Global Disability Insurance Market Size, Share, Industry Analysis Report By Type (Short-Term Disability Insurance (STD), Long-Term Disability Insurance (LTD)), By Coverage (Individual Disability Insurance, Group Disability Insurance, Government Disability Insurance), By Distribution Channel (Brokers/Agents, Direct Sales (Insurer-Owned Platforms), Bancassurance, Online Aggregators/InsurTech Platforms), By End-User (Government, Enterprise, Individual), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156625

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- U.S. Disability Insurance Market Size

- Emerging Trends

- Growth Factors

- Type Analysis

- Coverage Analysis

- Distribution Channel Analysis

- End-User Segment Analysis

- Top 5 Use Cases

- Customer Insights

- Key Market Segments

- Driver Factor

- Restraint Factor

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

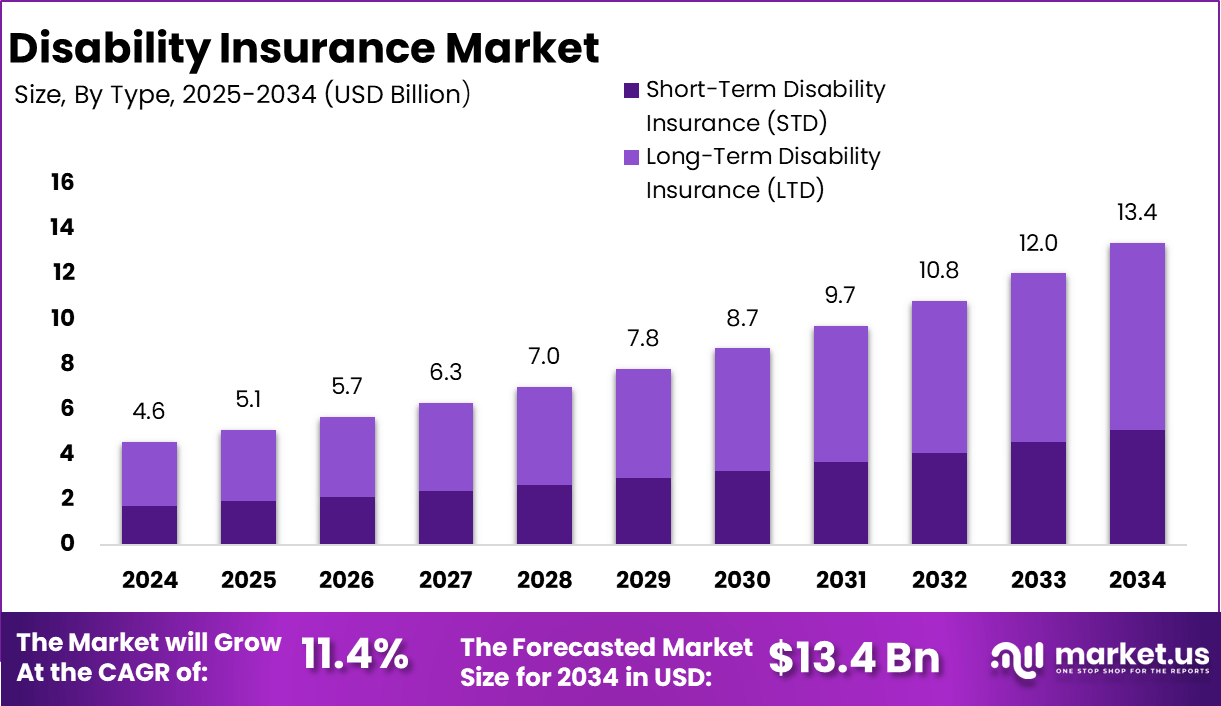

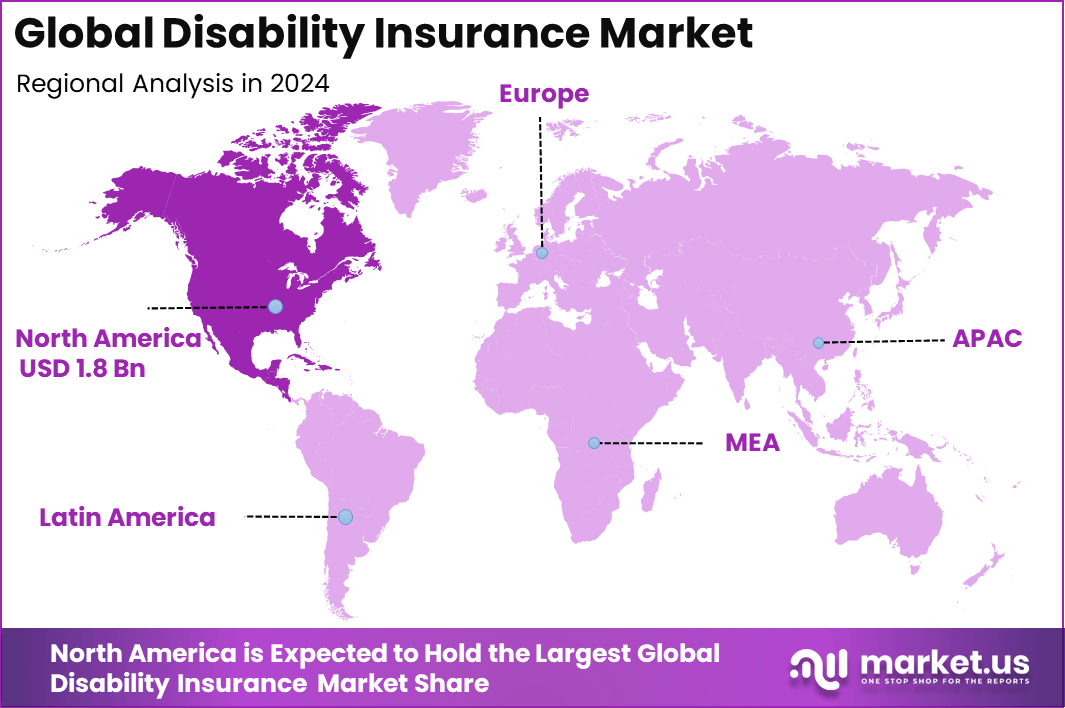

The Global Disability Insurance Market size is expected to be worth around USD 13.4 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.7% share, holding USD 1.8 Billion revenue.

Disability insurance is a financial protection product designed to provide income replacement to individuals who are unable to work due to a disability caused by illness, injury, or accident. It helps policyholders cover living expenses and medical costs when their ability to earn an income is compromised. This insurance can be offered as individual policies or as employer-sponsored plans, catering to various needs across different sectors and demographics.

The top driving factors of the disability insurance market include an aging global population, the increasing prevalence of chronic illnesses, and growing awareness of the financial implications of disability. Governments supporting favorable regulatory frameworks and social security benefits also substantially propel market growth. Additionally, economic shifts such as rising healthcare costs, more freelance and gig economy workers demanding coverage, and increasing mental health disability claims further accelerate demand.

Based on data from Student Loan Planner, more than 70 million adults in the United States live with a disability, and about 25% of today’s 20-year-olds are expected to experience a disability before reaching retirement age. Despite this reality, financial protection remains limited, as nearly 51 million working adults lack disability insurance beyond Social Security benefits, and about 65% of the private sector has no long-term disability insurance coverage.

According to the 2024 Insurance Barometer Study, the absence of coverage leaves many families financially vulnerable. Nearly 48% of consumers without disability insurance reported they would rely on personal savings, while 26% said they would turn to retirement funds to manage daily expenses if the primary wage earner became disabled. These findings highlight the significant financial risks families face without proper coverage.

Key Takeaway

- In 2024, the Long-Term Disability Insurance (LTD) segment dominated with a 62.2% share, reflecting its importance for income protection over extended periods.

