Global Direct Imaging System Market Size, Share Analysis Report By Technology (Laser Direct Imaging, Maskless Lithography), By Application (Printed Circuit Boards, Semiconductor Manufacturing, Flat Panel Displays, Others), By End-User Industry (Electronics, Automotive, Aerospace, Healthcare, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150875

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

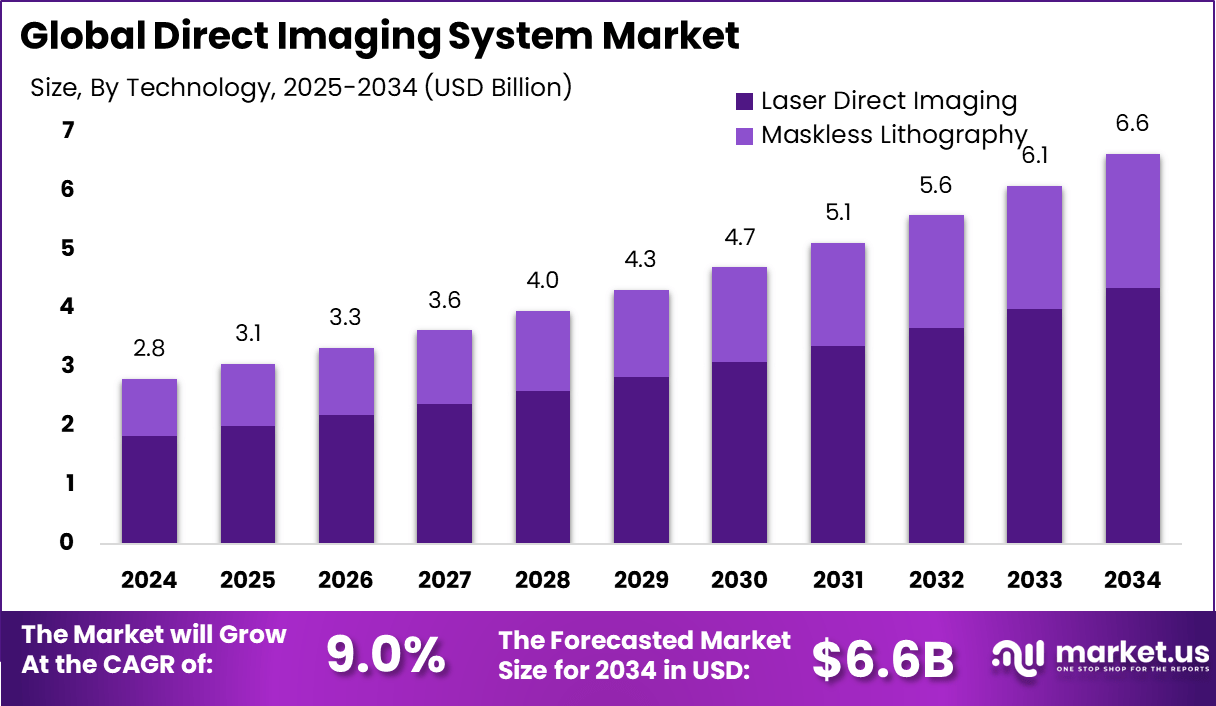

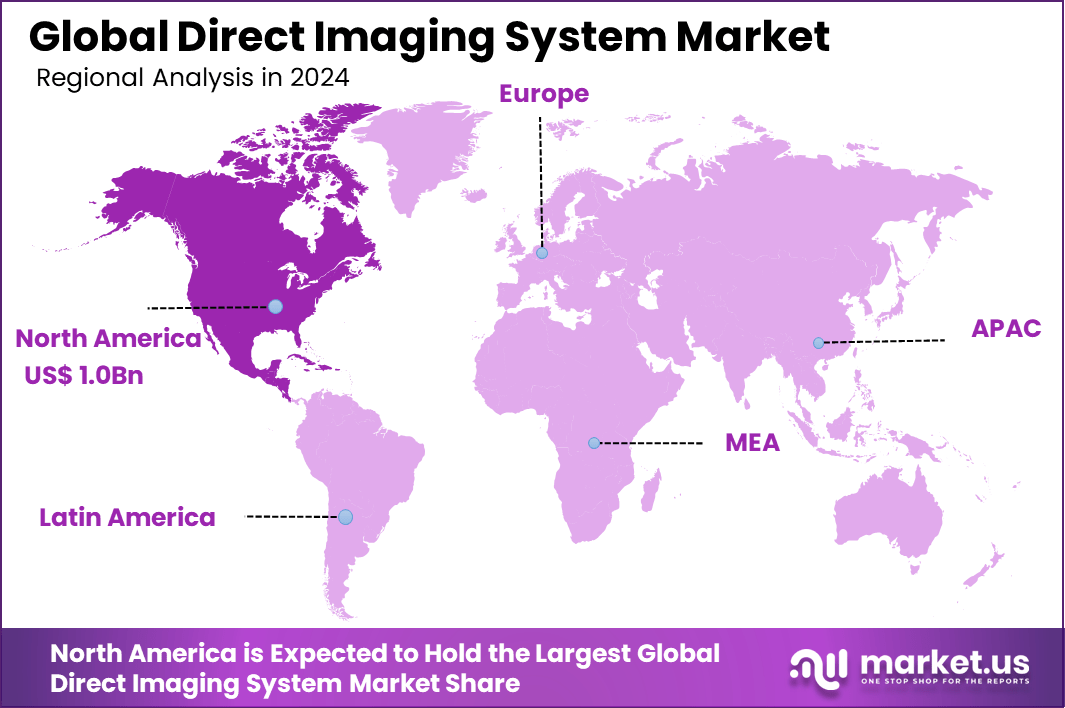

The Global Direct Imaging System Market size is expected to be worth around USD 6.6 Billion By 2034, from USD 2.8 billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.5% share, holding USD 1.0 Billion revenue.

The Direct Imaging System market is experiencing methodical growth driven by the escalating need for high-resolution, mask-free imaging across electronics, medical diagnostics, and industrial sectors. As precision and productivity demands intensify, direct imaging systems – particularly laser-based and maskless technologies – are increasingly preferred for their flexibility, swift turnarounds, and integration into automated workflows.

These systems enable accurate and rapid imaging without the constraints of traditional photomasks, aligning with modern manufacturing and diagnostic needs. The Top Driving Factor behind this market’s expansion is the convergence of miniaturization trends in electronics and the demand for precision in PCB fabrication.

Advanced applications, such as solder mask exposure and HDI (high-density interconnect) circuit fabrication, require ultra-fine patterning that only direct imaging can deliver cost-effectively at scale. Meanwhile, sectors such as automotive and medical imaging adopt these systems to meet stringent accuracy and safety standards.

Adoption is being accelerated by Increasing Technologies such as laser direct imaging (LDI), high-resolution CCD sensors, and adaptive optics. LDI systems are now capable of adjusting focus dynamically and handling variable substrate thickness, making them particularly suited for rapid, multi-layer PCB processing, where laser patterning replaces conventional masks.

Key Takeaways

- The Global Direct Imaging System Market is projected to reach USD 6.6 billion by 2034, rising from USD 2.8 billion in 2024, growing at a CAGR of 9.0% during 2025–2034.

- In 2024, North America led the market with over 37.5% share, generating approximately USD 1.0 billion in revenue.

