Global Disposable Gloves Market Analysis By Material Type (Natural Rubber, Nitrile, Polyethylene, Vinyl, Neoprene, Other Material Types), Product Type (Powdered, Powder-free), End-Use (Medical & Healthcare (Examination, Surgical), Automotive, Oil & Gas, Food & Beverage, Metal & Machinery, Chemical & Petrochemical, Pharmaceutical, Cleanroom, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 17725

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

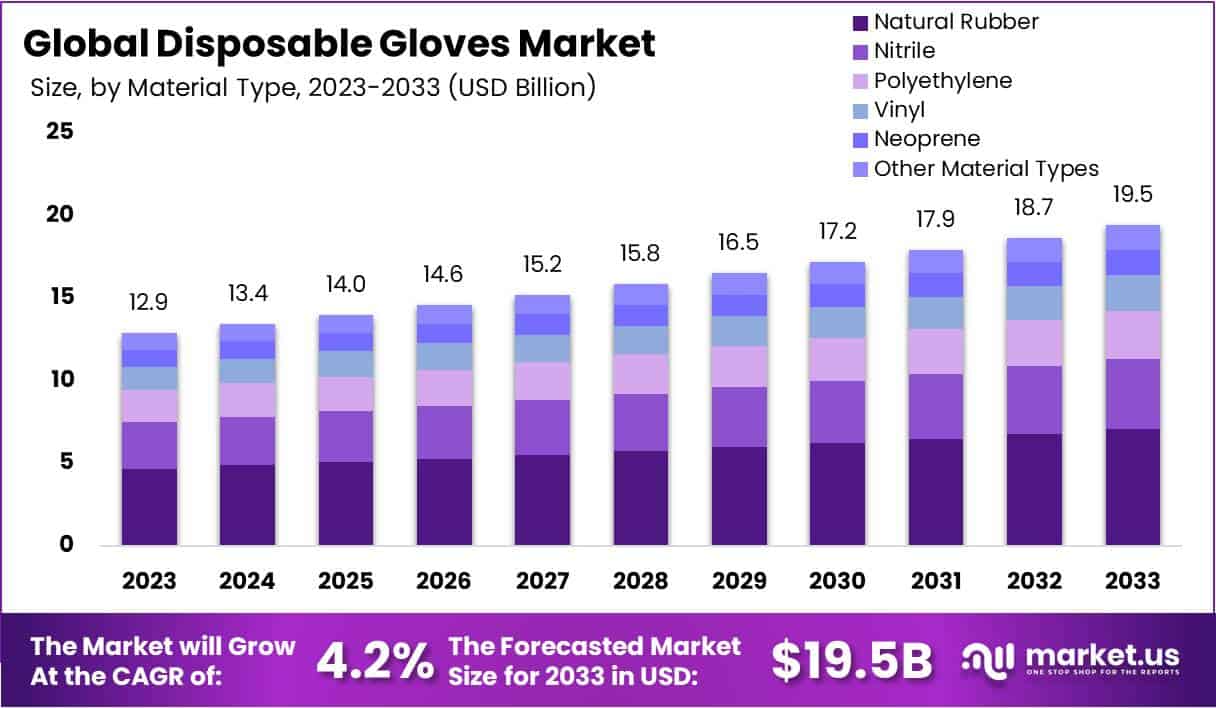

The Disposable Gloves Market Size is anticipated to reach approximately USD 19.5 billion by the year 2033, compared to USD 12.9 billion in 2023. This represents a compound annual growth rate (CAGR) of 4.2% during the forecast period spanning from 2024 to 2033.

Disposable gloves are a crucial protective tool in various fields like healthcare, food handling, and more. They shield the skin from chemicals, contamination, and infections. Commonly made from latex-free materials like nitrile or synthetic vinyl, these gloves are widely used in doctor’s offices, restaurants, and salons due to their affordability and easy replacement.