- The Group Disability Insurance segment captured a 40.2% share, showing the preference for employer-sponsored coverage models.

- The Brokers/Agents distribution channel held a 35.7% share, emphasizing their role in connecting insurers with customers.

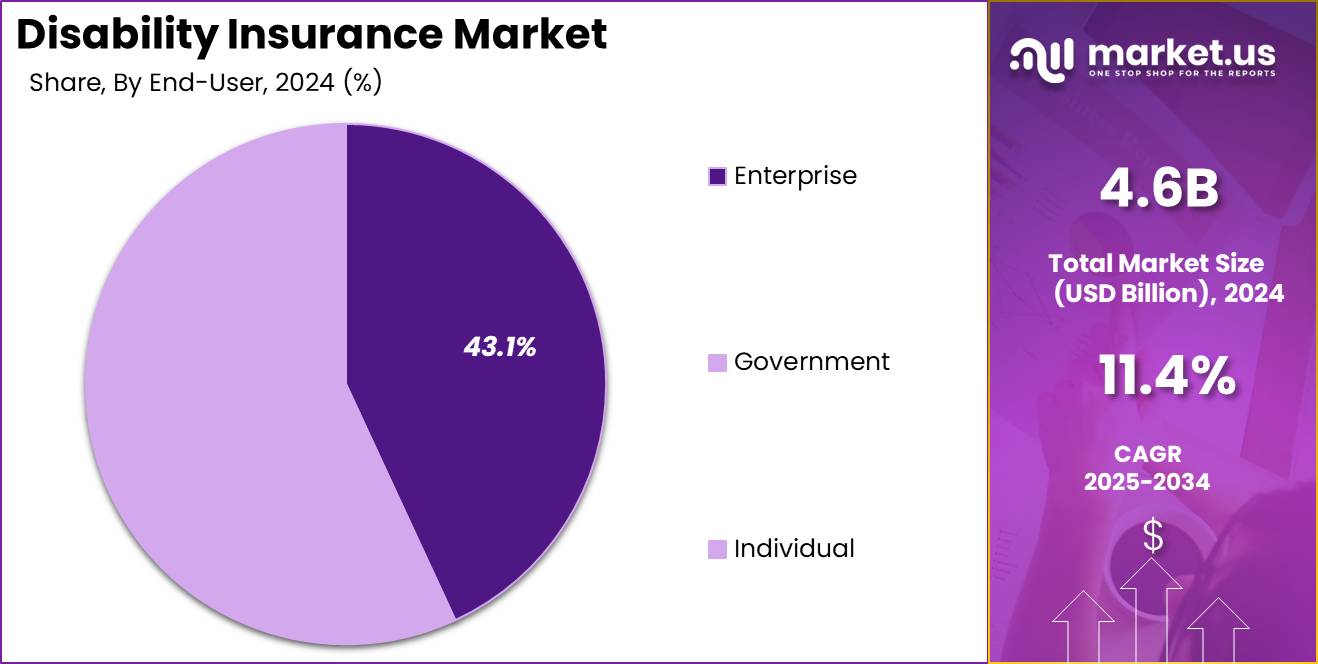

- The Enterprise segment led with a 43.1% share, driven by large-scale workforce coverage and corporate adoption.