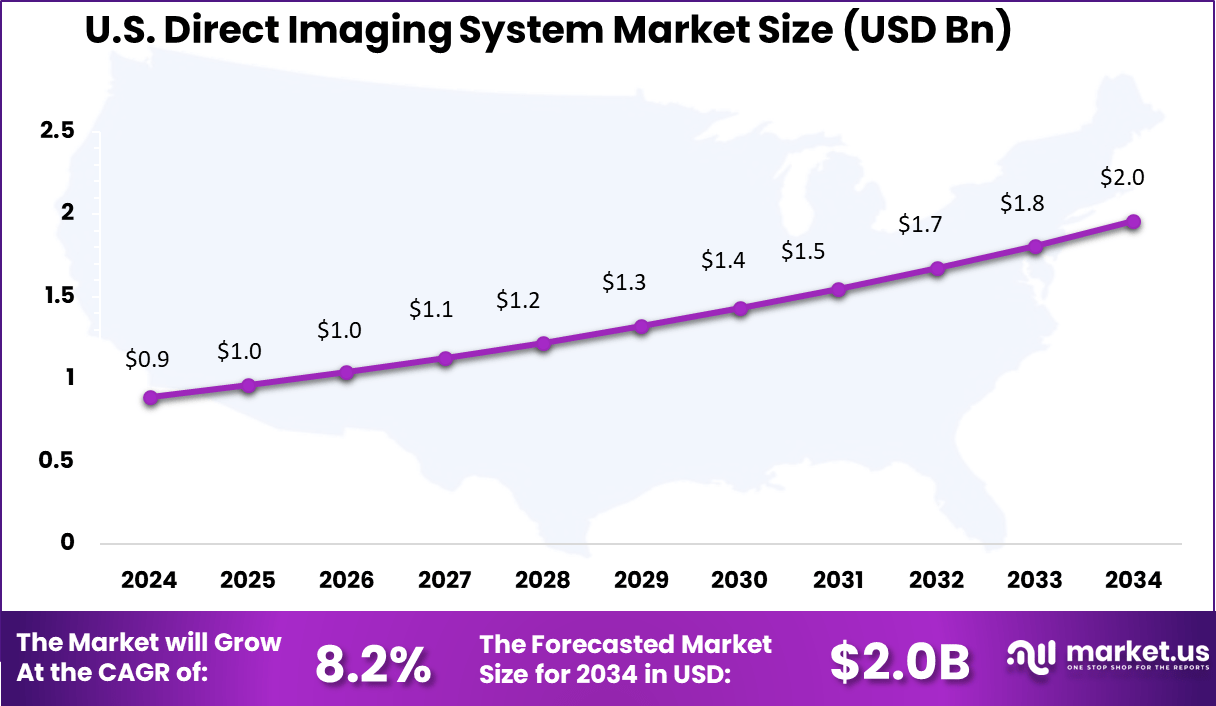

- The United States accounted for a significant portion, contributing USD 0.89 billion in 2024, and is expected to expand at a steady CAGR of 8.2% through 2034.

- Laser Direct Imaging (LDI) dominated the technology segment with a robust 65.7% share, highlighting its critical role in precision manufacturing.

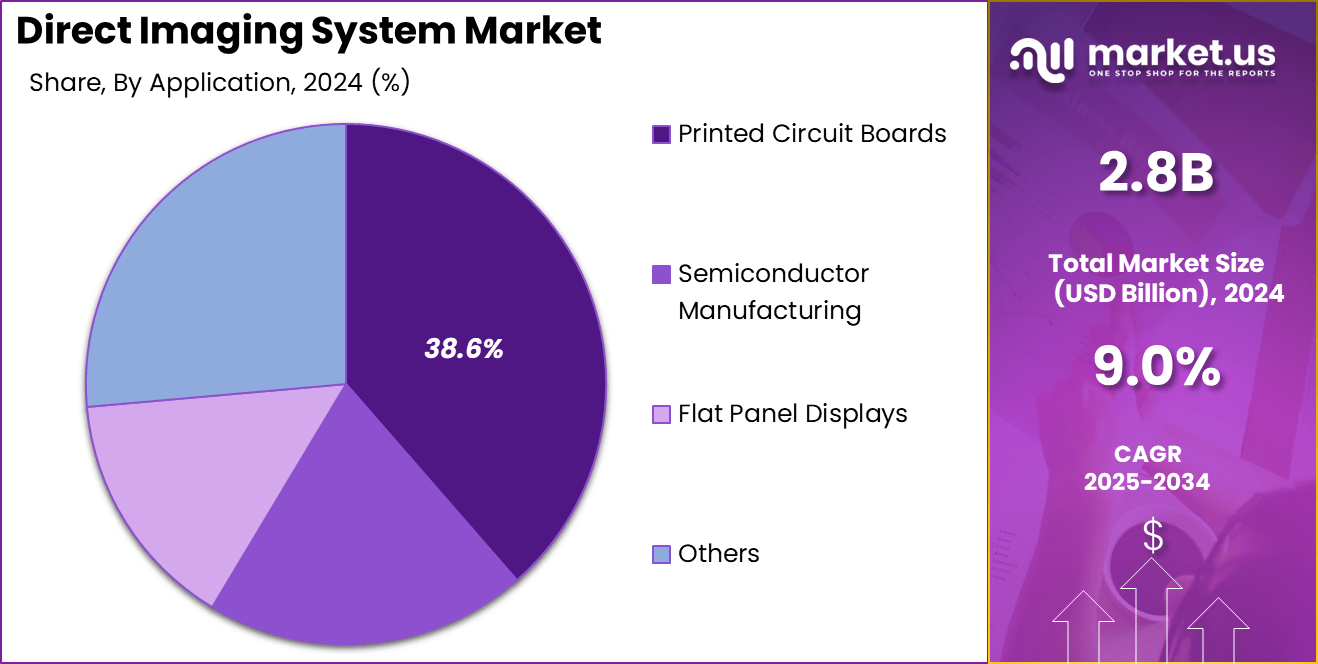

- The Printed Circuit Boards (PCBs) application segment captured 38.6% share, driven by rising adoption in telecom, automotive, and consumer electronics.

