Global DNA/RNA Extraction Market By Product Type (Kits & Reagents, Instruments, DNA Isolation & Purification Kits, RNA Isolation & Purification Kits, and Others), By Method (Magnetic Bead-based, Reagent-based, Column-based, and Other), By Application (Oncology, Precision Medicine, Health & Diagnostics, Drug Discovery & Development, and Others), By End-user (Hospital Laboratories, Academic & Research Laboratories, Diagnostic Laboratories, Biopharmaceutical Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168894

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

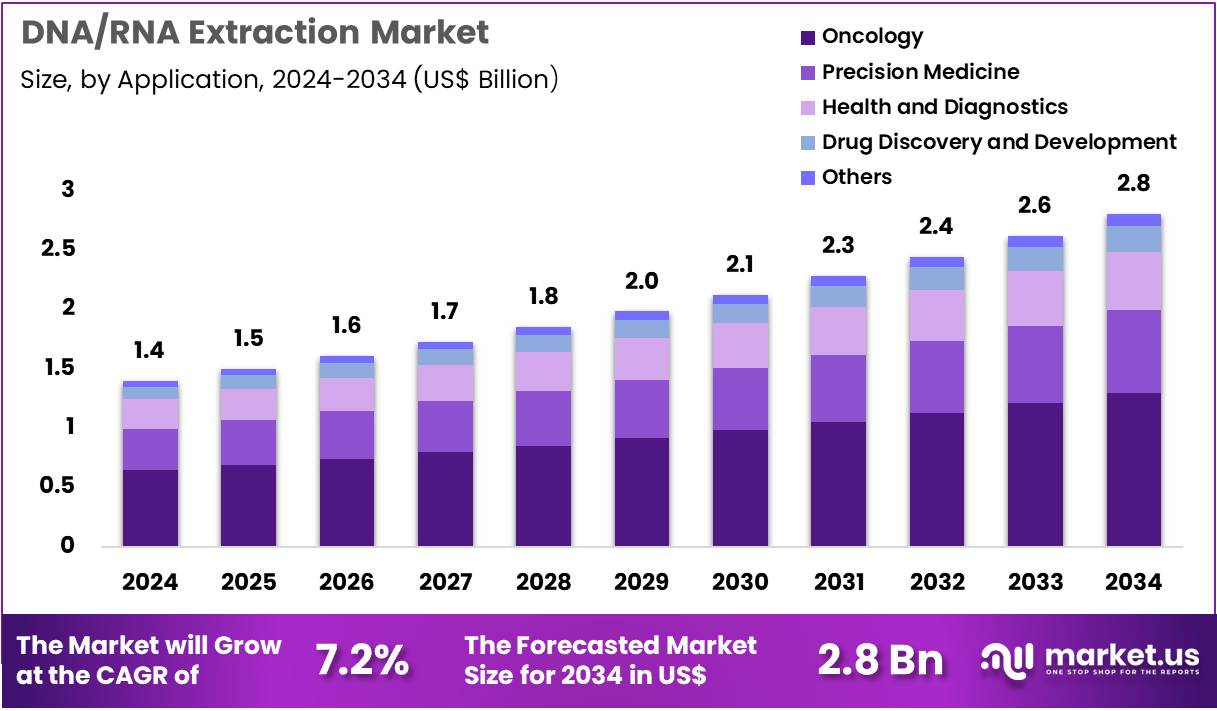

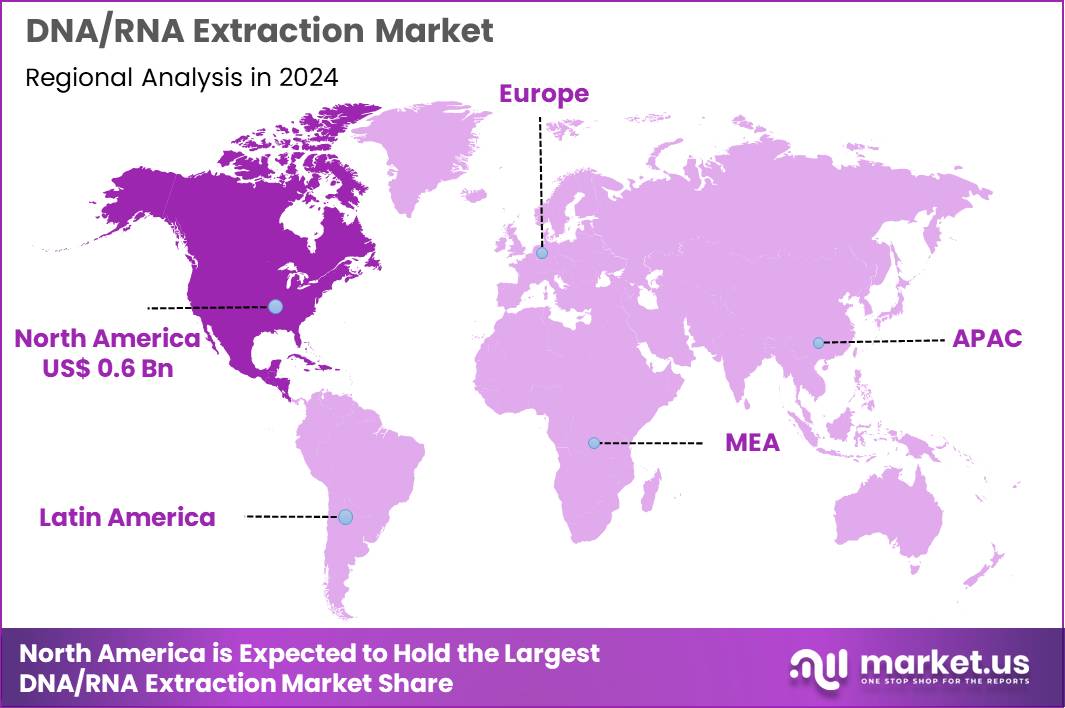

Global DNA/RNA Extraction Market size is expected to be worth around US$ 2.8 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.4% share with a revenue of US$ 0.6 Billion.

Increasing demand for high-quality nucleic acids in precision medicine propels the DNA/RNA Extraction market, as researchers and clinicians require pure, intact molecules to fuel advanced sequencing and diagnostic applications. Biotechnology firms engineer magnetic bead and silica membrane kits that efficiently lyse cells while removing PCR inhibitors from diverse sample matrices.

These solutions enable tumor mutation profiling from formalin-fixed paraffin-embedded tissues, viral load quantification in plasma for infectious disease monitoring, microbiome characterization from fecal specimens, and single-cell transcriptomics in oncology research.

Sustainability initiatives create opportunities for laboratories to adopt low-waste consumables without compromising yield or purity. QIAGEN expanded its QIAwave portfolio in September 2023 with the RNeasy Plus Mini Kit and DNA/RNA Mini Kit, delivering equivalent performance using substantially less plastic and cardboard than conventional products. This environmentally conscious innovation directly supports greener laboratory operations while meeting rigorous molecular biology standards.

