Global Display Market Size, Share, Industry Analysis Report By Product (Smartphones & Tablets, Laptops & Monitors, Televisions, Smart Wearables, Automotive Displays, Instrument Cluster, Center Stack Display, HUDs, Digital Signage / Outdoor Displays, Gaming Consoles & Devices, Medical Devices, Industrial Equipment Displays, POS Terminals & ATMs, Military & Avionics Displays), By Display Technology (LCD (Liquid Crystal Display), OLED (Organic Light Emitting Diode), LED (Light Emitting Diode), QLED (Quantum Dot LED), e-Paper / E-Ink Displays, Projection Displays, Plasma Display Panels (PDP) (declining usage)), By Display Type (Flat Panel Display, Flexible Display, Transparent Display, 3D Display, Holographic Display (emerging)), By Industry Vertical (Consumer Electronics, Automotive, Healthcare, Retail, Education, Banking & Finance, Transportation, Media & Entertainment, Defense & Aerospace, Industrial & Manufacturing), By Region, Competition Scenario and Companies - Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158035

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- Government-led investments

- Emerging Trends

- Growth Factors

- APAC Market Size

- Product Analysis

- Display Technology Analysis

- Display Type Insights

- Industry Vertical Insights

- Driver

- Restraint

- Opportunity

- Challenge

- Intense Competition and Market Saturation

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

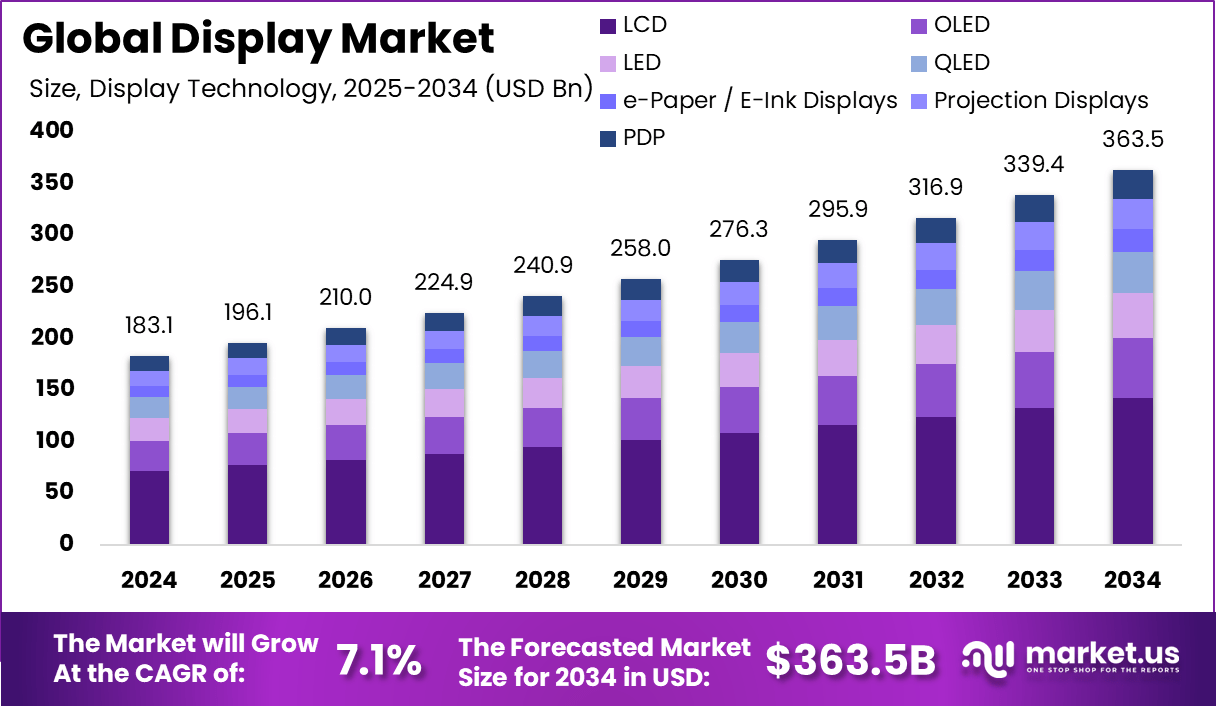

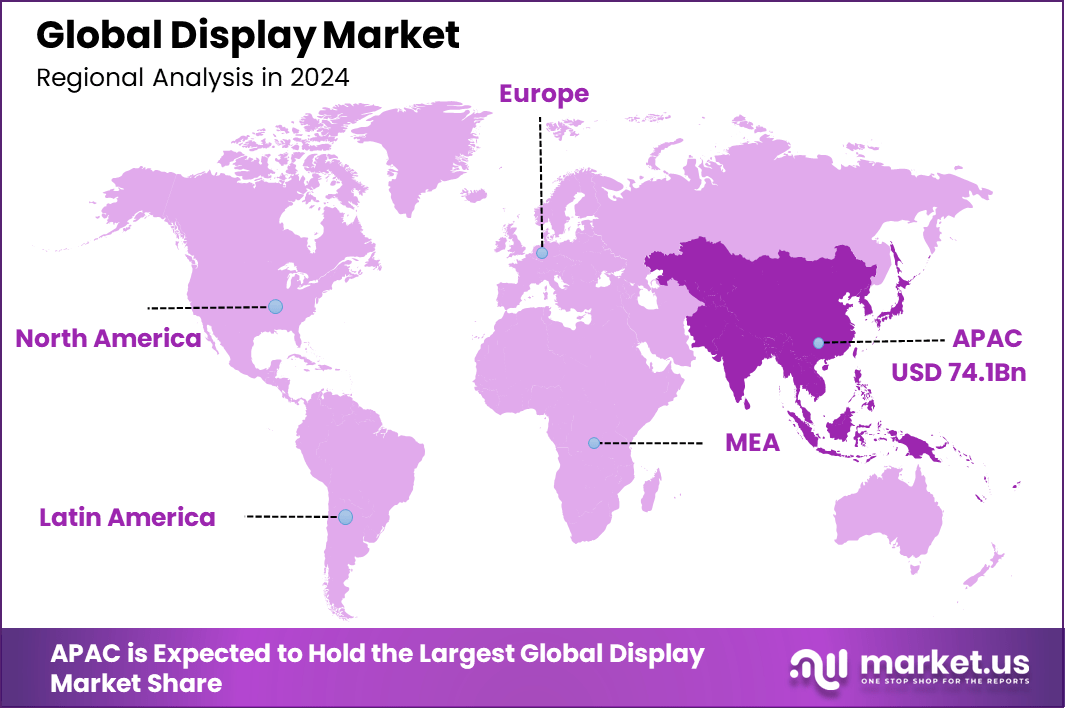

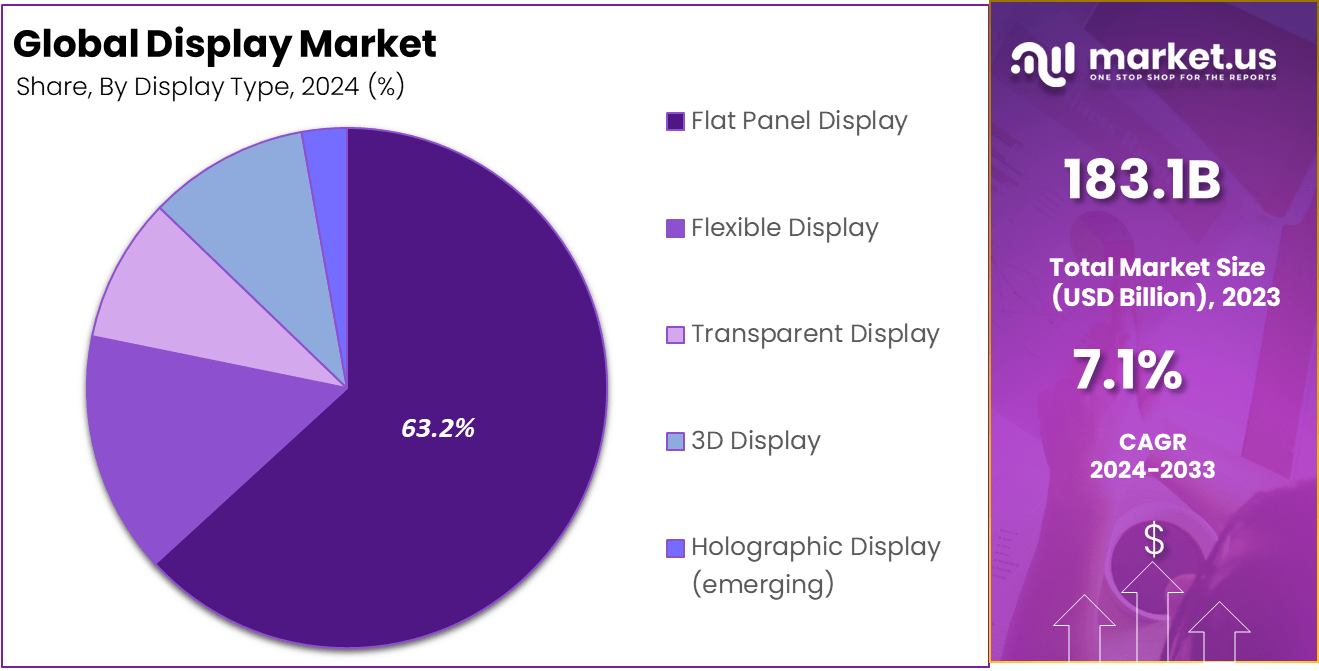

The Global Display Market size is expected to be worth around USD 363.5 Billion By 2034, from USD 183.1 billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 40.5% share, holding USD 74.15 Billion revenue.

