Global Document Storage and Management Services Market Size, Share Analysis Report By Service Type (Document Storage Services, Document Management Services), By Enterpise Size (Small and Medium-Sized Enterprises, Large Enterprises), By End-use (BFSI, Government, Healthcare, IT and Telecom, Retail, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152882

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

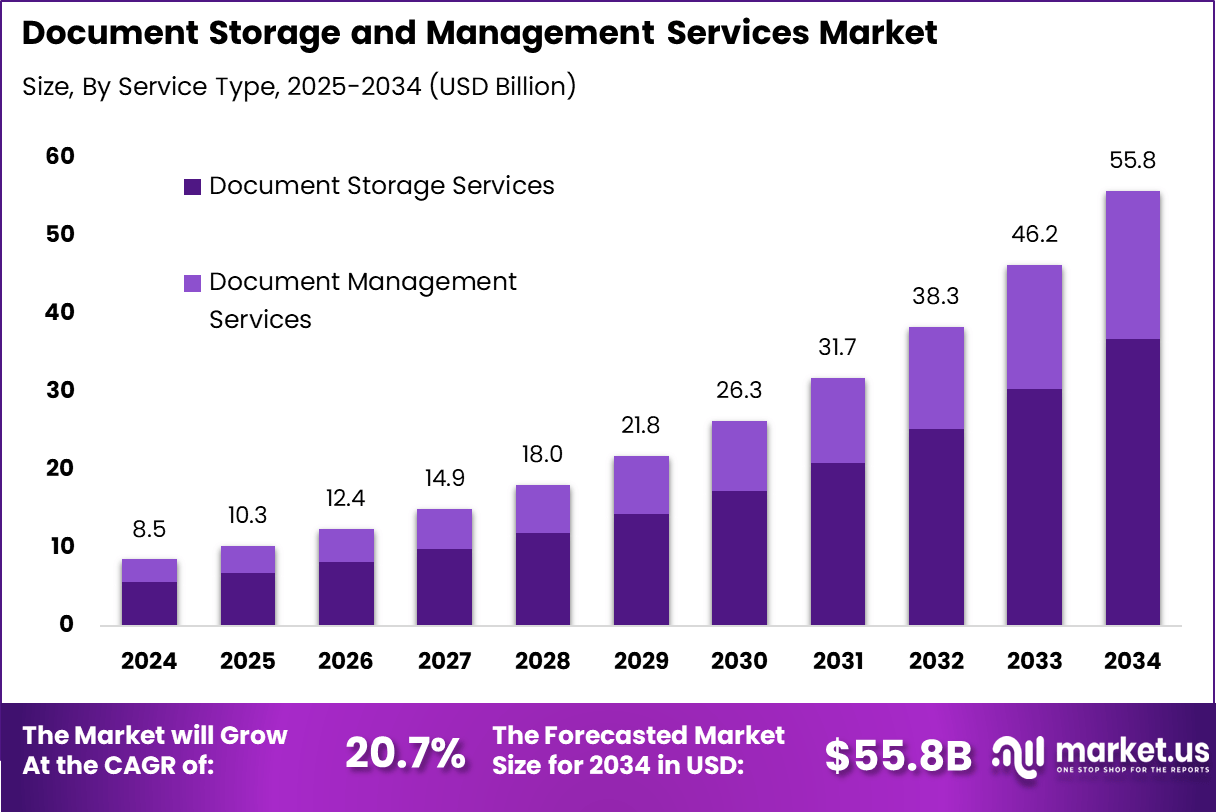

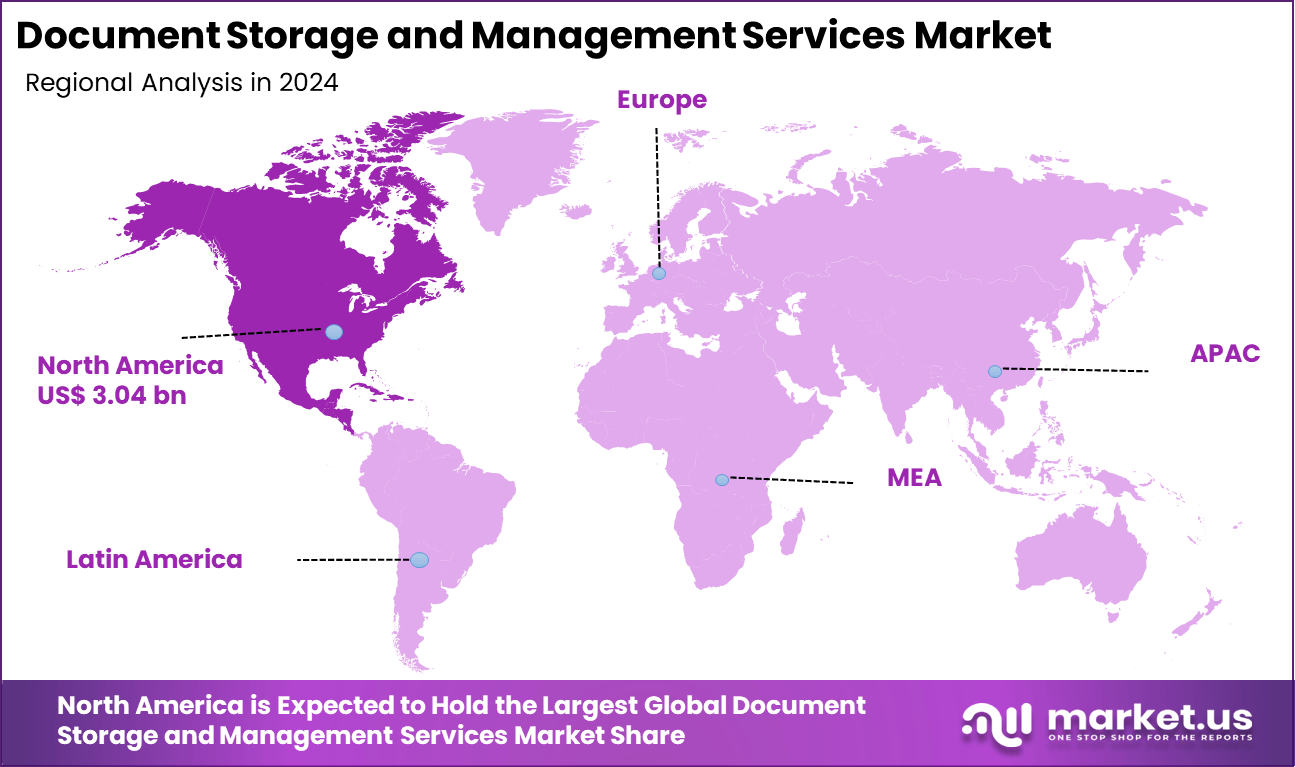

The Global Document Storage and Management Services Market size is expected to be worth around USD 55.8 billion by 2034, from USD 8.5 billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.8% share, holding USD 3.04 billion in revenue.

The Document Storage and Management Services Market revolves around solutions that help organizations efficiently store, organize, and retrieve documents in digital or physical formats. The industry has transformed significantly as more companies move to digital-first operations, with the primary focus on privacy, security, and quick access to information.

One of the most significant driving factors in this market is the push for digital transformation as businesses strive for greater efficiency and sustainability. Today, a growing concern for data security, the increasing amount of documents generated, and stricter compliance requirements have led organizations to prioritize advanced document storage solutions.

For instance, In January 2025, Restore won a contract to deliver mailroom and document management services for the Department for Work and Pensions (DWP). This partnership aims to improve DWP’s document storage and processing efficiency by streamlining mailroom operations. The agreement reinforces Restore’s presence in the public sector, demonstrating its capability to provide secure and scalable solutions for large government bodies.