- The Electronics industry remained the primary end-user, holding 28.8% market share in 2024, owing to increasing demand for miniaturized and high-performance components.

US Market Expansion

The US Direct Imaging System Market is valued at approximately USD 0.9 Billion in 2024 and is predicted to increase from USD 1.3 Billion in 2029 to approximately USD 2.0 Billion by 2034, projected at a CAGR of 8.2% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 37% share, holding approximately USD 1.0 billion in revenue in the Direct Imaging System Market. The region’s leadership can be attributed to the strong presence of technologically advanced semiconductor fabrication facilities and the rapid integration of automation across the PCB (Printed Circuit Board) manufacturing sector.

High investments in miniaturized electronics, 5G infrastructure development, and aerospace-grade printed circuits have further reinforced demand for direct imaging systems, which offer precise and contactless imaging advantages over traditional photolithography processes. The adoption of Industry 4.0 standards and the increasing trend toward smart manufacturing have created favorable conditions for direct imaging technologies to thrive.

Investment Opportunities

The Direct Imaging System market continues to show strong potential for capital investment as industries pursue greater precision, efficiency, and digital transformation. With the global shift toward miniaturization in electronics and high-resolution, non-contact diagnostics in healthcare, the demand for advanced imaging tools is rising across developed and emerging markets alike.

Investment appetite is particularly focused on firms that integrate laser direct imaging (LDI) with intelligent software control, offering rapid prototyping and seamless configuration for complex, multilayer circuit boards and micro-scale imaging. From an investment analysis perspective, the market’s attractiveness stems from its alignment with long-term industrial and technological trends, including the expansion of 5G infrastructure, electric vehicles, wearable medical devices, and smart manufacturing ecosystems.

Investors are paying close attention to companies that deliver modular systems capable of supporting high-throughput, precision fabrication for substrates like ceramics, polymers, and flexible electronics. These systems also present opportunities for high-margin growth due to their ability to reduce material waste, labor costs, and turnaround times in production lines.

Strategically, Asia–Pacific presents strong investment opportunities, driven by the presence of leading electronics manufacturing hubs in China, South Korea, and Taiwan. Simultaneously, North America is witnessing robust investments in diagnostic imaging technologies that leverage direct imaging principles, driven by increasing demand for early disease detection and AI-powered healthcare platforms.

By Technology Analysis

In 2024, Laser Direct Imaging segment held a dominant market position, capturing more than a 65.7 % share within the Direct Imaging System market. This dominance can be attributed to its superior resolution, enhanced throughput, and compatibility with advanced PCB and semiconductor manufacturing requirements. Laser Direct Imaging enables precise patterning without the need for traditional masks, reducing setup time and material waste – factors which continue to support its market leadership.

LDI’s technical strengths extend to semiconductor and advanced packaging applications, where its maskless approach significantly lowers production costs and shortens development cycles. It enables dynamic, automated patterning – supporting innovations like adaptive patterning and fan‑out wafer fabrication without reliance on reticles.

Summary of leading Segment – Laser Direct Imaging

Segment 2024 Share Strengths Outlook Summary Laser Direct Imaging > 65.7% High resolution; mask-free; auto-focus; rapid job change; large-scale use Poised to maintain leadership; CAGR estimated between 3.7%-9.5%; expanding within automotive, telecom, consumer electronics sectors Maskless Lithography < 35% (smaller) Cost-effective for prototyping; flexible; no mask required Growth expected in niche and R&D sectors; improvements in speed and throughput likely to broaden adoption By Application Analysis

In 2024, the Printed Circuit Boards (PCB) segment held a dominant market position in the global direct imaging system market, capturing more than a 38.6% share. This leadership can be attributed to the critical role of direct imaging in enabling high-resolution and high-throughput PCB fabrication, particularly for multilayer and high-density interconnect (HDI) boards.

The rising demand for compact, high-performance electronic devices – spanning consumer electronics, automotive ADAS systems, and telecommunications infrastructure – has driven manufacturers to adopt direct imaging solutions for finer trace widths and reduced defect rates.