The Display Market refers to the sector involved in the design, manufacturing, and sale of various types of visual display technologies. These displays are used in consumer electronics such as smartphones, televisions, and tablets, as well as in automotive dashboards, retail digital signage, healthcare devices, and industrial automation systems. The market includes technologies like OLED, LCD, microLED, and others that deliver visual output with varying resolutions and interactive capabilities.

Top driving factors in the Display Market include the growing demand for high-resolution screens that offer better image clarity and vibrant colors. Consumers and industries alike seek devices with improved visual experiences, which pushes manufacturers to innovate. Additionally, the rise of smart devices and digital signage, along with the increasing use of displays in automotive infotainment and healthcare, further fuels market growth by expanding usage scenarios.

Key Insight Summary

- By product, smartphones and tablets led the market in 2024, capturing 32.4% share.

- By technology, LCD (Liquid Crystal Display) dominated with a 39.2% share.

- By display type, flat panel displays held the top position with 63.2% share.

- By industry vertical, consumer electronics was the leading sector, accounting for 45.2% share.

Analysts’ Viewpoint

Increasing adoption technologies revolve around OLED, microLED, flexible displays, and AI-powered visual enhancements. These advanced technologies deliver better brightness, color accuracy, and lower power consumption. Buyers adopt these solutions primarily because of their superior image quality, energy savings, and the capability to support interactive and immersive experiences in consumer and professional contexts.

Investment opportunities arise from the continuous research and development in new display forms like foldable and rollable screens, ultra-thin panels, and sustainable, energy-efficient display manufacturing. Expansion in emerging markets and sectors like automotive, smart homes, and healthcare also present promising avenues for investor interest. Companies focusing on green production technologies and AI integration in displays are poised to benefit most from the evolving market.

Business benefits from investing in advanced display technologies include enhanced product differentiation, improved customer engagement through better visual quality, and energy cost savings. For manufacturers and end-users, smarter displays provide operational efficiency and the ability to offer tailor-made visual solutions suited to specific industry needs. These benefits translate into stronger market positioning and potential for revenue growth.

Role of Generative AI

Generative AI is playing a growing role in the display industry by enabling smarter and more creative content creation as well as improving manufacturing processes. It helps enhance user experience by powering AI-driven image processing, automatic color corrections, and adaptive brightness controls in displays.

Manufacturers are increasingly using generative AI not just for design and production optimization but also for innovating interactive and immersive visual content, which enriches consumer engagement. This intelligent automation is helping display companies enhance efficiency while delivering higher-quality images and dynamic visuals that adapt in real time to user environments.

