Global Digital Travel Market Size, Share, Growth Analysis By Tour Type (International, Domestic), By Consumer Orientation (Women, Men), By Tourist Type (Independent Traveler, Tour Group, Package Traveler), By Age Group (26-35 Years, 36-45 Years, 46-55 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153466

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

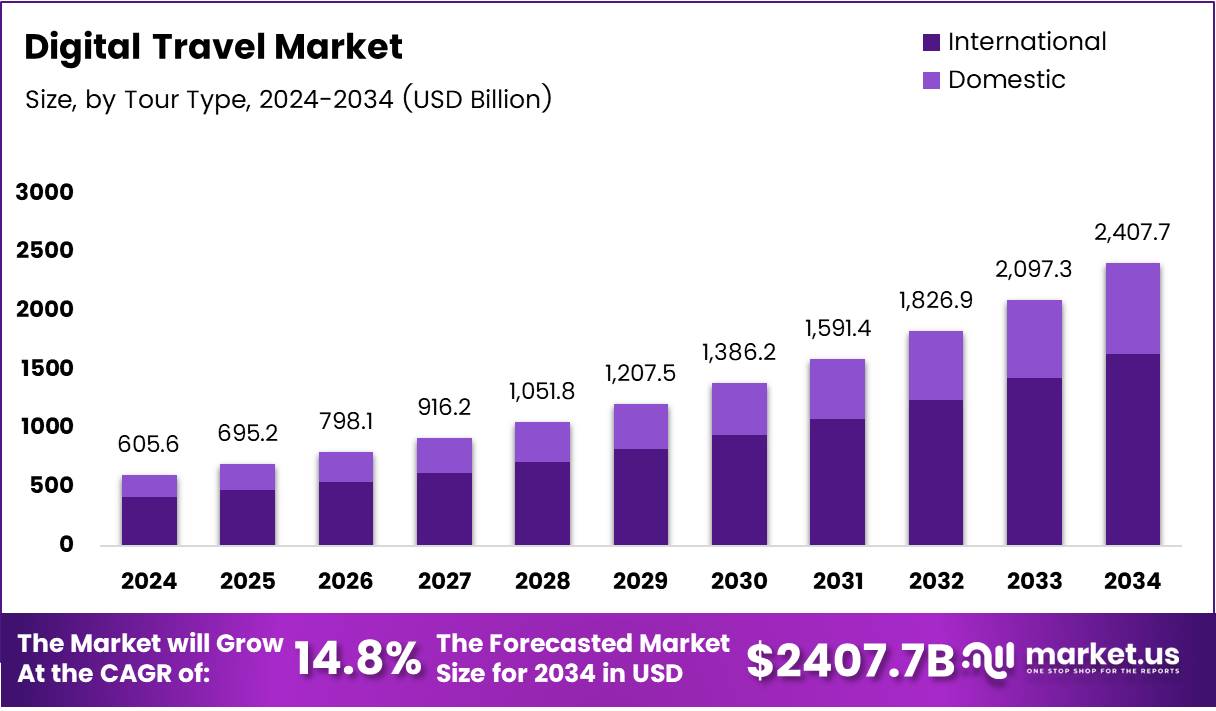

The Global Digital Travel Market size is expected to be worth around USD 2407.7 Billion by 2034, from USD 605.6 Billion in 2024, growing at a CAGR of 14.8% during the forecast period from 2025 to 2034.

The digital travel market is an emerging industry that encompasses the integration of technology in the travel and tourism sector. The market includes online platforms for booking, travel management, and digital tools aimed at enhancing the travel experience. These advancements are driving a shift in how consumers interact with travel services.

In recent years, the digital travel industry has witnessed rapid growth. Advancements in mobile applications, artificial intelligence (AI), and big data analytics are allowing businesses to personalize offerings for travelers. As consumers demand more convenience, digital platforms are evolving, offering seamless online booking, trip management, and personalized experiences for travelers worldwide.

The opportunities in the digital travel market are substantial. With an increasing reliance on smartphones and the internet, travelers now prefer digital means to plan and book their trips. Additionally, businesses can leverage data analytics to understand customer preferences better and design tailor-made travel experiences. The shift toward more immersive, tech-driven travel solutions opens new avenues for startups and established companies alike.

