Global Directed Energy Weapons Market By Technology (High Energy Lasers, High Power Microwaves), By Platform (Airborne, Land, Space And Naval), By Product Type (Lethal And Non-Lethal), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 28278

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

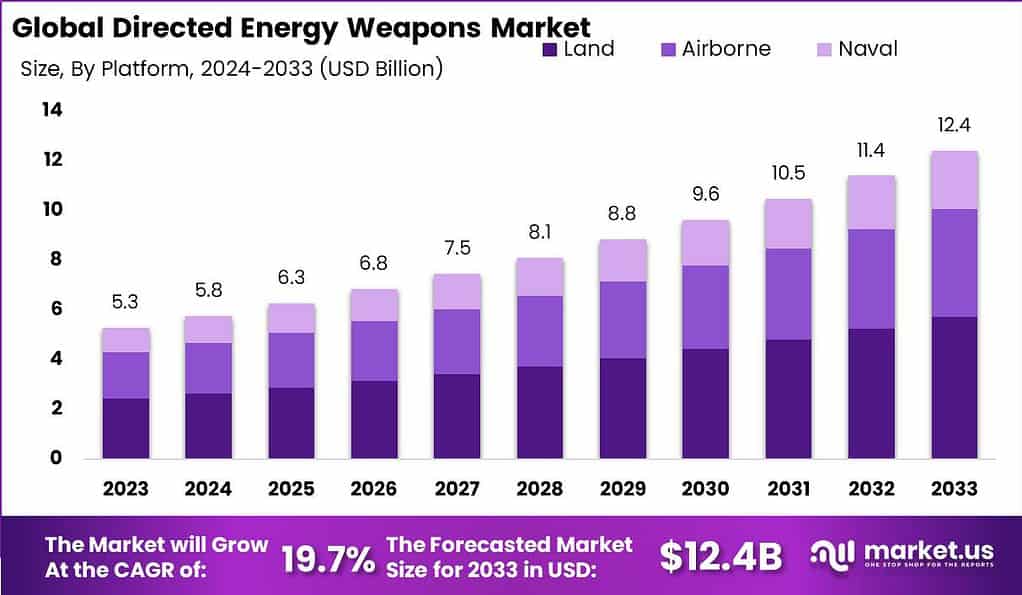

The Global Directed Energy Weapons Market is likely to secure a valuation of USD 5.8 Billion in 2024, with a CAGR of 19.7% during the forecast period. The global market is anticipated to capture a valuation of USD 12.4 Billion by 2033.

Directed Energy Weapons (DEWs) are specialized systems that release highly focused energy, like lasers or microwaves, to harm or incapacitate targets. These weapons leverage directed energy for various purposes, such as dismantling or disabling enemy equipment, mitigating threats, or enhancing defense capabilities.

The directed energy weapons market encompasses the development, production, and deployment of DEW systems. It involves various stakeholders, including defense contractors, technology providers, armed forces, and governments.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth Projection: The Directed Energy Weapons market is expected to achieve a remarkable Compound Annual Growth Rate (CAGR) of 19.7%. By 2033, it is forecasted to reach a substantial size of USD 36.6 billion, signifying substantial growth opportunities in the industry.

- Technology Dominance: In 2023, High Energy Lasers (HEL) emerged as a dominant technology within the DEW market. These lasers offer pinpoint accuracy and rapid target engagement, making them ideal for defense and military applications.

- Platform Diversity: The market is diverse in terms of platforms. In 2023, the Land platform segment led the market, offering flexible solutions for ground-based operations. Airborne platforms, mounted on aircraft, also played a significant role in aerial defense.

- Non-Lethal vs. Lethal: Non-lethal DEWs gained prominence in 2023 due to their focus on minimizing collateral damage in military and security operations. In contrast, lethal DEWs are designed for critical threat neutralization, subject to stringent regulations.

- Driving Factors: Factors driving market growth include an increased global threat landscape, technological advancements in laser and microwave technologies, cost-efficiency of DEWs, and the demand for non-lethal options in crowd control and law enforcement.

