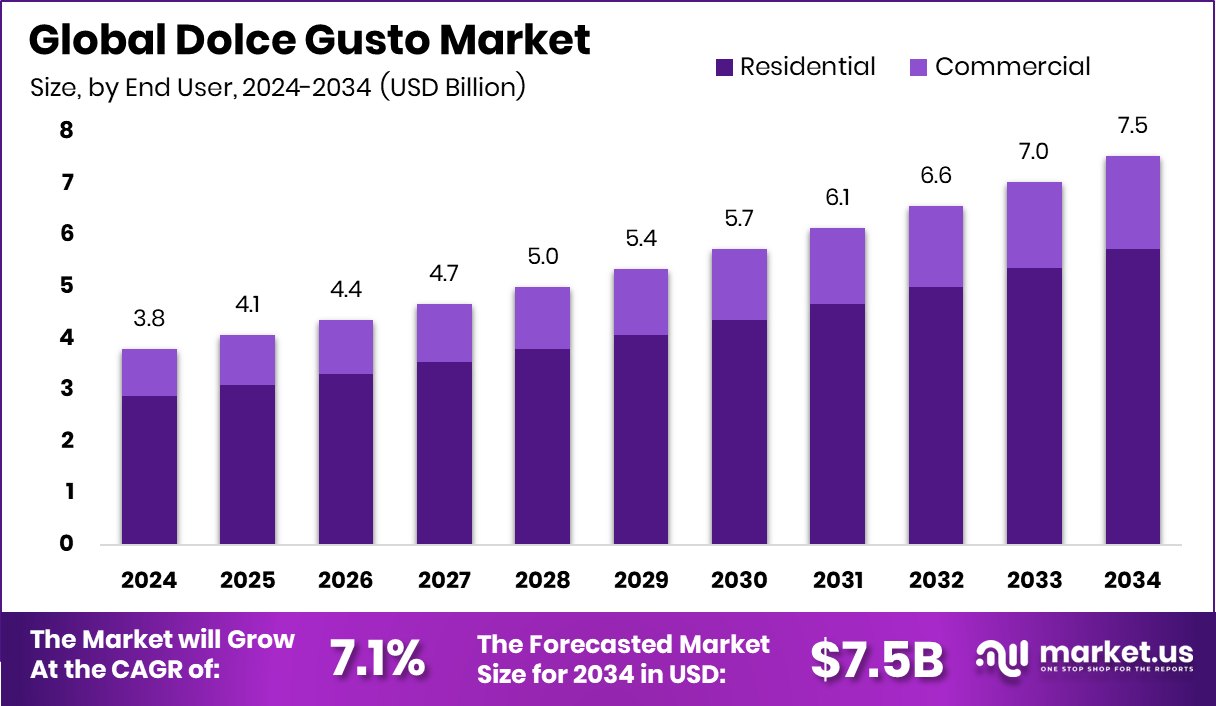

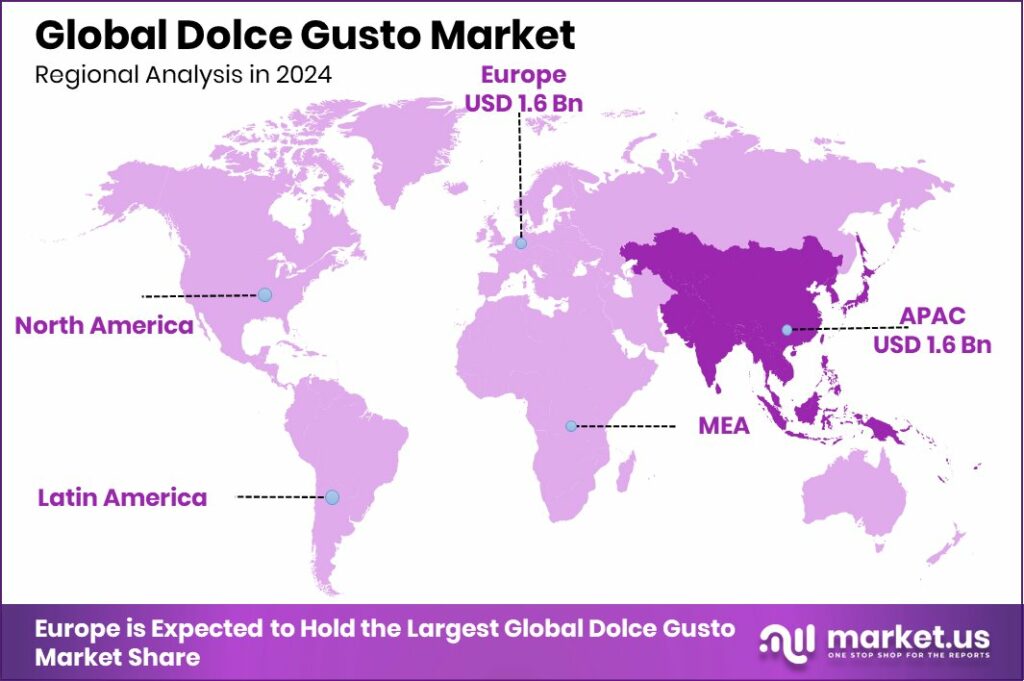

The Global Dolce Gusto Market is expected to be worth around USD 7.5 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034. Dolce Gusto Market growth in Europe hit 43.6%, valued at USD 1.6 Bn.