There are four key reasons why disposable gloves are indispensable. Firstly, they prevent cross-contamination by allowing quick changes between tasks, crucial in places like food processing and labs. Secondly, they effectively prevent the spread of pathogens in healthcare settings where contact with bodily fluids is routine.

Another important aspect is their ability to protect against unknown hazards. Workers in unpredictable environments, such as wildlife professionals or EMTs, find disposable gloves reliable against biohazards and toxins. Lastly, they won’t wear out, as they are designed for single use. While they may be thin, their affordability and ready supply make them a practical choice for various applications, especially considering their latex-free options for those with allergies.

The growing disposable gloves demand, especially from the healthcare industry amidst the COVID-19 pandemic, with the increasing awareness regarding healthcare infections, is expected to fuel the Disposable Gloves market growth. These gloves protect patients and caregivers from infection.

These gloves are used in medical examinations and during surgical procedures. The gloves used for the medical examination can be classified as sterile and non-sterile. Surgical gloves, however, are generally sterile.

Key Takeaways

- Market Overview: Valued at USD 12.9 billion in 2023, the Disposable Gloves Market forecasts a 4.2% CAGR to reach USD 19.5 billion by 2033.

- Material Trends: Natural Rubber dominates at 36.2%, while Nitrile gloves show growth, and sustainable Polyethylene gloves maintain market presence.

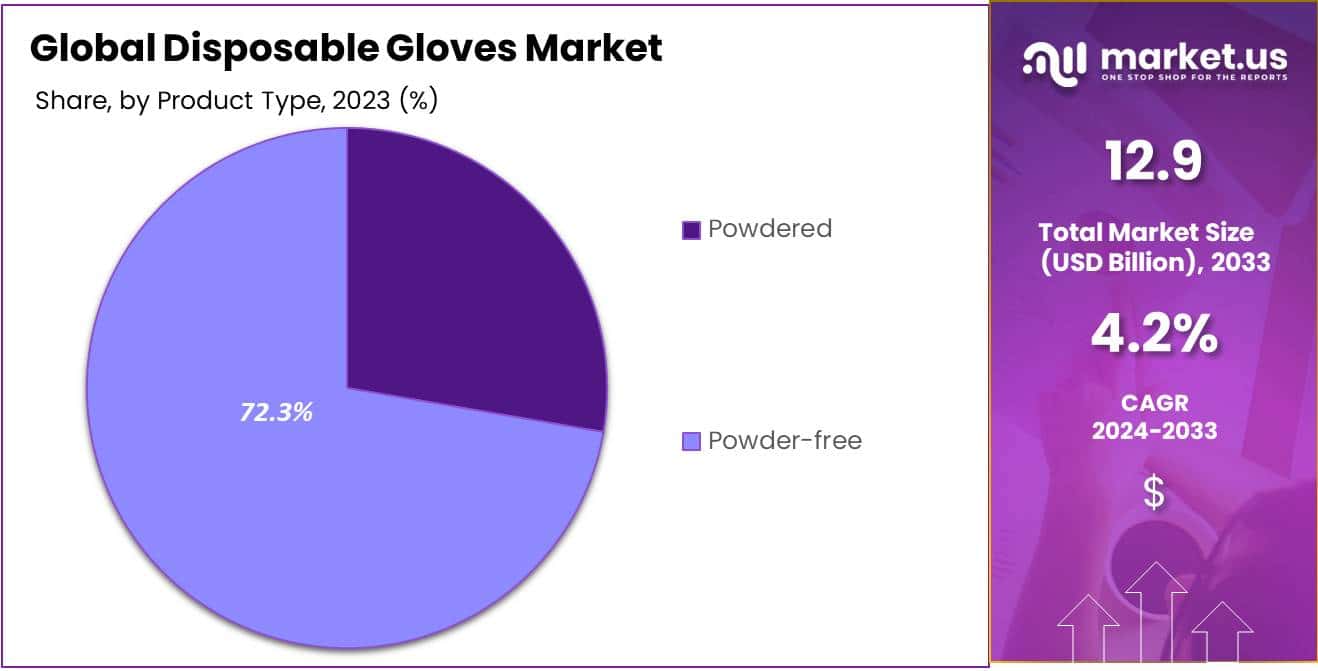

- Product Preferences: Powder-Free variants claim a significant 72.3% market share in 2023, surpassing the demand for Powdered gloves.