- Challenges: Key challenges include technical complexities in developing DEWs with the required power and range, regulatory hurdles, high development costs, and ensuring a stable power supply for these weapons.

- Growth Opportunities: Opportunities lie in the development of counter-UAV systems, inclusion of DEWs in military modernization programs, exploring non-military applications, and international collaboration for research and development.

- Regional Dominance: In 2023, North America held a dominant position in the DEW market due to extensive defense budgets and advanced capabilities. Europe and the Asia-Pacific region also displayed growth potential, with different market dynamics.

- Key Players: Leading companies in the DEW market include MBDA, Leonardo S.p.A., RTX, Lockheed Martin Corporation, BAE Systems, Northrop Grumman, Boeing, Rheinmetall AG, QinetiQ, and Thales Group.

Technology Insights

In 2023, the High Energy Lasers (HEL) segment indisputably commanded a commanding market position within the Directed Energy Weapons market landscape, firmly establishing its dominance and capturing a substantial share of the market. This segment’s prominence can be attributed to its inherent advantages, including pinpoint accuracy and rapid target engagement, making it an ideal choice for various defense and military applications. Furthermore, high energy lasers are increasingly garnering attention due to their cost-efficiency and versatility, offering a wide range of operational capabilities.

High Power Microwaves (HPM), while exhibiting notable potential, occupied a distinct segment within the market. Although not as prevalent as high energy lasers, the HPM technology segment demonstrated promising growth prospects. Its unique ability to disrupt and incapacitate electronic systems and communication networks is particularly valuable in modern warfare scenarios. As the demand for non-lethal, electronic warfare capabilities continues to rise, the HPM segment is expected to witness steady growth in the coming years.

By Platform Analysis

In 2023, the Land platform segment emerged as the dominant force within the Directed Energy Weapons market, solidifying its foothold and capturing a substantial share of the market. This commanding position can be attributed to the versatility and strategic significance of directed energy weapons when deployed on land-based platforms. These systems offer responsive and flexible solutions for ground-based operations, ranging from defense against hostile drones to countering missile threats. With an increasing emphasis on ground-based military applications worldwide, the Land platform segment exhibited significant growth potential.

The Airborne platform segment, while not surpassing the Land segment, held its ground as a crucial component of the directed energy weapons market. These systems, mounted on aircraft, provide aerial defense capabilities, including anti-aircraft laser systems. As air superiority remains a critical factor in modern warfare, the Airborne segment continued to attract investment and interest from defense organizations globally.

The Space and Naval platform segments, although noteworthy, represented a smaller portion of the market share. Directed energy weapons deployed in space and on naval vessels are seen as strategic assets for safeguarding against emerging threats, but their adoption and deployment are subject to various technical and operational challenges.

Product Type

In 2023, the Non-Lethal segment asserted its dominance within the Directed Energy Weapons market, securing a prominent market position and capturing a substantial share. This commanding presence can be attributed to the growing emphasis on minimizing collateral damage in military and security operations, making non-lethal directed energy weapons an attractive choice. These systems offer versatile options for incapacitating targets without causing permanent harm, providing effective crowd control and threat mitigation capabilities.

On the other hand, the Lethal segment, while still significant, occupied a distinct niche within the market. These directed energy weapons are designed for more lethal outcomes, targeting critical threats with lethal force when necessary. However, their adoption is often subject to stringent regulations and ethical considerations, which can limit their broader deployment.

Driving Factors

- Increased Threat Landscape: The rising global threat landscape, including unmanned aerial vehicles (UAVs) and missile proliferation, is a major driving factor for the Directed Energy Weapons market. These weapons offer rapid and precise threat neutralization, making them essential in modern defense strategies.

- Technological Advancements: Ongoing advancements in laser and microwave technologies are driving market growth. These innovations result in more powerful and efficient directed energy weapons, enhancing their effectiveness and expanding their applications.

