Global DNA Diagnostics Market By Offering (Instruments, Reagents & Kits, Services & Software) By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Microarrays, In Situ Hybridization, Mass Spectrometry) By Application (Oncology, Infectious Diseases, Genetic Disorders, Prenatal & Reproductive Health, Forensic Testing, Pharmacogenomics, Others) By End-User (Diagnostic Laboratories, Hospitals & Clinics, Research Institutes, Home Consumers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160838

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

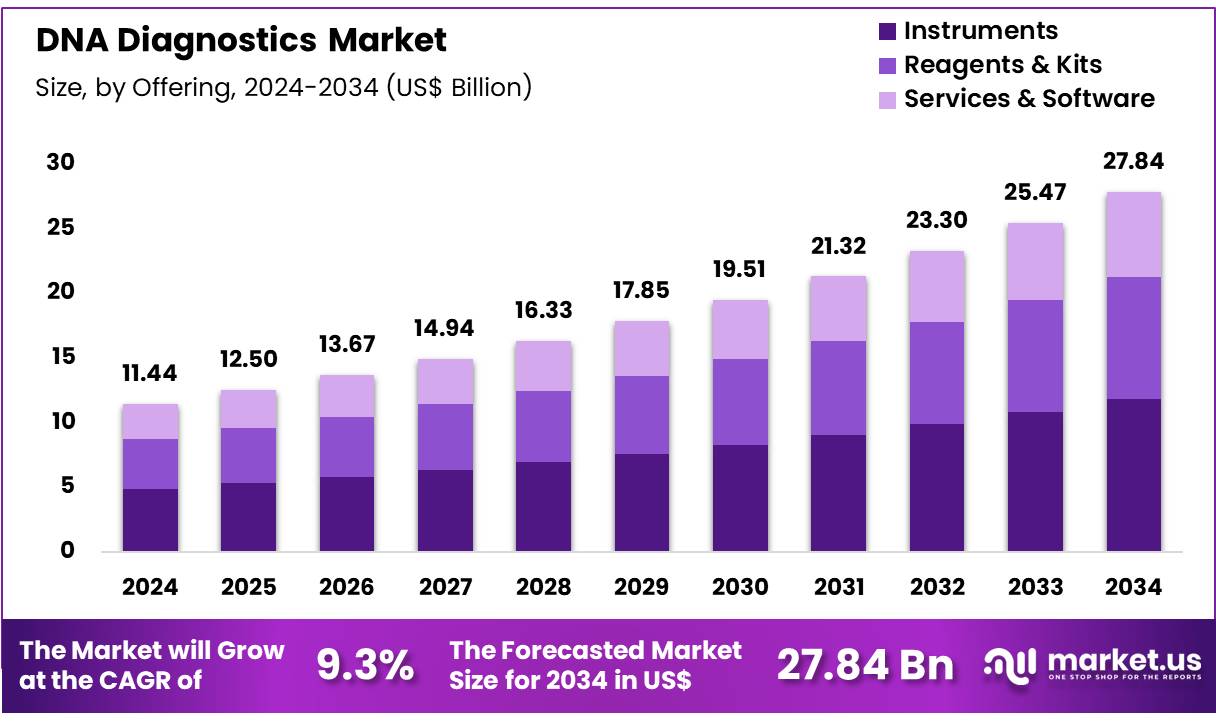

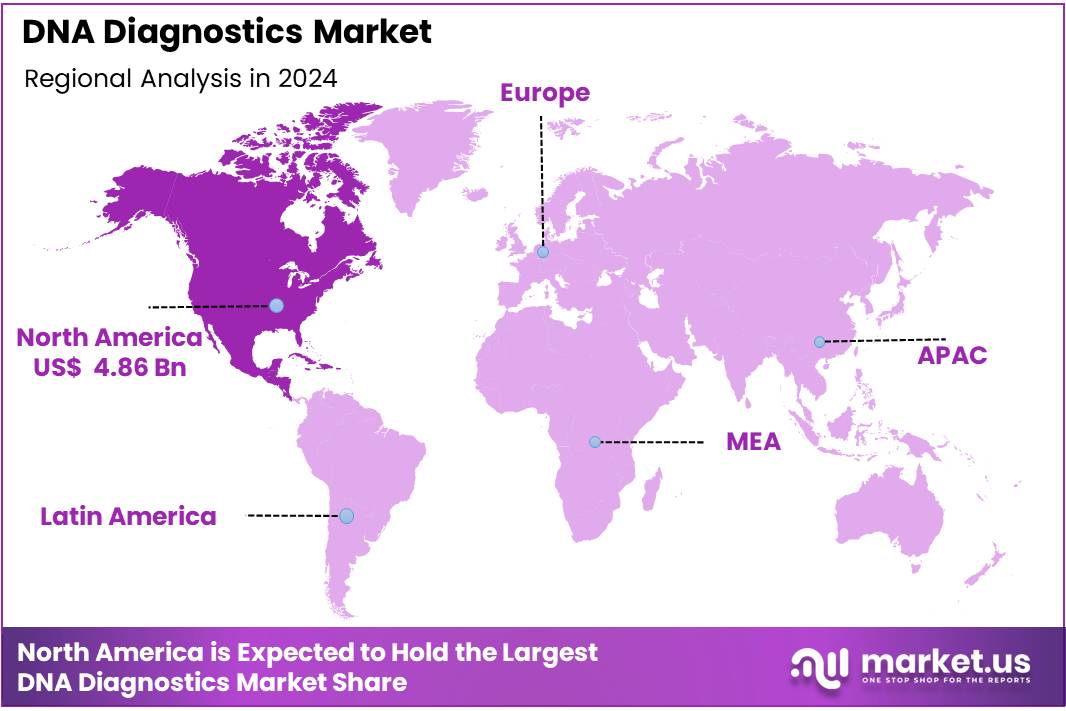

Global DNA Diagnostics Market size is expected to be worth around US$ 27.84 Billion by 2034 from US$ 11.44 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 4.86 Billion.

The DNA diagnostics sector is expanding rapidly due to the dual drivers of rising disease burden and advancing genomic technologies. Cancer illustrates this dynamic, with 20 million new cases and 9.7 million deaths recorded in 2022, projected to increase to 35 million new cases annually by 2050, according to the World Health Organization. This trend amplifies demand for genomic tests in oncology for early risk detection, diagnosis, therapy decisions, and monitoring. The ageing global population and persistent exposure to major risk factors further strengthen the role of DNA-based diagnostics across healthcare systems.

One of the most significant enablers of market growth is the dramatic decline in sequencing costs. Since the Human Genome Project, sequencing expenses have fallen by several orders of magnitude, as documented by the U.S. National Human Genome Research Institute. These cost reductions have broadened access to genomic testing by enhancing affordability, scalability, and throughput. As a result, DNA-based diagnostics are being integrated into clinical workflows and population-scale programs more readily.

Public health investments, especially post-COVID-19, are also accelerating adoption. WHO’s Global Genomic Surveillance Strategy aims to provide all member states with sequencing capabilities for epidemic and pandemic preparedness by 2032. The establishment of the International Pathogen Surveillance Network is enhancing global sequencing capacity, data exchange, and bioinformatics pipelines. This infrastructure not only benefits infectious disease monitoring but also strengthens the ecosystem for human DNA diagnostics.

Improved policy and reimbursement are facilitating market access. In the U.S., the Centers for Medicare & Medicaid Services (CMS) has expanded coverage for next-generation sequencing (NGS) tests in oncology, boosting physician confidence and supporting broader adoption. Similarly, national programs such as the NHS Genomic Medicine Service in England embed genomics into routine care, demonstrating diagnostic utility in both rare diseases and cancer while setting quality baselines for sustained integration.