The Dolce Gusto system is a single-serve coffee format designed to prepare a wide range of beverages using machines, capsules, and related accessories. It focuses on convenience, variety, and ease of use, allowing consumers to enjoy café-style drinks at home or in small commercial spaces. The market built around this system includes sales of machines, capsules, and accessories across different retail channels and user groups.

The Dolce Gusto Market refers to the growing ecosystem of products, services, and consumer demand surrounding these machines and their compatible capsules. It includes residential users who want quick, flavorful drinks at home and commercial users who appreciate compact systems for small offices or service environments. The market structure follows three key product types—machines, capsules, and accessories—and two major end-user categories, supported by both store-based and non-store-based distribution.

One of the major growth factors is the rising interest in sustainable and energy-efficient appliances. The latest machine design uses 50% recycled plastic, an 85% recycled aluminium thermoblock, and features an A++ energy rating with an eco-mode switch-off system. This sustainable approach strengthens consumer trust and supports long-term demand.

On the demand side, improving packaging sustainability adds further momentum. Dolce Gusto has committed to reducing virgin plastic by one-third by 2025. By March 2023, polypropylene in capsules was reduced by 13%, saving 8,200 tons of plastic since 2018, creating opportunities for environmentally conscious market expansion.

A key opportunity moving forward lies in continuous innovation in capsules and machine design, supported by more responsible material use and simplified repairability. This aligns with growing consumer expectations for eco-friendly, high-convenience beverage solutions globally.

Key Takeaways

- The Global Dolce Gusto Market is expected to be worth around USD 7.5 billion by 2034, up from USD 3.8 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- In the Dolce Gusto Market, capsules dominate with a strong 66.2% share globally.

- Residential users significantly drive the Dolce Gusto Market, contributing an impressive 76.1% segment share.

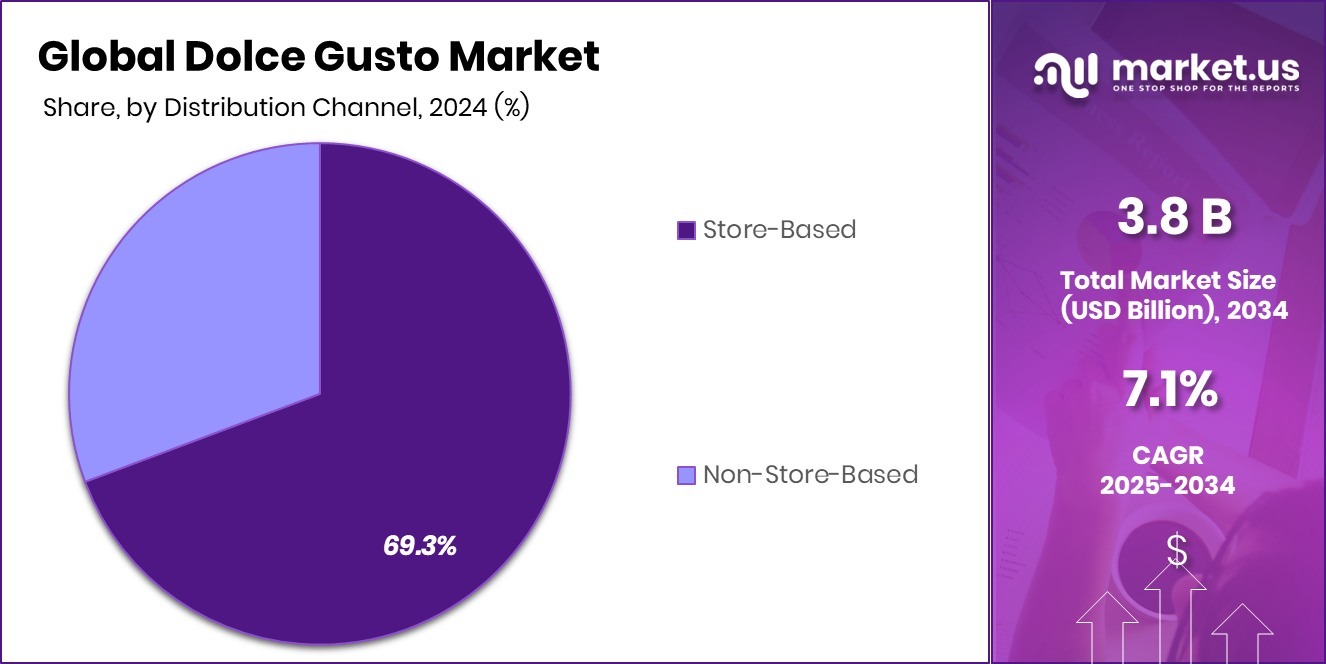

- Store-based retail channels remain crucial in the Dolce Gusto Market, capturing a solid 69.3% share.

