Global Digital Trust Market Size, Share, Industry Analysis Report By Component (Solution, Services), By Technology (AI & ML, Privacy Enhancing Technologies (PETs), Cloud Computing, Multi-Factor Authentication (MFA), Others), By Enterprise Size (Small & Medium size, Large Enterprises), By End Use (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and E-commerce, IT and Telecommunications, Government Sector, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155731

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

- Digital Trust Market size

- Key Insight Summary

- Market Overview

- Cybersecurity Statistics by Attack Type

- North America Market Size

- By Component – Solution (58.9%)

- By Technology – AI & ML (28.2%)

- By Enterprise Size – Large Enterprises (55.9%)

- By End Use – BFSI (29.9%)

- Key Trends and Innovations

- Top Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Digital Trust Market size

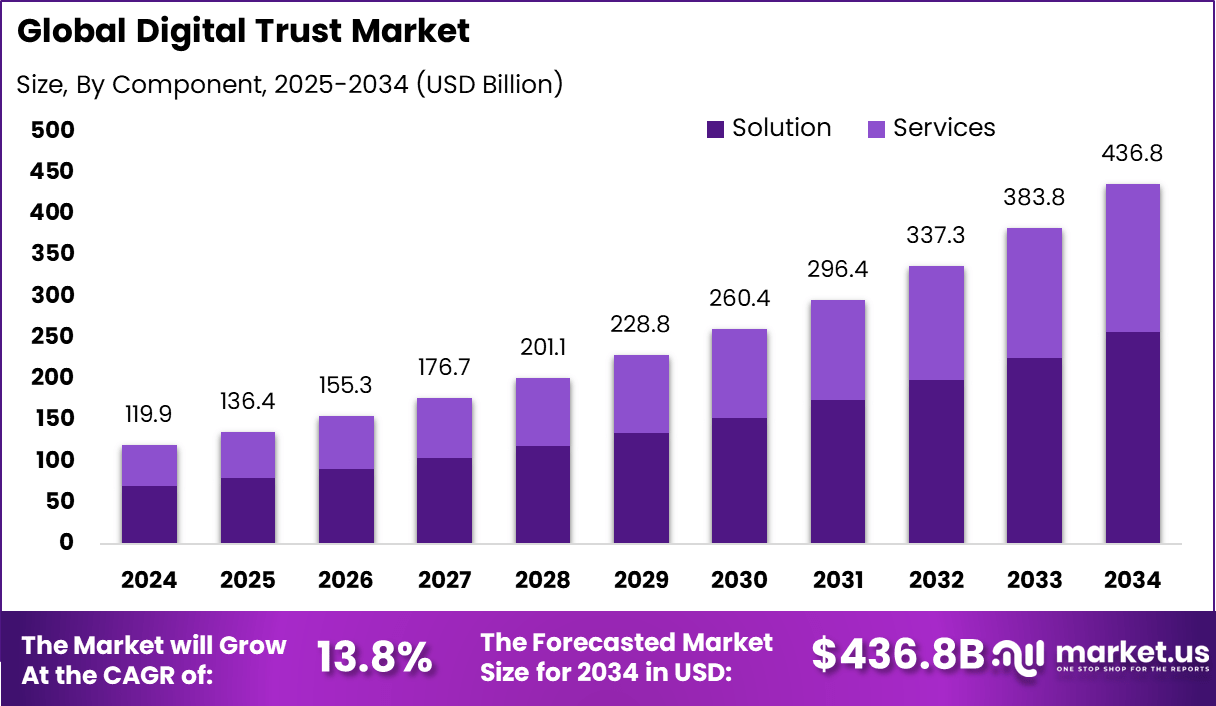

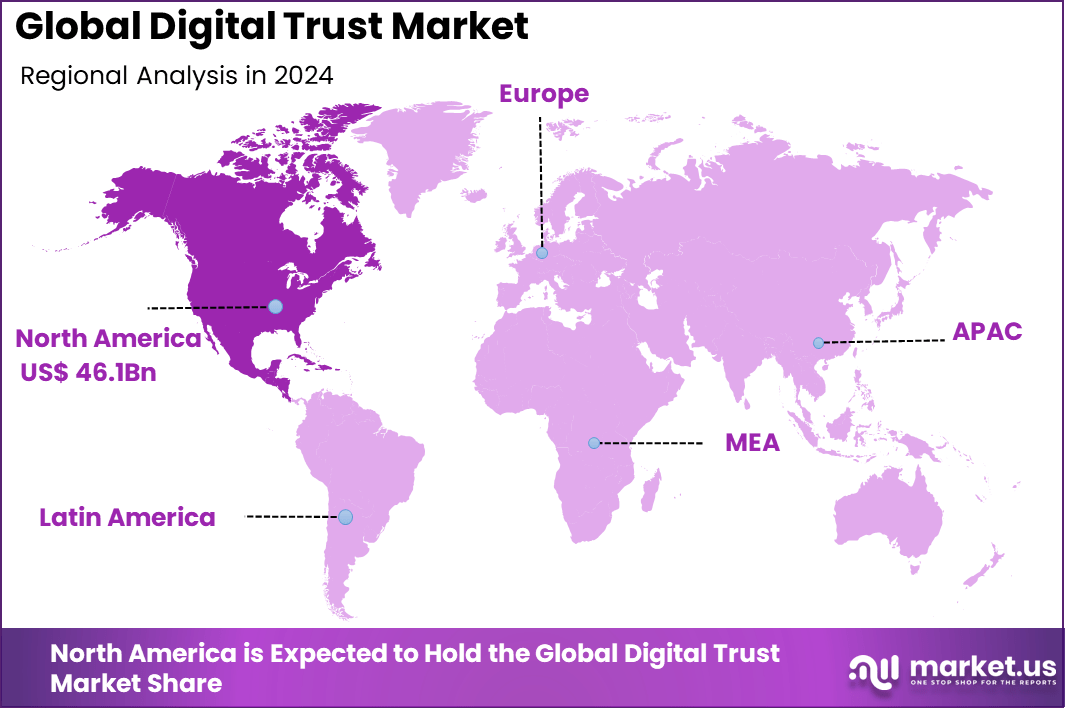

The Global Digital Trust Market size is expected to be worth around USD 436.8 Billion By 2034, from USD 119.9 billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 46.1 Billion revenue.

Key Insight Summary

- By Component, the Solution segment dominated with 58.9%, reflecting enterprises’ priority on deploying comprehensive digital trust solutions to safeguard online transactions and interactions.

- By Technology, AI & ML contributed 28.2%, showcasing the growing role of intelligent automation and advanced analytics in building secure and reliable digital ecosystems.

