Global Document Management System Market Size, Share Analysis Report By Component (Software, Services), By Deployment (Cloud, On-premises), By Enterprise Size (Large Enterprises, SMEs), By End Use (BFSI, Government, Healthcare, IT and Telecom, Retail, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150261

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

DMS Market Size

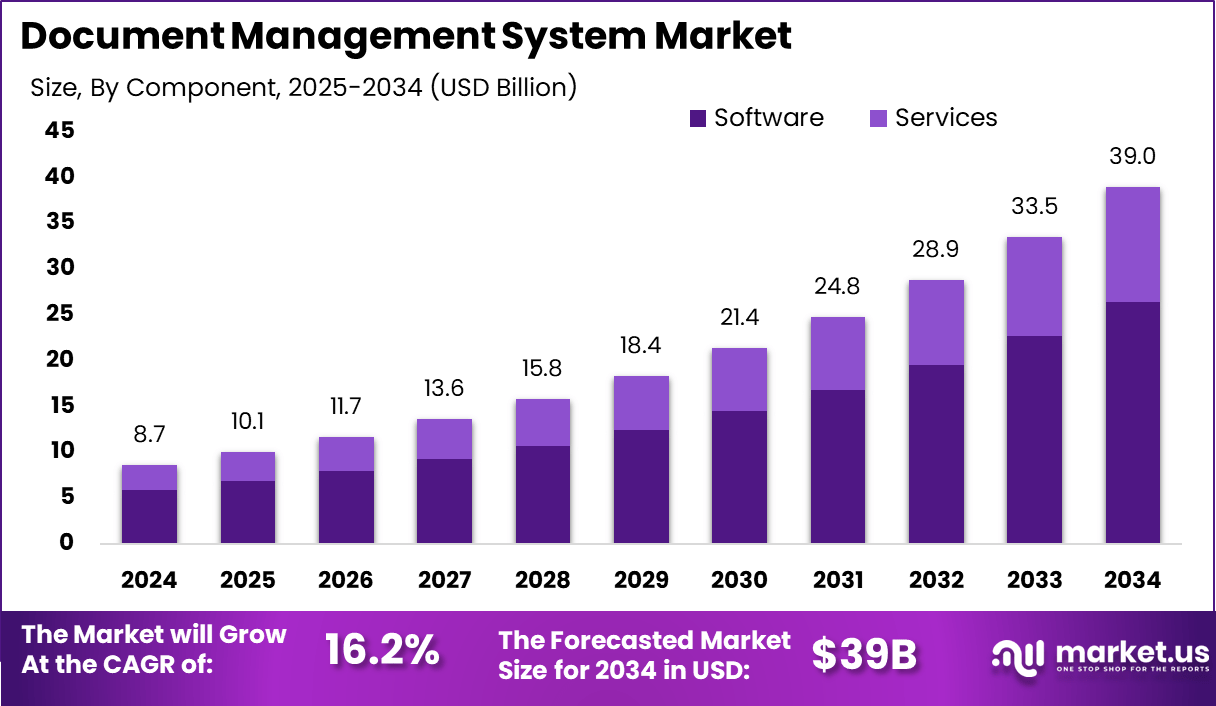

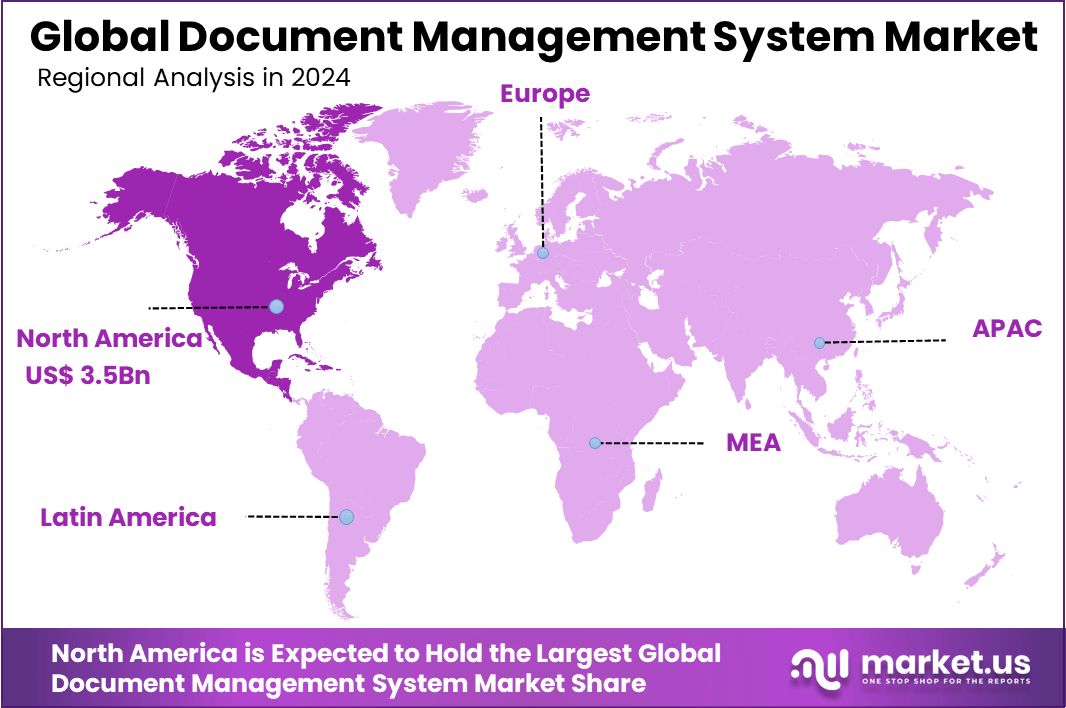

The Global Document Management System Market size is expected to be worth around USD 39 Billion By 2034, from USD 8.7 billion in 2024, growing at a CAGR of 16.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.8% share, holding USD 3.5 Billion revenue.

A Document Management System (DMS) is a software-driven infrastructure employed to store, manage, and track electronic documents and digital images of paper-based assets. Its functionality typically encompasses document capture, metadata tagging, version control, secure archiving, workflow automation, and retrieval tools such as optical character recognition (OCR) .

As per the latest insights from signhouse, Fortune 500 companies collectively lose around $12 billion per year due to inefficiencies from poor document management. A significant 45% of small businesses still rely on paper-based systems, while 11% have no document management setup at all.

As a result, 45% of companies take at least one week to get a contract signed, slowing down business operations. With the global data volume projected to hit 200 zettabytes by 2025, the need for efficient document handling has become more urgent than ever.

According to Keevee, more than 85% of companies are actively pursuing digital transformation, with document management being a key area of focus. Businesses that adopt digital workflows report a 60% rise in productivity as automation reduces manual work and errors.

Additionally, digital systems help cut paper usage by up to 80%, contributing to both cost savings and environmental sustainability. The move towards digital document management is becoming essential for businesses aiming to stay agile, efficient, and competitive.

Key Takeaways

- In 2024, the Software segment led the Document Management System (DMS) market by component, contributing over 67.9% of total revenue due to growing demand for automated content organization and integration with business workflows.