Scope and Forecast

Report Features Description Market Value (2024) USD 8.5 Bn Forecast Revenue (2034) USD 55.8 Bn CAGR (2025-2034) 20.7% Largest market in 2024 North America [35.8% market share] Digitalization plays a substantial role in fueling market demand. Organizations are handling ever-growing volumes of documents and information every day, which underscores the need for robust systems that guarantee seamless access and easy retrieval. As more enterprises move to a paperless setup, demand is rising for solutions that not only store but also help organize and track documents across the entire lifecycle.

Key Takeaway

- The Global Document Storage and Management Services market is projected to reach USD 55.8 billion by 2034, expanding at a robust 20.7% CAGR from 2025 to 2034, driven by digital transformation initiatives and regulatory compliance needs.

- In 2024, North America dominated the market with a 35.8% share, generating approximately USD 3.04 billion in revenue, reflecting strong demand for secure document handling and cloud-based solutions.

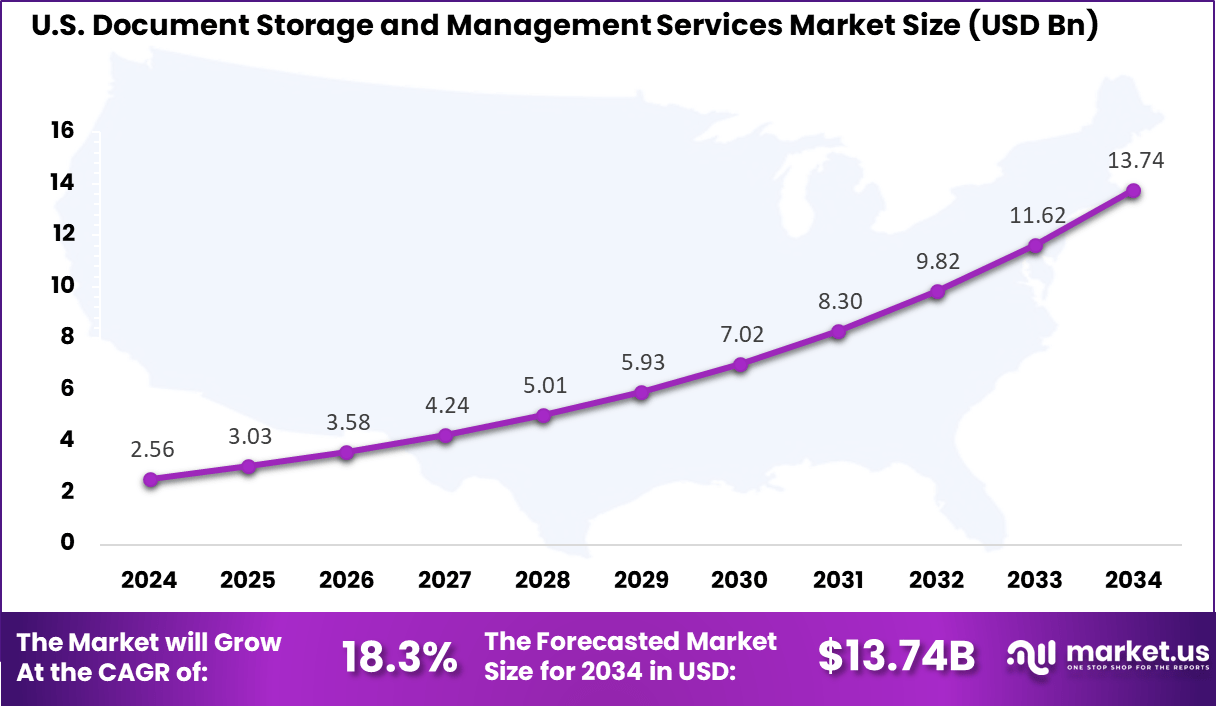

- The United States alone accounted for USD 2.56 billion in 2024, with a steady 18.3% CAGR expected, supported by high adoption among financial and healthcare sectors.

- By service type, Document Storage Services led the market, capturing a significant 65.8% share, as enterprises increasingly outsourced physical and digital archiving to improve efficiency.

