Global Disposable Syringes Market Analysis By Product Type (Conventional Syringes, Safety Syringes, Retractable Safety Syringes, Non-retractable Safety Syringes), By Application (Immunization Injections, Therapeutic Injections), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 20258

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

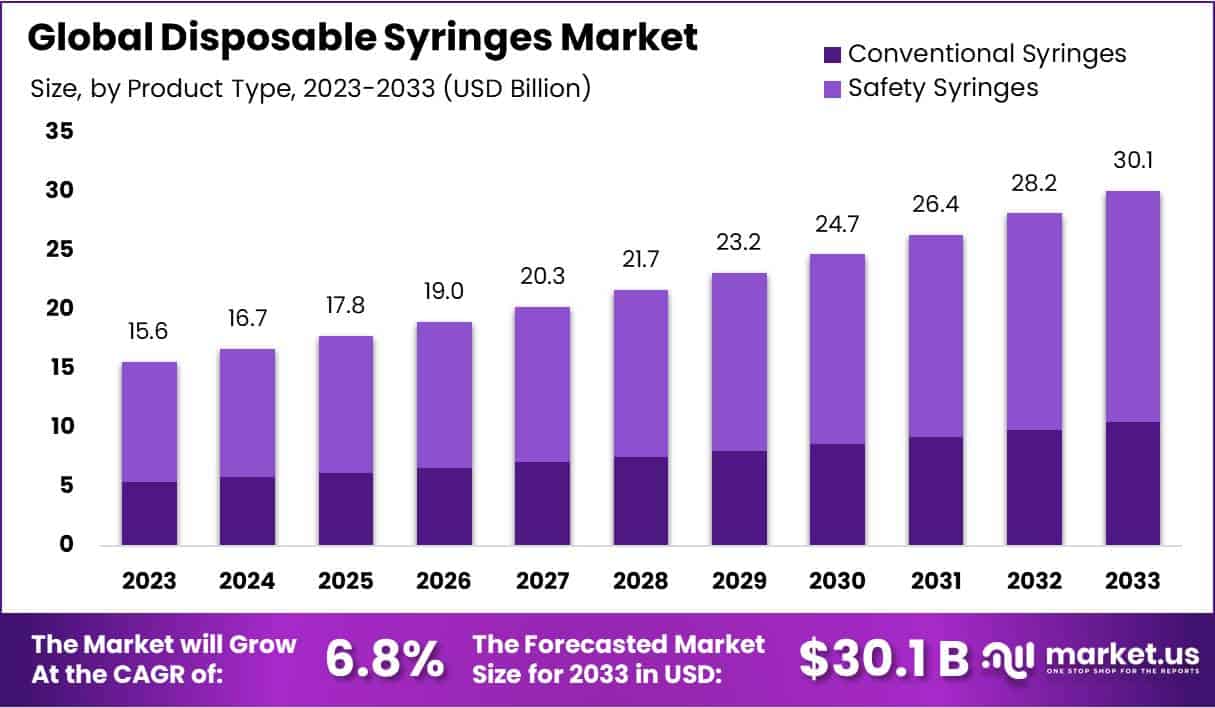

The disposable syringes market size is anticipated to reach approximately USD 30.1 billion by the year 2033, up from USD 15.6 billion in 2023. This growth is projected to occur at a Compound Annual Growth Rate (CAGR) of 6.8% within the forecast period spanning from 2024 to 2033.

Disposable syringes serve as essential medical tools for delivering medications or extracting fluids in healthcare settings. These single-use devices, distinct from reusable counterparts, are crucial in maintaining sterility and preventing infections. Engineered for simplicity and accuracy, disposable syringes feature clear volume markings, catering to diverse medical applications like vaccinations and insulin administration. They come in various sizes to accommodate different dosage needs. Constructed from lightweight and cost-effective plastic, these syringes are disposed of after a single application, promoting safety and hygiene. Some models also integrate safety features, such as needle guards, to minimize the risk of accidental needlestick injuries.