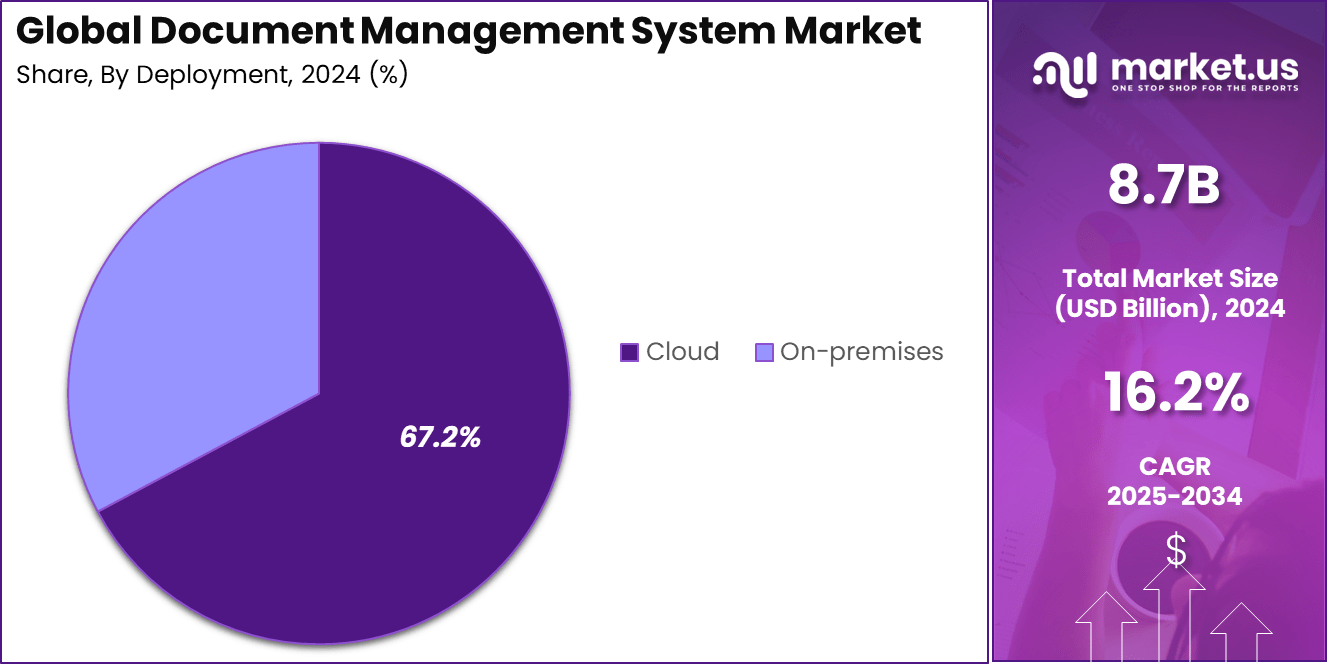

- The Cloud deployment segment captured the largest market share in 2024, exceeding 67.2%, driven by cost-effectiveness, scalability, and remote access benefits supporting hybrid work models.

- Among end-use industries, the Healthcare sector dominated the DMS market in 2024, accounting for approximately 23.6% of total revenue, supported by increased digital recordkeeping and compliance requirements like HIPAA.

- North America held a leading position in the global DMS market in 2024, contributing about 40.8% of total revenue, attributed to high digital maturity and early cloud adoption across enterprises.

Market Overview

The global Document Management System market is undergoing rapid expansion and transformation. The top driving factors include the shift toward paperless offices, which enhances operational efficiency and cost savings. Enterprises are increasingly adopting remote work models, accelerating demand for centralized, accessible document repositories.

Moreover, stringent regulatory requirements across industries (e.g., healthcare, finance, government) are compelling organizations to deploy DMS to ensure compliance with audit trails and secure record keeping. The increasing adoption of technologies such as AI-powered Optical Character Recognition (OCR), workflow automation, cloud computing, mobile accessibility, and blockchain for enhanced security and verification is reshaping the DMS landscape.

Key reasons for adopting these systems include improved collaboration, reduced manual paperwork, cost optimization, streamlined auditability, and enhanced compliance. Centralized access to documents supports remote work and operational continuity. AI and automation reduce human error, accelerating business cycles, while full audit trails enhance governance.

Investment opportunities lie in untapped sectors such as SMEs, government bodies, and regulated industries (e.g., healthcare, finance, legal). Cloud-native DMS offerings and mobile-first solutions are forecasted to deliver high returns. Investments in emerging technologies – particularly AI and blockchain – are expected to yield competitive differentiation.

Role of AI

The integration of Artificial Intelligence (AI) into Document Management Systems (DMS) is driving a fundamental transformation in how organizations capture, process, and govern documents. This shift is being shaped by advanced technologies such as Natural Language Processing (NLP), machine learning (ML), Intelligent Document Processing (IDP), and generative AI, culminating in substantial improvements in efficiency, accuracy, compliance, security, and insight generation.

AI-powered DMS solutions can extract structured data from up to 80 % of unstructured enterprise content, including emails, PDFs, and chats – a category that traditionally lay dormant in siloed repositories. This data unlocks value across industries by enabling semantic search, automated categorization, and intelligent routing. Semantic classification goes beyond keyword matching to uncover related documents by meaning, greatly reducing search time and improving information discovery.

Advanced IDP and NLP routines enable AI-DMS to process invoices, forms, contracts, and handwritten notes by converting them into actionable data. This capability is closely aligned with Intelligent Document Processing systems, which combine OCR, ML, and NLP to automate document ingestion, classification, and data extraction – with accuracy rates that markedly reduce manual effort

North America Growth

In 2024, North America held a dominant market position, capturing more than a 40.8 % share with approximately USD 3.5 billion in revenue. This leadership stemmed from a powerful combination of digital transformation across key industries, including healthcare, finance, government, and legal services, and from compliance demands tied to regulations such as HIPAA.

Organizations in the region pursued cloud-based, intelligent document management to ensure secure access, auditability, and efficient document workflows. Strong enterprise adoption – especially of software components – boosted the region’s share to nearly 40 % of global revenues, reinforcing its market authority.