Growing adoption of automated extraction platforms accelerates the DNA/RNA Extraction market, as high-throughput facilities integrate robotic systems to process hundreds of samples with minimal hands-on time and reduced cross-contamination risk. Manufacturers design cartridge-based workflows compatible with liquid handlers that maintain nucleic acid integrity across blood, saliva, and swab specimens.

Applications encompass non-invasive prenatal testing via cell-free DNA isolation, forensic human identification from degraded evidence, pathogen detection in food safety surveillance, and biobanking for large-scale genomic studies. Automated solutions open avenues for 24/7 operation and seamless downstream integration with next-generation sequencing pipelines. Clinical laboratories increasingly implement these systems to meet escalating testing volumes and regulatory traceability requirements.

Rising focus on multi-omic sample preparation invigorates the DNA/RNA Extraction market, as investigators pursue simultaneous genomic and transcriptomic analysis from limited biopsy material to uncover comprehensive disease mechanisms. Companies develop co-extraction kits that preserve both DNA and RNA quality through shared lysis and purification steps. These products support cancer driver mutation detection alongside gene expression profiling, epigenetic modification mapping with RNA-seq correlation, host-pathogen interaction studies in infectious samples, and spatial transcriptomics in tissue sections.

Dual-extraction capabilities unlock opportunities for cost-effective, data-rich experiments that accelerate biomarker discovery and therapeutic target validation. Research consortia actively standardize these protocols to enable reproducible multi-omic datasets across global collaborations. This convergence positions advanced extraction technologies as foundational enablers of integrated molecular diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 7.2%, and is expected to reach US$ 2.8 Billion by the year 2034.