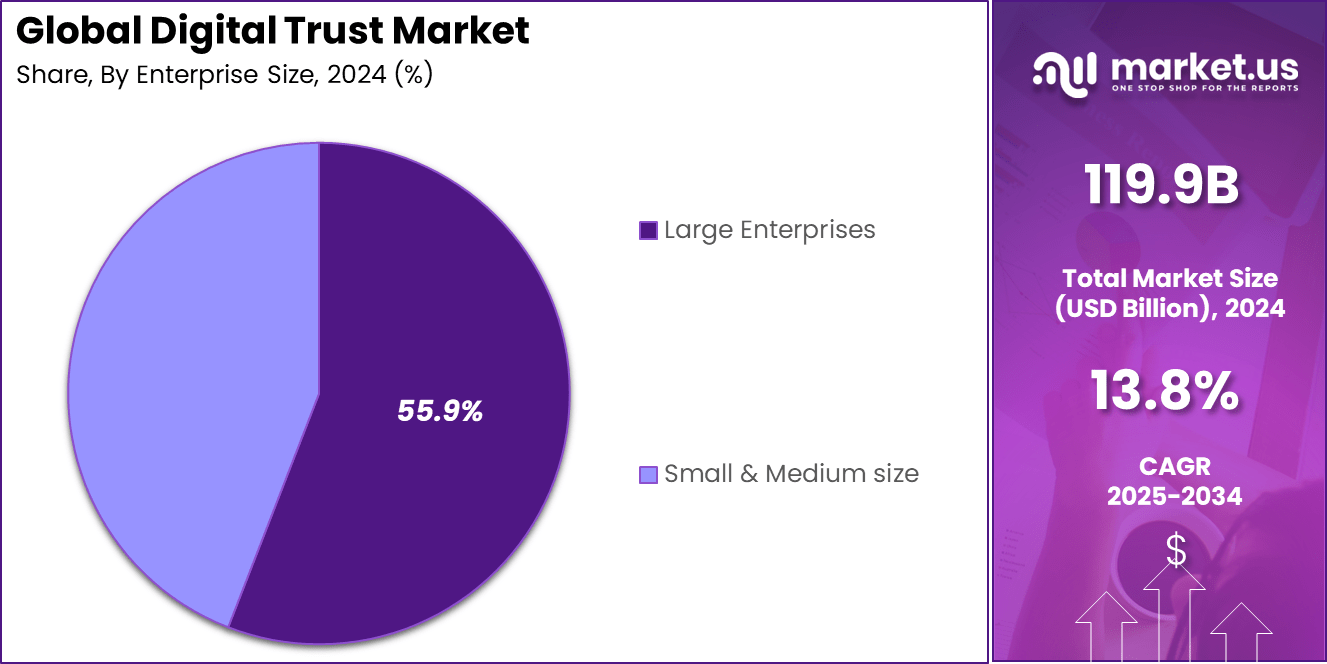

- By Enterprise Size, Large Enterprises led with 55.9%, highlighting their higher budgets and urgent need for scalable trust frameworks to manage large volumes of digital interactions.

- By End Use, the Banking, Financial Services, and Insurance (BFSI) sector accounted for 29.9%, emphasizing its reliance on digital trust to ensure security, regulatory compliance, and consumer confidence in financial services.

Market Overview

The Digital Trust Market covers solutions that ensure safe and reliable digital interactions. It includes identity verification, encryption, fraud detection, and data privacy technologies. The market is growing as organizations across banking, healthcare, retail, and government adopt more digital platforms. Consumers increasingly demand assurance that their data and transactions are protected, which makes digital trust a critical part of modern business operations.

The main factors driving growth are the expansion of digital services, rising cyber threats, and stronger regulatory requirements for data protection. The use of biometric systems, blockchain identity tools, and artificial intelligence in fraud prevention is supporting market momentum. Businesses are prioritizing trust in digital systems because customers are more likely to engage when security is transparent and reliable.

The adoption of digital trust technologies is expanding with a focus on artificial intelligence, blockchain, biometric authentication, cloud computing, Internet of Things (IoT), and decentralized identity systems. These technologies underpin secure digital identity verification, real-time threat detection, and data encryption. AI and machine learning help in predictive security and automating incident responses.

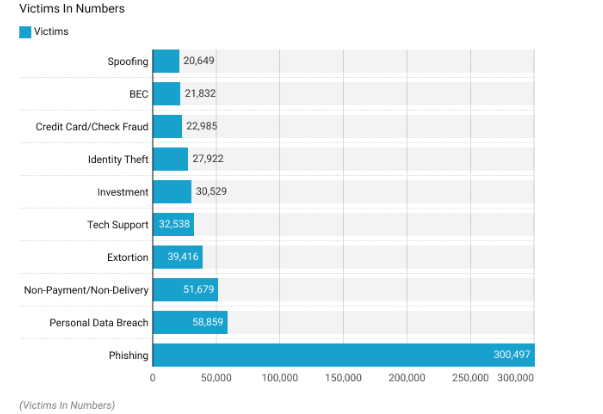

Cybersecurity Statistics by Attack Type

According to market scoop, Phishing has firmly established itself as the most widespread cyber threat, with nearly 3.4 billion spam emails flooding inboxes on a daily basis. The scale of this activity highlights the persistent reliance of cybercriminals on deceptive messaging to compromise individuals and organizations.