- End-Use Dynamics: Medical & Healthcare leads with a robust 75.7% market share, emphasizing the indispensable role of disposable gloves in healthcare.

- Key Market Segments: Segmented by Material Type, Product Type, and End-Use, the market caters to diverse industry needs.

- Market Drivers: Growing demand due to increased hygiene awareness, stringent regulations, rising global healthcare expenditure, and the ongoing COVID-19 pandemic.

- Market Restraints: Environmental concerns, fluctuating raw material prices, quality issues, and the rise of alternative solutions hinder market growth.

- Market Opportunities: Emerging markets offer growth, technological advancements present innovation opportunities, and e-commerce facilitates efficient distribution.

- Market Trends: Trends include a shift towards sustainability, prioritizing comfort in glove design, tailoring gloves for specific applications, and integrating smart technologies.

- Regional Insights: North America leads with over 37.2% market share, while Europe and Asia-Pacific show promising growth, and Latin America and MEA exhibit potential.

Material Analysis

In 2023, Natural Rubber emerged as the leading material in the disposable gloves market, securing a dominant market position with a substantial share of over 36.2%. This signifies a robust demand for gloves made from natural rubber, driven by their inherent properties and widespread application across various industries.

Nitrile gloves, another key player in the market, showcased a significant presence, reflecting a growing market share. This can be attributed to the increasing preference for nitrile gloves due to their durability, chemical resistance, and versatility. Nitrile held a notable position, accounting for a considerable share in the overall market.

Polyethylene, a material known for its cost-effectiveness and flexibility, also maintained a noteworthy market share in 2023. Industries favoring lightweight and economical glove options contributed to the sustained popularity of polyethylene gloves, securing a stable position in the segmented market.

Vinyl gloves, recognized for their affordability and comfort, maintained a steady market share as well. With a preference for vinyl gloves in certain applications, this material type retained its significance, capturing a share reflective of its market acceptance and demand.

Neoprene, though representing a smaller segment, demonstrated a distinct presence in the disposable gloves market. Its unique properties, including resistance to chemicals and oils, positioned neoprene gloves as a specialized choice in specific industries, contributing to its market share.

Other material types collectively played a role in diversifying the market landscape, with various specialized gloves catering to specific industry needs. This segment, encompassing materials beyond the primary categories, showcased a dynamic and evolving market environment.

Product Type Analysis

In 2023, the Disposable Gloves market witnessed a notable trend in favor of Powder-Free variants, solidifying their dominance with an impressive market share of over 72.3%. This shift reflects a growing preference among consumers and industries for gloves that are free from powder additives.

The Powder-Free segment’s popularity can be attributed to its enhanced comfort and reduced risk of allergies. With a focus on user well-being, these gloves have gained widespread acceptance across various sectors. Professionals and end-users alike appreciate the absence of powders, which minimizes the potential for skin irritation and respiratory issues.

On the other hand, Powdered gloves, while still maintaining a significant market presence, experienced a decline in comparison. The demand for Powder-Free alternatives underscores the industry’s commitment to providing safer and more comfortable options.

This shift in market dynamics suggests a broader industry movement towards more user-friendly and health-conscious disposable glove solutions. As we move forward, it will be intriguing to observe how these trends evolve and shape the disposable gloves market landscape.

End-Use Analysis

In 2023, the disposable gloves market witnessed a significant stronghold by the Medical and Healthcare segment, commanding an impressive 75.7% share. This dominance can be attributed to the crucial roles played by disposable gloves in medical practices. Whether for examinations or surgical procedures, these gloves are indispensable in maintaining hygiene standards and preventing cross-contamination.