- By enterprise size, Large Enterprises contributed the majority share of 72.5%, underscoring their greater need for scalable document management to handle complex workflows.

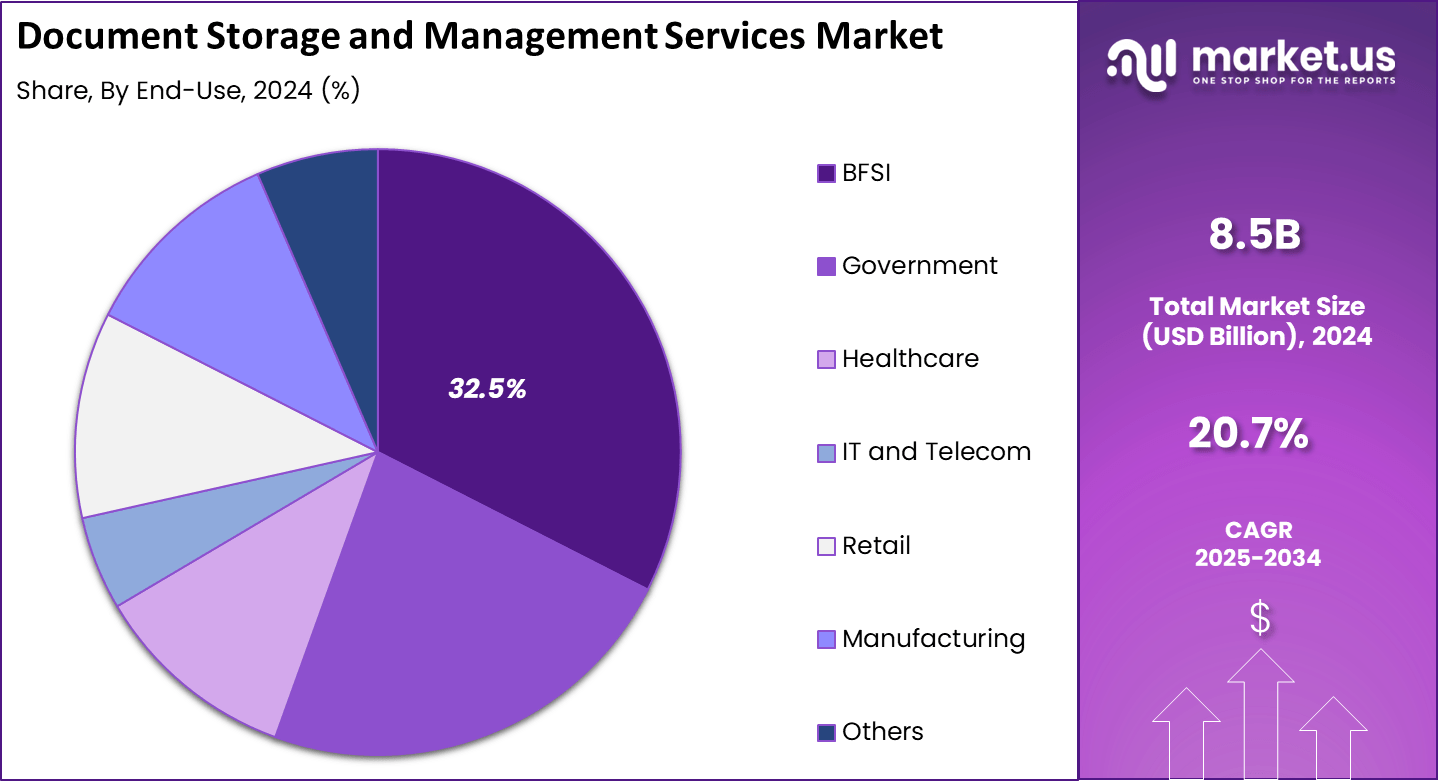

- By end-use, the BFSI sector emerged as the largest contributor, holding about 32.5% share, due to stringent data retention and privacy regulations in banking and insurance industries.