In 2022, the financial impact of cyber incidents was already severe, as the global average cost of a data breach stood at USD 4.35 million, while breaches linked to stolen or compromised login credentials carried an even higher average burden of USD 4.50 million. The reach of ransomware was equally alarming, affecting 71% of businesses in 2022 and demonstrating how disruptive encryption-based attacks have become.

Phishing remained the most damaging individual attack type, with more than 300,497 victims reported during the same year, underscoring its dominance as the leading cybercrime vector. Amid these risks, the banking and financial sector emerged as the most trusted industry, with 42% of consumers showing confidence in its digital services, reflecting ongoing investment in advanced security protocols and consumer protection mechanisms.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 38.5 % share in the global digital trust market, generating approximately USD 46.1 billion in revenue. This commanding lead can be attributed to the convergence of several foundational strengths.

The region boasts one of the most advanced digital infrastructures globally, paired with widespread internet penetration and a mature cybersecurity ecosystem. Enterprises and public institutions across industries have prioritized investments in identity verification, authentication mechanisms, and comprehensive cybersecurity frameworks to preserve user confidence in digital channels.

Regional Insights

Region Market Characteristics North America Largest market share driven by mature infrastructure and strong cyber regulations Asia-Pacific Fastest growth due to digital transformation, government initiatives, and e-commerce boom Europe Growth supported by strict privacy laws (e.g., GDPR) and increasing digital adoption Other Regions Emerging adoption in LATAM, Middle East, and Africa with growing technology penetration By Component – Solution (58.9%)

In 2024, the Solutions segment constitutes the largest share of the Digital Trust market, capturing 58.9% of the total market. This dominance arises from the critical need for organizations to implement robust solutions that address identity and access management, fraud detection and prevention, data encryption, digital signatures, and endpoint security.

These solutions play a fundamental role in establishing trust in digital interactions by safeguarding users and enterprises against evolving cyber threats and ensuring compliance with stringent data privacy regulations. Their proactive and reactive capabilities make them indispensable to organizations seeking to foster secure environments.

The growth of the Solutions component is closely tied to increasing digitization globally, which amplifies vulnerabilities and the demand for advanced technologies. Organizations, especially large enterprises with complex infrastructures, prefer integrated and scalable solutions that can adapt to diverse security requirements.

By Technology – AI & ML (28.2%)

In 2024, Artificial Intelligence (AI) and Machine Learning (ML) technologies hold a crucial 28.2% share in the Digital Trust market, driven by their ability to enhance threat detection, automate risk analysis, and improve predictive accuracy in cybersecurity.

AI and ML frameworks analyze vast volumes of data in real-time, identifying anomalies and potential fraud patterns faster and more precisely than traditional methods. This capability helps organizations stay ahead of cybercriminals by proactively addressing risks before they escalate into significant breaches.

Adoption of AI and ML in digital trust solutions also facilitates continuous learning and adaptation, crucial for evolving cyber threats. These technologies support identity verification, behavioral analytics, and cybersecurity automation, which improve operational efficiency and reduce manual intervention.

By Enterprise Size – Large Enterprises (55.9%)

Large enterprises represent a dominant segment in the Digital Trust market, accounting for 55.9% of the market share. Their leadership in this space is attributed to their vast digital footprints, extensive customer bases, and significant compliance obligations.

Large organizations often face more complex cybersecurity challenges, necessitating advanced digital trust solutions to protect sensitive data, maintain operational continuity, and avoid reputational damage caused by breaches or fraud.

Moreover, large enterprises have greater financial resources and technological expertise to invest in comprehensive digital trust frameworks. Their ability to deploy sophisticated identity management, fraud prevention solutions, and AI-driven analytics positions them as significant drivers in the adoption of digital trust technologies. These enterprises prioritize building customer confidence and ensuring regulatory compliance, making digital trust a strategic imperative.