- The product type segment is divided into kits & reagents, instruments, DNA isolation & purification kits, RNA isolation & purification kits, and others, with kits & reagents taking the lead in 2024 with a market share of 48.9%.

- Considering method, the market is divided into magnetic bead-based, reagent-based, column-based, and other. Among these, magnetic bead-based held a significant share of 44.3%.

- Furthermore, concerning the application segment, the market is segregated into oncology, precision medicine, health & diagnostics, drug discovery & development, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 46.1% in the market.

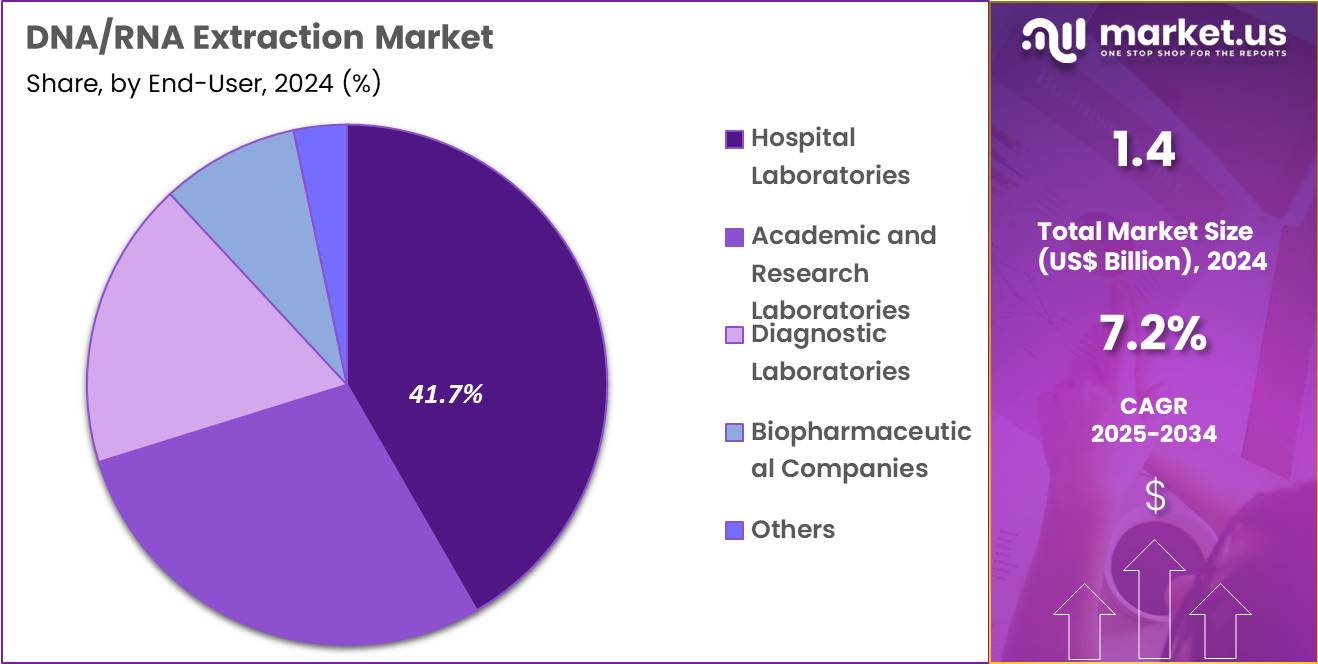

- The end-user segment is segregated into hospital laboratories, academic & research laboratories, diagnostic laboratories, biopharmaceutical companies, and others, with the hospital laboratories segment leading the market, holding a revenue share of 41.7%.

- North America led the market by securing a market share of 39.4% in 2024.

Product Type Analysis

Kits and reagents, holding 48.9%, are expected to dominate due to their essential role in high-throughput and routine extraction workflows across clinical, research, and pharmaceutical settings. Laboratories rely on ready-to-use extraction kits that ensure consistent nucleic-acid yield and purity from diverse sample types. Growth in molecular diagnostics expands daily use of extraction reagents for PCR, sequencing, and viral detection.

Manufacturers introduce advanced formulations that reduce processing time and improve inhibitor removal, enhancing workflow efficiency. Oncology and precision medicine programs increase demand for sensitive extraction reagents required for low-input samples.