The disposable syringes market is dynamic, driven by factors like the rising prevalence of chronic diseases and a growing emphasis on infection prevention. Key trends include a surge in demand for safety syringes designed to prevent needlestick injuries and the transmission of bloodborne diseases. Autoinjectors, featuring integrated needles and automatic injection mechanisms, are gaining popularity for self-administration of medications in chronic conditions. Ongoing technological advancements in materials and manufacturing contribute to user-friendly and efficient syringes. Global investments in healthcare infrastructure, particularly in emerging markets, propel market expansion. Stringent regulatory compliance and the impact of the COVID-19 pandemic on vaccine administration also shape market dynamics.

Amidst the competitive landscape, market players focus on innovation, collaborations, and mergers. The market is characterized by a range of players operating globally, with a keen eye on product development and strategic partnerships. Environmental considerations have led to a growing awareness of sustainability, prompting efforts to develop eco-friendly materials for disposable syringes. This evolving market underscores the intersection of healthcare needs, technological progress, and environmental consciousness. Stay informed by checking industry reports and news sources for the latest updates on market size, trends, and key players.

Key Takeaways

- Market Growth Projection: The disposable syringes market is set to reach USD 30.1 billion by 2033, reflecting a robust 6.8% CAGR from 2024 to 2033.

- Dominant Segment: In 2023, Safety Syringes held a commanding market share of 65.2%, driven by the increasing demand for safety-enhanced medical devices.

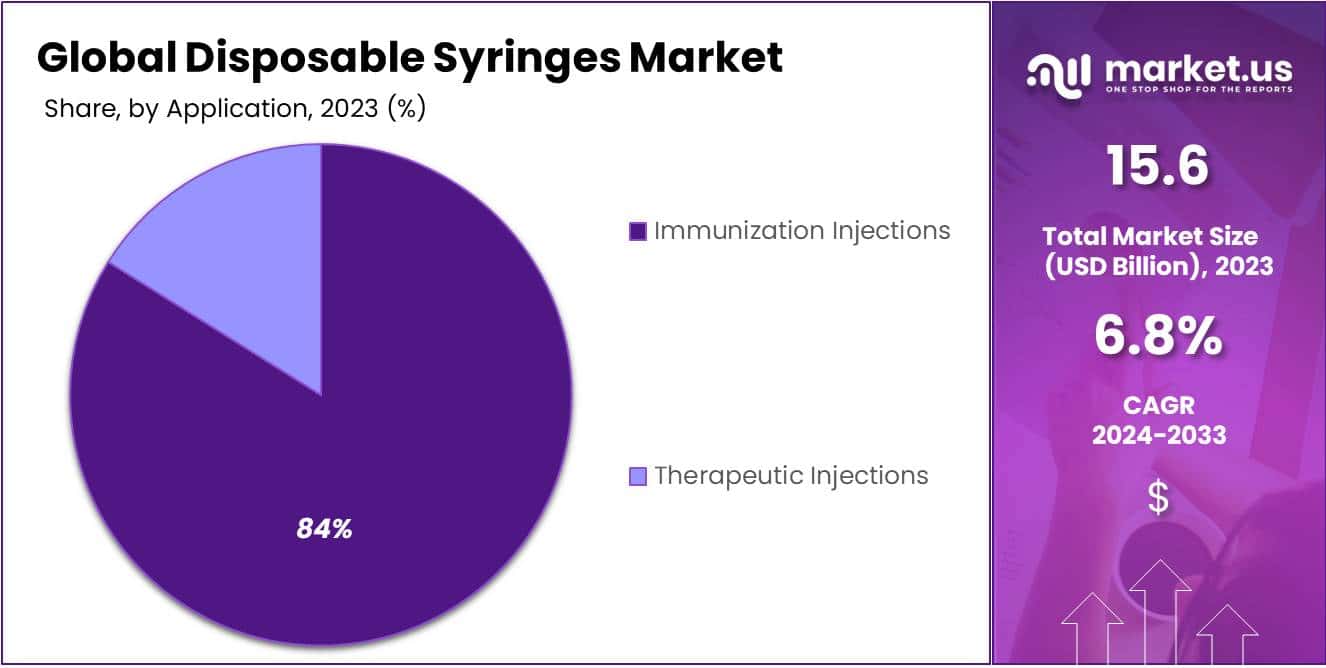

- Therapeutic Injections Lead: The Therapeutic Injections segment dominated with an impressive market share of 83.9% in 2023.