- In Europe, the Dolce Gusto Market achieved USD 1.6 Bn, holding 43.6% share.

By Product Type Analysis

The Dolce Gusto Market sees Capsules dominating with a strong 66.2% share.

In 2024, the Dolce Gusto Market continued to see remarkable dominance from the capsules segment, which captured a strong 66.2% share as consumers increasingly preferred convenient, single-serve coffee formats. The appeal of capsules grew as households sought café-style beverages at home without the need for complex machines or brewing skills. Dolce Gusto’s broad flavor range and compatibility options supported repeat purchases and subscription-driven sales.

Growing awareness of pod-based freshness, portion control, and reduced waste during preparation further boosted demand. With the rise of urban lifestyles and busy routines, capsules have become the go-to choice for quick yet premium-quality drinks. The segment’s leadership also reflected Dolce Gusto’s expanding retail presence and marketing efforts focused on flavor innovation and machine–capsule integration.

By End User Analysis

Residential users lead the Dolce Gusto Market segment with an impressive 76.1% share.

In 2024, the Residential segment held a commanding 76.1% share of the Dolce Gusto Market, driven by the shift toward at-home coffee consumption and increased investment in home beverage appliances. Consumers continued recreating café experiences at home, particularly post-pandemic, and Dolcé Gusto systems offered a cost-efficient way to enjoy diverse beverages. Rising remote work adoption strengthened household demand as daily coffee routines moved home.

The brand’s compact machines, easy-to-use interface, and wide capsule portfolio made it appealing to urban families, young professionals, and small households. Seasonal flavors and limited-edition launches also encouraged upgrades and higher consumption frequency. This strong home-centric trend reinforced residential buyers as the market’s primary growth engine.

By Distribution Channel Analysis

Store-based channels drive the Dolce Gusto Market forward, holding a notable 69.3% share.

In 2024, Store-Based channels accounted for 69.3% of the Dolce Gusto Market, reflecting consumers’ preference for physically checking machines, flavor options, and promotional bundles before purchasing. Retail outlets, including supermarkets, electronics stores, and specialty coffee shops, played a significant role in showcasing product demonstrations and offering instant deals. Many first-time buyers preferred offline outlets for guidance on machine features and capsule compatibility, helping maintain high foot traffic.

Additionally, store-based visibility strengthened brand trust, as consumers could compare multiple coffee systems side-by-side. Even with rising e-commerce growth, traditional retail remained dominant due to impulse buying behavior, broader product assortment, and frequent festive discounts that influenced customer decisions across key markets.

Key Market Segments

By Product Type

- Machines

- Capsules

- Accessories

By End User

- Residential

- Commercial

By Distribution Channel

- Store-Based

- Non-Store-Based

Driving Factors

Rising Preference for Convenient Home Coffee Brewing

The Dolce Gusto Market is benefiting strongly from consumers shifting toward convenient, café-style drinks prepared at home. Busy routines and rising remote work have made single-serve systems more appealing, especially when they offer fast brewing and consistent results. This growing preference is further supported by brand-level sustainability actions that strengthen market confidence.

A key example is Nestlé Spain’s €15 million investment in its Girona factory, aimed at improving recyclable Nescafé packaging. This funding enhances packaging efficiency and aligns with rising expectations for responsible coffee consumption. As convenience, better design, and environmental improvements converge, demand for capsule-based coffee solutions continues to expand across households looking for premium yet effortless brewing experiences.

Restraining Factors

High Capsule Costs Limiting Frequent Purchases

Despite strong demand, the market faces a restraint tied directly to the cost of capsules. Many consumers enjoy the convenience of single-serve brewing but reduce purchase frequency when capsule prices stretch beyond everyday budgets. This becomes more visible when promotional events highlight the sharp contrast in pricing.

For example, a £60 deluxe pod machine recently dropped to £14 during a Currys Black Friday double-deal, pushing shoppers to focus on machine affordability while remaining cautious about long-term capsule spending. Such situations show how price sensitivity affects usage habits. While machines may attract strong interest, consistent capsule purchasing remains a key challenge in driving stable, repeat revenue.

