Global Disposable Endoscopes Market, By Application (Bronchoscopy, Urologic Endoscopy, and Other Applications), By End-User (Hospitals, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100571

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

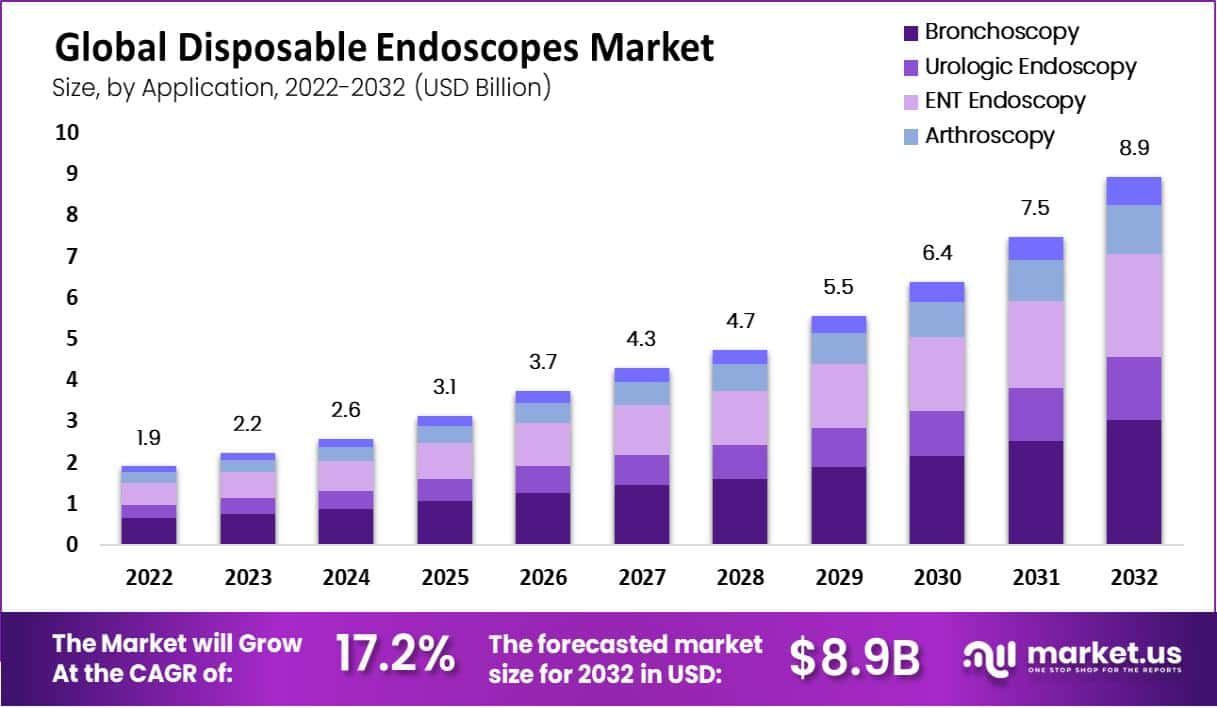

In 2022, the global disposable endoscopes market accounted for USD 1.9 billion and is expected to reach USD 8.9 billion in 2032. This market is estimated to register a CAGR of 17.2% between 2023 and 2032.

The disposable endoscopes market refers to the global market for endoscopes that are designed to be used once and then disposed of. They are medical devices that are used for visualizing the internal organs & tissues of the human body.

They are widely used for both therapeutic purposes and diagnostic, especially in the fields of gastroenterology, pulmonology, gynecology, and urology. These endoscopes offer several advantages over traditional reusable endoscopes like reduced risk of cross-contamination & infection, convenience, and cost-effectiveness. They are also ideal for use in emergencies or in remote locations where access to traditional endoscopes may be limited.

The disposable endoscopes market is driven by factors like the increasing prevalence of chronic diseases, rising healthcare expenditure, the need for infection control, and increasing demand for minimally invasive surgeries. The market is also influenced by factors like the development of advanced disposable endoscopes with improved imaging capabilities, the entry of new players, and increasing partnerships & collaborations among market players.

Key Takeaways

- The disposable endoscopes market is projected to achieve a valuation of USD 8.9 billion by 2032.

- This market is expected to grow at a CAGR of 17.2% from 2023 to 2032.

- Bronchoscopy procedures captured over 33.8% of the total market share in 2022.