By End Use – BFSI (29.9%)

The BFSI sector commands a significant 29.9% share of the Digital Trust market, reflecting the industry’s critical need for secure and reliable digital transactions, identity verification, and fraud prevention. Given the sensitive nature of financial data and high transaction volumes, BFSI organizations face relentless cybersecurity threats, pushing them to adopt digital trust solutions that protect customers and preserve regulatory compliance.

Digital trust solutions in BFSI focus on mitigating risks related to identity theft, payment fraud, and compliance violations through comprehensive authentication measures and real-time fraud detection capabilities. The sector’s ongoing digitization, including mobile banking and online insurance platforms, has further emphasized the requirement for robust digital trust frameworks that safeguard both institutional assets and customer trust.

Key Trends and Innovations

Trend / Innovation Description Zero Trust Architectures Continuous verification and least-privilege access models becoming standard Decentralized Identity Systems Blockchain-based identity solutions for enhanced user control and privacy AI-Driven Fraud Detection Real-time anomaly detection and fraud prevention using machine learning Biometric Authentication Advanced facial, fingerprint, and behavioral biometrics gaining traction Privacy-Enhancing Technologies Techniques like differential privacy and homomorphic encryption protecting sensitive data Automated Compliance Monitoring AI-based tools tracking regulatory adherence with automated reporting Top Growth Factors

Growth Factor Description Increasing Digital Transactions Growth of online banking, e-commerce, and digital payments driving demand for trust solutions Rising Cybersecurity Threats Escalated threat landscape boosting adoption of identity verification and fraud prevention tools Regulatory Compliance & Data Privacy GDPR and similar regulations worldwide increasing adoption of compliance-enabling technologies Emerging Technologies Adoption AI, blockchain, biometrics, and zero trust models empowering secure digital identity management Expansion of Cloud & IoT Ecosystems Cloud and connected devices increase complexity and demand for digital trust Key Market Segments

By Component

- Solution

- Services

By Technology

- AI & ML

- Privacy Enhancing Technologies (PETs)

- Cloud Computing

- Multi-Factor Authentication (MFA)

- Others

By Enterprise Size

- Small & Medium size

- Large Enterprises

By End Use

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-commerce

- IT and Telecommunications

- Government Sector

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Escalating Cybersecurity Threats and Regulatory Compliance

A major driver propelling the Digital Trust Market is the sharp rise in cybersecurity threats and the growing need for compliance with stringent data protection regulations globally. The escalating frequency and sophistication of cyberattacks such as ransomware, data breaches, and identity theft have heightened businesses’ focus on securing digital interactions and protecting sensitive data.

Governments and regulators are enforcing comprehensive frameworks like GDPR, CCPA, and others that compel organizations to implement stringent digital trust measures, further accelerating market demand. This regulatory landscape compels enterprises across sectors including banking, healthcare, and e-commerce to invest heavily in identity verification, secure authentication, encryption, and real-time monitoring solutions.

Strong digital trust capabilities help not only to avoid financial and reputational damage but also to sustain customer confidence in increasingly digital ecosystems. The combined effect of rising cyber risks and compliance mandates is a powerful catalyst for digital trust adoption worldwide.

Restraint Analysis

High Implementation Costs and Integration Complexities

Despite robust demand, the Digital Trust Market faces restraints related to high implementation costs and integration complexities. Deploying comprehensive digital trust solutions involves considerable investments in infrastructure, specialized software, and skilled personnel, which can be prohibitive especially for small and medium-sized enterprises.

These upfront expenses include licensing fees, system upgrades, and ongoing maintenance, creating financial barriers to adoption. Moreover, integrating digital trust frameworks into existing legacy IT environments poses operational challenges. Differences in technology stacks, lack of standardized protocols, and interoperability issues can delay deployments and increase costs.

Opportunity Analysis

Expansion through IoT Security and Biometric Authentication

The proliferation of connected devices within the Internet of Things (IoT) ecosystem presents a significant growth opportunity for the Digital Trust Market. As billions of IoT devices communicate across networks, securing these interactions with robust digital trust solutions becomes critical.

