Global Disconnect Switches Market Size, Share, Growth Analysis By Product (Non-Fused, Fused), By Mounting (Panel Mounted, DIN Rail Mounted, Others), By Voltage (Upto 1 kV, 1 kV to 15 kV, Above 15 kV), By Current Rating (Below 200 A, 200 - 500 A, Above 500A), By Pole Type (1-Pole, 2-Pole, 3-Pole, 4-Pole & Above), By Switch Type (Rotary Disconnect Switches, Toggle Disconnect Switches, Others), By Applications (Residential, Commercial, Industrial, Automotive, Food & Beverage, Oil & Gas, Water/Wastewater, Paper & Packaging, Mining, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 152181

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

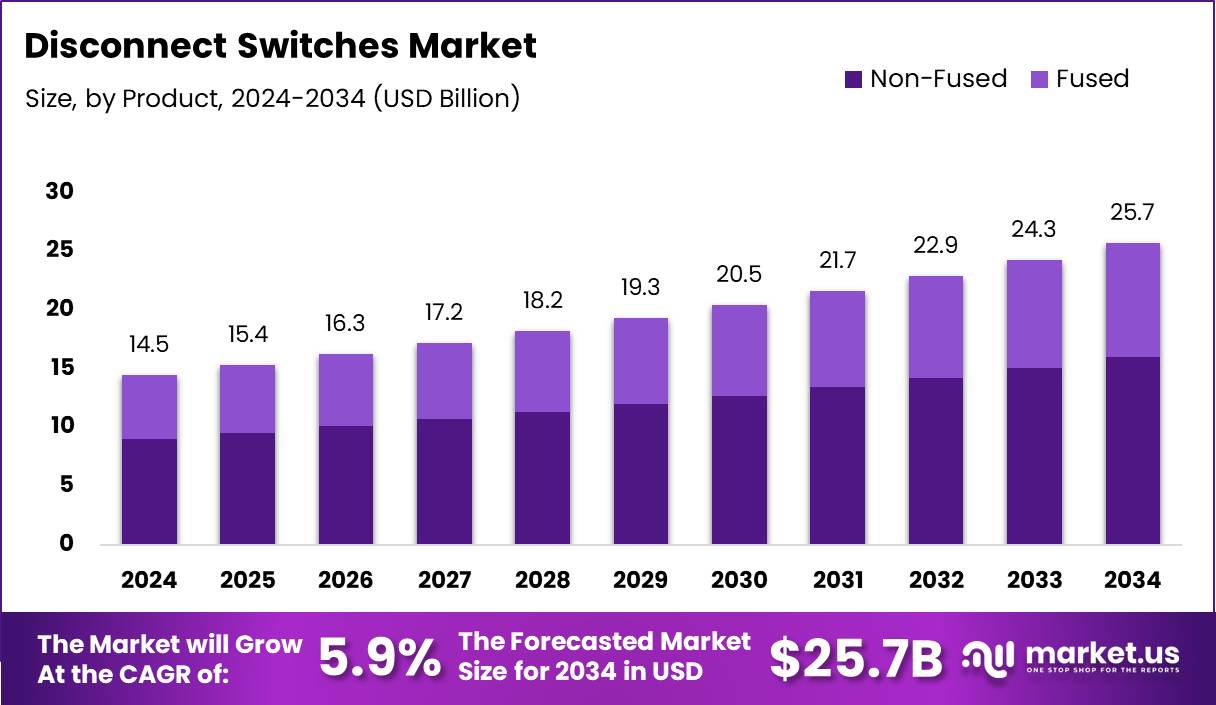

The Global Disconnect Switches Market size is expected to be worth around USD 25.7 Billion by 2034, from USD 14.5 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The disconnect switches market refers to the industry that designs, manufactures, and distributes switches used to isolate electrical circuits. These switches are crucial in ensuring safety during maintenance, repairs, and emergency shutdowns. They are commonly used across residential, commercial, industrial, and utility sectors, supporting uninterrupted energy operations.

Disconnect switches play a vital role in modern power systems. Their ability to safely disconnect electrical equipment from the power source minimizes risks and operational hazards. As industries continue to prioritize safety and compliance, demand for advanced, compact, and automated disconnect switches is steadily rising across global markets.

The disconnect switches market is experiencing consistent growth due to increased demand for reliable power distribution. Rapid urbanization and industrial expansion across developing regions are propelling the need for robust grid infrastructure.