- Global Focus on Vaccination: Increased emphasis on global vaccination initiatives propels a heightened demand for disposable syringes, essential for secure and hygienic injection practices.

- Chronic Disease Impact: The surge in chronic diseases, such as diabetes, fuels demand, emphasizing the necessity for disposable syringes in precise and sterile medication administration.

- Environmental Concerns: Growing environmental awareness may prompt a shift towards eco-friendly alternatives due to concerns about the environmental impact of disposable syringes, particularly plastic disposal.

- Cost Constraints: Initial expenses in regions with lower incomes pose challenges; healthcare facilities may opt for budget-friendly alternatives like traditional glass syringes.

- North America’s Dominance: In 2023, North America asserted its dominance with a substantial market share of 33.9% and a value of USD 5.2 billion, driven by advanced healthcare infrastructure.

- Emerging Market Opportunities: Untapped potential in emerging markets presents significant growth opportunities, fueled by increasing healthcare infrastructure and awareness.

- Digital Technologies Integration: A notable trend is the integration of digital technologies, with smart syringes featuring connectivity options, enhancing tracking of medication adherence and real-time monitoring.

Product Type Analysis

In 2023, the disposable syringes market showcased a noteworthy trend with the Safety Syringes segment emerging as the frontrunner, securing a dominant market position by capturing more than a 65.2% share. This robust presence underscores the growing preference for safety-enhanced medical devices among healthcare practitioners and end-users alike.

Safety Syringes, designed with advanced features to minimize the risk of accidental needlestick injuries and enhance user protection, have witnessed a substantial surge in demand. This surge can be attributed to the increasing awareness regarding healthcare safety standards and the paramount importance of protecting healthcare professionals from potential needle-related hazards.

Conventional Syringes, while maintaining a significant market presence, faced a notable shift in market dynamics, holding a commendable yet comparatively lower market share. The enduring popularity of Conventional Syringes can be attributed to their familiarity and cost-effectiveness, catering to certain healthcare settings and applications where advanced safety features may not be deemed essential.

Within the Safety Syringes category, the market displayed a noteworthy dichotomy between Retractable Safety Syringes and Non-retractable Safety Syringes. Retractable Safety Syringes, equipped with a retractable needle mechanism post-use, gained prominence owing to their added layer of safety and ease of use. This subsegment carved a substantial niche for itself, appealing to healthcare professionals seeking an efficient solution to mitigate accidental needlestick injuries.

On the other hand, Non-retractable Safety Syringes, characterized by safety features integrated into the syringe design without needle retraction, maintained a stable but relatively smaller market share. This segment found its relevance in specific medical procedures and scenarios where needle retraction may not be a primary concern, aligning with the diverse needs of healthcare practices.

Application Analysis

In 2023, the Disposable Syringes market exhibited a robust performance, with the Therapeutic Injections segment taking the lead by securing a dominant market position, commanding an impressive share of over 83.9%.

The Therapeutic Injections segment’s commanding presence in the market can be attributed to its vital role in administering medications for various medical conditions. Healthcare professionals widely rely on disposable syringes for the precise delivery of therapeutic substances, ensuring effective treatment and patient well-being.

Immunization Injections, while essential, trailed behind with a market share that reflected its significant but comparatively lesser impact. This segment plays a crucial role in public health initiatives, safeguarding communities against infectious diseases through vaccination programs.