Clearer regulatory frameworks are reinforcing trust. In the European Union, the In Vitro Diagnostic Medical Devices Regulation (IVDR) has heightened quality and evidence requirements, while in the U.S., the FDA has advanced guidance for NGS-based IVDs. These frameworks reduce uncertainty, strengthen cross-border market access, and elevate confidence in genomic assays.

In parallel, demographic ageing, increasing prevalence of genetic disorders, and precision medicine initiatives are expanding the testable population base. Laboratories and vendors that demonstrate clinical validity, cost-effectiveness, and compliance are positioned to benefit, as health systems emphasize optimized diagnostic pathways.

Key Takeaways

- Market Size: Global DNA Diagnostics Market size is expected to be worth around US$ 27.84 Billion by 2034 from US$ 11.44 Billion in 2024.

- Market Growth: The market growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

- Offering Analysis: The Instruments segment dominates the market, accounting for 42.5% of the total share in 2024.

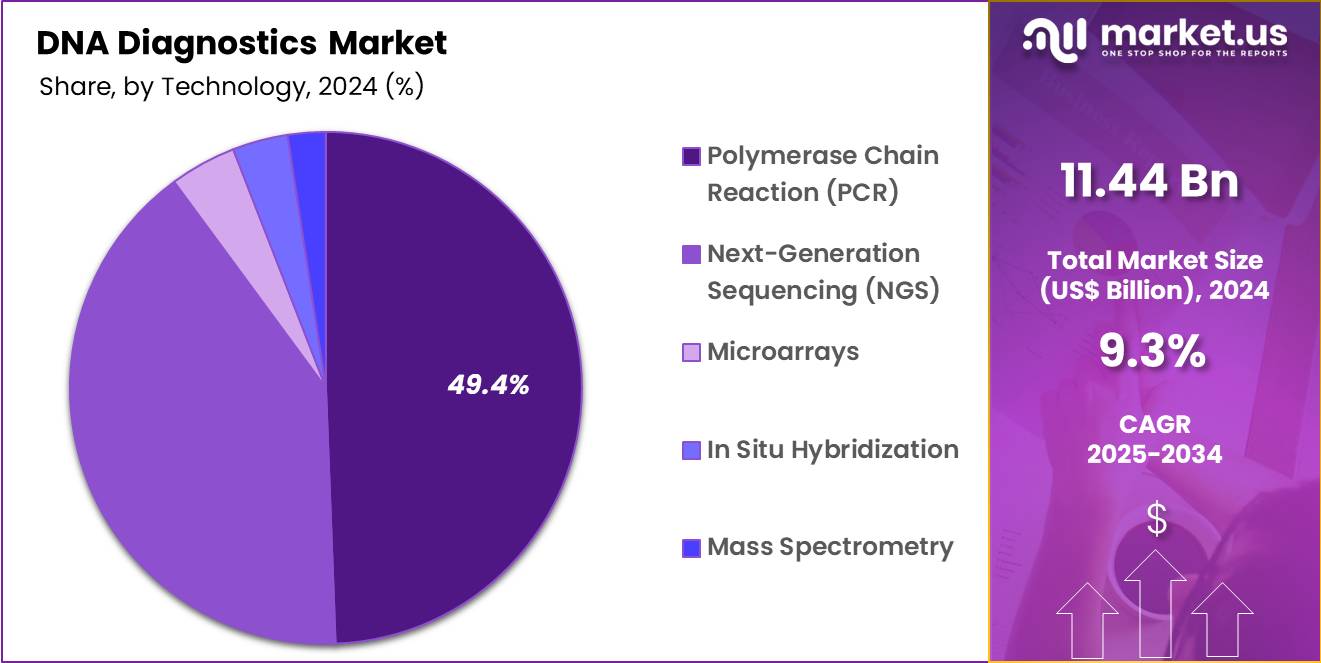

- Technology Analysis: In 2024, Polymerase Chain Reaction (PCR) remains the dominant technology, accounting for 49.4% of the global market share.