- The global disposable endoscopes market size was worth around USD 1.9 billion in 2022.

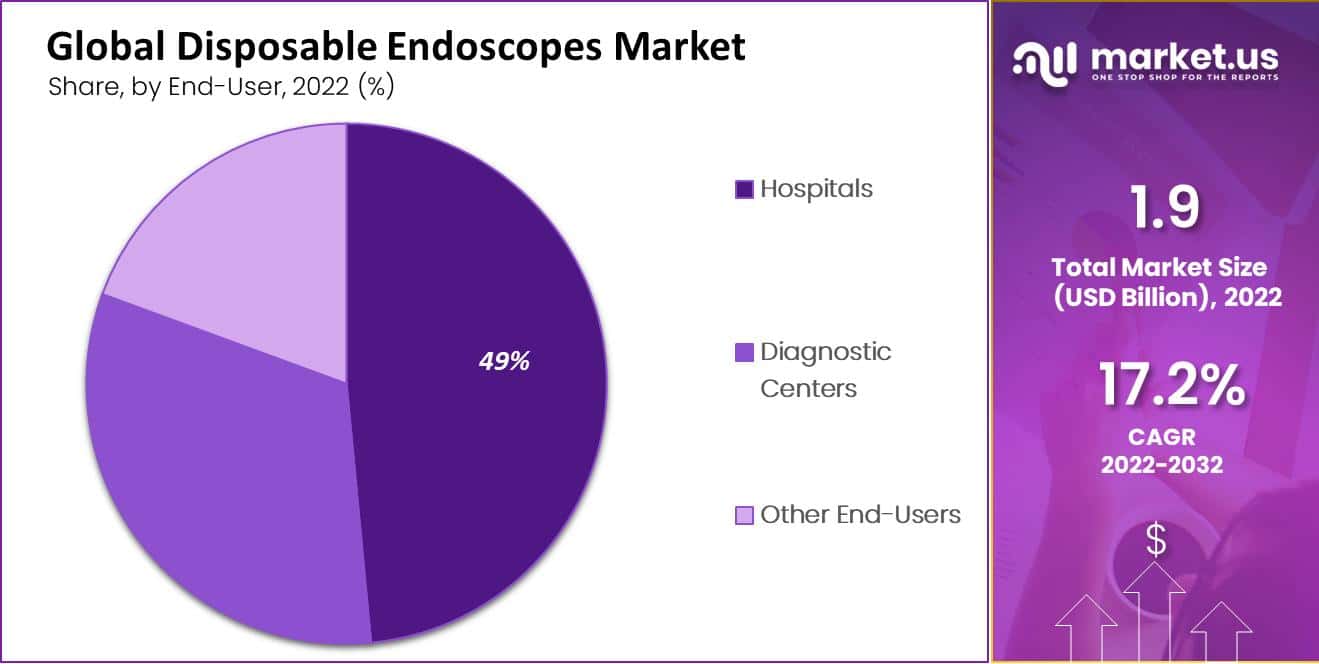

- By end-user, the hospital’s segment had the largest market share in 2022, contributing to a 48.5% market share.