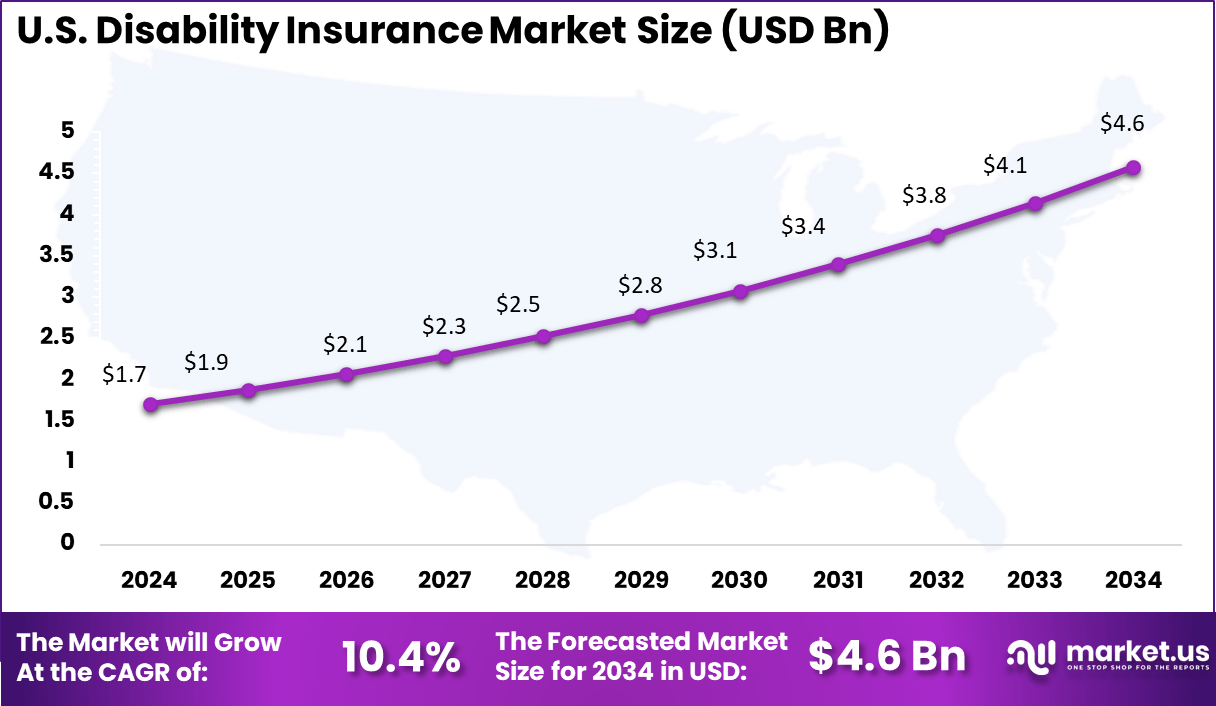

- The U.S. Disability Insurance Market was valued at USD 1.7 Billion in 2024, with a strong projected CAGR of 10.4%.

- North America dominated regionally, securing around 38.7% share of the global market in 2024.

Analysts’ Viewpoint

Investment opportunities within the disability insurance market stem from the growing need for personalized insurance products, expansion in emerging markets, and the integration of AI and data analytics. There is increasing demand for insurance plans covering mental health issues and for flexible policies fitting diverse lifestyles. Investors can also benefit from supporting companies implementing inclusive hiring practices and offering disability-friendly products and services.

The disability inclusion movement creates social impact and financial value, attracting ESG-focused investment aligned with sustainability and social equity goals. Business benefits of disability insurance adoption include a broader and more diverse talent pool, reduced employee turnover, increased productivity, and improved company reputation.

Employers that provide disability coverage can attract and retain skilled workers, especially among younger generations who value inclusive benefits. Disability inclusion policies have been shown to increase innovation and employee engagement, contributing positively to organizational success. Moreover, disability insurance helps organizations manage financial risks related to workforce incapacity, contributing to better overall business continuity.

The regulatory environment in the disability insurance market is complex and varies by region, requiring compliance with evolving legislation around disability definitions, healthcare delivery, and social security programs. Regulations often mandate minimum coverage requirements, influence product features, and affect pricing structures. Insurers must navigate these regulations while maintaining market competitiveness.

U.S. Disability Insurance Market Size

The U.S. Disability Insurance Market was valued at USD 1.7 Billion in 2024 and is anticipated to reach approximately USD 4.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 10.4% during the forecast period from 2025 to 2034. The U.S. disability insurance market is influenced by several key factors. One major driver is the Social Security Disability Insurance (SSDI) program, which provides financial assistance to individuals unable to work due to disability.