- Application Analysis: In 2024, oncology represents the largest segment, accounting for 30.5% of the global market share.

- End-Use Analysis: In 2024, diagnostic laboratories dominate the market, holding 43.6% of the total share.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than a 42.5% share and holding a market value of US$ 4.86 billion.

Offering Analysis

The DNA diagnostics market in 2024 is segmented into Instruments, Reagents & Kits, and Services & Software. Among these, the Instruments segment dominates the market, accounting for 42.5% of the total share in 2024. The growth of this segment is driven by the widespread adoption of advanced sequencing platforms, PCR systems, and automated analyzers that enhance testing efficiency, accuracy, and throughput. Increasing integration of next-generation sequencing instruments in clinical settings and research laboratories further strengthens this segment’s leading position.

The Reagents & Kits segment represents a critical component of the market, as it provides recurring revenue opportunities. The increasing demand for consumables, including DNA extraction kits, amplification reagents, and sequencing kits, supports routine diagnostic testing and personalized medicine applications. This segment is projected to register robust growth due to rising volumes of genetic testing and ongoing product innovations.

The Services & Software segment also contributes significantly, supported by the rising need for data interpretation, bioinformatics solutions, and diagnostic service outsourcing. Advanced software tools for genomic data analysis and cloud-based platforms are expected to accelerate adoption, particularly in precision medicine and clinical diagnostics.

Technology Analysis

The DNA diagnostics market is segmented on the basis of key technologies, each contributing to advancing precision medicine and molecular testing. In 2024, Polymerase Chain Reaction (PCR) remains the dominant technology, accounting for 49.4% of the global market share. The dominance of PCR can be attributed to its wide clinical utility, cost-effectiveness, high sensitivity, and established role in infectious disease detection, genetic testing, and oncology diagnostics. The widespread adoption in routine laboratories continues to strengthen its position.

Next-Generation Sequencing (NGS) represents the fastest-growing segment, supported by declining sequencing costs, improvements in bioinformatics, and its application in comprehensive genomic profiling for personalized medicine. The adoption of NGS is particularly significant in oncology, rare disease diagnostics, and pharmacogenomics.

Microarrays hold a considerable share due to their application in high-throughput analysis of genetic variants and expression profiling, although they are gradually being complemented by NGS. In Situ Hybridization (ISH) continues to be relevant in oncology diagnostics, particularly in detecting chromosomal abnormalities and gene expression in tissues.

Furthermore, Mass Spectrometry (MS) is gaining traction in clinical genomics for detecting genetic variants with high specificity and accuracy. Collectively, these technologies provide complementary advantages, enabling robust diagnostics, improved disease management, and expansion of precision medicine applications.

Application Analysis

The DNA diagnostics market is segmented by application into oncology, infectious diseases, genetic disorders, prenatal and reproductive health, forensic testing, pharmacogenomics, and other niche areas. In 2024, oncology represents the largest segment, accounting for 30.5% of the global market share.

The dominance of oncology can be attributed to the rising global cancer burden, increasing demand for early detection, and the adoption of companion diagnostics to support targeted therapies. Molecular assays and genomic profiling have become integral in guiding personalized treatment plans and improving survival outcomes.

Infectious diseases form another key application area, supported by the continued need for rapid and accurate pathogen detection. DNA-based testing has been instrumental in identifying viral, bacterial, and parasitic infections with high precision. Genetic disorders diagnostics are expanding as awareness of inherited diseases increases, coupled with the availability of advanced screening tools.

Prenatal and reproductive health applications are witnessing growth due to rising demand for non-invasive prenatal testing (NIPT) and fertility-related genetic screening. Forensic testing utilizes DNA analysis for identity verification and criminal investigations, while pharmacogenomics is emerging to enable precision drug selection. The “others” category encompasses rare disease diagnostics and emerging research applications, further contributing to overall market expansion.