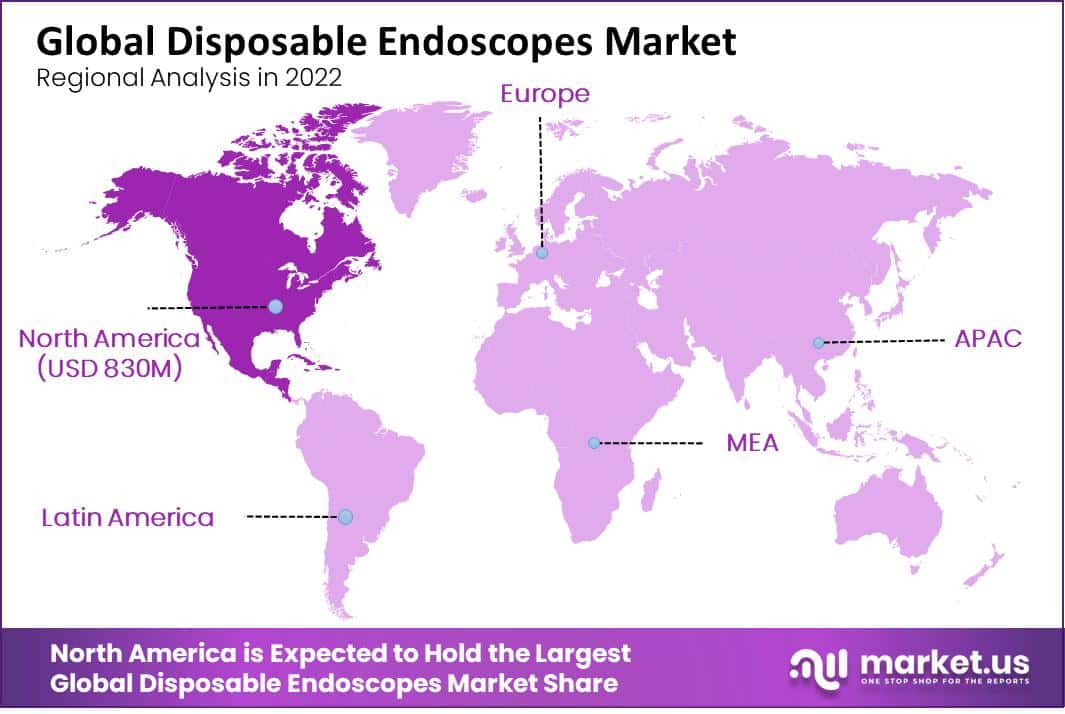

- In 2022, North America dominated the disposable endoscopes market with a revenue share of 43.7%.

- According to the World Health Organization (WHO), 65 million people suffered from COPD worldwide in 2017.

- Furthermore, according to WHO, 334 million people suffered from asthma worldwide in 2017.

Driving Factors

Increasing Prevalence of Chronic Diseases, Advancements in Endoscope Technology Drives the Market Growth of Disposable Endoscopes Market.

Disposable endoscopes have become increasingly popular due to the rising incidence of chronic diseases like cancer, gastrointestinal disorders, and respiratory problems. These instruments help diagnose and treat illnesses more quickly while decreasing the potential spread of infection. Disposable endoscopes have become increasingly popular due to advancements in endoscope technology such as high-definition (HD) cameras, 3D imaging, and robotic-assisted endoscopy.

These advanced tools offer improved vision and greater precision during diagnostics and treatments. Disposable endoscopes are more cost-effective and practical than their reusable counterparts, offering healthcare facilities a cost-effective option that eliminates cross-contamination risks and requires no costly reprocessing equipment. As such, disposable endoscopes make for a more appealing choice when providing healthcare services.

Disposable endoscopes have become increasingly popular due to the growing need for minimally invasive surgeries. Compared to open procedures, they offer patients less pain, faster healing times, and lower healthcare expenses. Governments around the globe are taking initiatives to improve healthcare services and lessen chronic illness burdens. These initiatives have propelled market expansion and raised the demand for disposable endoscopes.

Restraining Factors

Limited Availability, Technical Limitations, and Environmental Concerns are Some Restraints for the Disposable Endoscopes Market.

Disposable endoscopes have a limited lifespan and should only be used once, increasing the cost of healthcare services while creating additional waste. Disposable endoscopes are not as accessible as their reusable counterparts, particularly in developing countries. This may limit their adoption and usage in certain areas. Some procedures necessitate the use of more sophisticated endoscopes that are not yet available in disposable form.

This may restrict their use during certain diagnostic and therapeutic procedures. Disposable endoscopes generate additional medical waste that must be properly disposed of, potentially raising environmental concerns and driving up healthcare service costs. Disposable endoscopes must obtain regulatory approval and may face challenges in certain markets, which could restrict their availability and adoption.

Application Analysis

The Bronchoscopy Segment is the Most Lucrative Segment in the Application Analysis of the Disposable Endoscopes Market.

Based on application, the market for disposable endoscopes is segmented into bronchoscopy, urologic endoscopy, ENT endoscopy, arthroscopy, and other applications. Among these applications, the bronchoscopy segment is the most lucrative in the global disposable endoscopes market, with a projected CAGR of 13.6%. The total revenue share of bronchoscopy applications in the disposable endoscopes market is 33.8% in 2022.

Owing to the increasing prevalence of lung disorders & huge adoption of minimally invasive bronchoscope procedures are driving the growth of this segment. Additionally, asthma, COPD, acute lower respiratory tract infections, tuberculosis, and lung cancer are also some most common causes of severe acute illnesses & deaths globally. According to WHO about 65 Mn individuals were suffering from COPD and about 334 Mn individuals were suffering from asthma globally in 2017.