Summary of leading Segment – Printed Circuit Boards (PCB)

Application 2024 Position Key Drivers Outlook Summary Printed Circuit Boards (PCB) >38.6% (dominant) Demand for HDI & flexible PCBs, high throughput, waste reduction, industry automation acceleration Expected to sustain leadership; significant contributor to 8.3% CAGR through 2033 Semiconductor Manufacturing 2nd largest Advanced packaging, SoC complexity, maskless flexibility Incremental growth; adoption in niche and advanced nodes; depends on R&D Flat Panel Displays Smaller share Fine TFT & color filter patterning Modest growth; constrained by high cost and throughput limitations Others Niche Custom printed electronics, photomask prototyping Slow yet steady growth; aligned with IoT and sensor market expansion By End-User Industry Analysis

In 2024, the Electronics end-user industry segment held a dominant market position, capturing more than a 28.8 % share within the Direct Imaging System market. This leadership is attributed to the relentless demand for miniaturized, high-density electronic components – such as PCBs, flexible circuits, and advanced semiconductor packaging.

Precision imaging provided by these systems enables finer geometries and lower defect rates, which are essential for high-performance consumer electronics and telecommunications devices. Moreover, electronics manufacturers are increasingly investing in automation, AI-enhanced quality control, and laser-based patterning techniques to accelerate production cycles and reduce waste – factors that reinforce the segment’s market preeminence.

Summary of leading Segment – Electronics end-user industry

End-User Industry 2024 Share Growth Drivers Outlook Summary Electronics >28.8% Miniaturization; PCB/semiconductor complexity; automation; high precision Continues to lead; innovation in production; core driver of ~8.3% market CAGR Automotive 2nd largest ADAS, EV, sensor proliferation; multi-layer circuits Strong growth; imaging demand tied to vehicle electronics expansion Aerospace Small Avionics, satellite electronics with high reliability needs Steady demand; niche but strategic segment Healthcare Small Diagnostic, wearable, implantable electronics; personalized medical devices Emerging; High precision and regulatory compliance boosting uptake Others Niche Industrial IoT, printed electronics, renewable energy sensors Steady expansion; poised to support broader IoT/Industry 4.0 applications Key Market Segments

By Technology

- Laser Direct Imaging

- Maskless Lithography

By Application

- Printed Circuit Boards

- Semiconductor Manufacturing

- Flat Panel Displays

- Others

By End-User Industry

- Electronics

- Automotive

- Aerospace

- Healthcare

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Shift Toward UV‑LED and AI‑Integrated Imaging

The market is increasingly adopting UV‑LED direct imaging systems, which offer enhanced energy efficiency and lower operational costs compared to traditional laser systems. A recent report highlights that UV‑LED systems accounted for approximately 35% of market share, driven by demand for sustainable manufacturing and rapid throughput improvements.

Concurrently, integration of artificial intelligence and machine‑learning in imaging systems is gaining traction. AI‑enabled defect detection, predictive maintenance, and real‑time process optimization are improving yield and precision. One industry source reports AI integration as a notable trend in direct imaging for electronics and PCB applications.

Driver

Miniaturization & Electronics Demand

The rise in miniaturization across electronics and semiconductor devices is a key catalyst for direct imaging systems. As chips, sensors, and PCBs shrink, manufacturers increasingly favour imaging methods capable of ultra-fine patterning – a need that laser‑based direct imaging fulfills. This demand is especially pronounced in high‑density interconnects and advanced node semiconductor fabs.

Moreover, the growing electronics manufacturing sector – ranging from automotive and 5G to consumer and medical devices – is substantially boosting uptake. Estimates indicate that Asia‑Pacific alone accounts for around 40% of global market share, propelled by electronics output in China, Japan, and South Korea. In particular, automotive electronics for EVs and ADAS contribute approximately 40% to the growth, underscoring the breadth of direct imaging applications.

Restraint

High Capital Expenditure

A significant impediment to broader adoption remains the high upfront and maintenance costs for direct imaging equipment. In emerging economies especially, capital constraints cause nearly 30% of prospective adopters to delay or opt out of investment. Smaller PCB manufacturers, in particular, cite budget limitations as a primary barrier – even when long‑term cost savings are attainable.