In 2024, the Federal Disability Insurance Trust Fund reported an income of $193.8 billion, with a surplus of $36.2 billion, demonstrating the program’s financial strength. This continues to support the growth of the disability insurance market in the U.S. Additionally, the aging population plays a crucial role in driving demand. As more individuals reach retirement age and experience age-related disabilities, the need for coverage increases.

In 2024, North America held a dominant market position in the Global Disability Insurance Market, capturing around a 38.7% share. The North American disability insurance market is influenced by several key factors. One significant driver is the increasing demand for employer-sponsored disability insurance.

In 2024, 68% of U.S. employers offered Supplemental Long-Term Disability (SLTD) insurance benefits, up from 64% in 2023, indicating a growing recognition of the need for comprehensive employee benefits. This trend reflects a broader commitment to supporting employees’ financial security in the event of disability.

Another driver is the rising awareness of the financial impact of disabilities. According to the National Disability Institute, households with one adult who has a disability require 28% more income to maintain a similar standard of living compared to households without a disability. This statistic underscores the importance of disability insurance in mitigating financial strain for affected individuals and families.

Emerging Trends

Key Points Description Increased Awareness Enhanced public understanding of financial security needs and disability risks leading to growing insurance uptake. Digital Transformation Adoption of digital platforms for claims processing, underwriting, and policy purchase making processes faster and more transparent. Customization and Flexibility Policies increasingly customized with options for return-to-work benefits, mental health coverage, and residual benefits. Employer-Sponsored Growth Employers expanding disability insurance offerings as part of benefits to attract and retain talent. Inclusion of Mental Health Coverage increasingly addressing mental health disabilities driven by rising claims and societal focus. Growth Factors

Key Points Description Aging Workforce Older populations face higher disability risks, boosting demand for coverage. Rising Chronic Conditions Increase in lifestyle diseases like diabetes, heart disease, and cancer contributes to more claims and demand. Gig Economy Expansion Self-employed and freelancers seek individual disability insurance due to lack of traditional coverage. Regulatory Support Government programs and favorable regulations enhance market stability and consumer trust. Technological Advancements Telemedicine, automated claims, and underwriting improvements enhance market efficiency and reach. Type Analysis

Long-term disability insurance commands the largest share within the disability insurance market at 62.2%. This type of insurance provides financial protection by replacing income for extended periods when individuals are unable to work due to chronic illnesses, severe injuries, or permanent disabilities.

Due to its role in securing sustained income replacement, it is especially favored by employers and employees alike seeking comprehensive and enduring coverage for long-term health adversities. The dominance of long-term disability insurance highlights the growing awareness of the financial risks posed by prolonged disabilities.

Employers increasingly offer LTD coverage as part of employee benefits, recognizing its importance in supporting workforce productivity and retention. The segment’s stability is driven by demographic trends and an aging workforce vulnerable to long-lasting disabling conditions, ensuring ongoing demand for this type of insurance.

Coverage Analysis

Group disability insurance holds a significant market share of 40.2%, reflecting its role as a common employee benefits offering. Typically provided through employers to groups of employees, group disability insurance offers advantages including lower premiums due to pooled risk and streamlined administration. It is mainly popular within enterprises emphasizing employee welfare and financial security.

This segment’s growth is propelled by increasing corporate adoption of disability insurance as part of comprehensive benefits packages. Group plans help organizations mitigate the financial risks related to workplace disabilities and aid in maintaining workforce stability. Furthermore, the COVID-19 pandemic amplified attention to workplace health and disability, further reinforcing demand for group disability coverage.

Distribution Channel Analysis

In 2024, Brokers and agents represent a critical distribution channel, accounting for 35.7% of the market share in disability insurance distribution. They offer personalized advisory services tailored to the specific needs of clients, whether individuals or enterprises, by crafting suitable insurance solutions and navigating complex policy options.