- Cost-Efficiency: Directed energy weapons are increasingly seen as cost-effective alternatives to traditional kinetic weapons. They offer lower operational costs, reduced logistical burdens, and decreased reliance on costly ammunition, making them attractive to defense agencies.

- Non-Lethal Options: The demand for non-lethal directed energy weapons for crowd control and law enforcement is growing. These weapons provide a humane and effective means of handling civil disturbances and security challenges, contributing to market expansion.

Restraining Factors

- Technical Challenges: Developing directed energy weapons with the required power and range while maintaining reliability and precision remains a significant technical challenge. These complexities can hinder market growth.

- Regulatory Hurdles: Stringent international regulations and ethical concerns regarding the use of lethal directed energy weapons limit their deployment and export opportunities, posing regulatory challenges for manufacturers.

- High Development Costs: The research and development costs associated with creating advanced directed energy weapons are substantial. This can be a barrier for smaller players in the market, limiting their participation.

- Energy Supply and Storage: Directed energy weapons demand a stable and significant power supply. Ensuring a reliable and portable energy source for these weapons is a persistent challenge, especially for mobile or remote deployments.

Growth Opportunities

- Counter-UAV Systems: As UAV threats proliferate, the market for counter-UAV directed energy systems is poised for growth. These systems offer real-time defense against drones, creating opportunities for technology providers.

- Military Modernization Programs: The inclusion of directed energy weapons in military modernization programs across the globe presents lucrative opportunities for industry players. Governments are investing in next-generation weaponry, providing a substantial market for these advanced systems.

- Non-Military Applications: Directed energy weapons have non-military applications, including space debris removal and satellite protection. Exploring and expanding these non-military markets can lead to new growth avenues.

- International Collaboration: Collaborative efforts among nations for joint research and development of directed energy weapons can lead to cost-sharing and technology transfer opportunities, fostering market growth.

Challenges

- Scalability: Scaling up directed energy weapons for mass production and deployment can be challenging due to the complexity of the technology and the need for high precision.

- Safety Concerns: Ensuring the safety of personnel and bystanders when deploying directed energy weapons, especially non-lethal variants, requires stringent safety protocols and testing, adding to development timelines and costs.

- Public Perception: Public perception and acceptance of directed energy weapons, particularly non-lethal ones used in civilian contexts, may pose challenges. Education and communication efforts are necessary to address these concerns.

- Countermeasures: Adversaries are continually developing countermeasures against directed energy weapons, necessitating ongoing research and development to maintain effectiveness.

Key Market Trend

- Rise of Non-Lethal Options: The market is witnessing a notable trend towards non-lethal directed energy weapons due to their humanitarian applications in law enforcement and civil security, aligning with global efforts to minimize harm in conflict situations.

- Emerging Markets: Developing countries are showing increasing interest in acquiring directed energy weapons, creating opportunities for market expansion in regions where defense modernization is a priority.

Key Market Segments

Technology

- High Energy Lasers

- High Power Microwaves

By Platform

- Airborne

- Land Based

- Naval

- Space

Product Type

- Lethal

- Non-Lethal

Regional Analysis

In 2023, North America established a commanding market position within the Directed Energy Weapons market, capturing the lion’s share of the market. This dominance is mostly due to the region’s extensive defense budget, technologically advanced capabilities, and continuous modernization efforts in the military. In the United States, in particular is still a major driving force behind growth, with substantial investments in the research as well as development of weapons that use directed energy. Additionally, the focus of the region on defending against emerging threats, including UAVs or hypersonic weapons has led to the widespread adoption of these sophisticated technology.

Europe, while a formidable player in the market, held a substantial but comparatively smaller share. European nations have been actively exploring directed energy weapons as part of their defense strategies, but the market’s growth has been somewhat restrained by budget constraints and collaborative defense initiatives. Nevertheless, Europe continues to invest in these technologies to enhance its defense capabilities.

The Asia-Pacific (APAC) region displayed remarkable potential, with a rapidly growing market share. Several countries in APAC, including China and India, have been aggressively developing directed energy weapons as part of their military modernization agendas. The region’s dynamic geopolitical landscape and the need to protect critical assets are driving the demand for these advanced systems.