Diagnostic labs prefer standardized kits to maintain reproducibility across large volumes. Research centres use specialized reagents for genomics and transcriptomics studies. Expansion of decentralized testing boosts kit adoption. These factors keep kits and reagents anticipated to remain the leading product type.

Method Analysis

Magnetic bead-based methods, holding 44.3%, are anticipated to dominate due to their high efficiency, automation compatibility, and superior performance with complex samples. Laboratories adopt bead-based extraction to achieve high-quality DNA and RNA recovery with reduced manual handling. Automated magnetic platforms support rapid, contamination-free workflows in high-volume settings.

Oncology, virology, and metagenomics studies rely on bead-based methods for extracting nucleic acids from low-concentration or degraded samples. Manufacturers develop bead chemistries optimized for targeted capture and purification, increasing accuracy. High-throughput labs benefit from scalable bead-based workflows suitable for 96-well and 384-well formats.

Decentralized testing centres choose bead systems for rapid molecular diagnostics. Rising adoption of liquid biopsy and minimal residual disease testing further strengthens bead-based demand. These drivers keep magnetic bead-based extraction projected to remain the most influential method.

Application Analysis

Oncology, holding 46.1%, is expected to dominate application demand as cancer diagnosis increasingly depends on molecular profiling, mutation detection, and circulating nucleic-acid analysis. Precision oncology programs rely on high-quality DNA/RNA extraction for sequencing, PCR, and targeted assays. Liquid biopsy workflows expand testing demand across solid and hematologic cancers.

Hospital oncology units integrate extraction workflows to support treatment monitoring. Research institutions investigate tumour genomics, increasing extraction volumes. Pharmaceutical companies performing oncology drug trials depend on accurate extraction for biomarker validation. Early detection programs strengthen adoption of nucleic-acid–based diagnostics. Increasing global cancer incidence drives continuous testing needs. These factors keep oncology anticipated to remain the most influential application area.

End-User Analysis

Hospital laboratories, holding 41.7%, are expected to dominate as they manage large volumes of patient samples across oncology, infectious disease, and routine diagnostics. Hospitals rely on DNA/RNA extraction workflows for rapid molecular testing that supports critical clinical decisions. Integrated molecular laboratories expand extraction capacity to meet rising demand for PCR and sequencing-based diagnostics.

Growing adoption of precision medicine increases extraction needs in oncology departments. Automated extraction platforms improve turnaround time and reduce labour burden. Hospitals handle urgent testing for viral outbreaks, strengthening extraction-kit usage. Large patient populations support continuous procurement of high-throughput extraction systems. These drivers keep hospital laboratories anticipated to remain the dominant end-user in the DNA/RNA extraction market.

Key Market Segments

By Product Type

- Kits & Reagents

- Instruments

- DNA Isolation & Purification Kits

- RNA Isolation & Purification Kits

- Others

By Method

- Magnetic Bead-based

- Reagent-based

- Column-based

- Other

By Application

- Oncology

- Precision Medicine

- Health & Diagnostics

- Drug Discovery & Development

- Others

By End-user

- Hospital Laboratories

- Academic & Research Laboratories

- Diagnostic Laboratories

- Biopharmaceutical Companies

- Others

Drivers

Increasing Funding for Genomic Research is Driving the Market

The surge in government funding for genomic research has positioned it as a primary driver for the DNA/RNA extraction market, as these projects require high-quality nucleic acid isolation for sequencing and analysis. This financial support enables large-scale studies on disease genomics and personalized medicine, amplifying demand for efficient extraction kits. Research institutions are prioritizing automated systems to handle diverse sample types, from blood to tissue, ensuring purity for downstream applications.

Regulatory frameworks facilitate grant allocations toward extraction technologies, aligning with national innovation agendas. Collaborative consortia between funding bodies and suppliers accelerate kit validations, supporting multi-omics workflows. The economic rationale underscores investments, as superior extraction enhances data reliability and reduces re-run rates.

Professional societies advocate for standardized kits in funded protocols, embedding them in experimental designs. This driver spurs advancements in magnetic bead-based methods, improving yield for low-input samples. Educational grants target laboratory personnel, promoting best practices in extraction techniques.

Ultimately, sustained funding trajectories ensure market resilience amid evolving research priorities. The National Institutes of Health and National Science Foundation awarded $15.4 million in 2024 for RNA research initiatives, including extraction and purification technologies.

