Global Disposable Medical Gowns Market By Grade (Low, Average and Premium), By Product (Surgical gowns, Non-surgical gowns and Patient gowns), By Protection Level (Low-risk, Moderate-risk, and High-risk), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170660

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

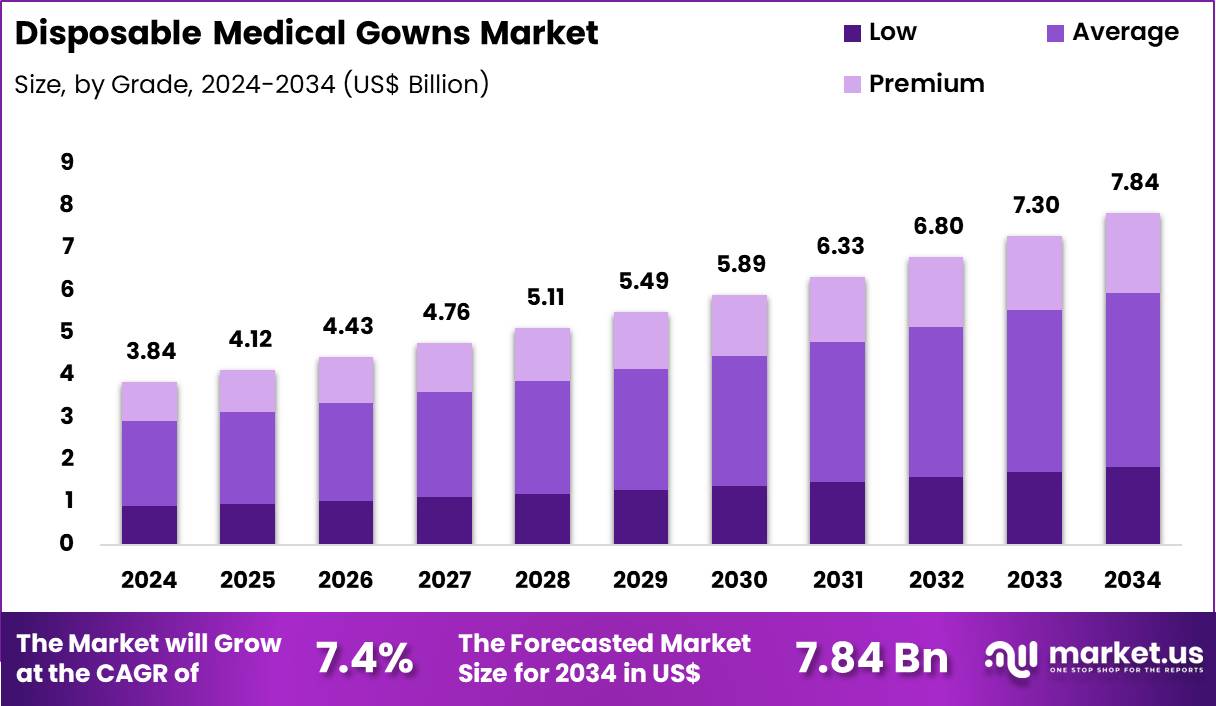

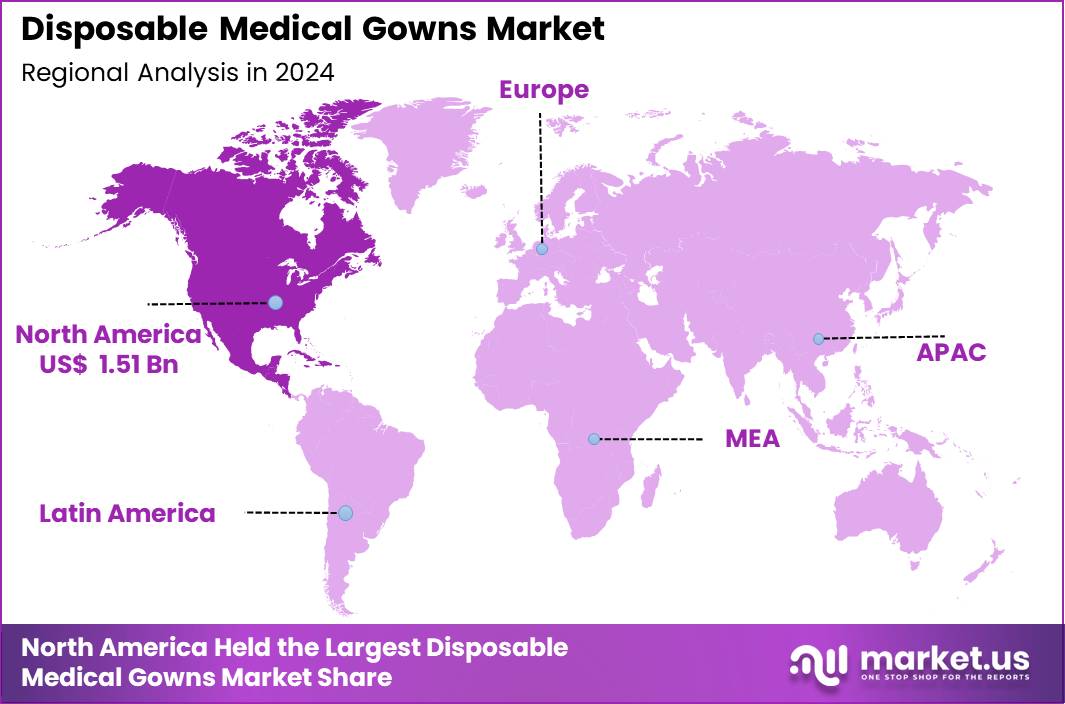

The Global Disposable Medical Gowns Market size is expected to be worth around US$ 7.84 Billion by 2034 from US$ 3.84 Billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 1.51 Billion.

The Disposable Medical Gowns Market represents one of the most essential components of modern hospital infection-prevention systems. Disposable gowns function as the primary barrier between healthcare workers and contaminants encountered during routine and high-intensity procedures. They are used extensively in operating theatres, inpatient wards, emergency units, isolation rooms, outpatient clinics, and diagnostic laboratories.

The need to prevent pathogen transmission, protect clinical staff, and maintain aseptic conditions drives consistent gown consumption across diverse healthcare environments. Global hospital systems continue integrating disposable gowns to meet standards established by organizations such as the CDC, OSHA, and WHO, which outline strict personal protective protocols for tasks involving bodily fluids, aerosol-producing procedures, contaminated surfaces, or contact with infectious patients.

Adoption remains high across both advanced and developing health systems due to rising surgical volumes, increasing chronic and infectious disease burdens, and expanding emergency-care networks. Disposable gowns are also widely used in maternal and newborn care, dental procedures, public-health campaigns, mobile medical teams, and field-hospital operations.

Technological advancements in nonwoven fabrics, breathable barrier materials, and fluid-resistant laminations have improved comfort and durability, making gowns suitable for extended shifts and high-risk medical activities. The global push toward improved hospital hygiene, combined with rising attention to occupational safety, continues to reinforce the long-term relevance of disposable medical gowns across healthcare delivery.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.84 billion, with a CAGR of 7.4%, and is expected to reach US$ 7.84 billion by the year 2034.

- The Grade segment is divided into Low, Average, and Premium, with Average taking the lead in 2024 with a market share of 52.3%