Specialized technologies for IoT data encryption, device authentication, and secure communication protocols are needed to ensure trustworthiness and privacy in smart homes, industrial automation, and healthcare applications. Additionally, advancements in biometric authentication such as facial recognition, fingerprint scanning, and behavioral biometrics offer opportunities for creating seamless, secure user access management.

These technologies enhance user convenience while strengthening security, enabling organizations to deploy zero-trust models effectively. Capitalizing on growing IoT adoption and biometric innovations will be crucial for digital trust providers aiming to capture emerging market segments.

Challenge Analysis

Privacy Concerns and Vendor Lock-In Risks

A significant challenge facing the Digital Trust Market is managing privacy concerns amidst expanding data collection and processing activities. Users and regulators demand transparency and rigorous data protection to maintain confidence, making privacy compliance a complex and ongoing task. Data breaches or misuse can severely damage trust and invite legal penalties.

Additionally, heavy reliance on specific digital trust technology providers can lead to vendor lock-in, restricting flexibility and increasing switching costs. Proprietary platforms, customization limits, and integration dependencies pose risks for organizations that seek scalable, interoperable solutions across diverse environments.

Competitive Analysis

In the Digital Trust Market, major technology leaders such as Amazon Web Services, Microsoft, and IBM are playing a central role in shaping security and compliance standards. Their cloud-based platforms provide strong identity management, advanced encryption, and scalable compliance tools that enterprises rely on for secure digital operations. These companies continue to strengthen their portfolios with artificial intelligence and blockchain integration, allowing organizations to manage risk more effectively.

Another group of key players, including Cisco Systems, Oracle, and Salesforce, focuses on delivering solutions that combine trust with connectivity and data governance. Cisco leads with network-level security innovations, while Oracle emphasizes secure databases and integrated applications. Salesforce plays an essential role by embedding trust into customer relationship management, ensuring data privacy across global operations.

Specialized companies such as DigiCert, OneTrust, RSA Security, and Symantec (by Broadcom) concentrate on areas like digital certificates, privacy compliance, encryption, and endpoint protection. DigiCert is a leader in public key infrastructure, while OneTrust dominates in compliance and privacy management platforms. RSA Security maintains a strong presence in authentication and identity solutions, and Symantec contributes with advanced threat intelligence.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- DigiCert, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle

- OneTrust, LLC

- RSA Security USA LLC

- Salesforce, Inc.

- Symantec (by Broadcom)

Recent Developments

- In June 2025, Oracle launched the Oracle Defense Ecosystem to drive innovation in the defense and government sectors by addressing procurement challenges and limited access to advanced tools. Built on Oracle Cloud Infrastructure, the ecosystem ensures strict compliance standards are met.

- In May 2025, Cisco and NVIDIA introduced the Cisco Secure AI Factory, an AI infrastructure framework that integrates security across applications, workloads, and infrastructure. Combining Cisco’s networking and security expertise with NVIDIA’s AI computing power, it enables faster, scalable, and secure enterprise AI adoption.

- In June 2024, Salesforce launched its public sector division in India to support government agencies and public organizations in improving citizen services with advanced digital trust technologies. Built on the Einstein 1 Platform, it offers ready-to-use applications that enable faster AI-powered service delivery while enhancing efficiency, security, data privacy, and flexibility.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Technology (AI & ML, Privacy Enhancing Technologies (PETs), Cloud Computing, Multi-Factor Authentication (MFA), Others), By Enterprise Size (Small & Medium size, Large Enterprises), By End Use (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and E-commerce, IT and Telecommunications, Government Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., Cisco Systems, Inc., DigiCert, Inc., IBM Corporation, Microsoft Corporation, Oracle, OneTrust, LLC, RSA Security USA LLC, Salesforce, Inc., Symantec (by Broadcom) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- DigiCert, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle

- OneTrust, LLC

- RSA Security USA LLC

- Salesforce, Inc.

- Symantec (by Broadcom)