Restraints

Supply Chain Disruptions for Critical Reagents is Restraining the Market

Ongoing supply chain disruptions for enzymes and buffers essential to DNA/RNA extraction kits continue to hinder market accessibility, causing delays in laboratory operations and escalating costs. These interruptions, stemming from global manufacturing dependencies, have led to stockouts during peak research seasons, affecting project timelines. Laboratories in remote or low-volume settings are particularly vulnerable, often resorting to suboptimal alternatives with lower purity. This restraint exacerbates inequities, as academic facilities with bulk contracts fare better than smaller entities.

Regulatory calls for diversified sourcing add administrative burdens, prolonging resolution efforts. Manufacturers grapple with quality assurance amid volatile inputs, compromising batch consistency. The issue perpetuates reliance on legacy manual methods, delaying automation adoption. Policy responses, including strategic reserves, remain insufficient for sustained relief. These challenges collectively erode investor confidence, tempering expansion plans. Mitigation through regional production hubs is gradual, limited by infrastructure gaps.

Opportunities

Capacity Building in Genomic Surveillance in Emerging Regions is Creating Growth Opportunities

The enhancement of genomic surveillance capabilities in emerging regions presents formidable growth opportunities for the DNA/RNA extraction market, as these initiatives demand robust kits for pathogen detection and outbreak response. Investments in regional labs enable high-throughput extraction, supporting real-time sequencing for public health threats. Opportunities lie in developing climate-stable kits suited for field use in tropical climates, appealing to international aid programs.

Regulatory alignments with global standards streamline tender processes, securing volume contracts for suppliers. Partnerships with health ministries facilitate pilot distributions, generating local validation data. This expansion diversifies revenue beyond traditional research segments into epidemiological applications. Economic models project returns from reduced transmission costs, incentivizing donor-backed procurement.

Training programs integrate extraction protocols, fostering long-term dependency on reliable products. These developments position the market for hybrid solutions combining manual and automated formats. Long-term, successful implementations pave the way for technology exports to similar geographies. From 2018/19 to 2022, the number of African countries with next-generation sequencing capacity in public health labs grew from 7 to 31, with over 410 individuals trained in viral sequencing.

Impact of Macroeconomic / Geopolitical Factors

Economic slowdowns and soaring chemical costs force diagnostic labs to stretch existing DNA/RNA extraction inventories, deferring upgrades to high-throughput systems in public facilities. Expanding gene therapy trials and infectious disease surveillance programs, however, compel manufacturers to prioritize scalable magnetic-bead and column-based kits, securing steady orders from leading research hubs.

Geopolitical frictions across vital shipping lanes stall silica membrane and lysis buffer deliveries from dominant Asian producers, lengthening lead times and pushing up freight premiums for global distributors. These same frictions ignite fresh supplier agreements in stable jurisdictions and accelerate automation rollouts that slash manual handling and reagent waste.

Ongoing U.S. Section 301 tariffs at 25% on Chinese-origin extraction consumables raise landed costs for American customers and nudge pricing revisions in multi-year contracts. Forward-thinking vendors counter this smoothly by qualifying USMCA routes, building regional blending centers, and locking in duty-relief pathways that keep shelves stocked without margin erosion.

Latest Trends

Launch of Monarch Mag Viral DNA/RNA Extraction Kit is a Recent Trend

The introduction of magnetic bead-based extraction kits optimized for viral nucleic acids has defined a prominent trend in 2024, emphasizing high-yield isolation from challenging samples like nasopharyngeal swabs. This advancement streamlines workflows in diagnostic labs, reducing processing times to under 30 minutes while maintaining RNA integrity. The trend prioritizes scalability, with kits supporting 96-well formats for high-volume testing during outbreaks.

Developers are incorporating inhibitor removal enhancements, addressing common contaminants in clinical specimens. Regulatory clearances validate performance for SARS-CoV-2 and other respiratory viruses, accelerating adoption. This evolution intersects with automated liquid handlers, enabling seamless integration in core facilities. Competitive launches focus on eco-friendly reagents, aligning with sustainability mandates.

Broader applications preview uses in metagenomics, adapting kits for environmental DNA/RNA. The trend fosters collaborations for custom formulations targeting emerging pathogens. Ethical guidelines ensure equitable distribution to low-resource labs. In April 2024, New England Biolabs launched the Monarch Mag Viral DNA/RNA Extraction Kit, designed for efficient isolation from viral samples.