The Automotive sector also demonstrated a noteworthy presence, securing a considerable market share. With a focus on worker safety and the need for protection against various substances encountered in automotive maintenance and repair, disposable gloves have become an essential component in this industry.

Furthermore, the Oil & Gas segment emerged as a key player in the disposable gloves market. The sector’s demanding operational environments necessitate stringent safety measures, making disposable gloves a vital protective accessory for workers handling various substances in the field.

Metal & Machinery, with its diverse manufacturing processes, showcased a considerable demand for disposable gloves. The need for hand protection against potential hazards in metalworking and machinery operations contributed to the segment’s notable market presence.

The Chemical & Petrochemical sector also embraced disposable gloves for safeguarding workers against hazardous chemicals. The stringent safety regulations within this industry further fueled the adoption of disposable gloves.

The Pharmaceutical segment, driven by stringent hygiene standards and the need for contamination control, marked its presence in the disposable gloves market. The sector’s emphasis on maintaining a sterile environment in pharmaceutical production facilities underscored the importance of disposable gloves.

Cleanroom applications demonstrated a specialized demand for disposable gloves, driven by the need for maintaining controlled and sterile environments in industries such as electronics and biotechnology.

Key Market Segments

Material Type

- Natural Rubber

- Nitrile

- Polyethylene

- Vinyl

- Neoprene

- Other Material Types

Product Type

- Powdered

- Powder-free

End-Use

- Medical & Healthcare

- Examination

- Surgical

- Automotive

- Oil & Gas

- Food & Beverage

- Metal & Machinery

- Chemical & Petrochemical

- Pharmaceutical

- Cleanroom

- Other End-Uses

Drivers

Increasing Awareness of Hygiene

The increasing recognition of the significance of hygiene and infection control, particularly in healthcare environments, is fueling the need for disposable gloves. This surge in demand is not limited to hospitals alone; it extends across diverse industries like food, pharmaceuticals, and manufacturing.

Stringent Regulations and Standards

Stringent regulations and standards related to worker safety and hygiene across different industries are compelling businesses to adhere to proper safety protocols. This is boosting the demand for disposable gloves as a crucial component in maintaining compliance with these regulations.

Rising Healthcare Expenditure

The increasing healthcare expenditure globally, coupled with the rising number of healthcare facilities, is contributing to the growth of the disposable gloves market. The expansion of healthcare infrastructure is directly translating into higher demand for gloves for medical professionals and staff.

Pandemic-Driven Demand

The ongoing COVID-19 pandemic has significantly increased the demand for disposable gloves as a preventive measure. The emphasis on personal protective equipment (PPE) to curb the spread of infections has led to a surge in demand, not only in healthcare but also in various public and private sectors.

Restraints

Environmental Concerns

The disposal of vast quantities of used disposable gloves is raising environmental concerns. The non-biodegradable nature of many glove materials contributes to pollution and waste management challenges, leading to increased scrutiny and potential restrictions.

Fluctuating Raw Material Prices

The disposable gloves market is sensitive to fluctuations in raw material prices, particularly for latex and nitrile. Price volatility can impact production costs for manufacturers, leading to potential margin pressures and increased product prices for end-users.

Quality Concerns

There are instances of substandard and counterfeit disposable gloves entering the market. Quality concerns related to the durability and effectiveness of these gloves can hinder market growth, as end-users become more discerning and prioritize product quality and reliability.

Alternative Solutions and Technologies

The development of alternative solutions, such as reusable gloves and advancements in hand hygiene technologies, poses a challenge to the disposable gloves market. End-users may opt for alternatives that offer cost-effectiveness and sustainability, affecting the market for single-use gloves.

Opportunities

Expansion in Emerging Markets

The disposable gloves market has significant growth opportunities in emerging markets where awareness of hygiene practices is increasing. Companies can capitalize on this by expanding their presence in regions with a rising number of healthcare facilities and a growing focus on safety standards.