The adoption of generative AI supported displays is gaining traction particularly in premium smartphones and PCs, where roughly 50% of devices are expected to feature local GenAI capabilities in 2025, driving differentiation and added value beyond volume sales.

Government-led investments

India has launched a major program worth ₹76,000 crore (over USD 10 billion) to strengthen domestic semiconductor and display manufacturing. The initiative covers fabs, advanced packaging, and related components, offering up to 50% financial aid for approved projects. By mid-2025, about ten projects had been cleared, signaling rapid progress toward building a local ecosystem.

The plan is backed by the Production Linked Incentive (PLI) Scheme, which provides 3% to 6% incentives on incremental sales of products made in India. This move is strategic, as displays represent nearly 25% of smartphone costs and up to 50% in televisions, making local production crucial for reducing reliance on imports.

Beyond manufacturing, the program is expected to create over 200,000 skilled jobs and deliver annual value addition of more than USD 11 billion within five years. With government commitments already exceeding ₹62,900 crore (USD 7 billion), India is positioning itself as a global hub for both innovation and production in the display sector.

Emerging Trends

Emerging trends in the display industry reflect a shift towards more immersive and flexible technologies. Transparent OLED displays are becoming more common, blending physical and digital worlds in ways that enable applications from augmented retail windows to automotive heads-up displays.

The use of microLED continues to advance towards mass production, offering better image quality and longevity at competitive prices. Interactive smart digital signage powered by AI and cloud content management is broadening use cases in retail, transportation, and public safety.

There is also rapid growth in immersive AR/VR displays and holographic projections that transform how people work, learn, and entertain themselves. Another notable trend is the push for energy-efficient and sustainable displays using low-power OLED, microLED, and e-paper technologies, aligning industry progress with growing environmental concerns.

Growth Factors

Growth factors in the display industry include rising consumer demand for high-resolution, flexible, and smart display devices. The increasing penetration of smartphones, automotive infotainment systems, and AR/VR applications drives the need for advanced display panels with features like high refresh rates, ultra-thin form factors, and AI-powered image optimization.

Advances in semiconductor design and quantum dot technology also contribute to better display quality and power efficiency. The industry gains momentum from expanding use across diverse sectors including healthcare, education, smart cities, and industrial automation.

However, growth remains tempered by challenges such as supply chain disruptions for key components and the high costs of developing sophisticated display technologies. Companies that innovate effectively in energy efficiency and immersive experiences are positioned to capture a significant share of the market’s progress.

APAC Market Size

In 2024, APAC held a dominant market position, capturing more than 40.5% share and generating USD 74.1 billion in revenue in the global display market. The region’s leadership is mainly driven by its strong manufacturing base, with countries like China, South Korea, Japan, and Taiwan leading in large-scale production of LCD, OLED, and emerging micro-LED technologies.

These countries not only supply displays to global markets but also benefit from strong domestic demand across consumer electronics, automotive, and smart devices. The widespread use of smartphones, televisions, and laptops in APAC has significantly boosted revenue, making it the largest contributor to global display sales.

The dominance of APAC is also reinforced by heavy investments in research and development by regional display manufacturers, who are continuously innovating with high-resolution, energy-efficient, and flexible displays. The region has become the hub for next-generation technologies such as foldable screens and transparent displays, further strengthening its leadership position.

Product Analysis

The smartphones and tablets segment held the largest share of 32.40% in the 2024 display market. These devices remain the key drivers of display demand globally due to the continuous rise in mobile device consumption and upgrades among consumers. The display panels used in smartphones and tablets are increasingly adopting advanced technologies like OLED and flexible displays, which offer better resolution, color accuracy, and energy efficiency.

The segment benefits from innovations in touch sensitivity and ultra-thin panels, meeting the demand for sleek, high-performance devices that support varied multimedia and application experiences. Growing consumer preferences for multi-functional mobile devices propel this segment’s dominance in the market.

The continual evolution in smartphone design, including foldable and bezel-less displays, further reinforces the demand for high-quality display panels in this product segment. Manufacturers are focusing on integrating next-generation display technologies to enhance visual experiences and battery life, which stimulates sales and replacement cycles.