End-User Analysis

The DNA diagnostics market is categorized by end-users into diagnostic laboratories, hospitals & clinics, research institutes, and home consumers. In 2024, diagnostic laboratories dominate the market, holding 43.6% of the total share.

Their dominance is driven by the availability of advanced testing infrastructure, specialized expertise, and the ability to process high testing volumes with cost efficiency. Laboratories also play a central role in offering specialized molecular assays and serving as referral centers for hospitals and clinics.

Hospitals and clinics represent a significant segment, benefiting from the integration of DNA-based testing into routine clinical practice. Their adoption is supported by the need for point-of-care diagnostics, cancer profiling, and infectious disease testing to provide immediate and accurate treatment decisions.

Research institutes contribute steadily, with demand driven by advancements in genomics research, biomarker discovery, and the development of novel diagnostic technologies.

Meanwhile, home consumer testing is emerging as a growing category, supported by the rise of direct-to-consumer (DTC) genetic testing services for ancestry, health risk assessment, and personalized wellness insights. Although currently smaller in scale, this segment is expected to expand as consumer awareness and affordability improve.

Key Market Segments

By Offering

- Instruments

- Reagents & Kits

- Services & Software

By Technology

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Microarrays

- In Situ Hybridization

- Mass Spectrometry

By Application

- Oncology

- Infectious Diseases

- Genetic Disorders

- Prenatal & Reproductive Health

- Forensic Testing

- Pharmacogenomics

- Others

By End-User

- Diagnostic Laboratories

- Hospitals & Clinics

- Research Institutes

- Home Consumers

Driving Factors

A key driver of the DNA diagnostics market is the integration of genomic sequencing into routine healthcare systems, supported by national genomics initiatives and government policies. Genomic methods are increasingly used for risk assessment, diagnosis, treatment selection, disease monitoring, and drug development. The dramatic drop in cost of next-generation sequencing (NGS) and related technologies has enabled broader adoption in clinical settings.

Moreover, the response to infectious disease outbreaks (e.g. SARS-CoV-2) has underscored the importance of DNA/RNA sequencing in pathogen surveillance and diagnostics, reinforcing the role of molecular diagnostics in public health infrastructures. Finally, governments and international bodies are actively promoting equitable access to genomics, aiming to expand capabilities in low- and middle-income regions.

Trending Factors

One prominent trend is the shift toward precision and value-based genomic diagnostics within health systems. Genomic tests are being embedded into clinical care pathways (e.g. oncology, rare disease diagnosis) and not just offered as stand-alone assays. Another trend is the uptake of comprehensive and multiplexed NGS panels replacing single-gene tests, enabling larger variant coverage in one assay.

There is also growth in pathogen genomics and DNA diagnostics for infectious disease surveillance, which link public health and diagnostics (e.g. pathogen sequencing). Ethical and policy trends are emerging around data sharing, interoperability, and genomic standards, exemplified by initiatives like the Global Alliance for Genomics and Health (GA4GH).

Restraining Factors

A primary restraint is the ethical, legal, and social implications (ELSI) of genomic data use, including privacy, informed consent, and genetic discrimination risks. Many jurisdictions lack harmonized regulation of genomic diagnostics, resulting in fragmented oversight, slow approvals, and uncertainty of reimbursement.

Resource constraints in terms of trained personnel (clinical geneticists, bioinformaticians), laboratory infrastructure and computational capacity also hamper uptake, especially in resource-limited settings. Technical challenges around variant interpretation, uncertain significance, and clinical utility reduce clinician confidence in some results.

Opportunity

A major opportunity lies in genomic capacity building in low- and middle-income countries, where diagnostic penetration remains low. The WHO and its Science Council have urged equitable access to genomics infrastructure globally. Integrating DNA diagnostics into public health surveillance and outbreak response systems (e.g. pathogen sequencing) offers strong potential synergy between diagnostics and epidemiology.

