Global Digital Twin in Finance Market Size, Share Report By Offering (Platforms & Solutions, Services), By Application (Risk Assessment & Compliance, Process Optimization, Insurance Claims Management, Testing & Simulation, Other Applications), By End-Use Industry (BFSI, Manufacturing, Transportation & Logistics, Healthcare, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 129502

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

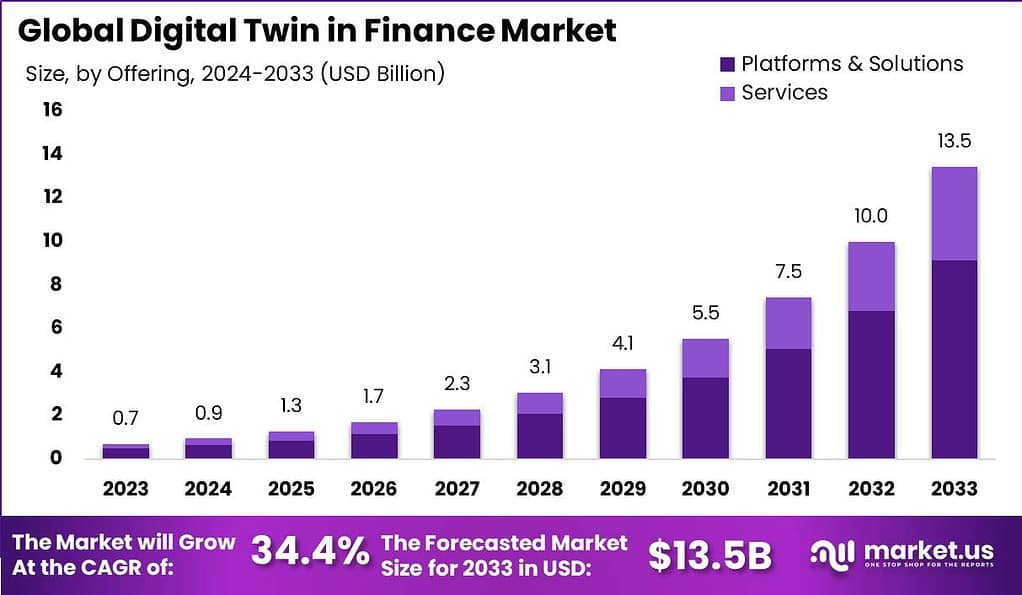

The global digital twin in finance market size is expected to be worth around USD 13.5 Billion by 2033, from USD 0.7 Billion in 2023, growing at a CAGR of 34.4% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 40% share, holding USD 0.2 billion revenue.

A digital twin in finance refers to a virtual replica of financial services and processes. This technology involves creating a dynamic digital representation of financial assets, transactions, or services to simulate real-world outcomes. By using digital twins, financial institutions can visualize the lifecycle of a product, anticipate issues, optimize operations, and improve decision-making. The application extends to various sectors including retail banking, investment management, and insurance, where it helps in risk assessment, fraud detection, and customer service enhancement.

The market for digital twins in finance is experiencing significant growth due to the increasing demand for innovative technologies to enhance decision-making and operational efficiency. Financial institutions are leveraging digital twins to create more robust risk management systems and improve customer experiences by personalizing services and optimizing product offerings. The global market’s expansion is driven by advancements in IoT, AI, and machine learning technologies, which make digital twins more accurate and effective.

The market growth for digital twins in finance is projected to be robust over the next decade. This growth is primarily driven by the integration of IoT and AI technologies, which enhance the capabilities of digital twins, making them indispensable tools for complex financial analysis and decision-making. The surge in data generation and the need for real-time data processing and simulation in finance also contribute to this growth.

Additionally, as regulatory pressures increase and financial markets become more volatile, the ability of digital twins to provide scenario-based planning and stress testing becomes more valuable, supporting further growth in this sector. The demand for digital twins in the finance sector is fueled by the need for greater precision in financial modeling and risk management.

Financial institutions are increasingly relying on digital twins to forecast and mitigate risks associated with credit, market fluctuations, and operational inefficiencies. This technology also meets the growing consumer expectation for personalized and rapid service delivery. As digital transactions continue to rise, driven by e-commerce and online banking, the need for advanced tools to monitor, analyze, and secure these transactions also grows, thereby boosting the demand for digital twins.

Opportunities within the digital twin market in finance are vast and varied. One significant opportunity lies in regulatory compliance, where digital twins can simulate the financial impacts of regulatory changes before they are implemented. Another opportunity is in the customization of financial products and services, as digital twins enable a deeper understanding of customer behaviors and preferences.