Analysts’ Viewpoint

There has been a remarkable surge in the adoption of cloud-based storage, artificial intelligence (AI), and automation technologies in this sector. Cloud platforms enable document storage without physical limitations, while AI-driven indexing and search features boost organizational productivity by automating document categorization and retrieval.

There are substantial investment opportunities in areas such as cloud document storage, AI-enhanced content management, and industry-specific solutions for sectors like healthcare and legal services. Companies that innovate on security, compliance, and real-time collaboration stand to gain, especially with the growing adoption of digital technologies across emerging markets.

The regulatory landscape in this market is shaped by laws and standards that require organizations to store and manage records securely for specified durations. Stringent compliance requirements such as GDPR and HIPAA put pressure on firms to adopt robust document management platforms that enable proper access control, audit trails, and secure long-term storage of sensitive information.

U.S. Market Size

The market for Document Storage and Management Services within the U.S. is growing tremendously and is currently valued at USD 2.56 billion, the market has a projected CAGR of 18.3%. This dominance is due to the rapid adoption of cloud technologies, evolving regulatory standards, and the rise of remote and hybrid work environments.

Businesses across various industries are prioritizing secure, scalable solutions to ensure compliance with regulations like HIPAA and SOX while improving data accessibility and operational efficiency. The ongoing digital transformation, combined with the integration of AI and automation, is further accelerating the demand for smarter, more efficient document management systems.

For instance, in May 2025, Xerox acquired Document Systems to strengthen its presence in the U.S. SMB market. This acquisition enables Xerox to expand its document management and storage solutions, providing small and medium-sized businesses with more efficient, scalable, and secure document handling options. By integrating Document Systems’ capabilities, Xerox aims to offer enhanced workflow automation and improved document security.

In 2024, North America held a dominant market position in the Global Document Storage and Management Services Market, capturing more than a 35.8% share, holding USD 3.04 billion in revenue. This dominance is due to the region’s advanced digital infrastructure, high levels of regulatory compliance, and widespread adoption of cloud-based solutions.

The presence of major industry players, coupled with the growing demand for secure, scalable document management solutions in sectors like healthcare, finance, and legal, has further fueled market growth. Additionally, the accelerated shift toward remote and hybrid work models in North America has significantly boosted the need for efficient and accessible document storage and management services.

For instance, in April 2025, Microsoft showcased how AI is transforming document storage and management in North America by streamlining workflows, enhancing search capabilities, and automating data extraction. This integration improves efficiency and security, enabling organizations to better manage critical information and driving the adoption of AI-powered document solutions across industries.

Service Type Analysis

In 2024, Document Storage Services segment held a dominant market position, capturing a 65.8% share of the Global Document Storage and Management Services Market. This dominance can be attributed to the rising volume of both physical and digital documents generated by businesses, which fuels the need for secure, efficient, and scalable storage solutions.

Companies are focusing on securely archiving critical records to meet regulatory compliance and ensure quick access when needed. Furthermore, the increasing adoption of hybrid storage models that blend on-premises and cloud-based solutions has further driven demand, making the Document Storage Services segment a significant driver of market growth.

For instance, In January 2024, AMIDATA introduced a cloud storage service based on ActiveScale object storage to strengthen its document storage solutions. The service offers a scalable, secure, and cost-efficient cloud infrastructure. By integrating quantum end-to-end solutions, AMIDATA enables businesses to manage large data volumes with high availability and seamless document access.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 72.5% share of the Global Document Storage and Management Services Market. The demand in this sector is driven by the large-scale, complex document management needs of large enterprises, including regulatory compliance, data security, and efficient workflow automation.

These organizations manage vast amounts of sensitive information, prompting significant investments in scalable, reliable document storage solutions that integrate seamlessly with other enterprise systems. Furthermore, their substantial financial resources enable the adoption of advanced technologies like AI and cloud-based platforms, which further accelerate growth in this segment.

For instance, in March 2025, GRM Information Management announced its participation in the United States and Canadian Academy of Pathology (USCAP) Annual Meeting, showcasing its document storage and management solutions for large enterprises. The company highlighted how its services help organizations, particularly in the healthcare sector, manage vast amounts of critical data securely and efficiently.