By Component Analysis

In 2024, Software segment held a dominant market position, capturing more than a 67.9 % share of the global Document Management System market. This performance was underpinned by widespread demand for comprehensive solutions capable of handling document capture, storage, indexing, version control, and security.

Organizations across industries leaned heavily on software suites that integrate Optical Character Recognition (OCR), Intelligent Metadata extraction, and cloud-native interfaces to support remote and hybrid work models. Rising regulatory obligations and the need for seamless collaboration drove persistent investments in robust, scalable software platforms. The leadership of the software component can also be attributed to accelerated enterprise digitalization during and following the pandemic.

These end‑users prioritized centralized and secure document handling systems over one-time documentation services, resulting in recurring revenue models and longer software lifecycles. Coupled with the growing integration with CRM, ERP, and AI‑driven automations, software platforms became the preferred choice for strategic digital transformation across verticals such as healthcare, finance, and government.

By Deployment Analysis

In 2024, the cloud deployment segment held a dominant position within the Document Management System (DMS) market, accounting for more than 67.2 % of total deployment share. This leadership was driven by the integration of advanced technologies such as AI, machine learning, and intelligent automation within cloud-based DMS platforms.

Organizations prioritized cloud solutions for their inherent scalability, reliable 24/7 availability (up to 99.9%), and remote accessibility – attributes that support hybrid and distributed workforce models. The pay-as-you-go cost model reduced initial capital outlay, which further encouraged adoption, particularly among small and medium enterprises (SMEs) seeking efficient document management without heavy upfront investment.

The cloud segment’s dominance can also be attributed to enterprise focus on compliance, security, and disaster recovery. Leading cloud providers consistently invest in robust infrastructure and stringent data protection measures, aligning with evolving regulatory standards and reducing internal IT burden. As a result, many organizations, especially in regulated industries, shifted toward cloud DMS to leverage these built-in capabilities while achieving seamless collaboration and operational agility across global teams.

By Enterprise Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing more share due to their extensive investment capabilities, complex regulatory requirements, and strong focus on digital transformation. These organizations were able to allocate substantial budgets to deploy enterprise-grade document management systems (DMS), ensuring secure storage, compliance, and advanced workflow automation.

The need to manage high volumes of documentation across departments – such as legal, finance, HR, and operations – contributed significantly to their preference for scalable, cloud-based solutions that support global collaboration and data governance. Furthermore, large enterprises benefited from economies of scale and vendor partnerships, enabling them to negotiate favorable contracts and access premium features (e.g., AI-powered OCR, analytics dashboards, and multilayered security protocols).

Those features are particularly valued within sectors like banking, BFSI, and healthcare, where compliance with regulations such as GDPR and HIPAA is critical. The presence of hybrid deployment models allowed flexibility in balancing on‑premise control with cloud scalability, reinforcing adoption among large organizations.

By End Use Analysis

In 2024, the healthcare segment held a dominant market position, capturing more than 23.0 % of the global Document Management System market. This leadership was driven by a pronounced shift toward electronic health records (EHRs) and paperless operations.

Healthcare providers recognized the need for secure access to patient data – ranging from lab reports to imaging files – which propelled investments in DMS platforms designed to reduce errors, accelerate clinician access, and enhance overall patient care. The healthcare sector’s prominence was further supported by stringent regulatory and privacy requirements.

DMS solutions were employed to ensure compliance with standards such as HIPAA in the US and GDPR in Europe, promoting secure storage, robust audit trails, and controlled document access. This focus on regulatory readiness drove preference for advanced systems capable of automatic metadata tagging, encryption, and intelligent governance.

Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- SMEs

By End Use

- BFSI

- Government

- Healthcare

- IT and Telecom

- Retail

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The integration of artificial intelligence (AI) and machine learning (ML) within DMS has been observed as a critical trend. AI-powered document categorization, advanced data extraction, and intelligent search capabilities are being increasingly implemented. This enables organizations to streamline workflows, enhance decision-making efficiency, and reduce time spent on manual sorting.

A second notable trend is the increased adoption of mobile‑optimized and cloud‑native DMS platforms. These platforms support hybrid and remote work environments by enabling seamless access to documents across devices. The emphasis on user experience and mobility is enhancing workforce productivity and driving adoption across all enterprise sizes.

Driver

One key growth driver is the shift toward paperless offices. Organizations are increasingly pursuing digital transformation initiatives, focusing on reducing paper usage while achieving operational cost savings. The digitalization of hard-copy documents has accelerated adoption across sectors such as healthcare, BFSI, government, and education.