The ENT Endoscopy Segment is Expected to Grow Faster in the Projected Period in the Disposable Endoscopes Market.

Followed by, the ENT endoscopy application, which accounted for the growth in coming years with a CAGR of 16.3% due to the increasing prevalence of ear, throat, and nose infections which is expected to drive the segment growth. Additionally, technological advancement and subsequent product launches are also driving the fastest growth. For example, 3NT Medical launched a single-use ENT endoscope called “Calibri Micro Scope” in the U.S. Furthermore, the reduction of cross-contamination & costs related to disposable endoscopes ENT cleaning & services and its growing adoption.

End-User Analysis

The Hospitals Segment Accounted for the Largest Revenue Share in Disposable Endoscopes Market in 2022.

Based on end-user, the market is segmented into hospitals, diagnostic centers, and other end-users. Among these, the hospital’s segment dominates the disposable endoscopes market with the largest share 48.5% in 2022. Owing to the presence of the number of hospitals performing endoscopic procedure in developed & developing countries is driving the growth of this segment.

Increasing awareness about infection risks related to reusable endoscopic devices is also expected to propel the adoption of disposable devices in hospitals. Additionally, favorable reimbursement policies & high product preferences in hospitals for patients and undergoing endoscopic procedures.

The Diagnostic Center Segment is Expected to be the Fastest Growing End-User Segment in the Disposable Endoscopes Market.

Diagnostic Center is anticipated to witness the fastest growth rate in the forecasted period with a CAGR of 14.2%. Disposable endoscopes are commonly used for various diagnostic procedures such as gastroscopy, colonoscopy, bronchoscopy, and cystoscopy. Disposable endoscopes save clinics money on costly reprocessing equipment while decreasing cross-contamination risk.

Key Market Segments

Based on Application

- Bronchoscopy

- Urologic Endoscopy

- ENT Endoscopy

- Arthroscopy

- Other Applications

Based on End-User

- Hospitals

- Diagnostic Centers

- Other End-Users

Growing Opportunities

Expansion in Emerging Markets, Technological Advancements, and Rising Demand for Home Healthcare Create Opportunities in Disposable Endoscopes Market.

Companies have an enormous opportunity to expand their operations into emerging markets such as Asia-Pacific, Latin America, and the Middle East. These regions boast growing populations and an increasing need for healthcare services – creating a large potential market for disposable endoscopes. With the rapid advancements in endoscope technology, companies have the chance to develop more advanced and innovative disposable endoscopes.

This can improve diagnostic accuracy and efficiency during therapeutic procedures, thus increasing disposable endoscope adoption across the market. The growing demand for home healthcare services presents an opportunity for companies to develop disposable endoscopes that can be utilized in these settings, helping reduce the burden on healthcare facilities and improving patient outcomes.

Companies can pursue strategic partnerships and collaborations with other players in the market to diversify their product portfolios, strengthen their market presence, and boost their competitive edge. With an ever-increasing focus on infection control in healthcare facilities, there is now a growing demand for disposable medical devices such as endoscopes. This presents companies with an opportunity to design more advanced and reliable disposable endoscopes that can help reduce the risk of transmission of infection.

Latest Trends

Growing Demand for Minimally Invasive Procedures the advantages of Disposable Endoscopes Over Traditional Reusable Devices are Some Recent Trends in the Disposable Endoscopes Market.

There has been an increasing trend towards minimally invasive surgeries due to their faster recovery times, shorter hospital stays, and fewer complications. This has driven demand for disposable endoscopes which are less invasive and can be utilized for various procedures. Disposable endoscopes offer several advantages over traditional reusable endoscopes, such as the reduced risk of infection, no need for cleaning and sterilization, and lower costs associated with maintenance and repair.

Globally, the prevalence of diseases such as cancer, gastrointestinal disorders, and respiratory ailments is rising; this has necessitated an increase in endoscopic procedures. Disposable endoscopes are often chosen due to their lower risk of infection when performing these operations. Disposable endoscope manufacturers are investing heavily in research and development to enhance the performance of their devices. For instance, there have been advances made with single-use endoscopes featuring high-resolution imaging capabilities. Disposable endoscopes are becoming more and more popular in hospitals and clinics due to their convenience and reduced risk of infections. This trend has had a beneficial effect on the disposable endoscope market as well.