Additionally, there is a growing opportunity in cybersecurity, where digital twins can be used to predict and prevent potential breaches. As technology evolves, there will also be new opportunities in merging digital twins with other emerging technologies such as blockchain and advanced cybersecurity measures, opening further avenues for innovation and market expansion.

A recent survey by Altair reveals that 71% of professionals in the BFSI (Banking, Financial Services, and Insurance) sector consider digital twin technology to be “very important” for their organizations. This underscores the technology’s growing significance in enhancing operational capabilities within the industry.

Furthermore, 18% of BFSI respondents who are currently utilizing digital twin technology reported that they have started investing in it within the last six months. This highlights an emerging trend of increased adoption, indicating that the technology is becoming a critical part of digital transformation strategies in the BFSI sector

Key Takeaways

- The Global Digital Twin in Finance Market is poised for substantial growth, projected to escalate from USD 0.7 Billion in 2023 to approximately USD 13.5 Billion by 2033. This growth trajectory represents a robust compound annual growth rate (CAGR) of 34.4% over the forecast period from 2024 to 2033.

- In the composition of the market in 2023, the platforms and solutions segment asserted a significant influence, securing a commanding 68% market share. This segment’s dominance underscores its critical role in providing the necessary infrastructure and capabilities essential for deploying digital twins effectively within financial environments.

- Simultaneously, the risk assessment and compliance segment also emerged prominently in 2023, obtaining a substantial 38.7% of the market share. This segment’s predominance highlights the increasing reliance on digital twin technologies to enhance accuracy in risk evaluation and ensure stringent compliance with evolving financial regulations.

- Moreover, the Banking, Financial Services, and Insurance (BFSI) sector exhibited a dominant presence within the market, capturing over 64% of the Global Digital Twin in Finance Market. This indicates a deep integration of digital twin technologies within traditional financial institutions aiming to innovate and enhance operational efficiencies.

- Regionally, North America led the Global Digital Twin in Finance Market in 2023, holding more than 40% of the market share. This dominant market position can be attributed to the advanced technological infrastructure and the rapid adoption of innovative technologies by North American financial institutions.

Offering Segment Analysis

In 2023, the Platforms & Solutions segment held a dominant market position in the Digital Twin in Finance market, capturing more than 68% of the market share. This substantial share can be attributed to the increasing reliance of financial institutions on advanced digital platforms to enhance decision-making, optimize operations, and reduce costs.

Financial entities are leveraging digital twin technologies to create dynamic virtual models of their financial services and operations. These platforms enable real-time simulation, testing, and optimization of processes in a virtual environment, which significantly reduces the risk and cost associated with physical trials.

The demand for these platforms and solutions is driven by their capability to provide deep insights into the lifecycle of financial products and customer interactions. This allows for a more accurate analysis of risk, improvement in asset management, and enhanced customer service by anticipating client needs through behavior prediction and personalization strategies.

The integration of IoT, AI, and machine learning technologies within these platforms further strengthens their market position by offering more precise and predictive analytics, fostering a more proactive approach to financial management. Moreover, the regulatory landscape in the financial sector, which increasingly demands transparency and accountability, is also a major driver behind the adoption of digital twin platforms and solutions.

These technologies enable financial institutions to maintain comprehensive and compliant records of their operations, simulate the impact of potential regulatory changes, and ensure robust risk management practices. As the financial industry continues to face disruptions from technological advancements, the Platforms & Solutions segment is expected to maintain its leadership by evolving with emerging tech trends and expanding its capabilities to meet the changing needs of the market.

Overall, the Platforms & Solutions segment’s leadership in the Digital Twin in Finance market is a reflection of its integral role in transforming traditional financial operations into agile, data-driven enterprises. As digital transformation continues to penetrate deeper into the financial sector, platforms and solutions that offer comprehensive, scalable, and regulatory-compliant tools will remain critical for institutions aiming to capitalize on the benefits of digital twin technology.

Application Segment Analysis

In 2023, the Risk Assessment & Compliance segment held a dominant market position within the Digital Twin in Finance market, capturing more than 38.7% of the market share. This leadership can largely be ascribed to the escalating demands for enhanced risk management solutions and stringent regulatory compliance across the financial sector.

Financial institutions are increasingly adopting digital twin technology to simulate various financial scenarios and assess the potential impacts of financial decisions and market changes on their operations. This capability not only improves risk assessment accuracy but also ensures higher standards of compliance with evolving financial regulations.