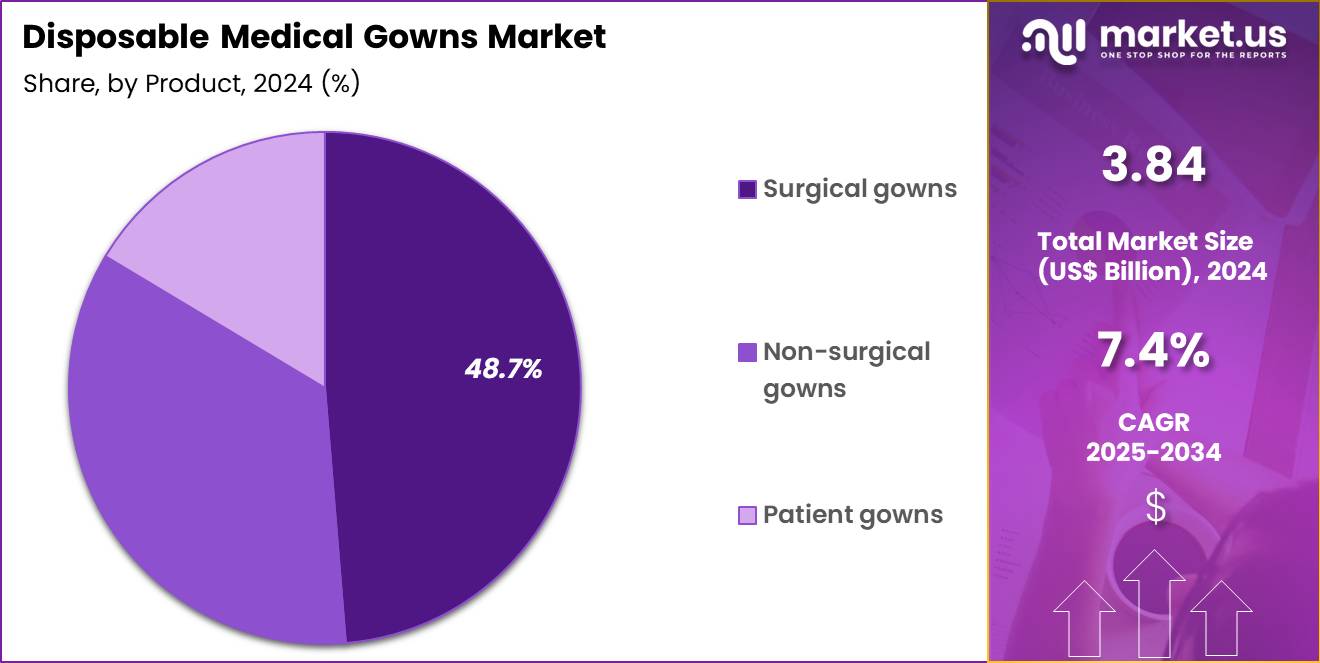

- The Product segment is divided into Surgical gowns, Non-surgical gowns, and Patient gowns, with Surgical gowns taking the lead in 2024 with a market share of 48.7%.

- The Protection Level segment is divided into Low-risk, Moderate-risk, and High-risk, with High-risk taking the lead in 2024 with a market share of 44.8%

- North America led the market by securing a market share of 39.3% in 2024.

Grade Analysis

Average-grade gowns dominated the market with 52.3% market share as it represents the backbone of everyday hospital infection-control practices. They are common in emergency departments, critical-care pathways, oncology infusion rooms, rehabilitation units, and general medical wards where exposure to moderate fluid contact is frequent. These gowns provide improved strength and barrier performance, making them important for procedures such as wound examinations, IV placements, respiratory assessments, catheter management, and blood-draw stations.

Many hospitals prefer average-grade gowns because they provide reliable protection while maintaining breathability an essential feature for nurses who continually move between patients. Healthcare systems with rising outpatient loads, such as those in India, Brazil, and Southeast Asia, increasingly adopt average-grade gowns to meet demanding procedural workflows in pathology labs, radiology units, dialysis centers, and maternal-health departments. Low-grade disposable medical gowns serve fundamental protective needs in low-intensity clinical activities.

They are widely used in general wards, routine check-ups, administrative patient interactions, and non-invasive diagnostic tasks. This category is preferred for basic movements such as patient transport, temperature assessments, physiotherapy preparation, and routine physical evaluations. Their usage aligns closely with WHO and CDC recommendations for non-surgical but hygiene-sensitive environments. Community health centers, vaccination sites, and rural clinics often rely on low-grade gowns due to high patient volume and the need for cost-efficient protective apparel.