End-use Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 32.5% share of the Global Document Storage and Management Services Market. This dominance is driven by the sector’s strict regulatory compliance needs, large volumes of sensitive customer data, and the critical demand for secure and efficient document management.

BFSI organizations are increasingly adopting advanced solutions to streamline operations, mitigate data breach risks, and enhance customer service with quicker document retrieval and processing. The ongoing digitalization of financial services and the transition to paperless transactions have further boosted demand within this segment.

For Instance, in May 2025, Apoidea Group improved visual information extraction from banking documents by using multimodal models on Amazon SageMaker Hyperpod with Llama Factory. This innovation enhances document processing efficiency in the BFSI sector, automating workflows, improving data accuracy, and ensuring better compliance with regulatory standards.

Key Market Segments

By Service Type

- Document Storage Services

- Secure storage

- Centralized Access

- Automated Storage

- Backup and Recovery

- Others

- Document Management Services

- Document Capture

- Indexing and Metadata

- Version Control

- Workflow Automation

- Access Control

- Others

By Enterprise Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By End-use

- BFSI

- Government

- Healthcare

- IT and Telecom

- Retail

- Manufacturing

- Others

Emerging Trend

Cloud-Based and AI-Powered Document Management

The digital transformation wave has set a powerful pace for how organizations handle documents. One of the most notable trends is the growing reliance on cloud-based solutions paired with artificial intelligence. Companies are moving their files away from paper and isolated desktops into unified cloud environments.

These platforms are getting smarter every day, driven by machine learning tools that help with organizing, searching, and securing documents. As a result, teams can access their work from anywhere, collaborate in real time, and benefit from features like automatic file tagging and quick data retrieval, which simplifies complex tasks considerably.

Drivers

Digital Transformation

Digital transformation is a significant factor in the rapid growth of many industries. The adoption of digital document management systems is a swift and efficient approach that streamlines workflows, decreases paper storage expenses, and enhances regulatory compliance.

This shift supports operational agility and data centralization, enabling better decision-making and efficiency. As businesses prioritize automation and remote control, digital solutions are becoming an integral part of everyday operations, transforming traditional document management into a vital enabler of enterprise growth.

For instance, in August 2024, Iron Mountain launched a new digital data document management service that leverages MongoDB Atlas to enhance its document storage and management capabilities. This service supports digital transformation by offering scalable, secure, and flexible solutions for businesses to manage their critical data. It enables businesses to streamline workflows and boost operational efficiency in a digital-first environment.

Restraint

High Initial & Implementation Costs

Despite long-term benefits, the high initial investment for document management solutions poses a significant barrier, particularly for small and medium-sized enterprises (SMEs). Costs associated with software licensing, customization, user training, and system integration are often substantial.

Additionally, ongoing maintenance and support services can strain limited IT budgets. These financial hurdles slow adoption, especially in resource-constrained environments. For instance, in July 2025, a report from Continia highlighted the high initial and implementation costs of document storage services, particularly for physical storage, which averages $20 to $100 per box per year.

Additionally, digital document management systems incur significant costs for software licensing, integration, training, and maintenance, posing a challenge for small and medium-sized enterprises (SMEs) despite the long-term benefits.

Opportunities

Cloud-Based Solutions

Growth is largely driven by the increasing use of cloud-based document management systems. Cloud-based solutions are a cost-effective, flexible solution that allows organizations to access information anywhere and anytime, regardless of the company’s size or location. These solutions reduce infrastructure expenses, improve disaster recovery procedures, and enhance departmental collaboration.

With the development of security and compliance features in cloud settings, numerous companies are shifting to hosted document solutions, resulting in a significant need for providers that offer flexible, secure, and fully integrated cloud services.

For instance, in May 2024, Noventiq launched its next-generation AWS cloud-based Document Management System (uDMS), designed to revolutionize how businesses manage and store their documents. The new solution offers enhanced scalability, security, and collaboration features, enabling organizations to streamline their document workflows while ensuring seamless integration with other enterprise systems.