Digital twins facilitate a robust framework for risk management by enabling real-time monitoring and prediction of potential pitfalls in financial operations, thus allowing preemptive action to mitigate risks. Moreover, they support compliance officers in keeping pace with regulatory changes by providing a dynamic platform to test and adapt operations to new regulatory requirements without disrupting existing workflows.

As financial markets grow in complexity, the ability to predict and manage risk with higher precision and adapt to regulations proactively becomes a competitive advantage, fueling further adoption of these technologies. Additionally, the integration of advanced analytics, machine learning, and AI with digital twin platforms significantly enhances the effectiveness of these tools in identifying and addressing vulnerabilities and compliance gaps before they escalate into larger issues.

This proactive approach not only reduces potential financial losses but also helps in maintaining the credibility and reliability of financial institutions in the eyes of regulators and stakeholders. The Risk Assessment & Compliance segment’s prominence in the Digital Twin in Finance market is poised to continue as institutions seek to leverage advanced technologies to fortify their financial systems against a backdrop of increasing regulatory scrutiny and complex risk vectors.

The ongoing digital transformation in the financial sector, combined with growing awareness of the capabilities of digital twin technology, suggests that this segment will remain vital and continue to expand in the coming years.

End User Segment Analysis

In 2023, the BFSI segment held a dominant market position in the Digital Twin in Finance Market, capturing more than a 64% share. This significant market share can be attributed primarily to the increasing adoption of digital twins by banks, insurance companies, and financial service providers to enhance their operational efficiencies and customer experiences.

Financial institutions are leveraging digital twin technology to create virtual models of their financial services environments. This allows them to simulate different scenarios and predict outcomes, leading to improved decision-making processes and risk management. The BFSI sector’s leadership in this market also stems from its need to comply with stringent regulatory requirements and manage complex assets efficiently.

Digital twins help in monitoring system performances and predicting future breakdowns or failures, thus reducing downtime and maintenance costs. Moreover, they enable personalized customer services by analyzing various customer interaction touchpoints and predicting future behaviors, thus enhancing customer satisfaction and loyalty.

Additionally, the ongoing digital transformation in the BFSI sector, coupled with investments in advanced technologies like AI and machine learning, integrates well with digital twin capabilities, pushing the segment’s growth further. These technologies complement digital twins by providing them with predictive analytics and real-time data, making the financial models more dynamic and accurate.

Key Market Segments

By Offering

- Platforms & Solutions

- Services

By Application

- Risk Assessment & Compliance

- Process Optimization

- Insurance Claims Management

- Testing & Simulation

- Other Applications

By End-Use Industry

- BFSI

- Manufacturing

- Transportation & Logistics

- Healthcare

- Others

Drivers

Growing Adoption of Industry 4.0 Technologies

The adoption of Industry 4.0 technologies is a major driver for the Digital Twin in Finance Market. These technologies, including AI, IoT, and big data analytics, facilitate the creation of digital twins which are virtual replicas of financial assets and processes.

Financial institutions use digital twins to simulate different scenarios, enhancing decision-making and risk management. By virtually replicating financial assets and operations, banks can predict outcomes based on varying conditions, thereby minimizing risks and optimizing strategies.

Restraint

High Implementation Costs

A significant restraint for the Digital Twin in Finance Market is the high cost associated with implementing these systems. The development and deployment of digital twins require substantial initial investment in technology such as IoT, AI, and advanced data analytics platforms.

Additionally, the complexity of integrating digital twin technology with existing financial systems can incur further expenses in terms of both time and resources. For many financial institutions, especially smaller ones, these costs can be prohibitive, slowing down the adoption rate of digital twin technologies.

Opportunities

Increased use of Digital Twins in risk management

The increased use of digital twins in risk management presents a significant opportunity for the market. By creating a virtual replica of financial systems, institutions can simulate different risk scenarios and assess the potential impacts in real time. This capability enhances predictive analytics, enabling more accurate forecasting and proactive risk mitigation strategies.

Digital twins facilitate a deeper understanding of complex financial environments, improving decision making and reducing the exposure to unexpected events. As financial organizations increasingly focus on advanced risk management techniques, the demand for digital twins is expected to grow, driving innovation and expansion in the market.

Challenges

Data Security and Privacy Concerns

A major challenge in the adoption of digital twin technology in finance is addressing data security and privacy concerns. Financial institutions handle sensitive information, and the deployment of digital twins involves the replication of this data into virtual models, which can increase the risk of data breaches.