Government investments are playing a crucial role in driving market growth. As part of their digitalization efforts, governments around the world are increasingly investing in technology infrastructure to support the growing demand for online travel services. These investments contribute to the overall development of the digital travel ecosystem, improving both customer experiences and industry efficiency.

Regulations are also a significant consideration in the digital travel landscape. Governments are setting up frameworks to ensure data privacy and security in online travel transactions. These regulations help foster trust between consumers and service providers, which is essential for the market’s long-term success. As such, compliance with these standards is crucial for businesses looking to enter the market.

In 2024, 72% of travelers preferred to book their trips online, according to Travelperk. This growing trend underscores the shift toward digital platforms, where convenience, speed, and personalization are key. Furthermore, 95% of travelers surveyed by Travelperk in 2024 indicated that they would cut spending in other areas, such as food or entertainment, to fund their travels. These statistics highlight the prioritization of travel in consumers’ budgets, reinforcing the importance of digital travel platforms to meet these demands.

As the digital travel market continues to grow, the focus will remain on enhancing customer experiences through cutting-edge technologies and personalized services. The future of travel is digital, and businesses that capitalize on these trends will likely see substantial growth in the coming years.

Key Takeaways

- The Global Digital Travel Market size is expected to reach USD 2407.7 Billion by 2034, growing at a CAGR of 14.8% from 2025 to 2034.

- In 2024, International travel dominated the market with a 58.9% share in the By Tour Type Analysis segment.

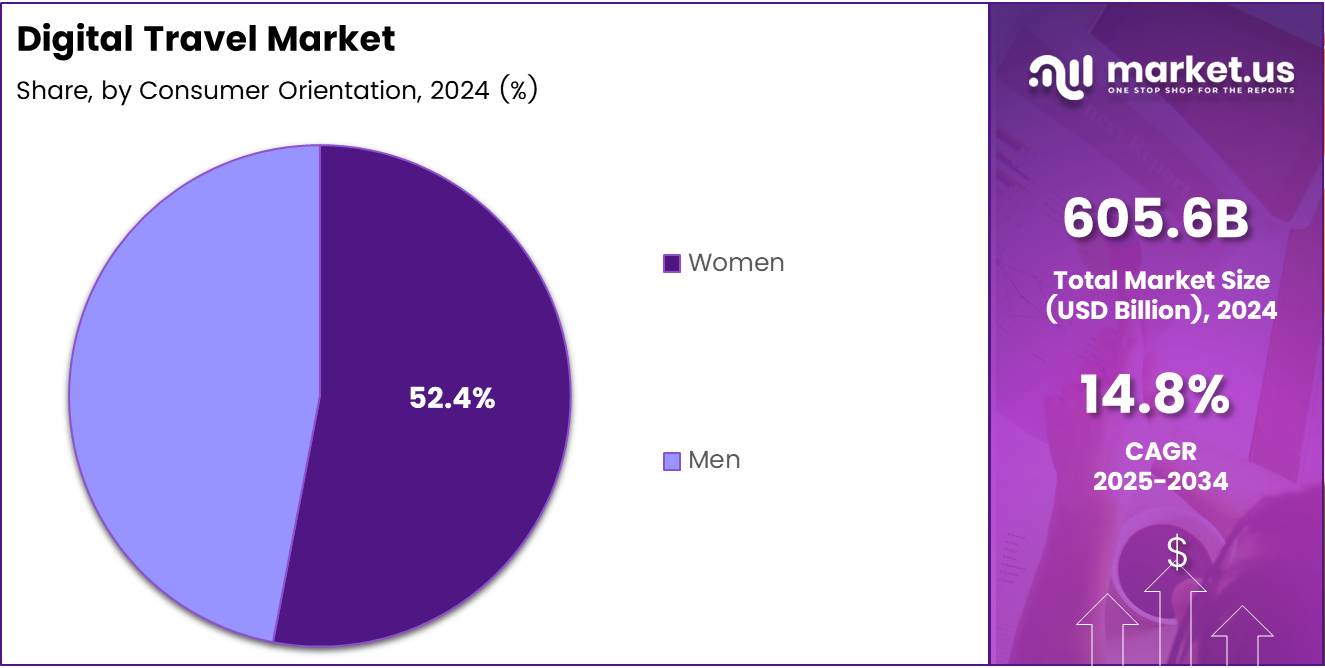

- In 2024, Women held a dominant market share of 52.4% in the By Consumer Orientation Analysis segment.