Product Analysis

Surgical gowns remain the most technically demanding category in this market space due to strict hygiene, sterility, and barrier requirements. Surgical gowns held dominant market share of 48.7% in 2024. They are used in operating theatres, interventional radiology, cardiac cath labs, endoscopy units, and organ-transplant programs. These gowns must comply with detailed performance standards such as ASTM and AAMI classifications, which define parameters for fluid resistance, microbial penetration, tensile strength, and lint generation.

Their structural reinforcement is essential during long and complex surgeries where fluid exposure is substantial such as orthopedic implants, trauma repair, neurosurgery, and obstetric emergencies. Hospitals increasingly pair surgical gowns with controlled-environment packaging, double-layered glove systems, and sterile drapes to minimize surgical-site infection risks. Rising global surgical rates, especially in oncology and cardiovascular procedures, supports strong demand for high-specification disposable surgical gowns.

Non-surgical gowns are widely used across daily hospital operations and constitute a major share of patient care activities. They appear in emergency triage, general medicine, infectious-disease wards, outpatient departments, physiotherapy units, and routine procedural rooms. These gowns manage moderate splash risks during specimen collection, suture removal, nebulization sessions, wound dressing, and blood sampling.

Protection Level Analysis

High-risk gowns held a majority market share of 44.8% in 2024 as it offers superior fluid-barrier performance and are essential for aerosol-generating procedures, trauma care, intensive care, infectious-disease management, and high-risk obstetric activities. These gowns incorporate reinforced sleeves, sealed seams, and multilayer fabric structures designed to withstand heavy exposure conditions. They are required during intubation, bronchoscopy, dialysis catheter placement, labor complications, and infectious-disease isolation protocols.

Hospitals escalated their use of high-risk gowns during large-scale outbreaks where exposure to respiratory and blood-borne pathogens was elevated. ICUs, negative-pressure rooms, surgical theaters, and emergency trauma bays depend heavily on high-risk gowns to maintain staff safety and reduce nosocomial transmission. As global preparedness programs strengthen, healthcare systems continue to prioritize high-risk gowns for rapid deployment in emergency stockpiles and frontline response units.

Key Market Segments

By Grade

- Low

- Average

- Premium

By Product

- Surgical gowns

- Non-surgical gowns

- Patient gowns

By Protection Level

- Low-risk

- Moderate-risk

- High-risk

Drivers

Increasing focus on infection-prevention standards in Healthcare Systems

A major driver for disposable medical gowns is the worldwide focus on infection-prevention standards in hospitals, emergency care, and diagnostic environments. Healthcare systems treat millions of patients annually with conditions such as respiratory infections, surgical wounds, sepsis, and chronic diseases, each requiring varying levels of protective apparel.

WHO estimates that healthcare-associated infections affect millions of patients every year, prompting strict PPE protocols that include disposable gowns. The expansion of surgical care, intensive-care capacities, and emergency medicine further accelerates gown usage. Increasing global mobility has also elevated the need for robust infection-control measures, as hospitals must manage both endemic and imported infectious diseases.

Growth in outpatient services, home-care visits, and mobile diagnostic programs results in continuous demand for disposable gowns to safeguard healthcare workers during high patient throughput. For instance, in April 2020, Kontoor Brands aimed to produce approximately 50,000 Level 1 patient gowns and 10,000 disposable isolation gowns to address the shortage of personal protective equipment (PPE) in hospitals.

Restraints

Environmental disposal challenges and compliance with waste-management regulations

Environmental disposal challenges and compliance with waste-management regulations remain key restraints for disposable gown adoption. Healthcare facilities generate large volumes of single-use PPE waste daily, placing pressure on incineration capacity and landfill infrastructure. Regions with limited medical-waste management capabilities face additional disposal burdens as gowns used in high-risk settings require specific handling procedures.

Training gaps among healthcare workers also present barriers; improper doffing of gowns contributes to contamination risks, as highlighted in several infection-control audits conducted globally. Supply-chain vulnerabilities during health crises can further restrict access, as disruptions in nonwoven fabric production and cross-border logistics delay procurement cycles. These restraints require hospitals and policymakers to balance infection-prevention needs with sustainability and resource constraints.