Technological Advancements

Ongoing research and development in glove materials and manufacturing technologies present opportunities for product innovation. The introduction of gloves with enhanced features such as improved barrier protection, comfort, and eco-friendly materials can create a competitive advantage.

E-commerce Growth

The increasing trend of online purchasing, especially in the wake of the COVID-19 pandemic, opens up avenues for growth in the disposable gloves market. E-commerce platforms provide a convenient and efficient distribution channel for both businesses and individual consumers.

Diversification of Product Portfolio

Companies can explore diversification by expanding their product portfolios to include specialized gloves catering to specific industries. Customized solutions for sectors such as food processing, automotive, and cleanroom environments can tap into niche markets and drive growth.

Trends

Embracing Sustainability

A noteworthy shift in the disposable gloves market is the increasing preference for sustainable and environmentally friendly materials. Biodegradable gloves crafted from plant-based polymers are gaining traction as businesses aim to minimize their ecological impact.

Prioritizing Comfort and Ergonomics

Manufacturers are placing a growing emphasis on enhancing the comfort and ergonomic features of disposable gloves. Ongoing innovations in both design and materials strive to elevate user experience, reduce hand fatigue, and ensure optimal dexterity-especially vital in industries requiring precision.

Tailored Solutions for Specific Applications

A rising trend involves tailoring disposable gloves to meet the unique demands of various applications. For example, gloves designed for healthcare differ in features from those intended for the food industry. This customization results in more specialized and efficient products catering to specific needs.

Infusion of Smart Technologies

The integration of smart technologies, including sensors and indicators, is emerging as a notable trend in disposable gloves. These technological additions offer real-time information, such as hand hygiene compliance and exposure to hazardous substances. This contributes to the implementation of enhanced safety protocols across various industries.

Regional Analysis

North America took the lead in the Disposable Gloves Market, holding a strong market position with over 37.2% share and a substantial market value of USD 820 million for the year 2023. The region’s robust dominance can be attributed to heightened awareness of hygiene practices, stringent safety regulations, and a growing demand for disposable gloves across various industries.

The United States played a pivotal role in North America’s market stronghold, boasting a significant share owing to increased healthcare activities and a surge in the food processing industry. Canada also contributed positively, aligning with the region’s emphasis on safety standards.

In contrast, other regions like Europe and Asia-Pacific showed promising growth trajectories, with Europe closely following North America’s lead, driven by a similar surge in healthcare and food-related industries. Meanwhile, the Asia-Pacific region demonstrated a burgeoning market, influenced by rising healthcare awareness, expanding industrial activities, and an increasing emphasis on safety measures in emerging economies.

Latin America and the Middle East & Africa, although displaying a comparatively smaller market share, exhibited potential growth. These regions witnessed an uptick in disposable glove adoption due to escalating healthcare concerns and an expanding hospitality sector.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The disposable gloves market is characterized by intense competition among key players, each striving to offer cutting-edge solutions while maintaining cost-effectiveness. Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, and Kossan Rubber Industries Bhd dominate the landscape, leveraging their unique strengths in technology, sustainability, and market reach.

As the market witnesses a surge in demand, driven by factors such as increased healthcare awareness and stringent safety regulations, these key players continue to invest in research and development, production capacity, and global distribution networks. Their collective efforts not only address the current market needs but also anticipate and adapt to future trends, ensuring a resilient and responsive disposable gloves market.

Ansell Ltd is a prominent player in the disposable gloves market, distinguished for its high-quality and innovative glove solutions. Their commitment to research and development results in a diverse product range catering to various industries, making them a reliable choice for those seeking superior protection.

Top Glove Corporation Bhd holds a substantial market share, offering an extensive portfolio of disposable gloves globally. Emphasizing cost-effective solutions without compromising quality, the company’s continuous efforts in expanding production capacity contribute to its prominence.