Governments worldwide are investing heavily in grid modernization projects. For example, initiatives focused on renewable integration and smart grids are boosting installations of disconnect switches. Policy frameworks in North America and Europe have allocated billions in energy infrastructure upgrades, opening avenues for manufacturers to expand.

Regulatory compliance is another major driver. Safety regulations such as OSHA and IEC standards are pushing utilities and factories to adopt certified disconnection systems. This regulatory pressure ensures high-quality installations, increasing demand for advanced switchgear with improved monitoring and control.

Emerging economies like India, Brazil, and Southeast Asia present significant growth opportunities. Rapid industrialization, coupled with rising electricity access targets, is increasing the adoption of switchgear solutions.

Digital transformation in the energy sector is creating demand for intelligent disconnect switches. The integration of IoT and automation in switchgear is enabling remote operation and fault detection, reducing downtime and enhancing system efficiency. This is attracting utility-scale investments.

In commercial spaces, disconnect switches are being adopted widely in HVAC relay systems and backup generators. The rising number of data centers, retail buildings, and hospitals is creating a growing requirement for safe electrical isolation systems, especially in compliance-heavy industries.

Furthermore, sustainability trends are influencing switch design. Manufacturers are investing in eco-friendly and recyclable materials to align with ESG goals. This not only supports regulatory compliance but also attracts environmentally conscious customers and investors.

Key Takeaways

- The Global Disconnect Switches Market is projected to reach USD 25.7 Billion by 2034, up from USD 14.5 Billion in 2024, growing at a CAGR of 5.9% from 2025 to 2034.

- In 2024, Non-Fused disconnect switches dominated the product segment with a 62.1% market share due to their cost-effectiveness and simple design.

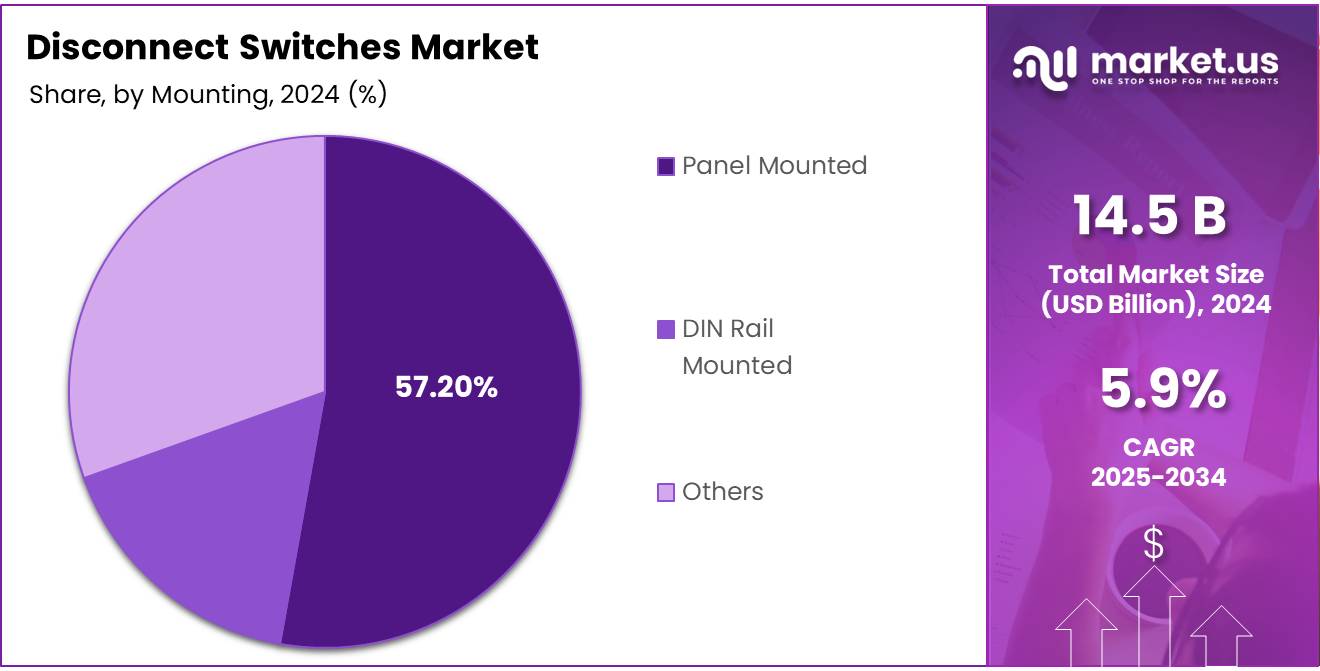

- Panel Mounted disconnect switches led the mounting segment in 2024 with a 57.2% share, driven by ease of integration and installation.