- In 2024, Independent Travelers accounted for 44.2% of the By Tourist Type Analysis segment in the Digital Travel Market.

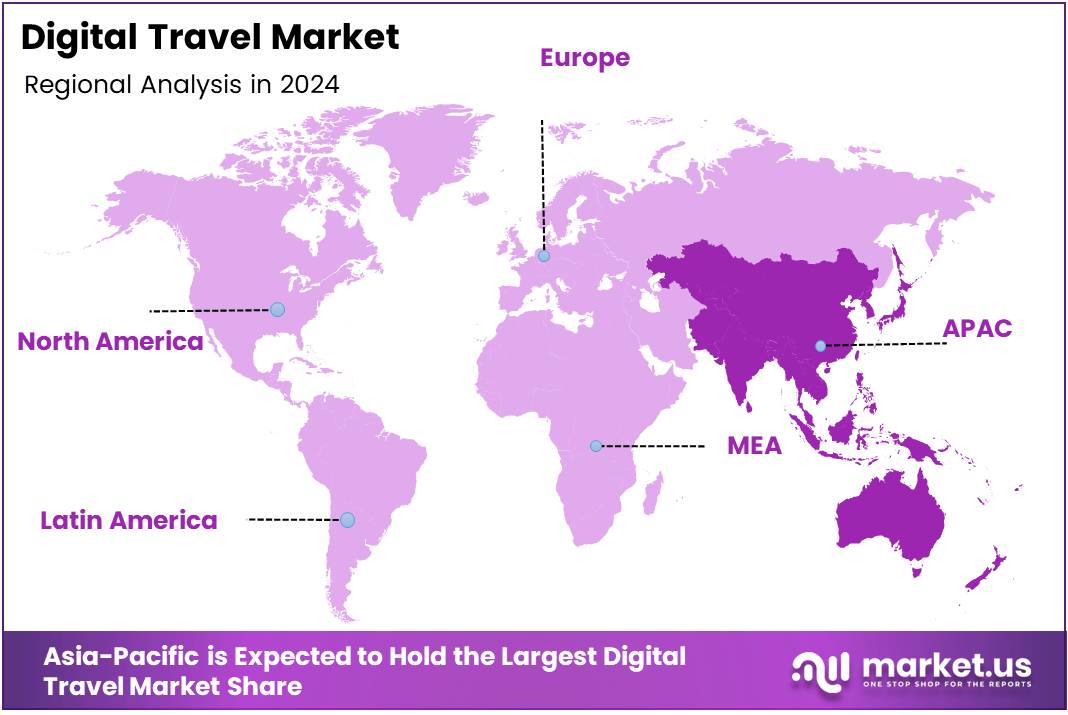

- Asia-Pacific is the leading region in the Digital Travel Market, capturing the largest share due to growing adoption of digital travel solutions.

Tour Type Analysis

International dominates with 58.9% due to increasing demand for overseas travel and global tourism trends.

In 2024, International travel held a dominant position in the Digital Travel Market under the By Tour Type Analysis segment, commanding a strong share of 58.9%. This segment is driven by travelers seeking global experiences, with increasing interest in international destinations and cultural explorations. As international travel becomes more accessible due to advancements in digital platforms, travelers are opting for seamless booking experiences and customized international itineraries.

On the other hand, Domestic travel also plays a significant role but lags behind international tours in terms of market share. Domestic travel remains popular, especially in regions with strong local tourism infrastructures. Despite this, international destinations continue to capture a larger portion of the market, given the growing trend of cross-border travel and the global reach of travel services.

Consumer Orientation Analysis

Women dominate with 52.4% due to increasing travel preferences and rising influence in decision-making.

In 2024, women held a dominant market share of 52.4% in the By Consumer Orientation Analysis segment of the Digital Travel Market. Women are increasingly driving the demand for digital travel bookings, with a growing preference for personalized, unique travel experiences. This demographic values convenience, safety, and tailored travel options, making them significant contributors to the market’s growth.

Men also play a notable role, but women’s dominance in the sector highlights their expanding influence in travel decision-making, particularly in areas like family vacations, wellness travel, and cultural trips. This trend is set to continue as more women take control of travel planning, further bolstering their presence in the market.

Tourist Type Analysis

Independent Traveler dominates with 44.2% due to the rising trend of personalized, self-guided travel experiences.