Growth Opportunity

Sustainable Materials Creating New Market Potential

A major opportunity for the Dolce Gusto Market lies in expanding the use of sustainable materials and eco-forward manufacturing. Consumers increasingly look for products that reduce waste and support long-term environmental goals, making sustainable capsules and efficient machines more attractive. This direction is reinforced by significant investment within the coffee ecosystem, such as Nescafé Dolce Gusto’s CHF 64 million initiative to double its coffee capsule production. This funding enables expanded output while improving material efficiency and supporting future recyclable formats. As sustainability becomes a defining purchasing factor, brands that combine performance with responsible material choices stand to capture new market segments and increase global adoption.

Latest Trends

Eco-Designed Machines Gaining Strong Consumer Interest

A leading trend in the Dolce Gusto Market is the growing attraction toward compact, eco-designed machines that use fewer resources and fit easily into varied household spaces. Shoppers increasingly seek appliances that consume less energy and reduce material waste without compromising drink quality. This trend becomes clearer through rising interest in affordable, travel-friendly designs.

For instance, a Nescafé coffee machine described as “small enough to take on holiday” recently dropped to under £30, drawing strong attention from value-focused and space-conscious consumers. Such lightweight, efficient designs reflect the market’s move toward minimalistic, eco-smart brewing solutions that match modern lifestyle needs.

Regional Analysis

Europe led the Dolce Gusto Market with a strong 43.6% share, reaching USD 1.6 Bn.

In the Dolce Gusto Market, Europe emerged as the dominating region in 2024 with a commanding 43.6% market share, valued at USD 1.6 Bn, driven by strong household adoption of premium capsule-based coffee systems and widespread retail availability across major EU countries.

North America continued to show steady growth as consumers increasingly favored convenient, single-serve brewing formats supported by rising demand for flavored capsules and compact machines suitable for modern kitchens. The Asia Pacific region witnessed expanding interest as urbanization, café culture influence, and younger consumers’ preference for at-home café beverages supported wider product acceptance.

Markets in the Middle East & Africa reflected growing exposure to branded coffee machines through retail and lifestyle outlets, while Latin America experienced gradual adoption supported by increasing familiarity with home-brewing appliances. Across all regions, rising inclination toward café-style beverages at home continued strengthening demand, with Europe clearly maintaining its leadership position based on deep market penetration and consistent capsule consumption patterns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé, the core driver behind Dolce Gusto, remained at the forefront by expanding its capsule portfolio and enhancing machine compatibility to meet changing tastes. Its focus on flavor variety, sustainability efforts around pods, and strong retail positioning helped reinforce consumer loyalty. Nestlé’s consistent investment in packaging upgrades and user-friendly appliance designs further supported its leadership across major markets.

Keurig Dr Pepper maintained a competitive edge by leveraging its broad single-serve coffee expertise and established relationships with retailers. While not directly producing Dolce Gusto machines, Keurig’s influence in the single-serve segment indirectly shaped competitive benchmarks, encouraging performance improvements and flavor diversification within the broader capsule ecosystem. Its strong brand visibility across North America continued to influence consumer expectations for convenience and brewing consistency.

Peet’s Coffee contributed to premiumization trends by promoting high-quality coffee standards that indirectly supported demand for specialty capsules. With a strong brand reputation for rich blends and artisanal roasting, Peet’s encouraged consumers to explore higher-end flavor options within pod-based systems. Its focus on authenticity and freshness shaped evolving preferences, indirectly benefiting the premium capsule segment of the Dolce Gusto landscape.

Top Key Players in the Market

- Nestle

- Keurig Dr Pepper

- Peet’s Coffee

- Jacobs Douwe Egberts

- Lavazza

- Starbucks

- Café Royal

Recent Developments

- In August 2025, Keurig Dr Pepper announced it agreed to acquire JDE Peet’s, the parent company of Jacobs Douwe Egberts, in a large all-cash deal valued at approximately €15.7 billion (about USD 18 billion). This move brings well-known coffee brands, including Jacobs, under the ownership of Keurig, forming a broader global coffee portfolio spanning single-serve machines and coffee products worldwide. Closing of the acquisition is expected by the first half of 2026. The combined business will later be split into two independent companies focused on beverages and coffee.

- In April 2024, Lavazza agreed to increase its share in Italian vending operator IVS Group by buying a larger stake and planning to fully acquire the business by 2027. This move aims to strengthen Lavazza’s presence in vending channels and coffee services beyond just capsules or machines, expanding how and where consumers can enjoy coffee.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Nestle, Keurig Dr Pepper, Peet’s Coffee, Jacobs Douwe Egberts, Lavazza, Starbucks, Café Royal Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape By Product Type (Machines, Capsules, Accessories), By End User (Residential, Commercial),By Distribution Channel (Store-Based, Non-Store-Based) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestle

- Keurig Dr Pepper

- Peet's Coffee

- Jacobs Douwe Egberts

- Lavazza

- Starbucks

- Café Royal