Opportunities

Technological innovations

Technological innovation offers major opportunities for the Disposable Medical Gowns Market. Advances in breathable impermeable fabrics, antimicrobial coatings, and biodegradable or compostable materials are reshaping product development. Research groups in East Asia and North America are experimenting with bio-engineered nonwovens and plant-based polymers to reduce environmental impact.

Government-funded initiatives promoting PPE self-sufficiency in countries across Asia, Europe, and the Middle East have opened avenues for local gown production with improved quality and consistency. The expansion of ambulatory care, telemedicine-linked home-visit programs, and community health services increases gown utilization outside traditional hospital settings. Rising attention to women’s health, elder care, and global immunization campaigns also generates demand for specialized gowns optimized for maternity, neonatal care, and field clinics.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic fluctuations and geopolitical shifts increasingly influence the demand, production, and distribution of disposable medical gowns. Inflationary pressure raises raw material costs, especially polypropylene and polyethylene, which are widely used in gown manufacturing. When global oil prices surge, material suppliers revise contract rates, prompting healthcare facilities to reassess procurement volumes. Currency depreciation in import-dependent countries also elevates purchasing costs, impacting supply stability for hospitals that rely on overseas manufacturers.

Geopolitical tensions continue reshaping trade routes and exporting regulations. For example, export restrictions on PPE during global health emergencies have previously disrupted gown availability across Europe, Africa, and Southeast Asia, forcing regional health systems to expand domestic production capabilities. Tariff revisions between the US and Asian manufacturers further affect cost structures and shipment timelines. Additionally, conflicts or sanctions in key manufacturing hubs lead to logistics bottlenecks, delayed container movement, and higher freight charges.

These dynamics influence long-term procurement strategies among hospitals and government agencies. Many transition toward multi-regional supplier portfolios to reduce dependency on single-country sourcing. Growing emphasis on emergency stockpiles, mandatory PPE reserves, and localized manufacturing incentives strengthens market resilience. As economies stabilize, healthcare institutions prioritize supply continuity, quality assurance, and risk-protected purchasing frameworks to mitigate volatility.

Latest Trends

Shift towards high-performance gowns

A significant trend shaping the market is the shift toward high-performance gowns featuring reinforced barrier zones, breathable membranes, ergonomic tailoring, and low-lint nonwoven fabrics. Hospitals increasingly prefer gowns that reduce heat stress during long procedures, enhancing clinician comfort and productivity. Global adoption of color-coded gowns for surgical, isolation, and procedural use supports rapid workflow identification and better compliance.

Automation across manufacturing facilities is improving fabric bonding precision, reducing contamination risks, and increasing output consistency. Another prominent trend is the integration of environmentally conscious materials and recycling programs as hospitals aim to reduce their PPE-related carbon footprint. Additionally, public-health agencies maintain strategic PPE reserves, resulting in stable recurring demand for disposable gowns year-round.

Regional Analysis

North America is leading the Disposable Medical Gowns Market

North America represents the largest regional share of 39.3% in the disposable medical gowns market due to its advanced healthcare infrastructure, high procedural volumes, and strict infection-control regulations. Demand increases as hospitals, outpatient centers, and long-term care facilities adhere to CDC and OSHA guidelines for protective apparel usage during surgical, diagnostic, and isolation procedures. The region also benefits from strong domestic manufacturing capabilities in the US and Canada, ensuring supply continuity during global disruptions. Rising adoption of high-risk and moderate-risk gowns in operating rooms and emergency departments further drives consumption.

Additionally, federal initiatives supporting pandemic preparedness and strategic PPE stockpiles strengthen procurement activity across public and private health systems. With increasing emphasis on healthcare worker safety and widespread usage of single-use garments to reduce cross-contamination, North America maintains its dominance as a high-consumption and compliance-driven market for disposable medical gowns.

In December 2024, six US companies are set to produce about 250 million medical gowns under a federal initiative to strengthen PPE supplies following COVID-19 shortages, according to the Associated Press. Led by ASPR, the effort represents one of the final steps in rebuilding the Strategic National Stockpile, supported by at least $350 million in funding. The stockpile will then maintain a 90-day supply of gowns, alongside 1.5 billion gloves and 1.1 billion masks already stored.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific emerges as the fastest growing region in the disposable medical gowns market due to expanding healthcare capacity, rising surgical interventions, and rapid adoption of infection-prevention protocols across hospitals. Countries such as China, India, Japan, and South Korea continue investing in hospital upgrades, isolation units, and emergency care facilities, supporting strong demand for disposable protective apparel.