This channel benefits from longstanding client relationships and trust built through local presence and expertise. Brokers and agents also provide ongoing support during claims processing, ensuring smooth communication between insured parties and insurers. Despite the growth of digital platforms, this human-centric approach remains essential in a complex market where tailored advice is highly valued.

End-User Segment Analysis

In 2024, Enterprises are the largest end-users of disability insurance, constituting 43.1% of the market. Corporations and businesses invest in disability coverage mainly to protect their workforce against income loss due to temporary or permanent disabilities. This not only enhances employee security but also supports organizational productivity and talent retention.

By offering disability insurance, enterprises transfer the financial risks of employee disabilities to insurers, reducing the burden on company resources. The provision of such benefits underlines a commitment to employee well-being, which is increasingly seen as vital in competitive labor markets. Enterprise demand continues to rise in parallel with heightened awareness of disability-related financial risks.

Top 5 Use Cases

Key Points Description Income Replacement Provides financial protection replacing income during temporary or permanent disability. Employer Benefits Group policies offered by employers support workforce well-being and retention. Individual Policies Tailored coverage for self-employed, professionals, and high-income earners with flexible terms. Business Overhead Expenses Policies cover ongoing business expenses for owners unable to work due to disability. Mental Health Coverage Growing use for mental health disabilities reflecting societal and regulatory shifts. Customer Insights

Key Points Description Increasing Ownership About 40% of US adults own some form of disability insurance, with millennials and high-income earners driving growth. Gender Representation Women policyholders increased to 47% in 2023, with targeted campaigns boosting awareness. Preferences for Flexibility Customers increasingly prefer customizable policies with enhanced benefits like partial disability coverage. Digital Adoption Customers appreciate easier access, quicker claims, and transparent information through digital platforms. Financial Security Concern Consumers prioritize protecting income and savings against unforeseen disabilities, seeking peace of mind. Key Market Segments

By Type

- Short-Term Disability Insurance (STD)

- Long-Term Disability Insurance (LTD)

By Coverage

- Individual Disability Insurance

- Group Disability Insurance

- Government Disability Insurance

By Distribution Channel

- Brokers/Agents

- Direct Sales (Insurer-Owned Platforms)

- Bancassurance

- Online Aggregators/InsurTech Platforms

By End-User

- Government

- Enterprise

- Individual

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Driver Factor

Rising Awareness and Demand for Disability Insurance

One of the strongest drivers in the disability insurance market is the growing awareness among individuals and organizations about the financial protection this insurance offers. As more people recognize the risks of income loss due to accidents or illnesses that cause disability, they see disability insurance as a necessary safeguard for themselves and their families.

Increasing education efforts by insurers and promotional campaigns have made potential policyholders better informed about how disability coverage can help maintain financial stability in difficult times. Additionally, governments and employers are encouraging insurance adoption by emphasizing social security benefits and offering tax advantages related to disability insurance.

This rise in awareness also comes with improvements in digital access to insurance products, which makes it easier for consumers to learn about, compare, and purchase policies. As people become more conscious of the need for protection against disability-related income gaps, this market’s growth is significantly supported.

Restraint Factor

Cost and Complex Underwriting Process

One major restraint slowing down disability insurance market growth is the issue of affordability. For many individuals, especially those with modest incomes, premium payments for disability insurance can be a financial burden. When insurance policies seem expensive or out of reach, potential buyers may decide not to invest in coverage, lowering overall market penetration.

Another related factor is the complexity of the underwriting process. Disability insurance applications often require detailed medical examinations and thorough assessments of health histories. This lengthy and sometimes invasive process can discourage people from applying. If the steps to qualify for insurance are cumbersome or intimidating, fewer individuals will complete the process, limiting policy adoption and market growth.