Expansion in precision medicine and companion diagnostics presents opportunity for DNA diagnostics to support targeted therapies, especially in oncology and rare diseases. Finally, the development of standards and federated data sharing frameworks (e.g. via GA4GH) can enable cross-institutional collaboration, accelerating variant interpretation and clinical translation.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.5% share and holding a market value of US$ 4.86 billion. The region’s leadership can be attributed to advanced healthcare infrastructure, high adoption of molecular diagnostic technologies, and favorable reimbursement frameworks.

The growth of DNA diagnostics in North America has been strongly supported by rising cases of genetic disorders, cancer, and infectious diseases. Increased awareness about early diagnosis and preventive healthcare further accelerated test adoption. The presence of leading academic institutions and research organizations contributed to continuous innovation in diagnostic techniques.

Government support and rising healthcare expenditure also played a crucial role. Investments in precision medicine and genomics have enhanced the scope of DNA-based testing in clinical practice. The U.S. accounted for the largest share within the region, driven by widespread clinical trials and the rapid integration of genomic data in patient care.

Canada also showed strong progress, aided by national genomics initiatives and growing collaborations between public health agencies and private laboratories. Rising demand for personalized medicine and newborn screening programs is expected to continue driving growth across the region.

The combination of high healthcare spending, strong R&D ecosystem, and expanding patient base has reinforced North America’s leading position in the DNA diagnostics market.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The DNA diagnostics market is highly competitive, with the presence of established players, specialized diagnostic firms, and emerging biotechnology enterprises. Market participants focus on technological innovation, particularly in next-generation sequencing, polymerase chain reaction, and microarray platforms, to strengthen their product portfolios. Continuous investments in research and development have enabled the introduction of faster, more accurate, and cost-effective testing solutions.

Strategic collaborations with academic institutions and healthcare providers are widely adopted to expand clinical applications and increase adoption rates. Companies also emphasize expanding geographic reach through partnerships, joint ventures, and distribution agreements. In addition, significant resources are allocated to regulatory approvals and compliance to ensure reliability and global acceptance of diagnostic products.

The competitive landscape is further shaped by growing emphasis on personalized medicine and precision healthcare. Players that integrate advanced bioinformatics and data analytics are gaining a strong advantage, positioning themselves to meet rising global demand for genetic testing.

Market Key Players

- Illumina, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Siemens Healthineers AG

- Natera, Inc.

- 23andMe, Inc.

- Grail, Inc.

- NeoGenomics Laboratories, Inc.

- Other key players

Recent Developments

- Illumina, Inc. (January 2025): Released upgrades to its NovaSeq X Series including single–flow-cell mode and new 100-/200-cycle kits, enhancing throughput and supporting multiomic applications.

- Thermo Fisher Scientific, Inc. (April 2025): Committed US$2 billion investment over four years to expand U.S. manufacturing and R&D capacity in life sciences.

- Thermo Fisher Scientific, Inc. (June 2025): Launched next-generation mass spectrometers (Orbitrap Astral Zoom and Orbitrap Excedion Pro) at ASMS 2025 to boost sensitivity and speed in omics research.

- Natera, Inc. (August 2025): Launched proprietary AI foundation models trained on large multimodal oncology / plasma datasets to drive diagnostic and therapeutic innovation.

Report Scope

Report Features Description Market Value (2024) US$ 11.44 Billion Forecast Revenue (2034) US$ 27.84 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Instruments, Reagents & Kits, Services & Software) By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Microarrays, In Situ Hybridization, Mass Spectrometry) By Application (Oncology, Infectious Diseases, Genetic Disorders, Prenatal & Reproductive Health, Forensic Testing, Pharmacogenomics, Others) By End-User (Diagnostic Laboratories, Hospitals & Clinics, Research Institutes, Home Consumers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Illumina, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Siemens Healthineers AG, Natera, Inc., 23andMe, Inc., Grail, Inc., NeoGenomics Laboratories, Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Siemens Healthineers AG

- Natera, Inc.

- 23andMe, Inc.

- Grail, Inc.

- NeoGenomics Laboratories, Inc.

- Other key players