The growth of the Disposable Syringes market is intricately linked to the increasing demand for therapeutic injections in diverse medical settings. Hospitals, clinics, and other healthcare facilities prioritize the use of disposable syringes for their convenience, safety, and efficiency in delivering accurate doses of medications.

Factors contributing to the dominance of the Therapeutic Injections segment include the rising prevalence of chronic diseases requiring ongoing treatment, an aging population with diverse healthcare needs, and advancements in pharmaceuticals requiring precise dosage administration.

Looking ahead, the Disposable Syringes market is anticipated to continue its upward trajectory, driven by ongoing developments in healthcare and an expanding global population. The pivotal role of disposable syringes in therapeutic injections is expected to maintain the dominance of this segment, solidifying its position as a key driver of market growth.

Key Market Segments

Product Type

- Conventional Syringes

- Safety Syringes

- Retractable Safety Syringes

- Non-retractable Safety Syringes

Application

- Immunization Injections

- Therapeutic Injections

Drivers

Increasing Demand for Vaccinations

The surging global focus on vaccination initiatives, particularly in emerging economies, is fueling a heightened demand for disposable syringes. This demand stems from the imperative need for secure and hygienic injection practices to curb the spread of diseases.

Rising Incidence of Chronic Diseases

A rise in chronic diseases like diabetes and autoimmune disorders is amplifying the necessity for disposable syringes, crucial for the precise and sterile administration of medications essential for long-term condition management.

Stringent Regulatory Standards

The landscape is shaped by stringent regulatory standards within the healthcare and medical devices realm. These regulations are compelling healthcare providers to adopt disposable syringes to ensure compliance, prioritizing patient safety and mitigating infection risks associated with the use of reusable syringes.

Technological Advancements

The ongoing technological advancements in design and materials, featuring safety enhancements, needleless options, and user-friendly designs, are contributing significantly to the increased adoption of disposable syringes. These innovations collectively enhance the efficiency and safety of healthcare practices.

Restraints

Environmental Concerns

The environmental impact of disposable syringes, particularly the disposal of plastic components, is a significant concern. Increasing awareness about environmental sustainability may lead to a shift towards alternative, eco-friendly solutions.

Cost Constraints

The initial expense of disposable syringes, especially in regions with lower incomes, can pose a challenge. In such cases, healthcare facilities might choose more budget-friendly options like traditional glass syringes or those that can be sterilized and used again.

Limited Reimbursement Policies

In certain regions, limited or inadequate reimbursement policies for disposable syringes may impede their widespread adoption. Healthcare providers may face financial challenges in incorporating these syringes into their practices without proper reimbursement support.

Concerns about Needlestick Injuries

Despite safety features in disposable syringes, concerns about needlestick injuries among healthcare professionals still exist. Perceived risks and the need for additional safety measures may influence the choice of alternative injection methods.

Opportunities

Rapid Expansion in Emerging Markets

The untapped potential in emerging markets presents a significant growth opportunity. Increasing healthcare infrastructure, rising awareness, and government initiatives to improve healthcare access contribute to the expanding market in these regions.

Focus on Self-Administration Devices

The growing trend of self-administration of medications, especially in the case of chronic diseases, opens up new avenues for disposable syringes. Manufacturers are exploring innovations to make self-administration more convenient and safe.

Collaborations and Partnerships

Collaborations between pharmaceutical companies, healthcare providers, and disposable syringe manufacturers can drive market growth. Partnerships can lead to the development of customized solutions and the integration of syringe technologies with drug delivery systems.

Rising Adoption of Biologics

The increasing use of biologic drugs, which often require precise and sterile administration, creates a demand for advanced disposable syringes. The growth of biopharmaceuticals and biosimilars further amplifies the market potential.

Trends

Shift toward Autoinjectors

The market is witnessing a notable trend toward the adoption of autoinjectors for drug administration. These devices, incorporating disposable syringes, offer user-friendly, self-administration options, especially for patients with chronic conditions.