Hartalega Holdings Berhad specializes in nitrile gloves and stands out for its emphasis on sustainability and environmental responsibility. With a strategic focus on innovation and capacity expansion, Hartalega is well-positioned to meet evolving market demands.

Supermax Corporation Berhad is recognized for its comprehensive range of disposable gloves, ensuring quality assurance and compliance with international standards. Their strategic global distribution network further strengthens their competitive position.

Kossan Rubber Industries Bhd is a key player known for latex and nitrile gloves, aligning with market trends through a commitment to sustainability and corporate responsibility. Their focus on product diversification and quality control contributes to their competitiveness in the market.

Market Key Players

- Ansell Ltd

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd

- Ammex Corporation

- Kimberly-Clark Corporation

- Sempermed USA Inc

- MCR Safety

Recent Developments

- In February 2023: Global leader in personal protective equipment (PPE), Ansell Ltd., announced the acquisition of Touch Medical, a leading provider of disposable gloves for the medical and dental industries. The acquisition expands Ansell’s portfolio of disposable gloves, providing access to Touch Medical’s innovative and high-quality products.

- In March 2023: Top Glove Corporation Berhad, the world’s largest manufacturer of disposable gloves, launched its new biodegradable nitrile disposable gloves. These eco-friendly gloves are designed to break down naturally, reducing their environmental impact. The introduction of these gloves aligns with Top Glove’s commitment to sustainability.

- In April 2023: Honeywell International Inc. and Resolute Forest Products Inc. announced a collaboration to develop bio-based disposable gloves made from renewable materials. This partnership aims to create a more sustainable alternative to traditional disposable gloves.

Report Scope

Report Features Description Market Value (2023) USD 12.9 Bn Forecast Revenue (2033) USD 19.5 Bn CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Material Type (Natural Rubber, Nitrile, Polyethylene, Vinyl, Neoprene, Other Material Types), Product Type (Powdered, Powder-free), End-Use (Medical & Healthcare (Examination, Surgical), Automotive, Oil & Gas, Food & Beverage, Metal & Machinery, Chemical & Petrochemical, Pharmaceutical, Cleanroom, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, Kimberly-Clark Corporation, Sempermed USA Inc, MCR Safety Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Disposable Gloves Market in 2023?The Disposable Gloves Market size is USD 12.9 Billion in 2023.

What is the projected CAGR at which the Disposable Gloves Market is expected to grow at?The Disposable Gloves Market is expected to grow at a CAGR of 4.2% (2024-2033).

List the segments encompassed in this report on the Disposable Gloves Market?Market.US has segmented the Disposable Gloves Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). Material Type the market has been further divided intoNatural Rubber, Nitrile, Polyethylene, Vinyl, Neoprene, and Other Material Types). By Product Type the market has been further divided into Powdered, and Powder-free. By End-Use the market has been further divided into Medical & Healthcare (Examination, Surgical), Automotive, Oil & Gas, Food & Beverage, Metal & Machinery, Chemical & Petrochemical, Pharmaceutical, Cleanroom, and Other End-Uses.

List the key industry players of the Disposable Gloves Market?Ansell Ltd, Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, Kimberly-Clark Corporation, Sempermed USA Inc, MCR Safety and Other Key Players are engaged in the Disposable Gloves market

Which region is more appealing for vendors employed in the Disposable Gloves Market?North America is expected to account for the highest revenue share of 37.2% and a substantial market value of USD 820 million for the year 2023. Therefore, the Disposable Gloves industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Disposable Gloves?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Disposable Gloves Market.

Which segment accounts for the greatest market share in the Disposable Gloves industry?With respect to the Disposable Gloves industry, vendors can expect to leverage greater prospective business opportunities through the Natural rubber segment, as this area of interest accounts for the largest market share.

-

-

- Top Glove Corporation Bhd

- Ansell Ltd.

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Hartalega Holdings Berhad

- Ammex Corporation

- Sempermed USA Inc.

- Kimberly-Clark Corporation

- Other Key Players