Display Technology Analysis

LCD (Liquid Crystal Display) technology retained its leadership in the display technology segment in 2024 with a 39.20% market share. LCDs remain highly favored for their cost-effectiveness, mature manufacturing processes, and versatility across various applications including televisions, monitors, smartphones, and digital signage.

Despite emerging competitors like OLED and MicroLED, LCD technology continues to hold a large share due to its balance of performance, availability, and affordability. Key drivers for LCD’s prominence include widespread usage in consumer electronics and industrial applications where reliable, clear displays at controlled costs are essential.

Advances in LCD technology, such as improved backlighting and higher resolutions up to 8K, have ensured that LCDs remain competitive. However, the segment faces challenges from newer technologies that offer better contrast ratios and flexibility, indicating a competitive but stable position for LCDs in the display market.

Display Type Insights

Flat panel displays dominated the 2024 market with a commanding 63.2% share. These displays, characterized by their thin, light, and energy-efficient design, cover a broad spectrum of devices including monitors, televisions, laptops, and handheld gadgets.

The flat panel format is favored for its space-saving profile and ability to deliver sharp, vibrant images, making it ideal for consumer electronics and commercial applications. The flat panel display segment’s growth is spurred by advancements in OLED and LCD technology, enabling manufacturers to produce increasingly larger, more flexible, and higher-resolution screens.

The widespread adoption of touch-enabled flat panels in smartphones, tablets, and kiosks further bolsters this segment. Innovations such as ultra-thin bezels, curved edges, and foldable designs integrate into flat panel displays, driving consumer and enterprise adoption.

Industry Vertical Insights

Consumer electronics accounted for the largest vertical segment in the display market in 2024 with a 45.2% share. This vertical encompasses devices such as smartphones, tablets, televisions, laptops, and wearable gadgets where display quality directly impacts user experience.

Rising consumer demand for high-resolution, energy-efficient, and multifunctional devices fuels this segment’s growth. The consumer electronics industry benefits from the integration of innovative display technologies such as OLED, AMOLED, and flexible panels that enhance device performance and aesthetics.

Additionally, the demand for smart TVs, gaming monitors, and visual wearables is expanding rapidly, contributing to consistent growth in the display market. The sector’s large-scale production capacity and distribution network ensure sustained demand for display panels worldwide.

Driver

Growing Demand from Construction and Automotive Sectors

The expansion of the construction and automotive industries is a key driver fueling market growth in 2025. Rising urbanization and infrastructure projects worldwide have increased the need for efficient power tools and advanced technologies, especially in assembling and maintenance tasks.

The automotive sector’s shift toward electric vehicles further boosts demand for specialized tools to support new manufacturing and service protocols. This continuous increase in foundational industries creates steady market activity and growth momentum. Simultaneously, the DIY home improvement segment is gaining traction as consumers invest more in renovation projects.

This trend broadens the consumer base beyond professionals, amplifying demand for innovative, user-friendly products. Together, these dynamics ensure a robust market environment driven by practical needs across diverse sectors, confirming the strength of foundational industrial and consumer trends in 2025.

Restraint

Rising Costs Due to Tariffs and Supply Chain Disruptions

A significant restraint challenging markets in 2025 is the increased cost pressure from tariffs and supply chain disruptions. For example, tariffs on key raw materials like steel and synthetic fabrics have driven up production costs for various equipment categories. Manufacturers face elevated sourcing expenses that cascade through their supply chains, impacting pricing and profitability.

For instance, In February 2024, Apple decided to shut down its in-house efforts on micro-LED research for future smartwatches and specialized displays, a move that resulted in the loss of hundreds of jobs at its California facility. According to Bloomberg, the decision was shaped by the high technical complexity and the heavy cost burden of the program.

Additionally, volatility in global logistics prolongs delivery times and forces inventory adjustments, creating uncertainty. Businesses are pushed to negotiate volume commitments or invest in alternative in-house manufacturing to mitigate dependency on affected suppliers. These factors create a cost and operational dilemma that slows market expansion and requires strategic supply chain management.