Challenges

Data Security and Privacy Concerns

Data security and privacy remain critical challenges for document management systems. Organizations must safeguard sensitive information from breaches and unauthorized access through encryption, access controls, and multi-factor authentication.

Regulatory compliance with frameworks like GDPR, HIPAA, and SOC 2 is non-negotiable. Any failure in data protection can lead to reputational damage and financial penalties. As cyber threats evolve, companies face growing pressure to invest in advanced security frameworks and ensure consistent data governance across platforms.

For instance, In January 2025, a report by Infosecurity Magazine underscored rising concerns over data security and privacy in document storage and management services. The shift toward digital and cloud-based solutions has amplified risks of breaches and unauthorized access. This trend has made it essential for businesses to implement strong security measures, such as encryption and multi-factor authentication, to safeguard sensitive data and comply with evolving privacy regulations.

Key Players Analysis

Agiloft, Alfresco Software, and Cflowapps have been recognized for their customizable and user-friendly document management platforms. These companies focus on providing cloud-based solutions that enhance workflow automation and improve operational efficiency. DocLogix and Hyland Software have strengthened their market presence through continuous innovation and integration capabilities with enterprise applications.

IBM, Microsoft, and Oracle remain dominant due to their robust product portfolios and global customer reach. These corporations leverage advanced technologies such as artificial intelligence and analytics to deliver intelligent document management systems. Open Text and Nuxeo have focused on enhancing digital collaboration and enabling scalable solutions for enterprises transitioning to paperless workflows.

Ricoh and Xerox have retained competitive advantage by combining hardware expertise with digital transformation services, making them preferred vendors for businesses modernizing their document environments. Zoho Corporation and Logicaldoc cater to small and medium-sized enterprises with cost-effective and flexible solutions. Their products emphasize ease of deployment and integration with productivity tools, which appeals to organizations with limited IT resources.

Integrify, on the other hand, differentiates itself by offering process-centric document solutions that streamline complex approval chains. Other emerging players continue to enter the market by addressing niche requirements, such as industry-specific compliance or localized language support, contributing to a dynamic and competitive ecosystem.

Top Key Players in the Market

- Agiloft, Inc.

- Alfresco Software Inc.

- Cflowapps

- DocLogix

- Hyland Software, Inc.

- IBM Corporation

- Integrify

- Logicaldoc

- Microsoft

- Nuxeo

- Open Text Corporation

- Oracle Corporation

- Ricoh Company Ltd.

- Xerox Corporation

- Zoho Corporation

- Others

Recent Developments

- In June 2025, CflowApps further enhanced its document management capabilities by introducing new features designed to automate workflows, improve collaboration, and ensure regulatory compliance. These updates are aimed at helping businesses streamline their document management processes while maintaining high standards of security and efficiency.

- In July 2025, Hyland unveiled Agentic, an AI-powered document processing solution designed to automate and streamline document handling workflows. This innovative tool leverages advanced artificial intelligence to improve content management, enhance document categorization, and enable faster processing.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Document Storage Services, Document Management Services), By Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises), By End-use (BFSI, Government, Healthcare, IT and Telecom, Retail, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agiloft, Inc., Alfresco Software Inc., Cflowapps, DocLogix, Hyland Software, Inc., IBM Corporation, Integrify, Logicaldoc, Microsoft, Nuxeo, Open Text Corporation, Oracle Corporation, Ricoh Company Ltd., Xerox Corporation, Zoho Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Document Storage and Management Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Document Storage and Management Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agiloft, Inc.

- Alfresco Software Inc.

- Cflowapps

- DocLogix

- Hyland Software, Inc.

- IBM Corporation

- Integrify

- Logicaldoc

- Microsoft

- Nuxeo

- Open Text Corporation

- Oracle Corporation

- Ricoh Company Ltd.

- Xerox Corporation

- Zoho Corporation

- Others