Another primary driver relates to remote and hybrid work models. As distributed teams become standard, demand for secure, centrally accessible document solutions has risen significantly. DMS supports version control, secure sharing, and regulatory compliance, which are essential in remote workflows.

Restraint

High initial costs of implementation and licensing continue to inhibit adoption among SMEs. Upfront investment in infrastructure, software licenses, and staff training can be substantial, triggering budgetary constraints.

Integration complexities present a further barrier. Incompatibilities with legacy enterprise systems (ERP, CRM, etc.) and the need for technical expertise often lead to increased deployment times, customization costs, and hesitancy among IT departments.

Opportunity

New markets are emerging in sectors requiring robust compliance and legal audit trails. Financial services, healthcare, and legal industries exhibit growing demand for regulated document handling capabilities – such as detailed version control, secure audit logs, and retention policies – presenting a significant growth opportunity.

The trend toward sustainability and paperless operations also offers opportunity. Organizations aiming to reduce environmental footprint are adopting cloud‑based DMS as part of green initiatives. This promotes DMS not only as a compliance tool but also as an enabler of environmental responsibility.

Challenge

Cybersecurity remains a persistent challenge. With rising cyber threats, organizations demand tight access control, encryption, and authentication. However, cloud-based solutions also attract concerns over data breaches and unauthorized access, requiring continuous investment in security updates and compliance frameworks.

Resistance to change poses another implementation challenge. Employees accustomed to traditional paper workflows may show reluctance toward DMS adoption. Without adequate training and change management, this can elongate adoption timelines and reduce ROI.

Key Player Analysis

Key players in the document management system (DMS) industry such as Microsoft, IBM Corporation, Oracle Corporation, Open Text Corporation, and Hyland Software, Inc. continue to shape the competitive landscape through a range of strategic initiatives.

These companies are actively engaging in new product development, technological enhancements, and cloud-based integrations to improve scalability, data security, and workflow automation across enterprises. In addition, these firms are pursuing strategic partnerships, collaborations, and commercial agreements with both public and private entities.

Such efforts are aimed at expanding regional presence, enhancing service portfolios, and integrating advanced technologies like artificial intelligence and machine learning. This ongoing innovation and expansion are enabling market leaders to strengthen their positions and deliver differentiated value propositions in an increasingly competitive and compliance-driven environment.

Top Key Players Covered

- Integrify

- Logicaldoc

- Microsoft

- Agiloft, Inc.

- Alfresco Software Inc.

- Cflowapps

- DocLogix

- Hyland Software, Inc.

- IBM Corporation

- Nuxeo

- Open Text Corporation

- Oracle Corporation

- Ricoh Company Ltd.

- Xerox Corporation

- Zoho Corporation

Recent Developments

- Microsoft made significant advancements across its DMS ecosystem. In May 2024, SharePoint introduced updates to simplify formatting and support automation workflows. Throughout late 2024 and early 2025, OneDrive and File Explorer in Windows 11 received Copilot integration, allowing users to summarize documents and interact with files using AI prompts.

- In January 2024, Integrify was acquired by PSPDFKit, which rebranded itself as Nutrient. This move was aimed at expanding its capabilities in low-code workflow automation. Later, in April 2024, Nutrient integrated generative AI features into Integrify’s platform, enhancing its ability to automate complex document tasks and enabling smarter workflow experience.

Report Scope

Report Features Description Market Value (2024) USD 8.7 Bn Forecast Revenue (2034) USD 39 Bn CAGR (2025-2034) 16.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (Cloud, On-premises), By Enterprise Size (Large Enterprises, SMEs), By End Use (BFSI, Government, Healthcare, IT and Telecom, Retail, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Integrify, Logicaldoc, Microsoft, Agiloft, Inc., Alfresco Software Inc., Cflowapps, DocLogix, Hyland Software, Inc., IBM Corporation, Nuxeo, Open Text Corporation, Oracle Corporation, Ricoh Company Ltd., Xerox Corporation, Zoho Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Document Management System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Document Management System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Integrify

- Logicaldoc

- Microsoft

- Agiloft, Inc.

- Alfresco Software Inc.

- Cflowapps

- DocLogix

- Hyland Software, Inc.

- IBM Corporation

- Nuxeo

- Open Text Corporation

- Oracle Corporation

- Ricoh Company Ltd.

- Xerox Corporation

- Zoho Corporation