Opportunity

Advances in Battery Technology and Emerging Markets

One of the most promising opportunities for growth comes from advancements in battery technology, particularly lithium-ion variants. These improvements are extending run times and shortening charge cycles for cordless power tools and other mobile devices, making them highly attractive to both professional and consumer markets.

Products that combine efficiency with environmental friendliness align well with consumer preferences, driving adoption. Furthermore, rapidly developing economies in the Asia Pacific region offer a growing base of industrial and DIY consumers.

Urbanization, rising middle-class incomes, and increasing industrial activity fuel higher demand for power tools and related equipment. Companies that customize offerings to suit local needs and pricing in these emerging markets can capture significant new revenue streams. This dual opportunity from tech innovation and expanding markets positions 2025 as a year of substantial commercial potential.

Challenge

Intense Competition and Market Saturation

A major challenge facing markets in 2025 is the high level of competition and product saturation. Numerous players offer similar products, which often leads to price wars and shrinking profit margins. Brands must constantly innovate to differentiate themselves and avoid being commoditized.

Counterfeit products also pose a threat, undermining brand reputation and consumer trust by flooding markets with low-quality imitations. To sustain growth, companies need robust innovation pipelines and strong brand protection measures. Navigating this crowded landscape requires strategic marketing, investment in R&D, and proactive quality control to maintain a competitive edge and long-term viability.

Key Market Segments

By Product

- Smartphones & Tablets

- Laptops & Monitors

- Televisions

- Smart Wearables

- Smartwatches

- Smart Glasses (AR/VR Headsets)

- Automotive Displays

- Instrument Cluster

- Center Stack Display

- HUDs

- Digital Signage / Outdoor Displays

- Gaming Consoles & Devices

- Medical Devices

- Industrial Equipment Displays

- POS Terminals & ATMs

- Military & Avionics Displays

By Display Technology

- LCD (Liquid Crystal Display)

- TFT LCD (Thin-Film Transistor)

- IPS LCD (In-Plane Switching)

- Others (TN, VA)

- OLED (Organic Light Emitting Diode)

- Passive Matrix OLED (PMOLED)

- Active Matrix OLED (AMOLED)

- LED (Light Emitting Diode)

- Micro-LED

- Mini-LED

- Edge-lit LED

- Direct-lit LED

- QLED (Quantum Dot LED)

- e-Paper / E-Ink Displays

- Projection Displays

- Plasma Display Panels (PDP) (declining usage)

By Display Type

- Flat Panel Display

- Flexible Display

- Transparent Display

- 3D Display

- Holographic Display (emerging)

By Industry Vertical

- Consumer Electronics

- Automotive

- Healthcare

- Retail

- Education

- Banking & Finance

- Transportation

- Media & Entertainment

- Defense & Aerospace

- Industrial & Manufacturing

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

In the global display market, Samsung, LG Display, Sharp Corporation, and Panasonic Corporation stand out as leading players. Their dominance is built on advanced display technologies, large production capacities, and global distribution networks. These companies supply LCD, OLED, and advanced flat-panel displays for consumer electronics, automotive, and industrial applications.

Asian manufacturers such as BOE Technology Group, Innolux Corporation, AU Optronics, Chi Mei Corporation, HannStar Display, and Chunghwa Picture Tubes play a critical role in shaping supply dynamics. With large-scale manufacturing bases in Taiwan and China, they offer cost-effective solutions while driving global adoption of flat-panel technologies.

European and Japanese companies including Barco, Siemens, Mitsubishi Electric, Fujitsu, and Sony contribute through premium and specialized display solutions. They focus on applications in professional environments, industrial automation, automotive, and medical systems. Firms such as Advantech and Schneider Electric strengthen the market with industrial-grade displays and integrated systems.