Regional Analysis

North America Accounted for the Largest Revenue Share in the Disposable Endoscopes Market in 2022.

North America is estimated to be the most lucrative market in the global disposable endoscopes market, with the largest market share of 43.7% in 2022. North America has a rising prevalence of cancer and gastrointestinal disorders, and an increasing population is expected to drive the regional growth of the market. The high adoption of advanced technologies, the presence of developed infrastructure, and increasing awareness about minimally invasive surgeries.

Additionally, the presence of key market players like Boston Scientific, Olympus Corporation, and Ambu A/S contributed to the dominance of the region in the market. Favorable healthcare infrastructure also drives the regional growth of the market.

APAC is expected as the Fastest Growing Region in the Projected Period in the Disposable Endoscopes Market.

Asia Pacific is expected as the fastest-growing region in the disposable endoscopes market with a CAGR of 15.8%. Owing to the increasing prevalence of chronic diseases, growing awareness about the benefits of disposable endoscopes, and rising healthcare expenditures.

Additionally, the presence of a large patient pool, favorable government initiatives in healthcare infrastructure, and increasing demand for minimally invasive surgeries are some factors that drive the regional growth of the market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Major manufacturers are focusing on adopting key business strategies, like acquisition, collaboration, and new product releases to increase their product portfolio & hold a strong position in the market. For Instance, Ambu launched its 3 new disposable endoscopes, the Ambu aScope colonoscope, gastroscope, and duodeno in 2021.

Zsquare, which is an Israel-based endoscopy company has received USD 10 Mn for the development of a single-use endoscopic platform multiply in 2019. It comprises a single-use, high-resolution, ultrathin, and flexible endoscope which improves usability & facilitates access for unreserved indications during the diagnosis of common indications.

Market Key Players

- Boston Scientific Corporation

- Flexicare Medical Limited

- OBP Medical Corporation

- EndoTherapeutics, Inc.

- Optim LLC

- Dornier MedTech GmbH

- Advin Health Care

- Ambu A/S

- Braun Melsungen AG

- Hill-Rom Holdings, Inc.

- Other Key Players

Recent Developments

- In March 2022, Zsquare raised US$ 15 Mn in a financing round headed by private equity firm Chartered Group for launching its single-use ENT endoscope.

- In February 2022, The Ambu aScope Gastro & Ambu aBox 2 received 510(k) regulatory clearance in U.S. Ambu’s first sterile single-use gastroscope, the aScope Gastro, coupled cutting-edge display & processing technology with new sophisticated imaging features.

Report Scope

Report Features Description Market Value (2022) USD 1.9 Bn Forecast Revenue (2032) USD 8.9 Bn CAGR (2023-2032) 17.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Bronchoscopy, Urologic Endoscopy, ENT Endoscopy, Arthroscopy, Other Applications), By End-User (Hospitals, Diagnostic Centers, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Boston Scientific Corporation, Flexicare Medical Limited, OBP Medical Corporation, EndoTherapeutics, Inc., Optim LLC, Dornier MedTech GmbH, Advin Health Care, Ambu A/S, B. Braun Melsungen AG, Hill-Rom Holdings, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Disposable Endoscopes Market in 2032?In 2032, the Disposable Endoscopes Market will reach USD 8.9 billion.

What CAGR is projected for the Disposable Endoscopes Market?The Disposable Endoscopes Market is expected to grow at 17.2% CAGR (2023-2032).

Name the major industry players in the Disposable Endoscopes Market.Boston Scientific Corporation, Flexicare Medical Limited, OBP Medical Corporation, EndoTherapeutics, Inc., Optim LLC, Dornier MedTech GmbH, Advin Health Care and Other Key Players are the main vendors in this market.

List the segments encompassed in this report on the Disposable Endoscopes Market?Market.US has segmented the Disposable Endoscopes Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Application, market has been segmented into Bronchoscopy, Urologic Endoscopy, ENT Endoscopy, Arthroscopy and Other Applications. By End-User, the market has been further divided into, Hospitals, Diagnostic Centers and Other End-Users.

Disposable Endoscopes MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Disposable Endoscopes MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Boston Scientific Corporation

- Flexicare Medical Limited

- OBP Medical Corporation

- EndoTherapeutics, Inc.

- Optim LLC

- Dornier MedTech GmbH

- Advin Health Care

- Ambu A/S

- Braun Melsungen AG

- Hill-Rom Holdings, Inc.

- Other Key Players