Furthermore, UV‑LED systems, while cheaper operationally, may not meet precision needs in advanced multi‑layer PCB or semiconductor applications. This technical limitation reduces confidence in their adoption for high‑end use cases, further slowing penetration into critical segments.

Challenge

Technical Complexity & Skill Shortages

The integration and operation of direct imaging systems, particularly for advanced laser‑based setups, require specialized technical expertise. Systems incorporating AI, precision alignment, or advanced software add complexity – representing a potential bottleneck in deploying new solutions.

Additionally, a shortage of skilled operators – similar to trends seen in diagnostic imaging industries – is slowing technology adoption. This skills gap can result in suboptimal system utilization, increased error rates, and longer integration times, ultimately reducing the anticipated ROI.

Key Player Analysis

Orbotech continued its aggressive expansion in early 2025 through three strategic acquisitions in semiconductor manufacturing equipment sectors, including SPTS Technologies, Photon Dynamics, and Imarad, aimed at broadening its product portfolio and strengthening synergies in direct-imaging technologies.

Screen remained focused on refining its laser-direct-imaging product line throughout 2025. Though new acquisitions were limited, the company invested in enhanced machine throughput and precision, aligning with industry trends toward HDI PCB applications. Direct-launch updates were embedded in regular product refreshes, maintaining Screen’s market competitiveness alongside Orbotech and others.

Hitachi’s April 2025 launch of a next-generation grid-forming inverter reflects diversification beyond imaging systems into power-stability tools. Within its broader Social Innovation portfolio, Hitachi is expected to integrate direct-imaging in digital systems, although no specific imaging acquisitions or product introductions were announced in 2025.

Top Key Players Covered

- Orbotech Ltd.

- Screen Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Hitachi High-Technologies Corporation

- Manz AG

- Limata GmbH

- First EIE SA

- Miva Technologies GmbH

- LPKF Laser & Electronics AG

- Altix Automation SA

- Koh Young Technology Inc.

- Schmoll Maschinen GmbH

- Ucamco NV

- Atg Luther & Maelzer GmbH

- Fujifilm Corporation

- Agfa-Gevaert Group

- Aiscent Technologies

- Han’s Laser Technology Industry Group Co., Ltd.

- CIMS China

- Orbotech Pacific Ltd.

- Others

Recent Developments

- In early 2025, Orbotech pursued a strategic expansion by acquiring SPTS Technologies, Photon Dynamics, and Imarad. These acquisitions are intended to strengthen its semiconductor equipment portfolio, particularly in direct-imaging technologies, aligning with growing demand in high-precision manufacturing.

- On March 17, 2025, Hitachi High-Tech commenced operations at its new semiconductor equipment production facility in Kasado (Yamaguchi Prefecture, Japan). The site, featuring automated production lines and renewable energy infrastructure, is expected to enhance output of semiconductor etch and imaging systems while supporting sustainable manufacturing goals

Report Scope

Report Features Description Market Value (2024) USD 2.8 Bn Forecast Revenue (2034) USD 6.6 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Laser Direct Imaging, Maskless Lithography), By Application (Printed Circuit Boards, Semiconductor Manufacturing, Flat Panel Displays, Others), By End-User Industry (Electronics, Automotive, Aerospace, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Orbotech Ltd., Screen Holdings Co., Ltd., Mitsubishi Electric Corporation, Hitachi High-Technologies Corporation, Manz AG, Limata GmbH, First EIE SA, Miva Technologies GmbH, LPKF Laser & Electronics AG, Altix Automation SA, Koh Young Technology Inc., Schmoll Maschinen GmbH, Ucamco NV, Atg Luther & Maelzer GmbH, Fujifilm Corporation, Agfa-Gevaert Group, Aiscent Technologies, Han’s Laser Technology Industry Group Co., Ltd., CIMS China, Orbotech Pacific Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Direct Imaging System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Direct Imaging System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Orbotech Ltd.

- Screen Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Hitachi High-Technologies Corporation

- Manz AG

- Limata GmbH

- First EIE SA

- Miva Technologies GmbH

- LPKF Laser & Electronics AG

- Altix Automation SA

- Koh Young Technology Inc.

- Schmoll Maschinen GmbH

- Ucamco NV

- Atg Luther & Maelzer GmbH

- Fujifilm Corporation

- Agfa-Gevaert Group

- Aiscent Technologies

- Han's Laser Technology Industry Group Co., Ltd.

- CIMS China

- Orbotech Pacific Ltd.

- Others