The region also acts as a major global manufacturing base, enabling cost-effective production and export of gowns to Europe, the Middle East, and North America. Increasing awareness of hospital-acquired infections encourages large-scale use of sterile and non-sterile gowns in medical and diagnostic settings. Government initiatives promoting medical device manufacturing and pandemic-preparedness infrastructure further accelerate growth. As public and private healthcare providers scale procurement of low, moderate, and high-risk gowns to meet international standards, Asia Pacific demonstrates the fastest adoption curve and sustained expansion in this market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Cardinal Health, Medline Industries, 3M, Mölnlycke Health Care, Halyard Health (Owens & Minor), Standard Textile, Paul Hartmann, Kimberly-Clark, Dynarex, Lohmann & Rauscher, and Others

Cardinal Health plays a significant role in the disposable medical gowns market through its extensive portfolio of surgical and isolation apparel designed for hospitals and ambulatory centers. The company emphasizes consistent quality, reliable sterilization standards, and broad distribution networks across North America, helping healthcare providers maintain uninterrupted supply during high-demand periods. Cardinal Health’s focus on infection prevention solutions strengthens its relevance in procedural and emergency care environments.

Medline Industries remains one of the largest suppliers of disposable medical gowns globally, supported by large-scale manufacturing facilities and vertically integrated supply chains. Its product lines span low to high-risk gowns aligned with AAMI standards, enabling wide adoption across surgical units, diagnostic centers, and long-term care facilities. Medline’s investments in capacity expansion and sustainability initiatives further enhance market presence.

3M contributes to the market through advanced protective apparel engineered for fluid resistance and enhanced barrier performance. Its innovations in breathable materials and occupational safety support growing demand in high-acuity settings, reinforcing its strategic position in infection-control solutions.

Top Key Players

- Cardinal Health

- Medline Industries

- 3M

- Mölnlycke Health Care

- Halyard Health (Owens & Minor)

- Standard Textile

- Paul Hartmann

- Kimberly-Clark

- Dynarex

- Lohmann & Rauscher

- Others

Recent Developments

- In July 2025, Medline launched its ComfortTemp® Patient Warming System, which includes disposable gowns and blankets designed to regulate patient body temperature before, during, and after surgery. This system addresses perioperative hypothermia risks an area of growing concern in surgical care.

- In November 2024, Cardinal Health introduced a novel disposable surgical gown called SmartGown EDGE™ Breathable Surgical Gown with ASSIST™ Instrument Pockets. This gown was developed under an exclusive license agreement with Mayo Clinic Ventures. Its unique feature built-in instrument pockets aims to improve procedure efficiency and usability for surgeons.

- In December 2024, 3M in collaboration with Medline moved to standardize surgical warming gowns, replacing multiple older blanket variants with a unified warming gown solution. The collaboration aims to improve consistency in patient care and simplify supply-chain and procurement for hospitals.

Report Scope

Report Features Description Market Value (2024) US$ 3.84 Billion Forecast Revenue (2034) US$ 7.84 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade (Low, Average and Premium), By Product (Surgical gowns, Non-surgical gowns and Patient gowns), By Protection Level (Low-risk, Moderate-risk, and High-risk) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cardinal Health, Medline Industries, 3M, Mölnlycke Health Care, Halyard Health (Owens & Minor), Standard Textile, Paul Hartmann, Kimberly-Clark, Dynarex, Lohmann & Rauscher, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Disposable Medical Gowns MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Disposable Medical Gowns MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cardinal Health

- Medline Industries

- 3M

- Mölnlycke Health Care

- Halyard Health (Owens & Minor)

- Standard Textile

- Paul Hartmann

- Kimberly-Clark

- Dynarex

- Lohmann & Rauscher

- Others