Integration of Digital Technologies

The integration of digital technologies, such as smart syringes with connectivity features, is becoming a prominent trend. These technologies enable tracking of medication adherence, dosage history, and real-time monitoring, enhancing patient care.

Customization and Patient-Centric Solutions

Manufacturers are focusing on providing customizable solutions to meet specific patient and healthcare provider needs. Tailored designs, materials, and features are being developed to enhance patient comfort and overall healthcare outcomes.

Emphasis on Safety Features

The market is witnessing a continuous emphasis on enhancing safety features in disposable syringes. This includes innovations like retractable needles, needle shields, and mechanisms to prevent accidental needlestick injuries, addressing concerns related to healthcare worker safety.

Regional Analysis

In 2023, North America emerged as a dominant force in the Disposable Syringes Market, asserting its prominence with a substantial market share of more than 33.9%. The region’s robust position is underscored by a staggering market value of USD 5.2 billion for the year. This commanding presence is reflective of a combination of factors that collectively contribute to the flourishing disposable syringes market in North America.

North America boasts a sophisticated and advanced healthcare infrastructure that facilitates the widespread adoption of disposable syringes. The region’s well-established medical facilities, coupled with a high degree of technological integration, create a conducive environment for the utilization of modern healthcare equipment, including disposable syringes.

The region’s commitment to maintaining high standards of healthcare is evident through stringent regulatory frameworks. Stringent guidelines ensure the quality and safety of medical devices, including disposable syringes, contributing to a high level of trust among healthcare professionals and end-users.

The increasing prevalence of chronic diseases in North America has propelled the demand for disposable syringes, particularly in the administration of medications and vaccines. Moreover, the region’s proactive approach to vaccination initiatives has further stimulated the market, as disposable syringes are indispensable tools in the efficient delivery of vaccines.

North America stands out as a thriving hub of innovation, constantly pushing the boundaries of medical technology. A testament to this progressive culture is the evolution of disposable syringes, now equipped with advanced features that elevate both efficiency and safety.

Growing awareness among healthcare professionals and end-users regarding the advantages of disposable syringes, such as reduced risk of infection transmission and enhanced precision in drug delivery, has significantly contributed to the market’s dominance in North America. The increasing acceptance of disposable syringes as a standard medical tool further solidifies their position in the region.

Collaborations between key market players, healthcare institutions, and research organizations in North America have played a pivotal role in advancing the disposable syringes market. These strategic alliances facilitate the development and distribution of innovative products, fostering market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Disposable Syringes Market, key players such as MEDTRONIC (Covidien), Nipro Corporation, Fresenius Kabi AG, Baxter International Inc., and B. Braun Melsungen AG play pivotal roles. These industry giants contribute significantly to the market’s growth and development through their unique strengths and strategies.

MEDTRONIC (Covidien) stands out with its commitment to innovation, consistently introducing cutting-edge disposable syringe technologies. This company’s emphasis on research and development ensures a steady stream of advanced products that meet evolving healthcare needs.

Nipro Corporation, known for its diverse portfolio of medical devices, has carved a niche in the disposable syringes sector. Their focus on quality manufacturing processes and adherence to stringent safety standards positions them as a reliable choice for healthcare providers globally.

Fresenius Kabi AG has established itself as a key player by offering a broad range of disposable syringes catering to various medical applications. Their strategic emphasis on global distribution networks enables them to reach diverse markets, contributing to their market influence.

Baxter International Inc. is recognized for its comprehensive healthcare solutions, and its involvement in the disposable syringes market aligns with their commitment to patient care. Their strong presence in both developed and emerging markets solidifies their impact on the industry.

B. Braun Melsungen AG brings a wealth of experience and expertise to the disposable syringes market. Known for its focus on sustainability and ethical business practices, the company has garnered trust among healthcare professionals and end-users alike.

In addition to these key players, there are other notable contributors shaping the disposable syringes market. These players, though diverse in size and scope, collectively influence market dynamics. Their innovations, strategic partnerships, and regional market penetration contribute to the overall growth and competitiveness of the disposable syringes sector.