Opportunity Analysis

Expansion through Digital Innovation and Customization

The disability insurance market has a promising opportunity to expand through the use of digital technology and personalized product offerings. Digital platforms and mobile applications are making insurance policies more accessible, simplifying purchasing and claims processes. These technologies reduce barriers for consumers in remote or underserved areas, helping insurers reach a wider audience and boost sales.

Moreover, insurers are increasingly able to tailor coverage to specific groups such as gig economy workers, freelancers, and young professionals. Customized short-term and long-term disability plans that meet the unique needs of these diverse groups fill gaps left by traditional employer-sponsored insurance.

Challenge Analysis

Low Customer Awareness and Trust Issues

Despite progress in marketing and product development, a key challenge remains in educating consumers about the importance of disability insurance. Many people still do not fully understand what disability insurance covers or why it is necessary. This lack of awareness leads to underutilization of available policies and low participation rates, especially among younger or lower-income populations.

Trust in insurance providers and the claims process is another hurdle. Negative past experiences, slow claim approvals, and perceived complexity can make customers hesitant to invest in disability insurance. Overcoming these trust issues requires insurers to improve transparency, speed up claim handling, and build stronger relationships with clients.

Key Players Analysis

The global disability insurance market is characterized by a diverse array of players, including both traditional insurers and newer entrants. Established companies such as MetLife, Unum Group, and Guardian Life Insurance Company of America have maintained strong market positions through comprehensive product offerings and extensive distribution networks.

For instance, MetLife has expanded its digital capabilities with the launch of My Leave Navigator, a tool designed to streamline the leave process for employees, enhancing their experience from pre-leave planning to claim submission. Similarly, Unum Group has introduced Unum Care Hub, a suite of solutions that assists employers in supporting employees during leave and disability events.

In contrast, newer entrants and insurtech companies are leveraging digital platforms to offer more personalized and flexible disability insurance solutions. This shift is prompting traditional insurers to innovate and adapt to the changing market dynamics. The competition is further intensified by regulatory changes and the increasing demand for customized insurance products that cater to the diverse needs of the global workforce.

Top Key Players in the Market

- MetLife, Inc.

- Mutual of Omaha Insurance Company

- Guardian Life Insurance Company of America

- Aegon N.V.

- Unum Group

- Principal Financial Group

- Sun Life Financial Inc.

- AXA Group

- Nippon Life Insurance Company

- Zurich Insurance Group

- Others

Recent Developments

- On May 20, 2024, MetLife launched My Leave Navigator, a digital platform aimed at enhancing the employee leave experience by providing a holistic view from pre-leave planning to claim submission.

- On March 13, 2024, Unum Group introduced Unum Care Hub, a suite of solutions designed to help employers provide support for top leave and disability drivers, addressing key causes of leave and disability with personalized, outcome-based support.

- On October 9, 2024, Guardian Life Insurance Company of America launched GuardianWell, a new digital hub designed to enhance benefits utilization and inspire well-being, offering a single self-service online platform for members to engage with their wellness benefits.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Bn Forecast Revenue (2034) USD 13.4 Bn CAGR(2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Short-Term Disability Insurance (STD), Long-Term Disability Insurance (LTD)), By Coverage (Individual Disability Insurance, Group Disability Insurance, Government Disability Insurance), By Distribution Channel (Brokers/Agents, Direct Sales (Insurer-Owned Platforms), Bancassurance, Online Aggregators/InsurTech Platforms), By End-User (Government, Enterprise, Individual) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MetLife, Inc., Mutual of Omaha Insurance Company, Guardian Life Insurance Company of America, Aegon N.V., Unum Group, Principal Financial Group, Sun Life Financial Inc., AXA Group, Nippon Life Insurance Company, Zurich Insurance Group, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Disability Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Disability Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- MetLife, Inc.

- Mutual of Omaha Insurance Company

- Guardian Life Insurance Company of America

- Aegon N.V.

- Unum Group

- Principal Financial Group

- Sun Life Financial Inc.

- AXA Group

- Nippon Life Insurance Company

- Zurich Insurance Group

- Others