Display Market Companies

- Chi Mei Corporation. (Taiwan)

- SAMSUNG (South Korea)

- SHARP CORPORATION (Japan)

- Schneider Electric (France)

- Siemens (Germany)

- Panasonic Corporation (Japan)

- LG Display Co., Ltd (South Korea)

- HannStar Display Corporation (Taiwan)

- AU Optronics Corp. (Taiwan)

- Mitsubishi Electric Corporation (Japan)

- SONY INDIA. (India)

- FUJITSU (Japan)

- Chunghwa Picture Tubes, LTD. (Taiwan)

- Barco.(Belgium)

- BOE Technology Group Co., Ltd. (China)

- Innolux Corporation (Taiwan)

- Advantech Co., Ltd (Taiwan)

Recent Developments

- In June 2024, LG Display began mass production of the industry’s first 13-inch Tandem OLED panel for laptops, offering double the lifespan, triple the brightness, and 40% lower power consumption than standard OLEDs. The panel is thinner, lighter, and optimized for high-performance IT devices, including AI-driven laptops.

- In May 2024, LG Display showcased its innovations at SID Display Week, presenting OLEDoS for VR with ultra-high brightness, the first 480 Hz OLED gaming panel, and 83-inch OLED TVs with META Technology 2.0. Transparent OLEDs, glassless 3D, and advanced automotive displays further emphasized the company’s leadership.

- In April 2024, CARUX and Innolux expanded their collaboration in the Smart Cockpit ecosystem, focusing on versatile, energy-saving automotive components. The move aims to secure a stronger position in the intelligent vehicle market with innovative display applications.

- In February 2024, Innolux and Vedanta invested USD 3-4 billion to begin LCD mass production in India. This initiative supports India’s policy objectives of meeting domestic demand, reducing imports, and driving export opportunities in the display sector.

- In January 2024, BOE celebrated its 30th anniversary at CES with over 50 new consumer electronics products developed with global brands. Its Automotive Ultra Large-Size Oxide Cockpit won the 2023–2024 Innovative Display Product Gold Award, strengthening its “Empowering IoT with Display” strategy.

- In January 2024, Sharp Corporation introduced its most advanced interactive AQUOS BOARD series, designed to deliver top-level performance, security, and durability for enterprise customers seeking reliable display solutions.

Report Scope

Report Features Description Market Value (2024) USD 183.1 Bn Forecast Revenue (2034) USD 363.5 Bn CAGR(2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Smartphones & Tablets, Laptops & Monitors, Televisions, Smart Wearables, Automotive Displays, Instrument Cluster, Center Stack Display, HUDs, Digital Signage / Outdoor Displays, Gaming Consoles & Devices, Medical Devices, Industrial Equipment Displays, POS Terminals & ATMs, Military & Avionics Displays), By Display Technology (LCD (Liquid Crystal Display), OLED (Organic Light Emitting Diode), LED (Light Emitting Diode), QLED (Quantum Dot LED), e-Paper / E-Ink Displays, Projection Displays, Plasma Display Panels (PDP) (declining usage)), By Display Type (Flat Panel Display, Flexible Display, Transparent Display, 3D Display, Holographic Display (emerging)), By Industry Vertical (Consumer Electronics, Automotive, Healthcare, Retail, Education, Banking & Finance, Transportation, Media & Entertainment, Defense & Aerospace, Industrial & Manufacturing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Display Market Companies, Panasonic Corporation (Japan), LG Display Co., Ltd (South Korea), HannStar Display Corporation (Taiwan), AU Optronics Corp. (Taiwan), Chi Mei Corporation. (Taiwan), SAMSUNG (South Korea), SHARP CORPORATION (Japan), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric Corporation (Japan), SONY INDIA. (India), FUJITSU (Japan), Chunghwa Picture Tubes, LTD. (Taiwan), Barco.(Belgium), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan), Advantech Co., Ltd (Taiwan) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chi Mei Corporation. (Taiwan)

- SAMSUNG (South Korea)

- SHARP CORPORATION (Japan)

- Schneider Electric (France)

- Siemens (Germany)

- Panasonic Corporation (Japan)

- LG Display Co., Ltd (South Korea)

- HannStar Display Corporation (Taiwan)

- AU Optronics Corp. (Taiwan)

- Mitsubishi Electric Corporation (Japan)

- SONY INDIA. (India)

- FUJITSU (Japan)

- Chunghwa Picture Tubes, LTD. (Taiwan)

- Barco.(Belgium)

- BOE Technology Group Co., Ltd. (China)

- Innolux Corporation (Taiwan)

- Advantech Co., Ltd (Taiwan)