- Disconnect switches rated Upto 1 kV held a dominant 52.2% market share in the voltage segment in 2024, favored for low-voltage applications.

- The Below 200 A current rating segment led with a 46.2% market share in 2024, due to affordability and compatibility with standard circuits.

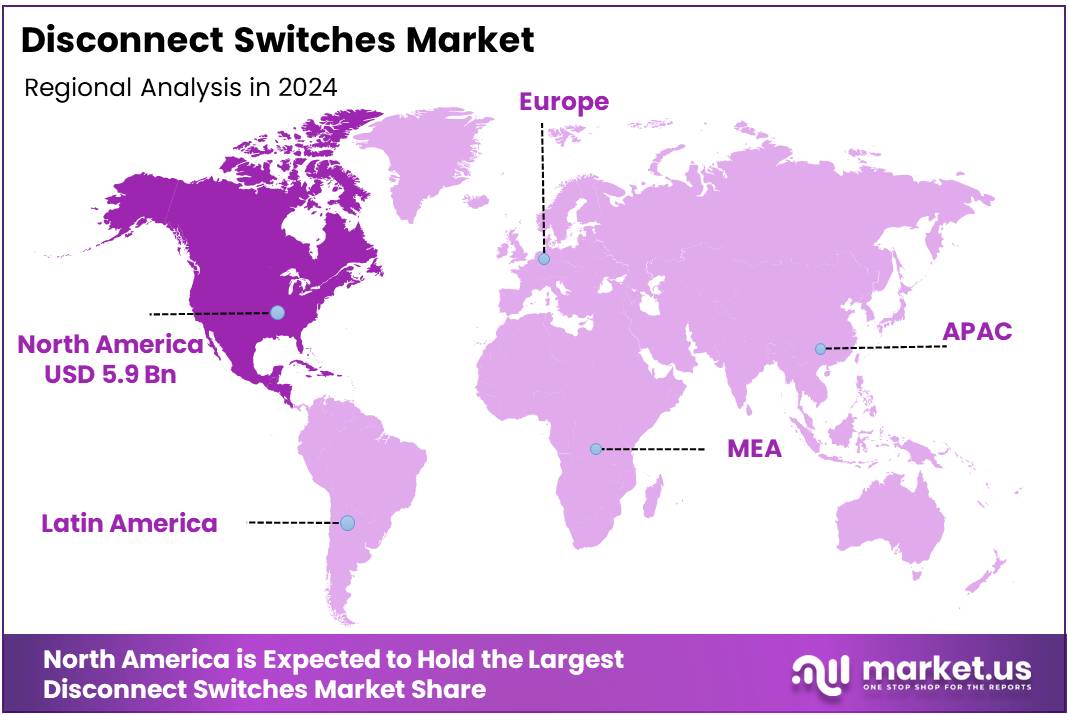

- North America held the largest regional market share in 2024 at 41.1%, valued at USD 5.9 Billion, supported by smart grid investments and industrial safety focus.

Product Analysis

Non-Fused dominates with 62.1% due to its lower maintenance and compact design benefits.

In 2024, Non-Fused held a dominant market position in the By Product Analysis segment of the Disconnect Switches Market, with a 62.1% share. This segment leads primarily because Non-Fused disconnect switches offer simplicity in design and cost-effectiveness, making them ideal for general-purpose applications. Their compact size and straightforward functionality reduce space requirements and installation complexity, which resonates strongly with industrial users prioritizing operational efficiency.

Fused disconnect switches, while slightly more complex, are preferred for applications where fault protection is critical. They integrate a fuse mechanism that provides added safety by interrupting excessive current flow. Although they accounted for a smaller share of the market, Fused switches are valued in settings where protection against short circuits is a top priority.

Growing emphasis on system reliability and cost optimization in power distribution and manufacturing sectors continues to drive demand for Non-Fused switches. Their lower replacement and maintenance costs make them an attractive long-term solution. As industries increasingly move toward compact and economical electrical solutions, Non-Fused options are expected to maintain their edge in this segment over the coming years.

Mounting Analysis

Panel Mounted dominates with 57.2% due to its compatibility with a wide range of control panels.