In 2024, Independent Travelers held a dominant market share of 44.2% in the By Tourist Type Analysis segment of the Digital Travel Market. This category has witnessed a surge as more travelers prefer to explore destinations at their own pace, outside the constraints of tour groups. Independent travelers are increasingly turning to digital platforms to plan, book, and manage their itineraries, enabling them to create bespoke travel experiences.

While Tour Groups and Package Travelers maintain a presence, they are gradually losing ground to the independent traveler trend. As digital platforms offer more flexible and affordable travel options, the share of independent travelers is expected to grow, reflecting a broader shift toward autonomy in travel planning and execution.

Key Market Segments

By Tour Type

- International

- Domestic

By Consumer Orientation

- Women

- Men

By Tourist Type

- Independent Traveler

- Tour Group

- Package Traveler

By Age Group

- 26-35 Years

- 36-45 Years

- 46-55 Years

Drivers

Surge in Smartphone Adoption and Mobile-Based Travel Services Drives Market Growth

The growing adoption of smartphones has significantly transformed the digital travel market. With more people relying on mobile devices for daily tasks, including travel planning, mobile-based travel services have become an essential part of the consumer experience. This shift has prompted travel providers to enhance their mobile platforms to cater to the increasing demand for on-the-go booking, seamless navigation, and real-time updates.

The rise in personalized travel experiences is another key driver in the market. Travelers now expect tailored recommendations, customized itineraries, and personalized services that align with their preferences. This demand for individuality is pushing digital travel platforms to leverage data and AI to offer unique travel solutions.

Restraints

Cybersecurity Concerns and Data Privacy Issues Restrain Market Growth

Cybersecurity concerns and data privacy issues remain significant challenges for the digital travel market. As more travelers share personal and financial information online, concerns over data breaches and misuse of sensitive data have intensified. Travel companies must invest heavily in robust security measures to protect user information and maintain trust.

The intense competition among digital travel service providers also poses a challenge. With numerous players offering similar services, maintaining competitive pricing and differentiation becomes increasingly difficult.

Moreover, the unpredictable global economic factors, such as fluctuating exchange rates and political instability, can disrupt market stability. Finally, complexities in user experience and interface design can hinder customer satisfaction, as travelers expect intuitive, fast, and user-friendly digital platforms.

Growth Factors

Expansion of Digital Travel Services in Emerging Markets Drives Market Growth

The expansion of digital travel services into emerging markets presents significant growth opportunities. As internet penetration increases in these regions, more consumers are gaining access to digital travel platforms. This shift allows businesses to tap into new customer segments, boosting overall market growth.

Rising demand for eco-friendly and sustainable travel options is another opportunity driving market development. With an increased awareness of environmental concerns, travelers are seeking greener, more sustainable travel choices.

Additionally, integrating voice-assisted technology in travel platforms enhances user convenience, offering more intuitive, hands-free booking options. Traditional travel businesses are also forming partnerships with digital platforms to expand their reach and cater to the growing demand for digitalized travel experiences.

Emerging Trends

Use of Blockchain Technology for Secure Travel Transactions Drives Market Growth

The use of blockchain technology in digital travel is gaining traction due to its ability to enhance security and transparency in transactions. By ensuring secure payments and eliminating intermediaries, blockchain is revolutionizing the way travelers book and pay for services.

Another trending factor is the implementation of augmented reality (AR), which is being used to create immersive travel experiences. AR allows users to visualize destinations and hotel rooms in real-time, offering a more interactive way of exploring potential travel options.

Subscription-based travel models are also gaining popularity, allowing consumers to pay upfront for a range of services, making travel planning more cost-effective. Additionally, the increasing focus on seamless cross-platform integration is enhancing the overall user experience, allowing travelers to book, plan, and manage their trips through a single, unified platform.

Regional Analysis

Asia-Pacific Dominates the Digital Travel Market

In 2024, Asia-Pacific holds a leading position in the Digital Travel Market, capturing the largest market share due to the increasing adoption of online travel platforms and mobile applications. The region’s dominance is driven by a large population, rapid urbanization, and the rising preference for digital travel solutions. With a growing middle-class population and rising disposable incomes, Asia-Pacific is projected to maintain its strong hold on the market in the coming years.

North America Digital Travel Market Trends

North America is a significant player in the digital travel market, driven by the increasing adoption of digital platforms for booking travel services and the rise of online travel agencies (OTAs). The U.S. remains the largest market in this region, with a high concentration of key players in the travel industry and a tech-savvy consumer base. The growing trend of personalized travel experiences and the integration of AI and big data further contribute to the region’s market expansion.