Regional Analysis

North America is leading the DNA/RNA Extraction Market

North America accounted for 39.4% of the overall market in 2024, and the region recorded strong growth as laboratories increased nucleic-acid purification volumes across infectious-disease surveillance, oncology, and genetic-testing programs. Hospitals expanded sequencing-linked workflows that required high-purity DNA and RNA, especially for respiratory-virus monitoring and antimicrobial-resistance studies. Research universities raised extraction throughput to support large-scale transcriptomics and precision-medicine initiatives.

Biotechnology companies advanced cell- and gene-therapy pipelines, which further increased demand for high-quality nucleic-acid isolation reagents. The CDC reported that the United States contributed over 3.6 million SARS-CoV-2 sequences to national genomic surveillance by 2023 (CDC – COVID Data Tracker: Genomic Surveillance), and this sustained sequencing activity significantly boosted extraction reagent consumption.

Diagnostic laboratories upgraded automated platforms to handle growing sample volumes from chronic-disease panels. These combined drivers strengthened the region’s overall market growth in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness strong expansion during the forecast period as healthcare systems scale genomic-medicine programs and broaden access to molecular diagnostics across rapidly growing clinical networks. Hospitals invest in high-throughput purification systems to support cancer mutation profiling, infectious-disease detection, and newborn-screening workflows.

Research institutes intensify genomics and virology studies, increasing reliance on consistent nucleic-acid isolation performance. Government-backed sequencing initiatives accelerate adoption of advanced extraction technologies across public laboratories. Diagnostic chains expand sample-processing capacity as urban centers demand broader molecular test coverage.

The Indian Ministry of Health reported that INSACOG sequenced 326,035 SARS-CoV-2 genomes as of December 2023 (MoHFW – INSACOG Genomic Surveillance Updates), highlighting the region’s growing emphasis on high-volume molecular workflows. Manufacturers strengthen regional supply networks to meet rising procurement from hospitals and academic centers. These developments collectively position Asia Pacific for strong forward-looking growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in nucleic-acid purification accelerate growth by expanding extraction kits and automated platforms that support workflows across research, clinical diagnostics, and industrial biotech applications. They focus on enhancing throughput, yield, and purity by developing proprietary chemistries and modular instrumentation that integrate easily with downstream PCR and sequencing systems.

They broaden market access by establishing global distribution channels, local manufacturing, and region-specific regulatory compliance especially in emerging markets where genomic research and diagnostics demand rises. They strengthen competitiveness by forming partnerships with academic institutions, diagnostic labs, and contract research organisations to validate performance and build long-term adoption. They pursue strategic acquisitions of niche reagent or automation firms to complement their portfolio and accelerate product innovation.

One prominent example, QIAGEN NV, drives growth through its broad portfolio of extraction kits and automation solutions, leverages global manufacturing and supply networks, and uses its reputation in molecular diagnostics and life-science research to position itself as a preferred supplier for labs worldwide.

Top Key Players

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Promega Corporation

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Merck KGaA

- Zymo Research Corporation

Recent Developments

- On June 25, 2024, Thermo Fisher Scientific launched the KingFisher™ PlasmidPro Maxi Processor, a fully automated system for large-scale plasmid DNA purification. It is designed to speed up plasmid production for cell and gene therapy applications, producing high-quality pDNA in roughly half the time required by conventional manual methods.

- On January 10, 2025, QIAGEN announced expanded multiplexing capacity for its QIAcuity Digital PCR platform. Although this upgrade affects downstream testing, it increases the need for highly purified, concentrated nucleic acid inputs so that multiple targets can be analyzed from small or limited sample volumes.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 2.8 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits & Reagents, Instruments, DNA Isolation & Purification Kits, RNA Isolation & Purification Kits, and Others), By Method (Magnetic Bead-based, Reagent-based, Column-based, and Other), By Application (Oncology, Precision Medicine, Health & Diagnostics, Drug Discovery & Development, and Others), By End-user (Hospital Laboratories, Academic & Research Laboratories, Diagnostic Laboratories, Biopharmaceutical Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape QIAGEN N.V., Thermo Fisher Scientific Inc., Roche Diagnostics, Promega Corporation, Bio‑Rad Laboratories, Inc., Agilent Technologies, Inc., Merck KGaA, Zymo Research Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Promega Corporation

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Merck KGaA

- Zymo Research Corporation