In 2024, Panel Mounted held a dominant market position in the By Mounting Analysis segment of the Disconnect Switches Market, with a 57.2% share. Panel-mounted disconnect switches are extensively used across industries due to their seamless integration into existing electrical control systems. Their versatility and ease of installation make them highly desirable for OEMs and system integrators.

DIN Rail Mounted switches represent another significant segment, often utilized in compact enclosures where space optimization is critical. These are especially common in modular systems and applications requiring quick maintenance and easy replacement.

The Others segment includes less conventional mounting methods that cater to niche or customized installations. While this category accounts for a smaller portion of the market, it plays a key role in highly specialized environments where traditional mounting solutions may not be viable.

Panel Mounted switches continue to dominate due to their robust build and adaptability. Their widespread usage in industrial, commercial, and residential sectors positions them strongly in the mounting segment, with market trends indicating continued preference for this form factor.

Voltage Analysis

Upto 1 kV dominates with 52.2% due to its suitability for residential and low-voltage industrial use.

In 2024, Upto 1 kV held a dominant market position in the By Voltage Analysis segment of the Disconnect Switches Market, with a 52.2% share. This voltage category is favored in low-voltage applications such as building distribution networks and smaller industrial setups, where reliability and cost-efficiency are essential.

Disconnect switches rated 1 kV to 15 kV serve medium-voltage environments, typically found in utilities and heavy industries. While critical for power distribution networks and substations, this range sees more limited adoption due to the specialized equipment and higher installation costs involved.

The Above 15 kV segment is tailored to high-voltage transmission and large-scale industrial systems. Although it occupies a smaller market share, this category is vital for applications requiring high energy throughput and stringent safety measures.

Overall, the Upto 1 kV category leads due to its applicability in the majority of commercial and residential settings, combined with a lower total cost of ownership. As the demand for decentralized and smaller-scale energy systems grows, this segment is expected to sustain its market dominance.

Current Rating Analysis

Below 200 A dominates with 46.2% due to its widespread use in standard industrial and commercial circuits.

In 2024, Below 200 A held a dominant market position in the By Current Rating Analysis segment of the Disconnect Switches Market, with a 46.2% share. These disconnect switches are commonly used in standard applications across manufacturing plants, commercial buildings, and residential power setups. Their affordability and compatibility with commonly used electrical circuits drive this segment’s success.

Switches rated between 200 – 500 A are preferred in environments requiring moderate current handling, such as processing units or medium-sized industrial operations. They offer a balance between performance and cost but are less prevalent compared to the lower current category.

Above 500 A switches cater to high-current industrial and utility-grade installations. While they serve essential roles in energy-intensive operations, the limited number of such applications results in a smaller market footprint.

The Below 200 A category continues to lead due to its flexibility, lower installation complexity, and broad applicability across diverse sectors. As industries focus on energy efficiency and operational scalability, this segment is likely to retain its market leadership.

Key Market Segments

By Product

- Non-Fused

- Fused

By Mounting

- Panel Mounted

- DIN Rail Mounted

- Others

By Voltage

- Upto 1 kV

- 1 kV to 15 kV

- Above 15 kV

By Current Rating

- Below 200 A

- 200 – 500 A

- Above 500A

By Pole Type

- 1-Pole

- 2-Pole

- 3-Pole

- 4-Pole & Above

By Switch Type

- Rotary Disconnect Switches

- Toggle Disconnect Switches

- Others

By Applications

- Residential

- Commercial

- Industrial

- Automotive

- Food & Beverage

- Oil & Gas

- Water/Wastewater

- Paper & Packaging

- Mining

- Manufacturing

- Others

Drivers

Rising Focus on Workplace Electrical Safety Regulations Drives Market Growth

A growing focus on workplace electrical safety is significantly driving the demand for disconnect switches. As industries follow stricter safety norms, disconnect switches are becoming essential for preventing electrical hazards. This is especially true in sectors like manufacturing and construction, where safety compliance is tightly regulated.

The integration of smart grids and advanced energy management systems is another key driver for market growth. These technologies rely on reliable electrical components, including disconnect switches, to improve energy efficiency and ensure system stability. This shift supports the development of intelligent and secure power distribution infrastructure.

Additionally, the expansion of data center infrastructure globally is increasing the need for dependable electrical protection devices. Disconnect switches help maintain uptime by allowing safe isolation during maintenance, making them vital components in large-scale data facilities.

Overall, the disconnect switches market is expected to grow steadily due to their critical role in supporting electrical safety, smart energy solutions, and data infrastructure.