Latin America, the Middle East, and Africa, while contributing to the market, collectively represented a smaller share. These regions face economic challenges and varying security priorities, impacting their adoption of directed energy weapons. However, localized conflicts and the need for innovative defense solutions are expected to drive incremental growth in these regions.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The directed energy weapons (DEW) market comprises several key players contributing to the development, production, and deployment of DEW systems. These companies are at the forefront of technological advancements in directed energy technologies and play a crucial role in shaping the market.

Top Key Players

- MBDA

- Leonardo S.p.A.

- RTX

- Lockheed Martin Corporation

- BAE Systems

- Northrop Grumman

- Boeing

- Rheinmetall AG

- QinetiQ

- Thales Group

Recent Developments

- In April of 2023, QinetiQ secured a contract from the Defense Science and Technology Group (DSTG) to work together with the Department of Defense in the development and production of a prototype high-energy defensive laser system for South Australia.

- In January 2023, BAE Systems entered into an $12.1 million agreement in partnership with Air Force Research Laboratory (AFRL) to develop a sophisticated seeker to target maritime targets using air-launched platforms. The seeker, created as part of the Maritime Weapon Innovation Program (MWIP) It is an all-weather, low-cost multi-mode (radar/infrared) open-architecture system.

- Also in January 2023, L3Harris Technologies, Inc. secured a $40 million contract to supply 14 units of anti-drone weapon systems to enhance the security forces of Ukraine.

- In December 2022, Lockheed Martin Corporation and Rafael Advanced Defense Systems Ltd. collaborated on the development of 100KW fiber-class directed energy weapons for the IRON BEAM project.

Report Scope

Report Features Description Market Value (2023) US$ 5.3 Bn Forecast Revenue (2033) US$ 12.4 Bn CAGR (2024-2033) 19.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (High Energy Lasers, High Power Microwaves), By Platform (Airborne, Land, Space And Naval), By Product Type (Lethal And Non-Lethal) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape MBDA, Leonardo S.p.A., RTX, Lockheed Martin Corporation, BAE Systems, Northrop Grumman, Boeing, Rheinmetall AG, QinetiQ, Thales Group Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Directed Energy Weapons (DEWs)?Directed Energy Weapons are advanced systems that emit focused energy, such as lasers or microwaves, to target and damage enemy assets. These weapons offer speed-of-light capabilities and are used in various defense applications.

How big is Directed Energy Weapons Market?The Global Directed Energy Weapons Market is likely to secure a valuation of USD 5.8 Billion in 2024, with a CAGR of 19.7% during the forecast period. The global market is anticipated to capture a valuation of USD 12.4 Billion by 2033.

What is driving the growth of the Directed Energy Weapons market?The market is primarily driven by the increasing need for precision and speed in military operations, advancements in technology, and the continuous pursuit of more effective and efficient defense solutions.

What are the key applications of Directed Energy Weapons?DEWs find applications in air and missile defense, counter-drone systems, anti-satellite operations, and other strategic defense initiatives. They are also explored for use in non-lethal capabilities for crowd control and security.

What challenges does the Directed Energy Weapons market face?Challenges include technological hurdles, high development costs, regulatory concerns, and ethical considerations. Integration into existing military infrastructure and addressing potential safety issues are also significant challenges.

Which companies are leading in the Directed Energy Weapons market?Key players in the market include major defense contractors and technology firms such as MBDA, Leonardo S.p.A., RTX, Lockheed Martin Corporation, BAE Systems, Northrop Grumman, Boeing, Rheinmetall AG, QinetiQ, Thales Group

Directed Energy Weapons MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Directed Energy Weapons MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- MBDA

- Leonardo S.p.A.

- RTX

- Lockheed Martin Corporation

- BAE Systems

- Northrop Grumman

- Boeing

- Rheinmetall AG

- QinetiQ

- Thales Group