Europe Digital Travel Market Trends

Europe represents a substantial share of the digital travel market, with an increasing preference for mobile-based services and seamless digital experiences. The region benefits from robust infrastructure and high internet penetration, fostering widespread adoption of digital travel solutions. The growing interest in eco-friendly travel options and the region’s established tourism industry are key factors driving the market’s growth.

Middle East and Africa Digital Travel Market Trends

The Middle East and Africa are experiencing rapid growth in digital travel services, particularly driven by an increasing number of digital platforms and mobile applications offering travel solutions. The region’s growing interest in leisure travel, business tourism, and government initiatives to enhance tourism infrastructure are helping accelerate digital travel market adoption. While the market is still developing, its potential for future growth remains significant.

Latin America Digital Travel Market Trends

Latin America is gradually adopting digital travel services, with increasing internet penetration and smartphone adoption playing a key role in this shift. Despite facing challenges related to economic instability and digital infrastructure in some areas, the region’s tourism growth and a young, tech-savvy population are expected to contribute to future market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Digital Travel Company Insights

In 2024, Booking Holdings Inc. continues to lead the global digital travel market, benefiting from its strong portfolio of online travel agencies (OTAs) including Booking.com and Priceline. The company is expected to leverage its extensive global network and innovative digital solutions to capture a substantial share of the market.

Expedia Group Inc. remains a dominant player, expanding its presence through multiple brands such as Expedia.com and Hotels.com. With its focus on integrating AI and personalized travel experiences, Expedia is projected to enhance customer engagement and further strengthen its competitive position.

Airbnb Inc. has revolutionized the travel accommodation market, offering unique stays and experiences. The company’s increasing focus on expanding its service offerings, such as experiences and long-term stays, positions it as a formidable competitor, particularly in the evolving post-pandemic travel landscape.

Trip.com Group Ltd. stands out in the Asia-Pacific region, where it has made significant strides with its integrated travel services, including booking for hotels, flights, and car rentals. By leveraging its strong presence in key markets like China, Trip.com is well-placed to capitalize on the growing demand for both domestic and international travel in the region.

Top Key Players in the Market

- Booking Holdings Inc.

- Expedia Group Inc.

- Airbnb Inc.

- Trip.com Group Ltd.

- MakeMyTrip Ltd.

- Tripadvisor Inc.

- Amadeus IT Group SA

- Sabre Corporation

- WEX Inc.

- TUI Group

Recent Developments

- In May 2025, EaseMyTrip is set to acquire Guideline Group, Dook Travels, and Tripshope Online, expanding its presence in the travel market and enhancing its service offerings to cater to a broader audience.

- In September 3, 2024, Yatra reinforces its dominance in the corporate travel sector by acquiring Globe Travels, cementing its leadership position in India’s travel industry.

- In March 2024, Amadeus strengthens its payment solutions portfolio by acquiring Voxel, a travel payments expert, which will boost Amadeus’ capabilities in delivering advanced payment technologies.

- In May 2024, SITA made a strategic move by acquiring Materna IPS, a key player in the air travel sector, enhancing its digital transformation solutions and supporting the growth of the air transport industry.

- In September 2024, Yatra further solidifies its position in the corporate travel space by acquiring Globe Travels, further expanding its corporate travel offerings and strengthening its competitive edge.

Report Scope

Report Features Description Market Value (2024) USD 605.6 Billion Forecast Revenue (2034) USD 2407.7 Billion CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tour Type (International, Domestic), By Consumer Orientation (Women, Men), By Tourist Type (Independent Traveler, Tour Group, Package Traveler), By Age Group (26-35 Years, 36-45 Years, 46-55 Years) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Booking Holdings Inc., Expedia Group Inc., Airbnb Inc., Trip.com Group Ltd., MakeMyTrip Ltd., Tripadvisor Inc., Amadeus IT Group SA, Sabre Corporation, WEX Inc., TUI Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Booking Holdings Inc.

- Expedia Group Inc.

- Airbnb Inc.

- Trip.com Group Ltd.

- MakeMyTrip Ltd.

- Tripadvisor Inc.

- Amadeus IT Group SA

- Sabre Corporation

- WEX Inc.

- TUI Group