Market Key Players

- MEDTRONIC (Covidien)

- Nipro Corporation

- Fresenius Kabi AG

- Baxter International Inc.

- B. Braun Melsungen AG

- BD

- Terumo Corporation

- Novo Nordisk

- UltiMed Inc.

- Henke-Sass Wolf

- Retractable Technologies

- Flextronics International Vita Needle Company

Recent Developments

- In September 2023, Terumo Corporation, a prominent Japanese medical device company, has successfully acquired Medtronic’s diabetes care business for a substantial $5.4 billion. This strategic acquisition encompasses a range of crucial assets, including insulin pumps, infusion sets, and glucose monitoring devices. The deal positions Terumo to solidify its foothold in the competitive diabetes care market, offering a more extensive product portfolio to both patients and healthcare providers.

- In August 2023, Becton, Dickinson and Company (BD), a global leader in medical technology, has introduced a cutting-edge product in the form of BD Ultra-Fine Insulin Syringes. These disposable insulin syringes boast a design innovation with a thinner needle wall, aiming to enhance the comfort of injections for patients. Furthermore, the syringes are available in various needle lengths, catering to the diverse needs of patients.

- In July 2023, A significant development unfolded in China as Henan Province Medical Device Group Corporation and China National Medical Devices Group Corporation joined forces through a merger, giving rise to the newly formed China Medical Device Corporation (CMDC). This strategic consolidation is anticipated to yield a more potent and competitive entity in the Chinese medical device market. With an expanded product portfolio and a wider distribution network, CMDC is poised to better serve the healthcare needs of patients and providers across China.

Report Scope

Report Features Description Market Value (2023) USD 15.6 Bn Forecast Revenue (2033) USD 30.1 Bn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Conventional Syringes, Safety Syringes, Retractable Safety Syringes, Non-retractable Safety Syringes), Application (Immunization Injections, Therapeutic Injections) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape MEDTRONIC (Covidien), Nipro Corporation, Fresenius Kabi AG , Baxter International Inc., B. Braun Melsungen AG, BD, Terumo Corporation, Novo Nordisk, UltiMed Inc., Henke-Sass Wolf, Retractable Technologies, Flextronics International Vita Needle Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the disposable syringes market in 2023?The disposable syringes market size is USD 15.6 billion in 2023.

What is the projected CAGR at which the disposable syringes market is expected to grow at?The disposable syringes market is expected to grow at a CAGR of 6.8% (2024-2033).

List the segments encompassed in this report on the disposable syringes market?Market.US has segmented the disposable syringes market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type the market has been segmented into Conventional Syringes, Safety Syringes, Retractable Safety Syringes, and Non-retractable Safety Syringes). By Application the market has been segmented into Immunization Injections, and Therapeutic Injections.

List the key industry players of the disposable syringes market?MEDTRONIC (Covidien), Nipro Corporation, Fresenius Kabi AG , Baxter International Inc., B. Braun Melsungen AG, BD, Terumo Corporation, Novo Nordisk, UltiMed Inc., Henke-Sass Wolf, Retractable Technologies, Flextronics International Vita Needle Company and Others

Which region is more appealing for vendors employed in the disposable syringes market?North America is expected to account for the highest revenue share of 33.9% and boasting an impressive market value of USD 5.2 billion. Therefore, the disposable syringes industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for disposable syringes?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the disposable syringes Market.

Which segment accounts for the greatest market share in the disposable syringes industry?With respect to the disposable syringes industry, vendors can expect to leverage greater prospective business opportunities through the Therapeutic Injections segment, as this area of interest accounts for the largest market share.

-

-

- MEDTRONIC (Covidien)

- Nipro Corporation

- Fresenius Kabi AG

- Baxter International Inc.

- B. Braun Melsungen AG

- BD

- Terumo Corporation

- Novo Nordisk

- UltiMed Inc.

- Henke-Sass Wolf

- Retractable Technologies

- Flextronics International Vita Needle Company