Restraints

Complexity in Retrofitting Existing Electrical Systems Limits Market Expansion

One major restraint for the disconnect switches market is the challenge of upgrading old electrical systems. Retrofitting these systems with modern disconnect switches often requires significant redesign and high costs, making it a less attractive option for facility managers.

In underdeveloped regions, limited awareness about the importance of electrical safety and disconnect switches also slows market adoption. Without proper education or promotion, the demand in these areas remains low despite growing electrification.

Moreover, the market is highly influenced by raw material prices. Components like copper, aluminum, and steel fluctuate in cost, affecting manufacturing expenses and overall product pricing. This volatility can limit profitability and market stability, particularly for smaller manufacturers.

These factors collectively hinder consistent market growth, even as demand increases in certain industrial sectors.

Growth Factors

Expansion of Renewable Energy Projects Globally Offers Market Opportunities

The global shift toward renewable energy projects, such as solar and wind, presents promising opportunities for the disconnect switches market. These installations require reliable disconnection devices to ensure safe maintenance and grid isolation, increasing the need for advanced switch solutions.

There’s also rising interest in modular switchgear solutions, which allow flexible and space-saving configurations. Modular designs are easy to install, maintain, and upgrade, which appeals to utility providers and large industrial users seeking scalable systems.

Electrification in remote and rural regions is another major opportunity. Governments and NGOs are working to expand electricity access, and disconnect switches are a crucial part of these installations for ensuring safety and reliability. This trend is expected to boost demand in developing countries.

Together, these factors open new paths for growth by aligning disconnect switch solutions with global energy and infrastructure trends.

Emerging Trends

Adoption of IoT-Enabled Disconnect Switches Boosts Market Innovation

One of the most notable trends in the disconnect switches market is the adoption of IoT-enabled devices. These smart switches allow real-time monitoring and remote operation, improving system reliability and reducing maintenance costs for industries and utilities.

There’s also a strong shift toward using environmentally friendly components that comply with RoHS (Restriction of Hazardous Substances) standards. Manufacturers are responding to regulatory and customer demands by developing safer, eco-conscious disconnect switches, which helps strengthen their market presence.

Customization is another rising trend. Customers are looking for configurable disconnect switch solutions that meet specific needs for voltage, size, and functionality. This demand for tailored products is encouraging innovation and expanding application areas across different industries.

These trends show how the disconnect switches market is evolving to meet modern industrial needs while promoting sustainability and smart operations.

Regional Analysis

North America Dominates the Disconnect Switches Market with a Market Share of 41.1%, Valued at USD 5.9 Billion

North America holds the largest share in the global disconnect switches market, accounting for a commanding 41.1% of the overall industry and valued at USD 5.9 Billion. The region’s dominance is driven by the widespread modernization of electrical infrastructure, a strong focus on industrial safety regulations, and increased investments in smart grid technology. The presence of a mature manufacturing and utility sector further contributes to the growing adoption of advanced disconnect switch solutions.

Europe Disconnect Switches Market Trends

Europe continues to exhibit stable growth in the disconnect switches market, fueled by ongoing industrial automation and stringent energy efficiency norms across the region. The emphasis on renewable energy integration and upgradation of legacy power systems is prompting higher demand for reliable switchgear components. In addition, supportive government initiatives around electrical safety and infrastructure resilience contribute to market expansion.

Asia Pacific Disconnect Switches Market Trends

The Asia Pacific region is witnessing accelerated growth in the disconnect switches market due to rapid industrialization, expanding urban infrastructure, and increasing electricity demand across emerging economies. Rising investments in manufacturing and energy sectors, especially in countries like China and India, are bolstering the need for efficient and safe electrical components. The region is also benefitting from expanding construction and utility projects.

Middle East and Africa Disconnect Switches Market Trends

In the Middle East and Africa, the disconnect switches market is gaining traction due to infrastructural development and growing focus on enhancing electrical safety standards. With increasing energy projects and grid modernization initiatives, the demand for disconnect switches is gradually rising. The region’s emphasis on oil, gas, and utility sectors also drives steady adoption of switchgear solutions.

Latin America Disconnect Switches Market Trends

Latin America’s disconnect switches market is progressing steadily, supported by improvements in energy infrastructure and industrial activities. Countries in the region are investing in modernizing electrical grids and adopting safer switching mechanisms to reduce downtime and electrical hazards. Economic recovery and development of the renewable energy sector are also expected to support market growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Disconnect Switches Company Insights

In 2024, the global Disconnect Switches Market continues to evolve with increased emphasis on grid modernization, renewable integration, and industrial safety. Among the key players, ABB stands out for its expansive global presence and robust portfolio of medium and high-voltage disconnect switches, which are crucial in substations and industrial automation. The company’s innovation in energy-efficient technologies further strengthens its market leadership.