Ensuring the security and integrity of financial data within digital twins is crucial, as any compromise could lead to significant financial losses and erosion of customer trust. This requires robust cybersecurity measures and constant vigilance to guard against potential cyber threats, adding another layer of complexity to the use of digital twins in finance

Growth Factors

Factors contributing to the growth of the digital twin in finance market includes the increasing complexity of financial systems and the need for advanced risk management solutions. The rise in regulatory requirements for transparent and compliance drive the demand for more sophisticated simulation tools.

Technological advancements in AI and machine learning enhances the capabilities of digital twins, making them more valuable for predictive analytics and decision making. Additionally, the growing focus on personalized customer experience and operational efficiency fuels the adoption of digital twins. The expanding digital transformation trends and the quest for innovative financial solutions further accelerates the market growth.

Latest Trends

There are various trends shaping the digital twin in finance market. One of the major trend among these is IoT, AI and machine learning technologies. Other key trends include the increased demand for real time data analytics, predictive maintenance in financial systems, and risk assessment solutions.

Digital twin technology is also enhancing cybersecurity protocols and fraud detection. The push towards personalized financial services, remote monitoring of financial assets and automation in banking processes are other trends in the market. Financial institutions are leveraging digital twins to stimulate economic scenarios, optimize operations, and improve customer experience, making them a crucial tool for digital transformation.

Regional Analysis

In 2023, North America held a dominant market position in the Digital Twin in Finance Market, capturing more than a 40% share, with revenues reaching USD 0.2 billion. This significant market share can be attributed to several key factors. Firstly, the region hosts a large number of digital twin technology pioneers and early adopters, which has spurred innovation and development within the sector.

Prominent technology hubs such as Silicon Valley and Boston are home to startups and established tech firms pushing the boundaries of digital twin applications in finance. Furthermore, North American financial institutions are increasingly adopting digital strategies that integrate advanced technologies like AI, IoT, and big data analytics, which are complementary to digital twin technologies.

This trend is driven by the need to enhance operational efficiencies and customer experiences, as well as to offer more personalized financial services. The robust IT infrastructure and high levels of investment in research and development activities also provide a conducive environment for the growth of the Digital Twin market in this region.

Moreover, regulatory support and initiatives promoting digital innovations in the financial sector have played a crucial role. For instance, regulatory sandboxes in the U.S. and Canada allow firms to test and refine digital twin applications in a controlled environment, reducing entry barriers and fostering market growth. This regulatory encouragement is crucial in a market where financial institutions prioritize compliance and security.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the prominent player in the market is IBM that offers digital twin technology through its IBM Watson and IBM cloud platforms, focusing on advanced analytics and AI driven insights for the financial services. Another significant player in the market is Microsoft that integrates digital twin technology with its azure IoT services. This would enable the financial institutions to stimulate and optimize operations and customer experience,

Top Key Players in the Market

- IBM Corporation

- PTC, Inc.

- Microsoft Corporation

- Siemens AG

- Ansys, Inc.

- SAP SE

- Oracle Corporation

- Robert Bosch Gmbh

- Rescale, Inc.

- Dassault Systems

- ABB Ltd.

- Honeywell International Corporation

- Schneider Electric SE

- Other Key Players

Recent Developments

- In March 2024, SDK.finance on announced its membership with Amazon Web Services (AWS) Partner Network and the immediate availability of its cloud digital wallet solution based on digital twin on the AWS Marketplace.

- In September 2023, Matera launched cloud-native software based on digital twin designed to sit on top of a financial institution’s core banking platform, enabling real-time transaction authorizations and balance updates 24/7 for various financial accounts.

Report Scope

Report Features Description Market Value (2023) USD 0.7 Bn Forecast Revenue (2033) USD 13.5 Bn CAGR (2024-2033) 34.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Platforms & Solutions, Services), By Application (Risk Assessment & Compliance, Process Optimization, Insurance Claims Management, Testing & Simulation, Other Applications) By End-Use Industry (BFSI, Manufacturing, Transportation & Logistics, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, PTC, Inc., Microsoft Corporation, Siemens AG, Ansys, Inc., SAP SE, Oracle Corporation, Robert Bosch GmbH, Rescale, Inc., Dassault Systems, ABB Ltd., Honeywell International Corporation, Schneider Electric SE, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Twin in Finance MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Twin in Finance MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- PTC, Inc.

- Microsoft Corporation

- Siemens AG

- Ansys, Inc.

- SAP SE

- Oracle Corporation

- Robert Bosch Gmbh

- Rescale, Inc.

- Dassault Systems

- ABB Ltd.

- Honeywell International Corporation

- Schneider Electric SE

- Other Key Players