Altech Corporation, though smaller in scale, maintains a competitive edge through its focus on high-quality, compact disconnect switches ideal for control panels and machine applications. Its niche approach appeals to OEMs and system integrators across North America.

B&J-USA Inc. brings a strong reputation for dependable and rugged switching devices, catering primarily to utility and power distribution sectors. Its steady performance is driven by consistent product reliability and customer-focused engineering.

Eaton, a major player, leverages its diversified electrical portfolio to offer advanced disconnect solutions with integrated safety features. The company’s emphasis on smart, connected devices aligns with industry shifts toward digitalization and predictive maintenance.

These companies play critical roles in shaping the disconnect switches landscape, responding to growing demand across industrial, commercial, and utility segments. With increasing global infrastructure investments and energy transition goals, competition is expected to intensify, particularly in delivering intelligent, compact, and environmentally compliant switchgear solutions. Players investing in R&D, sustainability, and IoT-enabled features will likely gain a competitive edge as end-users demand both operational efficiency and enhanced safety in power distribution systems.

Top Key Players in the Market

- ABB

- Altech Corporation

- B&J-USA Inc.

- Eaton

- Emerson Electric

- EMSPEC

- General Electric

- Havells India Ltd

- Honeywell International Inc.

- Hubbell

- MERSEN

- Orient Electric International Group Limited

- Richards Manufacturing Co.

- Rittal LLC

- Rockwell Automation

- Sälzer Electric GmbH

- Schneider Electric SE

- SDCEM

- Siemens AG

- WEG

- WENZHOU SHU GUANG FUSE CO., LTD.

Recent Developments

- In Apr 2025, Sécheron acquired LoPro high-voltage circuit breaker technology from TE Connectivity. This acquisition strengthens Sécheron’s portfolio in high-voltage rail and industrial protection systems.

- In Feb 2024, The Pioneer Safety Group acquired Petrel Limited, a UK-based manufacturer of explosion-proof lighting solutions. This move enhances Pioneer’s capabilities in hazardous area safety and lighting innovation.

- In Oct 2024, Power Grid Components acquired Vizimax, a leading supplier of electronic devices for grid protection. The acquisition supports Power Grid’s mission to modernize infrastructure and extend equipment lifespan.

- In Nov 2024, TE Connectivity acquired Harger, an American leader in lightning protection and grounding solutions for IEEE standards. This strategic move expands TE’s presence in critical electrical protection markets.

Report Scope

Report Features Description Market Value (2024) USD 14.5 Billion Forecast Revenue (2034) USD 25.7 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Non-Fused, Fused), By Mounting (Panel Mounted, DIN Rail Mounted, Others), By Voltage (Upto 1 kV, 1 kV to 15 kV, Above 15 kV), By Current Rating (Below 200 A, 200 – 500 A, Above 500A), By Pole Type (1-Pole, 2-Pole, 3-Pole, 4-Pole & Above), By Switch Type (Rotary Disconnect Switches, Toggle Disconnect Switches, Others), By Applications (Residential, Commercial, Industrial, Automotive, Food & Beverage, Oil & Gas, Water/Wastewater, Paper & Packaging, Mining, Manufacturing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB, Altech Corporation, B&J-USA Inc., Eaton, Emerson Electric, EMSPEC, General Electric, Havells India Ltd, Honeywell International Inc., Hubbell, MERSEN, Orient Electric International Group Limited, Richards Manufacturing Co., Rittal LLC, Rockwell Automation, Sälzer Electric GmbH, Schneider Electric SE, SDCEM, Siemens AG, WEG, WENZHOU SHU GUANG FUSE CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Altech Corporation

- B&J-USA Inc.

- Eaton

- Emerson Electric

- EMSPEC

- General Electric

- Havells India Ltd

- Honeywell International Inc.

- Hubbell

- MERSEN

- Orient Electric International Group Limited

- Richards Manufacturing Co.

- Rittal LLC

- Rockwell Automation

- Sälzer Electric GmbH

- Schneider Electric SE

- SDCEM

- Siemens AG

- WEG

- WENZHOU SHU GUANG FUSE CO., LTD.